Professional Documents

Culture Documents

International Taxation Partial Exam

Uploaded by

Joan RecasensOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Taxation Partial Exam

Uploaded by

Joan RecasensCopyright:

Available Formats

lOMoARcPSD|6017776

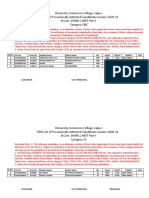

International Taxation Partial Exam

International Taxation (Universitat de Barcelona)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Joan Recasens (jrekasens@gmail.com)

lOMoARcPSD|6017776

Partial exam taxation

1. Regarding fiscal residence in Spain which of the following is wrong?

a) Las personas físicas que pasan 183 días en un un año

consideradas residentes

b) Presunción de residencia fiscal para hijos y esposa

c) Extended tax liability of 5 years if you go tax haven

d) Centro de intereses economicos se usa subsidiariamente si el test

de presencia no se cumple

2. Warehouse taxable base

a) Warehouse is not permanent establishment bc they sell nothing

in it

b) Warehouse permanent establishment that does not close

business cycle (real) and its taxable base is always negative

(porque siempre incurre en perdidas y gastos) falso

c) Arm’s length principle a gastos y ingresos

si no hay DTA, warehouse is considered a permanent establishment

(tribute 15% o arm’s length principle a gastos y ingresos)

si hay DTA, warehouse no tribute aqui

3. Spanish Company hires services foreign Company that does not

have DTA with. Pays 350.000€, gastos, salarios trabajadores

desplazados deducibles, materiales deducibles, design of project

made by country of origin (no deducible).

350,000 ingresos – gastos (salarios y materiales)=base imponible

base imponible x 24% = result

4. Una compañía francesa vende acciones a una co. Española que

mainly owns real estate properties in Spain.

When you sell shares you are taxed in residence country but if

shares are from real estate properties you are taxed where the

properties are located

(Anti rule shopping)

We pay taxes in spain bc shares are from real estate properties

located in Spain

Downloaded by Joan Recasens (jrekasens@gmail.com)

lOMoARcPSD|6017776

5. Un ciudadano alemán, considerado fiscal resident en Francia y

alemaña, cual de las siguientes es cierta?

a) Criterio decisivo es effective place of management

b) Pais donde tienes vivienda habitual tiene prioridad sobre centro

vital de intereses

c) Existencia de una vivienda permanente en uno de los países has

primacy over center of vital interests

d) Nacionalidad del citizen nunca es relevante

6. Mario loretto opera italiana, hace world tour, ha cantado liceo

Barcelona y ha cobrado 50.000 euros, asumiendo que hay DTA,

tiene que tributar?

Si que tiene que tributar y 19% porque es italiano.

Mario Loretto has to pay taxes in Spain for the 50.000 €

7. Spanish company, distribuye dividendos entre sus shareholders y

uno de ellos compañia Japonesa que tiene el 15%, hay DTA.

Tributa 15% porque hay DTA art.10 MCOECD y tiene menos del 25%

Así que tributa un 15%.

a) No hay withholding tax in spain if holding period excedes 1 year

b) 5% WH tax

c) 25% WH tax

d) none of the previous answers

8. French individual, fiscal resident in france le retienen un 19% de los

intereses del banco que tiene abierto, cuenta bancaria en España. El

banco dice que no sabía que era fiscal resident en España, ha

actuado correctamente el banco?

10% of MCOECD art.11 is for companies, not for yeild of banks. It is

exempted if you provide a certificado de residencia fiscal en el

extranjero.

a) Yes, the bank account holder should have provided a certificate

of residency in france.

9. Juridical double taxation?

a) Same income is taxed twice in the hands of the same tax payer.

b) Same income taxed in hands of different tax payer (economical)

c) Twice according to an anti rule shopping clause

Downloaded by Joan Recasens (jrekasens@gmail.com)

lOMoARcPSD|6017776

10. Shared taxation of source income under the model of convention

means that:

a) source country and residence country distribute equally the right

to tax

b) source country can tax the income, and residence country must

provide double taxation relief when taxing world wide income

c) residence country taxes unlimitedly and source country will

provide double taxation relief

d) source country can tax more than…

11. Income obtained in spain through a permanent establishment:

a) Is attributed to the shareholders of the permanent establishment

according to their participation

b) Is taxed in similar way than Spanish resident companies (annual

accrual, etc.)

c) Is taxed differently in accordance with the nature of the income

d) Is attributed to the headquarter using arm’s length principle

12. If there’s DTA, business income is taxed in residence country,

unless?

If operates through a permanent establishment in source country

13. About the possible consideration of an agent as a permanent

establishment,

a) An agent can be considered a PE in domestic legislation

b) an agent can’t be considered a PE under MC OECD

c) It will depend if the agent has a fixed place of business in source

country

d) Both answers a and b are correct

Puede ser considerado si tiene poderes de firma,etc.

14. Respecto al transfer pricing y al arms length principle, when is the

condition of related parties considered real?

a) If they are fiscal resident in two countries that have signed a DTA…

b) When both companies are resident in two EU member states

c) When both companies have the same shareholders with significant

ownership

Downloaded by Joan Recasens (jrekasens@gmail.com)

lOMoARcPSD|6017776

15. Leo is an Argentinian football player, he is fiscal resident in

Germany, he owns a property in Spain, a village in Ibiza where he

spends summer holidays and some weekends. The property has a

cadastral value of 300.000 updated in 2014. A possible taxation in

Spanish ground, how he will be taxed?

Extranjero tiene casa en españa que no la renta, es suya, tributa

asi imputación de la renta

1,1% valor cadastral. El tipo 19% porque es fiscal resident en UE

(me da igual si es argentino o de donde sea)

solution 1,1% de 300.000 por 19%

16. Marion is a french woman, fiscal resident in USA, that sells shares

of a spanish Company. Capital gains de shares? Donde tributa?

a) Marion doesn’t have to pay taxes in spain because tax treaties

establish that she must pay taxes in her residence country

b) Does not pay here bc the directives say…

c) Pays in Spain because it comes from a Spanish company.

17. Alfa is a company contracted for putting windows in a skyscraper

established in Bcn. It pays taxes here?

a) Alfa has to pay here if the works duran mas de 6 meses y hay

DTA.

b) Alfa has to pay taxes in any case, bc it is earning business income

from real estate

c) Alfa será considerado residente en españa si los trabajos duran

más de 183 dias

d) None of the previous answers is correct.

If there’s DTA it is 12 months of works

18. En el contexto de income obtained through a permanent

establishment, interest and royalties paid to the headquarters are

always deductible?

a) No

b) Administrative expenses of the headquarter can never be

deductible (si que se pueden reducir si son con un rational

criteria, functional analysis…)

Downloaded by Joan Recasens (jrekasens@gmail.com)

lOMoARcPSD|6017776

c) The permanent establishment must submit its own tax return

(correcta)

d) Options b and c are both correct

(??????)

19. RVD es una compañía Española, en abril de 2016 reparte

dividendos. DTA con todos menos con Perú. Cual es correcta?

Accionistas:

-compañía peruana 40% desde mayo 2015

- compañía francesa 8% desde marzo 2012

- compañía australiana 20%

- compañía italiana 32% desde septiembre 2015

a) RVD tiene que retenerle un 15% a la empresa francesa

b) RVD tiene que retenerle el 5% a la australiana

c) RVD must withhold a 5% to the Italian Company

d) RVD tiene que retener un 5% a la peruana (no hay DTA entonces

seria 19%)

- En España solo con un 5% ya se aplica la directiva

20. Entre los distintos métodos de doublé taxation relief. Cual de los

siguientes es falsa?

a) Credit method respect the fiscal benefits provided by the source

country. (Falso, porque si no pagas impuestos en source

country, en el residence y te dice tu tributa aqui por tu renta

mundial y luego te dejo restarte lo que has pagado fuera. Pero

si no has pagado nada fuera no te favorece: tu pierdes ese

beneficio fiscal)

b) Exemption with progressivity provides less double taxation relief

than pure exemption method.

c) Limitations to deductible foreign tax credit in partial credit

method only applies if tax rate in source country is higher than in

residence country (si tu has pagado mas que lo que tienes que

pagar aqui en residencia, es cuando tienen sentido las

limitaciones del partial credit method, si has pagado menos

pues te dejan restartelo entero)

d) In exemption method, the residence country refuses to tax

foreign income

Downloaded by Joan Recasens (jrekasens@gmail.com)

lOMoARcPSD|6017776

21. Mr. Jones, fiscal resident in UK, is thinking of selling its apartment

located in Madrid.

a) Mr. Jones tiene que declarar/reportar en España este capital gain

obtained with the selling of the apartment, according to article

13 of the MC OECD. (cierto, art.13 si tu vendes un immueble,

la capital gain la declaras y tributas en source country, donde

esta el inmueble)

b) El comprador del apartamento tiene que retener un 3% del

selling Price in any case (cierto, en España hay una retención del

3%, del precio de venta, cuando el que vende es un no

residente. Tenga ganancias o tenga perdidas)

c) Mr. Jones tiene que pagar 19% del capital gain of the selling of

the apartment. (cierto.)

d) All the previous options are true

22. In international taxation, the expression Treaty-shopping:

a) It refers to the distribution of the right to establish tax-free

shopping schemes for tax payers

b) It refers to a tax payer taking advantage of the provisions of a tax

treaty without really qualifying for.

c) It refers to a treat between two states when its granted by the

provisions of a tax treaty

d) It refers to the profit of business create under the provisions of a

tax treaty taxed only in residence country unless a permanent

establishment…

Treaty- shopping significa comprar las normas de un tratado

fiscal cuando en realidad tu no eres residente ni te mereces

ninguno de esos tratados.

Es como el rule shopping, cuando tu intentas disfrazar un tipo de

renta como si fuera otro tipo de renta para comprar esa norma.

Downloaded by Joan Recasens (jrekasens@gmail.com)

You might also like

- MorrisBreann Fall 2020 MGMT 343 Exam #1Document4 pagesMorrisBreann Fall 2020 MGMT 343 Exam #1Breann MorrisNo ratings yet

- BDO TestDocument7 pagesBDO TestMohsin AliNo ratings yet

- Tarea 06Document2 pagesTarea 06Pedro Miguel Vazquez Martinez0% (1)

- AnswerDocument8 pagesAnswerJericho PedragosaNo ratings yet

- Problems Retirement Withdrawal of A PartnerDocument4 pagesProblems Retirement Withdrawal of A PartnerMichaella ManlapazNo ratings yet

- Chapter 14 Multinational Tax Management Multiple Choice and True/False Questions 14.1 Tax PrinciplesDocument15 pagesChapter 14 Multinational Tax Management Multiple Choice and True/False Questions 14.1 Tax Principlesqueen hassaneenNo ratings yet

- Discussion - Example Problem of Keep or Drop DecisionsDocument2 pagesDiscussion - Example Problem of Keep or Drop DecisionsGiselle Martinez0% (1)

- 23Document83 pages23الملثم الاحمرNo ratings yet

- IAS 36 Impairment of Assets Illustrative Examples PDFDocument17 pagesIAS 36 Impairment of Assets Illustrative Examples PDFMaey RoledaNo ratings yet

- Annex 1 General Declaration by The Lead Beneficiary-Beneficiary1Document1 pageAnnex 1 General Declaration by The Lead Beneficiary-Beneficiary1Madalina SbarceaNo ratings yet

- Chapter 3 - Introduction To Income TaxationDocument4 pagesChapter 3 - Introduction To Income TaxationRoshel Rombaoa100% (1)

- Income TaxationDocument10 pagesIncome TaxationRocel Domingo100% (1)

- People Vs Castaneda DigestDocument3 pagesPeople Vs Castaneda DigestSteve NapalitNo ratings yet

- Monday Debra PYW216S EEDocument2 pagesMonday Debra PYW216S EEDeb LewisNo ratings yet

- 2015 VAT in Cambodia Sesion II 22aug 2015Document27 pages2015 VAT in Cambodia Sesion II 22aug 2015Sovanna HangNo ratings yet

- Value Added TaxDocument4 pagesValue Added TaxAllen KateNo ratings yet

- Practicequestions Mt3a 625Document25 pagesPracticequestions Mt3a 625sonkhiemNo ratings yet

- Direct Tax CodeDocument4 pagesDirect Tax CodeHardip MatholiyaNo ratings yet

- ch04 PDFDocument43 pagesch04 PDFdanielaNo ratings yet

- Problem 9Document1 pageProblem 9reemy13No ratings yet

- Module 6 - Operating SegmentsDocument3 pagesModule 6 - Operating SegmentsChristine Joyce BascoNo ratings yet

- Gross IncomeDocument32 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- Income Taxation IndividualDocument6 pagesIncome Taxation IndividualJessa BeloyNo ratings yet

- Lab Sessions 1 To 5 OTDocument95 pagesLab Sessions 1 To 5 OTShahbaz ahmadNo ratings yet

- SAP Lessons 1-5Document53 pagesSAP Lessons 1-5143incomeNo ratings yet

- Tax FinalDocument7 pagesTax FinalDinosaur KoreanNo ratings yet

- Tax 2 - Midterm Quiz 2-ModifiedDocument6 pagesTax 2 - Midterm Quiz 2-ModifiedUy SamuelNo ratings yet

- Handout 1 For Chapter 7 - Recognition and Valuation of Accounts ReceivablesDocument5 pagesHandout 1 For Chapter 7 - Recognition and Valuation of Accounts ReceivablesJamieNo ratings yet

- ch#5 of CFDocument2 pagesch#5 of CFAzeem KhalidNo ratings yet

- Cuartero - Unit 3 - Accounting Changes and Error CorrectionDocument10 pagesCuartero - Unit 3 - Accounting Changes and Error CorrectionAim RubiaNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- Chapter 11-12 VDocument30 pagesChapter 11-12 VAdd AllNo ratings yet

- Case 9-30 Master Budget With Supporting SchedulesDocument2 pagesCase 9-30 Master Budget With Supporting SchedulesCindy Tran20% (5)

- ArielleDocument2 pagesArielleVSRI1993100% (1)

- Cost and Management - Sample QuestionDocument5 pagesCost and Management - Sample Questionfreddy kwakwalaNo ratings yet

- CHAPTER 4 Regular Income Taxation Individuals ModuleDocument10 pagesCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- AISDocument20 pagesAISRhoda Mae Alba100% (1)

- RR Filing, Penalties, RemediesDocument7 pagesRR Filing, Penalties, RemediesLisa ManobanNo ratings yet

- Value Added TaxDocument6 pagesValue Added TaxjamNo ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Finama - FS Analysis - Quizlet 01 - 2016NDocument3 pagesFinama - FS Analysis - Quizlet 01 - 2016NKenneth Bryan Tegerero TegioNo ratings yet

- Chapter 6Document8 pagesChapter 6Romarie AbrazaldoNo ratings yet

- Aral Aral Din Bes Wag Puro Testbank Multiple Choice QuestionsDocument7 pagesAral Aral Din Bes Wag Puro Testbank Multiple Choice QuestionsKing MercadoNo ratings yet

- Incometaxation1 PDFDocument543 pagesIncometaxation1 PDFmae annNo ratings yet

- Chapter 11 Prob 11-27Document8 pagesChapter 11 Prob 11-27CelineAbbeyMangalindanNo ratings yet

- A. Condonation or Remission of A DebtDocument3 pagesA. Condonation or Remission of A DebtTk KimNo ratings yet

- Tax Chap 14 To 15Document7 pagesTax Chap 14 To 15Jea XeleneNo ratings yet

- IEB WireframeDocument7 pagesIEB WireframeVictor PaigeNo ratings yet

- K17405CA Assignment Kim Huong and Nhu ThuanDocument25 pagesK17405CA Assignment Kim Huong and Nhu Thuanthuylinh voNo ratings yet

- TAX.2814 Community-Taxes AnswersDocument1 pageTAX.2814 Community-Taxes AnswersCams DlunaNo ratings yet

- Income Taxation Answer ExamDocument5 pagesIncome Taxation Answer Examyezaquera100% (1)

- EDP Audit CIS Environment MeaningDocument7 pagesEDP Audit CIS Environment MeaningSushant MaskeyNo ratings yet

- Business and Transfer Tax Chapter 1Document27 pagesBusiness and Transfer Tax Chapter 1Deenji0% (1)

- Finacc 3 Question Set BDocument9 pagesFinacc 3 Question Set BEza Joy ClaveriasNo ratings yet

- Name: Section: Date:: Angel SantaDocument5 pagesName: Section: Date:: Angel SantaJoebet DebuyanNo ratings yet

- IllustrationsDocument3 pagesIllustrationsKristine Ira ConcepcionNo ratings yet

- Income TaxDocument109 pagesIncome TaxDaksh KohliNo ratings yet

- UNIT TWO Public Finance & TaxationsDocument37 pagesUNIT TWO Public Finance & Taxationstsegayeassefa5No ratings yet

- Final Tax ReviewerDocument35 pagesFinal Tax Revieweryza100% (1)

- Original Issuance of Shares of Stocks: Documentary Stamp TaxDocument4 pagesOriginal Issuance of Shares of Stocks: Documentary Stamp TaxJohn Paul EslerNo ratings yet

- R35 Capital Budgeting Q BankDocument15 pagesR35 Capital Budgeting Q BankAhmedNo ratings yet

- SIC InterpretationsDocument42 pagesSIC InterpretationsJean Fajardo Badillo100% (1)

- Chapter 4 - Reveneus and Other ReceiptsDocument57 pagesChapter 4 - Reveneus and Other ReceiptsBENITEZ, DIANNE ASHLEY G.100% (1)

- Tax Law NotesDocument6 pagesTax Law NotesDmitry MednovNo ratings yet

- Answer: D. All of The AboveDocument19 pagesAnswer: D. All of The AboveJomarNo ratings yet

- Untitled DocumentDocument4 pagesUntitled DocumentJoan RecasensNo ratings yet

- Summary On Fundamental Causes: Geography, Institutions, and CultureDocument56 pagesSummary On Fundamental Causes: Geography, Institutions, and CultureJoan RecasensNo ratings yet

- Topic 2 - Apunts 2 Topic 2 - Apunts 2Document30 pagesTopic 2 - Apunts 2 Topic 2 - Apunts 2Joan RecasensNo ratings yet

- Unit 1.1Document13 pagesUnit 1.1Joan RecasensNo ratings yet

- Final ExamDocument3 pagesFinal ExamJoan RecasensNo ratings yet

- Eco Env First ExerciseDocument3 pagesEco Env First ExerciseJoan RecasensNo ratings yet

- Introductory Aspects 2Document4 pagesIntroductory Aspects 2Joan RecasensNo ratings yet

- Management Accounting Final ExamDocument21 pagesManagement Accounting Final ExamJoan RecasensNo ratings yet

- Final Exam SolutionsDocument3 pagesFinal Exam SolutionsJoan RecasensNo ratings yet

- Official Texts: English and French. Registered Ex Officio On 2 July 1961Document29 pagesOfficial Texts: English and French. Registered Ex Officio On 2 July 1961Joan RecasensNo ratings yet

- Untitled DocumentDocument5 pagesUntitled DocumentJoan RecasensNo ratings yet

- Cases International Business LawDocument20 pagesCases International Business LawJoan RecasensNo ratings yet

- Southworth Company SelfDocument3 pagesSouthworth Company SelfJoan RecasensNo ratings yet

- CA6 Memotec SelfDocument2 pagesCA6 Memotec SelfJoan RecasensNo ratings yet

- Exercise 1: ApplicableDocument2 pagesExercise 1: ApplicableJoan RecasensNo ratings yet

- Case 1Document1 pageCase 1Joan RecasensNo ratings yet

- Percentage PDFDocument101 pagesPercentage PDFgopal.sivakrishNo ratings yet

- Double TaxationDocument4 pagesDouble TaxationLou Nonoi TanNo ratings yet

- Payslip For The Month of July-2020: Earnings Amount Deductions AmountDocument1 pagePayslip For The Month of July-2020: Earnings Amount Deductions AmountVikas GuptaNo ratings yet

- Republic of The Philippines Manila en Banc: Supreme CourtDocument4 pagesRepublic of The Philippines Manila en Banc: Supreme CourtCarmel Grace KiwasNo ratings yet

- CIR vs. Metro StarDocument1 pageCIR vs. Metro StarRodney SantiagoNo ratings yet

- FYI Memo Feb. 27, 2023 - CPS Revenue and AbatementsDocument3 pagesFYI Memo Feb. 27, 2023 - CPS Revenue and AbatementsWVXU NewsNo ratings yet

- CIR-vs-SM-Prime-Holdings DIGESTDocument3 pagesCIR-vs-SM-Prime-Holdings DIGESTMiguel100% (3)

- (Understanding TCC) TaxAdministrationDocument2 pages(Understanding TCC) TaxAdministrationhandoutNo ratings yet

- ASHIRVAAD PACKAGINGE-Way Bill SystemDocument1 pageASHIRVAAD PACKAGINGE-Way Bill SystemS V ENTERPRISESNo ratings yet

- Pre Mid Const 2Document4 pagesPre Mid Const 2AwitNo ratings yet

- (2023) 148 Taxmann - Com 185 (Bombay) (08-03-2023) Jetair (P.) Ltd. vs. Deputy Commissioner of Income-Tax Central Circle-5Document1 page(2023) 148 Taxmann - Com 185 (Bombay) (08-03-2023) Jetair (P.) Ltd. vs. Deputy Commissioner of Income-Tax Central Circle-5Jai ModiNo ratings yet

- Commonwealth Act Tax 466Document7 pagesCommonwealth Act Tax 466makulitkulit00No ratings yet

- TaxDocument4 pagesTaxKathlene JaoNo ratings yet

- Whatnext Edutech LLP: Salary Slip For October - 2019Document1 pageWhatnext Edutech LLP: Salary Slip For October - 2019NAVEEN ROYNo ratings yet

- University Commerce College, Jaipur Fifth List of Provisionally Admitted Candidates Session 2020-21 Category-OBCDocument8 pagesUniversity Commerce College, Jaipur Fifth List of Provisionally Admitted Candidates Session 2020-21 Category-OBCJugheadNo ratings yet

- Phil. History Module 14Document10 pagesPhil. History Module 14Janice Florece ZantuaNo ratings yet

- ARC Tip SheetDocument2 pagesARC Tip Sheetjoetodd_jtNo ratings yet

- Commissioner of Internal Revenue vs. Goodyear Philippines, Inc.Document2 pagesCommissioner of Internal Revenue vs. Goodyear Philippines, Inc.JoieNo ratings yet

- Unit 2 Scope of Total Income and Residential StatusDocument16 pagesUnit 2 Scope of Total Income and Residential StatusDeepeshNo ratings yet

- 1 Introduction To Tax Law and PracticeDocument47 pages1 Introduction To Tax Law and PracticePanashe MachekepfuNo ratings yet

- Tax Assignment 1Document8 pagesTax Assignment 1Jiaxi WNo ratings yet

- ESTATE TAX 1st Quiz Google Forms PDFDocument17 pagesESTATE TAX 1st Quiz Google Forms PDFJamaica DavidNo ratings yet

- Team Energy vs.Document2 pagesTeam Energy vs.MichelleNo ratings yet

- G.R. No. L-36081Document6 pagesG.R. No. L-36081Hannah Keziah Dela CernaNo ratings yet

- 9 ACCRA Investments Vs CA GR No. 96322 PDFDocument9 pages9 ACCRA Investments Vs CA GR No. 96322 PDFJeanne CalalinNo ratings yet