Professional Documents

Culture Documents

Root of All Evil

Uploaded by

Kost0 ratings0% found this document useful (0 votes)

7 views8 pagesThis document discusses different approaches and measures for defining money. It outlines two main approaches - the theoretical/conceptual approach which first defines money conceptually and then measures relevant assets, and the empirical approach which directly measures aggregates. The document also discusses debates around narrow vs. broad money measures, and how money is not a fixed concept but depends on preferences. It provides details on India's current monetary aggregate measures from M1 to M4, noting the distinctions between them and their characteristics and uses.

Original Description:

Original Title

money and banking lec-5

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses different approaches and measures for defining money. It outlines two main approaches - the theoretical/conceptual approach which first defines money conceptually and then measures relevant assets, and the empirical approach which directly measures aggregates. The document also discusses debates around narrow vs. broad money measures, and how money is not a fixed concept but depends on preferences. It provides details on India's current monetary aggregate measures from M1 to M4, noting the distinctions between them and their characteristics and uses.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views8 pagesRoot of All Evil

Uploaded by

KostThis document discusses different approaches and measures for defining money. It outlines two main approaches - the theoretical/conceptual approach which first defines money conceptually and then measures relevant assets, and the empirical approach which directly measures aggregates. The document also discusses debates around narrow vs. broad money measures, and how money is not a fixed concept but depends on preferences. It provides details on India's current monetary aggregate measures from M1 to M4, noting the distinctions between them and their characteristics and uses.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

“Lack of money is the root of all evil”

George Bernard Saw.

N. Jadhav

Money Concept and Measure

Definitional Issues

Concept of money and measure of

money are different issue.

Conceptualization of money shd precede

its measurement.

1. Priori or Theoretical Approach

2. Empirical Approach

In the theoretical approach money is

first conceptualized in terms of specific

functional or institutional approach and

then the corresponding measure is

obtained by aggregating relevant

financial assets possessing those specific

attributes.

On the other hand empirical approach

does not rely on any preconceived

notion of money. Instead it directly

arrives at a measure of money as an

aggregate of financial assets which,

when introduced in certain functions,

gives the best result in terms of specific

criteria.

-Theoretical approach is superior and

scientific. empirical approach defies

scientific sequence.

Money Stock Measures

The question of appropriate measure of

money is one of most debated issue in

economics. Two theories:

Transaction theories of money:

Money essentially is an inventory held

for transaction purposes. Narrow

Measure.

MV=PT

Asset Theories of money:

Different financial assets are regarded as

alternate ways of holding wealth.

Broader measure.

This debate suggests that what is

referred to as money is not a fixed and

invariant entity, but to a great extent is a

question of preference or judgement.

-As a matter of fact different financial

and real assets could be arranged in a

descending order with reference to

liquidity.

-Currency and demand deposits are the

most liquid assets as they are medium of

exchange. -Time deposits and

government bonds are liquid assets but

can not be converted into medium of

exchange without incurring some cost.

-At the bottom of the liquidity

continuum lie automobiles, real estates

and the like which can be liquidated at

short notice only at a substantial cost.

-The classification of monetary

aggregates currently used by most

central banks is based either on the

functional characteristics of monetary

assets or the institutional distinction

between banks and other financial

intermediaries.

Present Monetary Aggregate

-In India money stock measures

currently published ranges from M1 to

M4. Four measures used in India are:

M1 = Currency (with public) + Demand

Deposits + Other Deposits with RBI.

M1 = C+DD+OD most liquid narrow

money

M2 = M1 + Savings deposits with the

Post Office saving banks.

M3 = M1 + Time Deposits with banks.

Broad Money

M3=M1+TDs

M4 = M3 + All deposits with the post

office saving organization

Broadest measure

Characteristics of Present MA-:

1. Distinction between M1 and M3 is

based on separation of time deposits

with banks (which are deemed to be less

liquid) from currency and demand

deposits with banks.

2. the distinction between M1 and M3

on the one hand and M2 and M4 on the

other is based solely on the institutional

differentiation between banks and post

office saving organization.

3. Among the 4 measures of money, M1

and M3 are extensively used both for

policy purposes and in academic

exercise.

4. M3 captures the balance sheet of the

banking sector, the institutional

category, which has been the focus of

policy since it has a better correlation

with aggregate economic activity.

5. M1 does not adequately capture the

transaction balances of entities because

the manner in which savings deposits

with banks are partitioned into demand

and time categories-purely on the basis

of interest applications.

6. M1 is most liquid and M4 is least

liquid.

You might also like

- Summary of Michael M. Pompian's Behavioral Finance and Wealth ManagementFrom EverandSummary of Michael M. Pompian's Behavioral Finance and Wealth ManagementNo ratings yet

- Money SupplyDocument12 pagesMoney SupplyAppan Kandala VasudevacharyNo ratings yet

- 4 Week GEHon Economics IInd Semeter Introductory MacroeconomicsDocument14 pages4 Week GEHon Economics IInd Semeter Introductory Macroeconomicskasturisahoo20No ratings yet

- Agencies of Cash Flow: How to Raise and Invest Long-Term Money for Foundations and EndowmentsFrom EverandAgencies of Cash Flow: How to Raise and Invest Long-Term Money for Foundations and EndowmentsNo ratings yet

- Money Supply: Basic ConceptsDocument27 pagesMoney Supply: Basic ConceptsSandeep SinghNo ratings yet

- Business Economics Presentation On Money and Its MultiplierDocument15 pagesBusiness Economics Presentation On Money and Its MultiplierAnshNo ratings yet

- Lesson - 25 The Supply of Money Learning OutcomesDocument16 pagesLesson - 25 The Supply of Money Learning Outcomessaha1972No ratings yet

- RBI Classification of MoneyDocument10 pagesRBI Classification of Moneyprof_akvchary75% (4)

- Money Supply: Economics ProjectDocument9 pagesMoney Supply: Economics ProjectabhimussoorieNo ratings yet

- Class 12 Macro Economics Chapter 3 - Revision NotesDocument4 pagesClass 12 Macro Economics Chapter 3 - Revision NotesPappu BhatiyaNo ratings yet

- Liquidity Theory of MoneyDocument6 pagesLiquidity Theory of MoneyMujadid MuzamilNo ratings yet

- Money Demand and SupplyDocument22 pagesMoney Demand and SupplyHarsh Shah100% (1)

- Demand and Supply of MoneyDocument55 pagesDemand and Supply of MoneyKaran Desai100% (1)

- Demand and Supply of MoneyDocument55 pagesDemand and Supply of MoneyMayurRawoolNo ratings yet

- Bbs ProposalDocument7 pagesBbs ProposalChandni Kayastha69% (32)

- Money and Banking-St-1Document55 pagesMoney and Banking-St-1Safwa KhasimNo ratings yet

- Subject EconomicsDocument12 pagesSubject Economicsamitava deyNo ratings yet

- Chapter 3Document8 pagesChapter 3Jr AkongaNo ratings yet

- Money and Banking NotesDocument5 pagesMoney and Banking NotesNikhilGuptaNo ratings yet

- Monetary EconomicsDocument44 pagesMonetary EconomicsKintu GeraldNo ratings yet

- What is Money and How is it Created in 40 CharactersDocument7 pagesWhat is Money and How is it Created in 40 CharactersHassan NisarNo ratings yet

- Money in A Modern Economy: By-Sanskriti Kesarwani Roll No. - 22/COM) 120Document13 pagesMoney in A Modern Economy: By-Sanskriti Kesarwani Roll No. - 22/COM) 120SanskritiNo ratings yet

- MONEYDocument5 pagesMONEYShazia SadhikaliNo ratings yet

- Task 2Document2 pagesTask 2Danielle UgayNo ratings yet

- Unit II The Concept of Money SupplyDocument24 pagesUnit II The Concept of Money SupplyLoungo GopaneNo ratings yet

- money-and-banking-class-12-notesDocument19 pagesmoney-and-banking-class-12-notesananthanmb11No ratings yet

- What Is The Most Important Thing in Your Life ?: What Are We Aspiring For ?Document58 pagesWhat Is The Most Important Thing in Your Life ?: What Are We Aspiring For ?Shambhawi SinhaNo ratings yet

- The Supply of MoneyDocument12 pagesThe Supply of MoneyJoseph OkpaNo ratings yet

- Money SupplyDocument31 pagesMoney SupplyDivya JainNo ratings yet

- Economics ChapDocument8 pagesEconomics ChapJose J OlickalNo ratings yet

- PGDFM Finacial Mangment Final PDFDocument260 pagesPGDFM Finacial Mangment Final PDFAnonymous H4xWhTmNo ratings yet

- Distinguish narrow and broad money measuresDocument2 pagesDistinguish narrow and broad money measuresalibbaNo ratings yet

- Money Banking and The Financial System 2nd Edition Hubbard Solutions ManualDocument26 pagesMoney Banking and The Financial System 2nd Edition Hubbard Solutions ManualJoshuaSnowexds100% (48)

- Central Banking and Monetary Policy ExplainedDocument59 pagesCentral Banking and Monetary Policy ExplainedNherwin OstiaNo ratings yet

- Ch-5 MONEYDocument6 pagesCh-5 MONEYYoshita ShahNo ratings yet

- Chapter 4Document28 pagesChapter 4Santosh BhandariNo ratings yet

- The Supply of MoneyDocument6 pagesThe Supply of MoneyRobertKimtaiNo ratings yet

- Study On Behavioral Finance, Behavioral Biases, and Investment DecisionsDocument14 pagesStudy On Behavioral Finance, Behavioral Biases, and Investment DecisionsTJPRC PublicationsNo ratings yet

- Money and BankingDocument68 pagesMoney and BankingdivyaNo ratings yet

- Lecture 10money and Monetary PolicyDocument15 pagesLecture 10money and Monetary PolicyashwanisonkarNo ratings yet

- Financail Management 2 NotesDocument86 pagesFinancail Management 2 NotesRalph MindaroNo ratings yet

- 5money & BankingDocument53 pages5money & Bankingshikshita jainNo ratings yet

- Lecture No. 12 The Supply of MoneyDocument11 pagesLecture No. 12 The Supply of MoneyMilind SomanNo ratings yet

- Unit - 8: Monetary Theory Concept of Money SupplyDocument10 pagesUnit - 8: Monetary Theory Concept of Money SupplySamin maharjanNo ratings yet

- Money and Banking: 1. Write A Short Note On Evolution of MoneyDocument5 pagesMoney and Banking: 1. Write A Short Note On Evolution of MoneyShreyash HemromNo ratings yet

- Money Banking and The Financial System 2nd Edition Hubbard Solutions ManualDocument36 pagesMoney Banking and The Financial System 2nd Edition Hubbard Solutions Manualbonusredhot98cgt100% (19)

- SESSION-13 (REPORT) - Jessa LimpiadaDocument8 pagesSESSION-13 (REPORT) - Jessa LimpiadaJessaLimpiadaNo ratings yet

- University of The Philippines School of Economics: Study Guide No. 3Document4 pagesUniversity of The Philippines School of Economics: Study Guide No. 3Djj TrongcoNo ratings yet

- RBI Classification of MoneyDocument11 pagesRBI Classification of MoneyTejas BapnaNo ratings yet

- Macroeconomics Class 12 Money and BankingDocument11 pagesMacroeconomics Class 12 Money and BankingstudentNo ratings yet

- Econ 101 GrouphDocument17 pagesEcon 101 GrouphKARTIK GAGNEJANo ratings yet

- ACCOUNTS AND BUDGET SERVICE LEVEL-IV GUIDELINESDocument22 pagesACCOUNTS AND BUDGET SERVICE LEVEL-IV GUIDELINESeliyas mohammed100% (1)

- Wealth Management: Submitted byDocument7 pagesWealth Management: Submitted byChandan SrivastavaNo ratings yet

- Introduction FINANCEDocument9 pagesIntroduction FINANCEBOL AKETCHNo ratings yet

- Final Synopsis of VikasDocument13 pagesFinal Synopsis of VikasRakesh YadavNo ratings yet

- Advanced Corporate FinanceDocument8 pagesAdvanced Corporate Financenargis aliNo ratings yet

- Money and Monetarism: Unit HighlightsDocument18 pagesMoney and Monetarism: Unit HighlightsprabodhNo ratings yet

- Money and Banking 22-23Document17 pagesMoney and Banking 22-23larissa nazarethNo ratings yet

- Money and Banking - 10&11 PDFDocument8 pagesMoney and Banking - 10&11 PDFDebabrattaNo ratings yet

- Money and Banking Lec 1Document6 pagesMoney and Banking Lec 1KostNo ratings yet

- Annexure-92. (B.Com Hons) SYLLABUS PDFDocument136 pagesAnnexure-92. (B.Com Hons) SYLLABUS PDFPrakharNo ratings yet

- Relaxo CinderellaDocument14 pagesRelaxo CinderellatoughnedglassNo ratings yet

- Notes Toredemption of Preference SharesDocument40 pagesNotes Toredemption of Preference Sharesaparna bingiNo ratings yet

- Relaxo CinderellaDocument14 pagesRelaxo CinderellatoughnedglassNo ratings yet

- Relaxo CinderellaDocument14 pagesRelaxo CinderellatoughnedglassNo ratings yet

- Li Lu Lecture 2010 CBSDocument3 pagesLi Lu Lecture 2010 CBStatsrus1100% (2)

- Relaxo CinderellaDocument14 pagesRelaxo CinderellatoughnedglassNo ratings yet

- Relaxo Finale PDFDocument7 pagesRelaxo Finale PDFAditya MehtaNo ratings yet

- Minutes of Meeting MB GE32Document5 pagesMinutes of Meeting MB GE32Jay RaiNo ratings yet

- Li Lu Lecture 2010 Cbs PDF FreeDocument3 pagesLi Lu Lecture 2010 Cbs PDF FreeKostNo ratings yet

- Relaxo Finale PDFDocument7 pagesRelaxo Finale PDFAditya MehtaNo ratings yet

- Money and Banking Lec 4Document3 pagesMoney and Banking Lec 4KostNo ratings yet

- Li Lu Lecture 2010 CBSDocument3 pagesLi Lu Lecture 2010 CBStatsrus1100% (2)

- Li Lu Lecture 2010 CBSDocument3 pagesLi Lu Lecture 2010 CBStatsrus1100% (2)

- Money and Banking Paper Unique Code 12275303Document2 pagesMoney and Banking Paper Unique Code 12275303KostNo ratings yet

- 23 Dec 2020Document2 pages23 Dec 2020KostNo ratings yet

- Money and Banking Lec 1Document6 pagesMoney and Banking Lec 1KostNo ratings yet

- Money and Banking Lec 2Document6 pagesMoney and Banking Lec 2KostNo ratings yet

- Money and Banking Lec 3Document6 pagesMoney and Banking Lec 3KostNo ratings yet

- Innovation and Inclusive Growth: Spotting Mega OpportunitiesDocument7 pagesInnovation and Inclusive Growth: Spotting Mega Opportunitiesjeny babuNo ratings yet

- Compensation Management PDFDocument14 pagesCompensation Management PDFNarendiran SrinivasanNo ratings yet

- Unit 2: Marketing EnvironmentDocument22 pagesUnit 2: Marketing Environmentअभिषेक रेग्मीNo ratings yet

- Pain Relievers Trigger QuestionsDocument1 pagePain Relievers Trigger QuestionsAndrew ShinnNo ratings yet

- ReportDocument2 pagesReportumaganNo ratings yet

- Maloney SEC Letter July 23 2021Document30 pagesMaloney SEC Letter July 23 2021J.B.No ratings yet

- Exercise 12-8 Intangible AssetsDocument2 pagesExercise 12-8 Intangible AssetsJay LazaroNo ratings yet

- Write A Short Note On MNCS?Document2 pagesWrite A Short Note On MNCS?Ritesh KhandelwalNo ratings yet

- Global E-Business & CollaborationDocument2 pagesGlobal E-Business & CollaborationNurinda Ramadhanti PratamaNo ratings yet

- Dubai Logistics CorridorDocument2 pagesDubai Logistics CorridorhapuenjerNo ratings yet

- Eureka Forbes Case: Managing Sales EffortsDocument6 pagesEureka Forbes Case: Managing Sales EffortsPradeep PradeepNo ratings yet

- Introduction Voucher ConceptDocument9 pagesIntroduction Voucher Conceptnagesh dashNo ratings yet

- PDFDocument310 pagesPDFWaseem AhmedNo ratings yet

- 23-350001 Merit - Warba InvoiceDocument4 pages23-350001 Merit - Warba InvoicerameeshaNo ratings yet

- Shopee Malaysia BackgroundDocument2 pagesShopee Malaysia Backgroundazmi100% (3)

- Bank Tariff Guide For Hang Seng Wealth and Personal Banking CustomersDocument45 pagesBank Tariff Guide For Hang Seng Wealth and Personal Banking CustomersIsaacNo ratings yet

- N5 Economics June 2021Document10 pagesN5 Economics June 2021Honorine Ngum NibaNo ratings yet

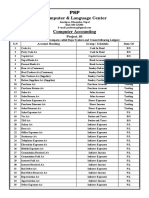

- Computer Accounting Project WorkDocument7 pagesComputer Accounting Project Workapi-319474134No ratings yet

- National Policy On Commuted Overtime For Medical & Dental PersonnelDocument13 pagesNational Policy On Commuted Overtime For Medical & Dental PersonnelNopepsi SobetwaNo ratings yet

- Traffic and Revenue PresentationDocument15 pagesTraffic and Revenue Presentationvivek1280No ratings yet

- Gautam KDocument12 pagesGautam Kgautam kayapakNo ratings yet

- Chapter Four: Investment/Project Appraisal - Capital BudgetingDocument40 pagesChapter Four: Investment/Project Appraisal - Capital BudgetingMikias DegwaleNo ratings yet

- Tax Invoice for OnePlus Nord BudsDocument1 pageTax Invoice for OnePlus Nord BudsAradhya BambamNo ratings yet

- Chapter 2 Answers For EconomicsDocument5 pagesChapter 2 Answers For EconomicsterrancekuNo ratings yet

- Questions Chapter 16 FinanceDocument23 pagesQuestions Chapter 16 FinanceJJNo ratings yet

- LD - Answer KeyDocument10 pagesLD - Answer KeyJeffrey Lois Sereño MaestradoNo ratings yet

- Account Statement: Page 1 of 3Document3 pagesAccount Statement: Page 1 of 3achyut kumarNo ratings yet

- From Seers to Sen: The Evolution of Economic DevelopmentDocument22 pagesFrom Seers to Sen: The Evolution of Economic DevelopmentBusola Esther DunmadeNo ratings yet

- Economics Today 17th Edition Roger Leroy Miller Solutions ManualDocument35 pagesEconomics Today 17th Edition Roger Leroy Miller Solutions Manualtuyetmanuelm5h5100% (26)

- Supply Chain Management of AMULDocument19 pagesSupply Chain Management of AMULashish chauhanNo ratings yet