Professional Documents

Culture Documents

Mod 7

Uploaded by

Renz Joshua Quizon Munoz0 ratings0% found this document useful (0 votes)

14 views1 pageOriginal Title

mod7

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 pageMod 7

Uploaded by

Renz Joshua Quizon MunozCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

OT rate: 25% of hourly rate - Deadline: On or before January 31

Reg. Holiday: 200% of hourly rate

Reg. Holiday OT: 260% of hourly rate BIR Form 1604C Annual Information Return of

Rest day in regular holiday: 260% of hourly rate Income Tax Withheld on Compensation

Rest day reg. Holiday OT: 338% - Attachment: Alphabetical List of

Special holiday: 130% of hourly rate Employees/Payees from whom Taxes were

Special holiday OT: 169% of hourly rate Withheld

Rest day special holiday: 150% of hourly rate - Declared and certified using BIR Form 2316

Rest day special holiday OT: 195% of hourly rate - Deadline: On or before January 31

Regular holiday on rest day: 260% of hourly rate

Special holiday on rest day: 150% of hourly rate 90,000 - Threshold of Nontaxable 13th Month Pay

Double holiday: 300% of hourly rate and Other benefits

Night diff: 10% of hourly rate

POLICIES:

Night diff OT: 10% of OT rate

7:30 - 16:30

Minimum Wage Earners:

7:46 - Late

CANLAS 16:14 - Undertime

CELESTIAL 18:31 - Overtime

GARCIA

Meal period – not less than1hr for every 6 days of

PEREZ

work scheduled by employer with consultation of

REYES

employees

SANTIAGO

13th month pay - 1/12 of the total basic salary

Newly Hired:

earned for the year

SORIANO - March

AGUILERA - May - is computed based on the guidelines of the

RIVERA - Dec Department of Labor and Employment (DOLE)

With tax dues: ZIP/RDO Codes

AGUILERA - 1654.10 SF- 2000/ 21B

SANTOS - 3825.24 AC - 2009/ 21A

Bacolor - 2001/ 21B

Tax withheld = 5489.34

Sta. Rita - 2002/ 21B

Tax remitted= 4611.04

Tarlac - 2316/ 17A

Magalang - 2011/ 21A

October Payroll Sheet

Porac - 2008/ 21A

Withholding Tax - Santos (894.38)

Mindoro - 5205/ 063

Social Security System (SSS) - social insurance Mexico - 2021/ 21B

program for employees for financial assistance Mabalacat 2020 / 21A

- basis: Gross Pay Manila -1000/ 033

Batangas - 4200/ 058

Philippine Health Insurance Company (PHIC) -

health insurance program for medical care

- 3%, minimum of 150

- basis: Basic Salary

Home Development Mutual Fund (HDMF)/Pag-

IBIG

- savings programs for housing loans

- 100 (maximum of 5000*2%)

BIR Form 2316 Certificate of Compensation

Payment/Tax Withheld for Compensation Payment

with or without Tax Withheld

- attached to BIR form 1700/1701 or the Annual

ITR

You might also like

- Salaries and WagesDocument8 pagesSalaries and WagesMc CasanoNo ratings yet

- E SocialDocument32 pagesE SocialKarolaine AraujoNo ratings yet

- Employee statutory deductions guideDocument1 pageEmployee statutory deductions guideGemelyn CuevaNo ratings yet

- Taxation - Withholding TaxDocument15 pagesTaxation - Withholding TaxJohn Francis IdananNo ratings yet

- Salary Slip (31431735 December, 2017)Document1 pageSalary Slip (31431735 December, 2017)sabahat cheemaNo ratings yet

- Aux Foods - Salary Slip - Okt 2023 - KothanayakeDocument1 pageAux Foods - Salary Slip - Okt 2023 - Kothanayakearrimon584No ratings yet

- Importance of Withholding Tax and How it WorksDocument14 pagesImportance of Withholding Tax and How it WorksJAYAR MENDZ100% (1)

- Salary Slip (30385759 October, 2021)Document1 pageSalary Slip (30385759 October, 2021)munafNo ratings yet

- Education Authority PunjabDocument1 pageEducation Authority PunjabMuhammad JamilNo ratings yet

- Salary Slip (30356680 April, 2019) PDFDocument1 pageSalary Slip (30356680 April, 2019) PDFMuhammad Farukh IbtasamNo ratings yet

- Withholding Taxes & Tax TablesDocument9 pagesWithholding Taxes & Tax Tableslloyd limNo ratings yet

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Document28 pagesModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyNo ratings yet

- PUA 1099G tax form summaryDocument1 pagePUA 1099G tax form summaryClifton WilsonNo ratings yet

- Codal Reference and Related IssuancesDocument17 pagesCodal Reference and Related IssuancesBernardino PacificAceNo ratings yet

- Personal TaxDocument7 pagesPersonal TaxNika JikaiiNo ratings yet

- Salary Slip PDFDocument1 pageSalary Slip PDFQamar BahadarNo ratings yet

- SABANADocument11 pagesSABANARamiro BalbiNo ratings yet

- Vida Laboral EditedDocument5 pagesVida Laboral Editedanderson sanchezNo ratings yet

- SalalalDocument1 pageSalalalHassan RanaNo ratings yet

- Tax Planning YT02Document87 pagesTax Planning YT02Fadhil El-HinduanNo ratings yet

- Tax Data Card 30 June 2014Document9 pagesTax Data Card 30 June 2014api-300877373No ratings yet

- Salary Slip (30385759 November, 2020)Document1 pageSalary Slip (30385759 November, 2020)munafNo ratings yet

- Benefit Payment Increase NSS - P239836957Document2 pagesBenefit Payment Increase NSS - P239836957Izzy BaeNo ratings yet

- June 2021Document138 pagesJune 2021SRO SEEDNo ratings yet

- Full & Final Pay Calculation: 368507 Nabata, Esathena BalderamaDocument4 pagesFull & Final Pay Calculation: 368507 Nabata, Esathena BalderamaËsatheńā ŃabaťāNo ratings yet

- Importance of Withholding Tax SystemDocument14 pagesImportance of Withholding Tax SystemAcademic Stuff100% (1)

- DOCUMENT HEALTH AUTHORITY PUNJAB DISTRICT ACCOUNTS OFFICE MONTHLY SALARY STATEMENTDocument1 pageDOCUMENT HEALTH AUTHORITY PUNJAB DISTRICT ACCOUNTS OFFICE MONTHLY SALARY STATEMENTAli ZiaNo ratings yet

- Gazala Shaheen SlipDocument1 pageGazala Shaheen Slipmumerfarooq684No ratings yet

- SPF 1984Document4 pagesSPF 1984sakthijack100% (2)

- Screenshot 2023-10-11 at 8.38.25 PMDocument1 pageScreenshot 2023-10-11 at 8.38.25 PMkhanversatile4No ratings yet

- Salary Slip (30677565 April, 2021)Document1 pageSalary Slip (30677565 April, 2021)MUHAMMAD SALEEM RAZANo ratings yet

- Tan No. of The Deductor Address of The Employee Nabagram C Block, Bara Bahera, Pin - 712 246Document1 pageTan No. of The Deductor Address of The Employee Nabagram C Block, Bara Bahera, Pin - 712 246Bhairab PrasadNo ratings yet

- GST 11th EditionDocument432 pagesGST 11th EditionBhavin PathakNo ratings yet

- HEALTH AUTHORITY PUNJAB SALARY STATEMENTDocument1 pageHEALTH AUTHORITY PUNJAB SALARY STATEMENTsaqib naveedNo ratings yet

- UnknownDocument4 pagesUnknownnayla marie santiago cuadradoNo ratings yet

- Statement of Axis Account No:919010012738847 For The Period (From: 08-09-2020 To: 07-09-2021)Document2 pagesStatement of Axis Account No:919010012738847 For The Period (From: 08-09-2020 To: 07-09-2021)Sayan SarkarNo ratings yet

- Salary Slip (30619303 October, 2023)Document1 pageSalary Slip (30619303 October, 2023)mytaxsgd202201No ratings yet

- MOBACK TECHNOLOGIES PAY SLIPDocument2 pagesMOBACK TECHNOLOGIES PAY SLIPAditya PLNo ratings yet

- Account SummaryDocument1 pageAccount SummaryBryan Peter DionisioNo ratings yet

- Formal Letter Opf DemandDocument8 pagesFormal Letter Opf DemandrcpanganibanNo ratings yet

- Withholding Tax Guide for COOPSDocument148 pagesWithholding Tax Guide for COOPSTagrit TagritNo ratings yet

- Salary Slip (30831376 November, 2019)Document1 pageSalary Slip (30831376 November, 2019)Muhammad AliNo ratings yet

- Monthly Salary Statement of Muhammad AwaisDocument2 pagesMonthly Salary Statement of Muhammad AwaisMuhammadNo ratings yet

- Salary Slip (30385759 November, 2019)Document1 pageSalary Slip (30385759 November, 2019)munafNo ratings yet

- Maharashtra Power Employee Payslip DetailsDocument1 pageMaharashtra Power Employee Payslip DetailsRajesh SirsathNo ratings yet

- PAYG payment summary individualDocument1 pagePAYG payment summary individualFook NgoNo ratings yet

- Reply To NelmarieDocument3 pagesReply To NelmarieHannah Mae CustodioNo ratings yet

- Wage Easy ATO Payment Summaries (2018 Jun 28)Document1 pageWage Easy ATO Payment Summaries (2018 Jun 28)Haillander Lopes viannaNo ratings yet

- JulyDocument1 pageJulyMike ElvisNo ratings yet

- How To Fill AGP SlipDocument1 pageHow To Fill AGP SlipFida DoxxNo ratings yet

- Madanapalle Institute of Technology & Science, (Autonomous)Document4 pagesMadanapalle Institute of Technology & Science, (Autonomous)vijay vijNo ratings yet

- Difference BillDocument6 pagesDifference BillHaseeb Ali GillNo ratings yet

- Punjab Education Salary StatementDocument1 pagePunjab Education Salary StatementSajjad AhmedNo ratings yet

- Ofelia Diana FalcesoDocument5 pagesOfelia Diana FalcesoOfelia Diana FalcesoNo ratings yet

- 130-Article Text-810-1-10-20200922Document20 pages130-Article Text-810-1-10-20200922Jeniffer Clarrisa AudreyNo ratings yet

- GST Invoice Organic PharmaDocument1 pageGST Invoice Organic PharmaVinay SharmaNo ratings yet

- Your Astro Bill: Muhd Ridhuan Bin Abdullah Sani NO 723, JLN EKAR 2/2 Bandar Ekar 71200, RANTAU, NEGDocument1 pageYour Astro Bill: Muhd Ridhuan Bin Abdullah Sani NO 723, JLN EKAR 2/2 Bandar Ekar 71200, RANTAU, NEGTokey IkanNo ratings yet

- R TSSDocument28 pagesR TSSAndri RodriguezNo ratings yet

- Monthly Salary StatementDocument1 pageMonthly Salary StatementAsim ShahzadNo ratings yet

- T R S A: HE Eview Chool of CcountancyDocument14 pagesT R S A: HE Eview Chool of CcountancyRenz Joshua Quizon MunozNo ratings yet

- Module 2 Environmental Scanning and Industry AnalysisDocument59 pagesModule 2 Environmental Scanning and Industry AnalysisRenz Joshua Quizon MunozNo ratings yet

- Straman Module 1 UpdatedDocument7 pagesStraman Module 1 UpdatedRenz Joshua Quizon MunozNo ratings yet

- After Reading This Chapter, You Should Be Able ToDocument7 pagesAfter Reading This Chapter, You Should Be Able ToRenz Joshua Quizon MunozNo ratings yet

- Module VIDocument13 pagesModule VIRenz Joshua Quizon MunozNo ratings yet

- Module VIDocument13 pagesModule VIRenz Joshua Quizon MunozNo ratings yet

- Taxation of rental income and partnerships under Philippine lawDocument13 pagesTaxation of rental income and partnerships under Philippine lawAnne Marieline BuenaventuraNo ratings yet

- Chapter 11 MCQs On Set Off and Carry Forward of LossessDocument10 pagesChapter 11 MCQs On Set Off and Carry Forward of LossessKaushar AlamNo ratings yet

- Proper execution of tax waiverDocument2 pagesProper execution of tax waiversmtm06No ratings yet

- Fundamental of Business 1st Assignment 2018Document21 pagesFundamental of Business 1st Assignment 2018Irfan MeharNo ratings yet

- Trade Policy in British IndiaDocument8 pagesTrade Policy in British IndiaSomtirtha SinhaNo ratings yet

- AP Micro Syllabus - 20222023Document11 pagesAP Micro Syllabus - 20222023Sarah SeeharNo ratings yet

- Quiz 1 Midterm - TaxDocument3 pagesQuiz 1 Midterm - TaxHazel Grace PaguiaNo ratings yet

- Arthur Lewis and Industrial Development in The Caribbean: An AssessmentDocument32 pagesArthur Lewis and Industrial Development in The Caribbean: An AssessmentRichardson HolderNo ratings yet

- Payslip CALCJB635 Apr 2023Document1 pagePayslip CALCJB635 Apr 2023alphonse INo ratings yet

- Duterte AdministrationDocument8 pagesDuterte Administrationvincent abrantesNo ratings yet

- Feldblum (Discounting Note)Document8 pagesFeldblum (Discounting Note)Anna KrylovaNo ratings yet

- The Economics of Progressive TaxationDocument8 pagesThe Economics of Progressive TaxationEphraim DavisNo ratings yet

- FICO Module Course ContentsDocument3 pagesFICO Module Course ContentsMohammed Nawaz Shariff100% (1)

- Tariff and Customs LawsDocument7 pagesTariff and Customs LawsRind Bergh DevelosNo ratings yet

- Sawan AdaniDocument1 pageSawan AdaniVijendraNo ratings yet

- Residential Status of HUFDocument2 pagesResidential Status of HUFyash agNo ratings yet

- Tax Collection at SourceDocument17 pagesTax Collection at SourceAARCHI JAINNo ratings yet

- ACC 1311 Introduction To Financial AccouDocument67 pagesACC 1311 Introduction To Financial AccouSharon Rose Galope100% (1)

- France: International Trading Project ReportDocument23 pagesFrance: International Trading Project Reportfun_maduraiNo ratings yet

- History of Public Fiscal AdministrationDocument13 pagesHistory of Public Fiscal AdministrationRonna Faith Monzon100% (1)

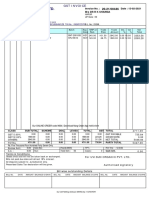

- Sample InvoiceDocument1 pageSample InvoiceEarnWealth Solutions Pvt LtdNo ratings yet

- City of Camden and Camden Redevelopment Agency v. Victor Urban Renewal Et Al.Document120 pagesCity of Camden and Camden Redevelopment Agency v. Victor Urban Renewal Et Al.jalt61No ratings yet

- Assign 7 Chapter 9 Financial Forecasting For Strategic Growth Cabrera 2019-2020Document6 pagesAssign 7 Chapter 9 Financial Forecasting For Strategic Growth Cabrera 2019-2020mhikeedelantar100% (1)

- Chapter 27 HW FinalDocument4 pagesChapter 27 HW FinalGabriel Aaron DionneNo ratings yet

- ELP-Exclusive Analysis Budget 2017Document66 pagesELP-Exclusive Analysis Budget 2017Panache ZNo ratings yet

- DTP 2nd ModuleDocument6 pagesDTP 2nd ModuleVeena GowdaNo ratings yet

- Expenditure StatementDocument100 pagesExpenditure StatementTaghral FarhanNo ratings yet

- DIF I - Regulatory IssuesDocument133 pagesDIF I - Regulatory Issuesparvez ansariNo ratings yet

- 1 Celestino v. CollectorDocument3 pages1 Celestino v. CollectorMark Anthony Javellana SicadNo ratings yet

- Capital Market Development in UgandaDocument83 pagesCapital Market Development in UgandaThach Bunroeun100% (1)