Professional Documents

Culture Documents

FXD 72 2021

FXD 72 2021

Uploaded by

Fitsum Tadesse0 ratings0% found this document useful (0 votes)

83 views3 pagesOriginal Title

FXD-72-2021

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

83 views3 pagesFXD 72 2021

FXD 72 2021

Uploaded by

Fitsum TadesseCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

PATEL Nd dPR AFA

NATIONAL BANK OF ETHIOPIA

A420 AN9/ADDIS ABABA

Foreign Exchange Surrender Requirements of Banks

{as Amended)

Directives No. FXD/72/2021

Whereas, it is necessary for the National Bank of Ethiopia to undertake activities conforming to

the achievement of safe and stable foreign exchange market in Ethiopia by setting foreign

exchange exposure limits and foreign exchange surrender requirements on Banks:

Now, therefore, pursuant to Articles 5(9) and 27(2) of the National Bank of Ethiopia

Establishment (as Amended) Proclamation No. 591/2008, these directives are hereby issued as

follows:

Articte= 1

Short Title

‘These direetives may be cited as “Foreign Exchange surrender requirements of Banks (as

Amended) Directives No. FXD/72/2021”

le -2

Definition

1.1 “Bank “means a company licensed by the National Bank of Ethiopia to undertake banking

business excluding Development Bank of Ethiopia;

1.2. “Foreign Exchange Inflow” for the purpose of these directives, refers to foreign exchange

received from export of goods, services, private transfers (remittance) and NGOs transfer.

1.3. “Mid exchange rate” means exchange rate between buying and selling rate of the day set

by the National Bank of Ethiopia.

Foreign Exchange Surrender Requirements

3.1. A Bank shall surrender Fifty Percent (50%) of receipts only from export of goods, services.

private transfers (remittance) and NGO's transfers to the National Bank of Ethiopia every

month within the first five working days of the next month,

RReI MRP A) sn: 40 nan #80

aren tomy Mi | Zot. sssooae | SM sasttrsstasee | OAK RPC sastarsst7.

3.2 The National Bank of Ethiopia shall credit the payment and seitlement account of the

bank with equivalent amount in Birt at the prevailing mid exchange rate,

Article-4

Reporting Requirement

4.1 A Bank shall report its foreign exchange cash flow signed by its President to the

National Bank of Ethiopia every week as per the format provided by the latter.

4.2. A Bank is required to send a foreign exchange surrender report to the National Bank of

Ethiopia every month within the first five working days of the next month;

Article 5

Penalty

5.1 A bank failing to surrender the foreign currency as required under these directives by

any means shall be subjected to a fine of USD 10,000(USD Ten Thousand) for each day

of delayed surrender up to a maximum of five working days following the final day of

surrender.

5.2 Notwithstanding the provision of sub-article 5.1 of these directives, who so ever fails to

comply with the provision of these directives or in any other manner violates or

obstructs the implementation of these directives shall be liable under Article 26 sub-

article 2 of the National Bank of Ethiopia Establishment (as amended) Proclamation

No.591/2008,

Repealed Directive

Directive No.FXD/54/2018 is hereby repealed and replaced by this Directive.

Article 7

Effective Date

‘These directives shall enter into force as of September 01, 2021.

Ate, GE RA

ie

ge (BIC)

Oy

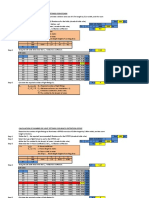

Table 1: Banks Monthly Total Foreign Exchange Surrender to NBE (In Millions of USD)

Name of the Bank:

Period: Ist Day of the month -Last day of the month

Of which: Total Forex Surrendered (50 percent of forex

receipts)

1. Exports (1.1+1.2)

1.1 Export of Goods

1.2 Export of Services

2. Private Transfers (2.1 + 2.2)

2.1 Individual Transfers(Remittance)

2.2 NGOs Transfers

i

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 5 - 5.8 Damp PreventionDocument8 pagesChapter 5 - 5.8 Damp PreventionFitsum TadesseNo ratings yet

- Chapter 5 - 5. 3 WallsDocument29 pagesChapter 5 - 5. 3 WallsFitsum TadesseNo ratings yet

- Chapter 5 - 5. 1 FoundationsDocument42 pagesChapter 5 - 5. 1 FoundationsFitsum TadesseNo ratings yet

- Chapter 5 - 5. 4 StairsDocument21 pagesChapter 5 - 5. 4 StairsFitsum TadesseNo ratings yet

- Project Information Document Access To Distributed Electricity and Lighting in Ethiopia P171742Document15 pagesProject Information Document Access To Distributed Electricity and Lighting in Ethiopia P171742Fitsum TadesseNo ratings yet

- Municipal Bid Specifications New Panel EditsDocument29 pagesMunicipal Bid Specifications New Panel EditsFitsum TadesseNo ratings yet

- Chapter 5 - 5. 2 FloorsDocument52 pagesChapter 5 - 5. 2 FloorsFitsum TadesseNo ratings yet

- Calculation of Number of Light Fittings For KitchenDocument10 pagesCalculation of Number of Light Fittings For KitchenFitsum TadesseNo ratings yet

- FXD 69 2021 - 2Document11 pagesFXD 69 2021 - 2Fitsum TadesseNo ratings yet

- FXD 70 2021Document3 pagesFXD 70 2021Fitsum TadesseNo ratings yet

- F Ft.. - P. FTR S 41 FH, 4 - Q .? H National Bank of EthiopiaDocument7 pagesF Ft.. - P. FTR S 41 FH, 4 - Q .? H National Bank of EthiopiaFitsum Tadesse100% (1)

- Residence Addis Ababa: Clinic Bill of Quantities For Electrical WorksDocument6 pagesResidence Addis Ababa: Clinic Bill of Quantities For Electrical WorksFitsum Tadesse100% (2)

- Electrical Design Report For G+1 Residential Building: Owner: Marta TemsgenDocument8 pagesElectrical Design Report For G+1 Residential Building: Owner: Marta TemsgenFitsum Tadesse100% (1)

- Zufan Wallelegn Electrical ReportDocument8 pagesZufan Wallelegn Electrical ReportFitsum Tadesse100% (3)

- Samiflex en Product CatalogDocument16 pagesSamiflex en Product CatalogFitsum TadesseNo ratings yet