50% found this document useful (2 votes)

1K views2 pagesLaura's Budgeting Case Study Analysis

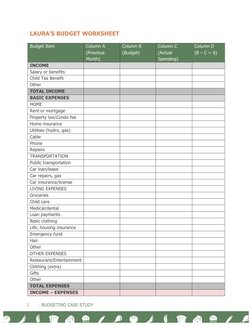

Laura receives $1,004 monthly from Ontario Works and $825.73 monthly in federal and provincial benefits. She pays $600 in rent and $144-165 monthly for utilities. She has a $100/month cell phone contract and some credit card debt requiring a $100 monthly payment. Laura takes her kids to restaurants on Fridays and for coffee, and the kids may need new clothes. Based on the information provided, Laura's expenses exceed her monthly income.

Uploaded by

Usman AliCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

50% found this document useful (2 votes)

1K views2 pagesLaura's Budgeting Case Study Analysis

Laura receives $1,004 monthly from Ontario Works and $825.73 monthly in federal and provincial benefits. She pays $600 in rent and $144-165 monthly for utilities. She has a $100/month cell phone contract and some credit card debt requiring a $100 monthly payment. Laura takes her kids to restaurants on Fridays and for coffee, and the kids may need new clothes. Based on the information provided, Laura's expenses exceed her monthly income.

Uploaded by

Usman AliCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Budgeting Case Study

- Laura's Budget Worksheet