Professional Documents

Culture Documents

2016 SCC Online Cestat 3269

Uploaded by

Himangini0 ratings0% found this document useful (0 votes)

8 views1 pageOriginal Title

2016 Scc Online Cestat 3269

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 page2016 SCC Online Cestat 3269

Uploaded by

HimanginiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

SCC Online Web Edition, © 2021 EBC Publishing Pvt. Ltd.

Page 1 Thursday, November 11, 2021

Printed For: Himangini Mishra, Gujarat National Law University - Koba

SCC Online Web Edition: http://www.scconline.com

© 2021 EBC Publishing Pvt.Ltd., Lucknow.

-----------------------------------------------------------------------------------------------------------------------------------------------------------

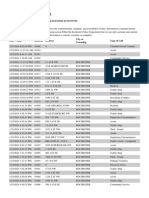

2016 SCC OnLine CESTAT 3269

In the Customs Excise and Service Tax Appellate Tribunal

West Zonal Bench at Mumbai

Court No. 1

(BEFORE M.V. RAVINDRAN, MEMBER (JUDICIAL) AND C.J. MATHEW, MEMBER (TECHNICAL))

(Arising out of Order-in-Original No. V/ST(HQ)/ADJ/HDFC-1022/09 dated

9.4.2012 passed by Commissioner of Central Excise, Thane-II)

HDFC Bank Ltd. … Appellant;

Versus

Commissioner of Central Excise, Thane-II … Respondent.

Application No. ST/MA(Ors)/93200/16-Mum and Appeal No. ST/488/12-Mum

Decided on August 9, 2016, [Date of Hearing: 9.8.2016]

Appearance:

Ms. Prajakta Menezes, C.A., for Appellant

Shri M.P. Damle, Assistant Commissioner (AR), for Respondent

ORDER NO.

M.V. RAVINDRAN, MEMBER (JUDICIAL):— This application is filed for raising

additional grounds of revenue neutrality in appeal No. ST/488/12.

2. After considering the submissions made by both sides, we find that this point of

revenue neutrality is a legal issue and hence we allow the application.

3. Since the appeal lies in a narrow compass, we take up the appeal for disposal.

4. Heard both sides and perused the records.

5. This appeal is filed against order-in-original No. V/ST(HQ)/ADJ/HDFC-1022/09

dated 9.4.2012, wherein the adjudicating authority has confirmed the demands raised

against the appellant categorizing the services rendered under ‘Merchant Banking

Services of Banking and other Financial Services’ by way of reverse charge

mechanism.

6. It is the case of the appellant before us that assuming, not accepting that the

tax liability arises under reverse charge mechanism, they are eligible to avail the

cenvat credit of such service tax paid by them as they are rendering taxable output

services. This is the argument not canvassed before the adjudicating authority. In our

considered view, this revenue neutrality point needs to be addressed to by the

adjudicating authority.

7. Without expressing any opinion on the merits of the case, keeping all the issues

open, we set aside the impugned order and remand the matter back to the

adjudicating authority to reconsider the issue afresh after following the principles of

natural justice.

8. The impugned order is set aside and the appeal is allowed by way of remand.

———

Disclaimer: While every effort is made to avoid any mistake or omission, this casenote/ headnote/ judgment/ act/ rule/ regulation/ circular/

notification is being circulated on the condition and understanding that the publisher would not be liable in any manner by reason of any mistake

or omission or for any action taken or omitted to be taken or advice rendered or accepted on the basis of this casenote/ headnote/ judgment/ act/

rule/ regulation/ circular/ notification. All disputes will be subject exclusively to jurisdiction of courts, tribunals and forums at Lucknow only. The

authenticity of this text must be verified from the original source.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Time Is of The Essence Even If The Extension Has Been Granted: 1. Bhudra Chand v. Betts ( (1915) 22 Cal. LJ 566)Document4 pagesTime Is of The Essence Even If The Extension Has Been Granted: 1. Bhudra Chand v. Betts ( (1915) 22 Cal. LJ 566)HimanginiNo ratings yet

- Enforcement of Indian JudgementsDocument23 pagesEnforcement of Indian JudgementsHimanginiNo ratings yet

- Uttam Singh Duggal & Co. LTD., v. United Bank of India and OthersDocument2 pagesUttam Singh Duggal & Co. LTD., v. United Bank of India and OthersHimanginiNo ratings yet

- DPCODocument2 pagesDPCOHimanginiNo ratings yet

- Drugs (Prices Control) Order, 2013Document18 pagesDrugs (Prices Control) Order, 2013HimanginiNo ratings yet

- Choice of LawDocument81 pagesChoice of LawHimanginiNo ratings yet

- Debt Recovery Tribunals in India: The Legal FrameworkDocument17 pagesDebt Recovery Tribunals in India: The Legal FrameworkHimanginiNo ratings yet

- In The High Court of Madhya Pradesh at Jabalpur: S.P. Khare, JDocument5 pagesIn The High Court of Madhya Pradesh at Jabalpur: S.P. Khare, JHimanginiNo ratings yet

- Ms. Manorama Kumari, Judicial Member and Chockalingam Thirunavukkarasu, Technical Member I.A. NO. 514 OF 2020 CP (IB) NO. 268 OF 2018 JANUARY 6, 2021Document5 pagesMs. Manorama Kumari, Judicial Member and Chockalingam Thirunavukkarasu, Technical Member I.A. NO. 514 OF 2020 CP (IB) NO. 268 OF 2018 JANUARY 6, 2021HimanginiNo ratings yet

- Ngo Jai Joseintroductionvol 11 Issue 2 IJCC2017Document8 pagesNgo Jai Joseintroductionvol 11 Issue 2 IJCC2017HimanginiNo ratings yet

- Australia Takes On Google Advertising Dominance in Latest Big Tech Fight - ReutersDocument1 pageAustralia Takes On Google Advertising Dominance in Latest Big Tech Fight - ReutersHimanginiNo ratings yet

- Canara Bank Vs Debts Recovery Appellate Tribunal aM140615COM402656Document12 pagesCanara Bank Vs Debts Recovery Appellate Tribunal aM140615COM402656HimanginiNo ratings yet

- Printout: Wednesday, August 16, 2017 7:21 PMDocument2 pagesPrintout: Wednesday, August 16, 2017 7:21 PMHimanginiNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Republic of The PhilippinesDocument5 pagesRepublic of The PhilippinesKenneth Cyrus OlivarNo ratings yet

- Motion To Reset HearingDocument2 pagesMotion To Reset HearingRogine ChaNo ratings yet

- Bill of Sale: Vehicle/Vessel DescriptionDocument1 pageBill of Sale: Vehicle/Vessel DescriptionTiffany NNo ratings yet

- (Revised Designation - Deputy Executive Engineer (Trans) No Roll No Category NameDocument10 pages(Revised Designation - Deputy Executive Engineer (Trans) No Roll No Category NameNagothane TestingNo ratings yet

- Signature Not VerifiedDocument9 pagesSignature Not VerifiedMuni ReddyNo ratings yet

- Oscar Wilde in America The Interviews PDFDocument212 pagesOscar Wilde in America The Interviews PDFkarhol del rioNo ratings yet

- Hail, Holy Queen Enthroned Above Hail, Holy Queen Enthroned AboveDocument2 pagesHail, Holy Queen Enthroned Above Hail, Holy Queen Enthroned AboveKennethSerpidoNo ratings yet

- Electronics Completion FormDocument2 pagesElectronics Completion FormAlvin ArlanzaNo ratings yet

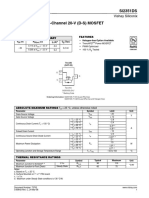

- Si2351DS: Vishay SiliconixDocument7 pagesSi2351DS: Vishay SiliconixbabasNo ratings yet

- Adgm Court Brochures Adm BrochuresDocument12 pagesAdgm Court Brochures Adm BrochuresDERICKNo ratings yet

- 15 Caltex vs. CIRDocument8 pages15 Caltex vs. CIRGnairah AmoraNo ratings yet

- Salazar vs. Achacoso, 183 SCRA 145, March 14, 1990Document12 pagesSalazar vs. Achacoso, 183 SCRA 145, March 14, 1990Mark ReyesNo ratings yet

- 04 - 41p - People of The Philippines vs. Mercado, G.R. No. 116239, November 29, 2000Document41 pages04 - 41p - People of The Philippines vs. Mercado, G.R. No. 116239, November 29, 2000Joshua RodriguezNo ratings yet

- What Are Hague-Visby Rules - Marine InsightDocument3 pagesWhat Are Hague-Visby Rules - Marine Insightanand raoNo ratings yet

- Astm B187Document7 pagesAstm B187Manivasagan VasuNo ratings yet

- Birth and Death Corrections (New) - CDMADocument2 pagesBirth and Death Corrections (New) - CDMADevendra DevNo ratings yet

- IMC No 2021-01 Revised Rules of Procedure Governing Administrative Cases Before The Insurance Commission w-Publication-DateREPDDocument13 pagesIMC No 2021-01 Revised Rules of Procedure Governing Administrative Cases Before The Insurance Commission w-Publication-DateREPDaligagNo ratings yet

- Case Study - Accounts Receivable (FI - AR)Document56 pagesCase Study - Accounts Receivable (FI - AR)Virgo CruzNo ratings yet

- Petitioners Vs Vs Respondent George Erwin M. Garcia Nicolas P. Lapena, JRDocument9 pagesPetitioners Vs Vs Respondent George Erwin M. Garcia Nicolas P. Lapena, JRCJ N PiNo ratings yet

- English: Quarter 4 - Module 3: Giving Expanded Definitions of WordsDocument12 pagesEnglish: Quarter 4 - Module 3: Giving Expanded Definitions of WordsGhen Marmito CostalesNo ratings yet

- Test Bank For Labour Relations 3 e 3rd Canadian Edition Larry SuffieldDocument10 pagesTest Bank For Labour Relations 3 e 3rd Canadian Edition Larry Suffieldfrankmooreepmgoaqjkb100% (20)

- Taiwan Kolin Corporation, LTD PowerpointDocument14 pagesTaiwan Kolin Corporation, LTD PowerpointCainta Mpl Jail TanNo ratings yet

- The Rule of Law (Lecture Notes)Document8 pagesThe Rule of Law (Lecture Notes)Brett SmithNo ratings yet

- CRPC Part-II Final AssignmentDocument7 pagesCRPC Part-II Final AssignmentMd Aríf Hussaín AlamínNo ratings yet

- Bharti AXA Life Elite Advantage Plan 502-9743977 Kiranmayi Sayi YerukalapudiDocument1 pageBharti AXA Life Elite Advantage Plan 502-9743977 Kiranmayi Sayi YerukalapudiDixit SushmithaNo ratings yet

- MVD 10002Document2 pagesMVD 10002idnac moralesNo ratings yet

- Law346 Chapter 2-Chapter 6Document64 pagesLaw346 Chapter 2-Chapter 6RAUDAHNo ratings yet

- Request For QuotationDocument2 pagesRequest For QuotationAbeh RamosNo ratings yet

- Media Statement Board Decision To Investigate Allegations Against Ceo 160823Document1 pageMedia Statement Board Decision To Investigate Allegations Against Ceo 160823Samane Junior MarksNo ratings yet

- RPD Daily Incident Report 1/23/24Document5 pagesRPD Daily Incident Report 1/23/24inforumdocsNo ratings yet