Professional Documents

Culture Documents

Notre Dame of Midsayap College: Performance/Activities

Uploaded by

Marites AmorsoloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notre Dame of Midsayap College: Performance/Activities

Uploaded by

Marites AmorsoloCopyright:

Available Formats

NOTRE DAME OF MIDSAYAP COLLEGE

MIDSAYAP, COLLEGE

COLLEGE OF BUSINESS AND ACCOUNTANCY

SUBJECT: COST ACCOUNTING AND CONTROL

TEACHER: HAMOD M. GULIDTEM, CPA

PERFORMANCE/ACTIVITIES

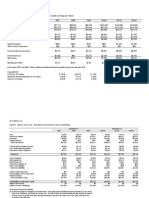

PROBLEM 1

LAKERS COMPANY contained the following account balances:

Cash P 100,000

Accounts Receivable 60,000

Finished Goods 35,000

Work in Process 18,000

Materials 50,000

Accounts Payable 10,000

Accrued Payroll 8,000

Ordinary Share Capital 200,000

Retained Earnings 45,000

During January 2019, the following transactions were completed.

1. Materials purchased on account, P200,000.

2. Factory overhead incurred on account, P35,000.

3. Payroll for the period consist of: direct labor – P140,000; indirect labor – P30,000; sales

salaries – P25,000; and administrative salaries – P15,000.

Deductions from payroll were as follows:

Withholding taxes P 18, 520

SSS Premiums 8,400

Phil Health Contributions 1,125

Pag-ibig Funds 6,300

4. P175,000 was paid for the payroll.

5. Computation of employer’s payroll tax is as follows:

Factory Selling Administrative

SSS Premiums P 8,500 P 1,250 P 750

Phil Health 600 375 150

Pag-ibig Fund 5,100 750 450

6. Materials issued: direct materials – P185,000; indirect – P35,000.

7. Factory overhead was charged to production at 80% of direct labor cost.

8. Work finished and placed in stock P410,000.

9. Cost of goods sold – P385,000. The markup was 40% of cost.

10. Cash collected from customers, P405,000

11. Payments for liabilities amounted to P220,000, other than payroll.

Requirements:

a. Journal entries to record the above entries.

b. Cost of Goods Sold Statement for January 2019.

c. Statement of Comprehensive Income for January 2019.

d. Statement of Financial Position as of January 31, 2019.

PROBLEM 2

On August 31, the inventory balances of CLIPPERS COMPANY, a manufacturer of high

quality men’s shirts, were as follows:

Materials Inventory P 21,360

Work in Process Inventory 15,112

Finished Goods Inventory 17,120

Job order cost cards for job in process as of September 30 had these totals:

Job No. Direct Materials Direct Labor Overhead

1 P1,596 P1,290 P1,677

2 1,492 1,380 1,794

3 1,984 1,760 2,288

4 1,608 1,540 2,002

The predetermined overhead rate is 130% of direct labor cost. Materials purchased and received

in September were as follows:

September 4 P 33, 120

September 15 28, 600

September 22 31, 920

Direct labor cost for September were as follows

September 15 P 23,680

September 25 25,960

Direct materials requested by production during September were as follows:

September 6 P 37,240

September 25 38,950

On September 30, CLIPPERS COMPANY sold on account finished goods with a 75% markup

over cost for P320,000.

Required:

1. Using T-accounts for Materials Inventory, Work in Process Inventory, Finished Goods

Inventory, Overhead, Accounts Receivable, Payroll Payable, Sales and Cost of Goods Sold,

reconstruct the transactions in September.

2. Compute the cost of units completed during the month.

3. What was the total cost of goods sold during the month?

4. Determine the ending inventory balances,

5. Jobs 1 and 3 were completed during the first week of October. No additional materials cost

were incurred, but Job 1 required P960 more of direct labor, and Job 3 needed an additional

P1,610 of direct labor. Job 1 was composed of 1,200 shirts and Job 3 of 900 shirts.

Compute the product unit cost for each job. (Round your answer to 2 decimal places.)

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Big Five Internal Audit Charter (Draft)Document5 pagesThe Big Five Internal Audit Charter (Draft)Marites AmorsoloNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Audit Command Language (ACL) What Is ACL?Document1 pageAudit Command Language (ACL) What Is ACL?Marites AmorsoloNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Notre Dame of Midsayap College: AssignmentDocument2 pagesNotre Dame of Midsayap College: AssignmentMarites AmorsoloNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Chapter 2Document9 pagesChapter 2Marites AmorsoloNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Seoul Seeking: Latagaw Travel & ToursDocument3 pagesSeoul Seeking: Latagaw Travel & ToursMarites AmorsoloNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Module 3 MacDocument8 pagesModule 3 MacBroniNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Chap 009Document11 pagesChap 009dbjn100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Cost Sheet (M-I)Document17 pagesCost Sheet (M-I)Yolo GuyNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Chapter 7 Supply ChainDocument15 pagesChapter 7 Supply Chainrahulg2710No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- SMCH 13Document47 pagesSMCH 13Lara Lewis AchillesNo ratings yet

- 27th Batch First PB MasDocument11 pages27th Batch First PB MasRommel Royce100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Restaurant P&L (Profit & Loss) : Learn & ShareDocument8 pagesRestaurant P&L (Profit & Loss) : Learn & Sharesaud khanNo ratings yet

- Budgeting: Principles of Managerial AccountingDocument82 pagesBudgeting: Principles of Managerial AccountingLucy UnNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- F2 Pre-Exam QuestionsDocument7 pagesF2 Pre-Exam Questionsaddi420100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Zkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSDocument34 pagesZkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSnabeel nabiNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Afar Merged PFD Cuties ClubDocument51 pagesAfar Merged PFD Cuties ClubKittenNo ratings yet

- E9-1 (L01) LCNRV: InstructionsDocument13 pagesE9-1 (L01) LCNRV: InstructionsTeam 1No ratings yet

- Dec-12 Solution PDFDocument58 pagesDec-12 Solution PDFOsan JewelNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- AKM 2 - Forum 7 - Andres - 43220110067Document13 pagesAKM 2 - Forum 7 - Andres - 43220110067tes doangNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- CODE: AIM 1003 Cost Accounting: AssignmentDocument10 pagesCODE: AIM 1003 Cost Accounting: AssignmentlifernNo ratings yet

- MSQ-01 - Standard Costs and Variance AnalysisDocument14 pagesMSQ-01 - Standard Costs and Variance Analysismimi supasNo ratings yet

- Basic Finance Module Materials List of Modules: No. Module Title CodeDocument49 pagesBasic Finance Module Materials List of Modules: No. Module Title CodeShaina LimNo ratings yet

- Flash Memory ExcelDocument4 pagesFlash Memory ExcelHarshita SethiyaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Cost 2 Finals Quiz 1 2Document15 pagesCost 2 Finals Quiz 1 2Jp Combis0% (1)

- CH 03Document41 pagesCH 03Nam NguyenNo ratings yet

- University of Perpetual Help System Dalta: Calamba Campus, Brgy. Paciano RizalDocument6 pagesUniversity of Perpetual Help System Dalta: Calamba Campus, Brgy. Paciano RizalJeanette Lampitoc100% (2)

- TeamExport A95152 Paris R Period 2Document71 pagesTeamExport A95152 Paris R Period 2HEM BANSALNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Example 2.1 ACCG 8307 (1) CPA Financial ReportingDocument2 pagesExample 2.1 ACCG 8307 (1) CPA Financial ReportingH M Yasir Muyid100% (1)

- Financial Statement Analysis Sip.... BhagyashreeDocument61 pagesFinancial Statement Analysis Sip.... BhagyashreeShubham PrasadNo ratings yet

- ProblemsDocument2 pagesProblemsJames AguilarNo ratings yet

- SMCH 12Document101 pagesSMCH 12FratFool33% (3)

- Activity 4 Job Order CostingDocument4 pagesActivity 4 Job Order CostingJOSCEL SYJONGTIANNo ratings yet

- Mas AssessmentDocument7 pagesMas AssessmentLuna VNo ratings yet

- Ca&c NotesDocument6 pagesCa&c NotesLourdes Sabuero TampusNo ratings yet

- Merchandise 1Document33 pagesMerchandise 1JcNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)