Professional Documents

Culture Documents

Accounting Principles Chapter 7 Solution Manual

Uploaded by

Kitchen UselessCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Principles Chapter 7 Solution Manual

Uploaded by

Kitchen UselessCopyright:

Available Formats

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

CHAPTER 7

Internal Control and Cash

Learning Objectives

1. Define cash and internal control.

2. Apply control activities to cash receipts and cash payments.

3. Describe the operation of a petty cash fund.

4. Describe the control features of a bank account and prepare

a bank reconciliation.

5. Report cash on the balance sheet.

Solutions Manual 7.1

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

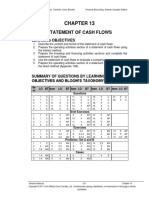

Summary of Questions by Learning Objectives and Bloom’s Taxonomy

Item LO BT Item LO BT Item LO BT Item LO BT Item LO BT

Questions

1. 1 K 6. 1 C 11. 2 C 16. 4 K 21. 4 C

2. 1 C 7. 2 K 12. 2 C 17. 4 C 22. 5 C

3. 1 K 8. 2 C 13. 2 C 18. 4 K 23. 5 K

4. 1 C 9. 2 C 14. 3 K 19. 4 K

5. 1 K 10. 2 C 15. 3 K 20. 4 K

Brief Exercises

1. 1 C 6. 2 AP 11. 4 C 16. 4 AP 21. 5 AP

2. 1 C 7. 3 AP 12. 4 C 17. 4 AP 22. 5 C

3. 2 C 8. 3 AP 13. 4 AP 18. 4 AP

4. 2 C 9. 4 K 14. 4 AP 19. 4 AP

5. 2 AP 10. 4 K 15. 4 AP 20. 4 AP

Exercises

1. 1 C 5. 3 AP 9. 4 AP 13. 4 AP 17. 5 AP

2. 1,2 C 6. 3 AP 10. 4 AP 14. 4 AP

3. 2 AP 7. 3 AP 11. 4 AP 15. 4 AP

4. 1,2 C 8. 4 AP 12. 4 AP 16. 5 AP

Problems

1. 1,2 C 4. 1,2,3 AP 7. 4 AP 10. 4 AP 13. 5 AP

2. 1,2 C 5. 1,2,3 AP 8. 4 AP 11. 4 AP

3. 1,2 C 6. 3,4 AP 9. 4 AP 12. 4 AP

Solutions Manual 7.2

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

Legend: The following abbreviations will appear throughout the

solutions manual file.

LO Learning objective

Bloom's

BT Taxonomy

K Knowledge

C Comprehension

AP Application

AN Analysis

S Synthesis

E Evaluation

Difficulty: Level of difficulty

S Simple

M Moderate

C Complex

Time: Estimated time to complete in minutes

AACSB Association to Advance Collegiate Schools of Business

Communication Communication

Ethics Ethics

Analytic Analytic

Tech. Technology

Diversity Diversity

Reflec. Thinking Reflective Thinking

CPA CM CPA Canada Competency Map

Ethics Professional and Ethical Behaviour

PS and DM Problem-Solving and Decision-Making

Comm. Communication

Self-Mgt. Self-Management

Team & Lead Teamwork and Leadership

Reporting Financial Reporting

Stat. & Gov. Strategy and Governance

Mgt. Accounting Management Accounting

Audit Audit and Assurance

Finance Finance

Tax Taxation

Solutions Manual 7.3

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

ASSIGNMENT CLASSIFICATION TABLE

Brief Problems Problems

Learning Objectives Questions Exercises Exercises Set A Set B

1. Define cash and internal 1, 2, 3, 4, 1, 2 1, 2, 4 1, 2, 3, 4, 1, 2, 3, 4,

control. 5, 6 5 5

2. Apply control activities to 7, 8, 9, 10, 3, 4, 5, 6 2, 3, 4 1, 2, 3, 4, 1, 2, 3, 4,

cash receipts and cash 11, 12 5 5

payments.

3. Describe the operation of a 13, 14, 15 7, 8 5, 6, 7 4, 5, 6 4, 5, 6

petty cash fund.

4. Describe the control features 16, 17, 18, 9, 10, 11, 8, 9, 10, 6, 7, 8, 9, 6, 7, 8, 9,

of a bank account and 19, 20, 21 12, 13, 14, 11, 12, 10, 11, 10, 11, 12

prepare a bank reconciliation. 15, 16, 17, 13, 14, 15 12

18, 19, 20

5. Report cash on the balance 22, 23 21, 22 16, 17 13 13

sheet.

Solutions Manual 7.4

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE

Problem Difficulty Time

Number Description Level Allotted (min.)

1A Identify internal control activities related to cash Moderate 25-35

payments.

2A Identify internal control weaknesses for cash receipts Moderate 25-35

and cash payments.

3A Identify internal control weaknesses over cash receipts Simple 25-35

and cash payments and suggest improvements.

4A Record petty cash transactions and identify internal Simple 25-35

controls.

5A Record debit and bank credit card and petty cash Moderate 25-35

transactions, and identify internal controls.

6A Record petty cash transactions, and identify impact on Moderate 20-30

financial statements.

7A Prepare bank reconciliation and related entries. Moderate 25-35

8A Prepare back reconciliation and related entries. Moderate 25-35

9A Prepare back reconciliation and related entries. Moderate 25-35

10A Prepare bank reconciliation and related entries. Moderate 40-50

11A Prepare bank reconciliation and related entries. Moderate 40-50

12A Prepare bank reconciliation and adjusting entries. Moderate 30-40

13A Calculate cash balance and report other items. Moderate 20-30

1B Identify internal control activities. Moderate 25-35

2B Identify internal control weaknesses over cash receipts Moderate 25-35

and suggest improvements.

3B Identify internal controls for cash receipts and cash Simple 25-35

payments.

4B Record petty cash transactions and identify internal Moderate 25-35

controls.

5B Record debit and bank credit card and petty cash Moderate 20-30

transactions and identify internal controls.

6B Record petty cash transactions, and identify impact on Moderate 20-30

financial statements.

7B Prepare bank reconciliation and related entries. Moderate 25-35

8B Prepare bank reconciliation and related entries. Moderate 40-50

Solutions Manual 7.5

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE (Continued)

Problem Difficulty Time

Number Description Level Allotted (min.)

9B Prepare bank reconciliation and related entries. Moderate 40-50

10B Prepare bank reconciliation and related entries. Complex 40-50

11B Prepare bank reconciliation and related entries. Moderate 40-50

12B Prepare bank reconciliation and adjusting entries. Moderate 30-40

13B Calculate cash balance and report other items. Moderate 20-30

Solutions Manual 7.6

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

BLOOM’S TAXONOMY TABLE

Correlation Chart between Bloom’s Taxonomy, Learning Objectives and End-of-

Chapter Material

Learning Objective Knowledge Comprehension Application Analysis Synthesis Evaluation

1. Define cash and internal Q7.1 Q7.2 P7.1A E7.4

control. Q7.3 Q7.4 P7.2A P7.4A

Q7.5 P7.3A P7.5A

Q7.6 P7.1B P7.4B

BE7.1 P7.2B P7.5B

BE7.2 P7.3B

E7.1

E7.2

2. Apply control activities to Q7.7 BE7.4 BE7.5 P7.4A

cash receipts and cash Q7.8 E7.2 BE7.6 P7.5A

payments. Q7.9 P7.1A E7.3 P7.4B

Q7.10 P7.2A E7.4 P7.5B

Q7.11 P7.3A

Q7.12 P7.1B

Q7.13 P7.2B

BE7.3 P7.3B

3. Describe the operation of a BE7.4 Q7.14 BE7.7 P7.5A

petty cash fund. Q7.15 BE7.8 P7.4B

E7.5 P7.5B

E7.6 P7.6A

E7.7 P7.6B

P7.4A

4. Describe the control Q7.16 Q7.17 BE7.13 E7.15

features of a bank account Q7.18 Q7.21 BE7.14 P7.6A

and prepare a bank Q7.19 BE7.11 BE7.15 P7.7A

reconciliation. Q7.20 BE7.12 BE7.16 P7.8A

BE7.9 BE7.17 P7.9A

BE7.10 BE7.18 P7.10A

BE7.19 P7.11A

BE7.20 P7.12A

E7.8 P7.6B

E7.9 P7.7B

E7.10 P7.8B

E7.11 P7.9B

E7.12 P7.10B

E7.13 P7.11B

E7.14 P7.12B

5. Report cash on the balance Q7.22 BE7.21 P7.13A

sheet. Q7.23 E7.16 P7.13B

BE7.22 E7.17

Broadening Your Perspective BYP7.1 Santé

BYP7.2 Saga

BYP7.3 BYP7.5

BYP7.4

Solutions Manual 7.7

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

ANSWERS TO QUESTIONS

1. Cash is cash on hand and in bank accounts. It includes coins, currency,

cheques, money orders, and travellers’ cheques. Cash equivalents are

short-term highly liquid (easily sold) investments that are not subject to

significant changes in value and with maturities of three months or less

when purchased. Cash would include cash and coins kept on hand to

make change at cash registers and cash equivalents would include a term

deposit for 60 days.

LO 1 BT: K Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

2. Agree. Internal control is the process designed and implemented by

management to help an organization achieve (1) reliable financial

reporting, (2) effective and efficient operations, and (3) compliance with

relevant laws and regulations. Through the implementation of internal

control, the efficiency of the operations will be improved.

LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

3. This is a violation of internal control. An essential control activity is to

make specific employees responsible for specific tasks. When all clerks

make change out of the same cash register drawer, this is a violation of

establishing responsibility. In this case, each sales clerk should have a

separate cash register, cash drawer, or password, and do pre- and post-

shift counts.

LO 1 BT: K Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

4. Independent checks of performance are necessary even if proper

segregation of duties is in place. This procedure is used to ensure that the

segregation of duties, and other control procedures are being correctly

followed and are working effectively. For example, the accounting records

are compared with existing assets or with external sources of information.

Problems or changes can be addressed immediately to restore the proper

controls and ensure the compliance with the business’ policies and

procedures.

LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

5. Documentation procedures provide evidence of the occurrence of

transactions and events. Many documents used in an organization require

pre-numbering and accounting for the numerical sequence of these

documents. An example is the use of pre-numbered cheques used for

payments. Checking the numerical sequence of used and recorded pre-

numbered documents helps to ensure that a transaction is not recorded

more than once or not at all.

Solutions Manual 7.8

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

LO 1 BT: K Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.9

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

QUESTIONS (Continued)

6. A company’s system of internal control can only give reasonable

assurance that assets are properly safeguarded and that accounting

records are reliable. The concept of reasonable assurance is based on the

belief that the cost of control activities should not be more than their

expected benefit. Ordinarily, a system of internal control provides

reasonable but not absolute, assurance. Absolute assurance would be too

costly.

The human element is an important factor in a system of internal control.

A good system may become ineffective through employee fatigue,

carelessness, and indifference. Moreover, internal control may become

ineffective as a result of collusion.

LO 1 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

7. Sales using debit cards and bank credit cards are similar in that they are

both considered cash transactions to retailers. Banks usually charge the

retailer a transaction fee for each debit card transaction and a fee that is a

percentage of the credit card sale. In both types of transactions, the

retailer’s bank will wait until the end of the day and make a deposit for the

full day’s transactions. Fees for bank credit cards are generally higher

than debit card fees.

Debit cards allow customers to spend only what is in their bank account

whereas a bank credit card gives the customer access to money made

available by a bank or other financial institution (similar to a short-term

loan).

LO 2 BT: K Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

8. Exact procedures will be different in every company, but the basic

principles should be the same. At the end of a day (or shift) the cashier

should count the cash in the cash register, record the amount, and turn

over the cash and the record of the amount to either a supervisor or the

person responsible for making the bank deposit. The person or persons

who handle the cash and make the bank deposit should not have access

to the cash register tapes or the accounting records. The cash register

tapes should be used in creating the journal entries in the accounting

records. An independent person who does not handle the cash should

make sure that the amount deposited at the bank agrees with the cash

register tapes and the accounting records.

LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.10

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

QUESTIONS (Continued)

9. Cash registers with scanners are readily visible to the customer. Thus,

they prevent the sales clerk from ringing up or scanning in a lower amount

and pocketing the difference. In addition, the customer receives an

itemized receipt, and the store’s cash register tape is locked into the

register for further verification.

LO 2 BT: C Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

10. Mail-in receipts in the form of cheques are generally accompanied by a

remittance slip. The envelopes should be opened in the presence of two

mail clerks. The amount of the remittance slip and the amount of the

cheque should be compared to establish any discrepancies. Each cheque

should be promptly stamped “For Deposit Only.” The remittance slips are

sent to the accounting department for recording and the cheques are sent

to the person responsible for making the bank deposits. Persons handling

the cheques must not be able to alter the accounting records. An

independent person should compare the deposit recorded by the bank

with the amount recorded in the accounting records. In a small company,

where it is not possible to have the necessary segregation of duties, the

owner should be responsible for cash receipts.

LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

11. Sanjeet is incorrect. Although internal controls for handling electronic

funds transfers (EFTs) are different from those for handling cash and

cheques, they nevertheless include proper authorization and segregation

of duties to ensure an employee cannot divert a customer payment to a

personal bank account and then cover it up through fraudulent accounting

entries.

LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

12. Incorrect. Payment by cheque or electronic funds transfer contributes to

effective internal control over cash payments. Pre-numbered cheques help

to ensure that all payments are accounted for. In addition, the bank

provides another record of the cash payments, and safekeeping of the

cash. However, effective control is also possible when small payments are

made from a petty cash fund.

LO 2 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.11

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

QUESTIONS (Continued)

13. Wanda could potentially commit a fraud by:

(1) shipping merchandise to herself and creating a false sale on account;

therefore, the inventory account will balance. She can then omit to

record a cash sale and take the cash from the cash sale and use it to

settle the false accounts receivable that was created as a result of the

false sale.

(2) when invoicing customers, Wanda could charge significantly lower

prices for sales to friends.

Instructor’s note: These are only two examples. Students may develop

other valid examples.

LO 2 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

14. The three activities that pertain to a petty cash fund and the related

internal control principles are:

(1) Establishing the fund. *

Establishment of responsibility for

custody of fund.

* Documentation procedures by

having the custodian cash the cheque

used to establish the fund.

(2) Making payments

from the fund. * Documentation

procedures because the custodian must

obtain receipts from cash registers or

invoices before the cash is paid out of the

petty cash fund.

(3) Replenishing the fund. * Segregation

of duties because individuals responsible

for the fund do not write or sign cheques.

* Documentation procedures.

Receipts or invoices must be provided to

justify the payment of the funds.

* Independent checks of

performance from the internal verification

because the request for replenishment

must be approved before the cheque is

issued.

LO 3 BT: K Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.12

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

QUESTIONS (Continued)

15. Journal entries are required for a petty cash fund when it is established

and replenished. Entries are also required when the size of the fund is

increased or decreased. Replenishment usually takes place before the

financial statements are prepared.

LO 3 BT: K Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

16. A company’s internal control is improved with the use of a bank account in

the following ways:

a. Physical control and restricted access over cash is more easily

maintained through the security and access controls provided by the

banking system.

b. The banking system provides a duplicate record of the transactions

affecting cash that are recorded in the company’s accounting records.

c. Endorsements of cheques by the payees provide proof of payment

that is invaluable in the case of disputes.

d. Most banks offer overnight deposit facilities that secure cash until the

deposits are processed, thereby discouraging robberies at the

company locations and providing for better security for company

employees.

e. Fast and efficient updates of cash transactions provide management

with real time information that avoids mistakes and clears up inquiries

through online access to banking activity.

f. Based on the company policies, the bank will enforce company policy

by allowing only authorized employees to sign cheques or have

access to banking information.

LO 4 BT: K Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

17. The purpose of the bank reconciliation is to establish the accuracy of the

amount reported as cash in the accounting records and to provide

effective internal control over cash. The employee that is assigned to

prepare the bank reconciliation should be someone who has no other

responsibilities that relate to cash. If a person had responsibility for

handling cash and also prepared the bank reconciliation, they could use

the bank reconciliation to hide fraud with cash receipts or cash payments.

If the division of the duties does not allow this segregation (handling of

cash and record keeping), then the owner of the business should prepare

the bank reconciliation.

LO 4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.13

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

QUESTIONS (Continued)

18. The four steps are: (1) determine deposits in transit, (2) determine

outstanding cheques, (3) discover any errors made (by the bank or by the

business), and (4) trace bank memoranda and other receipts and

payments.

LO 4 BT: K Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

19. a. An NSF cheque occurs when the cheque writer’s bank balance is less

than the amount of the cheque issued in payment.

b. In a bank reconciliation, a customer’s NSF cheque is deducted from

the balance per books. The bank has record of the NSF, but the

business does not.

c. An NSF cheque results in a journal entry in the company’s books,

as a debit to Accounts Receivable and a credit to Cash.

LO 4 BT: K Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

20. Paul should not rely on online banking to give him an accurate balance in

his bank account. Online banking can provide an up-to-date balance but

the balance will not be accurate if there are any deposits in transit or

outstanding cheques. The balance will also not be accurate if the bank

has made an error. Paul might also have made an EFT payment to a

supplier and post-dated the payment date to the due date of an invoice.

When looking at the balance online, he may have lost track of this pending

payment that does not yet appear on his bank account.

Paul should keep his own records and reconcile his calculation of the bank

balance with what the bank has reported. This is the only way to know if

there are any deposits in transit, outstanding cheques, or bank errors. This

is the only way to have accurate information on his bank account balance.

LO 4 BT: K Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

21. Jayne should include the monthly interest of $32 in the book section of her

bank reconciliation and not the bank section as is being suggested. The

bank has correctly reflected this transaction on the bank statement, while

the accounting records have not yet been updated for this transaction. The

bank has charged Jayne $32 in interest and she needs to update her

books to capture this. If the interest is not included, Jayne will be unable to

reconcile the bank and book balances.

LO 4 BT: C Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.14

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

QUESTIONS (Continued)

22. Disagree. The credit balance in the cash account does not mean there is

an error in the account. It is possible for the cash account to have a credit

balance to reflect a cash deficit or negative position. This situation can

occur assuming the business’ bank allows an overdraft position which is,

in effect, a temporary bank loan.

LO 5 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

23. A company may have cash that is not available for general use because it

is restricted for a special purpose. If the restricted cash is expected to be

used within the next year, the amount should be reported as a current

asset. When restricted funds will not be used in that time, they should be

reported as a non-current asset.

LO 5 BT: K Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.15

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 7.1

Cash in bank savings account $8,000

Cash on hand 850

Chequing account balance 14,000

Cash $22,850

LO 1 BT: C Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7.2

The six control activities include:

1. Establishment of responsibility: This control activity

involves assigning a task to one employee and making that

employee accountable for the task assigned. An example

would be assigning the responsibility to a cashier who is in

charge of taking in cash, using a cash register, and making

change when collecting parking fees.

2. Segregation of duties: This activity involves assigning tasks

to different individuals to prevent fraud or errors. An

example would be to separate the responsibility of

handling the cash from the record keeping of the parking

fee revenue.

3. Documentation procedures: This control activity provides

evidence of the transactions and events that have taken

place. This is particularly important when an employee is

handling cash. For Liberty Parking, when parking tickets

are issued giving customers parking access, the tickets

should be pre-numbered, and time and date stamped.

4. Physical and IT controls: These include mechanical and

electronic controls to safeguard (protect) assets and

improve the accuracy and reliability of the accounting

records. An example for the parking garage would be

barriers or gates for entering and exiting the parking lot.

Solutions Manual 7.16

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

BRIEF EXERCISE 7.2 (Continued)

5. Independent checks of performance: This control involves

the verification by an independent person that the control

activities are being followed. An example would be to have

a supervisor observe how the cashier is handling the

collection and recording of the cash using the cash

register.

6. Human resource controls: These controls involve protection

against employee fraudulent behaviour. The parking

garage should conduct thorough background checks

before hiring the parking lot cashier. Background checks

may include criminal records and reference checks,

verification of credentials, and credit checks.

LO 1 BT: C Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7.3

1. Human resource controls

2. Physical and IT controls

3. Independent checks of performance

4. Segregation of duties

5. Documentation procedures

6. Establishment of responsibility

LO 1 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.17

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

BRIEF EXERCISE 7.4

1. Documentation procedures

2. Physical and IT controls

3. Human resource controls

4. Independent checks of performance

5. Establishment of responsibility

6. Segregation of duties

LO 2 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7.5

Sept. 12 Cash..................................................... 496.50

Debit Card Expense (5 X $0.70)......... 3.50

Sales.............................................. 500.00

To record sales using debit cards.

LO 2 BT: AP Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7.6

April 16 Cash..................................................... 9,750

Credit Card Expense ($10,000 × 2.5%) 250

Sales.............................................. 10,000

To record sales using credit cards.

LO 2 BT: AP Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.18

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

BRIEF EXERCISE 7.7

March 2 Petty Cash......................................... 100

Cash.............................................. 100

To establish petty cash fund.

March 27 Supplies ............................................ 20

Postage Expense.............................. 27

Repairs Expense............................... 35

Cash.............................................. 82

To replenish petty cash fund.

LO 3 BT: AP Difficulty: S Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7.8

Nov. 30 Postage Expense.............................. 31

Supplies............................................. 42

Travel Expense................................. 16

Cash Over and Short........................ 1

....................................Cash ($100 − $10)

90

To replenish petty cash fund.

LO 3 BT: AP Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.19

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

BRIEF EXERCISE 7.9

a. A cheque is a written order to the bank to pay a specific

amount to a specific person. Control benefits of a

cheque include: 1) proper support for the payment is

provided before the cheque is issued and as subsequent

evidence of the payment; 2) pre-numbering, which

avoids unrecorded transactions; 3) dual signatures, to

ensure proper authorization of payments.

b. A bank statement shows a company’s bank transactions

and balance. Control benefits of a bank statement: The

bank statement is a document prepared by an entity

external to the business and it could highlight

unauthorized payments. It is used in the bank

reconciliation process, which is a key internal control

procedure for the business.

LO 4 BT: K Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7.10

1. c. EFT payment made by a customer

2. d. Bank debit memorandum for service charges

3. b. Outstanding cheques from the current month

4. b. Bank error in recording a $1,779 deposit as $1,977

5. b. Outstanding cheques from the previous month that are

still outstanding

6. e. Outstanding cheques from the previous month that are

no longer outstanding

7. a. Bank error in recording a company cheque made out

for $160 as $610

8. c. Bank credit memorandum for interest revenue

9. d. Company error in recording a deposit of $160 as $1,600

10. d. Bank debit memorandum for a customer’s NSF cheque

11. a. Deposit in transit from the current month

12. d. Company error in recording a cheque made out for $630

as $360

LO 4 BT: K Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.20

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

BRIEF EXERCISE 7.11

a. Outstanding cheques need to be deducted from the bank

balance to determine the adjusted bank balance. Since the

company has already recorded the cheques, the company

does not need to record an adjustment.

b. A bank debit memorandum for service changes will result

in an adjustment to the accounting records. In this case,

the adjustment will be a deduction from the unadjusted

cash balance per books.

c. An EFT payment made by a customer will result in an

adjustment to the accounting records. In this case the

adjustment will be an added to the unadjusted cash

balance per books.

d. Deposits in transit will need to be added to the unadjusted

bank balance to calculate the adjusted bank balance.

Since the company has already recorded the deposit, the

company does not need to record an adjustment.

e. A company error in recording cheque made out for $880

as $808 will result in an adjustment to the accounting

records. In this case the adjustment will be a deduction

from the unadjusted cash balance per books.

f. A bank error in clearing a cheque against Ellington

Company’s bank account when the cheque was written by

Wellington Company will be an adjustment to the bank

balance to calculate the adjusted bank balance. In this

case, the adjustment will be added to the unadjusted cash

balance per bank. The company has not made an error

and so does not need to make an adjustment.

LO 4 BT: C Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.21

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

BRIEF EXERCISE 7.12

a. Outstanding cheques of $1,200 – Deducted from the

unadjusted bank balance.

b. Deposits in transit of $5,250 – Added to the unadjusted

bank balance.

c. Debit memorandum for bank service charge of $25 –

Deducted from the unadjusted cash balance per books.

d. EFT of $1,970 from a customer for goods received – Added

to the unadjusted cash balance per books.

LO 4 BT: C Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7.13

Randolph Electric

Bank Reconciliation

December 31

Cash balance per bank..................................................... $6,653

Add: Deposits in transit................................................. 5,250

11,903

Less: Outstanding cheques............................................ 1,200

Adjusted cash balance per bank..................................... $10,703

Cash balance per books................................................... $8,758

Add: EFT from customer for goods received................ 1,970

10,728

Less: Service charge....................................................... 25

Adjusted cash balance per books................................... $10,703

LO 4 BT: AP Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.22

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

BRIEF EXERCISE 7.14

a. Bank Charges Expense.................... 35

...................................................Cash

35

To record bank service charge expense.

b. Cash................................................... 40

Interest Revenue.......................... 40

To record interest earned.

c. Cash................................................... 500

..................................................Sales

500

To record bank cash sale.

LO 4 BT: AP Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7.15

Cash balance per bank..................................................... $7,420

Add: Deposits in transit................................................. 1,620

9,040

Less: Outstanding cheques............................................ 762

Adjusted cash balance per bank..................................... $8,278

LO 4 BT: AP Difficulty: S Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7.16

Cash balance per books................................................... $9,500

Add: Interest earned........................................................ 40

9,540

Less: Charge for printing company cheques................ 35

Adjusted cash balance per books................................... $9,505

LO 4 BT: AP Difficulty: S Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.23

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

Solutions Manual 7.24

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

BRIEF EXERCISE 7.17

Howel Company

Bank Reconciliation

August 31

Cash balance per bank..................................................... $8,370

Add: Deposits in transit................................................. 3,005

11,375

Less: Outstanding cheques............................................ 1,623

Adjusted cash balance per bank..................................... $9,752

Cash balance per books................................................... $10,050

Add: Interest earned....................................................... 22

10,072

Less: NSF cheque............................................................ 280

Service charge....................................................... 00 40

Adjusted cash balance per books................................... $9,752

LO 4 BT: AP Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7.18

(a)Bank Charges Expense............................. 50

...................................................Cash

50

To record bank service charge expense.

(b)Accounts Receivable................................. 440

...................................................Cash

440

To record NSF cheque.

(c)Cash ($500 - $50)........................................ 450

Supplies........................................ 450

To correct error recording payment.

LO 4 BT: AP Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.25

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

BRIEF EXERCISE 7.19

1. a. The amount of the payment of an account payable

has been recorded in the books as $2,270 when the

correct amount is $1,270. The reconciling item of

$1,000 ($2,270 − $1,270) will appear as an increase to

the book cash balance.

b.

March 31 Cash................................................... 1,000

.............................Accounts Payable

1,000

To correct error recording payment on account.

2. a. The amount of the collection on account has been

recorded in the books as $2,450 when the correct

amount is $4,250. This is a transposition error. The

reconciling item of $1,800 ($2,450 − $4,250) will

appear as an increase to the book cash balance.

b.

March 31 Cash................................................... 1,800

.......................Accounts Receivable

1,800

To correct for error in recording deposit.

3. a. The amount of the deposit was recorded by the bank

as $5,750 when the correct amount is $2,720. The

reconciling item of $3,030 ($5,750 − $2,720) will

appear as a decrease to the bank cash balance.

b. No entry needed as this is a bank error.

LO 4 BT: AP Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.26

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

BRIEF EXERCISE 7.20

1. a. The amount of the payment of an account payable

has been recorded in the books as $2,810 when the

correct amount is $1,810. The reconciling item of

$1,000 ($2,810 − $1,810) will appear as an increase to

the book cash balance.

b.

June 30 Cash................................................... 1,000

.............................Accounts Payable

1,000

To correct for error in recording payment.

2. a. The amount of the collection on account has been

recorded in the books as $2,222 when the correct

amount is $3,333. The reconciling item of $1,111

($2,222 − $3,333) will appear as an increase to the

book cash balance.

b.

June 30 Cash................................................... 1,111

.......................Accounts Receivable

1,111

To correct for error in recording deposit.

3. a. The amount of the incorrect charge for the cheque

clearing was recorded by the bank as $825 when no

charge should have been recorded. This is a bank

error. The reconciling item of $825 will appear as an

increase to the bank cash balance.

b. No entry needed as this is a bank error.

LO 4 BT: AP Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.27

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

BRIEF EXERCISE 7.21

Cash and cash equivalents should be reported at $19,750

($5,500 + $750 + $10,000 + $3,500).

The cash refund due from CRA is a receivable. Stale-dated

cheques cannot be used, so the corresponding accounts

receivable remains outstanding. Postdated cheques are

receivables until they can be cashed on their valid date.

The treasury bill is a short-term investment of less than 90 days

and may be considered a cash equivalent.

LO 5 BT: AP Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 7.22

Current Assets:

Dupré Company should report the cash in bank, payroll bank

account, store cash floats, and petty cash as cash on its

balance sheet. The investments with original maturity dates of

fewer than 90 days may be grouped with cash as cash and cash

equivalents.

The short-term investments with maturity dates of 100 to 365

days should be reported as a separate item.

Non-current Assets:

The plant expansion fund cash should be reported as a non-

current asset because the fund is not expected to be used

during the next year.

LO 5 BT: C Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.28

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 7.1

a. Weakness or Strength b. Suggested Improvements

1. No establishment of The employees should use

responsibility over the cash separate cash drawers.

—weakness

Cash counts not performed Cash counts should be performed

independently—weakness by a supervisor at the end of the

shift and the totals compared to the

cash register tape.

2. Improper segregation of Different individuals should receive

duties could result in the cash, record cash receipts, and

misappropriation of cash— deposit the cash. In a small

weakness business this may be impossible;

therefore, it is imperative that

management take an active role in

the operations of the business to

be able to detect any accounting

irregularities.

3. Improper segregation of The same individual could omit the

duties—weakness documentation of a purchase

order, receive a shipment, and take

the merchandise, all without a

trace. Implement segregation of

duties to prevent the

misappropriation (loss) of assets.

4. Repair of physical control—

strength

5. Internal reviews completed

regularly, and issues

resolved—strength

6. Human resources control Apply the policy of replacing the

over employees’ duties position during vacations to the

including vacations— controller position.

strength except for the

controller position

Solutions Manual 7.29

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

LO 1 BT: C Difficulty: C Time: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.30

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

EXERCISE 7.2

1. a. Access to cash is not restricted. Cash is not placed

in a secure device until deposited. The locked metal

box being used is likely portable and not secure. The

control activity that is being violated is the physical

and IT control.

b. The excess cash should be stored in a secure

storage device such as a safe with no access

possible by the employees.

2. a. The responsibility for the cash drawer is not

assigned to a single employee. Follow up and control

over cash shortages is compromised. The control

activity that is being violated is the establishment of

responsibilities.

b. If several employees need to share the same cash

drawer to ring up sales, each employee should be

assigned an access code that is tracked by the cash

register for each transaction. Any cash shortages or

entry errors can be narrowed down to a particular

employee, by using the access code.

3. a. All employees handling cash should be bonded.

Failing to do so violates the human resource control.

Cash shortages through fraud may not be

recoverable from insurance.

b. Bond all employees handling cash.

4. a. Improper segregation of duties has been established,

leaving the possibility of the misappropriation of

company assets by the assistant controller. The

control activity violated is the segregation of duties.

b. Reassign the duties such that anyone having access

to cash does not also have access to the accounting

records.

Solutions Manual 7.31

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

EXERCISE 7.2 (Continued)

5. a. Destroying the remittance advices and credit card

sales receipts weekly exposes the business to the

risk of not being able to substantiate a claim against

a customer. The control activity violated is the

documentation procedures.

b. Obtain adequate storage space and eliminate the

weekly destruction of the documents.

LO 1,2 BT: C Difficulty: C Time: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting

EXERCISE 7.3

a. Mar. 15 Cash ($8,740 − $54)................... 8,686

Debit Card Expense

($1.35 × 40)............................. 54

Sales....................................... 8,740

To record debit card sales.

b. June 21 Cash ($2,000 − $80)................... 1,920

Credit Card Expense

($2,000 × 4%)......................... 80

Sales....................................... 2,000

To record credit card sales.

July 17 No entry

c. Oct. 7 Accounts Receivable—Ramos. 550

Sales....................................... 550

To record sales using company credit card.

Nov. 10 Cash............................................ 550

Accounts Receivable—Ramos 550

Collection on account.

LO 2 BT: AP Difficulty: M Time: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.32

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

EXERCISE 7.4

1. a. Company cheques are not pre-numbered and access

to blank cheques is not restricted, leaving the

possibility for someone to make an unauthorized

payment from the business bank account, which may

go undetected. Payment transactions may also

remain unrecorded in the accounting records. The

control activities that are being violated are

documentation and physical and IT controls.

b. Obtain pre-numbered cheques and account for their

numerical sequence. Store the unused cheques in a

secure area.

2. a. Improper segregation of duties, because only one

employee is signing cheques.

b. Require two employees to sign each cheque. It would

be appropriate to have only one person sign the

cheques, only if it was the owner.

3. a. Improper segregation of duties, leaving the

possibility of the misappropriation of company

assets as a result of having suppliers paid for goods

that have not been ordered or received. As well, the

purchasing agent can direct merchandise to be

delivered to a location other than the company’s

place of business. The control activities violated are

establishment of responsibility and the segregation

of duties.

b. Reassign the duties such that anyone having access

to inventory is not assigned the duty of authorizing

payments. As well, purchasing agents should be

restricted from having access to the inventory.

Solutions Manual 7.33

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

EXERCISE 7.4 (Continued)

4. a. Improper segregation of duties, leaving the

possibility of the misappropriation of company

assets through an unsupported payment or a

payment that is not a business expense. Duplicate

payments can be achieved by failing to stamp the

invoice as having been paid. The control activities

violated are establishment of responsibility and the

segregation of duties.

b. Reassign the duties such that anyone having signing

authority on the bank account does not have record

keeping duties or the task of stamping invoices paid.

5. a. The control activities violated is independent checks

of performance. The control achieved by verification

of the bank reconciliation has failed. The controller

prepares and signs all cheques, records all the

journal entries, and prepares the bank reconciliation

which would provide the controller the opportunity to

commit and conceal a fraud.

b. Have the owner properly scrutinize and approve the

bank reconciliation. Also, consider assigning

responsibility for the bank reconciliation to another

individual.

6. a. The control activity violated is human resource

controls. Individuals placed in a position of trust

could misappropriate company assets.

b. Perform thorough background checks.

Solutions Manual 7.34

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

EXERCISE 7.4 (Continued)

7. a. The control activity violated is human resource

controls. The purchasing agent may be

misappropriating company assets.

b. Insist that all personnel take scheduled vacation and

have their positions staffed during their absence.

LO 1,2 BT: C Difficulty: C Time: 30 min. AACSB: None CPA: cpa-t001 CM: Reporting

EXERCISE 7.5

a.

Feb. 14 Petty Cash......................................... 100

Cash.............................................. 100

To establish petty cash fund.

b.

Feb. 28 Supplies ($10 + $13 + $23)............... 46

Postage Expense.............................. 8

Merchandise Inventory.................... 30

Freight Out........................................ 17

Cash ($100 − $5)........................... 95

Cash Over and Short................... 6

To replenish petty cash fund.

LO 3 BT: AP Difficulty: S Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.35

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

EXERCISE 7.6

a.

Sept. 4 Petty Cash......................................... 200

Cash.............................................. 200

To establish petty cash fund.

b.

Sept. 30 Merchandise Inventory

($25 + $30 + $40).......................... 95

Freight Out ($15 + $20)..................... 35

Supplies............................................. 10

Cash Over and Short........................ 10

Petty Cash ($200 − $150)............. 50

Cash ($150 − $50)......................... 100

To replenish and decrease petty cash fund.

LO 3 BT: AP Difficulty: S Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

EXERCISE 7.7

May 1 Petty Cash......................................... 150.00

Cash.............................................. 150.00

To establish petty cash fund.

June 1 Delivery Expense.............................. 31.25

Postage Expense.............................. 39.00

Travel Expense................................. 62.00

Cash Over and Short........................ 13.00

Cash ($150.00 – $4.75)................. 145.25

To replenish petty cash fund.

July 1 Delivery Expense.............................. 31.00

Entertainment Expense.................... 71.00

Supplies............................................. 44.75

Cash ($150.00 – $3.25)................. 146.75

To replenish petty cash fund.

July 10 Petty Cash......................................... 50.00

Cash.............................................. 50.00

To increase petty cash fund.

Solutions Manual 7.36

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

LO 3 BT: AP Difficulty: S Time: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.37

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

EXERCISE 7.8

a.

TINDALL COMPANY

Bank Reconciliation

September 30, 2021

Cash balance per bank statement................................... $7,100

Add: Deposits in transit................................................. 1,380

8,480

Less: Outstanding cheques............................................ 3,120

Adjusted cash balance per bank..................................... $5,360

Cash balance per books..................................... $5,470

Add: Error in cheque No. 212: Supplies......... $ 54

EFT collection of Accounts Receivable 78 132

5,602

Less: Bank service charge................................ 22

NSF cheque.............................................. 220 242

Adjusted cash balance per books................................... $5,360

b. Sept. 30 Cash............................................ 132

Supplies ($482 – $428).......... 54

Accounts Receivable............ 78

To record bank reconciliation items.

30 Bank Charges Expense............. 22

Accounts Receivable................ 220

Cash....................................... 242

To record bank reconciliation items.

LO 4 BT: AP Difficulty: M Time: 25 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.38

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

EXERCISE 7.9

a.

Bank Reconciliation

January 31

Cash balance per bank statement................. $3,560.20

Add: Deposits in transit................................ 530.00

4,090.20

Less: Outstanding cheques.......................... 730.00

Adjusted cash balance per bank................... $3,360.20

Cash balance per books................................. $3,875.20

Less: NSF cheque.......................................... $490.00

Bank service charge............................ 25.00 515.00

Adjusted cash balance per books................. $3,360.20

b. Jan. 31 Accounts Receivable................ 490

Bank Charges Expense............. 25

Cash....................................... 515

To record bank reconciliation items.

LO 4 BT: AP Difficulty: M Time: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.39

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

EXERCISE 7.10

a.

CRANE VIDEO COMPANY

Bank Reconciliation

July 31

Cash balance per bank statement................. $7,263

Add: Deposits in transit................................ 1,300

8,563

Less: Outstanding cheques.......................... 591

Adjusted cash balance per bank................... $7,972

Cash balance per books................................. $7,284

Add: Collection of note receivable............... $700

Collection of interest revenue.............. 36 736

8,020

Less: Bank service charges ($28+ $20)...... 48

Adjusted cash balance per books................. $7,972

b. July 31 Bank Charges Expense............. 48

Cash....................................... 48

To record bank service charge expense.

31 Cash............................................ 736

Note Receivable.................... 700

Interest Revenue................... 36

To record bank reconciliation items.

LO 4 BT: AP Difficulty: M Time: 25 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.40

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

EXERCISE 7.11

a.

BRAD’S BURGER COMPANY

Bank Reconciliation

July 31

Cash balance per bank statement................. $7,363

Add: Bank error............................................... $700

Deposits in transit.................................. 2,200 2,900

10,263

Less: Outstanding cheques.......................... 594

Adjusted cash balance per bank................... $9,669

Cash balance per books................................. $8,784

Add: Collection of note receivable............... $1,250

Collection of interest revenue.............. 36 1,286

10,070

Less: NSF cheque........................................... 350

Error on cash sales ($32 - $23)............ 9

................................................................

Bank service charges ($22 + $20)........ 42 401

Adjusted cash balance per books................. $9,669

b. July 31 Bank Charges Expense............. 42

Sales........................................... 9

Accounts Receivable................ 350

Cash....................................... 401

To record bank reconciliation items.

31 Cash............................................ 1,286

Note Receivable.................... 1,250

Interest Revenue................... 36

To record bank reconciliation items.

LO 4 BT: AP Difficulty: M Time: 25 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.41

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

EXERCISE 7.12

a. Deposit in transit on May 31: $1,353

b. Other adjustments:

Interest earned of $32 must be added to the balance per

books.

EFT deposit of $956 must be added to the balance per

books

The error in the May 9 deposit must be corrected on the

books; therefore, the balance per books must increase

by $63 ($3,281 − $3,218).

LO 4 BT: AP Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

EXERCISE 7.13

a. Outstanding cheques on May 31:

No. 255 $ 262

No. 261 786

No. 264 680

$1,728

b. Other adjustments:

Decrease balance per books $54 for service charges

recorded by bank.

Decrease balance per books $450 for error in cheque

260—should be $500 not $50.

Decrease balance per books for NSF cheque of $395.

LO 4 BT: AP Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.42

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

EXERCISE 7.14

1. a. The amount of $40 ($2,090 – $2,050) needs to be added

to the company cash balance.

b. July 9 Cash....................................... 40

Accounts Receivable...... 40

To correct error recording deposit.

2. a. The amount of $450 ($1,060 – $610) needs to be added

to the company cash balance.

b. July 14 Cash....................................... 450

Accounts Payable........... 450

To correct error recording payment

on account.

3. a. The amount of $270 ($630 – $360) needs to be deducted

from the company cash balance.

b. July 16 Supplies................................. 270

Cash................................. 270

To correct recording purchase of supplies.

4. a. Nothing is recorded on the bank reconciliation. This was

a bank error and it was corrected by the bank on July

23.

b. No entry needed as this was a bank error.

5. a. The amount of $300 ($970 – $670) needs to be added to

the company cash balance.

b. July 31 Cash....................................... 300

Accounts Receivable...... 300

To correct for error recording deposit.

6. a. The amount of $200 needs to be added to the bank

balance.

b. No entry needed as this was a bank error.

Solutions Manual 7.43

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

LO 4 BT: AP Difficulty: C Time: 25 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.44

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

EXERCISE 7.15

a.

CLARESVIEW COMPANY

Bank Reconciliation

August 31, 2021

Cash balance per bank statement................................... $17,100

Add: Error cheque# 705 ($198 – $189).... $ 9

Deposits in transit............................ 17,050 17,059

34,159

Less: Outstanding cheques

# 673................................................. 1,490

# 710.................................................. 2,550

# 712.................................................. 2,480 6,520

Adjusted cash balance per bank..................................... $27,639

Cash balance per books................................................... $26,030

Add: EFT deposits of Accounts Receivable................ 2,050

28,080

Less: Bank service charge........................ $ 25

NSF cheque...................................... 416 441

Adjusted cash balance per books................................... $27,639

b. Aug. 31 Cash............................................ 2,050

Accounts Receivable............ 2,050

To record EFT collection on account.

31 Bank Charges Expense............. 25

Accounts Receivable................ 416

Cash....................................... 441

To record bank reconciliation items.

LO 4 BT: AP Difficulty: M Time: 25 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.45

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

EXERCISE 7.16

(a) Cash and cash equivalents balance June 30, 2021

1. Currency and coins............................................ $ 76

2. Guaranteed investment certificate ................... 12,900

3. June cheques...................................................... 375

5. Royal Bank chequing account........................... 2,360

6. Royal Bank savings account............................. 4,160

9. Cash register floats............................................ 330

10. Over-the-counter cash receipts for June 30:

Currency and coins........................................ 540

Cheques from customers.............................. 90

Debit card slips............................................... 550

Bank credit card slips.................................... 740

Total cash and cash equivalents....................... $22,121

b.

2. Note: The Guaranteed investment certificate in the

amount of $12,900 could be reported as a short-term

investment on the balance sheet instead of as a cash

equivalent. If it was reported as a short-term

investment, then the balance sheet would show Cash of

$9,221.

4. Postdated cheque—Balance sheet (accounts receivable)

7. Prepaid postage in postage meter—Balance sheet

(prepaid expense)

8. IOU from company receptionist—Balance sheet (other

receivables)

LO 5 BT: AP Difficulty: C Time: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.46

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

EXERCISE 7.17

(a) Cash and cash equivalents balance:

Cash in bank............................................ $42,000

Cash on hand.......................................... 12,000

Highly liquid investments...................... 34,000

Petty cash................................................ 500

Total cash and cash equivalents........... $88,500

b. The “Cash in plant expansion fund” should be reported as

part of long-term investments (a non-current asset).

“Receivables from customers” should be reported as accounts

receivable in the current assets. “Stock investments” should

also be reported in the current assets.

LO 5 BT: AP Difficulty: M Time: 20 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.47

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 7.1A

1. a. The same employee is responsible for purchasing and

receiving goods as well as matching the purchase

order to the receiving report and the supplier’s invoice.

This employee also approves the invoice for payment.

b. The following duties should be divided among the staff:

(1) Purchasing, (2) Receiving and preparing receiving

reports, (3) Matching receiving reports to invoices, and

(4) Approving the invoice for payment. The

responsibility for the matching of the purchase order

with the receiving report and the invoice should be

assigned to the assistant controller.

2. a. The numerical sequence of cheques is not tracked.

b. The numerical sequence of cheques should be tracked.

Checking the numerical sequence of used and

recorded pre-numbered cheques helps to ensure that a

payment is not recorded more than once, or not at all.

3. a. The controller is responsible for stamping the invoice

paid.

b. The owner, Stephanie Seegall, who is the cheque

signer, should be assigned the responsibility for

stamping the invoices paid, to prevent reuse.

4. a. The controller is responsible for preparing all the

cheques.

b. The responsibility for the preparation of the cheques,

along with the accompanying supporting documents

(invoices matched to receiving reports), should be

assigned to the assistant controller, as stated in item 1

above and the assistant should also check the

invoice’s accuracy and pricing.

Solutions Manual 7.48

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

PROBLEM 7.1A (Continued)

5. a. The controller is responsible for the preparation of all

the journal entries.

b. The journal entries should be prepared by the assistant

controller and the controller should approve the

entries.

6. a. The assistant controller posts the journal entries.

b. The task of posting approved journal entries should be

assigned to the bookkeeper or accountant in charge of

entering other business transactions.

7. a. Pre-signed cheques are left in the safe for the

controller to use in the owner’s absence.

b. During the absence of the owner, payments should be

postponed until the owner’s return, or signing authority

for reduced amounts of payments delegated to the

controller. Upon the owner’s return, the cheque

duplicates or journals of the cheques signed by the

controller should be approved by the owner.

8. a. Unrecorded cheques are charged to the owner’s

drawings account and there currently is no approval of

the bank reconciliation.

b. All entries relating to the owner’s account should be

approved by the owner. The owner should review and

approve the bank reconciliation monthly.

Taking It Further:

Designing and implementing a strong system of internal control

can help employees from being falsely accused of fraud. Any

errors in the purchasing and recording of payment transactions

could lead to false fraud accusations directed to anyone

involved in these activities.

LO 1,2 BT: C Difficulty: M Time: 35 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 7.49

Chapter 7

© 2019 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition

PROBLEM 7.2A

Taking It Further:

a. Weaknesses & b. Problems Suggested Improvements

1. No segregation of duties The duties of receiving cash and

between receiving the cash admitting students should be

and admitting students to the assigned to separate individuals.

lessons. The teachers could

admit students for free or

charge extra and pocket the

difference or report fewer

students and pocket the extra

money.

2. No segregation of duties in An independent person should

the accounting functions. The approve the invoices for payment

general manager could pre- and prepare the bank

pare fictitious invoices for reconciliations.

payment and it would not be

detected.

3. No segregation of duties. An independent person should

Sales persons are responsible be responsible for providing

for determining credit policies credit to customers.

and they receive a Alternatively, a policy could be

commission based on sales. implemented where salespeople

They could provide credit to a are only paid a commission on

bad credit risk customer to sales that are collected. This

receive the commission on would reduce motivation to make

the sale. sales to financially weak

customers.

4. No establishment of Access to the accounting

responsibility. No individual is records should be restricted and

solely responsible for the protected with password or

accounting software. All biometric restrictions.

programmers have access to

the accounting software,

which could provide

unauthorized changes to the

accounting records.