Professional Documents

Culture Documents

Problem 5-1A:: Selling Prices ($500 X 2.000 Units) $1.000.000

Uploaded by

Võ Triệu Vy0 ratings0% found this document useful (0 votes)

17 views6 pagesOriginal Title

5-1A-5-2A

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views6 pagesProblem 5-1A:: Selling Prices ($500 X 2.000 Units) $1.000.000

Uploaded by

Võ Triệu VyCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

Problem 5-1A:

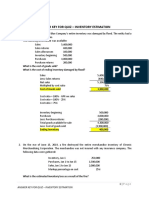

1. A contribution margin income statement:

Particulars Amounts ($) Amounts ($)

Selling prices ($500 x 2.000 units) $1.000.000

Variable costs:

Plastic for casing $34.000

Assembly worker wages $164.000

Drum stands $52.000

Sales commissions $30.000

-> Total variable costs $280.000

Contribution margin $720.000

Fixed costs:

Taxes on factory $10.000

Factory maintenance $20.000

Factory machinery depreciation $80.000

Sales equipment lease $20.000

Accounting staff salaries $70.000

Administrative management salaries $250.000

-> Total fixed costs $450.000

Pretax income $270.000

Income tax (25%) $67.500

Net income $202.500

2. Compute contribution margin per unit and contribution margin ratio:

Contribution margin per unit = Selling price - Variable cost

= $500 - ($280.000 / 2.000)

= $360

Contribution margin ratio = Contribution margin per unit / Selling price

= $360 / $500

= 72%

3. Interpret the contribution margin and the contribution margin ratio:

The contribution margin ($720.000) shows the difference between selling

prices and its variable costs.

The contribution margin ratio is 72%, this reveals that for each unit sold,

Harris Drum Company has $360 that contributes to covering fixed cost and

profit. If we consider sales in dollars, a contribution margin of 72% implies that

for each $1 in sales, this company has $0.72 that contributes to fixed cost and

profit.

5-2A:

1. Estimate Product HG’s break-even point in terms of (a) sales units and

(b) sales dollars.

a. Break - even point (sales in units):

The contribution margin per unit = $200 - $170 = $30

Break - even point (sale in units) = $330.000 / $30 = $11.000

b. Break - even point (sales in dollars) = $11.000 x $200 = $2.200.000

2. Prepare a CVP chart for Product HG like that in Exhibit 5.14. Use

20,000,000 yards as the maximum number of sales units on the

horizontal axis of the graph, and $4,000,000 as the maximum dollar

amount on the vertical axis.

3. Prepare a contribution margin income statement showing sales,

variable costs, and fixed costs for Product HG at the break-even point.

Particulars Amounts ($)

Selling prices $2.200.000

Variable costs (11.000 units at $170 $1.870.000

each)

Contribution margin $330.000

Fixed costs $330.000

Net income $0

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Exercises With Solutions - CH0104Document17 pagesExercises With Solutions - CH0104M AamirNo ratings yet

- CVP AnalysisDocument7 pagesCVP AnalysisKat Lontok0% (1)

- Assignment, Managerial AccountingDocument8 pagesAssignment, Managerial Accountingmariamreda7754No ratings yet

- UTECH CVP Income Statement 2010Document8 pagesUTECH CVP Income Statement 2010dcarruciniNo ratings yet

- Tutorial 7Document3 pagesTutorial 7Steven CHONGNo ratings yet

- Enigma Corporation Cost of Goods SoldDocument6 pagesEnigma Corporation Cost of Goods SoldEunice CoronadoNo ratings yet

- Session 4 Practice ProblemsDocument11 pagesSession 4 Practice ProblemsRishika RathiNo ratings yet

- Accounting - Exercise Chapter 22Document2 pagesAccounting - Exercise Chapter 22AmelynieNo ratings yet

- Variable & Absorption Costing Income Statements with Constant Sales & Variable ProductionDocument17 pagesVariable & Absorption Costing Income Statements with Constant Sales & Variable ProductionApurvAdarshNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Jawaban Soal UAS AkmenDocument3 pagesJawaban Soal UAS AkmenElyana IrmaNo ratings yet

- Soultions - Chapter 3Document8 pagesSoultions - Chapter 3Naudia L. TurnbullNo ratings yet

- Tugas Chapter 8Document8 pagesTugas Chapter 8wiwit_karyantiNo ratings yet

- Problem CH 7 Hansen Mowen Cornerstone of Managerial AccountingDocument8 pagesProblem CH 7 Hansen Mowen Cornerstone of Managerial Accountingwiwit_karyantiNo ratings yet

- Corporate Finance Management: Sumaira Riaz Test 1Document4 pagesCorporate Finance Management: Sumaira Riaz Test 1olga marnicaNo ratings yet

- BUACC2614Document6 pagesBUACC2614SanjeevParajuliNo ratings yet

- Spreadsheet ProjectDocument12 pagesSpreadsheet ProjectNiyathiNo ratings yet

- Chapter 2 and 3 Standard Costing & Fundamentals of Variance AnalysisDocument23 pagesChapter 2 and 3 Standard Costing & Fundamentals of Variance AnalysisFidelina CastroNo ratings yet

- Tutorial 4 SolutionsDocument14 pagesTutorial 4 Solutionss11186706No ratings yet

- UTS AKMEN - IRA MS - 01012622226026 - 52B FinalDocument7 pagesUTS AKMEN - IRA MS - 01012622226026 - 52B FinalIra M. SariNo ratings yet

- Tutorial 7 (Week 9) - Managerial Accounting Concepts and Principles - Cost-Volume-Profit AnalysisDocument7 pagesTutorial 7 (Week 9) - Managerial Accounting Concepts and Principles - Cost-Volume-Profit AnalysisVincent TanNo ratings yet

- Tutorial 2Document10 pagesTutorial 2Shah ReenNo ratings yet

- Managerial Accounting-Solutions To Ch06Document7 pagesManagerial Accounting-Solutions To Ch06Mohammed HassanNo ratings yet

- Garrison 14e Practice Exam - Chapter 6Document4 pagesGarrison 14e Practice Exam - Chapter 6Đàm Quang Thanh TúNo ratings yet

- MANACC - NotesW - Answers - BEP - The Master BudgetDocument6 pagesMANACC - NotesW - Answers - BEP - The Master Budgetldeguzman210000000953No ratings yet

- Notes CVP 2009, 2017Document13 pagesNotes CVP 2009, 2017Aaron ForbesNo ratings yet

- Acct 202 Exam 2 ReviewDocument4 pagesAcct 202 Exam 2 ReviewDrew TaylorNo ratings yet

- CVP AnalysisDocument8 pagesCVP AnalysisEricka Mae AntiolaNo ratings yet

- E8-29 Segmented Income Statement: Conceptual ConnectionDocument5 pagesE8-29 Segmented Income Statement: Conceptual ConnectionDhiva Rianitha Manurung100% (1)

- ACG 2071, Test 2-Sample QuestionsDocument11 pagesACG 2071, Test 2-Sample QuestionsCresenciano MalabuyocNo ratings yet

- Managerial Accounting Case 1 Break-Even AnalysisDocument4 pagesManagerial Accounting Case 1 Break-Even AnalysisKaren AlonsagayNo ratings yet

- 8a Acct2112 Week 8 Tute Q & S Ic s2 2023Document8 pages8a Acct2112 Week 8 Tute Q & S Ic s2 2023z8gss49hf4No ratings yet

- CH 06Document7 pagesCH 06Gus JooNo ratings yet

- Chapter 13 ExcelDocument42 pagesChapter 13 ExcelMd Al Alif Hossain 2121155630No ratings yet

- Principles of Accounting Vol 2 Managerial Accounting Chapter 3 - Answer KeysDocument4 pagesPrinciples of Accounting Vol 2 Managerial Accounting Chapter 3 - Answer KeysAnonymous MNo ratings yet

- Tutorial ContDocument25 pagesTutorial ContJJ Rivera75% (4)

- At Wid SolDocument4 pagesAt Wid SolglamfactorsalonspaNo ratings yet

- Europa Publications Financial AnalysisDocument4 pagesEuropa Publications Financial Analysisbella100% (1)

- Answer Key To Test #1 - ACCT-312 - Fall 2019Document8 pagesAnswer Key To Test #1 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- Problem 2.31 Contribution Margin Variance, Contribution Margin Volume Variance, Sales Mix VarianceDocument2 pagesProblem 2.31 Contribution Margin Variance, Contribution Margin Volume Variance, Sales Mix VarianceSunghoon SsiNo ratings yet

- Acc 301 Week 5Document9 pagesAcc 301 Week 5Accounting GuyNo ratings yet

- 202-0101-001 - ARIF HOSEN - Management Accounting Assignment 1Document11 pages202-0101-001 - ARIF HOSEN - Management Accounting Assignment 1Sayhan Hosen Arif100% (1)

- Problem 8-35 Hansen Mowen Cornerstone of Managerial AccountingDocument4 pagesProblem 8-35 Hansen Mowen Cornerstone of Managerial Accountingwiwit_karyantiNo ratings yet

- CVPDocument8 pagesCVPJessica EntacNo ratings yet

- MARGINAL COSTING ExamplesDocument10 pagesMARGINAL COSTING ExamplesLaljo VargheseNo ratings yet

- 4 Cvpbe PROB EXDocument5 pages4 Cvpbe PROB EXjulia4razoNo ratings yet

- Question 1-1-1Document14 pagesQuestion 1-1-1Aqsa AnumNo ratings yet

- Prepared by DR - Hassan Sweillam University of 6 of October, EgyptDocument18 pagesPrepared by DR - Hassan Sweillam University of 6 of October, EgyptjgjghNo ratings yet

- Tugas Variable Costing and The Measurement of ESG and Quality CostsDocument5 pagesTugas Variable Costing and The Measurement of ESG and Quality Costsirga ayudiasNo ratings yet

- Build A Spreadsheet 11-43Document4 pagesBuild A Spreadsheet 11-43anup akasheNo ratings yet

- Costing By-Product and Joint ProductsDocument36 pagesCosting By-Product and Joint ProductseltantiNo ratings yet

- Course Code: ACT 201 Course Title: Cost & Management Accounting Section: 2Document4 pagesCourse Code: ACT 201 Course Title: Cost & Management Accounting Section: 2Wild GhostNo ratings yet

- Tutorial 3 - Student AnswerDocument7 pagesTutorial 3 - Student AnswerDâmDâmCôNươngNo ratings yet

- Assgment 1 (Chapter 1-4) : Agung Rizal / 2201827622Document10 pagesAssgment 1 (Chapter 1-4) : Agung Rizal / 2201827622Agung Rizal DewantoroNo ratings yet

- Ma - Bep01 - LucioDocument4 pagesMa - Bep01 - LucioGrace SimonNo ratings yet

- Answer Key To Test #3 - ACCT-312 - Fall 2019Document8 pagesAnswer Key To Test #3 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- Tugasan 6 Bab 6Document4 pagesTugasan 6 Bab 6azwan88No ratings yet

- Bca 423-Marginal Vs Absoption Costing.Document8 pagesBca 423-Marginal Vs Absoption Costing.James GathaiyaNo ratings yet

- Contribution MarginDocument6 pagesContribution MarginLowellah Marie BringasNo ratings yet

- Kế Toán 5 85 9Document2 pagesKế Toán 5 85 9Võ Triệu VyNo ratings yet

- Contribution Margin Ratio 0.2: Compute The Break-Even Point in Dollar Sales For Each ProductDocument4 pagesContribution Margin Ratio 0.2: Compute The Break-Even Point in Dollar Sales For Each ProductVõ Triệu VyNo ratings yet

- Project Appraisal Assignment: Can Tho University College of EconomicsDocument47 pagesProject Appraisal Assignment: Can Tho University College of EconomicsVõ Triệu VyNo ratings yet

- Nhóm 5 KTQT - Chapter 35 Exercise 14 19Document7 pagesNhóm 5 KTQT - Chapter 35 Exercise 14 19Võ Triệu VyNo ratings yet

- Incoterms 2020 English Ebook ICCDocument195 pagesIncoterms 2020 English Ebook ICCVõ Triệu Vy100% (2)

- FDI - RP BodyDocument30 pagesFDI - RP BodyVõ Triệu VyNo ratings yet

- Simon-Kucher - Case Interview PreparationDocument23 pagesSimon-Kucher - Case Interview PreparationBil Ka0% (1)

- Simon-Kucher - Case Interview PreparationDocument23 pagesSimon-Kucher - Case Interview PreparationBil Ka0% (1)

- VBCC MiniCase - Amazon Omni ChannelDocument18 pagesVBCC MiniCase - Amazon Omni ChannelThu Thao NguyenNo ratings yet

- NumericalReasoningTest1 QuestionsDocument7 pagesNumericalReasoningTest1 QuestionssemplicetinyNo ratings yet

- Numerical ReasoningDocument224 pagesNumerical ReasoningNitesh Rastogi64% (14)

- Factors Affecting The Behavioral Intention and Behavior of Using E-Wallets of Youth in VietnamDocument9 pagesFactors Affecting The Behavioral Intention and Behavior of Using E-Wallets of Youth in VietnamToảnNo ratings yet

- Numerical Test 2 Practice QuestionsDocument31 pagesNumerical Test 2 Practice QuestionsVõ Triệu VyNo ratings yet

- Tesla Report: M02 Group 9Document20 pagesTesla Report: M02 Group 9Võ Triệu VyNo ratings yet

- Case Analysis PDFDocument20 pagesCase Analysis PDFMD KashfinNo ratings yet

- Global Generational Report November PDFDocument18 pagesGlobal Generational Report November PDFBella Apriliyani100% (1)

- Boston UniversityDocument17 pagesBoston UniversityhuarlyquinzalNo ratings yet

- Oxford MBA - (2) Financial ReportingDocument39 pagesOxford MBA - (2) Financial ReportingManoj Asanka ManamperiNo ratings yet

- Evaluation of CPM and EFA Matrix of Nepalese CompanyDocument4 pagesEvaluation of CPM and EFA Matrix of Nepalese CompanySubash AdhikariNo ratings yet

- Gymshark Annotation FinalDocument8 pagesGymshark Annotation FinalIrfan IbrahimNo ratings yet

- Minutes of Bogo Municipal Council session on traffic ordinancesDocument9 pagesMinutes of Bogo Municipal Council session on traffic ordinancesChickoLazaro100% (1)

- Hul Annual Report 2020 21 - tcm1255 561812 - 1 - enDocument146 pagesHul Annual Report 2020 21 - tcm1255 561812 - 1 - enRamyaNo ratings yet

- Customer Requirement Document (CRD)Document3 pagesCustomer Requirement Document (CRD)shekhar785424100% (1)

- VP Technology Software Sales in NYC Resume Sherri SklarDocument2 pagesVP Technology Software Sales in NYC Resume Sherri SklarSherriSklarNo ratings yet

- Determining Products, Selecting Activities, and Responding to Customer NeedsDocument2 pagesDetermining Products, Selecting Activities, and Responding to Customer NeedsJuan Miguel Salvador MaglalangNo ratings yet

- 1.01 PCoE Project Charter GuideDocument3 pages1.01 PCoE Project Charter GuideMajdi Fahmi Alkayed100% (1)

- 2 General Awareness Training (Gat) For Iso 14001-2015 Ems PDFDocument4 pages2 General Awareness Training (Gat) For Iso 14001-2015 Ems PDFSiddhartha Sankar RoyNo ratings yet

- CS341 Course Outline Professional PracticesDocument3 pagesCS341 Course Outline Professional PracticesKinza ShakeelNo ratings yet

- Mukul ShardaDocument3 pagesMukul Shardashubh_braNo ratings yet

- A Study On Inventory Management and Control: Pratap Chandrakumar. R Gomathi ShankarDocument9 pagesA Study On Inventory Management and Control: Pratap Chandrakumar. R Gomathi Shankarshravasti munwarNo ratings yet

- CH 01Document41 pagesCH 01Nee NotNo ratings yet

- Oman Tank Terminal Company (Ottco) : Project: Ras Markaz Crude Oil Park Project (Phase 1)Document2 pagesOman Tank Terminal Company (Ottco) : Project: Ras Markaz Crude Oil Park Project (Phase 1)ANIL PLAMOOTTILNo ratings yet

- Director Client Customer Operations in Chicago IL Resume Jill MazurcoDocument2 pagesDirector Client Customer Operations in Chicago IL Resume Jill MazurcoJillMazurcoNo ratings yet

- Ibm CHNDocument3 pagesIbm CHNSarvar PathanNo ratings yet

- Activity-Based Costing: A Tool To Aid Decision Making: Chapter SevenDocument49 pagesActivity-Based Costing: A Tool To Aid Decision Making: Chapter SevenFahim RezaNo ratings yet

- Answer Key For Quiz - Inventory EstimationDocument6 pagesAnswer Key For Quiz - Inventory EstimationMelogen Labrador100% (3)

- Analysis of Quality Procedures at HindalcoDocument95 pagesAnalysis of Quality Procedures at HindalcoGargy GuptaNo ratings yet

- MRO Material Master Data Cleansing Enrichment and ClassificationDocument7 pagesMRO Material Master Data Cleansing Enrichment and ClassificationindraNo ratings yet

- CH 07Document22 pagesCH 07amir nabilNo ratings yet

- Managerial Accounting - LemessaDocument112 pagesManagerial Accounting - Lemessaanteneh tesfaw100% (1)

- Brand Awareness of Kansai Nerolac PaintsDocument70 pagesBrand Awareness of Kansai Nerolac Paintskunal77787No ratings yet

- Strategic Management: Assignment#: 3Document3 pagesStrategic Management: Assignment#: 3FarooqChaudharyNo ratings yet

- ISO/IEC 17021 RequirementsDocument27 pagesISO/IEC 17021 RequirementsBudhi SuwarsonoNo ratings yet

- CEO Interview InsightsDocument3 pagesCEO Interview InsightskelvincjyNo ratings yet

- ISO 13485 and ISO 9001 Correspondence GuideDocument4 pagesISO 13485 and ISO 9001 Correspondence GuideGadus Spp100% (4)

- Chapter 4 AnswersDocument63 pagesChapter 4 AnswersPattraniteNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)

- Business Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsFrom EverandBusiness Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsNo ratings yet

- Emprender un Negocio: Paso a Paso Para PrincipiantesFrom EverandEmprender un Negocio: Paso a Paso Para PrincipiantesRating: 3 out of 5 stars3/5 (1)

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Full Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperFrom EverandFull Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperRating: 5 out of 5 stars5/5 (3)