0% found this document useful (0 votes)

791 views1 pageBIR Form No. 0605

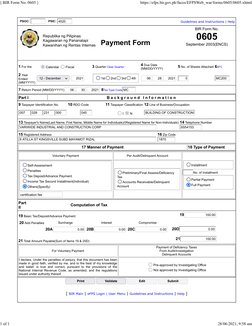

This document is a payment form submitted to the Bureau of Internal Revenue of the Philippines. It summarizes a payment being made by Variwide Industrial and Construction Corp for the 1st quarter of fiscal year 2021 ending June 30, 2021. The payment of 100 Philippine pesos is due by June 28, 2021 and is a voluntary self-assessment payment with no penalties or additional amounts owed. It certifies the truthfulness and accuracy of the information provided on the form.

Uploaded by

rhea CabillanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

791 views1 pageBIR Form No. 0605

This document is a payment form submitted to the Bureau of Internal Revenue of the Philippines. It summarizes a payment being made by Variwide Industrial and Construction Corp for the 1st quarter of fiscal year 2021 ending June 30, 2021. The payment of 100 Philippine pesos is due by June 28, 2021 and is a voluntary self-assessment payment with no penalties or additional amounts owed. It certifies the truthfulness and accuracy of the information provided on the form.

Uploaded by

rhea CabillanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Payment Form