Professional Documents

Culture Documents

Assignment On Taxation

Uploaded by

JasmeetKaur0 ratings0% found this document useful (0 votes)

40 views3 pagesOriginal Title

ASSIGNMENT ON TAXATION

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

40 views3 pagesAssignment On Taxation

Uploaded by

JasmeetKaurCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

ASSIGNMENT ON TAXATION

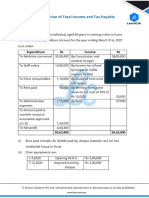

Q)Mr B aged 63 years, has earned rupees 75,00,000 out of his

business. His ex- wife gifted him cash in account worth rupees 6

lakh. He spent a total of rupees 15 lakh during a family trip. He

won a lottery of 19 lakh rupees. Out of happiness he gifted his

wife cash of rupees 450000. He bought a life insurance policy

and paid a premium of 50000 annually. He paid tuition fee for

his daughter for rupees 50000. He invested rupees 80000 in

PPF. One of his existing life insurance policy got matured and he

received a total of rupees 32 lakh. Seeing his health conditions

the doctor advised him a medical test of rupees 6000 following

he bought a health insurance for rupees 27000. Calculate his

taxable income and tax liability.

Answer:

1. Mr B's total income from various sources: - Business

income: 75,00,000 - Gift from ex-wife: 6,00,000 (gifts from

relatives are not taxable) - Lottery winnings: 19,00,000

(taxable at a flat rate of 30%) - Maturity amount from life

insurance policy: 32,00,000 (taxable if the premium paid is

more than 10% of the sum assured)

2. Mr B's total expenses and deductions: - Family trip:

15,00,000 (not deductible) - Gift to wife: 4,50,000 (not

deductible) - Life insurance premium: 50,000 (deductible

under section 80C) - Tuition fee for daughter: 50,000

(deductible under section 80C) - PPF investment: 80,000

(deductible under section 80C) - Medical test: 6,000 (not

deductible) - Health insurance premium: 27,000

(deductible under section 80D)

3. Calculate the taxable income: - Total income: 75,00,000 +

19,00,000 + 32,00,000 = 1,26,00,000 - Total deductions:

50,000 + 50,000 + 80,000 + 27,000 = 2,07,000 - Taxable

income = total income – total deduction

i.e 1,26,00,000 - 2,07,000 = 1,23,93,000

4. Calculate the tax liability: - Tax on lottery winnings:

19,00,000 * 30% = 5,70,000 - Tax on remaining income

(1,23,93,000 - 19,00,000) = 1,04,93,000

Up to 2,50,000: No tax

- 2,50,001 to 5,00,000: 5% of (5,00,000 - 2,50,000) =

12,500

- 5,00,001 to 10,00,000: 20% of (10,00,000 - 5,00,000) =

1,00,000

- Above 10,00,000: 30% of (1,04,93,000 - 10,00,000) =

28,47,900

- Total tax on remaining income: 12,500 + 1,00,000 +

28,47,900 = 29,60,400

5. Total tax liability: Tax on lottery winnings + Tax on

remaining income = 5,70,000 + 29,60,400 = 35,30,400

So, Mr B's taxable income is 1,23,93,000 and his tax

liability is 35,30,400.

You might also like

- Assignment ON Tax Calculation: Calculated byDocument4 pagesAssignment ON Tax Calculation: Calculated byAkanksha Sinha MBA20100% (2)

- Organizational Behaviour - Lecture NotesDocument143 pagesOrganizational Behaviour - Lecture NotesRachel Ruban80% (20)

- Based On Lto Records Hereunder Is The List of Pmvic ApplicantsDocument17 pagesBased On Lto Records Hereunder Is The List of Pmvic ApplicantsAladino BernaldezNo ratings yet

- Assignment: Mr. Chinmay Dev TiwariDocument4 pagesAssignment: Mr. Chinmay Dev TiwariShanu AggarwalNo ratings yet

- To Calculate TaxtationDocument2 pagesTo Calculate Taxtationmannu10091No ratings yet

- Taxable IncomeDocument2 pagesTaxable IncomeNavdeep SinghNo ratings yet

- DO IT Salary Income With SolutionDocument3 pagesDO IT Salary Income With SolutionAnsary LabibNo ratings yet

- Computation of Total IncomeDocument15 pagesComputation of Total Incomekhushi shahNo ratings yet

- FABM2Document27 pagesFABM2Shai Rose Jumawan QuiboNo ratings yet

- ATax - 03Document29 pagesATax - 03Haseeb Ahmed ShaikhNo ratings yet

- Advanced Taxation 2011-2019 DecDocument259 pagesAdvanced Taxation 2011-2019 Decrajeshkandel345No ratings yet

- Income TaxationDocument56 pagesIncome TaxationCianne Alcantara0% (2)

- Unit 4 Deductions From Gross Total IncomeDocument31 pagesUnit 4 Deductions From Gross Total IncomeDisha GuptaNo ratings yet

- Chap 6 Relief and RebateDocument15 pagesChap 6 Relief and RebateKelvin OngNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- Taxation Review June2017Document9 pagesTaxation Review June2017Shaiful Alam FCANo ratings yet

- Assesment of Individual Q-2Document4 pagesAssesment of Individual Q-2kalyanikamineniNo ratings yet

- Exercise 2Document8 pagesExercise 2Hồng Hạnh NguyễnNo ratings yet

- Chapter 12 TaxdeductionsDocument16 pagesChapter 12 TaxdeductionsRiya SharmaNo ratings yet

- Exclusion On Gross Income OlDocument7 pagesExclusion On Gross Income OlJoneric RamosNo ratings yet

- Retirement Planning 24-12-2020Document6 pagesRetirement Planning 24-12-2020Ishan AgarwalNo ratings yet

- Section 80 CDocument5 pagesSection 80 CAmit RoyNo ratings yet

- Budget 2015Document16 pagesBudget 2015Sachin SharmaNo ratings yet

- 3.0 General Principles of Income Tax and Gross IncomeDocument53 pages3.0 General Principles of Income Tax and Gross Incomedreample1003No ratings yet

- Unit 6-Computation of Total Income and Tax LiabilityDocument23 pagesUnit 6-Computation of Total Income and Tax LiabilityDisha GuptaNo ratings yet

- M12 Tax ActivityDocument6 pagesM12 Tax ActivityJanna RodriguezNo ratings yet

- Retirement Planning - Final Exam Tuesday, April 7, 2020, 12:00 Noon To 2:00 PM (2.0 Hours)Document17 pagesRetirement Planning - Final Exam Tuesday, April 7, 2020, 12:00 Noon To 2:00 PM (2.0 Hours)Harshi SoniNo ratings yet

- Year-End Adjustment NewDocument27 pagesYear-End Adjustment NewKyrzen Novilla0% (1)

- Ilyas 402-1904013 P.Finance Spring 2020 PDFDocument9 pagesIlyas 402-1904013 P.Finance Spring 2020 PDFilyasNo ratings yet

- Muthoot Finance Limited: Sarabjeet KaurDocument2 pagesMuthoot Finance Limited: Sarabjeet KaurYashapujaNo ratings yet

- Exclusion From Gross IncomeDocument8 pagesExclusion From Gross IncomeRonna Mae DungogNo ratings yet

- Risk Analysis and Insurance Policy PresentationDocument9 pagesRisk Analysis and Insurance Policy PresentationVishal TyagiNo ratings yet

- Taxation Law CIA 3Document3 pagesTaxation Law CIA 3Deepa GowdaNo ratings yet

- Taxable Income and Tax DueDocument13 pagesTaxable Income and Tax DueSheena Gane Esteves100% (1)

- Deductions: Basic Rule The Aggregate Amount of Deductions Under Sections 80C To 80U Cannot Exceed The Gross Total IncomeDocument29 pagesDeductions: Basic Rule The Aggregate Amount of Deductions Under Sections 80C To 80U Cannot Exceed The Gross Total IncomeashpakkhatikNo ratings yet

- TABL2751 Sample Calculation Questions For Quiz 1Document2 pagesTABL2751 Sample Calculation Questions For Quiz 1Peper12345No ratings yet

- 2019 PROBLEM EXERCISES IN INCOME TAXATION and TRAIN LAW (B)Document11 pages2019 PROBLEM EXERCISES IN INCOME TAXATION and TRAIN LAW (B)MGVMonNo ratings yet

- SAF GTL BrochureDocument12 pagesSAF GTL BrochureJoelNo ratings yet

- Exclusion From Gross IncomeDocument7 pagesExclusion From Gross Incomeanon_310411008100% (4)

- 2021 T2 TPLA601 Final Exam STUDENT v1Document16 pages2021 T2 TPLA601 Final Exam STUDENT v1Anas HassanNo ratings yet

- Income Taxation - Ampongan (SolMan)Document56 pagesIncome Taxation - Ampongan (SolMan)John Dale Mondejar75% (12)

- Sol Chap 5-7Document56 pagesSol Chap 5-7Anonymous QEcQfTeHl100% (1)

- Multiple Choice Questions Subject-Direct TaxationDocument14 pagesMultiple Choice Questions Subject-Direct TaxationRaj MondkarNo ratings yet

- Chapter 3Document4 pagesChapter 3Rosemarie Mae DezaNo ratings yet

- T11F CHP 03 1 Income Sources 2011Document140 pagesT11F CHP 03 1 Income Sources 2011jessie1614No ratings yet

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- Fifth PartDocument17 pagesFifth PartMahsinur RahmanNo ratings yet

- Introduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentDocument19 pagesIntroduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentRtr Sandeep ShekharNo ratings yet

- Basic Income Tax StructureDocument69 pagesBasic Income Tax StructureAditya AnandNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument5 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Livin Pay Plus 2Document12 pagesLivin Pay Plus 2SENSNo ratings yet

- AssignmentDocument3 pagesAssignmentLAKSHYANo ratings yet

- Tax TaskDocument2 pagesTax TaskDharmendra Kumar MalihanNo ratings yet

- Question Income From Salary Solved in ClassDocument4 pagesQuestion Income From Salary Solved in ClassFozle Rabby 182-11-5893No ratings yet

- 5.1 Income Tax PlanningDocument2 pages5.1 Income Tax PlanningYash DedhiaNo ratings yet

- Lecture 4Document16 pagesLecture 4ahmed qazzafiNo ratings yet

- Few Points To Be Kept in Mind While Doing Investment DeclarationDocument8 pagesFew Points To Be Kept in Mind While Doing Investment Declarationcool rock MohindraNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Money Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2From EverandMoney Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2No ratings yet

- Introduction To ERP SystemDocument2 pagesIntroduction To ERP SystemLeann BathanNo ratings yet

- Fourth Quarter SmeaDocument18 pagesFourth Quarter SmeaRenge TañaNo ratings yet

- Cartiersoumya 130929012428 Phpapp02Document17 pagesCartiersoumya 130929012428 Phpapp02Masafa AimanNo ratings yet

- Pathey - English - Sayings of Doctor Hedgewar PDFDocument26 pagesPathey - English - Sayings of Doctor Hedgewar PDFचन्द्र प्रकाशNo ratings yet

- New AIDS Law PDFDocument52 pagesNew AIDS Law PDFmille madalogdogNo ratings yet

- 00 - Indicadores para Certificado Sostenible BREEAM-NL para Evaluar Mejor Los Edificios Circulares-51Document1 page00 - Indicadores para Certificado Sostenible BREEAM-NL para Evaluar Mejor Los Edificios Circulares-51primousesNo ratings yet

- Sudan CrisisDocument2 pagesSudan CrisisSumitNo ratings yet

- Ethicalaspectsof FinanciaDocument6 pagesEthicalaspectsof FinanciaVinay RamaneNo ratings yet

- Kamini ProjectDocument24 pagesKamini ProjectKartik PathaniaNo ratings yet

- Module 1 Lesson 1&2Document33 pagesModule 1 Lesson 1&2amerizaNo ratings yet

- Pulalun Gets Recognition - Quo Vadis Other SultansDocument2 pagesPulalun Gets Recognition - Quo Vadis Other SultansIcas PhilsNo ratings yet

- Armory v. DelamirieDocument1 pageArmory v. DelamiriePerez_Subgerente01No ratings yet

- Op Ed Genre WorksheetDocument2 pagesOp Ed Genre Worksheetapi-532133127No ratings yet

- History II - Notes 1Document199 pagesHistory II - Notes 1Sridutta dasNo ratings yet

- Lac Session Narrative ReportDocument1 pageLac Session Narrative ReportVeronica LopezNo ratings yet

- Studentwise Final Placement DetailsLast 3 YearsDocument18 pagesStudentwise Final Placement DetailsLast 3 YearsAmitNo ratings yet

- Gonzales V HechanovaDocument2 pagesGonzales V HechanovaMicco PesuenaNo ratings yet

- Spotlight 2024 03Document70 pagesSpotlight 2024 03napipeterhaniNo ratings yet

- The Big Game of DevarayanadurgaDocument4 pagesThe Big Game of DevarayanadurgatumkurameenNo ratings yet

- Reasons Why Marijuani Should Be LegalizedDocument6 pagesReasons Why Marijuani Should Be LegalizedAlmasiNo ratings yet

- Krsna - Everything You Want To KnowDocument40 pagesKrsna - Everything You Want To Knowakash7641No ratings yet

- David HockneyDocument12 pagesDavid Hockneyrick27red100% (2)

- A Position Paper On The Legalization of Alcoholic Drinks To MinorsDocument2 pagesA Position Paper On The Legalization of Alcoholic Drinks To MinorsCristine Joy Remerata Villarosa69% (13)

- Akbar ArchiectureDocument52 pagesAkbar ArchiectureshaazNo ratings yet

- Module 8 TQMDocument19 pagesModule 8 TQMjein_amNo ratings yet

- Battle of Panipat-IIIDocument2 pagesBattle of Panipat-IIISuresh NatarajanNo ratings yet

- Project Management Book of KnowledgeDocument4 pagesProject Management Book of KnowledgeEdna VilchezNo ratings yet

- Timber Home Living - Annual Buyer's Guide 2015Document116 pagesTimber Home Living - Annual Buyer's Guide 2015janNo ratings yet