Professional Documents

Culture Documents

Assignment

Assignment

Uploaded by

LAKSHYA0 ratings0% found this document useful (0 votes)

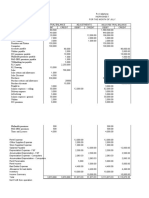

18 views3 pagesThe taxpayer had a total taxable income of $10 million, with $7.5 million from business earnings, $1.9 million from lottery winnings, and $600,000 from an ex-wife gift. Total deductions were $182,000, resulting in a net taxable amount of $9.818 million and a net tax liability of $2.755 million.

Original Description:

Original Title

Assignment.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe taxpayer had a total taxable income of $10 million, with $7.5 million from business earnings, $1.9 million from lottery winnings, and $600,000 from an ex-wife gift. Total deductions were $182,000, resulting in a net taxable amount of $9.818 million and a net tax liability of $2.755 million.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views3 pagesAssignment

Assignment

Uploaded by

LAKSHYAThe taxpayer had a total taxable income of $10 million, with $7.5 million from business earnings, $1.9 million from lottery winnings, and $600,000 from an ex-wife gift. Total deductions were $182,000, resulting in a net taxable amount of $9.818 million and a net tax liability of $2.755 million.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

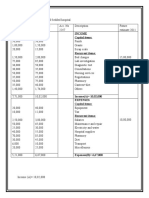

INCOME

Earnings from Business 7,500,000

Lottery 1,900,000

Gift Received From Ex-Wife 600,000

Total Taxable Income 10,000,000

Total Taxable Income 10,000,000

Total Deductions 182,000

Net Amount Total 9,818,000

Net Taxable Liability 27,55,400

DEDUCTIONS

Life Insurance 50,000

Tuition Fee for Daughter 50,000

PFF 80,000

Tax Rebate under 80 C 150,000

Medical Test 6,000

Medical Insurance 27,000

Tax Rebate under 80 D(50,000 for Premium and 5,000 for Checkup) 32,000

Total Deductions 182,000

EXPENSES

Family Trip 15,00,000

Gift to Wife 4,50,000

You might also like

- Activity / Assignment: Answer and SolutionDocument3 pagesActivity / Assignment: Answer and SolutionMa. Alexandria Palma0% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- CHAPTER 4 (Accounts)Document14 pagesCHAPTER 4 (Accounts)lcNo ratings yet

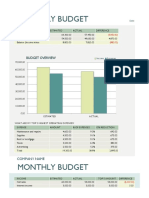

- Budget Template With ChartsDocument1 pageBudget Template With ChartsAli ErlanggaNo ratings yet

- Assignment ON Tax Calculation: Calculated byDocument4 pagesAssignment ON Tax Calculation: Calculated byAkanksha Sinha MBA20100% (2)

- Income Capital ItemsDocument2 pagesIncome Capital ItemsDeepti KukretiNo ratings yet

- AssignmentDocument1 pageAssignmentfzm6vfrpv7No ratings yet

- Assignment: Mr. Chinmay Dev TiwariDocument4 pagesAssignment: Mr. Chinmay Dev TiwariShanu AggarwalNo ratings yet

- Income Taxation Answer ExamDocument5 pagesIncome Taxation Answer Examyezaquera100% (1)

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument5 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- ExperimentDocument37 pagesExperimentErica Joy EscopeteNo ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- Learning Activity 3 - Inc TaxDocument3 pagesLearning Activity 3 - Inc TaxErica FlorentinoNo ratings yet

- INCOME TAX Part 2Document1 pageINCOME TAX Part 2honeylove uNo ratings yet

- 115,200.00 Two 100,200.00 TwoDocument19 pages115,200.00 Two 100,200.00 TwoAlexandra Nicole IsaacNo ratings yet

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- Illustrative Problem PayrollDocument23 pagesIllustrative Problem PayrollSophia VistanNo ratings yet

- Income Taxation - Regular Income Tax 2Document5 pagesIncome Taxation - Regular Income Tax 2Drew BanlutaNo ratings yet

- Assignment 19 3Document2 pagesAssignment 19 3sahibsinghthapar1No ratings yet

- Question Income From Salary Solved in ClassDocument4 pagesQuestion Income From Salary Solved in ClassFozle Rabby 182-11-5893No ratings yet

- CAT Exam 3 - 2018 Answer KeyDocument32 pagesCAT Exam 3 - 2018 Answer KeyCharity Lumactod AlangcasNo ratings yet

- Meenakshi - Aneja-Taxation AssignmentDocument1 pageMeenakshi - Aneja-Taxation AssignmentMeenakshi AnejaNo ratings yet

- Problem 12 & 13Document3 pagesProblem 12 & 13Mary Lynn Sta PriscaNo ratings yet

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceDocument14 pagesPurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyNo ratings yet

- Advance Tax ExampleDocument2 pagesAdvance Tax ExampleRitsikaGurramNo ratings yet

- Income Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionDocument4 pagesIncome Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionEr Amit JambhulkarNo ratings yet

- Topic 5 WorksheetDocument9 pagesTopic 5 WorksheetKristine Mae Tayab DalipeNo ratings yet

- Particulars Trial Balance Adjustments Adjusted Trial Balance DR CR DR CR DR CRDocument9 pagesParticulars Trial Balance Adjustments Adjusted Trial Balance DR CR DR CR DR CRasdfNo ratings yet

- Taxable IncomeDocument2 pagesTaxable IncomeNavdeep SinghNo ratings yet

- CCGB - Revised JadeDocument38 pagesCCGB - Revised Jadexavy villegasNo ratings yet

- PFP Tutorial 8Document2 pagesPFP Tutorial 8stellaNo ratings yet

- Monthely BudgetDocument4 pagesMonthely Budgetم سليمانNo ratings yet

- Good InformationDocument3 pagesGood InformationHoshen MollaNo ratings yet

- TAX SolutionsDocument24 pagesTAX SolutionsJerome MadrigalNo ratings yet

- TaxationDocument7 pagesTaxationRonald Allan caballesNo ratings yet

- Semi FinalDocument17 pagesSemi FinalJane TuazonNo ratings yet

- CCGB Final EditedDocument38 pagesCCGB Final Editedxavy villegasNo ratings yet

- Practice Problem SolutionDocument15 pagesPractice Problem SolutionTherese Noelle R. ARMADA100% (1)

- Amount REVENUE From Sales (-) COGS Total Revenue Expenses Direct CostsDocument6 pagesAmount REVENUE From Sales (-) COGS Total Revenue Expenses Direct CostsGurucharan BhatNo ratings yet

- Cash Receipts Cash DisbursementDocument5 pagesCash Receipts Cash DisbursementLala BubNo ratings yet

- Budget Template With ChartsDocument3 pagesBudget Template With ChartsAhmedNo ratings yet

- Lecture 4Document16 pagesLecture 4ahmed qazzafiNo ratings yet

- Palbot's Barber Shop Income Statement For The Year EndedDocument21 pagesPalbot's Barber Shop Income Statement For The Year EndedCocoy Llamas HernandezNo ratings yet

- Docs in A Box, Inc.Document6 pagesDocs in A Box, Inc.Leonardo D NinoNo ratings yet

- Acctg110 FinalsDocument21 pagesAcctg110 FinalsRoman Dominic LlanoNo ratings yet

- FinalsDocument11 pagesFinalsTong KennedyNo ratings yet

- Taxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Document4 pagesTaxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Beatrice ReynanciaNo ratings yet

- 9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsDocument4 pages9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsRyan CartaNo ratings yet

- Budget ControllingDocument1 pageBudget ControllingLester ErlanoNo ratings yet

- QUES PartnershipDocument2 pagesQUES PartnershipFaker MejiaNo ratings yet

- FIN-40220 Sunvalley Hospital Financial ReportsDocument6 pagesFIN-40220 Sunvalley Hospital Financial ReportsJohnson Yeu NzokaNo ratings yet

- Presented by Archana Gupta 0221031 Bharat Gaikwad 0221023Document12 pagesPresented by Archana Gupta 0221031 Bharat Gaikwad 0221023Bharat GaikwadNo ratings yet

- Casibang OEDocument2 pagesCasibang OEKrung KrungNo ratings yet

- Stock Acquisition Quiz 100% AnswerDocument2 pagesStock Acquisition Quiz 100% AnswerJohn BalanquitNo ratings yet

- Basic Salary of CM&CHDocument7 pagesBasic Salary of CM&CHamer.ms2711No ratings yet

- Compensation and Reward ManagementDocument3 pagesCompensation and Reward ManagementMeghana LohumiNo ratings yet

- Bsba2b INCOMETAXCOMP3 - 2 CABALLES, JERICALDocument30 pagesBsba2b INCOMETAXCOMP3 - 2 CABALLES, JERICALJerica CaballesNo ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- Answer To Question HWDocument3 pagesAnswer To Question HWYousuf SiyamNo ratings yet

- Monthly Budget: Company NameDocument2 pagesMonthly Budget: Company NameMalleshNo ratings yet