Professional Documents

Culture Documents

Advance Tax Example

Uploaded by

RitsikaGurramOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advance Tax Example

Uploaded by

RitsikaGurramCopyright:

Available Formats

Example

Ajay is a freelancer earning income from the profession of interior decoration. For the

FY 2019-20, Ajay estimates his annual gross receipts at Rs 20,00,000. Ajay

estimates his expenses at Rs 12,00,000. Ajay has deposited Rs 40,000 in PPF

account. Ajay has also paid Rs 25,000 towards LIC premium. Further, Ajay has paid

Rs 12,000 towards medical insurance premium. The professional receipts of Ajay

are subject to TDS.

Ajay estimates a TDS of Rs 30,000 on certain professional receipts for the FY 2019-

20. Besides professional receipts, Ajay estimates an interest of Rs 10,000 on fixed

deposits held by him. Ajay’s advance tax liability would be as below :

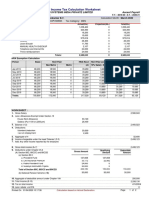

INCOME AMOUNT (Rs) AMOUNT (Rs)

ESTIMATION FOR

ADVANCE TAX

Income from profession:

Gross receipts 20,00,000

Less: Expenses 12,00,000 8,00,000

Income from other

sources:

Interest from fixed 10,000

deposit

GROSS TOTAL 8,10,000

INCOME

Less: Deduction under

section 80C

Contribution to PPF 40,000

LIC premium 25,000

65,000

Deduction under section 12,000 77,000

80D

TOTAL INCOME 7,33,000

TAX PAYABLE 59,100

Add: Education cess @ 2,364

4%

61,464

Less: TDS 30,000

TAX PAYABLE IN 31,464

ADVANCE

ADVANCE TAX PAYMENTS

Due date Advance tax payable Amount (Rs)

15th June 15% of Advance tax 4,700

15th September 45% of Advance tax 14,100

15th December 75% of Advance tax 23,600

15th March 100% of Advance tax 31,400

You might also like

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- Calculating Income Tax, Allowances and Liability for Mr. Shafiqul IslamDocument4 pagesCalculating Income Tax, Allowances and Liability for Mr. Shafiqul IslamFozle Rabby 182-11-5893No ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Assignment No 02 Business Law and Taxation: Tauraira Arshad 16320 SolutionDocument2 pagesAssignment No 02 Business Law and Taxation: Tauraira Arshad 16320 SolutionSYEDA -No ratings yet

- PSBA REFRESHER TAXATION QUIZDocument10 pagesPSBA REFRESHER TAXATION QUIZEdnalyn CruzNo ratings yet

- Illustration 1Document9 pagesIllustration 1Thanos The titanNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- Maria Beatrice N. Reynancia tax exam resultsDocument4 pagesMaria Beatrice N. Reynancia tax exam resultsBeatrice ReynanciaNo ratings yet

- Presented by Archana Gupta 0221031 Bharat Gaikwad 0221023Document12 pagesPresented by Archana Gupta 0221031 Bharat Gaikwad 0221023Bharat GaikwadNo ratings yet

- Assignment 4 - SolutionsDocument2 pagesAssignment 4 - SolutionsstoryNo ratings yet

- Rodel's 2020 Income Tax Computation with Itemized DeductionsTITLE Mulry's 2020 Taxable Income and Tax Payable TITLE Sharon's Various 2020 Tax Computations as Resident, Non-Resident ETB and NETBDocument5 pagesRodel's 2020 Income Tax Computation with Itemized DeductionsTITLE Mulry's 2020 Taxable Income and Tax Payable TITLE Sharon's Various 2020 Tax Computations as Resident, Non-Resident ETB and NETByezaquera100% (1)

- Salary On IncomeDocument22 pagesSalary On IncomeManjunathNo ratings yet

- ATPL10060 - Kolli Sravani - JUNE - 2018 PDFDocument1 pageATPL10060 - Kolli Sravani - JUNE - 2018 PDFsravani kolliNo ratings yet

- MR A's income tax computation for AY 2017-18Document1 pageMR A's income tax computation for AY 2017-18shyamiliNo ratings yet

- Paper 4Document16 pagesPaper 4Kali KhannaNo ratings yet

- Accounting for income taxesDocument6 pagesAccounting for income taxesRyll BedasNo ratings yet

- 99018037_MAR_2023Document1 page99018037_MAR_2023gaurav sharmaNo ratings yet

- E-Filling of Returns (Shivdas 10 Years)Document122 pagesE-Filling of Returns (Shivdas 10 Years)Unicorn SpiderNo ratings yet

- Taxation Income From SalaryDocument13 pagesTaxation Income From SalarySajid AhmedNo ratings yet

- Income and Business Taxation AssignmentsDocument5 pagesIncome and Business Taxation AssignmentsGideon Tangan Ines Jr.No ratings yet

- Financial StatementDocument11 pagesFinancial StatementMuhammad Ali AliNo ratings yet

- What is TDS? Advance Tax and ProblemsDocument8 pagesWhat is TDS? Advance Tax and ProblemsNishantNo ratings yet

- Tax AssignmentDocument11 pagesTax AssignmentAM NerdyNo ratings yet

- Nur Atiqah Binti Saadon (Kba2761a) - 2023448576Document3 pagesNur Atiqah Binti Saadon (Kba2761a) - 2023448576nuratiqahsaadon89No ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- STT - Mock - Test - S-24 - Suggested AnswersDocument8 pagesSTT - Mock - Test - S-24 - Suggested AnswersabdullahNo ratings yet

- Local Media479648801608356881Document8 pagesLocal Media479648801608356881Joeven DinawanaoNo ratings yet

- Solution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryDocument3 pagesSolution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryEmtiaz Ahmed AnikNo ratings yet

- Computation of Toatal IncomeDocument4 pagesComputation of Toatal IncomePRITAM PATRANo ratings yet

- Carry Over Next Period (Excl. Incentive)Document5 pagesCarry Over Next Period (Excl. Incentive)Divina BidarNo ratings yet

- Cash Flow Statement QuestionDocument5 pagesCash Flow Statement QuestionsatyaNo ratings yet

- Contoh DTA DTLDocument23 pagesContoh DTA DTLZahra MawarNo ratings yet

- Total Income Questions Set A Assessment Year 2021-22-18th EditionDocument30 pagesTotal Income Questions Set A Assessment Year 2021-22-18th EditionKaran Singh RanaNo ratings yet

- Miscellaneous TopicsDocument93 pagesMiscellaneous Topicsgean eszekeilNo ratings yet

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- Partnership - OperationDocument11 pagesPartnership - OperationAiziel OrenseNo ratings yet

- Dit Sem V SolnDocument10 pagesDit Sem V Solnmaaz11052020No ratings yet

- Deductions Dec 21Document26 pagesDeductions Dec 21snowbell 95No ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Casibang OEDocument2 pagesCasibang OEKrung KrungNo ratings yet

- Income Tax Sample ProblemsDocument12 pagesIncome Tax Sample ProblemsYellow BelleNo ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- Lecture 3Document22 pagesLecture 3ahmed qazzafiNo ratings yet

- Computation of Total Income & Tax LiabilityDocument24 pagesComputation of Total Income & Tax LiabilityKartikNo ratings yet

- AEC-7 MIDTERM EXAMINATION SOLUTIONSDocument9 pagesAEC-7 MIDTERM EXAMINATION SOLUTIONSDaisy TañoteNo ratings yet

- 18515pcc Sugg Paper Nov09 5 PDFDocument16 pages18515pcc Sugg Paper Nov09 5 PDFGaurang AgarwalNo ratings yet

- Module 1 - Cherry Alfuerte - Train LawDocument41 pagesModule 1 - Cherry Alfuerte - Train Lawgerry dacerNo ratings yet

- Case Study 1Document7 pagesCase Study 1Trisha Mae Mendoza MacalinoNo ratings yet

- Exercise 17.11 SolutionDocument3 pagesExercise 17.11 Solutionraphaelrachel100% (1)

- Review For Quiz 3 Part 2Document18 pagesReview For Quiz 3 Part 2Mariah ValizadoNo ratings yet

- Payslip June Upgrad (Talentedge)Document1 pagePayslip June Upgrad (Talentedge)kartik.chahal.ug21No ratings yet

- Anwar Group Manager Income Tax AssessmentDocument1 pageAnwar Group Manager Income Tax AssessmentMoment RevealersNo ratings yet

- ExamDocument15 pagesExamSyra Mae PorilloNo ratings yet

- Lobrigas - Week6 Ia3Document18 pagesLobrigas - Week6 Ia3Hensel SevillaNo ratings yet

- Taxable Income and Income Tax - Foreign Tax Credit - AdministrDocument52 pagesTaxable Income and Income Tax - Foreign Tax Credit - AdministrCharlotte MalgapoNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- Cash Flow Statement-ExampleDocument18 pagesCash Flow Statement-ExampleAnakha RadhakrishnanNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 3Document1 page3RitsikaGurramNo ratings yet

- Official Correspondence StylesDocument92 pagesOfficial Correspondence StylesRitsikaGurramNo ratings yet

- Dear (Recipient Name) :: (Date)Document1 pageDear (Recipient Name) :: (Date)SARA MARIN RINCONNo ratings yet

- CBT Model PaperDocument1 pageCBT Model PaperRitsikaGurramNo ratings yet

- Dear (Recipient Name) :: (Date)Document1 pageDear (Recipient Name) :: (Date)SARA MARIN RINCONNo ratings yet

- 3Document1 page3RitsikaGurramNo ratings yet

- 2Document1 page2RitsikaGurramNo ratings yet

- Sample Manuscript TemplateDocument11 pagesSample Manuscript TemplateИРадојичићNo ratings yet

- Quantitative Aptitude PDFDocument5 pagesQuantitative Aptitude PDFrouf86inNo ratings yet

- Wildlife (Protection) Act, 1972Document74 pagesWildlife (Protection) Act, 1972palatul89No ratings yet

- Quantitative Aptitude PDFDocument5 pagesQuantitative Aptitude PDFrouf86inNo ratings yet

- 518/810/negative Pressure Wound Therapy - Benefits Overview RevisedDocument12 pages518/810/negative Pressure Wound Therapy - Benefits Overview RevisedRitsikaGurramNo ratings yet

- Exsm Gradu EquavalentDocument3 pagesExsm Gradu EquavalentRitsikaGurramNo ratings yet

- APJ Kalam LectureDocument20 pagesAPJ Kalam LectureBharath VenkateshNo ratings yet

- Ehi 04N14Document4 pagesEhi 04N14RitsikaGurramNo ratings yet

- How to Issue a Medical Complaint EffectivelyDocument2 pagesHow to Issue a Medical Complaint EffectivelyRitsikaGurramNo ratings yet

- Rydell Review Final Draft Response 377Document3 pagesRydell Review Final Draft Response 377RitsikaGurramNo ratings yet

- CGL ProgrammeDocument23 pagesCGL ProgrammeRitsikaGurramNo ratings yet

- Mensuration Formulas GuideDocument13 pagesMensuration Formulas GuideRitsikaGurram0% (1)

- New Janaraksha Plan (91) Benefits & Highlights: Insurance AdviserDocument2 pagesNew Janaraksha Plan (91) Benefits & Highlights: Insurance AdviserRitsikaGurramNo ratings yet

- 122 D 020160524204015453747Document1 page122 D 020160524204015453747RitsikaGurramNo ratings yet

- 49 WPM 26Document1 page49 WPM 26RitsikaGurramNo ratings yet

- Angles Made by A Transverse Line:: Congruent and Similar TriangleDocument9 pagesAngles Made by A Transverse Line:: Congruent and Similar TriangleRitsikaGurramNo ratings yet

- Angles Made by A Transverse Line:: Congruent and Similar TriangleDocument9 pagesAngles Made by A Transverse Line:: Congruent and Similar TriangleRitsikaGurramNo ratings yet