Professional Documents

Culture Documents

Assignment: Mr. Chinmay Dev Tiwari

Uploaded by

Shanu AggarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment: Mr. Chinmay Dev Tiwari

Uploaded by

Shanu AggarwalCopyright:

Available Formats

ASSIGNMENT

On

TAX CALCULATION

By

JATIN AGGARWAL

Amity Business School, Noida

INTERNSHIP BATCH OF 5th JULY,2021

Under the Supervision of

Mr. Chinmay Dev Tiwari

Corporate sales manager at AIM INDIA

Q: Mr. B aged 62 years, has earned rupees 75,00,000 out of his business. His ex-wife

gifted him a car worth rupees 8 lakh. He spent a total of rupees 20 lakh during a family

trip. He won a lottery of 16 lakh rupees. Out of happiness he gifted his wife a diamond

set of rupees 450000. He bought a life insurance policy and paid a premium of 55000

annually. He paid tuition fee for his daughter for rupees 50000. He invested rupees 80000

in PPF. One of his existing life insurance policy got matured and he received a total of

rupees 35 lakh. Seeing his health conditions, the doctor advised him a medical test of

rupees 7000 following he bought a health insurance for rupees 28000. Calculate his

taxable income and tax liability.

SOLUTION

Interpretation of Data:

It is given that, Mr. B is 62yeras old. Therefore, he would fall

under the senior Citizen income Slab.

Income from winning of Lottery would fall under income from

other sources and therefore it is directly taxable @30% tax rate.

Tuition fees, Contribution to PPF, and LIC premium would be

allowed as a deduction under 80C.

Medical insurance contribution =28000 which is exceeding the

limit of 25000. Thus, 25000 would be an allowable deduction

under 80D

Maximum medical test expenditure allowed as a deduction would

be 500.

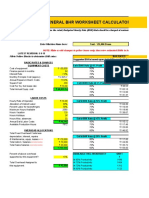

Computation of Taxable Income:

Particular Amount Amount

Income from 75,00,000

business

Add: Income from

other sources

Gift received from 8,00,000

ex-wife

Lottery Winning 16,00,000 24,00,000

Total Income 99,00,000

Less: Deductions

80C:

LIC Premium 55,000

Tuition Fee 50,000

PPF Contribution 80,000

Total 1,85,000

The maximum

allowable deduction

limit 1,50,000 -150,000

80D:

Medical health

insurance 25,000

Medical Test 5,000 -30,000

NET TAXABLE

INCOME 97,20,000

Computation of Taxable Income:

Particular Amount Amount

Taxable Income 97,20,000

Less: Income directly

taxed at 30% 16,00,000

Net taxable income

charged at normal tax

slab 81,20,000

Up to 300,000 nil

From 3,00,000-

5,00,000@5% 10,000

From 5,00,000-

10,00,000 @20% 1,00,000

Above 10,00,000

@30% 21,36,000

Add: Income from

speculation @30% 4,80,000

Total tax liability 27,26,000

Add: Surcharge @10% 2,72,600

Add: Cess@4%

(2726000+27600) *4% 1,19,994

TOTAL TAX

LIABILITY 31,18,544

You might also like

- Assignment ON Tax Calculation: Calculated byDocument4 pagesAssignment ON Tax Calculation: Calculated byAkanksha Sinha MBA20100% (2)

- Retention Problems at India RetailDocument10 pagesRetention Problems at India RetailManrit WaliaNo ratings yet

- Chartered Accountant - Income From ProfessionDocument3 pagesChartered Accountant - Income From ProfessionhanumanthaiahgowdaNo ratings yet

- GD On Ehtics or Profit: ControversiesDocument2 pagesGD On Ehtics or Profit: ControversiesSahil RaiNo ratings yet

- Strategic Financial Planning Is Subject To The Various Macro and Micro Environmental Factors'. Elucidate.Document4 pagesStrategic Financial Planning Is Subject To The Various Macro and Micro Environmental Factors'. Elucidate.DivyaDesai100% (1)

- Receivables ManagementDocument11 pagesReceivables ManagementAadil AhmedNo ratings yet

- Evolution and Role of Financial Services Companies inDocument11 pagesEvolution and Role of Financial Services Companies inRicha Sonali0% (2)

- M Com Strategic Management Project TopicsDocument4 pagesM Com Strategic Management Project TopicsAdelle Moldovan50% (4)

- Polycab Final ReportDocument97 pagesPolycab Final ReportAnjali PandeNo ratings yet

- On InternshipDocument12 pagesOn Internshipsandeep kumarNo ratings yet

- Leverage Unit-4 Part - IIDocument34 pagesLeverage Unit-4 Part - IIAstha ParmanandkaNo ratings yet

- Electronic Data Interchange: Nature, Benefits of E.D.I, Demerits of E.D.IDocument36 pagesElectronic Data Interchange: Nature, Benefits of E.D.I, Demerits of E.D.IutkaljyotiNo ratings yet

- Radhika Ghai AggarwalDocument6 pagesRadhika Ghai AggarwalShubham Rana100% (1)

- 16 - IND AS 108 - Operating Segment Final (R)Document18 pages16 - IND AS 108 - Operating Segment Final (R)S Bharhath kumarNo ratings yet

- 3C Report ON IDBI FEDDERALDocument10 pages3C Report ON IDBI FEDDERALAbhilash SahuNo ratings yet

- Impact of CSR On Financial Performance of Top 10 Performing CSR Companies in IndiaDocument7 pagesImpact of CSR On Financial Performance of Top 10 Performing CSR Companies in IndiaSoorajKrishnanNo ratings yet

- Questionnaire Icici PrudentialDocument13 pagesQuestionnaire Icici PrudentialKulvinder Singh Mehta100% (2)

- Sip Black BookDocument64 pagesSip Black BookDilzz KalyaniNo ratings yet

- Aditya Birla Company ProfileDocument8 pagesAditya Birla Company ProfileShubham NarwadeNo ratings yet

- Industrial Training ReportDocument34 pagesIndustrial Training ReportInderjeet Singh100% (1)

- HRM Project 00111-3Document53 pagesHRM Project 00111-3Rushikesh MaidNo ratings yet

- Winter Internship Report DV YaDocument70 pagesWinter Internship Report DV YaDivyaNo ratings yet

- 14 BibliographyDocument18 pages14 BibliographySAGARNo ratings yet

- My Project Report - Windshield Expert 1234Document82 pagesMy Project Report - Windshield Expert 1234Anam KhanNo ratings yet

- Case Studies On Tax Planning and Double TaxDocument19 pagesCase Studies On Tax Planning and Double TaxJayaNo ratings yet

- Marketing On Elkos PernDocument9 pagesMarketing On Elkos PernAJAI SINGHNo ratings yet

- Document 2Document73 pagesDocument 2Pooja75% (4)

- VLCC ReportDocument27 pagesVLCC ReportTakshi Batra100% (1)

- L-1 Basic ConceptsDocument4 pagesL-1 Basic Conceptskyunki143No ratings yet

- Cool-Aid Private LimitedDocument8 pagesCool-Aid Private Limitedpankajbhatt1993No ratings yet

- Sip ProjectDocument126 pagesSip Projectsolanki_dipen2000100% (2)

- E1049217251 12520 1322185717213Document5 pagesE1049217251 12520 1322185717213Sumit PattanaikNo ratings yet

- ANSWER KEY - FM - Mcom Sem 4 - June 2023Document5 pagesANSWER KEY - FM - Mcom Sem 4 - June 2023Faheem KwtNo ratings yet

- Customer Satisfaction - HDFC LifeDocument49 pagesCustomer Satisfaction - HDFC Liferaj0% (1)

- HR Policies - FMCDDocument11 pagesHR Policies - FMCDSheikh Zain UddinNo ratings yet

- Project Report HDFCDocument58 pagesProject Report HDFCKr Ish NaNo ratings yet

- Introduction of BajajDocument15 pagesIntroduction of BajajHimanshu Matta50% (2)

- EMIS Insights - India Insurance Sector Report 2020 - 2024Document79 pagesEMIS Insights - India Insurance Sector Report 2020 - 2024Kathiravan Rajendran100% (1)

- Ashwini G Report On Axis BankDocument49 pagesAshwini G Report On Axis BankVishwas DeveeraNo ratings yet

- AARTHI - SPDocument15 pagesAARTHI - SPMOHAMMED KHAYYUMNo ratings yet

- AirtelDocument10 pagesAirtelrahul ranjanNo ratings yet

- Organisational Structure of V Guard in KeralaDocument23 pagesOrganisational Structure of V Guard in Keralapratyush0501100% (1)

- Health Insurance in India-An Overview: K.Swathi, R.AnuradhaDocument4 pagesHealth Insurance in India-An Overview: K.Swathi, R.AnuradhaAnkit YadavNo ratings yet

- Internship Report FormatDocument4 pagesInternship Report FormatMian AhsanNo ratings yet

- Cost & Management Accounting: Cia-IiiDocument9 pagesCost & Management Accounting: Cia-IiiARYAN GARG 19212016No ratings yet

- Nidhi Bata ProjectDocument57 pagesNidhi Bata ProjectKashish AroraNo ratings yet

- Measuring SBU Level PerformanceDocument32 pagesMeasuring SBU Level PerformanceRevati ShindeNo ratings yet

- Bharti-Axa FinalDocument29 pagesBharti-Axa FinalAmit Bharti100% (1)

- Project RitesDocument72 pagesProject RitesSachin ChadhaNo ratings yet

- PROJECT REPORT BAJAJ ALLIAnzDocument33 pagesPROJECT REPORT BAJAJ ALLIAnzkittu sahooNo ratings yet

- Corporate Tax Planning and ManagemantDocument11 pagesCorporate Tax Planning and ManagemantVijay KumarNo ratings yet

- Srinath SirDocument19 pagesSrinath Sirmy Vinay100% (1)

- Presentation On Market Potential of TATA AIG LifeDocument25 pagesPresentation On Market Potential of TATA AIG LifeRinku Singh BhallaNo ratings yet

- Components of Wage System in Human Resource ManagementDocument7 pagesComponents of Wage System in Human Resource Managementbk1_786100% (1)

- Tax SavingsDocument32 pagesTax Savingsh946073000850% (2)

- Assignment On TaxationDocument3 pagesAssignment On TaxationJasmeetKaurNo ratings yet

- DO IT Salary Income With SolutionDocument3 pagesDO IT Salary Income With SolutionAnsary LabibNo ratings yet

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- Taxable IncomeDocument2 pagesTaxable IncomeNavdeep SinghNo ratings yet

- Tax TaskDocument2 pagesTax TaskDharmendra Kumar MalihanNo ratings yet

- Business Analytics and Modelling: Excel FormulaeDocument9 pagesBusiness Analytics and Modelling: Excel FormulaeShanu AggarwalNo ratings yet

- Session 3 - Skills Required For Business Analyst ProfileDocument6 pagesSession 3 - Skills Required For Business Analyst ProfileShanu AggarwalNo ratings yet

- What Is An Excel Pivot Table?Document10 pagesWhat Is An Excel Pivot Table?Shanu AggarwalNo ratings yet

- UPS Optimizes Delivery Routes: InterfacesDocument17 pagesUPS Optimizes Delivery Routes: InterfacesShanu AggarwalNo ratings yet

- Case OMDocument7 pagesCase OMShanu AggarwalNo ratings yet

- Working Document Capacity PlanningDocument4 pagesWorking Document Capacity PlanningShanu AggarwalNo ratings yet

- Final Research ProjectDocument60 pagesFinal Research ProjectShanu AggarwalNo ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- Online Payments Systems For E-CommerceDocument6 pagesOnline Payments Systems For E-Commerceoctal1No ratings yet

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument2 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterSharon JonesNo ratings yet

- Con Rmed: 1 Night in Zagreb, Croatia: ChargesDocument2 pagesCon Rmed: 1 Night in Zagreb, Croatia: ChargesNishanth NNo ratings yet

- For Revision of Income TaxDocument5 pagesFor Revision of Income TaxMA AttariNo ratings yet

- A Study On Customer Awareness Towards HDFC Bank Money Transfer App-PayZapp in Lucknow CityDocument109 pagesA Study On Customer Awareness Towards HDFC Bank Money Transfer App-PayZapp in Lucknow CityPari RastogiNo ratings yet

- Quotation Details: 100% Within 30 Days of Stfy RCPT of Matl at SiteDocument1 pageQuotation Details: 100% Within 30 Days of Stfy RCPT of Matl at SiteNapoleon DasNo ratings yet

- Acc 202 Notes StudentsDocument43 pagesAcc 202 Notes StudentsPhebieon MukwenhaNo ratings yet

- India Tax 2015Document9 pagesIndia Tax 2015Amit BahetiNo ratings yet

- Bank StatementDocument1 pageBank StatementMartinez ŁlyxNo ratings yet

- AB Limited Form Schedule K-1 DonDocument1 pageAB Limited Form Schedule K-1 Donsarah.gleasonNo ratings yet

- Final BLT203 SemIV Bcom Spring 2020Document4 pagesFinal BLT203 SemIV Bcom Spring 2020SunnyNo ratings yet

- Voucher For Deposit RepaymentDocument2 pagesVoucher For Deposit RepaymentYuga Sunder GogoiNo ratings yet

- .............................. Cash Receipt Journal .............................. (.................................... )Document22 pages.............................. Cash Receipt Journal .............................. (.................................... )Atalya PearlNo ratings yet

- Important MessageDocument4 pagesImportant MessageIlly ZahNo ratings yet

- Proforma InvoiceDocument3 pagesProforma InvoiceSuresh KumarNo ratings yet

- Cir vs. FisherDocument3 pagesCir vs. FisherAnna BautistaNo ratings yet

- Acct Statement XX5033 07072023Document4 pagesAcct Statement XX5033 07072023Prosenjjit GhosalNo ratings yet

- 582912020511776rpos PDFDocument3 pages582912020511776rpos PDFKarthik sankarNo ratings yet

- Problem Set 2Document1 pageProblem Set 2thighbone2003No ratings yet

- NON-ToD Bill PreviewDocument2 pagesNON-ToD Bill PreviewNaveen Kumar Singh78% (18)

- Appellant DSNLU VishakapatnamDocument40 pagesAppellant DSNLU VishakapatnamKeerthana Gedela89% (9)

- Prospects of GST in IndiaDocument6 pagesProspects of GST in IndiaShayan ZafarNo ratings yet

- JioMart Invoice 16497697570227658ADocument1 pageJioMart Invoice 16497697570227658Asnehashish gaurNo ratings yet

- GST Calculator: If The Calculations Do Not Update, Hit F9Document1 pageGST Calculator: If The Calculations Do Not Update, Hit F9computech instituteNo ratings yet

- SOA009005567079Document2 pagesSOA009005567079Jeevan NJNo ratings yet

- Just A Little Reminder, DevonaDocument2 pagesJust A Little Reminder, DevonaJasmineNo ratings yet

- Gayatri Trading Co.: Tax InvoiceDocument1 pageGayatri Trading Co.: Tax InvoiceNitya PatelNo ratings yet

- General BHR Worksheet CalculatorDocument2 pagesGeneral BHR Worksheet CalculatorEmba MadrasNo ratings yet

- Sold To: Tax InvoiceDocument1 pageSold To: Tax Invoiceমধু্স্মিতা ৰায়No ratings yet