Professional Documents

Culture Documents

Assignment

Assignment

Uploaded by

fzm6vfrpv70 ratings0% found this document useful (0 votes)

2 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageAssignment

Assignment

Uploaded by

fzm6vfrpv7Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

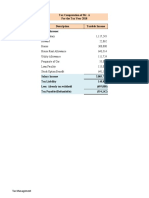

Question: To calculate Mr.

B's taxable income and tax liability, we need to consider his income, expenses, and eligible deductions.

Income: Expenses:

Business Income: ₹75,00,000 Gift to Wife: ₹4,50,000

Lottery Winnings: ₹19,00,000 Gift to Ex-Wife: ₹6,00,000

Maturity Amount from Life Insurance: ₹32,00,000 Tuition Fee: ₹50,000

Premium for Life Insurance: ₹50,000

Investment in PPF: ₹80,000

Medical Test: ₹6,000

Health Insurance Premium: ₹27,000

Family Trip Expenses: ₹15,00,000

Solution:

COMPUTATION OF TOTAL TAXABLE INCOME

Particulars Amount

Business Income 75,00,000

Maturity Amount from Life Insurance Tax-Free

Lottery Winnings 19,00,000

Gift to Wife Exempt

Gift to Ex-Wife Exempt

Investment in PPF 80,000

Medical Test 1,000

Tuition Fee (50,000)

Premium for Life Insurance (50,000)

Health Insurance Premium Exempt

Family Trip Expenses Exempt

Total Taxable Income 93,81,000

COMPUTATION OF TAX LIABILITY

Total Taxable Income other than Lottery income 74,81,000

General Tax Slabs for Individuals below 60:

- Income up to ₹3,00,000: No tax

- Income from ₹3,00,001 to ₹5,00,000: 5%

- Income from ₹5,00,001 to ₹10,00,000: 20%

- Income above ₹10,00,000: 30%

TAX LIABLITY Total Taxable Income other than Lottery income 20,59,300

TAX on Lottery Income 5,70,000

Total Tax liability 26,29,300

You might also like

- Schumann Etudes TreatiseDocument84 pagesSchumann Etudes TreatiseMarina SimeonovaNo ratings yet

- Assignment ON Tax Calculation: Calculated byDocument4 pagesAssignment ON Tax Calculation: Calculated byAkanksha Sinha MBA20100% (2)

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDocument1 pageMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNo ratings yet

- Quiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSDocument5 pagesQuiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSHunternotNo ratings yet

- Air Regulations RK Bali PDFDocument1 pageAir Regulations RK Bali PDFsai manoharNo ratings yet

- Sample Salary - 10lacDocument1 pageSample Salary - 10lacManpreet Kour100% (1)

- Civil Engineering EstimatesDocument5 pagesCivil Engineering Estimatesmy.nafi.pmp5283No ratings yet

- AssignmentDocument3 pagesAssignmentLAKSHYANo ratings yet

- Assignment: Mr. Chinmay Dev TiwariDocument4 pagesAssignment: Mr. Chinmay Dev TiwariShanu AggarwalNo ratings yet

- Computation of Total Income & Tax LiabilityDocument24 pagesComputation of Total Income & Tax LiabilityKartikNo ratings yet

- Taxation Assignment 2Document1 pageTaxation Assignment 2biju.mahapatra23No ratings yet

- Question Income From Salary Solved in ClassDocument4 pagesQuestion Income From Salary Solved in ClassFozle Rabby 182-11-5893No ratings yet

- Lecture 4Document16 pagesLecture 4ahmed qazzafiNo ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- Examples Salary 2019Document18 pagesExamples Salary 2019Asma ZeeshanNo ratings yet

- Assignment 19 3Document2 pagesAssignment 19 3sahibsinghthapar1No ratings yet

- Tax Midterm Practise SolutionsDocument5 pagesTax Midterm Practise SolutionsShan Ali ShahNo ratings yet

- Advanced Taxation 2011-2019 DecDocument259 pagesAdvanced Taxation 2011-2019 Decrajeshkandel345No ratings yet

- E-Filling of Returns (Shivdas 10 Years)Document122 pagesE-Filling of Returns (Shivdas 10 Years)Unicorn SpiderNo ratings yet

- Tax Calculator 2018-19 (Farrukh Iqbal Khan)Document2 pagesTax Calculator 2018-19 (Farrukh Iqbal Khan)FarrukhNo ratings yet

- Income-Taxation 5-7 ValenciaDocument56 pagesIncome-Taxation 5-7 ValenciaDevonNo ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument5 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Income Taxation Answer ExamDocument5 pagesIncome Taxation Answer Examyezaquera100% (1)

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- Theodore Is Single With No Qualified DependentDocument9 pagesTheodore Is Single With No Qualified Dependentalliah valenciaNo ratings yet

- Example of Tax PlanningDocument10 pagesExample of Tax PlanningGangothri Asok100% (1)

- Computation of Income Under The Head "Profits and Gains of Business or Profession"Document14 pagesComputation of Income Under The Head "Profits and Gains of Business or Profession"Shubham KumarNo ratings yet

- Income Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionDocument4 pagesIncome Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionEr Amit JambhulkarNo ratings yet

- Batch 1: Group Members: Akansha Mittal Jasneet Shivani Pandey Somansh Vivaswath K VDocument32 pagesBatch 1: Group Members: Akansha Mittal Jasneet Shivani Pandey Somansh Vivaswath K VJasneet SinghNo ratings yet

- Tax TaskDocument2 pagesTax TaskDharmendra Kumar MalihanNo ratings yet

- Salary Variance Report: Psno Employee NameDocument1 pageSalary Variance Report: Psno Employee NameAkhil MohammadNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- CTC Breakup For Technical RoleDocument1 pageCTC Breakup For Technical RoleDevansh BhardwajNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- Deductions - For StudentsDocument29 pagesDeductions - For Studentsdevkinger1212No ratings yet

- Income Tax Complete Question BankDocument281 pagesIncome Tax Complete Question BankNoorul Zaman KhanNo ratings yet

- Introduction To Income TaxDocument8 pagesIntroduction To Income TaxKartikNo ratings yet

- Tax Calculator - NewDocument8 pagesTax Calculator - NewSabareesh AthiNo ratings yet

- Solved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)Document45 pagesSolved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)muneeb razaNo ratings yet

- Revised - DeductionsDocument29 pagesRevised - Deductionsdevkinger1212No ratings yet

- TRAIN Part 1 - Income TaxDocument53 pagesTRAIN Part 1 - Income TaxGianna CantoriaNo ratings yet

- Income Tax Calculator FY 2020 2021Document8 pagesIncome Tax Calculator FY 2020 2021LalitNo ratings yet

- Income Tax Calculator FY 2014 15Document2 pagesIncome Tax Calculator FY 2014 15atul bansalNo ratings yet

- Compensation and Reward ManagementDocument3 pagesCompensation and Reward ManagementMeghana LohumiNo ratings yet

- Basic Concepts - QuestionsDocument6 pagesBasic Concepts - QuestionsbadalNo ratings yet

- TM PQsDocument9 pagesTM PQsAnooshayNo ratings yet

- Tax Calculator Version 2Document4 pagesTax Calculator Version 2SoikotNo ratings yet

- PFP Tutorial 8Document2 pagesPFP Tutorial 8stellaNo ratings yet

- Payslip 1Document2 pagesPayslip 1Pol Ian P AgustinNo ratings yet

- FICO Compensation Details - FTE ConversionDocument1 pageFICO Compensation Details - FTE ConversionNiteshNo ratings yet

- 2018-Income-Statement Copy-2Document9 pages2018-Income-Statement Copy-2api-464285260No ratings yet

- CAT Exam 3 - 2018 Answer KeyDocument32 pagesCAT Exam 3 - 2018 Answer KeyCharity Lumactod AlangcasNo ratings yet

- FIN-40220 Sunvalley Hospital Financial ReportsDocument6 pagesFIN-40220 Sunvalley Hospital Financial ReportsJohnson Yeu NzokaNo ratings yet

- Tax Assignment 4Document5 pagesTax Assignment 4pfungwaNo ratings yet

- ExperimentDocument37 pagesExperimentErica Joy EscopeteNo ratings yet

- NPS Document - Pension - Salary - Charges CalculationDocument9 pagesNPS Document - Pension - Salary - Charges Calculationcdem3782No ratings yet

- Finals Quiz No. 1 W AnswerDocument4 pagesFinals Quiz No. 1 W AnswerLouris DanielNo ratings yet

- Darshan Payslip Oct'19 PDFDocument1 pageDarshan Payslip Oct'19 PDFDarshan SubramanyaNo ratings yet

- Additional (Accelerated) Depreciation: Illustration PageDocument4 pagesAdditional (Accelerated) Depreciation: Illustration PageAmer Wagdy GergesNo ratings yet

- Good InformationDocument3 pagesGood InformationHoshen MollaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Applied Behavior AnalysisDocument9 pagesApplied Behavior AnalysisMakif NazNo ratings yet

- Artificial Intelligence TutorialDocument68 pagesArtificial Intelligence TutorialAnonymous HQuX2LUsD100% (1)

- Super Size Me HomeworkDocument4 pagesSuper Size Me HomeworkmujubujuNo ratings yet

- Appl Raman IoE PostDocs V1Document3 pagesAppl Raman IoE PostDocs V1BineshNo ratings yet

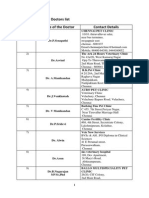

- Chennai Veterinary Doctors ListDocument7 pagesChennai Veterinary Doctors Listsrinivasa777100% (1)

- Making Words in EnglishDocument207 pagesMaking Words in EnglishNuwnu Astutie100% (2)

- Introduction To Computer LanguagesDocument11 pagesIntroduction To Computer LanguagesHarsh ModiNo ratings yet

- Drug Education, Consumer Health and NutritionDocument8 pagesDrug Education, Consumer Health and NutritionBabylyn FelicianoNo ratings yet

- OSS Yearend Report AY 2010-2011Document28 pagesOSS Yearend Report AY 2010-2011tkmedinaNo ratings yet

- Marche Pontificale - Papal Anthem - National Anthem of The VaticanDocument6 pagesMarche Pontificale - Papal Anthem - National Anthem of The VaticanJustine Leon A. UroNo ratings yet

- Terminal Con Copa 3M Cold Shrink QT-III 769X-S-4 KitsDocument20 pagesTerminal Con Copa 3M Cold Shrink QT-III 769X-S-4 KitsEnrique G.No ratings yet

- Non-Destructive Tests On Eco-Friendly Anti-Corrosion Paint: September 2017Document10 pagesNon-Destructive Tests On Eco-Friendly Anti-Corrosion Paint: September 2017nanoNo ratings yet

- 0607 Nbccedp Fs PDFDocument4 pages0607 Nbccedp Fs PDFNunung BuchoriNo ratings yet

- Inorganic Qualitative AnalysisDocument9 pagesInorganic Qualitative AnalysisShireen SuhailNo ratings yet

- Design Methodology of A UAV Propeller Implemented in Monitoring ActivitiesDocument17 pagesDesign Methodology of A UAV Propeller Implemented in Monitoring ActivitiesEdgar Cando NarvaezNo ratings yet

- O&M Manual - Air CurtainDocument70 pagesO&M Manual - Air CurtainRobert LazaroNo ratings yet

- Baƙin Aiki 3 RealDocument24 pagesBaƙin Aiki 3 Realmeenatmeelal4No ratings yet

- VIDEO Touring On The Aparri Chinese Temple WithDocument4 pagesVIDEO Touring On The Aparri Chinese Temple WithKurt RappelNo ratings yet

- Book of PriestcraftDocument130 pagesBook of PriestcraftEduardo Luiz Pinto100% (1)

- Develop and Practice Negotiation SkillsDocument18 pagesDevelop and Practice Negotiation SkillsLyka Mae Palarca IrangNo ratings yet

- Country Pleasures The Chronicle of A Year Chiefly in A Garden (1893)Document396 pagesCountry Pleasures The Chronicle of A Year Chiefly in A Garden (1893)Chuck AchbergerNo ratings yet

- Grade-3 Final PDFDocument30 pagesGrade-3 Final PDFJuvy Ann PalaginogNo ratings yet

- EDULIGHT Volume - 2, Issue - 4, Nov 2013Document278 pagesEDULIGHT Volume - 2, Issue - 4, Nov 2013EDULIGHT JOURNAL - A Peer Reviewed JournalNo ratings yet

- Geh 5305 PDFDocument18 pagesGeh 5305 PDFleidy vidalNo ratings yet

- Delimitation CommissionDocument3 pagesDelimitation CommissionNavraj Singh SahiNo ratings yet

- Article 05 MehboobDocument20 pagesArticle 05 MehboobMUHAMMAD HASHAAMNo ratings yet

- Karnataka Forest DepartmentDocument1 pageKarnataka Forest DepartmentRhiteshNo ratings yet