Professional Documents

Culture Documents

Tax Calculator 2018-19 (Farrukh Iqbal Khan)

Uploaded by

FarrukhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Calculator 2018-19 (Farrukh Iqbal Khan)

Uploaded by

FarrukhCopyright:

Available Formats

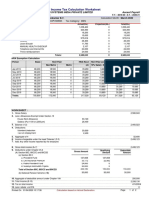

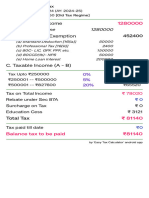

COMPUTATION OF INCOME TAX

TAX YEAR 2019 (01.07.2018 TO 30.06.2019)

Annual Salary

TAXABLE INCOME 960,000

Tax - salaried 2,000

Gross tax Annually Tax 2,000

WORKING OF TAX LIABILITY

TAX CALCULATION

SALARIED NON-SALARIED

Income Tax slabs Tax Tax slabs Tax Income

Tax rate % rate % Tax

1 - 0 400,000 0.00 1 0 400,000 0.00 -

2 - 400,001 800,000 0.00 2 400,001 800,000 0.00 1,000

3 2,000 800,001 1,200,000 0.00 3 800,001 1,200,000 0.00 2,000

4 - 1,200,001 2,400,000 5.00 4 1,200,001 2,400,000 5.00 -

5 - 2,400,001 4,800,000 10.00 5 2,400,001 4,800,000 10.00 -

6 - 4,800,001 15.00 6 4,800,001 15.00 -

7 7

8 TOTAL 3,000

9

10

11

2,000 TOTAL

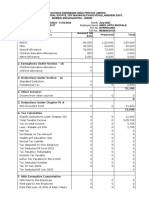

Tax cred its on average rate

S.61 Charitable donations Maximum Limit (lower of a, b and c)

a b

(i) for individual or AOP Total 30%

(ii) for a company Total 20% c

of taxable income

S.62 Investment in shares Total cost 500,000 of taxable income

& Insurance

15% of taxable income

S. 63 Contribution to an ApprovTotal cost No Limit

Pension Fund.

2% additional contribution allowed if fund is joined after 45 years of age 20% of taxable income

S. 64 Profit on debt Total profit 750,000

ReductIon In tax lIabIlIty 50% of taxable income

Clause (1A) of Part III of 2nd schedule 50% of tax shall be reduced if age is 60 years or more at the first day of

tax year and total income does not exceed Rs. 1,000,000

Clause (2) of Part III of 2nd schedule 50% of tax payable on income from salary shall be reduced in case of

a full time teacher or a researcher, employed in a non profit education

or research institution duly recognized by Higher Education

Commission, a Board of Education or a University recognized by the

Higher Education Commission, including government training and

research institution,

You might also like

- Modern Physique - Steve Cook's 8-Week Training PlanDocument7 pagesModern Physique - Steve Cook's 8-Week Training PlanRay0% (5)

- Analysis of JackWills' Marketing StrategiesDocument24 pagesAnalysis of JackWills' Marketing StrategiesAmanda Wong78% (9)

- For Holders: Automated Income Tax CalculationDocument16 pagesFor Holders: Automated Income Tax Calculationmaruf048No ratings yet

- Quiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSDocument5 pagesQuiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSHunternotNo ratings yet

- Amended Tax Certificate for 2020Document2 pagesAmended Tax Certificate for 2020Aurimas AurisNo ratings yet

- Declaration Acknowledgement Slip for Shahzad HaiderDocument2 pagesDeclaration Acknowledgement Slip for Shahzad HaiderShehzad HaiderNo ratings yet

- Shamily VisualCV Jun2022Document2 pagesShamily VisualCV Jun2022Vijay SamuelNo ratings yet

- Tricocat PDFDocument44 pagesTricocat PDFJuan PabloNo ratings yet

- Greaves Brewery Bottle Replenishment ForecastingDocument5 pagesGreaves Brewery Bottle Replenishment Forecastingshadynader50% (2)

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- TaxComputation SYEDL PUN0157 2023 2024Document2 pagesTaxComputation SYEDL PUN0157 2023 2024nitin patilNo ratings yet

- Bai Tap - IAS 12 - Tu LuanDocument14 pagesBai Tap - IAS 12 - Tu LuanTrần Nguyễn Tuệ MinhNo ratings yet

- Tax Calculator (Salaried Person) : Monthly Basic SalaryDocument5 pagesTax Calculator (Salaried Person) : Monthly Basic SalaryAbbas AliNo ratings yet

- Tax Calculator AY 2021-22Document1 pageTax Calculator AY 2021-22mehedi hasanNo ratings yet

- Taxation (Singapore) : March/June 2016 - Sample QuestionsDocument10 pagesTaxation (Singapore) : March/June 2016 - Sample QuestionsJobsdudeNo ratings yet

- Tax Calculator 2022-2023Document3 pagesTax Calculator 2022-2023Entertainment StudioNo ratings yet

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- Tax Calculator FY-2020-21Document12 pagesTax Calculator FY-2020-21Naveen Narasimha MurthyNo ratings yet

- CAF 2 Spring 2021Document8 pagesCAF 2 Spring 2021Muhammad Ahsan RiazNo ratings yet

- CpaDocument37 pagesCparav danoNo ratings yet

- E-Filling of Returns (Shivdas 10 Years)Document122 pagesE-Filling of Returns (Shivdas 10 Years)Unicorn SpiderNo ratings yet

- Pakistan Salary Income Tax Calculator Tax Year 2021 2022Document4 pagesPakistan Salary Income Tax Calculator Tax Year 2021 2022Kashif NiaziNo ratings yet

- Declaration 3310586406613Document4 pagesDeclaration 3310586406613Muhammad WaqasNo ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- Module 1 - Cherry Alfuerte - Train LawDocument41 pagesModule 1 - Cherry Alfuerte - Train Lawgerry dacerNo ratings yet

- Acknowledgement Slip Income Tax ReturnDocument3 pagesAcknowledgement Slip Income Tax ReturnIkramNo ratings yet

- Anwar Group Manager Income Tax AssessmentDocument1 pageAnwar Group Manager Income Tax AssessmentMoment RevealersNo ratings yet

- For Revision of Income TaxDocument5 pagesFor Revision of Income TaxMA AttariNo ratings yet

- Quikchex 2020 Tax Comparison CalculatorDocument1 pageQuikchex 2020 Tax Comparison CalculatorSankar rajNo ratings yet

- Activity 13 May 2023 Key To CorrectionDocument1 pageActivity 13 May 2023 Key To CorrectionJohn Paul MagbitangNo ratings yet

- Economics General Degree Program Faculty of Applied Sciences University of Sri JayewardenepuraDocument19 pagesEconomics General Degree Program Faculty of Applied Sciences University of Sri JayewardenepuraUmesha SavindiNo ratings yet

- New Tax Certi PDFDocument1 pageNew Tax Certi PDFAli Azhar KhanNo ratings yet

- MODULE 3-Short ProblemsDocument5 pagesMODULE 3-Short ProblemsJaimell LimNo ratings yet

- CS Executive Tax Laws Amendments by Vipul ShahDocument41 pagesCS Executive Tax Laws Amendments by Vipul ShahCloxan India Pvt LtdNo ratings yet

- Tri-Star Company Financial Statement AnalysisDocument10 pagesTri-Star Company Financial Statement AnalysisJuliana Angela VillanuevaNo ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- Budget 2023 Retabled EditionDocument36 pagesBudget 2023 Retabled EditionCharlene TooNo ratings yet

- Financial Aspect FinalDocument12 pagesFinancial Aspect Finalmelvanne tamboboyNo ratings yet

- 2019 Declaration PDFDocument4 pages2019 Declaration PDFIkramNo ratings yet

- Taxation (Singapore) : March/June 2018 - Sample QuestionsDocument10 pagesTaxation (Singapore) : March/June 2018 - Sample QuestionsLee WendyNo ratings yet

- Annual Computation of Taxable Salary FY 2021-22Document1 pageAnnual Computation of Taxable Salary FY 2021-22Irfan RazaNo ratings yet

- New Tax Rates vs Existing Tax Rates for IndividualsDocument2 pagesNew Tax Rates vs Existing Tax Rates for IndividualsCA Upendra Singh ThakurNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected Totalprakriti sankhlaNo ratings yet

- Chapter 4 - Income Taxes Problems Luzon CorporationDocument8 pagesChapter 4 - Income Taxes Problems Luzon CorporationJohanna Raissa CapadaNo ratings yet

- Taxation AssessmentDocument8 pagesTaxation AssessmentBhanumati BhunjunNo ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- Form 89(1) Relief CalculatorDocument8 pagesForm 89(1) Relief Calculatorsrinivasallam_259747No ratings yet

- TAXN 1016 FE - Long ProblemsDocument11 pagesTAXN 1016 FE - Long ProblemsCrystel Kate MananganNo ratings yet

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANo ratings yet

- Tax AssignmentDocument11 pagesTax AssignmentAM NerdyNo ratings yet

- Financial Management Assignment Analyzes IRA GrowthDocument5 pagesFinancial Management Assignment Analyzes IRA GrowthTen NineNo ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- Quiz Accounting For Income TaxDocument5 pagesQuiz Accounting For Income TaxCmNo ratings yet

- Correction in Income Tax Volume 1Document12 pagesCorrection in Income Tax Volume 1CrcNo ratings yet

- Easy TaxDocument1 pageEasy TaxSiva GaneshNo ratings yet

- DownloadDocument2 pagesDownloadSowbhagya VaderaNo ratings yet

- 1 BTAXREV Week 2 Income TaxationDocument48 pages1 BTAXREV Week 2 Income TaxationgatotkaNo ratings yet

- Income Tax Calculator FY 2014 15Document2 pagesIncome Tax Calculator FY 2014 15atul bansalNo ratings yet

- Introduction To Income TaxDocument8 pagesIntroduction To Income TaxKartikNo ratings yet

- Income Tax Complete Question BankDocument281 pagesIncome Tax Complete Question BankNoorul Zaman KhanNo ratings yet

- Provisional: Provisional Income Tax CalculationDocument1 pageProvisional: Provisional Income Tax CalculationM. A Hossain & Associates Tax ConsultantsNo ratings yet

- Income Tax Deductions List - Deductions On Section 80C, 80CCC, 80CCD and 80D - FY 2022-23 (AY 2023-24) - Tax2winDocument26 pagesIncome Tax Deductions List - Deductions On Section 80C, 80CCC, 80CCD and 80D - FY 2022-23 (AY 2023-24) - Tax2winJaydeep DasadiyaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 2u2 S4hana1809 BPD en XXDocument13 pages2u2 S4hana1809 BPD en XXFarrukhNo ratings yet

- SAP-ERP Financial Accounting Manual-3 TFDocument88 pagesSAP-ERP Financial Accounting Manual-3 TFFarrukhNo ratings yet

- Grant Management Requirement PDFDocument1 pageGrant Management Requirement PDFFarrukhNo ratings yet

- SAP Manual-2-2014Document81 pagesSAP Manual-2-2014MuhammadAkhlaqKhan100% (1)

- 1go S4hana1809 BPD en inDocument11 pages1go S4hana1809 BPD en inFarrukhNo ratings yet

- SAP Budget Reports Training GuideDocument18 pagesSAP Budget Reports Training GuideFarrukhNo ratings yet

- FICO Daily Use PDFDocument134 pagesFICO Daily Use PDFDeepak WadhwaNo ratings yet

- Salary Tax (2011 - 12) (Draft)Document4 pagesSalary Tax (2011 - 12) (Draft)FarrukhNo ratings yet

- Tax Deduction CertificateDocument1 pageTax Deduction CertificateFarrukhNo ratings yet

- SAP ProfileDocument1 pageSAP ProfileFarrukhNo ratings yet

- Post Natal, Irfan PDFDocument1 pagePost Natal, Irfan PDFFarrukhNo ratings yet

- LSMW Erp FundsmanagementDocument8 pagesLSMW Erp FundsmanagementFarrukhNo ratings yet

- StudentDocument7 pagesStudentFarrukhNo ratings yet

- Grant Management Requirement PDFDocument1 pageGrant Management Requirement PDFFarrukhNo ratings yet

- Reading Sample Sappress 1722 ConfiguringFinancialAccountinginSAPERP PDFDocument39 pagesReading Sample Sappress 1722 ConfiguringFinancialAccountinginSAPERP PDFJYOTI KUSHWAHANo ratings yet

- Supply Chain Management - BBA404Document4 pagesSupply Chain Management - BBA404Anonymous K0ZhcHT2iuNo ratings yet

- ISO 55001 Client Guide WebDocument4 pagesISO 55001 Client Guide WebmohammedgamalattiaNo ratings yet

- Sherefa Husein PaperDocument35 pagesSherefa Husein Paperkassahun mesele100% (1)

- Key Notes - Bankers Committee RetreatDocument3 pagesKey Notes - Bankers Committee RetreatLola OniNo ratings yet

- Slice N' Craft Marketing PlanDocument10 pagesSlice N' Craft Marketing PlanMaria Gella PerezNo ratings yet

- Hospital's Legal Opinion On Chapter 55ADocument8 pagesHospital's Legal Opinion On Chapter 55AEmily Featherston GrayTvNo ratings yet

- Certificate of IncorporationDocument1 pageCertificate of IncorporationFashionZone IndiaNo ratings yet

- Govt. of Andhra Pradesh (APTC Form - 47) : / Temporaray Head of Account DeductionsDocument16 pagesGovt. of Andhra Pradesh (APTC Form - 47) : / Temporaray Head of Account DeductionsDr MaldannaNo ratings yet

- Reverse Logistic Group4Document5 pagesReverse Logistic Group4Tavleen KaurNo ratings yet

- Scan To Scribd With CcscanDocument13 pagesScan To Scribd With CcscanclarkcclNo ratings yet

- (Ec) No. (Reach) Article 33 ("Candidate List") : Regul Tion 1907/2006Document2 pages(Ec) No. (Reach) Article 33 ("Candidate List") : Regul Tion 1907/2006TVE AcademyNo ratings yet

- Rewards credit card statement detailsDocument3 pagesRewards credit card statement detailsVvNo ratings yet

- Sola Guia Czarina D. Portfolio 2021-2-1Document18 pagesSola Guia Czarina D. Portfolio 2021-2-1Charrie Faye Magbitang HernandezNo ratings yet

- Tinywow - Unit 1 Assignment 2 Exploring Businesses - 6114684Document54 pagesTinywow - Unit 1 Assignment 2 Exploring Businesses - 6114684ali MuradNo ratings yet

- NDBT Feb 2022Document5 pagesNDBT Feb 2022shamim0008No ratings yet

- Masters Management AnalyticsDocument12 pagesMasters Management AnalyticsRonNo ratings yet

- Get Download All Report - 27ADMPJ5260G1ZG - 2023 - 2024Document26 pagesGet Download All Report - 27ADMPJ5260G1ZG - 2023 - 2024ajay.patelNo ratings yet

- Indian Coffee House: History and Growth of a Popular Cafe ChainDocument47 pagesIndian Coffee House: History and Growth of a Popular Cafe ChainSalman RazaNo ratings yet

- MBM Issue 5 - Ethos Magazine PDFDocument28 pagesMBM Issue 5 - Ethos Magazine PDFPAPALÓ ARSNo ratings yet

- Budget Cycle Both LGU and National Government AgenciesDocument41 pagesBudget Cycle Both LGU and National Government AgenciesKrizzel Sandoval100% (1)

- Oblicon Practice Sets To Premidterms ReviewerDocument21 pagesOblicon Practice Sets To Premidterms ReviewerCharles LaspiñasNo ratings yet

- DSSB Company Profile - Apr 2020 (V10)Document22 pagesDSSB Company Profile - Apr 2020 (V10)Samuel CarlosNo ratings yet

- The Modern Concept of MarketingDocument81 pagesThe Modern Concept of MarketingANUJ SHARMANo ratings yet

- Marketing Research Completed RevisedDocument70 pagesMarketing Research Completed RevisedJodel DagoroNo ratings yet

- Economics Principles Problems and Policies Mcconnell 20th Edition Solutions ManualDocument16 pagesEconomics Principles Problems and Policies Mcconnell 20th Edition Solutions ManualAntonioCohensirt100% (39)