Professional Documents

Culture Documents

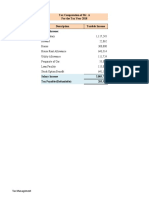

Annual Computation of Taxable Salary FY 2021-22

Uploaded by

Irfan Raza0 ratings0% found this document useful (0 votes)

4 views1 pageOriginal Title

1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageAnnual Computation of Taxable Salary FY 2021-22

Uploaded by

Irfan RazaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Annual Computation of Taxable Salary FY 2021-22

Element May - YTD YTD Total

Basic 357,050 3,124,150 3,481,200

HRA 160,673 1,405,868 1,566,540

Utility 35,705 312,415 348,120

POL 61,756 660,432 200,000

Acting Allowance - -

Driver wages 20,000 220,000 240,000

Car Monetization 52,000 454,133 -

Cola - 436,482 436,482

Danger Money 35,000 35,000

Gross salary 687,184 6,648,480 6,272,342

Add :

Value of Car 5% of Cost

Car Notional - -

7.5% of Basic Limit of ER Taxable Amount

PF Exceeding 150,000/- 261,090 150,000 111,090

Less:

Zakat -

Profit on House Loan -

-

Total Taxable Salary 6,383,432

Tax Slab Rates

Range Fixed Tax Additional Amount Rate of tax Additional tax Total Tax

1 600,000 0%

600,001 1,200,000 0 2.50%

1,200,001 2,400,000 15,000 12.5%

2,400,001 3,600,000 165,000 20.0%

3,600,001 6,000,000 405,000 - 25.0% - -

6,000,001 12,000,000 1,005,000 383,431 32.5% 124,615 1,129,615

12,000,001 9,900,000 2,955,000 - 35.0% - -

(35,682.39) (428,188.68)

Total Tax on Salary 1,129,615 94,134.59 180,000

30,499

Average rate of Tax 18% 130

374,420

Investment Amount In Rupees Max. Limit Tax Credit

Life Insurance - -

Mutual Fund - 1,276,686.40 -

Pension Fund - 1,915,029.60 -

Donation 1,915,029.60 -

- - 1,129,615

2571935

WHT Tax Adjustment (1,442,320)

Education - 190000

Vehicle - (1,252,320)

Bank / Cash withdrawal -

PTCL / V Phone/ Evo -

-

Tax Deducted till May 2020 1,077,582

Tax Liability in June 2020 52,033

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- Amended Tax Certificate for 2020Document2 pagesAmended Tax Certificate for 2020Aurimas AurisNo ratings yet

- Tax Calculator AY 2021-22Document1 pageTax Calculator AY 2021-22mehedi hasanNo ratings yet

- FM AssignmentDocument10 pagesFM AssignmentKaleab TadesseNo ratings yet

- Laketran FoloDocument1 pageLaketran Fololkessel5622No ratings yet

- Plas Mech BS 07-08Document32 pagesPlas Mech BS 07-08plasmechNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- Car Lease ComparisonDocument16 pagesCar Lease Comparisonrahul kumarNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- Cost Sheet - GenX - Team 4 .2Document7 pagesCost Sheet - GenX - Team 4 .2sanketmistry32No ratings yet

- Only Fill Yellow Cells: WorkingsDocument2 pagesOnly Fill Yellow Cells: WorkingsvikrammoolchandaniNo ratings yet

- BSNL Payslip August 2017Document1 pageBSNL Payslip August 2017etrshillongNo ratings yet

- TSU - Public AdminDocument45 pagesTSU - Public AdminaileenrconcepcionNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected Totalprakriti sankhlaNo ratings yet

- XYZ Private Limited Financial Projections 2010-11Document8 pagesXYZ Private Limited Financial Projections 2010-11Dhiraj RawatNo ratings yet

- EPF Universal Account Number: LIC ID / Policy IDDocument2 pagesEPF Universal Account Number: LIC ID / Policy IDBiswajit DasNo ratings yet

- Horizontal AnalysisDocument1 pageHorizontal Analysiswill burrNo ratings yet

- Employee Tax Calculation ReportDocument10 pagesEmployee Tax Calculation ReportFawazilHamdalahNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- BSNL Payslip February 2019Document1 pageBSNL Payslip February 2019pankajNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- TM PQsDocument10 pagesTM PQsAnooshayNo ratings yet

- Income Statment of RideyaDocument4 pagesIncome Statment of Rideyafaizan mughalNo ratings yet

- SONA BLW Precision Pay Slip TitleDocument2 pagesSONA BLW Precision Pay Slip Titleavisinghoo7No ratings yet

- 7.tax Calculation 2022-23 RazuDocument7 pages7.tax Calculation 2022-23 RazuFarrukh AhmedNo ratings yet

- SalaryDocument1 pageSalarypankajNo ratings yet

- Tax Calculator 2018-19 (Farrukh Iqbal Khan)Document2 pagesTax Calculator 2018-19 (Farrukh Iqbal Khan)FarrukhNo ratings yet

- Analyze Financial Performance and Tax Burden of CompaniesDocument14 pagesAnalyze Financial Performance and Tax Burden of CompaniesNur Maulidyah AzizahNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- MAT Calculation SheetDocument33 pagesMAT Calculation SheetLokesh KumarNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- Pay Slip DecDocument1 pagePay Slip DecMalix EagleNo ratings yet

- unknown (4)Document1 pageunknown (4)Firoz ShaikhNo ratings yet

- Aleosan Executive Summary 2019Document7 pagesAleosan Executive Summary 2019Joshua Luis BagadiongNo ratings yet

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument1 pageSalary Calculation Yearly & Monthly Break Up of Gross SalarySRS ENTERPRISESNo ratings yet

- Vodafone Idea Limited Standalone Profit & Loss Data Over 5 YearsDocument1 pageVodafone Idea Limited Standalone Profit & Loss Data Over 5 YearsMayank BhardwajNo ratings yet

- ToyotaDocument4 pagesToyotaعبدالرحمن منصورNo ratings yet

- Tax - Osman Gani - 22-23Document1 pageTax - Osman Gani - 22-23M N Sharif MintuNo ratings yet

- LoadAutoEstimateDocument2 pagesLoadAutoEstimatedlovasibongileNo ratings yet

- Quikchex CTC CalculatorDocument8 pagesQuikchex CTC CalculatoriamgodrajeshNo ratings yet

- Telangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaDocument1 pageTelangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaKANNE NITHINNo ratings yet

- 13 Mainit2020 - Part4 Annexes - A DDocument13 pages13 Mainit2020 - Part4 Annexes - A DLeo SindolNo ratings yet

- SESB-Budget 2013 (Departmental Budget) - Corp Comm Revised As at 17OCT2012Document38 pagesSESB-Budget 2013 (Departmental Budget) - Corp Comm Revised As at 17OCT2012roalan1No ratings yet

- Pfizer Income Tax ComputationDocument2 pagesPfizer Income Tax ComputationDsr Santhosh KumarNo ratings yet

- Renata Limited: Symbol: RENATA Sector: Pharmaceuticals & ChemicalsDocument2 pagesRenata Limited: Symbol: RENATA Sector: Pharmaceuticals & ChemicalsNayyab Alam TurjoNo ratings yet

- TELANGANA STATE POWER GENERATION CORPORATION PAY SLIP FOR FEBRUARY 2017Document1 pageTELANGANA STATE POWER GENERATION CORPORATION PAY SLIP FOR FEBRUARY 2017Ganesh DasaraNo ratings yet

- EPF Universal Account Number: LIC ID / Policy IDDocument1 pageEPF Universal Account Number: LIC ID / Policy IDRapole DathatriNo ratings yet

- HCL Technologies Financial Analysis 2018-21Document3 pagesHCL Technologies Financial Analysis 2018-21Joseph JohnNo ratings yet

- UnknownDocument1 pageUnknownSumanth MopideviNo ratings yet

- Project Report Final 1Document11 pagesProject Report Final 1ManiyarSant & Co., Chartered AccountantsNo ratings yet

- Client: PT Jambi Prima Coal Closing Date: 31 Desember 2018Document7 pagesClient: PT Jambi Prima Coal Closing Date: 31 Desember 2018Umar MukhtarNo ratings yet

- تتتتDocument1 pageتتتتmohdawood491No ratings yet

- Provisional: Provisional Income Tax CalculationDocument1 pageProvisional: Provisional Income Tax CalculationM. A Hossain & Associates Tax ConsultantsNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsMehwish ArsalNo ratings yet

- Pay Slip BSNLDocument1 pagePay Slip BSNLJohn FernendiceNo ratings yet

- Financial Aspect FinalDocument12 pagesFinancial Aspect Finalmelvanne tamboboyNo ratings yet

- Activity Data DashboardDocument9 pagesActivity Data DashboardAngel Yohaiña Ramos SantiagoNo ratings yet

- Novartis Bangladesh Limited Salary Income Certificate Tax Calculation for 2014-2015Document2 pagesNovartis Bangladesh Limited Salary Income Certificate Tax Calculation for 2014-2015Samiul Alim SanyNo ratings yet

- BSNL TM SalaryDocument1 pageBSNL TM SalaryDharmveer SinghNo ratings yet

- HEARING NOTICE ON 21-03-2024 AT OGRA KARACHI BY KHALILDocument1 pageHEARING NOTICE ON 21-03-2024 AT OGRA KARACHI BY KHALILIrfan RazaNo ratings yet

- SpotDocument3 pagesSpotIrfan RazaNo ratings yet

- Gas Theft ARPSE 2017-18Document2 pagesGas Theft ARPSE 2017-18Irfan RazaNo ratings yet

- PAR-147 SNPCL-I 04-06-2021 28002-03Document8 pagesPAR-147 SNPCL-I 04-06-2021 28002-03Irfan RazaNo ratings yet

- gasbill_5427550000_202403_20240328212939Document1 pagegasbill_5427550000_202403_20240328212939Irfan RazaNo ratings yet

- SS&CGTODocument2 pagesSS&CGTOIrfan RazaNo ratings yet

- Spot Awards Sept 2021Document4 pagesSpot Awards Sept 2021Irfan RazaNo ratings yet

- Key Performance Indicator Form: Key Result Area (Kra)Document1 pageKey Performance Indicator Form: Key Result Area (Kra)Irfan RazaNo ratings yet

- SS&CGTO - Intelligence WingDocument4 pagesSS&CGTO - Intelligence WingIrfan RazaNo ratings yet

- Sample Key Performance Indicator FormDocument1 pageSample Key Performance Indicator FormIrfan RazaNo ratings yet

- ReadmeDocument3 pagesReadmeIrfan RazaNo ratings yet

- Indentor Office DGM (Audit Despatch GM (F) : SSGC/FP/10699Document2 pagesIndentor Office DGM (Audit Despatch GM (F) : SSGC/FP/10699Irfan RazaNo ratings yet

- Overtime Hours and Payments by SSGC EmployeesDocument5 pagesOvertime Hours and Payments by SSGC EmployeesIrfan RazaNo ratings yet

- Spot Awards Oct 2021Document2 pagesSpot Awards Oct 2021Irfan RazaNo ratings yet

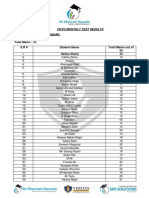

- SKH Solutions JAUHAR Fifth Monthly Test ResultsDocument4 pagesSKH Solutions JAUHAR Fifth Monthly Test ResultsIrfan RazaNo ratings yet

- Vol 14 Mar 2023Document1 pageVol 14 Mar 2023Irfan RazaNo ratings yet

- COVID 19 Pandemic - Risk AssessmentDocument2 pagesCOVID 19 Pandemic - Risk AssessmentIrfan RazaNo ratings yet

- Experience Personal Information: Front Desk Officer The Froebel's School, KarachiDocument2 pagesExperience Personal Information: Front Desk Officer The Froebel's School, KarachiIrfan RazaNo ratings yet

- Side Letter To Contract For Supply of GasDocument2 pagesSide Letter To Contract For Supply of GasIrfan Raza100% (1)

- Candidate exam results reportDocument13 pagesCandidate exam results reportIrfan RazaNo ratings yet

- Presentation On Gas Metering: by SNGPL-Metering DepartmentDocument276 pagesPresentation On Gas Metering: by SNGPL-Metering DepartmentIrfan RazaNo ratings yet

- Prime Ministers Focus Area - As at Dec 2020Document1 pagePrime Ministers Focus Area - As at Dec 2020Irfan RazaNo ratings yet

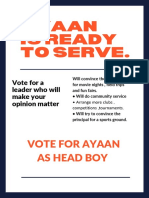

- Vote for Ayaan as Head BoyDocument1 pageVote for Ayaan as Head BoyIrfan RazaNo ratings yet

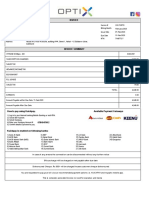

- MrcInvoicesFebruary2023371784 PDFDocument1 pageMrcInvoicesFebruary2023371784 PDFIrfan RazaNo ratings yet

- M Atif CV For SSGC Assistant Manager-1Document2 pagesM Atif CV For SSGC Assistant Manager-1Irfan RazaNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument16 pagesCambridge International General Certificate of Secondary EducationIrfan RazaNo ratings yet

- Organization Chart: DMD (Ind / Com)Document2 pagesOrganization Chart: DMD (Ind / Com)Irfan RazaNo ratings yet

- Procedure For Dealing With Theft of Gas CasesDocument6 pagesProcedure For Dealing With Theft of Gas CasesIrfan RazaNo ratings yet

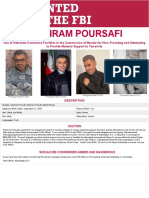

- Shahram PoursafiDocument1 pageShahram PoursafiIrfan RazaNo ratings yet

- Notice For Marks CertificateDocument1 pageNotice For Marks CertificateIrfan RazaNo ratings yet

- Section 45 & Case LawsDocument3 pagesSection 45 & Case Lawshemant rajNo ratings yet

- Introduction to Insurance FundamentalsDocument35 pagesIntroduction to Insurance FundamentalsPooja Tripathi0% (1)

- Consumer Math Score GuidesDocument30 pagesConsumer Math Score GuidesCrystal WelchNo ratings yet

- Project On LIC IndiaDocument73 pagesProject On LIC IndiaViPul86% (73)

- Case Digest For InsuranceDocument8 pagesCase Digest For InsurancenheldelaraNo ratings yet

- Asc Sept 18Document48 pagesAsc Sept 18Orhan Mc MillanNo ratings yet

- LLQP Text - 18 November 2014Document342 pagesLLQP Text - 18 November 2014miralbhatt67% (3)

- ICICI Pru GIFT Long Term BrochureDocument16 pagesICICI Pru GIFT Long Term BrochureShreyaNo ratings yet

- AEGON Religare Life Insurance CompanyDocument12 pagesAEGON Religare Life Insurance Companymayank_astroNo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS CertificateKesava KesNo ratings yet

- Terms & DisclaimersDocument2 pagesTerms & DisclaimersPavan SadaraNo ratings yet

- Sample Life Exam QuestionsDocument10 pagesSample Life Exam Questionsrita tamohNo ratings yet

- Chapter 27 Leveling The Net Single PremiumDocument19 pagesChapter 27 Leveling The Net Single PremiumradislamyNo ratings yet

- Havells India Ltd-15Document226 pagesHavells India Ltd-15Apoorva GuptaNo ratings yet

- The Bank of Punjab Latest Internship Report With Three Years Financial DataDocument23 pagesThe Bank of Punjab Latest Internship Report With Three Years Financial DataMuhammad Taif KhanNo ratings yet

- 18BC8171118 ArbazDocument51 pages18BC8171118 ArbazPiyush GuptaNo ratings yet

- A Project Report On Bharti AXA Life Insurance CoDocument67 pagesA Project Report On Bharti AXA Life Insurance CoLucifer Morningstar0% (1)

- Life Insurance Business Capability ModelDocument8 pagesLife Insurance Business Capability ModelCapability Model100% (1)

- Kotak Mahindra Life InsuranceDocument51 pagesKotak Mahindra Life InsuranceRiddhi GalaNo ratings yet

- SUPP - ANN. WITHDRAWAL FormDocument3 pagesSUPP - ANN. WITHDRAWAL FormDasharath PatelNo ratings yet

- Life Insurance Industry in IndiaDocument4 pagesLife Insurance Industry in Indiabharat1313No ratings yet

- Advance I Ch-IDocument61 pagesAdvance I Ch-IBamlak WenduNo ratings yet

- GSIP BrochureDocument2 pagesGSIP Brochureabdul.nm4064No ratings yet

- Offer Letter - Lipika GhoshDocument5 pagesOffer Letter - Lipika GhoshDipanwita SahaNo ratings yet

- MalobaDocument1 pageMalobaenyonyoziNo ratings yet

- Calculate Life Insurance Premiums for Various PoliciesDocument15 pagesCalculate Life Insurance Premiums for Various PoliciesVijay AgrahariNo ratings yet

- Agenda158SLBC PDFDocument44 pagesAgenda158SLBC PDFSandeep KumarNo ratings yet

- Part 1 - Income TaxesDocument31 pagesPart 1 - Income TaxesCharles MateoNo ratings yet

- Indemnity Bond For Claim Payout Without Original Policy Document - 18062019Document2 pagesIndemnity Bond For Claim Payout Without Original Policy Document - 18062019Vinod M DSOuzaNo ratings yet

- SUD Life Assured Income PlanDocument8 pagesSUD Life Assured Income PlanJason RodriguezNo ratings yet