Professional Documents

Culture Documents

7.tax Calculation 2022-23 Razu

Uploaded by

Farrukh AhmedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7.tax Calculation 2022-23 Razu

Uploaded by

Farrukh AhmedCopyright:

Available Formats

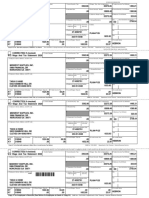

North West Power Generation Company Limited

Sirajganj 225 MW Power Plant

#REF!

#REF!

Monthly Yearly Exempted Taxable

Basic 45,010.00 540,120 540,120.00

House Rent Allowance 216,048 300,000.00

Conveyance Allowance -

Power House Allowance 135,030 135,030.00

Incentive Bonus -

Festival Bonus 99,022.00 99,022.00

Education Allowance - -

Shift Allowence 81,018.00 81,018.00

Residential Electricity 1,666.00 19,992.00 19,992.00

Employers Contributory PF 54,012.00 54,012.00

-

Total Taxable Income 929,194.00 Tax Rate Tax liability

300,000.00

629,194.00

100,000.00 5% 5,000.00

529,194.00

300,000.00 10% 30,000.00

229,194.00 15% 34,379.10

Total Tax 69,379

Rebate Calculation Less Rebate 34,845

Taxable Amount 929,194 Net Tax 34,534

25% Investment 232,299 Net Tax per month 2,878

15% Rebate 34,845

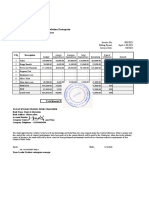

North West Power Generation Company Limited

Sirajganj 225 MW Power Plant

Name: Shyamal Kumar Das, SE

FY 2018-19

Monthly Yearly Exempted Taxable

Basic 52,680.00 632,160 632,160.00

House Rent Allowance 252,864 300,000.00

Conveyance Allowance -

Power House Allowance 158,040 158,040.00

Incentive Bonus -

Festival Bonus 115,896.00 115,896.00

Education Allowance - -

Shift Allowence -

Residential Electricity 1,666.00 19,992.00 19,992.00

Employers Contributory PF 63,216.00 63,216.00

-

Total Taxable Income 989,304.00 Tax Rate Tax liability

300,000.00

689,304.00

100,000.00 5% 5,000.00

589,304.00

300,000.00 10% 30,000.00

289,304.00 15% 43,395.60

Total Tax 78,396

Rebate Calculation Less Rebate 37,099

Taxable Amount 989,304 Net Tax 41,297

25% Investment 247,326 Net Tax per month 3,441

15% Rebate 37,099

North West Power Generation Company Limited

Sirajganj 225 MW Power Plant

Name: Shyamal Kumar Das, SE

FY 2018-19

Monthly Yearly Exempted Taxable

Basic 56,250.00 675,000 675,000.00

House Rent Allowance 270,000 300,000.00

Conveyance Allowance -

Power House Allowance 168,750 168,750.00

Incentive Bonus -

Festival Bonus 123,750.00 123,750.00

Education Allowance - -

Shift Allowence -

Residential Electricity 1,666.00 19,992.00 19,992.00

Employers Contributory PF 67,500.00 67,500.00

-

Total Taxable Income 1,054,992.00 Tax Rate Tax liability

300,000.00

754,992.00

100,000.00 5% 5,000.00

654,992.00

300,000.00 10% 30,000.00

354,992.00 15% 53,248.80

Total Tax 88,249

Rebate Calculation Less Rebate 39,562

Taxable Amount 1,054,992 Net Tax 48,687

25% Investment 263,748 Net Tax per month 4,057

15% Rebate 39,562

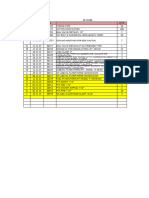

North-West Power Generation Company Limited

Sirajganj 225 MW Power Plant

Soydabad , Sirajganj

Tax Calculation of Salary for the financial year 2022-2023

Name : Rasel razu, Sub-Assistant Engineer

S/N Description Monthly Taxable

1 Basic 386,667.00

2 House Rent Allowance 156,267.00

3 Power House Allowance 94,667.00

4 Festival Bonus - 40,000.00

5 Incentive Bonus - -

6 Leave Encashment - -

7 Electricity 15,190.00

8 Employers Contributory PF #VALUE! 38,667.00

Other Allowances(Medical, conveyance education) 132,100.00

Gross Income 863,558.00

Exemption 450,000.00

Total Taxable Income [Gross Income-Exemption] 413,558.00 Tax Rate Tax liability

350,000.00 0% -

63,558.00

100,000.00 5% 3,177.90

300,000.00 10% -

400,000.00 15% -

500,000.00 20%

(400,000.00) 20% -

25% -

Rebate Calculation Total Tax 3,177.90

Taxable Amount 413,558.00 Less Rebate 11,600.10

20% Investment 82,712.00 Net Tax 3,000.00

Actual Investment CPFx2 77,334.00 Paid 9,900.00

15% Rebate 11,600.10 To be paid (6,900.00)

North-West Power Generation Company Limited

Sirajganj 225 MW Power Plant

Soydabad , Sirajganj

Tax Calculation of Salary for the financial year 2022-2023

Name : Md.Monirujjaman, Sub-Divisional Engineer

S/N Description Monthly Taxable

1 Basic 81,900.00 982,800.00

2 House Rent Allowance 32,760.00 393,120.00

3 Power House Allowance 20,475.00 245,700.00

4 Festival Bonus - 180,180.00

5 Leave Encashment - 81,900.00

7 Electricity - 18,545.00

8 Employers Contributory PF 8,190.00 98,280.00

Gross Income 2,000,525.00

Exemption 450,000.00

Total Taxable Income [Gross Income-Exemption] 1,550,525.00 Tax Rate Tax liability

350,000.00 0% -

1,200,525.00

100,000.00 5% 5,000.00

1,100,525.00

300,000.00 10% 30,000.00

800,525.00

400,000.00 15% 60,000.00

500,000.00 20%

400,525.00 20% 80,105.00

25% -

Rebate Calculation Total Tax 175,105.00

Taxable Amount 1,550,525.00 Less Rebate 29,484.00

20% Investment 310,105.00 Net Tax 145,621.00

Actual Investment CPFx2 196,560.00 Paid 157,880.00

15% Rebate 29,484.00 To be paid (12,259.00)

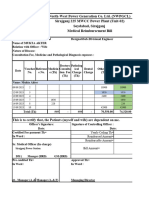

North West Power Generation Company Limited

Sirajganj 225 MW Power Plant

Name: Shyamal Kumar Das, SE

FY 2018-19

Monthly Yearly Exempted Taxable

Basic 102,370.00 1,228,440 1,228,440.00

House Rent Allowance 491,376 300,000.00 191,376.00

Conveyance Allowance -

Power House Allowance 307,110 307,110.00

Incentive Bonus -

Festival Bonus 225,214.00 225,214.00

Education Allowance - -

Leave Encashment - -

Residential Electricity 1,666.00 19,992.00 19,992.00

Employers Contributory PF 122,844.00 122,844.00

-

Total Taxable Income 2,094,976.00 Tax Rate Tax liability

300,000.00

1,794,976.00

100,000.00 5% 5,000.00

1,694,976.00

300,000.00 10% 30,000.00

1,394,976.00

400,000.00 15% 60,000.00

994,976.00

500,000.00 20% 100,000.00

494,976.00 25% 123,744.00

Total Tax 318,744

Rebate Calculation Less Rebate 52,374

Taxable Amount 2,094,976 Net Tax 266,370

25% Investment 523,744 Net Tax per month 22,197

10% Rebate 52,374

You might also like

- Plas Mech BS 07-08Document32 pagesPlas Mech BS 07-08plasmechNo ratings yet

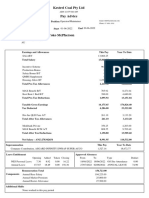

- Your Pay Advice For Pay Ending 30 06 2022Document2 pagesYour Pay Advice For Pay Ending 30 06 2022iqbal.shahid0374No ratings yet

- Commercial Confirmation JSW BarbilDocument1 pageCommercial Confirmation JSW BarbilSabuj SarkarNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected TotalDsr Santhosh KumarNo ratings yet

- EPF Universal Account NumberDocument1 pageEPF Universal Account NumberetrshillongNo ratings yet

- Pajak Rizki Rahmat Putra - 20AP2Document9 pagesPajak Rizki Rahmat Putra - 20AP2Alviana RenoNo ratings yet

- Apit CalculatorDocument2 pagesApit CalculatorShármílá FerdinandesNo ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- Annual Computation of Taxable Salary FY 2021-22Document1 pageAnnual Computation of Taxable Salary FY 2021-22Irfan RazaNo ratings yet

- Wells Fargo International Solutions Private Limited: Employee Pay History For The Period JAN-2021 To DEC-2021Document1 pageWells Fargo International Solutions Private Limited: Employee Pay History For The Period JAN-2021 To DEC-2021Sourabh PunshiNo ratings yet

- Xoriantlive 28051007Document1 pageXoriantlive 28051007susilaNo ratings yet

- PT Jayatama - Dhiwa - Laba Rugi (Standar)Document1 pagePT Jayatama - Dhiwa - Laba Rugi (Standar)Dhiwa RafiantoNo ratings yet

- SamplePayroll Processing and Withholding Tax On CompensationDocument2 pagesSamplePayroll Processing and Withholding Tax On CompensationReinalyn De VeraNo ratings yet

- Components Earnings: Amounts Are in INRDocument1 pageComponents Earnings: Amounts Are in INRDheeraj KumarNo ratings yet

- Components Earnings: Amounts Are in INRDocument1 pageComponents Earnings: Amounts Are in INRDheeraj KumarNo ratings yet

- Profit & Loss PT TCP M Arif Rahman - 2005151018 - Akp-3aDocument1 pageProfit & Loss PT TCP M Arif Rahman - 2005151018 - Akp-3aM Arif RahmanNo ratings yet

- Serv Let ControllerDocument2 pagesServ Let ControllerANAND RADHAWALNo ratings yet

- PatnershipDocument7 pagesPatnershipShevina MaghariNo ratings yet

- Servlet ControllerDocument1 pageServlet ControllerRohit SolomonNo ratings yet

- MboDocument4 pagesMboSum WhosinNo ratings yet

- Underwriting Report-Week Ending 03 September 2020Document12 pagesUnderwriting Report-Week Ending 03 September 2020Emmanuel MonzeNo ratings yet

- Nooruddin Aftab Azimuddin Sayyed 17-18Document4 pagesNooruddin Aftab Azimuddin Sayyed 17-18MUJAHIDUL ISLAM SHAIKHNo ratings yet

- 31 Jan 2024Document2 pages31 Jan 2024vikzNo ratings yet

- Evi14 104947Document1 pageEvi14 104947Al QadriNo ratings yet

- Servlet ControllerDocument2 pagesServlet ControllerRJNo ratings yet

- 31744534Document1 page31744534hamzabalouch1996No ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- Koreksi Fiskal KelompokDocument15 pagesKoreksi Fiskal KelompokAlfin m.r.No ratings yet

- Gopal Ji Steel GSTR3B jUNE2022Document1 pageGopal Ji Steel GSTR3B jUNE2022Nikita VarshneyNo ratings yet

- Deductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Document1 pageDeductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Fire SuperstarNo ratings yet

- MGM Budget 2008Document1 pageMGM Budget 2008Stonegate Subdivision HOANo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Employee Tax Calculation ReportDocument10 pagesEmployee Tax Calculation ReportFawazilHamdalahNo ratings yet

- Evi4 104957Document2 pagesEvi4 104957Al QadriNo ratings yet

- Taxation AssessmentDocument8 pagesTaxation AssessmentBhanumati BhunjunNo ratings yet

- Your Pay Advice For Pay Ending 30 09 2022Document2 pagesYour Pay Advice For Pay Ending 30 09 2022iqbal.shahid0374No ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Liabilities Assets Current Year 2019-20 Current Year 2019-20Document2 pagesLiabilities Assets Current Year 2019-20 Current Year 2019-20n dalviNo ratings yet

- Tax 1 PDFDocument16 pagesTax 1 PDFAli Azhar KhanNo ratings yet

- Confidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerDocument1 pageConfidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerAbdul Nayeem100% (1)

- PayslipDocument1 pagePayslipB.DurairajNo ratings yet

- Capital Contribution: Stockholder TINDocument17 pagesCapital Contribution: Stockholder TINEddie ParazoNo ratings yet

- Pay Slip of August 2023Document1 pagePay Slip of August 2023alim.siddiquiNo ratings yet

- Irma4 104904Document2 pagesIrma4 104904Al QadriNo ratings yet

- Payslip SepDocument1 pagePayslip SepBrajesh PandeyNo ratings yet

- Firm Balance SheetDocument5 pagesFirm Balance SheetHimanshu YadavNo ratings yet

- Web Payslip 332429 202305 PDFDocument3 pagesWeb Payslip 332429 202305 PDFN.SATHYAMOORTHY MoorthyNo ratings yet

- Tax Assignment 4Document5 pagesTax Assignment 4pfungwaNo ratings yet

- Habesha Unique Digital Health Solution Enterprise Financial Reporting Summary Sheet Apr-21 Debre MarkosDocument5 pagesHabesha Unique Digital Health Solution Enterprise Financial Reporting Summary Sheet Apr-21 Debre Markosbinaym tarikuNo ratings yet

- Payslip Tax 1 2024Document2 pagesPayslip Tax 1 2024Trilok SHARMANo ratings yet

- Web Payslip 266675 202306Document2 pagesWeb Payslip 266675 202306prabhat.finnproNo ratings yet

- MDRRMODocument4 pagesMDRRMOSum WhosinNo ratings yet

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocument1 page2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1No ratings yet

- Darlami Hardware & Suppliers 3Document1 pageDarlami Hardware & Suppliers 3Manoj gurungNo ratings yet

- FM AssignmentDocument10 pagesFM AssignmentKaleab TadesseNo ratings yet

- July, 2008Document2 pagesJuly, 2008dujust_hudesNo ratings yet

- Paye Calculator-2Document11 pagesPaye Calculator-2MORRIS MURIGINo ratings yet

- REPORT February 2023Document36 pagesREPORT February 2023leniemirandaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Evaluation Form - 2Document3 pagesEvaluation Form - 2Farrukh AhmedNo ratings yet

- MMD R.list-02 - 2Document2 pagesMMD R.list-02 - 2Farrukh AhmedNo ratings yet

- Shariful IslamDocument2 pagesShariful IslamFarrukh AhmedNo ratings yet

- MDCLDocument5 pagesMDCLFarrukh AhmedNo ratings yet

- Tax RazuDocument1 pageTax RazuFarrukh AhmedNo ratings yet

- Equipment Type Code Equipment TypeDocument24 pagesEquipment Type Code Equipment TypeFarrukh AhmedNo ratings yet

- Weekly PM Schedule S2Document43 pagesWeekly PM Schedule S2Farrukh AhmedNo ratings yet

- Mechanical Maintenance Division (Unit-2) : Maintenance Works For The Month: July 2021Document9 pagesMechanical Maintenance Division (Unit-2) : Maintenance Works For The Month: July 2021Farrukh AhmedNo ratings yet

- GT (Unit-01) Overhauling (Store Report)Document30 pagesGT (Unit-01) Overhauling (Store Report)Farrukh AhmedNo ratings yet

- National ID No (If (Any) :: Md. Golam Azam Khan (Mukul)Document16 pagesNational ID No (If (Any) :: Md. Golam Azam Khan (Mukul)Farrukh AhmedNo ratings yet

- PAYE Tax TablesDocument3 pagesPAYE Tax TablesDanushka MarasingheNo ratings yet

- Metropolis Town Villa Cost SheetDocument1 pageMetropolis Town Villa Cost SheetpreanandNo ratings yet

- Steps in Closing SPDocument2 pagesSteps in Closing SPphilip william altaresNo ratings yet

- Revenue Regulations No. 31-2020Document2 pagesRevenue Regulations No. 31-2020zelayneNo ratings yet

- TANGEDCO - Application PortalDocument2 pagesTANGEDCO - Application Portalsubash nateshanNo ratings yet

- Coker Depreciation CalculatorDocument6 pagesCoker Depreciation CalculatorOmar ChaudhryNo ratings yet

- Goods and Services Tax (GST) : Simplified byDocument14 pagesGoods and Services Tax (GST) : Simplified byMohan ChoudharyNo ratings yet

- Account Closure Form: Health Savings Account (HSA)Document1 pageAccount Closure Form: Health Savings Account (HSA)ElaNo ratings yet

- MintechDocument1 pageMintechA3 VenturesNo ratings yet

- Donor's Tax Return BIR Form No. 1800Document2 pagesDonor's Tax Return BIR Form No. 1800May DinagaNo ratings yet

- Tax For Corp - AnswersDocument8 pagesTax For Corp - AnswersChelsea SabadoNo ratings yet

- September 2023 - Dhea Kuntum MawarniDocument1 pageSeptember 2023 - Dhea Kuntum MawarnimhdwiabdiNo ratings yet

- Other Than Senior and Super Senior CitizenDocument6 pagesOther Than Senior and Super Senior CitizenKishan PatelNo ratings yet

- Melo - Quiz#6Document4 pagesMelo - Quiz#6tricia meloNo ratings yet

- MANFOOLDocument1 pageMANFOOLSandesh JainNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument5 pagesCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- GCash Bills Pay ReceiptDocument1 pageGCash Bills Pay ReceiptRCVZ BKNo ratings yet

- Puma Sports India PVT LTD: Tax InvoiceDocument1 pagePuma Sports India PVT LTD: Tax Invoiceowais zargarNo ratings yet

- Suture Al Wali 13-1Document1 pageSuture Al Wali 13-1Arsal Ghulam MustafaNo ratings yet

- Examination Session 2021-22: Exam Form # Verification #Document4 pagesExamination Session 2021-22: Exam Form # Verification #vikas guptaNo ratings yet

- E-Way Bill: Mode Vehicle / Trans Doc No & Dt. From Entered Date Entered by Cewb No. (If Any) Multi Veh - Info (If Any)Document1 pageE-Way Bill: Mode Vehicle / Trans Doc No & Dt. From Entered Date Entered by Cewb No. (If Any) Multi Veh - Info (If Any)Harsh SinghalNo ratings yet

- ComercialInvoice BRH130463434Document1 pageComercialInvoice BRH130463434cornelis nooijensNo ratings yet

- SEC. 2. DEFINITION OF TERMS. - For Purposes of These Regulations, The FollowingDocument2 pagesSEC. 2. DEFINITION OF TERMS. - For Purposes of These Regulations, The Followingkat de castroNo ratings yet

- Dynasty Corporation 2019 2019 2019 Phils. China TotalDocument17 pagesDynasty Corporation 2019 2019 2019 Phils. China TotalAngela RuedasNo ratings yet

- Procedure of AssessmentDocument2 pagesProcedure of AssessmentRohit ojhaNo ratings yet

- ENPL To MSIPL-ENPL SiranchowkDocument1 pageENPL To MSIPL-ENPL SiranchowkDeepak SinghNo ratings yet

- Flow ChartDocument2 pagesFlow ChartKristal JuditNo ratings yet

- Quiz Estate TaxDocument1 pageQuiz Estate TaxRenz CastroNo ratings yet

- Preparation of Tax ReturnsDocument6 pagesPreparation of Tax ReturnsChel GualbertoNo ratings yet

- AbDocument1,714 pagesAbkanchan mauryaNo ratings yet