Professional Documents

Culture Documents

Tax - Osman Gani - 22-23

Uploaded by

M N Sharif MintuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax - Osman Gani - 22-23

Uploaded by

M N Sharif MintuCopyright:

Available Formats

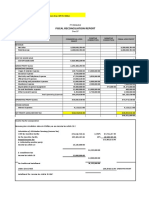

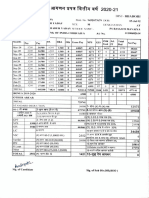

Computation of Tax Liability

Assessee : Osman Gani

e-T I N :

Assessment Year : 2023 - 2024

Income Year : 2022-2023

Amount of

Amount of Net Taxable

INCOME FROM SALARY Exempted

Income (Tk) Income (Tk.)

Income (Tk)

Basic Salary 274,670 274,670

House Rent 137,335 137,335

Medical Allowance 27,467 27,467

Conveyance Allowance 30,000 30,000

Bonus 91,870 91,870

PF ( Employer) 27,624 27,624

Others 185,008 185,008

-

TOTAL INCOME FROM SALARY (A) Certificate enclosed 773,974 257,991 515,983

Less : Exempted ( 1/3 of Total Salary or Tk. 4,50,000/=which is less)

BANK INTEREST INCOME (B) Document enclosed -

OTHER INCOME Dividend (C ) Document enclosed -

TOTAL TAXABLE INCOME ( A+B+C) 515,983

ADMISSIBLE INVESTMENT ALLOWANCES FOR TAX CREDIT (As per PART- B of Sixth Schedule)

Life Insurance Premium -

Employees & Employer's Cont.to P.F 55,248

Investment in approved stocks, shares etc. -

Deposit Pension Scheme, BSP 8,287

Total Actual Investment 55,248

Allowable limit 25% of Total Income (Excluding Employer Contribution)

(whichever is lower)

15% TAX CREDIT ON ABOVE INVESTMENT ALLOWANCE COMES 8,287

Tax Taxable Rate of Income Tax Tax

Computation Income Tax Payable Liability (Tk)

On first 350,000 Nil -

On the next 100,000.00 100,000 5% 5,000

On the next 3,00,000.00 65,983 10% 6,598

On the next 4,00,000.00 - 15% #VALUE! 11,598

On the next 5,00,000.00 - 20% #VALUE!

On balance - 25% -

Total Tk. 515,983 11,598

TAX REBATE FOR DECLERATION OF MORE THAN 15% HIGHER INCOME

Less : 15% TAX REBATE ON Tk. -

TAX CREDIT ON INVESTMENT (AS ABOVE) Tk. 8,287

TOTAL REBATE 8,287

NET TAX PAYABLE( after rebate) 3,311

Less : Tax deducted at source and deposited by ACME 5,000

Adjustment of Tax Return -

Less : Minimum Tax Payment

BALANCE TAX PAYABLE/(REFUNDABLE) -

________________

Osman Gani

You might also like

- Pay Electric Bill by October 3rd to Avoid Late FeesDocument5 pagesPay Electric Bill by October 3rd to Avoid Late Feesnguyen tungNo ratings yet

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDocument1 pageMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNo ratings yet

- Donatus Pharmacy: Personnel Scheduling With Employee PreferencesDocument11 pagesDonatus Pharmacy: Personnel Scheduling With Employee PreferencesHridaya RamanarayananNo ratings yet

- Salaried Tax Calculator Ay 23-24Document2 pagesSalaried Tax Calculator Ay 23-24Proddut BasakNo ratings yet

- NON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationDocument2 pagesNON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationlaskarmohinNo ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- AY2021-22 ANISETTY SINDHU-EFPPS3410N-ComputationDocument3 pagesAY2021-22 ANISETTY SINDHU-EFPPS3410N-Computationforty oneNo ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- Payslip India April - 2023Document3 pagesPayslip India April - 2023RAJESH DNo ratings yet

- STT - Mock - Test - S-24 - Suggested AnswersDocument8 pagesSTT - Mock - Test - S-24 - Suggested AnswersabdullahNo ratings yet

- Vinod Singh Computation Revised-3Document4 pagesVinod Singh Computation Revised-3vinodNo ratings yet

- Itr 1 FormatDocument3 pagesItr 1 FormatPawanNo ratings yet

- BSNL Payslip February 2019Document1 pageBSNL Payslip February 2019pankajNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- Payslip IndiaApproved On30 Nov 2023 - UnlockedDocument3 pagesPayslip IndiaApproved On30 Nov 2023 - UnlockedrithulblockchainNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- Direct Tax SolutionsDocument8 pagesDirect Tax SolutionsGaurav SoniNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- Tax Return - Mr. X - AY 2022-23Document12 pagesTax Return - Mr. X - AY 2022-23Rasel AshrafulNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- Suggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Document7 pagesSuggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Muhammad Usama SheikhNo ratings yet

- SalaryDocument1 pageSalarypankajNo ratings yet

- T10 Ans 3Document2 pagesT10 Ans 3PUI TUNG CHONGNo ratings yet

- Tax Calculator Version 2Document4 pagesTax Calculator Version 2SoikotNo ratings yet

- Malarmangai 2021-2022Document10 pagesMalarmangai 2021-2022Karthick KumarNo ratings yet

- Computation of Total Income & Tax LiabilityDocument24 pagesComputation of Total Income & Tax LiabilityKartikNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected Totalprakriti sankhlaNo ratings yet

- Novartis Bangladesh Limited Salary Income Certificate Tax Calculation for 2014-2015Document2 pagesNovartis Bangladesh Limited Salary Income Certificate Tax Calculation for 2014-2015Samiul Alim SanyNo ratings yet

- Provisional: Provisional Income Tax CalculationDocument1 pageProvisional: Provisional Income Tax CalculationM. A Hossain & Associates Tax ConsultantsNo ratings yet

- Computation 22-23 AyDocument2 pagesComputation 22-23 AysonuNo ratings yet

- Financial Aspect FinalDocument12 pagesFinancial Aspect Finalmelvanne tamboboyNo ratings yet

- Srinivas Vutukuri AY 2021-2022: Computation of Income (ITR4)Document3 pagesSrinivas Vutukuri AY 2021-2022: Computation of Income (ITR4)forty oneNo ratings yet

- Computation FY 18-19 PDFDocument6 pagesComputation FY 18-19 PDFRuch JainNo ratings yet

- Overnight Auto Service Income Statement for 2011Document2 pagesOvernight Auto Service Income Statement for 2011Maham FarooquiNo ratings yet

- UnknownDocument1 pageUnknownAnji BaduguNo ratings yet

- Income Tax Calculator FY 2014 15Document2 pagesIncome Tax Calculator FY 2014 15atul bansalNo ratings yet

- Telangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaDocument1 pageTelangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaKANNE NITHINNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- Servlet ControllerDocument2 pagesServlet ControllerRJNo ratings yet

- EPF Universal Account Number: LIC ID / Policy IDDocument2 pagesEPF Universal Account Number: LIC ID / Policy IDBiswajit DasNo ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- Advanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Document23 pagesAdvanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Oyebisi OpeyemiNo ratings yet

- Com 23Document3 pagesCom 23TAX INDIANo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Spring 2019Document7 pagesSuggested Answers Certificate in Accounting and Finance - Spring 2019Abdullah QureshiNo ratings yet

- Computation of Total Income: Zenit - A KDK Software Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software Software Productkunjal mistryNo ratings yet

- Form 1Document1 pageForm 1Ganesh DasaraNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- TM PQsDocument10 pagesTM PQsAnooshayNo ratings yet

- Complete Financial ModelDocument47 pagesComplete Financial ModelArrush AhujaNo ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- Heads of Income Monthly Actual YTD Projected Total: EIT Services India PVT LTD Income Tax Computation StatementDocument2 pagesHeads of Income Monthly Actual YTD Projected Total: EIT Services India PVT LTD Income Tax Computation Statementsunit pattanayakNo ratings yet

- Draft Computation SheetDocument3 pagesDraft Computation Sheettax advisorNo ratings yet

- Dec 2022Document1 pageDec 2022n1234567890987654321No ratings yet

- Form 1Document1 pageForm 1mdarsalankhan.hseNo ratings yet

- 2017-18 CoiDocument2 pages2017-18 CoiAshok ShahNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- Annual Computation of Taxable Salary FY 2021-22Document1 pageAnnual Computation of Taxable Salary FY 2021-22Irfan RazaNo ratings yet

- Corporate Financial Reporting PDFDocument3 pagesCorporate Financial Reporting PDFIshan SharmaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Vortex Mixer - KoreaDocument3 pagesVortex Mixer - KoreaM N Sharif MintuNo ratings yet

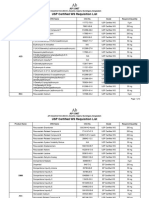

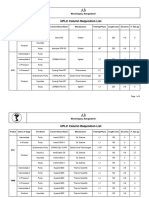

- USP Certified WS Requisition List.Document3 pagesUSP Certified WS Requisition List.M N Sharif MintuNo ratings yet

- USP Certified WS Requisition List.Document3 pagesUSP Certified WS Requisition List.M N Sharif MintuNo ratings yet

- Column Requisition ListDocument3 pagesColumn Requisition ListM N Sharif MintuNo ratings yet

- Column Requisition ListDocument3 pagesColumn Requisition ListM N Sharif MintuNo ratings yet

- Property Assessed Clean EnerDocument41 pagesProperty Assessed Clean Enermd shoebNo ratings yet

- Increase Google Reviews Using G Popcard and Must Know The BenefitsDocument3 pagesIncrease Google Reviews Using G Popcard and Must Know The Benefitsgpopcard.seoNo ratings yet

- IDMC EST Practice Paper For AY2223Document6 pagesIDMC EST Practice Paper For AY2223zy hoongNo ratings yet

- Job Application Letter Internal Vacancy SampleDocument8 pagesJob Application Letter Internal Vacancy Sampleafdlxeqbk100% (1)

- DLL FABM Week17Document3 pagesDLL FABM Week17sweetzelNo ratings yet

- BrandsDocument6 pagesBrandsEverythingNo ratings yet

- #34 Naranjo V Biomedica Health Care (Magsino)Document2 pages#34 Naranjo V Biomedica Health Care (Magsino)Trxc MagsinoNo ratings yet

- Amigo Manufacturing V. Cluett Peabody CoDocument3 pagesAmigo Manufacturing V. Cluett Peabody CoShiela Arboleda MagnoNo ratings yet

- Provisions, Contingent Liabilities and Contingent Assets: Problem 1: True or FalseDocument6 pagesProvisions, Contingent Liabilities and Contingent Assets: Problem 1: True or FalseKim HanbinNo ratings yet

- Operations Management (Zheng) SU2016 PDFDocument9 pagesOperations Management (Zheng) SU2016 PDFdarwin12No ratings yet

- MPU3222 - Course Introduction Briefing For Student (Sem 1 - 2022-2023) (I)Document24 pagesMPU3222 - Course Introduction Briefing For Student (Sem 1 - 2022-2023) (I)trickyhunter9999No ratings yet

- Income Tax Agadan PrapatraDocument3 pagesIncome Tax Agadan Prapatraat.amitkumarbstNo ratings yet

- ELSS Investment ReceiptDocument6 pagesELSS Investment ReceiptKaran MitrooNo ratings yet

- Regulating E-hailing in Malaysia - Over-regulation DebateDocument8 pagesRegulating E-hailing in Malaysia - Over-regulation DebateAmin AkasyafNo ratings yet

- Defining Globalization Through FriendshipDocument18 pagesDefining Globalization Through FriendshipRachel PetersNo ratings yet

- CA 08105001 eDocument3 pagesCA 08105001 eRicardo LopezNo ratings yet

- Capital Budgeting Techniques GuideDocument19 pagesCapital Budgeting Techniques GuideNikka SanzNo ratings yet

- Edexcel IGCSE Accounting Student S Book Answers PDFDocument92 pagesEdexcel IGCSE Accounting Student S Book Answers PDFArshad Bashir100% (1)

- MANGILIMAN, Neil Francel Domingo (Sep 28)Document8 pagesMANGILIMAN, Neil Francel Domingo (Sep 28)Neil Francel D. MangilimanNo ratings yet

- Derivatives FundamentalsDocument1 pageDerivatives FundamentalsShailaja RaghavendraNo ratings yet

- Contractor's taxable gross receipts include salaries, SSS contributionsDocument3 pagesContractor's taxable gross receipts include salaries, SSS contributionsSuzanne Pagaduan CruzNo ratings yet

- Company Profile - Tri-Wall IndiaDocument35 pagesCompany Profile - Tri-Wall IndiaPrateek Singh SengarNo ratings yet

- Assessment Review - Corporate Finance Institute-21-40Document27 pagesAssessment Review - Corporate Finance Institute-21-40刘宝英No ratings yet

- Output Determination: Contributed by Prabhakant Tiwari Under The Guidance of SAP GURU INDIADocument9 pagesOutput Determination: Contributed by Prabhakant Tiwari Under The Guidance of SAP GURU INDIASeren SökmenNo ratings yet

- Cir VS Transitions OpticalDocument2 pagesCir VS Transitions OpticalDaLe AparejadoNo ratings yet

- Commentary: Ophthalmic Increasing Operations ofDocument2 pagesCommentary: Ophthalmic Increasing Operations ofDurval SantosNo ratings yet

- Sap Fi Budget Balance ReportsDocument58 pagesSap Fi Budget Balance ReportsPallavi ChawlaNo ratings yet

- Empowering Others Through DelegationDocument8 pagesEmpowering Others Through DelegationMonique LasolaNo ratings yet