Professional Documents

Culture Documents

Heads of Income Monthly Actual YTD Projected Total

Uploaded by

prakriti sankhla0 ratings0% found this document useful (0 votes)

19 views2 pagesOriginal Title

Document

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views2 pagesHeads of Income Monthly Actual YTD Projected Total

Uploaded by

prakriti sankhlaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

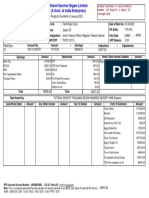

JP Morgan Services India Private Limited

Income Tax Computation Statement

Tax Regime - Old Regime

Employee Code : 40090501 PAN Number : MKZPS8571D

Employee Name : Sankhla Prakriti Employee ID : N732944

Gender : Female Date of Joining : 20.08.2020

Assessment Year : 2024-25 For Month : APR,2023

Heads of Income Monthly Actual YTD Projected Total

(A) (B) (C) (B+C)

Income from Salary

Regular Income

Basic 46,225.00 46,225.00 508,475.00 554,700.00

Special Allowance 75,865.50 75,865.50 834,520.50 910,386.00

HRA 23,112.50 23,112.50 254,237.50 277,350.00

.

1,742,436.00

Gross Salary 1,742,436.00

Less Exemptions U/s 10

A. Actual HRA 277,350.00

B. 40% OR 50% of Basic 221,880.00

C. Rent paid - 10% Basic 136,530.00

.

HRA Exemption(Least of A, B, C) 136,530.00

Net Salary 1,605,906.00

Standard Deduction 50,000.00

Employment tax 2,400.00

.

Total deduction 52,400.00

Net Taxable Salary 1,553,506.00

Add/Less Inc from oth sources

Deds S24 (Maximum Limit) 200,000.00-

.

Deds S24 (Interest) 200,000.00-

Gross Total Income 1,353,506.00

.

Less Deds under Chapter VI A 132,799.00

Total Taxable Income 1,220,707.00

Tax on Total Income 178,712.10

.

Tax Payable ( Refer 2nd page ) 178,712.10

Health and Education Cess (4%) 7,148.48

Total Tax Payable 185,860.58

Tax Deducted so Far (Incl.curr.month) 15,488.00

.

Tax deducted from current employer 15,488.00

Balance Tax Payable 170,372.58

.

Tax Deducted in this Month 15,488.00

.

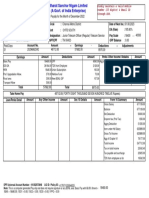

Employee Code: 40090501 Tax Regime - Old Regime PAN Number: MKZPS8571D

Tax Payable Breakdown

From Slab To Slab Amount to be taxed Tax Rate (%) Taxed Amount

0.00 250,000.00 250,000.00 0.00 0.00

250,000.00 500,000.00 250,000.00 5.00 12,500.00

500,000.00 1,000,000.00 500,000.00 20.00 100,000.00

1,000,000.00 1,220,707.00 220,707.00 30.00 66,212.10

HRA CLA

From Date To Date Rent/Month Metro From Date To Date Rent/Month Metro

01.04.2023 31.03.2024 16,000.00 No

Exemptions U/s 10 Amount

HRA Annual Exemption 136,530.00

Total 136,530.00

Deductions under Chapter VIA

Section Code Section Description Contribution Deductible

Amount Amount

80C Payment towards Life Insurance Policy 41,235.00

80C PF 66,564.00

Total deduction U/S 80C, 80CCC, 80CCD(1) 107799.00

80D Medical Insr Premium(Payment on behalf of parents non-senior Ctz) 25,000.00 25,000.00

Aggr.Deductions under Chapter VI A 132,799.00

Notes:

1. Aggregate amount deductible under Section 80 C shall not exceed 150,000.00 Rupees.

2. Aggregate amount deductible under three sections i.e 80C, 80 CCC and 80 CCD(1B) shall not exceed 2,00,000.00 Rupees.

You might also like

- DownloadDocument2 pagesDownloadSowbhagya VaderaNo ratings yet

- Pfizer Income Tax ComputationDocument2 pagesPfizer Income Tax ComputationDsr Santhosh KumarNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- Heads of Income Monthly Actual YTD Projected Total: EIT Services India PVT LTD Income Tax Computation StatementDocument2 pagesHeads of Income Monthly Actual YTD Projected Total: EIT Services India PVT LTD Income Tax Computation Statementsunit pattanayakNo ratings yet

- Rajiv Verma - Income Tax Computation StatementDocument2 pagesRajiv Verma - Income Tax Computation StatementRajiv VermaNo ratings yet

- unknown (4)Document1 pageunknown (4)Firoz ShaikhNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDocument1 page175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020No ratings yet

- UnknownDocument1 pageUnknownAnji BaduguNo ratings yet

- SalaryDocument1 pageSalarypankajNo ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- Payslip IndiaApproved On30 Nov 2023 - UnlockedDocument3 pagesPayslip IndiaApproved On30 Nov 2023 - UnlockedrithulblockchainNo ratings yet

- JuneDocument1 pageJuneRmillionsque FinserveNo ratings yet

- BSNL Payslip February 2019Document1 pageBSNL Payslip February 2019pankajNo ratings yet

- Servlet ControllerDocument2 pagesServlet ControllerRJNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- Salary Slip EDIT-AUGDocument4 pagesSalary Slip EDIT-AUGpathyashisNo ratings yet

- PDF&Rendition 1Document2 pagesPDF&Rendition 1vijaybhaskar damireddyNo ratings yet

- EPF Universal Account Number: LIC ID / Policy IDDocument2 pagesEPF Universal Account Number: LIC ID / Policy IDBiswajit DasNo ratings yet

- Paywithtaxslip 102324 PDFDocument1 pagePaywithtaxslip 102324 PDFamitshrivastava154218No ratings yet

- UnknownDocument2 pagesUnknownSudip MondalNo ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- Salary Slip XLXDocument2 pagesSalary Slip XLXDeepak50% (4)

- Nov Salary SlipDocument1 pageNov Salary Slipvarunyadav3050No ratings yet

- Deloitte Consulting India Private LimitedDocument2 pagesDeloitte Consulting India Private LimitedChinni SreenivasNo ratings yet

- Pay Slip BSNLDocument1 pagePay Slip BSNLJohn FernendiceNo ratings yet

- May 2019Document2 pagesMay 2019Vinodhkumar ShanmugamNo ratings yet

- May 2019 PDFDocument2 pagesMay 2019 PDFVinodhkumar ShanmugamNo ratings yet

- BSNL Payslip January 2022Document1 pageBSNL Payslip January 2022saravananbsnlslm3866No ratings yet

- Final Payslip of Circle For 7-17Document11 pagesFinal Payslip of Circle For 7-17Manas Kumar SahooNo ratings yet

- Paystub 02.28.2019 PDFDocument1 pagePaystub 02.28.2019 PDFAnonymous dDiu2yq2KNo ratings yet

- BSNL TM SalaryDocument1 pageBSNL TM SalaryDharmveer SinghNo ratings yet

- Telangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaDocument1 pageTelangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaKANNE NITHINNo ratings yet

- Info Sys Salary SlipDocument2 pagesInfo Sys Salary SlipGurpreetS Myvisa100% (1)

- UnknownDocument1 pageUnknownBSNL BBOVERWIFINo ratings yet

- Payslip Sep 2022Document1 pagePayslip Sep 2022GloryNo ratings yet

- TSGENCO June 2020 payslipDocument1 pageTSGENCO June 2020 payslipSuresh DoosaNo ratings yet

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDocument1 pageMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNo ratings yet

- Irp0000006225 1Document1 pageIrp0000006225 1Devender RajuNo ratings yet

- Form 1Document1 pageForm 1Ganesh DasaraNo ratings yet

- Projected Income Tax Computation Statement For The Month of Feb 2021Document2 pagesProjected Income Tax Computation Statement For The Month of Feb 2021LokeswaraRaoNo ratings yet

- Telangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruDocument2 pagesTelangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruSuresh DoosaNo ratings yet

- Form 1Document1 pageForm 1mdarsalankhan.hseNo ratings yet

- IIT-D EV BrochureDocument2 pagesIIT-D EV BrochureKarthick FerruccioNo ratings yet

- PAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDDocument2 pagesPAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDevilghostevilghost666No ratings yet

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocument1 page2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1No ratings yet

- AP Govt Pension Payment Slip Jan 2022Document1 pageAP Govt Pension Payment Slip Jan 2022katya surapurajuNo ratings yet

- PAYSLIP FOR MAY 2019Document2 pagesPAYSLIP FOR MAY 2019kumar Ranjan 22No ratings yet

- Global Edge Software Limited: Payslip For The Month of December - 2018Document1 pageGlobal Edge Software Limited: Payslip For The Month of December - 2018Manoj SahooNo ratings yet

- Payslip Jul2023 EDU - 01098Document1 pagePayslip Jul2023 EDU - 01098PrabhuNo ratings yet

- YdryDocument2 pagesYdryVinodhkumar Shanmugam100% (1)

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- UnknownDocument1 pageUnknownSumanth MopideviNo ratings yet

- april 2023_unlockedDocument2 pagesapril 2023_unlockedajinkya jagtapNo ratings yet

- EPF Universal Account Number: LIC ID / Policy IDDocument1 pageEPF Universal Account Number: LIC ID / Policy IDRapole DathatriNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- AWS NotesDocument27 pagesAWS Notesprakriti sankhlaNo ratings yet

- Serial Communication With 8051Document25 pagesSerial Communication With 8051prakriti sankhlaNo ratings yet

- AMMC Advanced Multi-Core Memory ControllDocument4 pagesAMMC Advanced Multi-Core Memory Controllprakriti sankhlaNo ratings yet

- 6thsem Mid-1 PapersDocument7 pages6thsem Mid-1 Papersprakriti sankhlaNo ratings yet

- Shariah Princiles in Islamic Securities Bba, Murabahah, Istisna & SalamDocument47 pagesShariah Princiles in Islamic Securities Bba, Murabahah, Istisna & Salamilyan_izaniNo ratings yet

- Transfer Pricing Regulations OverviewDocument19 pagesTransfer Pricing Regulations OverviewamanNo ratings yet

- Convertible Debt Term Sheet SummaryDocument3 pagesConvertible Debt Term Sheet SummaryholtfoxNo ratings yet

- NikeDocument47 pagesNikeRishabh AgarwalNo ratings yet

- Chapter Two - Types of Information SystemsDocument20 pagesChapter Two - Types of Information SystemsMary KalukiNo ratings yet

- A Review of Critical Project Management Success - 2014 - International Journal oDocument10 pagesA Review of Critical Project Management Success - 2014 - International Journal oAmin HilaliNo ratings yet

- The Global Pharmaceutical IndustryDocument8 pagesThe Global Pharmaceutical IndustryVelan10No ratings yet

- Ito Na Talaga Totoo Pramis Teksman Mamatay Man-2Document11 pagesIto Na Talaga Totoo Pramis Teksman Mamatay Man-2ReveRieNo ratings yet

- Depreciation MethodsDocument25 pagesDepreciation Methodsluvy acerdenNo ratings yet

- Entrepreneurial Ecosystem in LebanonDocument10 pagesEntrepreneurial Ecosystem in LebanonTarek TomehNo ratings yet

- Bye Laws For Printing Updated 9.12.2022Document52 pagesBye Laws For Printing Updated 9.12.2022Tamsil khanNo ratings yet

- Audit AccaDocument10 pagesAudit AccamohedNo ratings yet

- Souleymanou KadouamaiDocument12 pagesSouleymanou KadouamaijavisNo ratings yet

- Judge Cannon May 2023 Financial DisclosureDocument7 pagesJudge Cannon May 2023 Financial DisclosureFile 411No ratings yet

- ACC 305 Week 2 Quiz 01 Chapter 17Document6 pagesACC 305 Week 2 Quiz 01 Chapter 17LereeNo ratings yet

- The Mahalanobis ModelDocument4 pagesThe Mahalanobis Modelsainandan510% (1)

- Inaugural Lecture - Prof. Dr. Désirée Van Gorp PDFDocument64 pagesInaugural Lecture - Prof. Dr. Désirée Van Gorp PDFDésirée van Gorp100% (1)

- Questions about your billDocument3 pagesQuestions about your billVarun AryaNo ratings yet

- Toyota Production SystemDocument27 pagesToyota Production Systemmentee111100% (3)

- Course9 - Introduction To Economic FluctuationsDocument12 pagesCourse9 - Introduction To Economic FluctuationsAngga ArsitekNo ratings yet

- Lwob - Application-Form Edited Edited EditedDocument2 pagesLwob - Application-Form Edited Edited Editedjessamaeballesteros21100% (1)

- IoBM Catalog 2021 2022Document205 pagesIoBM Catalog 2021 2022Yashal AlamNo ratings yet

- ACCT 4230 - Final ReviewDocument21 pagesACCT 4230 - Final ReviewRaquel VandermeulenNo ratings yet

- Financial Markets and Institutions Madura 10th Edition Test BankDocument16 pagesFinancial Markets and Institutions Madura 10th Edition Test Bankhannahhuffmanabjskxqgnm100% (29)

- Jun Freolo Figueroa STDocument3 pagesJun Freolo Figueroa STwarlitopadernaNo ratings yet

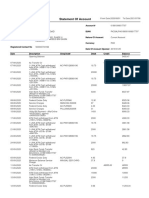

- 'Account StatementDocument11 pages'Account StatementSikander Qazi100% (2)

- Pricing Strategy and Growth of Dmart - Project (1) UpdatedDocument17 pagesPricing Strategy and Growth of Dmart - Project (1) Updatednilesh.das22hNo ratings yet

- Pakistan's Ghost Kitchen Industry AnalysisDocument4 pagesPakistan's Ghost Kitchen Industry AnalysisHaiqa SheikhNo ratings yet

- Chapter 32 - Multiple ChoiceDocument2 pagesChapter 32 - Multiple ChoiceLorraineMartinNo ratings yet

- MTF InstituteDocument7 pagesMTF InstituteHaidir AuliaNo ratings yet