Professional Documents

Culture Documents

EMPH2800 TAXSHEET March 2021

Uploaded by

the anonymous0 ratings0% found this document useful (0 votes)

9 views1 pageOriginal Title

EMPH2800_TAXSHEET_March_2021-converted

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageEMPH2800 TAXSHEET March 2021

Uploaded by

the anonymousCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

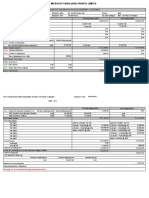

MAQ SOFTWARE HYDERABAD PRIVATE LIMITED

TAX REPORT FOR THE MONTH OF: DECEMBER 2021

Employee Code: EMPH2800 PAN : ABCPQ1371R

Employee Name : Mohammad Quraishi Tax Regime Option : Old

Sr No. Particulars Actual Projected Total

Salary Earnings

Basic 185,354.00 87,868.75 273,222.75

Overtime Wages 84,030.00 00.00 84,030.00

Bonus 15,449.00 7,322.50 22,771.50

House Rent Allowance 92,677.00 43,934.50 136,611.50

Conveyance 12,800.00 00.00 12,800.00

Medical Reimbursement 10,000.00 00.00 10,000.00

Other Allowance 4,167.00 12,500.00 16,667.00

Rounding Off Paisa b/f 02.00 00.00 02.00

Medical Health Ins Reimbursement 3,316.00 00.00 3,316.00

1 Total Earnings 407,795.00 151,625.75 559,420.75

Exemptions

2 Total Exemptions 00.00

3 Gross Salary (1 minus 2) 559,420.75

4 Deduction u/s 16

a Standard Deduction 50,000.00

b Prof Tax 2,400.00

Total Deduction u/s 16 52,400.00

5 Income From Salaries 507,020.75

6 a)Interest on Self Occupied House Property (24-B) 0

b)Income From Let Out Property 0

c)Income from House Property reported by employee [6(a)+6(b)] 00.00

(Set-off of loss restricted to Rs. 200000 Lacs in a financial year )

7 Any other income reported by Employee 00.00

8 Gross Total Income [5+6(c)+7] 507,020.75

Deduction u/s VI-A

9 Total Deduction u/s VI-A 00.00

10 Deduction u/s 80-C

Provident Fund 21,600.00

Public Provident Fund 100,000.00

Deduction u/s 80C 121,600.00 121,600.00

11 Less Deduction u/s 80-CCD(2)

Employer's National Pension Scheme 80CCD(2) 00.00

Less Deduction u/s 80-CCD(2) 00.00

12 Total Taxable Income 785,421.00

13 Rounded Total Taxable Income (Rounding off to next ten) 785,430.00

14 Tax on Total Income 6,772.00

15 Less: Income Tax Rebate u/s 87 A 6,772.00

16 Net Tax on Total Income 00.00

Max Tax Plus surcharge(marginal relief) 00.00

17 Surcharge 00.00

18 Health and Education Cess 00.00

19 Total Tax Payable 00.00

20 Less Relief Under Section 89(1) 00.00

21 Tax Payable 00.00

Tax deducted at source

22 Previous Employer 00.00

23 Current Employer 00.00

24 Other Income Tax 00.00

25 Total Tax Deducted 00.00

26 Balance Tax Payable 00.00

27 Normal Tax 00.00

28 One Time Tax 00.00

29 Additional Tax 00.00

30 Tax for other than salary income 790000.00

31 Tax Deductible For The Month 790000.00

32 Tax Deducted For The Month of March 00.00

Note:-THIS IS A COMPUTER GENERATED STATEMENT AND DOES NOT REQUIRE ANY SIGNATURE OR STAMP.

You might also like

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Pfizer Income Tax ComputationDocument2 pagesPfizer Income Tax ComputationDsr Santhosh KumarNo ratings yet

- DownloadDocument2 pagesDownloadSowbhagya VaderaNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- IBCC Tax Projection Sheet 2022-23Document1 pageIBCC Tax Projection Sheet 2022-23Ankush SinghNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected Totalprakriti sankhlaNo ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- Salary Slip EDIT-AUGDocument4 pagesSalary Slip EDIT-AUGpathyashisNo ratings yet

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDocument1 page175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020No ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- Concentrix Daksh Services India Private Limited: Income Tax Calculation For The PeriodDocument5 pagesConcentrix Daksh Services India Private Limited: Income Tax Calculation For The Periodgthapliyal31No ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- Servlet ControllerDocument2 pagesServlet ControllerRJNo ratings yet

- Telangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaDocument1 pageTelangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaKANNE NITHINNo ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- Serv Let ControllerDocument2 pagesServ Let ControllerANAND RADHAWALNo ratings yet

- Greytip April PayslipDocument1 pageGreytip April PayslipvigneshNo ratings yet

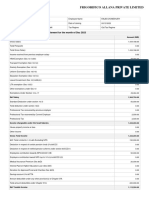

- Tax computation for Alkem employeeDocument3 pagesTax computation for Alkem employeeMAHESH A TNo ratings yet

- FormDocument1 pageFormKANHAIYA KUMARNo ratings yet

- Income Tax Calculation For The Period 01/04/2021 To 07/07/2021Document4 pagesIncome Tax Calculation For The Period 01/04/2021 To 07/07/2021Srinath AllaNo ratings yet

- AugDocument1 pageAugsrikanth0483287No ratings yet

- SMS0928 - 31 12 2022Document1 pageSMS0928 - 31 12 2022UTF RecordsNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Taxation AssessmentDocument8 pagesTaxation AssessmentBhanumati BhunjunNo ratings yet

- TAX COMPUTATION FOR 2017-18Document1 pageTAX COMPUTATION FOR 2017-18Ravi KumarNo ratings yet

- Rajiv Verma - Income Tax Computation StatementDocument2 pagesRajiv Verma - Income Tax Computation StatementRajiv VermaNo ratings yet

- Anwar Group Manager Income Tax AssessmentDocument1 pageAnwar Group Manager Income Tax AssessmentMoment RevealersNo ratings yet

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDocument1 pageMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNo ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- TSGENCO June 2020 payslipDocument1 pageTSGENCO June 2020 payslipSuresh DoosaNo ratings yet

- Employee tax statement Apr 2021Document2 pagesEmployee tax statement Apr 2021Lady KillerNo ratings yet

- LGU Receipts and Expenditures Report for Q2 2020Document4 pagesLGU Receipts and Expenditures Report for Q2 2020Ann LiNo ratings yet

- Irp0000006225 1Document1 pageIrp0000006225 1Devender RajuNo ratings yet

- Provisional: Provisional Income Tax CalculationDocument1 pageProvisional: Provisional Income Tax CalculationM. A Hossain & Associates Tax ConsultantsNo ratings yet

- SamplePayroll Processing and Withholding Tax On CompensationDocument2 pagesSamplePayroll Processing and Withholding Tax On CompensationReinalyn De VeraNo ratings yet

- Adecco India Private Limited: Payslip For The Month of October 2022Document1 pageAdecco India Private Limited: Payslip For The Month of October 2022VeereshPammarNo ratings yet

- Xoriantlive 28051007Document1 pageXoriantlive 28051007susilaNo ratings yet

- 99018037_MAR_2023Document1 page99018037_MAR_2023gaurav sharmaNo ratings yet

- Income Tax Projection202206Document1 pageIncome Tax Projection202206Rakhi JadavNo ratings yet

- Confidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerDocument1 pageConfidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerAbdul Nayeem100% (1)

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- UnknownDocument1 pageUnknownrahulagarwal33No ratings yet

- HCL Tech Ltd. - Iomc: Income Tax Computation Sheet Upto July - 2021Document1 pageHCL Tech Ltd. - Iomc: Income Tax Computation Sheet Upto July - 2021Kittu SinghNo ratings yet

- Payslip Aug 2019 PDFDocument1 pagePayslip Aug 2019 PDFAbhishek MitraNo ratings yet

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocument1 page2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1No ratings yet

- Cdadc69d Bb7c 4a3d A96a 73cdebed7ab2 4e9a8540 62f6 4bd7 9ad1 Eb878cdb0d28 PayslipDocument1 pageCdadc69d Bb7c 4a3d A96a 73cdebed7ab2 4e9a8540 62f6 4bd7 9ad1 Eb878cdb0d28 PayslipHenry CagaNo ratings yet

- FF PayslipDocument1 pageFF PayslipYviie VANo ratings yet

- May 2019 PDFDocument2 pagesMay 2019 PDFVinodhkumar ShanmugamNo ratings yet

- May 2019Document2 pagesMay 2019Vinodhkumar ShanmugamNo ratings yet

- 12 2022 Salary Slip SintexDocument1 page12 2022 Salary Slip SintexpathyashisNo ratings yet

- Projected Income Tax Computation Statement For The Month of Feb 2021Document2 pagesProjected Income Tax Computation Statement For The Month of Feb 2021LokeswaraRaoNo ratings yet

- Paywithtaxslip 102324 PDFDocument1 pagePaywithtaxslip 102324 PDFamitshrivastava154218No ratings yet

- Tax Computation 12 2023Document3 pagesTax Computation 12 2023Rajib ChowdhuryNo ratings yet

- BSNL Payslip February 2019Document1 pageBSNL Payslip February 2019pankajNo ratings yet

- Monthly payslip summary for Ankit KumarDocument1 pageMonthly payslip summary for Ankit Kumarrajkannamdu100% (1)

- Statement of Salary As of 2019-08-2: Earnings DeductionsDocument1 pageStatement of Salary As of 2019-08-2: Earnings DeductionsHenry CagaNo ratings yet

- SalaryDocument1 pageSalarypankajNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Shagufta Khan: Professional SummaryDocument2 pagesShagufta Khan: Professional Summarythe anonymousNo ratings yet

- Shagufta Khan: Professional SummaryDocument2 pagesShagufta Khan: Professional Summarythe anonymousNo ratings yet

- Plagiarism Scan Report: Plagiarised UniqueDocument3 pagesPlagiarism Scan Report: Plagiarised Uniquethe anonymousNo ratings yet

- Mohammad Faisal QuraishiDocument1 pageMohammad Faisal Quraishithe anonymousNo ratings yet

- Q1. Construct A New Product Component Model For Indian People. Answer-Product Managers Only Manage The Brands Produced andDocument12 pagesQ1. Construct A New Product Component Model For Indian People. Answer-Product Managers Only Manage The Brands Produced andthe anonymousNo ratings yet

- Plagiarism Scan Report: Plagiarised UniqueDocument3 pagesPlagiarism Scan Report: Plagiarised Uniquethe anonymousNo ratings yet

- Holden Commodore Sedan VT To VZDocument6 pagesHolden Commodore Sedan VT To VZابو سعدNo ratings yet

- Natural Gas Engines 2019Document428 pagesNatural Gas Engines 2019Паша Шадрёнкин100% (1)

- Return Snowball Device SafelyDocument1 pageReturn Snowball Device SafelyNoneNo ratings yet

- Written Work 1 Q1 Science 10Document6 pagesWritten Work 1 Q1 Science 10JOEL MONTERDENo ratings yet

- NCP GeriaDocument6 pagesNCP GeriaKeanu ArcillaNo ratings yet

- PassportDocument4 pagesPassportVijai Abraham100% (1)

- Talent Level 3 Grammar Tests Unit 2Document2 pagesTalent Level 3 Grammar Tests Unit 2ana maria csalinasNo ratings yet

- Policy Based Routing On Fortigate FirewallDocument2 pagesPolicy Based Routing On Fortigate FirewalldanNo ratings yet

- Diesel Engines 16V 4000 M23/M33: 50 HZ 60 HZDocument2 pagesDiesel Engines 16V 4000 M23/M33: 50 HZ 60 HZAlberto100% (1)

- 41 Programmer Isp RT809F PDFDocument3 pages41 Programmer Isp RT809F PDFArunasalam ShanmugamNo ratings yet

- CartridgeDocument26 pagesCartridgeMnavya SaiNo ratings yet

- Sesame Seed: T. Y. Tunde-Akintunde, M. O. Oke and B. O. AkintundeDocument20 pagesSesame Seed: T. Y. Tunde-Akintunde, M. O. Oke and B. O. Akintundemarvellous ogbonnaNo ratings yet

- Jumpin' Beans Cafe Near SchoolDocument4 pagesJumpin' Beans Cafe Near SchoolJhon Axl Heart RaferNo ratings yet

- QRT1 WEEK 8 TG Lesson 22Document5 pagesQRT1 WEEK 8 TG Lesson 22Bianca HernandezNo ratings yet

- Agility Logistics SolutionsDocument5 pagesAgility Logistics SolutionsWagner MontielNo ratings yet

- Maximizing ROI Through RetentionDocument23 pagesMaximizing ROI Through RetentionSorted CentralNo ratings yet

- Unilever BD Recruitment and Selection ProcessDocument34 pagesUnilever BD Recruitment and Selection Processacidreign100% (1)

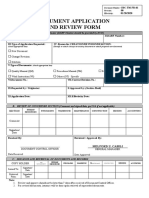

- Document Application and Review FormDocument1 pageDocument Application and Review FormJonnel CatadmanNo ratings yet

- L.G.B.T. Fiction: Book ReviewDocument4 pagesL.G.B.T. Fiction: Book ReviewDejana KosticNo ratings yet

- UTH homework template for English exercisesDocument8 pagesUTH homework template for English exercisesCinthya Peña de MezaNo ratings yet

- Form of SpesDocument2 pagesForm of SpesMark Dave SambranoNo ratings yet

- CV HannahDocument3 pagesCV HannahRoxan DosdosNo ratings yet

- Make Money OnlineDocument9 pagesMake Money OnlineTimiNo ratings yet

- A Case of Haemochromatosis and Diabetes A Missed OpportunityDocument111 pagesA Case of Haemochromatosis and Diabetes A Missed Opportunitymimran1974No ratings yet

- Diseñadores Del Siglo XX - Las Figuras Clave Del Diseño y - Dormer, Peter - 1993 - Barcelona - Ceac - 9780747202684 - Anna's ArchiveDocument264 pagesDiseñadores Del Siglo XX - Las Figuras Clave Del Diseño y - Dormer, Peter - 1993 - Barcelona - Ceac - 9780747202684 - Anna's ArchiveSilvina RodríguezNo ratings yet

- Reported SpeechDocument2 pagesReported SpeechlacasabaNo ratings yet

- Thesis Chapter 123Document15 pagesThesis Chapter 123Chesca Mae PenalosaNo ratings yet

- Lesson 1 Context CluesDocument33 pagesLesson 1 Context CluesRomnick BistayanNo ratings yet

- USA V Brandon Hunt - April 2021 Jury VerdictDocument3 pagesUSA V Brandon Hunt - April 2021 Jury VerdictFile 411No ratings yet

- Surveying 2 Practical 3Document15 pagesSurveying 2 Practical 3Huzefa AliNo ratings yet