Professional Documents

Culture Documents

SMS0928 - 31 12 2022

Uploaded by

UTF RecordsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SMS0928 - 31 12 2022

Uploaded by

UTF RecordsCopyright:

Available Formats

SequelOne Solutions Pvt. Ltd.

Garage Society, 6th Floor, BPTP Centra One, Golf Course Extension Road,

Gurgaon-122002 Haryana

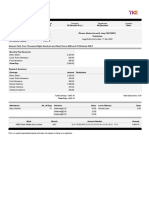

Payslip for the month of Dec 2022

Employee

: SMS0928

Code

DOJ : 24-Jan-2022 Location : Gurugram

Name : Nitesh Kumar Tiwari

Month Days : 31 Bank Name : HDFC

Department : Payroll

Arrear Days : 0 Bank A/c : 50100461378120

Sub

: Payroll Arrear LWOP : 0 PAN No : BGAPT7310R

Department

Designation : Executive - Payroll Services Payable Days : 31 UAN No : 101605706348

Gender : Male ESI No : 6932597038 PF No : GNGGN00287GNGGN00287400000037135

Job band : 11

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Basic 13,065.00 13,065.00 0.00 13,065.00 Labour walfare fund 25.00

HRA 5,835.00 5,835.00 0.00 5,835.00 ESI 150.00

Statutory Bonus 1,088.00 1,088.00 0.00 1,088.00 Provident Fund 1,568.00

GROSS PAY 19,988.00 0.00 19,988.00 GROSS DEDUCTION 1,743.00

Net Pay : 18,245.00 (EIGHTEEN THOUSAND TWO HUNDRED FORTY FIVE ONLY)

Income Tax Worksheet for the Period July 2022 - March 2023

Description Gross Exempt Taxable Deduction Under Chapter VI-A

Basic 107,470.00 0.00 107,470.00 Employee Provident Fund 12,898.00

HRA 44,470.00 0.00 44,470.00

Total of Investment u/s 80C 12,898.00

Special Allowance 4,652.00 0.00 4,652.00 Tax Deducted Details

DEDUCTION U/C 80C 12,898.00

Statutory Bonus 7,826.00 0.00 7,826.00 Month Amount

Deduction Under Chapter VI-A 12,898.00 Jul 2022 0.00

Gross Salary 164,418.00 0.00 164,418.00

Deduction Aug 2022 0.00

Total Income Other Than Salary 0.00

Previous Employer Professional Tax 0.00 Sep 2022 0.00

Standard Deduction 50,000.00 Oct 2022 0.00

Professional Tax 0.00 Nov 2022 0.00

Under Chapter VI-A 12,898.00 Dec 2022 0.00

Any Other Income 0.00

Taxable Income 101,520.00

Total Tax 0.00

Tax Rebate 0.00

Surcharge 0.00

Tax Due 0.00

Educational Cess 0.00

Net Tax 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted Till Date 0.00

Tax to be Deducted 0.00

Tax /Month 0.00

Tax on Non-Recurring Earnings 0.00

Tax Deduction for this month 0.00

HRA Exemption Calculation

From To Rent Paid Actual HRA 40/50% of Basic Rent - 10% of Basic Exempted HRA

You might also like

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- Payslip India April - 2023Document3 pagesPayslip India April - 2023RAJESH DNo ratings yet

- Essilor India Payslip TitleDocument1 pageEssilor India Payslip TitlekrishnaNo ratings yet

- Payslip For The Month of May 2022: VVDN Technologies Private LimitedDocument1 pagePayslip For The Month of May 2022: VVDN Technologies Private LimitedAbinashNo ratings yet

- Payslip India May - 2023Document2 pagesPayslip India May - 2023RAJESH DNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- Payslip Jul2023 EDU - 01098Document1 pagePayslip Jul2023 EDU - 01098PrabhuNo ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedArul Mhmmd10No ratings yet

- Pay No. Period EndingDocument2 pagesPay No. Period EndingKen Melchizedec MarañonNo ratings yet

- Payslip details in 40 charactersDocument2 pagesPayslip details in 40 charactersNikhil KumarNo ratings yet

- Lalit Payslip LGDocument1 pageLalit Payslip LGLalit JainNo ratings yet

- Payslip For: FEB-2022: Louis Berger SASDocument1 pagePayslip For: FEB-2022: Louis Berger SASMukhtar AhmedNo ratings yet

- Inr014298 53291001Document2 pagesInr014298 53291001NARASIMHS MURTHYNo ratings yet

- Payslip To Print - Report Design 03 06 2023Document1 pagePayslip To Print - Report Design 03 06 2023shani ChahalNo ratings yet

- Payslip 4 2023Document1 pagePayslip 4 2023Aman Jaiswal100% (1)

- Payslip 11 2020Document1 pagePayslip 11 2020Sk Sameer100% (1)

- Payslip For The Month of September-2021: Personal InformationDocument1 pagePayslip For The Month of September-2021: Personal InformationDeep KoleyNo ratings yet

- Payslip August 09Document1 pagePayslip August 09api-19975640No ratings yet

- Payslip 30019967 January 2023Document1 pagePayslip 30019967 January 2023RED BULLNo ratings yet

- "Maxim Infrastructure LTD." Old Nlunicipal Jail IndiaDocument3 pages"Maxim Infrastructure LTD." Old Nlunicipal Jail IndiaAmanNo ratings yet

- Quess Corp Limited Head Office 3/3/2, Amblipura, Bellandur Gate, Sarjapur Road, Bengaluru, Karnataka 560103Document1 pageQuess Corp Limited Head Office 3/3/2, Amblipura, Bellandur Gate, Sarjapur Road, Bengaluru, Karnataka 560103AnshumanNo ratings yet

- Jun 2021 NikDocument2 pagesJun 2021 NikNikhil KumarNo ratings yet

- Pay Slip For The Month of OCt-09Document1 pagePay Slip For The Month of OCt-09shah_rahul1981No ratings yet

- Tata Business Support Services LTD: 00110283 KhushbuDocument1 pageTata Business Support Services LTD: 00110283 KhushbuKhushbu SinghNo ratings yet

- Feb 2023Document1 pageFeb 2023hari teja100% (1)

- Amara Raja Batteries LimitedDocument1 pageAmara Raja Batteries LimitedNani AnugaNo ratings yet

- Earnings Deductions MTH - Rate Arrears Total Earned Arrears Total DedDocument1 pageEarnings Deductions MTH - Rate Arrears Total Earned Arrears Total DedShubham GargNo ratings yet

- Payslip 9 2021.pdf3301655635205489526Document1 pagePayslip 9 2021.pdf3301655635205489526ShecallsmefraudNo ratings yet

- Paytm Services Private LimitedDocument1 pagePaytm Services Private LimitedMohd SarifNo ratings yet

- PellaUSOnlinePayslip PDFDocument2 pagesPellaUSOnlinePayslip PDFJoshuaM.ByrneNo ratings yet

- TELEPERFORMANCE GLOBAL SERVICES PRIVATE LIMITED Payslip for December 2021Document1 pageTELEPERFORMANCE GLOBAL SERVICES PRIVATE LIMITED Payslip for December 2021gajala jamirNo ratings yet

- Payslip 2023 2024 5 200000000029454 IGSLDocument2 pagesPayslip 2023 2024 5 200000000029454 IGSLMohit SagarNo ratings yet

- Amazon Development Center India Pvt. LTD: Amount in INRDocument1 pageAmazon Development Center India Pvt. LTD: Amount in INRMaaz Uddin Siddiqui0% (1)

- March 2023 Pay Slip for Ajay Palsinh JetavatDocument1 pageMarch 2023 Pay Slip for Ajay Palsinh Jetavatajay jetavatNo ratings yet

- UltraTech Cement Employee PayslipDocument1 pageUltraTech Cement Employee PayslipSaurabh DugarNo ratings yet

- Presto Mart SDN BHD (757250-V) : Pay Slip Month EndDocument1 pagePresto Mart SDN BHD (757250-V) : Pay Slip Month EndAwais IqbalNo ratings yet

- Payslip 2018 2019 1 100000000421201 IGSLDocument1 pagePayslip 2018 2019 1 100000000421201 IGSLArivu AkilNo ratings yet

- March 2022 Salary PayslipDocument3 pagesMarch 2022 Salary PayslipParveen SainiNo ratings yet

- Arshiya Logistics April 2020 PayslipDocument1 pageArshiya Logistics April 2020 PayslipSuhas AmbadeNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- Nov 2015 Payslip PDFDocument1 pageNov 2015 Payslip PDFkarthikaNo ratings yet

- Infogain Solutions settlement statement summaryDocument1 pageInfogain Solutions settlement statement summaryArmaanNo ratings yet

- Ub23m03 689321Document1 pageUb23m03 689321RachitNo ratings yet

- PAY SLIPDocument1 pagePAY SLIPKFS BANKINGNo ratings yet

- Pay Slip 17623 March, 2022Document1 pagePay Slip 17623 March, 2022Abrham TadesseNo ratings yet

- PaySlip of JanuaryDocument1 pagePaySlip of JanuaryBharat YadavNo ratings yet

- Combined Submitted DocsDocument15 pagesCombined Submitted DocsViraj ShahNo ratings yet

- Hdfcbank-Slip CompressDocument1 pageHdfcbank-Slip CompressTEAM INDIANo ratings yet

- INTELENET BUSINESS SERVICES PAYSLIPDocument1 pageINTELENET BUSINESS SERVICES PAYSLIPshail100% (1)

- Concentrix Daksh Services India Private Limited Payslip For The Month of November - 2022Document1 pageConcentrix Daksh Services India Private Limited Payslip For The Month of November - 2022Mohammad AnisNo ratings yet

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument2 pagesSutherland Global Services Philippines, Inc. - Philippine BranchJonathan Diane SasisNo ratings yet

- Paystub 202109Document1 pagePaystub 202109Ankush BarheNo ratings yet

- Payslip 10 2020Document1 pagePayslip 10 2020anil sangwanNo ratings yet

- Sep2022 STFC PayslipDocument1 pageSep2022 STFC PayslipAjith NandhaNo ratings yet

- 28 Feb 2020Document1 page28 Feb 2020Anup KumarNo ratings yet

- Razorpay Software P.L: Pay Slip For The Month of April 2021Document1 pageRazorpay Software P.L: Pay Slip For The Month of April 2021ARSHU . SNo ratings yet

- Payslip Sep-2022 NareshDocument3 pagesPayslip Sep-2022 NareshDharshan RajNo ratings yet

- Swiggy Delivery Boy Salary SlipDocument31 pagesSwiggy Delivery Boy Salary SlipAshis palaiNo ratings yet

- Payslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, GurugramDocument1 pagePayslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, Gurugramps384077No ratings yet

- DownloadDocument1 pageDownloadAnimesh JenaNo ratings yet

- NZ Tax IndividualDocument60 pagesNZ Tax IndividualSusana SembranoNo ratings yet

- JURNAL Siti Fatimah, (11021800330) (AutoRecovered)Document9 pagesJURNAL Siti Fatimah, (11021800330) (AutoRecovered)Adhya FauzanNo ratings yet

- Solved MR and Mrs Lund and Their Two Children Ben andDocument1 pageSolved MR and Mrs Lund and Their Two Children Ben andAnbu jaromiaNo ratings yet

- LM Business Finance Q3 W1 Module 1Document15 pagesLM Business Finance Q3 W1 Module 1Minimi LovelyNo ratings yet

- Form No. 12B: Prabhakarappa ShashidharDocument1 pageForm No. 12B: Prabhakarappa ShashidharAmbika BpNo ratings yet

- Essential Elements of A TaxDocument3 pagesEssential Elements of A Taxcosmic lunacyNo ratings yet

- 2017 California National Merit Scholarship WinnersDocument24 pages2017 California National Merit Scholarship WinnersBayAreaNewsGroupNo ratings yet

- TXH 1706 Compensation Income FBTDocument12 pagesTXH 1706 Compensation Income FBTLouiseNo ratings yet

- Request Letter For Compromise - KbindustrialDocument1 pageRequest Letter For Compromise - KbindustrialJedah Ibarra VillaflorNo ratings yet

- Ahmirah Ali Weekly Stub 1Document1 pageAhmirah Ali Weekly Stub 1Lillian AwtNo ratings yet

- PENSION - Calculation SheetDocument5 pagesPENSION - Calculation SheetsaurabhsriNo ratings yet

- DR Bill PDFDocument1 pageDR Bill PDFAvinash VoraNo ratings yet

- Solved in 2002 Florence Purchased 30 Acres of Land She HasDocument1 pageSolved in 2002 Florence Purchased 30 Acres of Land She HasAnbu jaromiaNo ratings yet

- Order Invoice / ReceiptDocument1 pageOrder Invoice / ReceiptJose Otilio Chavez CantuNo ratings yet

- Consolidated StatementDocument1 pageConsolidated StatementParameswararao BillaNo ratings yet

- Sap 6Th Bn. Barrackpore Pay Slip Government of West Bengal: Constable OthersDocument1 pageSap 6Th Bn. Barrackpore Pay Slip Government of West Bengal: Constable Otherskartick royNo ratings yet

- Peshawar Electric Supply Company: Say No To CorruptionDocument1 pagePeshawar Electric Supply Company: Say No To CorruptionFaheem UllahNo ratings yet

- A Guide To Zimbabwe Taxation NyatangaDocument303 pagesA Guide To Zimbabwe Taxation NyatangaAlbert Murutayi100% (1)

- Updated Arrears Estimator Clerical StaffDocument8 pagesUpdated Arrears Estimator Clerical Staffkmuraleedharan09No ratings yet

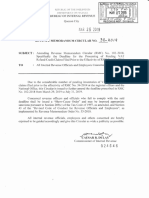

- RMC No 38-2019Document1 pageRMC No 38-2019TrishNo ratings yet

- HPCL, 3/C, DR Ambedkar Road, Near Nehru Memorial Hall, Camp, Pune-411001Document1 pageHPCL, 3/C, DR Ambedkar Road, Near Nehru Memorial Hall, Camp, Pune-411001Sangram MundeNo ratings yet

- Hotel de l'Etoile Revenue Analysis 2015Document2 pagesHotel de l'Etoile Revenue Analysis 2015asadNo ratings yet

- BP SFSF PY ERP607 Wagetypes Catalog Workbook en USDocument48 pagesBP SFSF PY ERP607 Wagetypes Catalog Workbook en USMahmoud ElManakhlyNo ratings yet

- Sample Philippine personal income tax calculationDocument2 pagesSample Philippine personal income tax calculationDave Mar IdnayNo ratings yet

- Conferinta FABBV 2010 - EnglezaDocument875 pagesConferinta FABBV 2010 - EnglezaAnna ZamfirNo ratings yet

- W-8ben For CDN Beachbody Coaches SampleDocument1 pageW-8ben For CDN Beachbody Coaches Sampleapi-295933330No ratings yet

- Basics of Income TaxDocument20 pagesBasics of Income Taxsakshi chauhanNo ratings yet

- Road User TaxationDocument83 pagesRoad User TaxationDonny Dwi SaputroNo ratings yet

- KNUST Taxation Course OutlineDocument6 pagesKNUST Taxation Course OutlineAndrews DwomohNo ratings yet

- Sbu Taxation Law 2021 XVDocument468 pagesSbu Taxation Law 2021 XVNaethan Jhoe L. Cipriano100% (1)