Professional Documents

Culture Documents

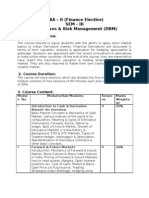

Derivatives Fundamentals

Uploaded by

Shailaja RaghavendraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivatives Fundamentals

Uploaded by

Shailaja RaghavendraCopyright:

Available Formats

DERIVATIVES

Credits: 03

SUGGESTED MATERIAL

Course workload: 3 hours per Week (2 hours of

BOOKS

theory and 2 hours of practical)

Evaluation: Continuous Internal Assessment 1. John C. Hull, Options, Futures, and

- 50 marks Other Derivatives.

Semester-end Examination - 50 marks 2. John Hull, Fundamentals o f Futures and

Options Markets,

Objective: To acquaint the students with the 3. Robert McDonald, Derivative Markets

risk management tools and give them the 4. Franklin Edwards and Cindy Ma, Futures

practical exposure. and Options

5. R. Stafford Johns on and Carmelo

Pedagogy: Lectures, Case study discussions and Giaccotto, Options and Futures

Seminars. 6. Mishra V, Financial Derivatives, Excel

Books.

Module 1 : Introduction; Meaning of 7. Vohra and Bagri, Option s & Futures,

derivatives, forwards and futures contract, TMH

option, traders in futures and option markets,

functions of derivatives market, world URLs

derivatives market. http://www.geojit.com/derivatives/

futures-and-options-market-instruments

Module 2 : Forwards and Futures contract - http://www.icmrindia.org/casestudies

Basics of forwards and futures, forwards and http://www.moneycontrol.com

futures market trading mechanism, http://premiacap.com/publications/

determination of forward prices, Valuation of EDHEC_Working_Paper_Case_Studies_

and_Risk_Management.pdf

forwards and futures, stock index futures,

http://www.investopedia.com/ask/

valuation of stock index futures,. Arbitrage answers/12/derivative.asp

opportunities using futures

PRACTICAL COMPONENTS:

Module 3 : Option contracts - Types of

options, characteristics of option contracts, 1. Students should visit a financial

buyer and seller attitudes, option position, institution dealing in commodity

determination of option pricing, option derivatives and study the products

moneyness, offered by it.

2. Students should individually select

Module 4: Valuation of option - Value of an various futures or options and watch the

option- intrinsic value, time value and factors behavior of these futures and options on

influencing time value. Pay off profiles of option a day to day for 15 days to see how

position. Put-call parity, models of valuation of futures and options might help mitigate

option, applicability of Black and Scholes Model the risks of investors.

and Binomial Option pricing model.

3. Applicability of excel to find out the

Module 5: Swap contract - Meaning, types, future and option price.

features of swaps, the swap market, economic

motives of swap. Valuation of swaps.

You might also like

- Financial DerivativesDocument2 pagesFinancial Derivativesviveksharma51No ratings yet

- Finance Elective Syllabus Tri-IV Batch 2021-23Document9 pagesFinance Elective Syllabus Tri-IV Batch 2021-23sanket patilNo ratings yet

- Derivatives & Risk ManagementDocument4 pagesDerivatives & Risk Managementadil1787No ratings yet

- Financial Derivatives Notes MBADocument87 pagesFinancial Derivatives Notes MBAnaren mishraNo ratings yet

- DERIVATIVES COURSEDocument2 pagesDERIVATIVES COURSEShubakar ReddyNo ratings yet

- Investment Analysis and Portfolio Management CourseDocument3 pagesInvestment Analysis and Portfolio Management CoursejebekNo ratings yet

- Credits Faculty Name Program Academic Year and Term Option, Futures and Swaps 1. Course DescriptionDocument3 pagesCredits Faculty Name Program Academic Year and Term Option, Futures and Swaps 1. Course DescriptionAyushi GautamNo ratings yet

- 1 Course IntroductionDocument2 pages1 Course IntroductionAndrew HoldenNo ratings yet

- Risk Management Derivatives Semester IIIDocument2 pagesRisk Management Derivatives Semester IIIDivyeshNo ratings yet

- Risk ManagementDocument6 pagesRisk ManagementsaurabhNo ratings yet

- FinDerviatives CourseOutlineDocument2 pagesFinDerviatives CourseOutlineShivani Patnaik RajetiNo ratings yet

- PPM123Document4 pagesPPM123sneha bhongadeNo ratings yet

- Investing in Stock MarketsDocument2 pagesInvesting in Stock MarketsJobin GeorgeNo ratings yet

- RMD New SyllabusDocument4 pagesRMD New SyllabusRancho RanchoNo ratings yet

- FIN4224Document2 pagesFIN4224garbage DumpNo ratings yet

- FIN 421: Portfolio Management and Security Analysis Course ObjectiveDocument1 pageFIN 421: Portfolio Management and Security Analysis Course Objectivegurpreet maanNo ratings yet

- Understanding Derivatives Pricing Models and StrategiesDocument4 pagesUnderstanding Derivatives Pricing Models and StrategiesMai Hiếu TrinhNo ratings yet

- Chapter 1 070804 - 2Document5 pagesChapter 1 070804 - 2Muhammad Zahid FaridNo ratings yet

- Local Media9137169469609511829Document2 pagesLocal Media9137169469609511829Patricia Mae Lauron DairoNo ratings yet

- Uniform Course Outline (DBA, CU) FIN601Document3 pagesUniform Course Outline (DBA, CU) FIN601Jubayer AhmedNo ratings yet

- HDFC Ar 17Document3 pagesHDFC Ar 17baz chackoNo ratings yet

- Futures Options Synopsis 2015Document5 pagesFutures Options Synopsis 2015cherry_1152003No ratings yet

- Derivative Securities Course OutlineDocument5 pagesDerivative Securities Course OutlineMohammad Latef Al-AlsheikhNo ratings yet

- MMS-Financial-Markets-and-Institutions-1Document167 pagesMMS-Financial-Markets-and-Institutions-1Sonali MoreNo ratings yet

- 1.1: Accounting Conventions and Standards ObjectivesDocument6 pages1.1: Accounting Conventions and Standards ObjectivesbijuNo ratings yet

- FRM Course OutlineDocument1 pageFRM Course OutlineHarry PorterNo ratings yet

- Syllabus Mba4Document7 pagesSyllabus Mba4Vishal SoodNo ratings yet

- Security Analysis and Portfolio ManagementDocument3 pagesSecurity Analysis and Portfolio Managementharsh dhuwaliNo ratings yet

- Derivatives CourseDocument5 pagesDerivatives Coursengoctraiden1905No ratings yet

- DerivativesDocument3 pagesDerivativesAditya SukhijaNo ratings yet

- Fina602 DRMDocument1 pageFina602 DRMRuchi KashyapNo ratings yet

- School of Management Internship Diary: Strategy SpecializationDocument10 pagesSchool of Management Internship Diary: Strategy SpecializationRohit YadavNo ratings yet

- Syllabus 1Document2 pagesSyllabus 1Ketan SutariaNo ratings yet

- Course Outline Derivatives (Term-IV) 2017-19 SKDocument5 pagesCourse Outline Derivatives (Term-IV) 2017-19 SKAnkit BhardwajNo ratings yet

- SMU Structured Products Sales and Trading CourseDocument4 pagesSMU Structured Products Sales and Trading CourseHohoho134No ratings yet

- Post Graduate Programme in Management 2014-15 Term: V Title of The Course: Option, Futures and Other DerivativesDocument6 pagesPost Graduate Programme in Management 2014-15 Term: V Title of The Course: Option, Futures and Other DerivativesMISS_ARORANo ratings yet

- JJKDocument5 pagesJJKEmiraslan MhrrovNo ratings yet

- CO Derivative ManagementDocument8 pagesCO Derivative ManagementAbhinav MahajanNo ratings yet

- PAM Outlines 07012021 042154pmDocument7 pagesPAM Outlines 07012021 042154pmzainabNo ratings yet

- Fixed Income and Derivative AnalysisDocument5 pagesFixed Income and Derivative AnalysisDaood AbdullahNo ratings yet

- Teaching Learning Contract for Investment CourseDocument6 pagesTeaching Learning Contract for Investment CourseDewi RenitasariNo ratings yet

- MBA 662 Financial Institutions and Investment ManagementDocument4 pagesMBA 662 Financial Institutions and Investment ManagementAli MohammedNo ratings yet

- Introductory Microeconomics - 2021-22Document4 pagesIntroductory Microeconomics - 2021-22Sapnali MohapatraNo ratings yet

- MBA 3rd Sem SyllabusDocument6 pagesMBA 3rd Sem Syllabussanjeev_singh_17No ratings yet

- Skills Thinking, Social Profiles: Principled, Balanced: Planning The InquiryDocument4 pagesSkills Thinking, Social Profiles: Principled, Balanced: Planning The InquiryAnonymous ICXsadSbBNo ratings yet

- CourseOutline - Financial DerivativesDocument8 pagesCourseOutline - Financial DerivativesYaarbaileeNo ratings yet

- Financial DerivativesDocument2 pagesFinancial DerivativesrajputbabitaNo ratings yet

- Session Plan DerivativesandRiskMgtDocument3 pagesSession Plan DerivativesandRiskMgtRasesh ShahNo ratings yet

- Risk ManagementDocument152 pagesRisk ManagementKim Bales BlayNo ratings yet

- Understanding Stock Exchange OperationsDocument7 pagesUnderstanding Stock Exchange OperationscườngNo ratings yet

- Financial MarketsDocument10 pagesFinancial MarketsNayab ZahraNo ratings yet

- Co CB2017-18Document10 pagesCo CB2017-18neelNo ratings yet

- FIN F311 Derivatives & Risk Management Course HandoutDocument6 pagesFIN F311 Derivatives & Risk Management Course HandoutSaksham GoyalNo ratings yet

- Financial Risk ManagementDocument2 pagesFinancial Risk Managementtashi vermaNo ratings yet

- FRM Syllabus of AUDocument9 pagesFRM Syllabus of AUMeer Mazhar AliNo ratings yet

- FD Course OutlineDocument8 pagesFD Course OutlineSudip ThakurNo ratings yet

- Fin SylabusDocument1 pageFin Sylabusanuragch000No ratings yet

- FAC SyllabusDocument6 pagesFAC SyllabusRahul RadhakrishnanNo ratings yet

- Weekly Project Diary: Report - Option Trading Strategies and Risk ManagementDocument4 pagesWeekly Project Diary: Report - Option Trading Strategies and Risk ManagementBhavesh ChoudharyNo ratings yet

- PERSONALITY AND GROUP DYNAMICS COURSE OUTLINEDocument84 pagesPERSONALITY AND GROUP DYNAMICS COURSE OUTLINEShailaja RaghavendraNo ratings yet

- Introduction To PersonalityDocument32 pagesIntroduction To PersonalityShailaja RaghavendraNo ratings yet

- SWOT Analysis WorksheetDocument2 pagesSWOT Analysis Worksheetwaw wawNo ratings yet

- Understanding self-awareness through the Johari Window modelDocument22 pagesUnderstanding self-awareness through the Johari Window modelShailaja RaghavendraNo ratings yet

- How to Motivate Yourself & OthersDocument4 pagesHow to Motivate Yourself & OthersShailaja RaghavendraNo ratings yet

- Psychophysiology of Executive Functions: Language Development and BrainDocument13 pagesPsychophysiology of Executive Functions: Language Development and BrainShailaja RaghavendraNo ratings yet

- Swot AnalysisDocument32 pagesSwot AnalysisShailaja RaghavendraNo ratings yet

- Theories of AttitudeDocument5 pagesTheories of AttitudeShailaja RaghavendraNo ratings yet

- Physiological Basis of Higher Mental FunctionsDocument22 pagesPhysiological Basis of Higher Mental FunctionsShailaja RaghavendraNo ratings yet

- Success Goal FailureDocument11 pagesSuccess Goal FailureShailaja RaghavendraNo ratings yet

- Counselling Psychology 2ND AssignmentDocument1 pageCounselling Psychology 2ND AssignmentShailaja RaghavendraNo ratings yet

- Uploads/ Understanding - Consumer - Behaviour PDFDocument1 pageUploads/ Understanding - Consumer - Behaviour PDFShailaja RaghavendraNo ratings yet

- Cognitive PsychologyDocument14 pagesCognitive PsychologyShailaja RaghavendraNo ratings yet

- Story How To Build Self - EsteemDocument11 pagesStory How To Build Self - EsteemShailaja RaghavendraNo ratings yet

- UNIT-4 Textual Notes - Psychophysiology of Personality and ConsciousnessDocument12 pagesUNIT-4 Textual Notes - Psychophysiology of Personality and ConsciousnessShailaja RaghavendraNo ratings yet

- Company Profile Report ContentDocument1 pageCompany Profile Report ContentShailaja RaghavendraNo ratings yet

- STRATEGIC MANAGEMENT Model Question Paper - 1Document6 pagesSTRATEGIC MANAGEMENT Model Question Paper - 1Shailaja RaghavendraNo ratings yet

- International Human Resource ManagementDocument1 pageInternational Human Resource ManagementShailaja RaghavendraNo ratings yet

- Recruitment Selection and PayrollDocument1 pageRecruitment Selection and PayrollShailaja RaghavendraNo ratings yet

- Business Quiz: Baseline/Tag Line/ Adline of Company/BrandsDocument2 pagesBusiness Quiz: Baseline/Tag Line/ Adline of Company/BrandsShailaja RaghavendraNo ratings yet

- Written CommunicationDocument18 pagesWritten CommunicationShailaja RaghavendraNo ratings yet

- Career ObjectiveDocument2 pagesCareer ObjectiveShailaja RaghavendraNo ratings yet

- Management of Change and DevelopmentDocument1 pageManagement of Change and DevelopmentShailaja RaghavendraNo ratings yet

- UGC NET Management SyllabusDocument3 pagesUGC NET Management SyllabusShailaja RaghavendraNo ratings yet

- Written CommunicationDocument18 pagesWritten CommunicationShailaja RaghavendraNo ratings yet

- Writing Business LettersDocument28 pagesWriting Business LettersShailaja RaghavendraNo ratings yet

- Discipline and GrievanceDocument28 pagesDiscipline and GrievanceShailaja RaghavendraNo ratings yet

- Discipline and GrievanceDocument28 pagesDiscipline and GrievanceShailaja RaghavendraNo ratings yet

- Written CommunicationDocument18 pagesWritten CommunicationShailaja RaghavendraNo ratings yet

- NEw IC 38 SummaryDocument80 pagesNEw IC 38 SummaryMadhup tarsolia100% (2)

- Computation of Basic and Diluted Eps Charles Austin of The PDFDocument1 pageComputation of Basic and Diluted Eps Charles Austin of The PDFAnbu jaromiaNo ratings yet

- Essay On The Food Security in IndiaDocument8 pagesEssay On The Food Security in IndiaDojo DavisNo ratings yet

- Krishna Grameena BankDocument101 pagesKrishna Grameena BankSuresh Babu ReddyNo ratings yet

- Procurement-Lecture 3 Customer Service and Logistics: Abdikarim Mohaidin AhmedDocument33 pagesProcurement-Lecture 3 Customer Service and Logistics: Abdikarim Mohaidin AhmedMA. CHRISTINE BODUANNo ratings yet

- Matrix - PALC and DP RequirementsDocument25 pagesMatrix - PALC and DP RequirementsTajNo ratings yet

- From Vision To Reality: GebizDocument10 pagesFrom Vision To Reality: Gebizmaneesh5100% (1)

- Understanding Students' BackgroundsDocument4 pagesUnderstanding Students' BackgroundsBright Appiagyei-BoakyeNo ratings yet

- NAME: - Grade Level: 12 Q:2 - Lesson: 1Document2 pagesNAME: - Grade Level: 12 Q:2 - Lesson: 1neschee leeNo ratings yet

- Minutes Feb 28 2022Document5 pagesMinutes Feb 28 2022Raquel dg.BulaongNo ratings yet

- Tanzania Catholic Directory 2019Document391 pagesTanzania Catholic Directory 2019Peter Temu50% (2)

- Study On Comparative Analysis of Icici Bank and HDFC Bank Mutual Fund SchemesDocument8 pagesStudy On Comparative Analysis of Icici Bank and HDFC Bank Mutual Fund SchemesRaja DasNo ratings yet

- Truth in Lending ActDocument20 pagesTruth in Lending ActAbel Francis50% (2)

- Rural Immersion Activity: A Report OnDocument14 pagesRural Immersion Activity: A Report OnShivprakash VarimaniNo ratings yet

- Gokuldham Marathi Prelim 2023Document8 pagesGokuldham Marathi Prelim 2023Aarushi GuptaNo ratings yet

- List of Polling Stations For Pec Election 2021-24Document8 pagesList of Polling Stations For Pec Election 2021-24Rasheed Shahwani0% (1)

- The Gnostic and Their RemainsDocument271 pagesThe Gnostic and Their RemainsAT SuancoNo ratings yet

- Bhanu ResumeDocument7 pagesBhanu ResumeOrugantirajaNo ratings yet

- History of The Alphabet Sejarah AbjadDocument29 pagesHistory of The Alphabet Sejarah AbjadEmian MangaNo ratings yet

- Psyche Arzadon Ans Key DrillsDocument11 pagesPsyche Arzadon Ans Key Drillsjon elle100% (1)

- 49 People V RamosDocument7 pages49 People V RamosIsagani CastilloNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document27 pagesIndividual Account Opening Form: (Demat + Trading)Sarvar PathanNo ratings yet

- PIL For Generic Drugs by DR Sanjay KulshresthaDocument23 pagesPIL For Generic Drugs by DR Sanjay KulshresthaSanjay KulshresthaNo ratings yet

- The Influence of The English Language On The Russian Youth SlangDocument10 pagesThe Influence of The English Language On The Russian Youth SlangВасилий БоровцовNo ratings yet

- ALL Night Long: THE Architectural Jazz OF THE Texas RangersDocument8 pagesALL Night Long: THE Architectural Jazz OF THE Texas RangersBegüm EserNo ratings yet

- Basic Microeconomics Semi Final Exam ReviewDocument3 pagesBasic Microeconomics Semi Final Exam ReviewEnergy Trading QUEZELCO 1No ratings yet

- An Argument For The Eastern Origins of CatharismDocument22 pagesAn Argument For The Eastern Origins of CatharismDiana Bernal ColonioNo ratings yet

- General Provisions On ContractsDocument5 pagesGeneral Provisions On ContractsyoursHAHAHANo ratings yet

- DRRM School Memo No. 7Document5 pagesDRRM School Memo No. 7Mime CarmleotesNo ratings yet

- P15a PPT SlidesDocument18 pagesP15a PPT Slidesdiktiedu5984No ratings yet