Professional Documents

Culture Documents

Company

Uploaded by

Elisa Ferrer Ramos0 ratings0% found this document useful (0 votes)

5 views1 pageUpload docsss

Original Title

Q v1.0

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentUpload docsss

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageCompany

Uploaded by

Elisa Ferrer RamosUpload docsss

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

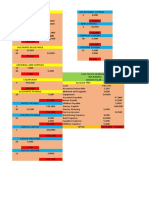

Retail Pharma Ltd

Date Company % $ Details

Retail Pharma (RP) Ltd was registered on 1 Jan 2020.

Authorised capital was approved to be 410,000

Funds raised

1.1.20 Issued $10 Ordinary share for a sum of 50.0% 100,000

1.1.20 Issued $20 Preference share capital for a sum of 10.0% 41,000

31.12.20 Preference dividend paid at end of year @ / $ 8.0% 3,280

1.1.20 $100 Bond issued for a sum of 8.0% 32,800

Bond interest paid at end of year @ / $ 6.0% 1,968

1.1.20 See transaction below related to NCA 24,600

31.12.20 Loan interest expense is paid 5.0% 1,230

Useful Resale

NCA Acquired life Value Dep exp

1.1.20 Acquired tangible NCA1 for check 12.0% 49,200 5 -

1.1.20 Acquired tangible NCA2 for issue of $10 ordinary share 8.0% 32,800 4 -

1.1.20 Acquired tangible NCA3 via a loan of 6.0% 24,600 3 -

1.1.20 Acquired by check NCA 4 & NCA 5 for a basket or bundle deal 40,000

NCA4 Fair market value on date of acquisition was 50.0% 25,000 4 -

NCA5 Fair market value on date of acquisition was 50.0% 25,000 5 -

Intangible NCA acquired for check 16.0% 65,600 8 -

Inventory

Purchased inventory for check 8.00% 32,800

Purchased inventory on credit 7.00% 28,700

Returned inventory to credit supplier as it was poor quality 0.70% 2,870

Cost of inventory sold during 2020 6.00% 24,600

31.12.20 Loss to be recorded due to inventory write down below cost 0.50% 2,050

Distributed as free sample inventory with a cost of 0.40% 1,640

Donated inventory with a cost of 0.20% 820

Uninsured inventory lost due to fire. 0.10% 410

Sales

Cash sales 30.00% 123,000

Credit sales 25.00% 102,500

Expenses

Check paid for operating expenses for currrent year 8.00% 42,000

Check paid for operating expenses for next year 2.00% 8,000

Unpaid / credit operating expenses for current year 1.50% 11,000

Calculate depreciation exp as per details in NCA

Bad debts expense for the year 1.22% 5,000

31.12.20 Record tax expense at year end to be paid in next year 1.80% 7,380

AR

Collection from AR during the year 60% 61,500

Bad debts suffered during the year 5% 5,125

Cancellation again AP 2,000

Allowed discount to AR for early collection above 1,000

Check advances received from customers (use bank and AR column) 5,000

AP

Payment to AP during the year 60% 17,220

See above set off in AR 2,000

Discount received from AP for early payment 2% 574

Other events

Won cash award in a competition 1,230

Competitor introduced a new product which may reduce sales by 6%

Government policy changed leading to increase in share price of 4%

Operating cost savings in 2020 due to workflow redesign 4,000

Dividend

Calculate Net profit & transfer to Retained Profit Now

1.9.20 Paid interim ordinary dividend in cash 9,900

1.10.20 Paid share dividend to ordinary SH in the ratio of 1 : 10 10%

31.12.20 Final ordinary dividend approved by SH payable in early next year. 12200

Reserves

31.12.20 Transfer to reserves 4% 16,400

31.12.20 Record stock split in the ratio of 2:1

END OF TRANSACTIONS

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- P21.6 (LO 2, 3) (Lessee-Lessor Entries, Lease With A Guaranteed Residual Value) GlausDocument2 pagesP21.6 (LO 2, 3) (Lessee-Lessor Entries, Lease With A Guaranteed Residual Value) GlausWarmthxNo ratings yet

- Teacher's Manual - Financial Acctg 2Document233 pagesTeacher's Manual - Financial Acctg 2Adrian Mallari71% (21)

- Particulars 2015 2016 2017 2018 2019Document2 pagesParticulars 2015 2016 2017 2018 2019monikatatteNo ratings yet

- Colgate Palmolive Financial StatementDocument10 pagesColgate Palmolive Financial StatementDeepa Milind GalaNo ratings yet

- Highland Malt Accounting Project PDFDocument12 pagesHighland Malt Accounting Project PDFEng Chee Liang100% (1)

- Bedb Sme Guide Book (2012)Document58 pagesBedb Sme Guide Book (2012)Mohd Fadhilullah100% (1)

- Chart of Account FusionDocument16 pagesChart of Account FusionzafernaseerNo ratings yet

- Unit 4Document85 pagesUnit 4Ankush Singh100% (1)

- 02-Spa Final Business PlanDocument22 pages02-Spa Final Business PlanIvy CruzadaNo ratings yet

- P6 SMART Notes Till 03.25Document61 pagesP6 SMART Notes Till 03.25Ali AhmedNo ratings yet

- Book Keeping System in Public SectorDocument15 pagesBook Keeping System in Public SectorcwkkarachchiNo ratings yet

- Chapter 13 Audit of Long LiDocument37 pagesChapter 13 Audit of Long LiKaren Balibalos100% (1)

- SW-16 UTB Merchandising AsDocument4 pagesSW-16 UTB Merchandising AsAlexis Marie Balagot100% (1)

- Chapter 1 PowerPointDocument23 pagesChapter 1 PowerPointth3hackerssquadNo ratings yet

- Profit and Loss Statement - StatementDocument1 pageProfit and Loss Statement - StatementTirta syah putra AlamNo ratings yet

- Cash Flows Statement - HandoutDocument15 pagesCash Flows Statement - HandoutThanh UyênNo ratings yet

- Quiz - Financial Statements With SolutionDocument6 pagesQuiz - Financial Statements With SolutionMary Yvonne AresNo ratings yet

- TES-AMM (Singapore) Pte. LTD.: Company Registration No. 200508881RDocument43 pagesTES-AMM (Singapore) Pte. LTD.: Company Registration No. 200508881RJoyce ChongNo ratings yet

- Name: Priyanka M. Salunkhe Roll No - 24: Accounts AssignmentDocument20 pagesName: Priyanka M. Salunkhe Roll No - 24: Accounts AssignmentVinitNo ratings yet

- Quizzers 12Document13 pagesQuizzers 12Niña Yna Franchesca PantallaNo ratings yet

- Fusion HCM Talent Management Student GuideDocument20 pagesFusion HCM Talent Management Student Guidevreddy123No ratings yet

- Trial Balance (Assignment 1)Document1 pageTrial Balance (Assignment 1)veronica abanNo ratings yet

- SM-2 - Lesson - 1 To 7 in EnglishDocument128 pagesSM-2 - Lesson - 1 To 7 in EnglishMayank RajputNo ratings yet

- Ar067 68Document72 pagesAr067 68sauravkafle1No ratings yet

- Fundamentals of Human Resource Management 7th Edition Noe Test BankDocument35 pagesFundamentals of Human Resource Management 7th Edition Noe Test Bankaffluencevillanzn0qkr100% (16)

- Rmo 1984Document139 pagesRmo 1984Mary graceNo ratings yet

- Office Manual Part-XIII-Vol-III PDFDocument273 pagesOffice Manual Part-XIII-Vol-III PDFAli AkbarNo ratings yet

- ECONOMICDocument2 pagesECONOMICKimberly HipolitoNo ratings yet

- NR Tds 195 (1) CA Kapil GoelDocument63 pagesNR Tds 195 (1) CA Kapil GoelSridharRaoNo ratings yet

- Gen Principles of TaxationDocument437 pagesGen Principles of TaxationJurilBrokaPatiñoNo ratings yet