Professional Documents

Culture Documents

Plot-1441, Opp. IOCL Petrol Pump, CRP Square, Bhubaneswar-751015 Ph.:8093556677, 9040456677, Web

Uploaded by

NRUSINGHA PATRA0 ratings0% found this document useful (0 votes)

9 views1 pageThe document discusses non-banking financial companies (NBFCs) in India. Some key points covered include:

- An infrastructure finance company (IFC) NBFC must deploy a minimum of 50% of its total assets in infrastructure loans.

- An NBFC-MFI is defined as a non-deposit taking NBFC with minimum net owned funds of Rs. 3 crore.

- Deposits in NBFCs are not insured by the Deposit Insurance and Credit Guarantee Corporation.

- The NBFC Ombudsman scheme is introduced under Section 35A of the RBI Act, 1934.

- NBFCs cannot accept demand deposits from the public like commercial

Original Description:

Original Title

Question_NBFC_

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses non-banking financial companies (NBFCs) in India. Some key points covered include:

- An infrastructure finance company (IFC) NBFC must deploy a minimum of 50% of its total assets in infrastructure loans.

- An NBFC-MFI is defined as a non-deposit taking NBFC with minimum net owned funds of Rs. 3 crore.

- Deposits in NBFCs are not insured by the Deposit Insurance and Credit Guarantee Corporation.

- The NBFC Ombudsman scheme is introduced under Section 35A of the RBI Act, 1934.

- NBFCs cannot accept demand deposits from the public like commercial

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pagePlot-1441, Opp. IOCL Petrol Pump, CRP Square, Bhubaneswar-751015 Ph.:8093556677, 9040456677, Web

Uploaded by

NRUSINGHA PATRAThe document discusses non-banking financial companies (NBFCs) in India. Some key points covered include:

- An infrastructure finance company (IFC) NBFC must deploy a minimum of 50% of its total assets in infrastructure loans.

- An NBFC-MFI is defined as a non-deposit taking NBFC with minimum net owned funds of Rs. 3 crore.

- Deposits in NBFCs are not insured by the Deposit Insurance and Credit Guarantee Corporation.

- The NBFC Ombudsman scheme is introduced under Section 35A of the RBI Act, 1934.

- NBFCs cannot accept demand deposits from the public like commercial

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

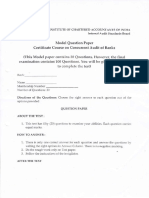

NBFC

1. A minimum of good much % of total assets of an IFC-NBFC should be deployed in infrastructure

loans?

(a) 60% (b) 50% (c) 75% (d) 80% (e) None of these

2. An NBFC-MFI is defined as a non-deposit taking NBFC (other than a company licensed under

section – 25 of the Indian companies act-1956) with minimum net owned funds of ___?

(a) Rs. 5 crore (b) Rs. 4 crore (c) Rs. 3 crore (d) Rs. 2 crore (e) None of these

3. What is the maximum limit of deposit that is insured in NBFC?

(a) Rs 1 lakh (b) Rs 50000 (c) No Limit (d) Not insured (e)None of these

4. NBFC Ombudsman scheme is introduced under ___of the RBI act, 1934?

(a) Section – 35(A) (b) Section – 35(IA) (c) Section – 25(A)

(d) Section – 45(IA) (e) None of these

5. Which of the following cannot accept demand deposit?

(a) NBFC’s (b) Commercial banks (c) Foreign banks

(d) RRB’s (e) Local area banks

6. NBFC engaged in the business of ___

(a) Loans & advances

(b) Acquisition of shares

(c) Acquisition of stocks (gold, etc)

(d) Acquisition of banks

(e) All of these

7. NBFC’s should have a minimum net owned capital of ____?

A) Rs. 100 lakh B) Rs. 200 lakh C) Rs. 150 lakh

D) Rs. 50 lakh E) None of these

8. NBFC does not indulged in __________ which of the following activity?

A) Agriculture activity

B) Industrial activity

C) Construction of immovable property

D) All of these

E) None of these

9. IFC – NBFC company should have minimum net – worth of how much crore?

A) Rs. 100 crore B) Rs. 200 crores C) Rs. 300 crore D) Rs. 500 crore E) None of these

10. Which of the following is true?

A) NBFCs can accept deposits from the public

B) NBFCs can not offer deposit schemes to the public

C) Deposits of NBFC’s are insured with DICGC

D) NBFC’s can accept deposits from public if they are registered & permitted by RBI

E) None of these

Plot-1441, Opp. IOCL Petrol Pump, CRP Square, Bhubaneswar-751015

Ph. :8093556677, 9040456677, Web: www.vanik.org, E-mail: vanikbbsr@gmail.com

You might also like

- Multiple Choice Questions On BANKINGDocument12 pagesMultiple Choice Questions On BANKINGIndu GuptaNo ratings yet

- Objective Type Questions in BankingDocument27 pagesObjective Type Questions in Bankingmidhungbabu81% (31)

- Important Banking Awareness PDFDocument193 pagesImportant Banking Awareness PDFsidNo ratings yet

- MsmeDocument22 pagesMsmeAbhinandan Golchha100% (1)

- All Banking McqsDocument28 pagesAll Banking McqsManoranjan SethiNo ratings yet

- Fundamentals of Banking Multiple Choice Question (GuruKpo)Document18 pagesFundamentals of Banking Multiple Choice Question (GuruKpo)GuruKPO100% (3)

- MCQ Financial Regulatory FrameworkDocument13 pagesMCQ Financial Regulatory Frameworkthorat82No ratings yet

- 2000 Banking Awareness MCQsDocument193 pages2000 Banking Awareness MCQsSniper Souravsharma100% (1)

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in BangladeshFrom EverandFinancial Soundness Indicators for Financial Sector Stability in BangladeshNo ratings yet

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet

- Mcomm16 PDFDocument256 pagesMcomm16 PDFdipti ingaleNo ratings yet

- (Exam) (SET - A)Document11 pages(Exam) (SET - A)hr Param SoftwareNo ratings yet

- IBPS Law Officer Study Material Banking LawDocument0 pagesIBPS Law Officer Study Material Banking Lawsagarrathod777No ratings yet

- Banking Quiz (Round 1) : InstructionsDocument10 pagesBanking Quiz (Round 1) : InstructionsRana JamalNo ratings yet

- 50 MCQs On Banking & FinanceDocument7 pages50 MCQs On Banking & Financearun xornorNo ratings yet

- JANBI Model Questions - Principles & Practices of Banking - 0Document8 pagesJANBI Model Questions - Principles & Practices of Banking - 0Biswajit Das0% (1)

- Model Question Paper On Cerificate Course On Concurrent AuditDocument5 pagesModel Question Paper On Cerificate Course On Concurrent Auditdelhi guyNo ratings yet

- Banking GKDocument19 pagesBanking GKapi-248451009No ratings yet

- MCQ On Banking Finance & Economy-1Document4 pagesMCQ On Banking Finance & Economy-1Shivarajkumar JayaprakashNo ratings yet

- BCK Test Ans (Neha)Document3 pagesBCK Test Ans (Neha)Neha GargNo ratings yet

- Principles of Banking: Sample Questions and AnswersDocument15 pagesPrinciples of Banking: Sample Questions and AnswersvanamamalaiNo ratings yet

- Important Banking GK PDFDocument26 pagesImportant Banking GK PDFPriya BanothNo ratings yet

- Ut - 1 Economics - Xii 2021-22Document5 pagesUt - 1 Economics - Xii 2021-22Nandini JhaNo ratings yet

- Multiple Choice Questions On Priority Sector Advances: SBI - SBLC - HYD / Key To Success 63Document5 pagesMultiple Choice Questions On Priority Sector Advances: SBI - SBLC - HYD / Key To Success 63منظور سولنگیNo ratings yet

- Principles of Banking: Sample Questions and AnswersDocument15 pagesPrinciples of Banking: Sample Questions and Answersmaninder_6No ratings yet

- QUIZ 3 - Prepared by Baroda Academy, AHMEDABAD - Print - Quizizz-1Document26 pagesQUIZ 3 - Prepared by Baroda Academy, AHMEDABAD - Print - Quizizz-1Shilpa Jha100% (1)

- MCQDocument4 pagesMCQAjaySharmaNo ratings yet

- Banking and Finance QuestionsDocument22 pagesBanking and Finance Questionsatul mishraNo ratings yet

- Indian Financial System & Commercial BankingDocument3 pagesIndian Financial System & Commercial BankingsubramanianNo ratings yet

- Formatted Principles Practices of Banking PPB 2Document5 pagesFormatted Principles Practices of Banking PPB 2Business SelfNo ratings yet

- Sankalp Education: General Awareness QuizDocument37 pagesSankalp Education: General Awareness Quizavinash.kumar.876424No ratings yet

- Financial Awareness Top 500 QuestionsDocument104 pagesFinancial Awareness Top 500 QuestionsRanjeeth KNo ratings yet

- MCQ Financial Regulatory FrameworkDocument13 pagesMCQ Financial Regulatory FrameworkNaziya TamboliNo ratings yet

- Bank MCQSDocument27 pagesBank MCQSSanjeev SubediNo ratings yet

- AK Series Dec 2017Document25 pagesAK Series Dec 2017Akhilesh Kumar GautamNo ratings yet

- Qpammcom17 P211 PDFDocument239 pagesQpammcom17 P211 PDFSufiyan BagwanNo ratings yet

- 12th EcoDocument3 pages12th EcoHarjinder SinghNo ratings yet

- Bankers Training Institute: Mock TestDocument5 pagesBankers Training Institute: Mock TestHirokjyoti KachariNo ratings yet

- 01 Pob Mock Test 1 Cce EditedDocument19 pages01 Pob Mock Test 1 Cce EditedShaik MunnaNo ratings yet

- Xii Commerce Unit Test-1 Exam Economics Q.paper Dt.2021Document3 pagesXii Commerce Unit Test-1 Exam Economics Q.paper Dt.2021mekavinashNo ratings yet

- GHSHZHXHDocument88 pagesGHSHZHXHbishwajitNo ratings yet

- Certificate Course MCQ Answers PDFDocument17 pagesCertificate Course MCQ Answers PDFSijal KhanNo ratings yet

- Amfi PT A Q&aDocument8 pagesAmfi PT A Q&aallmutualfund100% (2)

- Hoursl L - (1) : Semcstcr-III Indian Paper-MBA/3101/FDocument3 pagesHoursl L - (1) : Semcstcr-III Indian Paper-MBA/3101/FPavan BasundeNo ratings yet

- RKG Eco Mock 3Document6 pagesRKG Eco Mock 3Tushar AswaniNo ratings yet

- Important Banking Awareness QuestionsDocument9 pagesImportant Banking Awareness QuestionsJagriti AryanNo ratings yet

- QuizDocument6 pagesQuizAnees AhmadNo ratings yet

- Banking Awareness MCQs For RBI Assistant MainsDocument22 pagesBanking Awareness MCQs For RBI Assistant MainskavinkumareceNo ratings yet

- Macro CH 5 & 6 PDFDocument38 pagesMacro CH 5 & 6 PDFAKSHARA JAINNo ratings yet

- International Finance CorporationDocument10 pagesInternational Finance CorporationJagjeet S. BhardwajNo ratings yet

- General Awareness For All Competitive ExamsDocument8 pagesGeneral Awareness For All Competitive ExamspummygNo ratings yet

- Economics Study Material Xii 2021-22 Term I-KvsDocument44 pagesEconomics Study Material Xii 2021-22 Term I-KvsShivanshNo ratings yet

- Banking Awareness Question: WWW - TNPSCROCK.inDocument11 pagesBanking Awareness Question: WWW - TNPSCROCK.inSenthamil ArasanNo ratings yet

- Sem 4 - Indian Financial System - IFS - 53403Document3 pagesSem 4 - Indian Financial System - IFS - 53403Gangsta OfficalNo ratings yet

- Banking AwarenessDocument94 pagesBanking Awarenesschandrashekhar prasadNo ratings yet

- Question KYCDocument2 pagesQuestion KYCNRUSINGHA PATRANo ratings yet

- Term 1 Preboard 2021-22 Class XiiDocument12 pagesTerm 1 Preboard 2021-22 Class XiiAkshat GulatiNo ratings yet

- Progress Report on Establishing a Regional Settlement Intermediary and Next Steps: Implementing Central Securities Depository-Real-Time Gross Settlement Linkages in ASEAN+3From EverandProgress Report on Establishing a Regional Settlement Intermediary and Next Steps: Implementing Central Securities Depository-Real-Time Gross Settlement Linkages in ASEAN+3No ratings yet

- CRP Po/Mt-XiiDocument5 pagesCRP Po/Mt-XiiNRUSINGHA PATRANo ratings yet

- COVID-19 Vaccination Appointment Details: Center Date Time Preferred Time SlotDocument1 pageCOVID-19 Vaccination Appointment Details: Center Date Time Preferred Time SlotNRUSINGHA PATRANo ratings yet

- Recruitment of Junior Associates (Customer Support & Sales) Advertisement No. CRPD - CR - 2022-23 - 15Document5 pagesRecruitment of Junior Associates (Customer Support & Sales) Advertisement No. CRPD - CR - 2022-23 - 15NRUSINGHA PATRANo ratings yet

- TL Tickets Trains T8123AEDEC557005948578A00Document3 pagesTL Tickets Trains T8123AEDEC557005948578A00NRUSINGHA PATRANo ratings yet

- +3 FinalmarksheetDocument1 page+3 FinalmarksheetNRUSINGHA PATRANo ratings yet

- Assignment-Unit-Iii - (Software & It'S Types) : (PART-B)Document4 pagesAssignment-Unit-Iii - (Software & It'S Types) : (PART-B)NRUSINGHA PATRANo ratings yet

- (Part B) Application Software:: Software & It'S Types Unit-IiiDocument5 pages(Part B) Application Software:: Software & It'S Types Unit-IiiNRUSINGHA PATRANo ratings yet

- Syllogism Class TestDocument3 pagesSyllogism Class TestNRUSINGHA PATRANo ratings yet

- Unit-Iii) History of Computers:: AbacusDocument5 pagesUnit-Iii) History of Computers:: AbacusNRUSINGHA PATRANo ratings yet

- Reasoning (Direction) : Directions (Q. 6 - 7) : Study The Following Information and Answer The Questions?Document4 pagesReasoning (Direction) : Directions (Q. 6 - 7) : Study The Following Information and Answer The Questions?NRUSINGHA PATRANo ratings yet

- Order and Ranking: Directions (7-8) : Study The Information Given Below and Answer The Questions That FollowDocument3 pagesOrder and Ranking: Directions (7-8) : Study The Information Given Below and Answer The Questions That FollowNRUSINGHA PATRANo ratings yet

- Test-Doc-15-Mcq - (Rbi - I)Document2 pagesTest-Doc-15-Mcq - (Rbi - I)NRUSINGHA PATRANo ratings yet

- Question KYCDocument2 pagesQuestion KYCNRUSINGHA PATRANo ratings yet