Professional Documents

Culture Documents

Tutorial 10 Questions

Uploaded by

Stenerth Neretaba0 ratings0% found this document useful (0 votes)

14 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views2 pagesTutorial 10 Questions

Uploaded by

Stenerth NeretabaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Resources

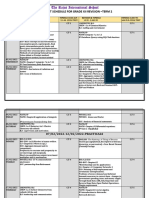

& Environmental Economics EC307

Lekima Nalaukai Semester II, 2020

Tutorial 10 Questions

Week 12 – Callan, S. J. and Thomas, J. M. (2013) – Chapter 18

Section A: Multiple Choices

1. In terms of nonhazardous waste, the federal government is responsible for

A. every aspect of nonhazardous waste management

B. setting recycling rates for each state

C. establishing markets for recovered MSW

D. setting minimum criteria for sanitary landfills and other land disposal sites

2. Electronics wastes are a potential problem because

A. recovery rates have been declining

B. consumption of electronics products and hence waste generation are rising over time

C. some contain toxic materials

D. (b) and (c) only

3. Municipal solid waste (MSW)

A. refers to the collection of hazardous and toxic wastes disposed of in local communities

B. can cause problems if improperly managed

C. poses no health or ecological risks to society

D. is a problem only in developing countries

4. Available data on the generation of MSW in the United States indicates that

A. durable goods represent the largest proportion by weight of all product groups

B. plastics are the largest proportion by weight across all materials groups

C. containers and packaging are the largest proportion by weight of all product groups

D. none of the above

Consider the following model of the municipal solid waste (MSW) services market in the city of

Houston.

MSC = 1.5 + 1.25Q MSB = 30 – 2.5Q

MEC = 0.75Q MEB = 0

where Q is the number of trash containers serviced per household per month.

5. A flat fee pricing system for MSW services

A. ignores the positively sloped MPC of MSW services

B. causes an underallocation of resources to MSW services

C. means that demanders pay nothing for MSW services

D. provides an incentive for waste reduction

1

Resources & Environmental Economics EC307

Lekima Nalaukai Semester II, 2020

Tutorial 10 Questions

Week 12 – Callan, S. J. and Thomas, J. M. (2013) – Chapter 18

Section B: Review of the Basics and Calculations

1. Suppose you are a public official responsible for setting a retail disposal charge on

antifreeze. Estimated marginal benefit and cost functions for antifreeze are as follows:

MPB = 10.0 – 0.5Q MPC = MSC = 1.0 + 0.4Q

MSB = 10.0 – 1.1Q,

where MPB, MSB, and MPC are measured in dollars per gallon, and Q is in millions of

gallons.

A. Identify the Marginal External Benefit (MEB) function, and briefly explain what this

function is measuring.

B. In the absence of government intervention, find the equilibrium price (PC) and Quantity

(QC) being exchanged in the antifreeze market?

C. Determine the retail disposal charge that will produce an efficient allocation of

antifreeze.

2. State officials are establishing a deposit/refund system for batteries. Marginal costs and

benefits have been estimated to be:

MPC = 5 + 0.5Q MPB = MSB = 20 – 0.5Q

MSC = 5 + 0.7Q,

where Q is in millions, and the marginal cost and benefit values are in dollars per battery.

A. Determine the deposit/refund amount that achieves an efficient solution.

B. Explain the economics of why the refund might be set higher than the deposit.

You might also like

- Money Master The GameDocument48 pagesMoney Master The GameSimon and Schuster72% (18)

- Session 2 - Deductions From Gross Income, Part 1Document10 pagesSession 2 - Deductions From Gross Income, Part 1ABBIE GRACE DELA CRUZNo ratings yet

- 1 Handbook of Business PlanningDocument326 pages1 Handbook of Business PlanningjddarreNo ratings yet

- 2011 AP Microeconomics ExamsDocument47 pages2011 AP Microeconomics ExamsjoshNo ratings yet

- EnP ReviewerDocument10 pagesEnP ReviewerAngel Ramos SalazarNo ratings yet

- CIPS L3M5 Sample Exam QuestionsDocument7 pagesCIPS L3M5 Sample Exam QuestionsHus NiaNo ratings yet

- Revisiting Public-Private Partnerships in the Power SectorFrom EverandRevisiting Public-Private Partnerships in the Power SectorNo ratings yet

- Paper-1 Set A Key: General InstructionsDocument128 pagesPaper-1 Set A Key: General InstructionsTiNtiNNo ratings yet

- 14TH Exam-Paper - 1 - Set - A PDFDocument17 pages14TH Exam-Paper - 1 - Set - A PDFrana_eieNo ratings yet

- Friedrich Ulrich Maximilian Johann Count of LuxburgDocument4 pagesFriedrich Ulrich Maximilian Johann Count of LuxburgjohnpoluxNo ratings yet

- Environmental Economics An Introduction 7th Edition Field Test BankDocument9 pagesEnvironmental Economics An Introduction 7th Edition Field Test Bankkennethmooreijdcmwbxtz100% (15)

- Quiz 4 Sample Questions EC307Document5 pagesQuiz 4 Sample Questions EC307Stenerth NeretabaNo ratings yet

- Tutorial 6 - 10Document8 pagesTutorial 6 - 10Mindy Mayda JohnNo ratings yet

- EC 307 Summer Flexi Tutorial 3Document3 pagesEC 307 Summer Flexi Tutorial 3R and R wweNo ratings yet

- Tutorial 6 QuestionsDocument3 pagesTutorial 6 QuestionsStenerth NeretabaNo ratings yet

- Tutorial 4 QuestionsDocument3 pagesTutorial 4 QuestionsStenerth NeretabaNo ratings yet

- Envi. Review QuestionsDocument3 pagesEnvi. Review Questionsm2287637No ratings yet

- Tutorial 1 QuestionsDocument4 pagesTutorial 1 QuestionsShayal ChandNo ratings yet

- Tutorial 2 QuestionsDocument3 pagesTutorial 2 QuestionsStenerth NeretabaNo ratings yet

- Public Finance 10Th Edition Rosen Test Bank Full Chapter PDFDocument28 pagesPublic Finance 10Th Edition Rosen Test Bank Full Chapter PDFjesus.snyder171100% (12)

- 2020 SPRING Final Exam Environmental Economics and Policy 101 Economics 125Document8 pages2020 SPRING Final Exam Environmental Economics and Policy 101 Economics 125JL HuangNo ratings yet

- MCQs ID LawDocument13 pagesMCQs ID LawRobben23No ratings yet

- Esc5302 HW2Document1 pageEsc5302 HW2ikhwanstorageNo ratings yet

- NCEEM 2007 Paper 1 Solution TitleDocument14 pagesNCEEM 2007 Paper 1 Solution TitleSarah FrazierNo ratings yet

- Assignment 3B - Linear Programming IIIDocument1 pageAssignment 3B - Linear Programming IIIhannah iberaNo ratings yet

- Intro To Sustainable Engineering SampleDocument6 pagesIntro To Sustainable Engineering SamplepramodNo ratings yet

- ENVIRONMENT MANAGEMENT AND HUMAN RIGHTSB - Com-187Document2 pagesENVIRONMENT MANAGEMENT AND HUMAN RIGHTSB - Com-187mariyambma7No ratings yet

- Environmental Economics An Introduction 7th Edition by Field ISBN Test BankDocument9 pagesEnvironmental Economics An Introduction 7th Edition by Field ISBN Test Banksandra100% (22)

- CH 02Document13 pagesCH 02Ahmed ElfeqiNo ratings yet

- Pre Mid-Term Exam Paper (Sample 2) Eco 335 2014Document3 pagesPre Mid-Term Exam Paper (Sample 2) Eco 335 2014bob joeNo ratings yet

- EC 307 Summer Flexi Tutorial 2 - SolutionsDocument5 pagesEC 307 Summer Flexi Tutorial 2 - SolutionsR and R wweNo ratings yet

- 141 ADocument17 pages141 ArajubaluNo ratings yet

- EE SET 1Document2 pagesEE SET 1AyushiNo ratings yet

- Paper 1 - Set B Solutions: General InstructionsDocument16 pagesPaper 1 - Set B Solutions: General InstructionsMukesh KumarNo ratings yet

- Environment 2022Document2 pagesEnvironment 2022Neeraj KrishnaNo ratings yet

- Test Bank For Environmental Economics An Introduction 7Th Edition by Field Isbn 9780078021893 Full Chapter PDFDocument30 pagesTest Bank For Environmental Economics An Introduction 7Th Edition by Field Isbn 9780078021893 Full Chapter PDFelizabeth.martin408100% (12)

- Cost-Benefit Analysis of Public ProjectsDocument4 pagesCost-Benefit Analysis of Public Projectskaruna141990100% (1)

- Macroeconomics 9th Edition Boyes Test BankDocument25 pagesMacroeconomics 9th Edition Boyes Test BankMadisonKirbyeqko100% (54)

- ch02 - EFFICIENT MARKETS AND GOVERNMENTDocument18 pagesch02 - EFFICIENT MARKETS AND GOVERNMENTwatts183% (6)

- Natural Resource and Environmental EconomicsDocument6 pagesNatural Resource and Environmental EconomicsshankarNo ratings yet

- Topic 4 AW and BC Ratio ComparisonsDocument7 pagesTopic 4 AW and BC Ratio Comparisonssalman hussainNo ratings yet

- Microeconomics 5th Edition Hubbard Test BankDocument39 pagesMicroeconomics 5th Edition Hubbard Test Bankmasonpowellkp28100% (14)

- Microeconomics 9th Edition Boyes Test BankDocument35 pagesMicroeconomics 9th Edition Boyes Test Bankrattingbivial7ac1gr100% (25)

- MCQ - Topic 2Document11 pagesMCQ - Topic 2elena dhelado de limonNo ratings yet

- Rajas International School Grade XII Revision and Cycle Test ScheduleDocument4 pagesRajas International School Grade XII Revision and Cycle Test ScheduleMohamed LaqinNo ratings yet

- 1 ADocument13 pages1 ASsr RaoNo ratings yet

- FieldOlewiler3ce Sample Midterm Answer KeyDocument4 pagesFieldOlewiler3ce Sample Midterm Answer KeyJessica TangNo ratings yet

- 2ND NATIONAL CERTIFICATION EXAMINATION FOR ENERGY MANAGERS AND AUDITORSDocument7 pages2ND NATIONAL CERTIFICATION EXAMINATION FOR ENERGY MANAGERS AND AUDITORSThulasi Raman KowsiganNo ratings yet

- Microeconomics 9th Edition Boyes Test BankDocument5 pagesMicroeconomics 9th Edition Boyes Test BankStephanieMorrismpgx100% (54)

- Unit-1 Renewable Energy ResourcesDocument6 pagesUnit-1 Renewable Energy ResourcesRohit kannojiaNo ratings yet

- ECON3755 Midterm2009Document4 pagesECON3755 Midterm2009Chóa IuzNo ratings yet

- Quizzes 1 14Document29 pagesQuizzes 1 14Sieggy Bennicoff YundtNo ratings yet

- ch02 Efficient Markets and GovernmentDocument31 pagesch02 Efficient Markets and GovernmentnashleyNo ratings yet

- EVS MCQ REVISION QUESTION BANK ON URBAN ENVIRONMENTDocument5 pagesEVS MCQ REVISION QUESTION BANK ON URBAN ENVIRONMENTOjas MaratheNo ratings yet

- Dwnload Full Microeconomics 9th Edition Boyes Test Bank PDFDocument20 pagesDwnload Full Microeconomics 9th Edition Boyes Test Bank PDFgranillaenglutqij2i8100% (11)

- Econ 2 Deg Exam 2016 - 2017 - FINAL PDFDocument11 pagesEcon 2 Deg Exam 2016 - 2017 - FINAL PDFAriel WangNo ratings yet

- Answers To Assignment 1 (Chs1-3)Document7 pagesAnswers To Assignment 1 (Chs1-3)Subashini Maniam100% (1)

- Assignment 2Document2 pagesAssignment 2xiannvwaiwaiNo ratings yet

- Itaipu Dam Problem AnalysisDocument4 pagesItaipu Dam Problem AnalysisbitternessinmymouthNo ratings yet

- ECO3110 Assignment1 Sep 20112012Document7 pagesECO3110 Assignment1 Sep 20112012Razif RoketmanNo ratings yet

- Econ 1000 - Test 2Document165 pagesEcon 1000 - Test 2Akram SaiyedNo ratings yet

- Microeconomics Canada in The Global Environment Canadian 8th Edition Parkin Test BankDocument35 pagesMicroeconomics Canada in The Global Environment Canadian 8th Edition Parkin Test Bankserenadinhmzi100% (31)

- NRDC - TURN Joint Opening Testimony of Sylvie Ashford and Mohit ChhabraDocument98 pagesNRDC - TURN Joint Opening Testimony of Sylvie Ashford and Mohit ChhabraRob NikolewskiNo ratings yet

- Economics of Exhaustible Resources: Hotelling's Rule and Resource PricingDocument37 pagesEconomics of Exhaustible Resources: Hotelling's Rule and Resource PricingStenerth NeretabaNo ratings yet

- Conventional Solutions To Environmental Problems:: Command-And-Control ApproachDocument31 pagesConventional Solutions To Environmental Problems:: Command-And-Control ApproachStenerth NeretabaNo ratings yet

- Economic Solutions To Environmental Problems: The Market ApproachDocument38 pagesEconomic Solutions To Environmental Problems: The Market ApproachStenerth NeretabaNo ratings yet

- Economics of Climate Change: Causes, Impacts, and Policy OptionsDocument29 pagesEconomics of Climate Change: Causes, Impacts, and Policy OptionsStenerth NeretabaNo ratings yet

- Managing Municipal Solid Waste (MSW)Document25 pagesManaging Municipal Solid Waste (MSW)Stenerth NeretabaNo ratings yet

- Tutorial 2 QuestionsDocument3 pagesTutorial 2 QuestionsStenerth NeretabaNo ratings yet

- EC307 Quiz 2 Sample QuestionsDocument5 pagesEC307 Quiz 2 Sample QuestionsStenerth NeretabaNo ratings yet

- CLIMATE SURVEY QUESTIONNAIREDocument10 pagesCLIMATE SURVEY QUESTIONNAIREMatthew BloomfieldNo ratings yet

- Barangay Annual Gender and Development (Gad) Plan and Budget FY 2021Document8 pagesBarangay Annual Gender and Development (Gad) Plan and Budget FY 2021HELEN CASIANONo ratings yet

- Furkhan Pasha - ResumeDocument3 pagesFurkhan Pasha - ResumeFurquan QuadriNo ratings yet

- Factors Affecting The Income Velocity of Money in The Commonwealth PDFDocument20 pagesFactors Affecting The Income Velocity of Money in The Commonwealth PDFmaher76No ratings yet

- Systems Analysis & Design 7th EditionDocument45 pagesSystems Analysis & Design 7th Editionapi-24535246100% (1)

- PPG Asian Paints PVT LTD: Indian Institute of Management Tiruchirappalli Post Graduate Programme in Business ManagementDocument15 pagesPPG Asian Paints PVT LTD: Indian Institute of Management Tiruchirappalli Post Graduate Programme in Business ManagementMohanapriya JayakumarNo ratings yet

- ProdmixDocument10 pagesProdmixLuisAlfonsoFernándezMorenoNo ratings yet

- Company Profile 032019 (Autosaved)Document29 pagesCompany Profile 032019 (Autosaved)ePeople ManpowerNo ratings yet

- Monopoly Profit MaximizationDocument29 pagesMonopoly Profit MaximizationArmanNo ratings yet

- FincourseDocument6 pagesFincoursebrandonxstarkNo ratings yet

- A Quick Guide To The Program DPro PDFDocument32 pagesA Quick Guide To The Program DPro PDFstouraNo ratings yet

- Unit 10 - Assignment 2 (LO3&LO4) (Essam Hamad) (19011285)Document11 pagesUnit 10 - Assignment 2 (LO3&LO4) (Essam Hamad) (19011285)Essam HamadNo ratings yet

- GCM Challan - 10Document1 pageGCM Challan - 10neeraj bansalNo ratings yet

- Ra 11058 OshlawDocument17 pagesRa 11058 OshlawArt CorbeNo ratings yet

- Module 13 Cost Accounting ManufacturingDocument23 pagesModule 13 Cost Accounting Manufacturingnomvulapetunia460No ratings yet

- Franchising: Bruce R. Barringer R. Duane IrelandDocument18 pagesFranchising: Bruce R. Barringer R. Duane IrelandWazeeer AhmadNo ratings yet

- Jwi 530 Assignment 4Document3 pagesJwi 530 Assignment 4gadisika0% (1)

- Statistic For ManagementDocument20 pagesStatistic For ManagementHương GiangNo ratings yet

- Day 2 SBL Practice To PassDocument22 pagesDay 2 SBL Practice To PassRaqib MalikNo ratings yet

- D0683SP Ans5Document20 pagesD0683SP Ans5Tanmay SanchetiNo ratings yet

- The State of Mysore Vs The Workers of Gold Mines, AIR 1958 SC 923 Art. 39 (2), The Constitution of India Art. 39 (3), The Constitution of IndiaDocument3 pagesThe State of Mysore Vs The Workers of Gold Mines, AIR 1958 SC 923 Art. 39 (2), The Constitution of India Art. 39 (3), The Constitution of IndiaSanu RanjanNo ratings yet

- Case Study RajeevDocument1 pageCase Study Rajeevyatin rajput100% (1)

- SIT Artikel 5Document20 pagesSIT Artikel 5Oxky Setiawan WibisonoNo ratings yet

- Rewarding Human Resources: Unit VDocument78 pagesRewarding Human Resources: Unit VVanisha MurarkaNo ratings yet

- Full Notes SapmDocument472 pagesFull Notes SapmJobin JohnNo ratings yet

- Parallax Workshop Clearwater 2016Document3 pagesParallax Workshop Clearwater 2016Alex BernalNo ratings yet

- AIS Reviewer PDFDocument20 pagesAIS Reviewer PDFMayNo ratings yet