Professional Documents

Culture Documents

Shiv Prasad - Assured Income Plus - Presentation

Uploaded by

sam ahuja0 ratings0% found this document useful (0 votes)

17 views7 pagesHi

Original Title

Shiv Prasad_Assured Income Plus_Presentation

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHi

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views7 pagesShiv Prasad - Assured Income Plus - Presentation

Uploaded by

sam ahujaHi

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 7

ABSLI Assured Income Plus

A Non-Linked Non-Participating Individual Life Insurance Savings Plan

tes

eR aU Ua

Eee ca aa ee eg

PS RU ce te UU Ue Uae Tea)

eave

oe ae

Sea Moe

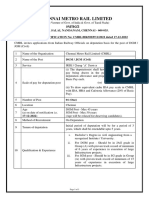

Mr. Shiv Prasad, 32, Male

POLICY DETAILS

Income Benefit With

8 years - Annual 9 years Return of

Premium Paying Term Policy Term Premium(RoP)

Benefit Option

WHAT YOU GIVE

<" Pay Annual premium of %60,000* for 8 years

WHAT YOU GET

&

Guaranteed Annual

income for 20 years

&

Loyalty Additions’ to

boost to your payouts

-

Guaranteed Life cover

upto %7,68,000

Get 76,26,400 as RoP

benefit at the end of

29 yrs

* Loyalty Addition is applicable only for policies that have paid all the due premiums under the policy.

“excludes underwriting extra premium, frequency loadings on premiums, if any, the premiums paid towards the

riders, if any and Goods & Service Tax (if any)

TES ray)

%4,80,000 & %12,91,960

YOU GET

YOU GIVE

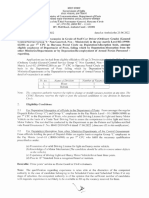

TIMELINE ILLUSTRATION

se

You Get

Guaranteed Life Cover

wtranor nates

t

' t

| Nominee continues to |

| receive the Income Benefits

'

= Pay Meee }

~

Annual Premium :

of €60,000" :

eo o—e—e—_f#___e

Age 32 39°40 41 60

&...8

You Get

Annualized Income

of 833,278 &

You Get

Retum of Total

Premiums %6,26,400

excludes underwriting extra premium, frequency loadings on premiums, if any, the premiums paid towards the

riders, if any and Goods G Service Tax (if any)

Plan Details

PLAN DETAILS

ABSLI Assured Income Plus (UIN 109N127W04)

Policy Term (In Yrs) 9

Premium Paying Term 8B years - Annual

Sum Assured 27,68,000

Benefit Payout Period 20 years - Annual

2 Income Benefit With Return of

Benen Premium(RoP)

fa) PREMIUM DETAILS

Premium. First Year 2nd Year Onwards

Base Premium 60,000 %60,000

GST 22,700 21,350

Total Premium 62,700 61,350

ACT De mO- ce)

Single/ Guaranteed Loyalty Se eee Guaranteed

Age Annualized Income ‘Additions Survival Death

Premium* Benefit Benefit Benefit

32 60,000 z0 20 20 27,68,000

33 60,000 0 0 20 27,68,000

34 260,000 0 20 20 27,68,000

oa 760,000 0 20 20 27,68,000

36 260,000 0 z0 0 27,68,000

37 260,000 20 20 20 27,68,000

38 260,000 20 zo 20 27,68,000

39 260,000 0 z0 z0 27,68,000

40 20 %0 20 20 27,68,000

41 20 225,500 27,778 333,278 Z0

42 20 225,500 27,778 $33,278 z0

43 20 225,500 27,778 $33,278 0

4a 20 25,500 27,778 33,278 @0

45 20 225,500 27,778 $33,278 0

46 20 225,500 27,778 33,278 al]

47 20 225,500 7,778 333,278 Zo

48 20 225,500 27,778 233,278 0

49 20 225,500 37,778 33,278 Zo

“excludes underwriting extra premium, frequency loadings on premiums, if any, the premiums paid towards the

riders, if any and Goods & Service Tax (if any)

ACT De mO- ce)

Single/ Guaranteed Loyalty Se eee Guaranteed

Age Annualized Income ‘Additions Survival Death

Premium* Benefit Benefit Benefit

50 20 225,500 27,778 $33,278 0

51 20 225,500 27,778 233,278 0

52 20 225,500 27,778 333,278 20

53 20 225,500 27,778 $33,278 20

54 20 225,500 27,778 33,278 al]

55. 20 225,500 27,778 233,278 20

56 20 225,500 37,778 333,278 0

57 20 225,500 &7,778 33,278 Z0

58 20 225,500 27,778 $33,278 0

59 20 225,500 27,778 333,278 Z0

60 20 225,500 21,54,178 %6,59,678 z0

Totals %4,80,000 %5,10,000 %3,01,960 %12,91,960

“excludes underwriting extra premium, frequency loadings on premiums, if any, the premiums paid towards the

riders, if any and Goods & Service Tax (if any)

‘SURYAPRAKASH

/GHURAHUGUPTA@ADITYABIRLACAPITAL

PRESENTED BY

SURYAPRAKASH ‘CoM

GHURAHU GUPTA

AGENCY MANAGER

9167741613

ei eM Ur La ley Ae)

y ’ : en

Aditya Birla Sun Life Insurance Company Limited

Cee ocean) E Read

Set Ee ee eee

Ce We ee ee eee cad

OO eC nee en eu e a

PRIVATE LIMITED (Trademark Owner) And Used By ADITYA BIRLA SUN LIFE INSURANCE COMPANY LIMITED (ABSLI)

Picard

ABSLI Assured Income Plus is underwritten by Aditya Birla Sun Life Insurance Company Limited (ABSLI). This is 0

SE ue Ro ci ee ire ects

added (extra) to your premium and levied as per extant tax laws. An extra premium may be charged as per our

CO ee Rn a ence cd

etc. For policies issued on minor life, the date of commencement of risk shall be the date of commencement of

COC Ie a Oa eee Ue cee)

Insured. Where the Life Insured (whether major or minor} and Proposer/Palicyholder is different, on the death of

the Propaser/Policyholder, his legal heirs, in accordance with the existing succession laws, will be considered as

new Proposer/Policyholder. As there is no death benefit payable on the death of the Propaser/Policyholder, the

Cee oe ee et eee er

Ce LS eee ed ee eee

Ce one Re ee a een eed

ee eee Goleta

See RCO a ca tn ed

ry

TRI ee

COL Ee a ca Re a ce

Mill Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400013. Website:

Si Re ree Ls

Tee ari ana

BEWARE OF SPURIOUS / FRAUD PHONE CALLS! IRDAI is not involved in activities like selling insurance

policies, announcing bonus or investment of premiums. Public receiving such phone calls are

requested ta lodge a police complaint.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Postadvt 1671187976Document1 pagePostadvt 1671187976sam ahujaNo ratings yet

- Postadvt 1669790480Document1 pagePostadvt 1669790480sam ahujaNo ratings yet

- Employment Notification No CMRL HR DEP 11 2022 DGM JGM Civil On Depuation 1Document3 pagesEmployment Notification No CMRL HR DEP 11 2022 DGM JGM Civil On Depuation 1sam ahujaNo ratings yet

- PTMC Notification SBD 2022Document6 pagesPTMC Notification SBD 2022sam ahujaNo ratings yet

- Advt - CE12 - 2021Document3 pagesAdvt - CE12 - 2021sam ahujaNo ratings yet

- Employment Notification No. CMRL HR CON 03 2022 Website FinalDocument7 pagesEmployment Notification No. CMRL HR CON 03 2022 Website Finalsam ahujaNo ratings yet

- Advt TBSG 2022 SADocument2 pagesAdvt TBSG 2022 SAsam ahujaNo ratings yet

- 6399705914c5c - Walk in Interview Advertisement For The Post of Project Scientist-C (Medical)Document4 pages6399705914c5c - Walk in Interview Advertisement For The Post of Project Scientist-C (Medical)sam ahujaNo ratings yet

- 637342b384d29 - Advertisement For Project Technician Dr. Rupa MamDocument5 pages637342b384d29 - Advertisement For Project Technician Dr. Rupa Mamsam ahujaNo ratings yet

- MHAOrderextendthevalidity 28082021 0Document1 pageMHAOrderextendthevalidity 28082021 0sam ahujaNo ratings yet

- 6380bd23ec7c8 - Advertisement For Data Entry OperatorDocument7 pages6380bd23ec7c8 - Advertisement For Data Entry Operatorsam ahujaNo ratings yet

- On By: Sports THE Asststants StaffDocument12 pagesOn By: Sports THE Asststants Staffsam ahujaNo ratings yet

- Ip 27062022 Car EngDocument12 pagesIp 27062022 Car Engsam ahujaNo ratings yet

- Appendix I Section I: Plan of ExaminationDocument7 pagesAppendix I Section I: Plan of Examinationsam ahujaNo ratings yet