Professional Documents

Culture Documents

Question: Economics (41 Points)

Uploaded by

Shweta ChhabraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question: Economics (41 Points)

Uploaded by

Shweta ChhabraCopyright:

Available Formats

Question: Economics (41 points)

During 2015 most of the currencies from the important emerging economies suffered from a

remarkable depreciation. The Brazilian real lost 33% of its value against the US dollar, the

Russian ruble depreciated by 15%, the Turkish lira by 26%, and the South African rand by 25%

against the dollar.

At the beginning of January 2016, The Financial Times reported that the median forecast

regarding the speed at which the Federal Reserve Bank chairman, Janet Yellen, is expected to

raise interest rates in the next two years. According to this projection, the Fed is going to lift

rates by 75 basis points in 2016 and by a further 100 basis points in 2017.

a) State and briefly explain the terms in the Uncovered Interest Parity (UIP) equation and

demonstrate how it can be used to determine the spot exchange rate, assuming domestic

and foreign interest rates as well as the expectation on the future exchange rate are given.

Answer this question, assuming that Turkish lira (TRY) is the domestic currency, while the

U.S. dollar is the foreign one. (3 points)

b) Give a detailed explanation of how the variables impact upon and determine the spot rate

according to the uncovered interest parity equation. Answer the question, assuming first

that the expectation on the future exchange rate is given (unchanged), second that it also

changes. (6 points)

c) Consider that on January the 9th, 2015, the Turkish lira (TRY) reached its peak against the

dollar. At that date, one USD was worth 2.30 TRY, while in December 2015 the average

exchange rate was such as to require 2.91 TRY to purchase one USD. During 2015, the

Turkish National Bank reduced the interest rate from 7.75% to 7.5%. Assuming an overall

(actual and expected) increase in the Fed Fund rate to 2% (starting from 0.25%), discuss

whether the movement in the TRY/USD exchange rate can be explained using the

uncovered interest rate parity equation. (6 points)

From 2009 to 2015 the 15 most important emerging economies experienced a very strong

increase in their GDP, an increase which, however, had been fueled by increasing foreign debt.

The IMF estimated that in ten years, from 2004 to 2014, the corporate debt in the emerging

economies had more than quadrupled (in nominal dollars). In many economies, the share of

bank and corporate debt denominated in foreign currency is very high. For example, the share

of dollar-denominated debt of the Brazilian company Petrobras is as high as 70% of its total

debt value, while the liabilities of the Russian conglomerate Gazprom, in either dollars or euros,

amounts to an astonishing 80% of the total. Given this situation, the currency depreciation

mentioned above could lead to extensive, or maybe even systemic, defaults in some emerging

economies.

d) Using the Mundell-Fleming model, suggest a fiscal policy that could be used to offset (or

reduce) the currency depreciation, and depict the suggested policy using a graph to illustrate

your answer. [Hint: Draw the IS-LM and UIP curves to explain the effects of the suggested

policy (use two graphs to illustrate your answer). Comment your graphs.] (8 points)

ACIIA® Question Economics – September 2016

e) Suggest a monetary policy that could be used for the same purpose in d), above, and portray

its effects. [Hint: Use two graphs to illustrate your answer.] (7 points)

Consider that many emerging economies, in part due to the reduction in oil and commodity

prices, suffered in 2015 from a foreign trade imbalance. For Indonesia, the current account

deficit was 1.6% of GDP, for India, again as a share of GDP, it amounted to 0.8%, for Turkey

to 5.3%, and for Brazil to 3.4% (Russia is the exception, since it ran a 6.6% surplus). Most of

the emerging economies also run a government budget deficit. In Indonesia the budget deficit

to GDP ratio was 2.0%, in India 6.6%, in Turkey it was close to 1%, in Brazil it amounted to

7.4% of GDP, while for Russia the deficit was 4% of GDP.

f) First, define the terms budget deficit and the trade balance. Then, analyse how they are

affected by the alternative policies suggested in answers to questions d) and e), above.

Finally, suggest the policy that will most likely be adopted by many emerging economies.

(11 points)

ACIIA® Question Economics – September 2016

You might also like

- Macroeconomics in The Global Economy Ilian MihovDocument7 pagesMacroeconomics in The Global Economy Ilian MihovKrisna Mukti WibowoNo ratings yet

- Foreign Exchange Consensus Forecasts by Consensus Economics Inc.Document36 pagesForeign Exchange Consensus Forecasts by Consensus Economics Inc.Consensus EconomicsNo ratings yet

- Int Econ Final ExamDocument9 pagesInt Econ Final ExamWilson LiNo ratings yet

- Global Economy Currency WarDocument43 pagesGlobal Economy Currency WarCoker Charles FolusholaNo ratings yet

- Unit h460 2 Macroeconomics Sample Assessment MaterialDocument44 pagesUnit h460 2 Macroeconomics Sample Assessment MaterialRania KuraaNo ratings yet

- WTO Assignment On China Currency and Its Impact On Other CountriesDocument7 pagesWTO Assignment On China Currency and Its Impact On Other Countriesrulerz004No ratings yet

- LAC Semiannual Report, October 2013: Latin America’s Deceleration and the Exchange Rate BufferFrom EverandLAC Semiannual Report, October 2013: Latin America’s Deceleration and the Exchange Rate BufferNo ratings yet

- World Economic Situation and Prospects 2009: - Global Outlook 2009Document35 pagesWorld Economic Situation and Prospects 2009: - Global Outlook 2009MarianinaTrandafirNo ratings yet

- 2. Bài tậpDocument15 pages2. Bài tậpVi Võ Thị HoàngNo ratings yet

- Chapter 1 2Document3 pagesChapter 1 2K60 Đào Phương NgânNo ratings yet

- Gold Yield Reports Investors IntelligenceDocument100 pagesGold Yield Reports Investors IntelligenceAmit NadekarNo ratings yet

- USA QE Effects On EMDocument22 pagesUSA QE Effects On EMMbongeni ShongweNo ratings yet

- Newly Observed Financial WordsDocument5 pagesNewly Observed Financial WordsProkash MondalNo ratings yet

- Macroeconomics: Theory and Applications: SpringDocument15 pagesMacroeconomics: Theory and Applications: Springmed2011GNo ratings yet

- Model QuestionDocument4 pagesModel QuestionJahidul IslamNo ratings yet

- 08 Currency Crises in GeorgiaDocument7 pages08 Currency Crises in Georgiagr3atNo ratings yet

- Goldstein XieDocument54 pagesGoldstein XieDvcLouisNo ratings yet

- Chapter - 3 National Income and Related Aggregates 3.1 Background: Performance of An Economy Depends On The Amount ofDocument21 pagesChapter - 3 National Income and Related Aggregates 3.1 Background: Performance of An Economy Depends On The Amount ofnavneetNo ratings yet

- Global Imbalances and China by Yu YongdingDocument21 pagesGlobal Imbalances and China by Yu YongdingWan NjNo ratings yet

- Global Interest RatesDocument36 pagesGlobal Interest Rateskokibonilla123No ratings yet

- Vietnam Economic Update - August 2016Document34 pagesVietnam Economic Update - August 2016ChungKhoanNo ratings yet

- 5) Exam Is Due Back Before Midnight (EST) On Nov 5: WWW - Federalreserve.govDocument3 pages5) Exam Is Due Back Before Midnight (EST) On Nov 5: WWW - Federalreserve.govTrevor TwardzikNo ratings yet

- 14.02 Principles of Macroeconomics: Read Instructions FirstDocument11 pages14.02 Principles of Macroeconomics: Read Instructions Firstamrith vardhanNo ratings yet

- E - Portfolio Assignment-1 Econ 2020 Valeria FinisedDocument7 pagesE - Portfolio Assignment-1 Econ 2020 Valeria Finisedapi-317277761No ratings yet

- Ijrmec 881 32616Document14 pagesIjrmec 881 32616Nguyễn Viết ĐạtNo ratings yet

- Another - CIPDocument36 pagesAnother - CIPCosmin CiobanuNo ratings yet

- Daily Breakfast Spread: EconomicsDocument6 pagesDaily Breakfast Spread: EconomicsShou Yee WongNo ratings yet

- ECON6000 Economics Principles and Decision Making: TitleDocument13 pagesECON6000 Economics Principles and Decision Making: TitleShubham AgarwalNo ratings yet

- Chapter 2 EssayDocument1 pageChapter 2 EssayVân AnhNo ratings yet

- The Effect of Reducing Quantitative Easing On Emerging MarketsDocument13 pagesThe Effect of Reducing Quantitative Easing On Emerging MarketsMbongeni ShongweNo ratings yet

- Class Work 02 - Practice Questions On Unit 01 and Unit 02 Unit 01 - Introduction To Forex MarketsDocument4 pagesClass Work 02 - Practice Questions On Unit 01 and Unit 02 Unit 01 - Introduction To Forex MarketsSushmitha SureshNo ratings yet

- Rupee Depreciation - Probable Causes and OutlookDocument10 pagesRupee Depreciation - Probable Causes and OutlookAshok ChakravarthyNo ratings yet

- Global Outlook: Research BriefingDocument4 pagesGlobal Outlook: Research BriefingZerohedgeNo ratings yet

- $bank NotesDocument3 pages$bank NotesKatriel HeartsBigbangNo ratings yet

- Jei 2024002Document21 pagesJei 2024002Ahmadi AliNo ratings yet

- International Finance 2Document4 pagesInternational Finance 2Mis Alina DenisaNo ratings yet

- What Is The Difference Between Bank Rate and Repo RateDocument6 pagesWhat Is The Difference Between Bank Rate and Repo RateVikrant MishraNo ratings yet

- WP 1914Document36 pagesWP 1914choonkiat.leeNo ratings yet

- Speech 985Document44 pagesSpeech 985TBP_Think_TankNo ratings yet

- Lane Asset Management Stock Market Commentary September 2015Document10 pagesLane Asset Management Stock Market Commentary September 2015Edward C LaneNo ratings yet

- SPEX Issue 31Document13 pagesSPEX Issue 31SMU Political-Economics Exchange (SPEX)No ratings yet

- 27 Up: The Implications For China of Abandoning Its Dollar Peg Barry Eichengreen and Andrew Rose June 2010Document15 pages27 Up: The Implications For China of Abandoning Its Dollar Peg Barry Eichengreen and Andrew Rose June 2010unwantedstuffNo ratings yet

- Following The Money in em Currency Markets: EconomicDocument5 pagesFollowing The Money in em Currency Markets: EconomicdpbasicNo ratings yet

- Edwards US CA DeficitDocument15 pagesEdwards US CA DeficitecrcauNo ratings yet

- Macroeconomics Exam - BBS - January 2021Document5 pagesMacroeconomics Exam - BBS - January 2021Peris WanjikuNo ratings yet

- An Econometric Analysis of The DeterminaDocument11 pagesAn Econometric Analysis of The Determinashaibal_iujNo ratings yet

- Transpacific Imbalances and Macroeconomic CodependencyDocument24 pagesTranspacific Imbalances and Macroeconomic CodependencyADBI PublicationsNo ratings yet

- Global Recovery Stalls, Downside Risks Intensify: Figure 1. Global GDP GrowthDocument7 pagesGlobal Recovery Stalls, Downside Risks Intensify: Figure 1. Global GDP GrowthMichal ZelbaNo ratings yet

- MCD 2090 Tutorial Questions T11-Wk11Document4 pagesMCD 2090 Tutorial Questions T11-Wk11kazuyaliemNo ratings yet

- School of Economics: Ecos2002-Intermediate MacroeconomicsDocument1 pageSchool of Economics: Ecos2002-Intermediate MacroeconomicsAngelaNo ratings yet

- Strategic Analysis: Is The Recovery Sustainable?Document16 pagesStrategic Analysis: Is The Recovery Sustainable?varj_feNo ratings yet

- Aciia Information Booklet 2020 05Document19 pagesAciia Information Booklet 2020 05Shweta ChhabraNo ratings yet

- SFI 2006 CIIA HandbookDocument22 pagesSFI 2006 CIIA HandbookShweta ChhabraNo ratings yet

- Associate Wealth Manager AWMDocument8 pagesAssociate Wealth Manager AWMShweta ChhabraNo ratings yet

- Registration Form Ciia: ParticipantsDocument2 pagesRegistration Form Ciia: ParticipantsShweta ChhabraNo ratings yet

- ACIIA - The World of Investment ProfessionalsDocument8 pagesACIIA - The World of Investment ProfessionalsShweta ChhabraNo ratings yet

- Reference Literature: 1. Financial Accounting and Financial Statement AnalysisDocument3 pagesReference Literature: 1. Financial Accounting and Financial Statement AnalysisDavid OparindeNo ratings yet

- Ahead of The Curve - May 23 2023Document11 pagesAhead of The Curve - May 23 2023Gustavo FariaNo ratings yet

- CNRR Certificate of Non-Requiring ReceiptDocument1 pageCNRR Certificate of Non-Requiring ReceiptLyra angela AzarconNo ratings yet

- 352750236X SummDocument5 pages352750236X SummwilliamNo ratings yet

- Mock 21 HL Paper 2 EconomicsDocument9 pagesMock 21 HL Paper 2 EconomicsiafraserNo ratings yet

- Consolidated Tax Invoice: Recipient Details Registrant DetailsDocument2 pagesConsolidated Tax Invoice: Recipient Details Registrant DetailsAccounts SkyHawkNo ratings yet

- PDFDocument5 pagesPDFBuşuMihaiCătălinNo ratings yet

- Cosco - Hapag - ONE - MaerskDocument16 pagesCosco - Hapag - ONE - MaerskAgro Export and importNo ratings yet

- What Is The Difference Between A Liner & Tramp Services ?: Whoisaliner?Document9 pagesWhat Is The Difference Between A Liner & Tramp Services ?: Whoisaliner?Vijay ChanderNo ratings yet

- Nursery Two Lavender 1st Term Exam QuestionDocument10 pagesNursery Two Lavender 1st Term Exam QuestionSamson ObinnaNo ratings yet

- Cat 1 Bba 123 MacroeconomicsDocument3 pagesCat 1 Bba 123 Macroeconomicselijah thonNo ratings yet

- Glosar de Termeni Bancari EnglezDocument13 pagesGlosar de Termeni Bancari EnglezEma ButnaruNo ratings yet

- CH 2Document2 pagesCH 2Aryan RawatNo ratings yet

- 4 B.5 Review Quiz - Integrated Skills - Modo - Resolver - Module B - B.5 - Shopping Trip - Review Quizzes - %coursename% - MyEnglishLabDocument1 page4 B.5 Review Quiz - Integrated Skills - Modo - Resolver - Module B - B.5 - Shopping Trip - Review Quizzes - %coursename% - MyEnglishLabAlejandra KassNo ratings yet

- Teller: Temenos Education CentreDocument50 pagesTeller: Temenos Education CentreStephens Tioluwanimi OluwadamilareNo ratings yet

- Binance CoinDocument3 pagesBinance Coins160821004No ratings yet

- Press Release Crypto Research Report English.01Document5 pagesPress Release Crypto Research Report English.01AndreiNo ratings yet

- Rek Koran Mandiri Juli 20Document10 pagesRek Koran Mandiri Juli 20sdwg0% (1)

- February BOLT 2023Document140 pagesFebruary BOLT 2023teliwar vineelNo ratings yet

- Salesman: S018 AccountDocument3 pagesSalesman: S018 Accountandry hardianNo ratings yet

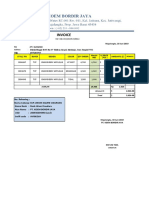

- Invoice: NO: KBJ-INV/2019-VI/0011Document3 pagesInvoice: NO: KBJ-INV/2019-VI/0011susanti retno hidayah watiNo ratings yet

- Quitclaim and Waiver: - in Full and Final PaymentDocument1 pageQuitclaim and Waiver: - in Full and Final PaymentRex Sagauinit50% (2)

- Currency Conversion Test ProceduresDocument4 pagesCurrency Conversion Test ProceduresMartin MillerNo ratings yet

- Nicole InglotDocument110 pagesNicole InglotdanielaNo ratings yet

- The Indonesian Sentence IsDocument2 pagesThe Indonesian Sentence IsDodi PurnamaNo ratings yet

- Bmat La 1Document11 pagesBmat La 1Ruth AbrogarNo ratings yet

- Fatores Atualiz Monet 0123Document4 pagesFatores Atualiz Monet 0123Leandro Fonseca de AndradeNo ratings yet

- CAPE Economics 2007 U2 P1Document10 pagesCAPE Economics 2007 U2 P1Nikki LorraineNo ratings yet

- London Philatelist:: 25th Anniversary PhilatelicDocument28 pagesLondon Philatelist:: 25th Anniversary PhilatelicVIORELNo ratings yet

- Countermarks On Roman Coins PDFDocument3 pagesCountermarks On Roman Coins PDFSvetlozar StoyanovNo ratings yet

- East India CompanyDocument13 pagesEast India CompanyJagadeeshkeerthi KeerthiNo ratings yet