Professional Documents

Culture Documents

Bank Management Midterm Question Total Mark 70

Uploaded by

Dishant KhanejaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Management Midterm Question Total Mark 70

Uploaded by

Dishant KhanejaCopyright:

Available Formats

BANK MANAGEMENT

MIDTERM QUESTION

Total mark 70

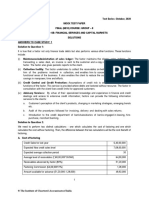

Section A: 40 Marks (1 * 40)

1. Followings are the information on expected inflows of principal and interest payment on assets

and expected outflows of principal and interest payment on liabilities.

Time Cash inflow Cash outflow

1 1,275,600 1,295,500

2 746,872 831,454

3 341,555 123,897

4 62,482 1,005

5 9,871 0

The discount rate applicable on cash flow is 4.25%. If the total assets and total liabilities are Rs.

20,000,000 and Rs. 18,000,000 respectively, calculate the leverage adjusted duration gap of the

bank. Moreover, if the interest rate rise to 4.75%, what will be the change in the value of the net

worth of the bank.

Section B: 30 marks (2 * 15)

Attend any two out of followings questions.

1. Why financial institutions are crucial for the economic development of a country? Discuss

various roles and functions of financial institutions.

2. Calculate bank’s ratio of Tier 1 capital to risk-weighted-assets and total capital to risk-weighted-

assets under the terms of Basel 1 Agreement by using the following information.

On Balance Sheet Items (Assets) Amount $

Cash 4,000,000

U.S Treasury securities 30,600,000

Deposit balances due from other 4,000,000

banks

Loans secured by first liens on 66,000,000

residential property (1-4 family

dwellings)

Loans to corporations 105,300,000

Off Balance Sheet Items

Standby letters of credit backing 20,500,000

municipal bond

Long term unused loan commitments 25,500,000

to corporate customers

Tier 1 capital 7,500,000

Tier 2 capital 5,800,000

3. Discuss in detail about the Loan securitization as a tool for managing risks by banks. Discuss

about the parties involved in securitization process and the benefits of the securitization.

You might also like

- Tutorial 3 QsDocument5 pagesTutorial 3 QsYauweiNo ratings yet

- High Rock Industries CaseDocument19 pagesHigh Rock Industries CaseRohan Raj MishraNo ratings yet

- Financial Reporting Tutorial QSN Solutions 2021 JC JaftoDocument31 pagesFinancial Reporting Tutorial QSN Solutions 2021 JC JaftoInnocent GwangwaraNo ratings yet

- Cashflowstatement 150402074118 Conversion Gate01Document30 pagesCashflowstatement 150402074118 Conversion Gate01vini2710No ratings yet

- 21 Problems For CB NewDocument31 pages21 Problems For CB NewNguyễn Thảo MyNo ratings yet

- Problems For Commercial BankDocument9 pagesProblems For Commercial BankPhạm Thúy HằngNo ratings yet

- Credit Risk Assessment 1 - May 2015Document6 pagesCredit Risk Assessment 1 - May 2015Basilio MaliwangaNo ratings yet

- IAS 30 and IFRS 7 CPA Anthony NjiruDocument51 pagesIAS 30 and IFRS 7 CPA Anthony NjiruMovie MovieNo ratings yet

- BUS 505 - Final Exam - Fall 2021Document2 pagesBUS 505 - Final Exam - Fall 2021Rafid AhnafNo ratings yet

- Interpretation of Public Sector Financial StatementsDocument4 pagesInterpretation of Public Sector Financial StatementsEsther AkpanNo ratings yet

- Fimd Training Unit 1 - Financial AnalysisDocument31 pagesFimd Training Unit 1 - Financial AnalysisErrol ThompsonNo ratings yet

- Liquidity Cash Flow Model Sample InformationDocument8 pagesLiquidity Cash Flow Model Sample InformationAva Vierra Perez-ViejoNo ratings yet

- Paper18 Solution PDFDocument24 pagesPaper18 Solution PDFI'm Just FunnyNo ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- NHTMDocument7 pagesNHTMLinh LinhNo ratings yet

- Cashflowstatement 150402074118 Conversion Gate01Document39 pagesCashflowstatement 150402074118 Conversion Gate01vini2710No ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument23 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementZrake 24No ratings yet

- Financial Analysis TestsDocument25 pagesFinancial Analysis Teststheodor_munteanuNo ratings yet

- 21 Problems For CBDocument10 pages21 Problems For CBThu HòaiNo ratings yet

- 21 Problems For CBDocument10 pages21 Problems For CBNguyễn QuỳnhNo ratings yet

- Analysis of Financial StatementsDocument17 pagesAnalysis of Financial StatementsRajesh PatilNo ratings yet

- ExportDocument21 pagesExportBükre PNo ratings yet

- Cai Acc. Imp Questions (Part 1)Document100 pagesCai Acc. Imp Questions (Part 1)SheenaNo ratings yet

- Siddharth Education Services LTDDocument5 pagesSiddharth Education Services LTDBasanta K SahuNo ratings yet

- Problems Set On Ratio AnalysisDocument7 pagesProblems Set On Ratio AnalysispriyankaNo ratings yet

- MBA AFM Probs On FS Analysis, Ratio Analysis and Com SizeDocument6 pagesMBA AFM Probs On FS Analysis, Ratio Analysis and Com SizeAngelsony AmmuNo ratings yet

- Balance Sheet CompanyDocument16 pagesBalance Sheet CompanyNidhi ShahNo ratings yet

- FIN 4003 FWA Problem Solving Revision 2020 10 Key Answers1Document6 pagesFIN 4003 FWA Problem Solving Revision 2020 10 Key Answers1Nourhan KhaterNo ratings yet

- F7.2 - Mock Test 1Document5 pagesF7.2 - Mock Test 1huusinh2402No ratings yet

- FM Eco Test BookDocument73 pagesFM Eco Test BookkonaNo ratings yet

- P8 FM ECO Q MTP 1 Nov 23Document5 pagesP8 FM ECO Q MTP 1 Nov 23spyverse01No ratings yet

- Internal Reconstruction NotesDocument16 pagesInternal Reconstruction NotesAkash Mehta100% (1)

- Corporate Finance 2 SyllabusDocument11 pagesCorporate Finance 2 SyllabusMai NguyenNo ratings yet

- 66649bos53803 Cp8u4 PDFDocument30 pages66649bos53803 Cp8u4 PDFpratham.mishra1809No ratings yet

- Problems For CBDocument28 pagesProblems For CBĐức HàNo ratings yet

- LM02 Fixed-Income Cash Flows and Types IFT NotesDocument13 pagesLM02 Fixed-Income Cash Flows and Types IFT NotesClaptrapjackNo ratings yet

- Sample Question MCom 2019 PatternDocument6 pagesSample Question MCom 2019 PatternPRATIKSHA CHAUDHARINo ratings yet

- B.B.A., Sem.-IV CC-213: Corporate Financial StatementsDocument4 pagesB.B.A., Sem.-IV CC-213: Corporate Financial StatementsJJ NayakNo ratings yet

- Week 7 Class Exercises (Answers)Document4 pagesWeek 7 Class Exercises (Answers)Chinhoong OngNo ratings yet

- Chapter 4 - Financial Statements of CompaniesDocument198 pagesChapter 4 - Financial Statements of CompaniesVaidehee MishraNo ratings yet

- Unit IIIDocument9 pagesUnit IIIkuselvNo ratings yet

- Framework - QB PDFDocument6 pagesFramework - QB PDFHindutav aryaNo ratings yet

- Bos 50091Document15 pagesBos 50091Gokul dnNo ratings yet

- TREASURY MANAGEMENT - TUTORIAL Qs2 - 240417 - 160705Document3 pagesTREASURY MANAGEMENT - TUTORIAL Qs2 - 240417 - 160705John diggleNo ratings yet

- Css Business Administration 2020Document1 pageCss Business Administration 2020Hafsa HamidNo ratings yet

- Financial Statement of CompaniesDocument35 pagesFinancial Statement of CompaniesTanyaNo ratings yet

- Frsa Module 4 Problems SolutionsDocument12 pagesFrsa Module 4 Problems SolutionsKushal MpvsNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- Fund Flow Statement: by Dr. Aleem AnsariDocument18 pagesFund Flow Statement: by Dr. Aleem AnsariPRIYAL GUPTANo ratings yet

- MA A-3 Ratio AnalysisDocument3 pagesMA A-3 Ratio AnalysisShilpa AroraNo ratings yet

- B Exercises: E24-1B (Post-Balance-Sheet Events) (A) (B)Document4 pagesB Exercises: E24-1B (Post-Balance-Sheet Events) (A) (B)Saleh RaoufNo ratings yet

- 2021 Business AccountingDocument5 pages2021 Business AccountingVISHESH 0009No ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- B407F Consolidated Cash Flow StatementDocument19 pagesB407F Consolidated Cash Flow StatementTomson ChungNo ratings yet

- Ga PP Module 3 Dec2022Document125 pagesGa PP Module 3 Dec2022preethi alNo ratings yet

- Indian Institute of Banking & FinanceDocument90 pagesIndian Institute of Banking & Financegopalmeb67% (3)

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- Financial Instruments and Institutions: Accounting and Disclosure RulesFrom EverandFinancial Instruments and Institutions: Accounting and Disclosure RulesNo ratings yet

- Credit Risk Management In and Out of the Financial Crisis: New Approaches to Value at Risk and Other ParadigmsFrom EverandCredit Risk Management In and Out of the Financial Crisis: New Approaches to Value at Risk and Other ParadigmsRating: 1 out of 5 stars1/5 (1)

- MBA 2020-22 Term-V Class ScheduleDocument1 pageMBA 2020-22 Term-V Class ScheduleDishant KhanejaNo ratings yet

- Yardstick Educational Initiatives (FZE) : Information Checklist and Tracker Last Updated On: 11/30/2021Document8 pagesYardstick Educational Initiatives (FZE) : Information Checklist and Tracker Last Updated On: 11/30/2021Dishant KhanejaNo ratings yet

- Expressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDocument5 pagesExpressed in Canadian Dollars ($ CAD), Unaudited: Digital Bull Technologies LTDDishant KhanejaNo ratings yet

- Agile Presentation For IIM Ranchi - V2.2Document46 pagesAgile Presentation For IIM Ranchi - V2.2Dishant KhanejaNo ratings yet

- IIM Ranchi - Naman AroraDocument1 pageIIM Ranchi - Naman AroraDishant KhanejaNo ratings yet

- Indian Institute of Management Ranchi: - Anything Written Beyond ThreeDocument2 pagesIndian Institute of Management Ranchi: - Anything Written Beyond ThreeDishant KhanejaNo ratings yet

- MIMA - Mid-Term Exam-MBA - 2020-22Document1 pageMIMA - Mid-Term Exam-MBA - 2020-22Dishant KhanejaNo ratings yet

- Agile Presentation For IIM Ranchi - V2.2Document46 pagesAgile Presentation For IIM Ranchi - V2.2Dishant KhanejaNo ratings yet

- National Finance Olympiad 2021: B-School Finance Competition Cum Learning ProgramDocument17 pagesNational Finance Olympiad 2021: B-School Finance Competition Cum Learning ProgramDishant KhanejaNo ratings yet

- Session 9-10Document42 pagesSession 9-10Dishant KhanejaNo ratings yet

- Sl. Stu ID Name Date Case To Be Presented: 27th November, 2021 (Saturday) New Delhi Water and PowerDocument4 pagesSl. Stu ID Name Date Case To Be Presented: 27th November, 2021 (Saturday) New Delhi Water and PowerDishant KhanejaNo ratings yet

- Nordex Financial StatementsDocument6 pagesNordex Financial StatementsDishant KhanejaNo ratings yet

- LBO (Leveraged Buyout) Model For Private Equity FirmsDocument2 pagesLBO (Leveraged Buyout) Model For Private Equity FirmsDishant KhanejaNo ratings yet

- CH 5 Exchange Rates of IfmDocument12 pagesCH 5 Exchange Rates of Ifmpagal larkiNo ratings yet

- Walmart Inc.: Monthly Rates of ReturnDocument11 pagesWalmart Inc.: Monthly Rates of ReturnChristopher KipsangNo ratings yet

- Econ Unit 5 Test Study GuideDocument2 pagesEcon Unit 5 Test Study Guideapi-692271993No ratings yet

- SBM QuestionsDocument148 pagesSBM QuestionsGeorge NicholsonNo ratings yet

- Uncertainity in GI & Solvency Issues - PI MajmudarDocument15 pagesUncertainity in GI & Solvency Issues - PI MajmudarRajendra SinghNo ratings yet

- ABirla Common Appln FormDocument92 pagesABirla Common Appln FormJason Kenneth D’SilvaNo ratings yet

- Iapm AssignmentDocument7 pagesIapm Assignmentankitabhat93No ratings yet

- Business-Valuation-And Financial ModellingDocument4 pagesBusiness-Valuation-And Financial ModellingSid7664No ratings yet

- D Tutorial 6Document6 pagesD Tutorial 6AlfieNo ratings yet

- Finance Coursework ExampleDocument8 pagesFinance Coursework Examplegbfcseajd100% (2)

- CMT Curriculum Level IDocument8 pagesCMT Curriculum Level ISandeep L100% (1)

- Financial Markets and Institutions 11Th Edition Jeff Madura Test Bank Full Chapter PDFDocument40 pagesFinancial Markets and Institutions 11Th Edition Jeff Madura Test Bank Full Chapter PDFMeganPrestonceim100% (12)

- Feasibilty Study For LPGDocument28 pagesFeasibilty Study For LPGdinba12382% (33)

- Valuing Real Assets in The Presence of Risk: Strategic Financial ManagementDocument15 pagesValuing Real Assets in The Presence of Risk: Strategic Financial ManagementAnish Mittal100% (1)

- Baja PDFDocument3 pagesBaja PDFdindakharismaNo ratings yet

- A Study On Financial Performance of Nbfc'sDocument22 pagesA Study On Financial Performance of Nbfc'shelna francisNo ratings yet

- Midterm Exam in Finance 2Document3 pagesMidterm Exam in Finance 2UnivMan LawNo ratings yet

- TRM ResumeDocument8 pagesTRM ResumeJustin PageNo ratings yet

- 9609 w16 Ms 31Document12 pages9609 w16 Ms 31PRIYES BAMNENo ratings yet

- Best ADX Strategy Built by Professional Traders PDFDocument13 pagesBest ADX Strategy Built by Professional Traders PDFDoug TrudellNo ratings yet

- Far TB2Document195 pagesFar TB2MarieJoiaNo ratings yet

- 1 BVD Jun98 V4i1Document37 pages1 BVD Jun98 V4i1gioro_miNo ratings yet

- Money Management TradingDocument4 pagesMoney Management TradingBagus Krida0% (1)

- Behavioral Biases of Investors: Mohd. Anisul Islam, CFA Assistant Professor March 2021Document14 pagesBehavioral Biases of Investors: Mohd. Anisul Islam, CFA Assistant Professor March 2021Shaikh Saifullah KhalidNo ratings yet

- Analisis Kelayakan Finansial Irr, NPVDocument19 pagesAnalisis Kelayakan Finansial Irr, NPVACHMAD DHAN MAULINo ratings yet

- AAFR Notes IFRS 2Document20 pagesAAFR Notes IFRS 2WaqasNo ratings yet

- DTCC Public (White)Document15 pagesDTCC Public (White)dakilokicaNo ratings yet

- Trading SimDocument10 pagesTrading Siminspired.gene100% (1)

- Fundamental & Technical Analysis of Stock For BeginnersDocument6 pagesFundamental & Technical Analysis of Stock For BeginnersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Financial Ratio AnalyzesDocument11 pagesFinancial Ratio AnalyzesNardsdel RiveraNo ratings yet