Professional Documents

Culture Documents

4.4.3 Monetary Issues Related With GST-Returns Filings

4.4.3 Monetary Issues Related With GST-Returns Filings

Uploaded by

Harsh Dixit0 ratings0% found this document useful (0 votes)

3 views3 pagesThe document summarizes a survey of 70 respondents on the monetary issues they face with filing GST returns as non-filers. The top 3 issues reported were insufficiency of funds (93% of respondents), waiting for input tax credit setoff (84%), and differences between payment and collection periods due to purchases being made in cash and sales being made on credit (69%). A majority of respondents also reported facing difficulties with payments (51%) and having tax refunds still in process (2-3% of respondents).

Original Description:

Original Title

4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes a survey of 70 respondents on the monetary issues they face with filing GST returns as non-filers. The top 3 issues reported were insufficiency of funds (93% of respondents), waiting for input tax credit setoff (84%), and differences between payment and collection periods due to purchases being made in cash and sales being made on credit (69%). A majority of respondents also reported facing difficulties with payments (51%) and having tax refunds still in process (2-3% of respondents).

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views3 pages4.4.3 Monetary Issues Related With GST-Returns Filings

4.4.3 Monetary Issues Related With GST-Returns Filings

Uploaded by

Harsh DixitThe document summarizes a survey of 70 respondents on the monetary issues they face with filing GST returns as non-filers. The top 3 issues reported were insufficiency of funds (93% of respondents), waiting for input tax credit setoff (84%), and differences between payment and collection periods due to purchases being made in cash and sales being made on credit (69%). A majority of respondents also reported facing difficulties with payments (51%) and having tax refunds still in process (2-3% of respondents).

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

4.4.

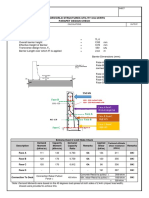

3 Monetary Issues related with GST-Returns Filings:

The following table shows the various monetary issues affecting non-filers of GST

returns. The tabulated issues were the suggested/top-rated issues/problems

referred by the

Commercial Tax Officers and Field officers in GST department.

Table 10-Monetary issues related with GST-returns filings

MONETARY ISSUES

YES

NO

TOTAL

REFUNDS RECEIVABLE FROM DEPARTMENT

2

68

70

TAX REFUNDS IN PROCESS

2

68

70

66

39

57

17

30

32

19

4

31

13

53

40

38

51

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

LACK OF FUNDS

NO TIME FOR FILING

BACKING UP INVOICES

GENERATING OUTWARD INVOICES

GENERATING INWARD INVOICES

MUTIPLE RATES OF TAXES

CATEGORIZATION OF GOODS

ADMINISTRATIVE ISSUES RELATED WITH NON-FILERS

YES

NO37

WAITING FOR SETOFF FROM ITC

59

11

70

INSUFFICIENCY OF FUNDS

65

5

70

DIFFERENCES BETWEEN PAYMENT AND COLLECTION PERIOD

(purchases through cash and sales through credit)

48

22

70

DIFFICULTIES IN PAYMENTS

36

34

70

The above table consist of responses from 70 respondents regarding the monetary issues faced by

them while filing returns under GST and the issues were recognised by the field-level

observation

and suggestion given by the commercial tax department. Out of 7 issues, which were taken into

notice of respondents, it has been observed that a majority of the respondents indicated their

concern regarding the issues demonstrated graphically below on a bar diagram.

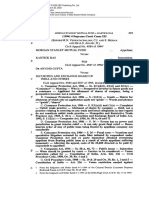

Graphical Illustration of Monetary Issues Affecting GST Returns Of Non-Filers

Figure 10-Monetary issues related with GST-returns filings

In the above graph we can see that a majority of respondents are facing major problem in the

case

of Insufficiency of funds (93%). The response rate for other issues are as follows: Waiting for

Input

Tax Credit (84%), Time gap between GST paid and ITC received (69%), difficulties of payments

(51%), tax refunds in process (2 to 3%), and refunds receivable from department (2 to 3%).

2

2

59

65

48

36

68

68

11

5

22

34

0%

10% 20% 30% 40% 50%

60% 70% 80% 90% 100%

REFUNDS RECEIVABLE FROM DEPARTMENT

TAX REFUNDS IN PROCESS

WAITING FOR SETOFF FROM ITC

INSUFFICIENCY OF FUNDS

DIFFERENCES BETWEEN PAYMENT AND COLLECTION PERIOD

DIFFICULTIES IN PAYMENTS

MONETARY ISSUES RELATED WITH NON-FILER'S

YES

NO

“They are either overly centralised, depriving the sub-federal levels of fiscal autonomy

(Australia,

Germany, and Austria); or where there is a dual structure, they are either administered

independently creating too many differences in tax rates that weaken compliance and make inter

state transactions difficult to tax (Brazil, Russia and Argentina); or administered with a

modicum

of coordination, which minimises these disadvantages (Canada and India today) but does not do

away with them

You might also like

- Park Avenue TranscriptDocument33 pagesPark Avenue Transcripttheactioneer50% (2)

- Receipt Collection For WEBDocument8 pagesReceipt Collection For WEBWSB-TVNo ratings yet

- Key Words: Perceptions Challenges Presumptive Taxation Category C' Tax PayersDocument18 pagesKey Words: Perceptions Challenges Presumptive Taxation Category C' Tax Payersmubarek oumerNo ratings yet

- Corp Tax Refunds Nov2011Document1 pageCorp Tax Refunds Nov2011Hayley-Marrie YendellNo ratings yet

- 1999 Audit Program For - Revenue - DistrictDocument35 pages1999 Audit Program For - Revenue - Districtelizeymontes0209No ratings yet

- Solution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1St Edition by Byrd and Chen Isbn 0133115097 9780133115093 Full Chapter PDFDocument30 pagesSolution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1St Edition by Byrd and Chen Isbn 0133115097 9780133115093 Full Chapter PDFmary.graf929100% (11)

- Comprehensive Examination 1 TaxationDocument2 pagesComprehensive Examination 1 TaxationAlysa Sandra HizonNo ratings yet

- 21 Usefulcharts 2012-13Document20 pages21 Usefulcharts 2012-13sharmaji23No ratings yet

- TAX 203 Other Percentage TaxesDocument9 pagesTAX 203 Other Percentage TaxesYess poooNo ratings yet

- Tax Assessment-Part ADocument20 pagesTax Assessment-Part Ajoseph lupashaNo ratings yet

- Nature of Payments Made To ResidentDocument28 pagesNature of Payments Made To Residentbonnie.barma2831No ratings yet

- Dr. Felipe Medalla Financial SectorDocument104 pagesDr. Felipe Medalla Financial SectorLianne Carmeli B. Fronteras100% (1)

- Self Assessments SchemeDocument10 pagesSelf Assessments SchemeRafae ShahidNo ratings yet

- ITI Submission On Pay & FileDocument10 pagesITI Submission On Pay & FileKHumphreysTDNo ratings yet

- Public FinnceDocument57 pagesPublic FinnceJim MathilakathuNo ratings yet

- Fiscal Policy of BangladeshDocument12 pagesFiscal Policy of BangladeshMd HarunNo ratings yet

- Acc 423 Advanced TaxationDocument50 pagesAcc 423 Advanced Taxationkajojo joyNo ratings yet

- A. Not Filing Income Tax ReturnsDocument4 pagesA. Not Filing Income Tax ReturnsNishchal AnandNo ratings yet

- Bakehe-Mbondo2021 Article WhatDrivesInformalityOfMicroAnDocument14 pagesBakehe-Mbondo2021 Article WhatDrivesInformalityOfMicroAnnkemghaguivisNo ratings yet

- Taxation of Salaried EmployeesDocument39 pagesTaxation of Salaried Employeessailolla30No ratings yet

- Solution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition by Byrd and Chen ISBN 0133115097 9780133115093Document36 pagesSolution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition by Byrd and Chen ISBN 0133115097 9780133115093juliebeasleywjcygdaisn100% (23)

- Rmo 13-12Document60 pagesRmo 13-12Kris CalabiaNo ratings yet

- 22222Document4 pages22222gudataaNo ratings yet

- Factors Affecting Turnover Tax Collection Performance: A Case of West Shoa Zone Selected DistrictsDocument17 pagesFactors Affecting Turnover Tax Collection Performance: A Case of West Shoa Zone Selected Districtsyedinkachaw shferawNo ratings yet

- UK Tax SystemDocument13 pagesUK Tax SystemMuhammad Sajid Saeed100% (1)

- Challenges of Business Income Tax AdministrationDocument14 pagesChallenges of Business Income Tax AdministrationZed AlemayehuNo ratings yet

- Emerging Tax TrendsDocument10 pagesEmerging Tax TrendsJesreene Lee-BowraNo ratings yet

- Effectiveness of Tax Deduction at Source (TDS) in IndiaDocument4 pagesEffectiveness of Tax Deduction at Source (TDS) in IndiaIJEMR JournalNo ratings yet

- Genzeb 2 On TaxDocument15 pagesGenzeb 2 On TaxAbu DadiNo ratings yet

- TAX MGT PPT 1Document28 pagesTAX MGT PPT 1Rahul DesaiNo ratings yet

- Articulo 3Document16 pagesArticulo 3Josua RodriguezNo ratings yet

- (9781513577043 - IMF How To Notes) Volume 2021 (2021) : Issue 004 (May 2021) : How To Manage Value-Added Tax RefundsDocument28 pages(9781513577043 - IMF How To Notes) Volume 2021 (2021) : Issue 004 (May 2021) : How To Manage Value-Added Tax RefundsJoaca PerezNo ratings yet

- Tax PlanningDocument7 pagesTax PlanningCharan AdharNo ratings yet

- Vivad Se Vishwas Tax 2025Document17 pagesVivad Se Vishwas Tax 2025Juzer JiruNo ratings yet

- SPDF May 2007Document8 pagesSPDF May 2007BfpCamarinesNorteNo ratings yet

- Research QuestionsDocument3 pagesResearch QuestionsDESSIE FIKIRNo ratings yet

- Indian Institute of Technology Madras: CircularDocument5 pagesIndian Institute of Technology Madras: CircularAravinthram R am18m002No ratings yet

- Chapter 13 OutlineDocument4 pagesChapter 13 OutlineBeka ZedelashviliNo ratings yet

- Rmo 28-07Document31 pagesRmo 28-07nathalie velasquezNo ratings yet

- Tax Expenditure FinalDocument34 pagesTax Expenditure Finalመቅዲ ሀበሻዊትNo ratings yet

- 1049-3301-1-PB Presumptive Tax System and Its Influence On The Ways Informal Entrepreneurs Behave in TanzaniaDocument19 pages1049-3301-1-PB Presumptive Tax System and Its Influence On The Ways Informal Entrepreneurs Behave in TanzaniaIshmael OneyaNo ratings yet

- Chapter One SolutionsDocument9 pagesChapter One Solutionsapi-3705855100% (1)

- TAX 2 Group 1 Handout PDFDocument6 pagesTAX 2 Group 1 Handout PDFMi-young SunNo ratings yet

- Frequently Asked Questions: 1. How Is The Withholding Tax On Commission Calculated?Document9 pagesFrequently Asked Questions: 1. How Is The Withholding Tax On Commission Calculated?vanguardNo ratings yet

- ECSU - Proposal Thesis INSTITUTE - OF - TAX - AND - CUSTOMS - ADMINISTRATDocument39 pagesECSU - Proposal Thesis INSTITUTE - OF - TAX - AND - CUSTOMS - ADMINISTRATGadaa TDhNo ratings yet

- Ms. Luisa M. LabadDocument14 pagesMs. Luisa M. LabadLaarnie ManalastasNo ratings yet

- Circular 3 2018Document6 pagesCircular 3 2018sandeepNo ratings yet

- Tax Evasion, Disclosure, andDocument14 pagesTax Evasion, Disclosure, andCorina-maria DincăNo ratings yet

- Proposal BaDocument17 pagesProposal BaDùķe HPNo ratings yet

- Question No: 2Document18 pagesQuestion No: 2Rameez AbbasiNo ratings yet

- Rebates and Reliefs: Mitigation of ProgressionDocument26 pagesRebates and Reliefs: Mitigation of ProgressionVishal ThkurzNo ratings yet

- GST Implementation Issues: Input Tax CreditDocument5 pagesGST Implementation Issues: Input Tax CreditSiva SankariNo ratings yet

- Amendment Consolidated FileDocument128 pagesAmendment Consolidated FileRanga AmarNo ratings yet

- 6 Activities For Business Structure & TaxationDocument16 pages6 Activities For Business Structure & Taxationyabmitiku123No ratings yet

- 6 Activities For Business Structure & TaxationDocument16 pages6 Activities For Business Structure & TaxationDawit TilahunNo ratings yet

- ProposalDocument9 pagesProposalDùķe HPNo ratings yet

- Scott Hodge, President Will Mcbride, Chief EconomistDocument20 pagesScott Hodge, President Will Mcbride, Chief EconomistTax FoundationNo ratings yet

- Idt AacDocument177 pagesIdt AacVinay KumarNo ratings yet

- Drafting - Dec 2018Document119 pagesDrafting - Dec 2018rk_19881425No ratings yet

- RMO No. 6-2023Document11 pagesRMO No. 6-2023Anostasia NemusNo ratings yet

- CA Final Revision MaterialDocument477 pagesCA Final Revision Materialsathish_61288@yahooNo ratings yet

- Bir Singh v. Mukesh Kumar, (2019) 4 SCC 197Document13 pagesBir Singh v. Mukesh Kumar, (2019) 4 SCC 197Harsh DixitNo ratings yet

- Agreement For Sale - LabellingDocument3 pagesAgreement For Sale - LabellingHarsh DixitNo ratings yet

- Bhupesh Rathod v. Dayashankar Prasad Chaurasia, (2022) 2 SCC 355.Document10 pagesBhupesh Rathod v. Dayashankar Prasad Chaurasia, (2022) 2 SCC 355.Harsh DixitNo ratings yet

- First Draft in BhupdevDocument60 pagesFirst Draft in BhupdevHarsh DixitNo ratings yet

- Versus: Efore HavanDocument20 pagesVersus: Efore HavanHarsh DixitNo ratings yet

- Interference in Second AppealDocument4 pagesInterference in Second AppealHarsh DixitNo ratings yet

- Relief Beyond PrayerDocument5 pagesRelief Beyond PrayerHarsh DixitNo ratings yet

- Morgan StanleyDocument22 pagesMorgan StanleyHarsh DixitNo ratings yet

- Substantial Question of Law: Means A Substantial Question of Law As Between TheDocument5 pagesSubstantial Question of Law: Means A Substantial Question of Law As Between TheHarsh DixitNo ratings yet

- Appeal Against Interlocutory OrderDocument3 pagesAppeal Against Interlocutory OrderHarsh DixitNo ratings yet

- Right of Appeal Is Vested Right and Accrues On The Date On Which First ProceedingsDocument3 pagesRight of Appeal Is Vested Right and Accrues On The Date On Which First ProceedingsHarsh DixitNo ratings yet

- Final Exam - Introdution of Economics - 1Document3 pagesFinal Exam - Introdution of Economics - 1Dilaver GashiNo ratings yet

- Contemporary Financial ManagementDocument33 pagesContemporary Financial ManagementHayat TarrarNo ratings yet

- ReceptionistDocument3 pagesReceptionistYuniarso Adi NugrohoNo ratings yet

- Corporate Financial Management, 6e Glen Arnold, Deborah LewisDocument90 pagesCorporate Financial Management, 6e Glen Arnold, Deborah Lewissolvedpapers123No ratings yet

- Supplementary NotificationDocument2 pagesSupplementary Notificationpallavi kNo ratings yet

- Loans &advances (Mantu) - Project - 1-2Document48 pagesLoans &advances (Mantu) - Project - 1-2Shivu BaligeriNo ratings yet

- Quiz 14 - Financial ManagementDocument9 pagesQuiz 14 - Financial ManagementAurelio Delos Santos Macatulad Jr.No ratings yet

- Chapter 05 TestBankDocument57 pagesChapter 05 TestBankHaris KhanNo ratings yet

- The History of Economic Thought A Reader Second Edition Ebook PDF VersionDocument62 pagesThe History of Economic Thought A Reader Second Edition Ebook PDF Versioncraig.suarez457100% (40)

- Lesson 11 - Introduction To Compound Interest - 2019-2020Document8 pagesLesson 11 - Introduction To Compound Interest - 2019-2020kelvinNo ratings yet

- Marketing: Real People, Real Choices: Global, Ethical and Sustainable MarketingDocument43 pagesMarketing: Real People, Real Choices: Global, Ethical and Sustainable MarketingJonathan LimNo ratings yet

- Flue Gas Desulfurization FGD - Global Market Status and Trend Report 2014-2026 PDFDocument70 pagesFlue Gas Desulfurization FGD - Global Market Status and Trend Report 2014-2026 PDFsusovan bIswasNo ratings yet

- Presentation NHDP - PPT - RevDocument37 pagesPresentation NHDP - PPT - RevSanjay AgrawalNo ratings yet

- Edge Wall Final-ModelDocument1 pageEdge Wall Final-ModelAbanoub ShakerNo ratings yet

- Motorworld Structures Utility Culverts Parapet Design Check: MM MM 1070 TL-5 1330Document1 pageMotorworld Structures Utility Culverts Parapet Design Check: MM MM 1070 TL-5 1330Jemicah YumenaNo ratings yet

- Raus Compass 2022 EconomyDocument220 pagesRaus Compass 2022 EconomyTanishk MehataNo ratings yet

- Bucking The Buck Us Financial Sanctions and The International Backlash Against The Dollar Daniel Mcdowell 2 Full ChapterDocument68 pagesBucking The Buck Us Financial Sanctions and The International Backlash Against The Dollar Daniel Mcdowell 2 Full Chapterrobert.hanson139100% (5)

- T7 Po9 Pa PoaDocument103 pagesT7 Po9 Pa PoaAnastasia roseNo ratings yet

- Best Way & Lucky Cement Case StudyDocument16 pagesBest Way & Lucky Cement Case StudyArisha BaigNo ratings yet

- InternalDocument6 pagesInternalalmeiidany97No ratings yet

- ManDocument33 pagesManNursidikNo ratings yet

- The Indian Forest Under British RajDocument26 pagesThe Indian Forest Under British RajKovid VermaNo ratings yet

- ECO211 Chapter 4Document158 pagesECO211 Chapter 4Adam ZafryNo ratings yet

- Answer Key Supply Demand 1332948228Document6 pagesAnswer Key Supply Demand 1332948228Asmady AhmadNo ratings yet

- CHAPTER 6 Planning The Business To EstablishDocument23 pagesCHAPTER 6 Planning The Business To EstablishSaturnino MojarNo ratings yet

- Summary MKI Chapter 2Document2 pagesSummary MKI Chapter 2DeviNo ratings yet

- Entrepreneurship Development Class 12 NotesDocument27 pagesEntrepreneurship Development Class 12 NotesHsnNo ratings yet

- Two-Factor EconomyDocument6 pagesTwo-Factor EconomyTrần Hải ĐăngNo ratings yet