Professional Documents

Culture Documents

PROBLEM 3: Two Sole Proprietors Form A Partnership

Uploaded by

Yesha Sibayan0 ratings0% found this document useful (0 votes)

52 views2 pagesTwo sole proprietors, B. Maramba and S. Zaragosa, formed a partnership called Nonstop Computer Shop. Their statement of financial positions as of December 31, 2014 are provided. The partners agreed to several adjustments including estimating the realizability of accounts receivable, decreasing Maramba's inventory, adjusting the fair value of land, and transferring other assets and liabilities at net book value. Required is to prepare the adjusting and closing entries for each proprietor and the partnership.

Original Description:

Original Title

PF-P3P4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTwo sole proprietors, B. Maramba and S. Zaragosa, formed a partnership called Nonstop Computer Shop. Their statement of financial positions as of December 31, 2014 are provided. The partners agreed to several adjustments including estimating the realizability of accounts receivable, decreasing Maramba's inventory, adjusting the fair value of land, and transferring other assets and liabilities at net book value. Required is to prepare the adjusting and closing entries for each proprietor and the partnership.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

52 views2 pagesPROBLEM 3: Two Sole Proprietors Form A Partnership

Uploaded by

Yesha SibayanTwo sole proprietors, B. Maramba and S. Zaragosa, formed a partnership called Nonstop Computer Shop. Their statement of financial positions as of December 31, 2014 are provided. The partners agreed to several adjustments including estimating the realizability of accounts receivable, decreasing Maramba's inventory, adjusting the fair value of land, and transferring other assets and liabilities at net book value. Required is to prepare the adjusting and closing entries for each proprietor and the partnership.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

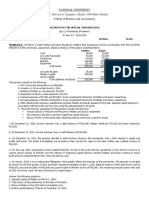

PROBLEM 3: Two Sole Proprietors form a partnership.

On January 1, 2015, B. Maramba and S. Zaragosa agreed to combine their proprietorships as

a partnership. The partnership would be called Nonstop Computer Shop. Their statement of

financial position as at December 31, 2014 is as follows:

B. S. Zaragosa

Maramba

Cash P 15,000 P 130,000

Accounts Receivable 80,000 150,000

Inventories 200,000 235,000

Prepaid Rent - 5,000

Land 180,000 -

Building 250,000 -

Accumulated Depreciation (75,000) -

Computer Equipment 450,000 600,000

Accumulated Depreciation (270,000) (360,000)

Total Assets P 830,000 P 760,000

Accounts Payable P 150,000 P 60,000

Mortgage Payable 75,000 -

B. Maramba, Capital 605,000 -

S. Zaragosa, Capital - 700,000

Total Liabilities & Partner’s Capital P 830,000 P 760,000

The partners have agreed to affect the following adjustments:

a. Accounts receivable of B. Maramba is estimated to be 90% realizable.

b. Accounts receivable of S. Zaragosa is estimated to be 80% realizable.

c. Inventory of B. Maramba is to be decreased by P 15,000.

d. Land has a fair value of P 185,000.

e. All the other assets and liabilities are to be transferred at their net book values.

Required:

1. Prepare the journal entries in the Books of B. Maramba and S. Zaragosa. (Adjusting Entries &

Closing Entries)

2. Prepare the journal entries in the Books of Partnership (To record the investment)

3. Prepare the partnership’s statement of financial position as at the date of formation of the

partnership.

PROBLEM 4

As of November 10, 2014, M. Melendez and J. Valdez decided to form a partnership. Their balance

sheets on this date are:

M. Melendez J. Valdez

Cash P15,000 P37,500

Accounts Receivable 540,000 225,000

Merchandise Inventory - 202,500

Machinery and Equipment 150,000 270,000

Total P705,00 P735,000

0

Accounts Payable P135,00 P240,000

0

M. Melendez, Capital 570,000 -

J. Valdez, Capital - 495,000

Total P705,00 P735,000

0

The partners agreed that the machinery and equipment of M. Melendez is under depreciated by P

15,000 and that of J. Valdez by P 45,000. Allowance for doubtful accounts is to be set up amounting

to P 120,000 for M. Melendez and P 45,000 for J. Valdez.

Instructions:

1. Give the adjusting entries to adjust the accounts of M. Melendez and J. Valdez.

2. Compute for the net investment of each partner to the partnership.

3. Prepare a compound entry to record their investments to the new partnership books.

4. Prepare the statement of financial position of MV partnership after the formation.

You might also like

- Partnership & Business CombinationDocument32 pagesPartnership & Business CombinationJason Bautista100% (1)

- ReSA B45 AFAR First PB Exam - Questions, Answers - SolutionsDocument23 pagesReSA B45 AFAR First PB Exam - Questions, Answers - SolutionsDhainne Enriquez100% (1)

- Partnership Formation 001Document20 pagesPartnership Formation 001Ma Teresa B. Cerezo50% (2)

- UAE New ListDocument18 pagesUAE New ListForline Fernando100% (1)

- QUIZ 1 - Preparation of Financial StatementsDocument3 pagesQUIZ 1 - Preparation of Financial StatementsDorothy Romagos100% (7)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Partnership THEORIES AND PROBLEMSDocument5 pagesPartnership THEORIES AND PROBLEMSMa Teresa B. CerezoNo ratings yet

- Problems Chapter 1-5Document19 pagesProblems Chapter 1-5u got no jams100% (1)

- The Wealth of NationsDocument786 pagesThe Wealth of Nationsleosilveira100% (1)

- Problems Chapter 7-1: RequiredDocument16 pagesProblems Chapter 7-1: RequiredTanyelle Louv0% (1)

- Aquatic Recreational ActivitiesDocument25 pagesAquatic Recreational ActivitiesYesha Sibayan100% (1)

- MATH11 ADM Org Man Q2 Module16 The Basic Concept of Small Family BusinessDocument16 pagesMATH11 ADM Org Man Q2 Module16 The Basic Concept of Small Family BusinessMark James Rico50% (2)

- ILLUSTRATIVE PROBLEMS - Formation of A PartnershipDocument7 pagesILLUSTRATIVE PROBLEMS - Formation of A PartnershipKathleen MangualNo ratings yet

- The Professional CPA Review SchoolDocument24 pagesThe Professional CPA Review SchoolKYLE LEIGHZANDER VICENTENo ratings yet

- Partnership FormationDocument51 pagesPartnership FormationGarp BarrocaNo ratings yet

- Partnership Formation, Operation, Dissolution, and Liquidation by Lump Sum OnlyDocument11 pagesPartnership Formation, Operation, Dissolution, and Liquidation by Lump Sum OnlyJoyce Ann Cortez100% (2)

- Kotaka Form16 41970Document4 pagesKotaka Form16 41970sai_gsrajuNo ratings yet

- A Study and Analysis On The Usage of Digital PaymentDocument92 pagesA Study and Analysis On The Usage of Digital PaymentRiya LokhandeNo ratings yet

- Partnership Formation ExercisesDocument8 pagesPartnership Formation ExercisesMarjorie NepomucenoNo ratings yet

- Uniqlo: A Supply Chain Going Global Case Analysis: Dr. Diane Badame Fall 2019Document14 pagesUniqlo: A Supply Chain Going Global Case Analysis: Dr. Diane Badame Fall 2019Pandu Zea ArdiansyahNo ratings yet

- Acctg13exercise3 FinalDocument10 pagesAcctg13exercise3 FinalGarp Barroca100% (1)

- Carbon TaxDocument24 pagesCarbon Taxasofos100% (1)

- ACCTSPTRANS All About PartnershipDocument7 pagesACCTSPTRANS All About PartnershipShailene David0% (1)

- BSA 1 13 Group 4 - Exercises 6 1 and 6 2Document10 pagesBSA 1 13 Group 4 - Exercises 6 1 and 6 2vomawew647No ratings yet

- Partnership - FormationDocument5 pagesPartnership - FormationJay Mayca TyNo ratings yet

- Sample P-FDocument3 pagesSample P-FMYDMIOSYL ALABENo ratings yet

- Practical Accounti ng2: Jonathan M. Tipay, CpaDocument10 pagesPractical Accounti ng2: Jonathan M. Tipay, CpaCristine Joy FerrerNo ratings yet

- Topic 10 - Practice ProblemsDocument2 pagesTopic 10 - Practice ProblemsAnna Mariyaahh DeblosanNo ratings yet

- Journal, T Accounts, TrialDocument14 pagesJournal, T Accounts, TrialJasmine ActaNo ratings yet

- Activity 1 PartnershipDocument4 pagesActivity 1 PartnershipJanet AnotdeNo ratings yet

- Assignment July 2022Document6 pagesAssignment July 2022Dusabamahoro JoniveNo ratings yet

- Corporate Liquidation & Joint Venture2Document5 pagesCorporate Liquidation & Joint Venture2jjjjjjjjjjjjjjjNo ratings yet

- Sample Problems Part FormDocument4 pagesSample Problems Part FormkenivanabejuelaNo ratings yet

- Unit II CFS Subsequent To Date of AcquisitionDocument10 pagesUnit II CFS Subsequent To Date of AcquisitionDaisy TañoteNo ratings yet

- Kesmore CorporationDocument1 pageKesmore CorporationAyeshaNo ratings yet

- AFAR - Quiz PrelimDocument1 pageAFAR - Quiz PrelimLugh Tuatha DeNo ratings yet

- Unit 1 ActvitiesDocument6 pagesUnit 1 ActvitiesLeslie Mae Vargas ZafeNo ratings yet

- IllustrationsDocument5 pagesIllustrationsabbeangedesireNo ratings yet

- Group 6 Partnership Formation PDFDocument6 pagesGroup 6 Partnership Formation PDFRhystle Ann BalcitaNo ratings yet

- Partnership-Formation HandoutDocument1 pagePartnership-Formation HandoutKarl SolomeroNo ratings yet

- Accounting QuizDocument5 pagesAccounting QuizLloyd Lameon0% (1)

- Illustrative Problem 4-2Document5 pagesIllustrative Problem 4-2Nicole Anne Santiago SibuloNo ratings yet

- Answer Key Activity 39Document15 pagesAnswer Key Activity 39MAXINE CLAIRE CUTINGNo ratings yet

- Practical Accounting P-2Document7 pagesPractical Accounting P-2KingChryshAnneNo ratings yet

- Problem No 5 (Acctg. 1)Document5 pagesProblem No 5 (Acctg. 1)Ash imoNo ratings yet

- P2 01v2Document11 pagesP2 01v2Rhegee Irene RosarioNo ratings yet

- Amalgamation - Example 1 To 4Document4 pagesAmalgamation - Example 1 To 4Zhong HanNo ratings yet

- Journalizing Business Transactions-EspinaDocument3 pagesJournalizing Business Transactions-EspinaVanessa FajardoNo ratings yet

- MCQ PartnershipDocument24 pagesMCQ Partnershiplou-924No ratings yet

- Chapter 1 AccDocument11 pagesChapter 1 AccHussein BaidounNo ratings yet

- Multiple Choice ProblemsDocument5 pagesMultiple Choice ProblemsHannahbea LindoNo ratings yet

- Partnership and Corporation Accounting Chapter 2 - Partnership Operations and Financial ReportingDocument13 pagesPartnership and Corporation Accounting Chapter 2 - Partnership Operations and Financial ReportingSylvannas WindrunnerNo ratings yet

- Reviewer On Partnership Problems - Q2 PDFDocument3 pagesReviewer On Partnership Problems - Q2 PDFAdrian Montemayor33% (3)

- Implied Value Implied Value BV Equity BV EquityDocument12 pagesImplied Value Implied Value BV Equity BV Equitysean franciscusNo ratings yet

- Parcoac C1 - Formation ProbsDocument8 pagesParcoac C1 - Formation Probskris salacNo ratings yet

- Partnership Formation-2 ActivitesDocument14 pagesPartnership Formation-2 ActivitesJasmine ActaNo ratings yet

- Afar Assign 1Document8 pagesAfar Assign 1버니 모지코No ratings yet

- Partnership: Q#1. Record The Following in The Necessary Journals and Show The Relevant ProprietorshipDocument7 pagesPartnership: Q#1. Record The Following in The Necessary Journals and Show The Relevant ProprietorshipUnais AhmedNo ratings yet

- Solution Formation and OperationDocument7 pagesSolution Formation and OperationShampaigne Mheg PadaoNo ratings yet

- Tabular AnalysisDocument5 pagesTabular AnalysisjamesmakarioslabruscaNo ratings yet

- Partnership RequirementDocument6 pagesPartnership RequirementAlyssa Marie Miguel100% (1)

- Test Bank Paccounting Information Systems Test Bank Paccounting Information SystemsDocument23 pagesTest Bank Paccounting Information Systems Test Bank Paccounting Information SystemsFrylle Kanz Harani PocsonNo ratings yet

- Accounting Equation ch5Document19 pagesAccounting Equation ch5Ebony Ann delos SantosNo ratings yet

- Accounting Equation ch4Document13 pagesAccounting Equation ch4Ebony Ann delos SantosNo ratings yet

- Sample Practice Exam 29 March 2019 Answers - CompressDocument7 pagesSample Practice Exam 29 March 2019 Answers - CompressShevina Maghari shsnohsNo ratings yet

- Partnership Problems Partnership Problems: Accountancy (La Consolacion College) Accountancy (La Consolacion College)Document35 pagesPartnership Problems Partnership Problems: Accountancy (La Consolacion College) Accountancy (La Consolacion College)Jay Ann DomeNo ratings yet

- PArtnership FormationDocument6 pagesPArtnership FormationJasmine ActaNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Chapter 6Document14 pagesChapter 6Yesha SibayanNo ratings yet

- Global Governance in The Twenty First CenturyDocument3 pagesGlobal Governance in The Twenty First CenturyYesha SibayanNo ratings yet

- TCW-Global Governanceppt3Document7 pagesTCW-Global Governanceppt3Yesha SibayanNo ratings yet

- Business Tax Chap 1Document10 pagesBusiness Tax Chap 1Yesha SibayanNo ratings yet

- Chapter 4 - RoblesDocument18 pagesChapter 4 - RoblesYesha SibayanNo ratings yet

- Vertical Analysis Base Denominator Company ADocument6 pagesVertical Analysis Base Denominator Company AYesha SibayanNo ratings yet

- GE.12 Virtue EthicsDocument21 pagesGE.12 Virtue EthicsYesha SibayanNo ratings yet

- Accounting (Partnership Prob.)Document9 pagesAccounting (Partnership Prob.)Yesha SibayanNo ratings yet

- ACC104 - Job Order Costing - For PostingDocument22 pagesACC104 - Job Order Costing - For PostingYesha SibayanNo ratings yet

- THE Evolution of Media: The MC Luhan MantraDocument24 pagesTHE Evolution of Media: The MC Luhan MantraYesha SibayanNo ratings yet

- Poetry and SymbolismDocument42 pagesPoetry and SymbolismYesha SibayanNo ratings yet

- Elasticities of Demand and SupplyDocument11 pagesElasticities of Demand and SupplyYesha SibayanNo ratings yet

- Master Thesis Examples FinanceDocument4 pagesMaster Thesis Examples Financenikkismithmilwaukee100% (2)

- BPS 3203 Transport Planning and Policy CourseoutlineDocument2 pagesBPS 3203 Transport Planning and Policy CourseoutlineArnold MainaNo ratings yet

- Skripsi Tanpa Bab PembahasanDocument82 pagesSkripsi Tanpa Bab PembahasanMichael WiloNo ratings yet

- Gains and Losses On Futures ContractsDocument3 pagesGains and Losses On Futures Contractshkm_gmat4849No ratings yet

- Starbucks BankoneDocument7 pagesStarbucks BankoneDharun BlazerNo ratings yet

- 4 5931462806300787575Document16 pages4 5931462806300787575Waad MajidNo ratings yet

- Industrial Management ModelDocument2 pagesIndustrial Management Modelrajendrakumar100% (1)

- Rana Khalid CV 2020-Converted - 3Document2 pagesRana Khalid CV 2020-Converted - 3Rana FaizanNo ratings yet

- Student List RSDocument6 pagesStudent List RSIfa ChanNo ratings yet

- Chapter 06 Audit ArensDocument34 pagesChapter 06 Audit ArensRahman AnshariNo ratings yet

- Industrial Development Report 2002-2003Document203 pagesIndustrial Development Report 2002-2003umer shafiqueNo ratings yet

- World Trade Organization: Kushal KatariaDocument12 pagesWorld Trade Organization: Kushal KatariaSurbhi JainNo ratings yet

- Audit Chap 1Document18 pagesAudit Chap 1AR Ananth Rohith BhatNo ratings yet

- Accounting Research EssayDocument4 pagesAccounting Research EssayInsatiable LifeNo ratings yet

- Recommended Approach To CFAP 3Document1 pageRecommended Approach To CFAP 3Mateen AhmedNo ratings yet

- SumanDocument3 pagesSumanDibya Kumari RaiNo ratings yet

- Marketing Warfare StrategyDocument16 pagesMarketing Warfare StrategyAneeie100% (3)

- NPC International, Inc. Research AnlysisDocument7 pagesNPC International, Inc. Research Anlysisacademicwriter peterNo ratings yet

- Lukas Mazal ThesisDocument33 pagesLukas Mazal ThesisAkshay RawatNo ratings yet

- Project BS ItemsDocument25 pagesProject BS ItemsSumeet BhatereNo ratings yet

- Labor Standards CasesDocument6 pagesLabor Standards CasesJuan Luis LusongNo ratings yet

- Ch03 Intermediate Accounting Ifrs Edition Vol 1 The Accpunting Information SystemDocument107 pagesCh03 Intermediate Accounting Ifrs Edition Vol 1 The Accpunting Information SystemoniNo ratings yet

- Operations Management: An Integrated ApproachDocument11 pagesOperations Management: An Integrated Approachsam heisenbergNo ratings yet