Professional Documents

Culture Documents

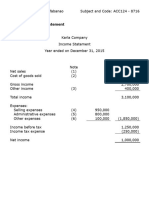

Practice Exercise 4-1. COMPLETING THE ACCOUNTING CYCLE

Uploaded by

Nichole Joy XielSera Tan0 ratings0% found this document useful (0 votes)

23 views2 pagesJupiter's Store's account balances on December 31 are provided, including cash, inventory, various expenses, assets and liabilities. Adjustments are also given, such as updated inventory amounts, expired insurance amounts, depreciation, and salaries payable. The document provides the starting financial information and adjustments needed to complete the accounting cycle for Jupiter's Store on December 31.

Original Description:

Original Title

Practice Exercise 4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJupiter's Store's account balances on December 31 are provided, including cash, inventory, various expenses, assets and liabilities. Adjustments are also given, such as updated inventory amounts, expired insurance amounts, depreciation, and salaries payable. The document provides the starting financial information and adjustments needed to complete the accounting cycle for Jupiter's Store on December 31.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views2 pagesPractice Exercise 4-1. COMPLETING THE ACCOUNTING CYCLE

Uploaded by

Nichole Joy XielSera TanJupiter's Store's account balances on December 31 are provided, including cash, inventory, various expenses, assets and liabilities. Adjustments are also given, such as updated inventory amounts, expired insurance amounts, depreciation, and salaries payable. The document provides the starting financial information and adjustments needed to complete the accounting cycle for Jupiter's Store on December 31.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Practice Exercise 4-1.

COMPLETING THE ACCOUNTING CYCLE

The account balances in the ledger of Jupiter's Store on December 31 of the current year

are as follows:

Cash P 34,150 Sales 577,800

Accounts Receivable 62,750 Sales returns and allowances 3,300

Merchandise inventory 81,700 Purchases 379,650

Prepaid insurance 7,125 Purchase discount 4,930

Store supplies 895 Sales salaries expense 61,150

Office supplies 575 Advertising expense 16,400

Store equipment 52,500 Misc. selling expense 1,960

Accum. Dep'n - Store equipt 17,200 Office salaries expense 31,500

Office equipment 18,300 Rent expense – selling 16,000

Accum. Dep'n – Office equipt 7,800 Rent expense – general 8,000

Accounts payable 41,650 Misc. general expense 1,440

Note Payable (due in 5 years) 25,000 Gain on sale of equipment 800

J. Perez, Capital 124,215 Interest expense 2,000

J. Perez, Drawing 20,000

The data for adjustments on December 31 are as follows:

a. Merchandise inventory on December 31 - P89, 200

b. Insurance expired during the year: Allocable as selling expense - P2, 550; Allocable as general expense - P715

c. Inventory of supplies on December 31: Office supplies - P295; Store supplies - P235

d. Depreciation for the current year: Store equipment - P4, 050; Office equipment - P 1,240

e. Bad debts is estimated at P2, 750

f. Salaries payable on December 31 - Sales salaries P1, 525; Office salaries P1, 200

You might also like

- Shareholders' EquityDocument39 pagesShareholders' EquityNichole Joy XielSera TanNo ratings yet

- Income Statement MerchandisingDocument1 pageIncome Statement MerchandisingPatrick Romero100% (1)

- Auditing Problems3Document32 pagesAuditing Problems3Kimberly Milante100% (2)

- Questionnaires BSA SubjectsDocument27 pagesQuestionnaires BSA SubjectsJamila Mae FabiaNo ratings yet

- Loan Agreement (3743902)Document5 pagesLoan Agreement (3743902)Nichole Joy XielSera TanNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Merchandising and ManufacturingDocument3 pagesMerchandising and ManufacturingCELINE ANNE CAPANGYARIHANNo ratings yet

- DocumentDocument4 pagesDocumentJuliana ZamorasNo ratings yet

- Home Office QuestionsDocument10 pagesHome Office QuestionsLara FloresNo ratings yet

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDocument9 pagesEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanNo ratings yet

- Problem 1 - The Accounts and Their Balances in The Ledger of Generic Pharma On December 31Document2 pagesProblem 1 - The Accounts and Their Balances in The Ledger of Generic Pharma On December 31Pepegon SalinasNo ratings yet

- Merchandising Lecture MRFDDocument59 pagesMerchandising Lecture MRFDMaria Louella MagadaNo ratings yet

- RIO FLORENDO - YOUR HARDWARE PROBLEM - Jenny Boo, 12 Dwigh MoodyDocument2 pagesRIO FLORENDO - YOUR HARDWARE PROBLEM - Jenny Boo, 12 Dwigh MoodyJenny BooNo ratings yet

- Chapter 6 - MerchandisingDocument44 pagesChapter 6 - MerchandisingMaria FransiscaNo ratings yet

- HomeworkDocument16 pagesHomeworkZaida RectoNo ratings yet

- 08.12.2017 Activity - Acfunda LabDocument2 pages08.12.2017 Activity - Acfunda LabPatOcampoNo ratings yet

- Akuntansi ManufakturDocument7 pagesAkuntansi ManufakturZEN AMALIANo ratings yet

- FDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFDocument5 pagesFDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFJames de LeonNo ratings yet

- Problem NoDocument6 pagesProblem NoJayvee BalinoNo ratings yet

- AGONCILLO LORIELYN HomeOfficeQuestionsDocument13 pagesAGONCILLO LORIELYN HomeOfficeQuestionsLara FloresNo ratings yet

- ActivityDocument5 pagesActivityNicole CalmaNo ratings yet

- Worksheet On Accounting For Merchandising OperationDocument11 pagesWorksheet On Accounting For Merchandising Operationbereket nigussieNo ratings yet

- MerchandisingDocument14 pagesMerchandisingMARY ANN PALAPANNo ratings yet

- Clairemont Co Tarea #2Document3 pagesClairemont Co Tarea #2carlos huertasNo ratings yet

- Add'l Exercises For Merchandising - Jenny Boo, 12 Dwight MoodyDocument6 pagesAdd'l Exercises For Merchandising - Jenny Boo, 12 Dwight MoodyJenny BooNo ratings yet

- B. It May Be Used To Estimate Inventories For Annual StatementsDocument2 pagesB. It May Be Used To Estimate Inventories For Annual StatementsGray JavierNo ratings yet

- ACC124 Part2Document6 pagesACC124 Part2Christine LigutomNo ratings yet

- Exam in FundamentalsDocument3 pagesExam in FundamentalsFranchesca CortezNo ratings yet

- The Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Document3 pagesThe Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Tahani Awar Gurar0% (1)

- Grace Fidelia - AKD (Pertemuan 10)Document6 pagesGrace Fidelia - AKD (Pertemuan 10)Grace FideliaNo ratings yet

- Home Office and Branch Accounting ProblemsDocument3 pagesHome Office and Branch Accounting ProblemsJerah TorrejosNo ratings yet

- PDF Ap Problems 2016Document29 pagesPDF Ap Problems 2016Raca DesuNo ratings yet

- A. Adjusting Entries Description Debit CreditDocument4 pagesA. Adjusting Entries Description Debit CreditRocel Avery SacroNo ratings yet

- Projecct Accounting 2Document3 pagesProjecct Accounting 2Russell Von DomingoNo ratings yet

- SCI WeiLong TradingDocument4 pagesSCI WeiLong TradingJoyce CalmaNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Abigail Santos Boutique, FS ProblemDocument3 pagesAbigail Santos Boutique, FS ProblemFeiya LiuNo ratings yet

- Income Statement and OCI - Exercises - AnswerDocument3 pagesIncome Statement and OCI - Exercises - AnswerYstefani ValderamaNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsFelsie Jane PenasoNo ratings yet

- Simple Company-WPS OfficeDocument3 pagesSimple Company-WPS OfficeAngeline BautistaNo ratings yet

- Ap.m-1401-Correction of ErrorsDocument12 pagesAp.m-1401-Correction of Errorsjulie anne mae mendozaNo ratings yet

- DocumentDocument4 pagesDocumentJuliana ZamorasNo ratings yet

- Tugas Mike P5-3ADocument6 pagesTugas Mike P5-3Awinda dwi lestariNo ratings yet

- Year 1Document20 pagesYear 1lov3m3No ratings yet

- Solano Ruth Home Office SeatworkDocument11 pagesSolano Ruth Home Office SeatworkLara FloresNo ratings yet

- I. Adjustments Ii. WorksheetDocument11 pagesI. Adjustments Ii. WorksheetDarwyn MendozaNo ratings yet

- Problem 1 (Branch Was Billed at Cost)Document16 pagesProblem 1 (Branch Was Billed at Cost)James AguilarNo ratings yet

- AE212 EXERCISE 2-5,6, and 7Document7 pagesAE212 EXERCISE 2-5,6, and 7Nhel AlvaroNo ratings yet

- NlktaDocument9 pagesNlktaYến Hoàng HảiNo ratings yet

- HOBA Special ProbDocument14 pagesHOBA Special ProbRujean Salar AltejarNo ratings yet

- Financial StatementDocument48 pagesFinancial StatementShakir IsmailNo ratings yet

- Week 11 Sole Trader AccountsDocument24 pagesWeek 11 Sole Trader AccountsGaba RieleNo ratings yet

- ACC124 - Assignment On Income StatementDocument6 pagesACC124 - Assignment On Income StatementRuzuiNo ratings yet

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- Merchant Center Income Statement For The Year Ended, DECEMBER 31, 2018Document7 pagesMerchant Center Income Statement For The Year Ended, DECEMBER 31, 2018Melissa RaboNo ratings yet

- Output No. 2Document6 pagesOutput No. 2KRISTINE RIO BACSALNo ratings yet

- GW Ba2Document9 pagesGW Ba2Marjorie Kate PagaoaNo ratings yet

- Quiz 3 Cost AccountingDocument2 pagesQuiz 3 Cost AccountingRocel DomingoNo ratings yet

- Accounting RatiosDocument30 pagesAccounting RatiosPetrinaNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Partnership Formation Answer KeyDocument8 pagesPartnership Formation Answer KeyNichole Joy XielSera TanNo ratings yet

- MODULE 1a - Partnership Nature and FormationDocument31 pagesMODULE 1a - Partnership Nature and FormationNichole Joy XielSera TanNo ratings yet

- Accounting For Labor ExercisesDocument6 pagesAccounting For Labor ExercisesNichole Joy XielSera TanNo ratings yet

- POM Module3 Unit2Document4 pagesPOM Module3 Unit2Nichole Joy XielSera TanNo ratings yet

- AE 112-CMPC 131 - Module 1B: Partnership Operations)Document30 pagesAE 112-CMPC 131 - Module 1B: Partnership Operations)Nichole Joy XielSera TanNo ratings yet

- Sales Agency and Credit TransactionsDocument41 pagesSales Agency and Credit TransactionsNichole Joy XielSera TanNo ratings yet

- CMPC AnswerDocument6 pagesCMPC AnswerNichole Joy XielSera TanNo ratings yet

- Preliminary Report 8Q-MBCDocument21 pagesPreliminary Report 8Q-MBCNichole Joy XielSera TanNo ratings yet

- Chapter 5 Contract With Customers-Franchise and ConsignmentDocument34 pagesChapter 5 Contract With Customers-Franchise and ConsignmentNichole Joy XielSera TanNo ratings yet

- POM Module3 Unit3Document10 pagesPOM Module3 Unit3Nichole Joy XielSera TanNo ratings yet

- 4th QTR Week 6 (Risk Return Trade-Off)Document40 pages4th QTR Week 6 (Risk Return Trade-Off)Nichole Joy XielSera TanNo ratings yet

- Vintage Moodboard SlidesDocument24 pagesVintage Moodboard SlidesNichole Joy XielSera TanNo ratings yet

- 4th QTR Week 4-5 - Time Value Money (Part 1)Document47 pages4th QTR Week 4-5 - Time Value Money (Part 1)Nichole Joy XielSera TanNo ratings yet

- (BusFin1) Week 1-2Document31 pages(BusFin1) Week 1-2Nichole Joy XielSera TanNo ratings yet