Professional Documents

Culture Documents

Stamp Duty On Arbitration Award

Uploaded by

ranjanjhallbOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stamp Duty On Arbitration Award

Uploaded by

ranjanjhallbCopyright:

Available Formats

$~

* IN THE HIGH COURT OF DELHI AT NEW DELHI

Date of Decision:- 08.11.2021

+ W.P.(C) 886/2021

M/S. INDSAO CONSTRUCTION PVT. LTD. ..... Petitioner

Through Mr. Prashant Kumar Mittal, Adv.

versus

THE COLLECTOR OF STAMP/ SUB-DIVISIONAL

MAGISTRATE ..... Respondent

Through Mr. Anuj Aggarwal, ASC with Mr.

Vikrant Chawla, Ms. Ayushi Bansal

and Mr. Vishesh Jagga, Advs.

CORAM:

HON'BLE MS. JUSTICE REKHA PALLI

REKHA PALLI, J (ORAL)

1. Even though, despite opportunity, no counter affidavit has been filed;

the matter is taken up for disposal with the consent of the parties.

2. The brief facts, leading to the filing of the present petition, are that an

Arbitral Award, pertaining to a dispute between the petitioner company and

M/s Baroda House NRGE CGHS, came to be passed on 11.10.2013. The

Award was made on a non-judicial stamp paper of Rs.1,000/- with directions

to the petitioner to have the amount of stamp duty payable thereon

adjudicated by the Collector of Stamps.

3. Consequently, on 07.11.2013, the petitioner filed an application

before the respondent/Sub Divisional Magistrate, Dwarka for adjudication of

stamp duty on the Arbitral Award. The said application came to decided

Signature Not Verified

DigitallySigned By:AWANISH W.P.(C) 886/2021 Page 1 of 5

CHANDRA MISHRA

Signing Date:09.11.2021

12:22:39

vide the impugned order on 03.01.2020, whereunder the respondent has held

that the petitioner was liable to pay stamp duty @ 2% on the awarded

amount. While passing the impugned order, the respondent has placed

reliance on a decision dated 03.02.2010 of a Co-ordinate Bench in OMP No.

78/2003 titled “Eider Pwi Paging Limited & Eider Pwi Communications

Ltd. v. Union of India”.

4. In support of the petition, Mr. Mittal, learned counsel for the

petitioner submits that the impugned order is wholly perverse as while

determining the payable stamp duty, the respondent has erroneously applied

the provisions of Clause (a) of Article 12 of Schedule-1A, as amended vide

the Indian Stamp (Delhi Amendment) Act, 2001 to the petitioner’s case as

against Clause (b) under which the petitioner’s case was covered. The

Award in question is, admittedly, for an amount more than Rs.1,000/- and

therefore, the respondent has erred in applying Clause (a) of Article 12,

without appreciating the fact that Clause (a) would be only applicable in a

case where the amount under the Award does not exceed Rs.1,000/-. He,

therefore, contends that the petitioner was liable to pay the stamp duty only

@0.1% in terms of Clause (b) of Article 12 of Schedule-1A of the Act.

5. Learned counsel for the respondent is not in a position to dispute

either the fact that the Award is for a value of more than Rs.1,000/- or that

Clause (b) of Article 12 is applicable to such cases where the Award is for a

sum exceeding Rs.1,000/-.

6. Even though, learned counsel for the respondent has not disputed the

petitioner’s plea that Clause (b) of Article 12 would be applicable to the

present case, for the sake of clarity, the said provision is reproduced

hereinbelow:

Signature Not Verified

DigitallySigned By:AWANISH W.P.(C) 886/2021 Page 2 of 5

CHANDRA MISHRA

Signing Date:09.11.2021

12:22:39

Sch./ Description of Instrument Proper Stamp Duty

Art.

12. Award, that is to say any decision in

writing by an arbitrator or umpire, not

being an award directing a partition on a

reference made otherwise than by an

order of this Court in the course of a suit,

--

(a) Where the amount or value of the The same duty as a Bond

property to which the award relates (No.15) for such amount.

are set forth in such award does not

exceed Rs.1,000.

(b) If it exceeds Rs.1,000 but does not One rupee for every one

exceed Rs.5,000 thousand of the value of

and for every additional Rs.1,000 or the property to which the

part thereof in excess of Rs.5,000. award relates.

7. From a perusal of the aforesaid provision, there can really be no

dispute to the fact that as per Article 12 of Schedule-1A, as amended vide

the Indian Stamp (Delhi Amendment) Act, 2001 w.e.f. 28.03.2001, when an

Arbitral Award exceeds the value of Rs.1,000/-, the stamp duty on the

Award is payable only in terms of Clause (b) thereof; and Clause (a) would

be applicable only when the Award does not exceed the value of Rs.1,000/-.

8. Moreover, the reliance placed by the respondent on a decision of the

Co-ordinate Bench in OMP No. 78/2003 titled “Eider Pwi Paging Limited

& Eider Pwi Communications Ltd. v. Union of India” is also wholly

misplaced. It appears that the said decision has been applied mechanically,

without even appreciating the fact that the issue raised in the said decision

was not regarding as to which Clause of Article 12 would be applicable in a

case where the Award is of a value of more than Rs.1,000/-.

Signature Not Verified

DigitallySigned By:AWANISH W.P.(C) 886/2021 Page 3 of 5

CHANDRA MISHRA

Signing Date:09.11.2021

12:22:39

9. At this stage, the petitioner also points out that the respondent has

erroneously determined the payable stamp duty by applying Clause (a) on

the basis of an internal circular issued by the Govt. of India, NCT of Delhi,

directing all SDMs to calculate the stamp duty payable on Arbitral Awards

@ 2%. He submits that though a copy of the said circular is not available

with the petitioner, appropriate directions be issued to the respondent to

correctly apply Clause (b) of Article 12 in all such cases where the Award

exceeds the value of Rs.1,000/-.

10. I, therefore, have no hesitation in setting aside the impugned order

and accepting the petitioner’s plea that it was liable to pay stamp duty only

at @0.1% on the awarded amount, in accordance with Clause (b) of Article

12, Schedule 1-A.

11. The matter is, therefore, remanded back to the respondent for

determining the stamp duty in accordance with the observations made

hereinabove.

12. However, before concluding, this Court is constrained to express its

anguish in the lethargic manner in which the petitioner’s application has

been dealt with by the respondent. The record shows that application for

adjudication of stamp duty was preferred by the petitioner way back on

07.11.2013, to decide which, the respondent took more than six years vide

its impugned order, which too, as already held hereinabove, is contrary to

the plain language of Article 12 of Schedule 1-A itself. The respondent is,

therefore, directed to determine the stamp duty payable by the petitioner on

the Award dated 11.10.2013, within two weeks from the receipt of this

order.

13. A copy of this order be sent to the Chief Secretary, Govt. of NCT of

Signature Not Verified

DigitallySigned By:AWANISH W.P.(C) 886/2021 Page 4 of 5

CHANDRA MISHRA

Signing Date:09.11.2021

12:22:39

Delhi for information and appropriate action, so that other similarly placed

persons do not have to approach this Court on account of erroneous

determination of stamp duty.

(REKHA PALLI)

JUDGE

NOVEMBER 08, 2021

ms

Signature Not Verified

DigitallySigned By:AWANISH W.P.(C) 886/2021 Page 5 of 5

CHANDRA MISHRA

Signing Date:09.11.2021

12:22:39

You might also like

- Log/lumber Supply ContractDocument3 pagesLog/lumber Supply ContractLyn OlitaNo ratings yet

- In The High Court of Delhi at New Delhi: Signature Not Verified Signature Not VerifiedDocument22 pagesIn The High Court of Delhi at New Delhi: Signature Not Verified Signature Not VerifiedSinger Saksham SharmaNo ratings yet

- judgement2023-09-22Document18 pagesjudgement2023-09-22beingplatinum.legalNo ratings yet

- In The High Court of Delhi at New Delhi: Signature Not VerifiedDocument11 pagesIn The High Court of Delhi at New Delhi: Signature Not VerifiedPrasannanjaneyulu ChamartiNo ratings yet

- In The High Court of Delhi at New DelhiDocument5 pagesIn The High Court of Delhi at New DelhiRakeshNo ratings yet

- Stamp Paper Divorce Not Valid Case LawDocument3 pagesStamp Paper Divorce Not Valid Case LawswapnilanandkarNo ratings yet

- Microsoft Word - 04032020Document4 pagesMicrosoft Word - 04032020sandeepNo ratings yet

- High Court Order on Bank Loan RestructuringDocument3 pagesHigh Court Order on Bank Loan RestructuringNikhil DanakNo ratings yet

- 2021LHC7627Document7 pages2021LHC7627ranaallahditta7717No ratings yet

- GetFile DoDocument3 pagesGetFile DoAman DwivediNo ratings yet

- Signature Not Verified: Digitally Signed By:Amit Arora Signing Date:31.12.2021 16:39:29Document13 pagesSignature Not Verified: Digitally Signed By:Amit Arora Signing Date:31.12.2021 16:39:29Shivani ChoudharyNo ratings yet

- In The High Court of The United Republic of The Tanzania (Commercial Division) at Dar-Es-Salaam Misc. Commercial Cause No. 9 of 2022Document39 pagesIn The High Court of The United Republic of The Tanzania (Commercial Division) at Dar-Es-Salaam Misc. Commercial Cause No. 9 of 2022KELVIN A JOHNNo ratings yet

- Delhi HC Meena Saini LPADocument4 pagesDelhi HC Meena Saini LPANational HeraldNo ratings yet

- Buildmyinfra Private Limited Versus Gyan Prakash Mishra 428447Document8 pagesBuildmyinfra Private Limited Versus Gyan Prakash Mishra 428447Akash GulatiNo ratings yet

- Supreme Court Case LawsDocument6 pagesSupreme Court Case LawsVINAY MEKHANo ratings yet

- JudgementDocument6 pagesJudgementSATISH JOONNo ratings yet

- Suggested Solution For 2022 Leaked Civil Procedure 2Document21 pagesSuggested Solution For 2022 Leaked Civil Procedure 2Naomi Bley AlNo ratings yet

- Order 8 Rule 6a ApplicationDocument8 pagesOrder 8 Rule 6a ApplicationAshutosh Kumar SinghNo ratings yet

- DRT 501373Document26 pagesDRT 501373Prasad VaidyaNo ratings yet

- Appa432.14: Criminal Application (Appa) No.432/2014 IN CRIMINAL APPEAL NO.260/2017Document3 pagesAppa432.14: Criminal Application (Appa) No.432/2014 IN CRIMINAL APPEAL NO.260/2017Pramod PatilNo ratings yet

- Unibros+Vs.+All+India+Radio+-+19.10.2023+Supreme+CourtDocument17 pagesUnibros+Vs.+All+India+Radio+-+19.10.2023+Supreme+CourtAnshuman PandeyNo ratings yet

- KAMAL SIDHU Very ImpDocument6 pagesKAMAL SIDHU Very ImpRaj VardhanNo ratings yet

- judgement2023-10-31Document7 pagesjudgement2023-10-31beingplatinum.legalNo ratings yet

- Vib05122022faoc602021153450 448295Document13 pagesVib05122022faoc602021153450 448295Devanshu PareekNo ratings yet

- Execution Petition - Narasingh Rao Draft 2Document9 pagesExecution Petition - Narasingh Rao Draft 2Sharath KanzalNo ratings yet

- High Court Upholds Conviction in Bounced Check CaseDocument2 pagesHigh Court Upholds Conviction in Bounced Check CaseBANDI VARAPRASADARAONo ratings yet

- 2021 12 1505 33976 Judgement 10-Mar-2022Document34 pages2021 12 1505 33976 Judgement 10-Mar-2022SulaimanNo ratings yet

- This Suit For Money Recovery Was ... Vs Auto Pick Up Products Passed in Rfa ... On 27 September, 2019Document28 pagesThis Suit For Money Recovery Was ... Vs Auto Pick Up Products Passed in Rfa ... On 27 September, 2019Varun RameshNo ratings yet

- Banks - V - CadwalladrDocument4 pagesBanks - V - CadwalladrCallum JonesNo ratings yet

- 2022 Tzhccomd 168Document6 pages2022 Tzhccomd 168HASHIRU MDOTANo ratings yet

- Bharti Airtel LTD. Vs Jamshed KhanDocument22 pagesBharti Airtel LTD. Vs Jamshed KhanRiishabh GaurNo ratings yet

- Valid Tender of Payment Extinguishes Obligation Despite RefusalDocument3 pagesValid Tender of Payment Extinguishes Obligation Despite RefusalLiaa AquinoNo ratings yet

- High Court Reviews Lack of Personal Hearing in Income Tax AssessmentDocument7 pagesHigh Court Reviews Lack of Personal Hearing in Income Tax Assessmentvenugopal murthyNo ratings yet

- Para 51Document27 pagesPara 5118123 ASHISH SHARMANo ratings yet

- Digitally Signed By:Dushyant Rawal: O.M.P. (T) (COMM.) 16/2021 Page 1 of 18Document18 pagesDigitally Signed By:Dushyant Rawal: O.M.P. (T) (COMM.) 16/2021 Page 1 of 18HASIT SETHNo ratings yet

- 100% Award AmountDocument8 pages100% Award AmountDhruv TiwariNo ratings yet

- Venue of arbitration if MSME nd arbitration clause contradictsDocument22 pagesVenue of arbitration if MSME nd arbitration clause contradictsVibhor BhatiaNo ratings yet

- Order: Signature Not VerifiedDocument3 pagesOrder: Signature Not Verifiedprakashgiri2009No ratings yet

- ADGMCFI-2023-071 - Costs Judgment of Justice Stone SBS KC 12122023 SEALEDDocument6 pagesADGMCFI-2023-071 - Costs Judgment of Justice Stone SBS KC 12122023 SEALEDabdeali hazariNo ratings yet

- Asian Construction & Dev. Corp. vs. SannaedleDocument2 pagesAsian Construction & Dev. Corp. vs. SannaedleRussellNo ratings yet

- CT Cases 5332/2020 Yogender Panwar vs. Ram Kishore: NoonDocument6 pagesCT Cases 5332/2020 Yogender Panwar vs. Ram Kishore: Noonroopsi ratheeNo ratings yet

- Full Judgement of BSNL Vs NortelDocument27 pagesFull Judgement of BSNL Vs NortelSidhant WadhawanNo ratings yet

- Application For Condonation of Delay in Filing AppealDocument6 pagesApplication For Condonation of Delay in Filing AppealkomalNo ratings yet

- Delhi HC Mohini Marwaha LPADocument5 pagesDelhi HC Mohini Marwaha LPANational HeraldNo ratings yet

- 138 Valid Legal Notice Rahul Builders SC 2007Document4 pages138 Valid Legal Notice Rahul Builders SC 2007roopsi ratheeNo ratings yet

- 169624-2014-Asian Construction and Development Corp. V.Document6 pages169624-2014-Asian Construction and Development Corp. V.Nichole Patricia PedriñaNo ratings yet

- Judgment: T.S. Thakur, JDocument32 pagesJudgment: T.S. Thakur, JrameshbajiyaNo ratings yet

- Yva30112023fac3152019 141644Document25 pagesYva30112023fac3152019 141644Ausaf AyyubNo ratings yet

- Delhi High Court Maintenance StayDocument216 pagesDelhi High Court Maintenance Stayaditi100% (2)

- This Product Is Licensed To: NAVEEN BANNINTHAYA P R ADVOCATEDocument1 pageThis Product Is Licensed To: NAVEEN BANNINTHAYA P R ADVOCATEabhishekkomeNo ratings yet

- JudgementDocument6 pagesJudgementMehul AroraNo ratings yet

- 2023:bhc-As:28274-Db: 1/19 905-WP-1210-2022Document19 pages2023:bhc-As:28274-Db: 1/19 905-WP-1210-2022BHAGWAN LONARE AGP HIGH COURT BENCH AT NAGPURNo ratings yet

- Equiv Alent Citation: 2016 (3) AC R3108, 2016 (167) AIC 168, AIR2016SC 4363, 2016 (2) ALD (C RL.) 809 (SC), 2016 (97) AC C 487, 2017 (1) ALTDocument6 pagesEquiv Alent Citation: 2016 (3) AC R3108, 2016 (167) AIC 168, AIR2016SC 4363, 2016 (2) ALD (C RL.) 809 (SC), 2016 (97) AC C 487, 2017 (1) ALTMohit JainNo ratings yet

- 2019 3 18 37306 Judgement 16-Aug-2022Document8 pages2019 3 18 37306 Judgement 16-Aug-2022OiiSHEE RedNo ratings yet

- Court Hearing on Seat AllotmentDocument6 pagesCourt Hearing on Seat Allotmentraj singh100% (1)

- OTgw MJ EDocument27 pagesOTgw MJ Ebookmarkbuddy365No ratings yet

- JK Bail OrderDocument8 pagesJK Bail OrderHari Krishna IlangoNo ratings yet

- Aftab Ahmad V Mirza Beg (DHC)Document4 pagesAftab Ahmad V Mirza Beg (DHC)Tanish ManujaNo ratings yet

- Ashima Goyal and Ors Vs Reserve Bank of India Anr On 19 October 2022Document4 pagesAshima Goyal and Ors Vs Reserve Bank of India Anr On 19 October 2022sathish15779No ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- A Guide to District Court Civil Forms in the State of HawaiiFrom EverandA Guide to District Court Civil Forms in the State of HawaiiNo ratings yet

- Amity International School, Noida Holiday Homework Class VII SubjectsDocument5 pagesAmity International School, Noida Holiday Homework Class VII SubjectsranjanjhallbNo ratings yet

- WP (T) 231 21 (18.11.21)Document5 pagesWP (T) 231 21 (18.11.21)ranjanjhallbNo ratings yet

- Alchemist LTD Vs Dinesh Chandra Tripathi and Ors 0UP2019170120155449324COM901174Document19 pagesAlchemist LTD Vs Dinesh Chandra Tripathi and Ors 0UP2019170120155449324COM901174ranjanjhallbNo ratings yet

- TERM 1 Half SYLLABUS PDFDocument5 pagesTERM 1 Half SYLLABUS PDFranjanjhallbNo ratings yet

- State of Gujarat vs. DHIRUBHAI RAVATBHAI DHRANGADocument53 pagesState of Gujarat vs. DHIRUBHAI RAVATBHAI DHRANGAranjanjhallbNo ratings yet

- The Legal Industry Reviews, India Vol1, November 2022Document38 pagesThe Legal Industry Reviews, India Vol1, November 2022ranjanjhallbNo ratings yet

- ICICI Bank and Chanda Kochhar legal disputeDocument60 pagesICICI Bank and Chanda Kochhar legal disputeranjanjhallbNo ratings yet

- Form N Maharashtra Shops Rules 2018 87Document1 pageForm N Maharashtra Shops Rules 2018 87ranjanjhallbNo ratings yet

- UP Stamp ActDocument123 pagesUP Stamp ActranjanjhallbNo ratings yet

- Apprenticeship FAQsDocument28 pagesApprenticeship FAQsGanesh GaniNo ratings yet

- Employment Law Overview of India 2021-2022Document37 pagesEmployment Law Overview of India 2021-2022ranjanjhallbNo ratings yet

- Haryana Government Gazette: ExtraordinaryDocument2 pagesHaryana Government Gazette: ExtraordinaryranjanjhallbNo ratings yet

- Osho Gs Company Versus Wapcos Limited 451073Document20 pagesOsho Gs Company Versus Wapcos Limited 451073ranjanjhallbNo ratings yet

- Gau HC Additional Work 450844Document44 pagesGau HC Additional Work 450844ranjanjhallbNo ratings yet

- Dell Technologies Flexible Work Policy PDFDocument6 pagesDell Technologies Flexible Work Policy PDFKanikaNo ratings yet

- General Circular 37-2014Document1 pageGeneral Circular 37-2014ranjanjhallbNo ratings yet

- GTSE - Online - Class V - EVSDocument13 pagesGTSE - Online - Class V - EVSranjanjhallbNo ratings yet

- List of Empanelled Arbitrator All RegionsDocument89 pagesList of Empanelled Arbitrator All Regionsranjanjhallb100% (1)

- Private Wealth IndiaDocument26 pagesPrivate Wealth IndiaranjanjhallbNo ratings yet

- Faqs On WillDocument5 pagesFaqs On WillranjanjhallbNo ratings yet

- Posh Case Judgments Reporting Guidelines Bombay High Court 401420Document7 pagesPosh Case Judgments Reporting Guidelines Bombay High Court 401420ranjanjhallbNo ratings yet

- The Law Reviews - The Executive Remuneration ReviewDocument20 pagesThe Law Reviews - The Executive Remuneration ReviewranjanjhallbNo ratings yet

- NEW Labour - Code - EngDocument36 pagesNEW Labour - Code - EngMani SeshadrinathanNo ratings yet

- Section 36 of ID ActDocument15 pagesSection 36 of ID ActranjanjhallbNo ratings yet

- FAQ Intermediary Rules 2021Document28 pagesFAQ Intermediary Rules 2021ranjanjhallbNo ratings yet

- CCLI Legal Opinion India Directors DutiesDocument37 pagesCCLI Legal Opinion India Directors DutiesranjanjhallbNo ratings yet

- Future of MobilityDocument41 pagesFuture of MobilityranjanjhallbNo ratings yet

- Bombay High Court Commercial Suit JudgmentDocument42 pagesBombay High Court Commercial Suit JudgmentranjanjhallbNo ratings yet

- Bombay High Court Commercial Suit JudgmentDocument42 pagesBombay High Court Commercial Suit JudgmentranjanjhallbNo ratings yet

- Karnali Province bids for construction of HT linesDocument1 pageKarnali Province bids for construction of HT linesBipin GyawaliNo ratings yet

- Lessons Learned and Lost From The Salem Village Witch Trials - The Enduring Dangers of Coerced ConfessionsDocument34 pagesLessons Learned and Lost From The Salem Village Witch Trials - The Enduring Dangers of Coerced ConfessionsKylah ClayNo ratings yet

- D 608 - 90 R01 - RdywoaDocument2 pagesD 608 - 90 R01 - RdywoaMarcel NascimentoNo ratings yet

- ForensicDocument9 pagesForensicishanNo ratings yet

- Inbound Seller ScriptDocument4 pagesInbound Seller ScriptMario FerreiraNo ratings yet

- 2015 Bar Exam Suggested Answers in Mercantile Law by The UP Law ComplexDocument14 pages2015 Bar Exam Suggested Answers in Mercantile Law by The UP Law ComplexLenar GamoraNo ratings yet

- Adrmisin Vs JavierDocument5 pagesAdrmisin Vs JavierMelanie Rojo BoiserNo ratings yet

- Incident Report FormDocument1 pageIncident Report FormChristopher AiyapiNo ratings yet

- Plaintiff-Appellee vs. vs. Appellant The Solicitor General Brigido G. EstradaDocument3 pagesPlaintiff-Appellee vs. vs. Appellant The Solicitor General Brigido G. EstradaAndrei Jose V. LayeseNo ratings yet

- Formal Offer of Evidence (Practice Court)Document5 pagesFormal Offer of Evidence (Practice Court)TeacherEliNo ratings yet

- 201 208Document9 pages201 208Dan LocsinNo ratings yet

- PoliRev Assignment 2Document182 pagesPoliRev Assignment 2Jermaine SemañaNo ratings yet

- Case Review Petition AppealsDocument33 pagesCase Review Petition AppealsBunny Fontaine100% (1)

- IEEE Standard For General Requirements For Dry-Type Distribution and Power TransformersDocument49 pagesIEEE Standard For General Requirements For Dry-Type Distribution and Power TransformersLucas BrasileiroNo ratings yet

- Lecture 4 PDFDocument17 pagesLecture 4 PDFsajjadNo ratings yet

- WashingtonTimesMarch262021 UserUpload NetDocument38 pagesWashingtonTimesMarch262021 UserUpload NetEren Ali PlaysNo ratings yet

- 32 Senate Blue Ribbon Committee v. MajaduconDocument7 pages32 Senate Blue Ribbon Committee v. MajaduconGene Charles MagistradoNo ratings yet

- Criminal Law 2Document11 pagesCriminal Law 2Carl Griffen GomezNo ratings yet

- Taxation 1 Prelims ReviewerDocument5 pagesTaxation 1 Prelims ReviewerRey Alexander PalmaresNo ratings yet

- Decision 08 2023 Ministry of Finance HeadquartersDocument15 pagesDecision 08 2023 Ministry of Finance HeadquartersBernewsAdminNo ratings yet

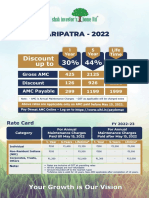

- Paripatra - 2022: Discount Up ToDocument2 pagesParipatra - 2022: Discount Up ToNafisur RahmanNo ratings yet

- 2023-05-02 BTT V8Document262 pages2023-05-02 BTT V8Carlos EstevãoNo ratings yet

- Jefferson County DEC Violations Dec. 29, 2020Document3 pagesJefferson County DEC Violations Dec. 29, 2020NewzjunkyNo ratings yet

- Types of Agendas: Colette Collier TrohanDocument1 pageTypes of Agendas: Colette Collier Trohantwagemmy20No ratings yet

- 1208 Asplen SCSBDocument36 pages1208 Asplen SCSBMelissa R.No ratings yet

- Hizon Notes - FormattedDocument31 pagesHizon Notes - Formattednicole5anne5ddddddNo ratings yet

- Natural Resources and Environmental LawDocument6 pagesNatural Resources and Environmental LawJica GulaNo ratings yet

- March of The Penguins (USA)Document16 pagesMarch of The Penguins (USA)Tsamis IoannisNo ratings yet

- ETHICSDocument4 pagesETHICSgeraldin cruzNo ratings yet