Professional Documents

Culture Documents

CVP Analysis Review Problem With Solution

Uploaded by

SUNNY BHUSHAN0%(1)0% found this document useful (1 vote)

17 views1 pageThe document provides an analysis of Voltar Company's contribution format income statement and profitability. It includes calculations of the company's [1] CM ratio, variable expense ratio, and break-even point. It also examines how [2] net operating income would increase if total sales rose by $400,000 and how many units would need to be sold to earn a $90,000 profit. Further, it calculates the company's [3] margin of safety and degree of operating leverage. Finally, it analyzes the impact of using a higher quality speaker that would increase costs by $3 per unit but potentially increase sales.

Original Description:

Original Title

Cvp Analysis Review Problem

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides an analysis of Voltar Company's contribution format income statement and profitability. It includes calculations of the company's [1] CM ratio, variable expense ratio, and break-even point. It also examines how [2] net operating income would increase if total sales rose by $400,000 and how many units would need to be sold to earn a $90,000 profit. Further, it calculates the company's [3] margin of safety and degree of operating leverage. Finally, it analyzes the impact of using a higher quality speaker that would increase costs by $3 per unit but potentially increase sales.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0%(1)0% found this document useful (1 vote)

17 views1 pageCVP Analysis Review Problem With Solution

Uploaded by

SUNNY BHUSHANThe document provides an analysis of Voltar Company's contribution format income statement and profitability. It includes calculations of the company's [1] CM ratio, variable expense ratio, and break-even point. It also examines how [2] net operating income would increase if total sales rose by $400,000 and how many units would need to be sold to earn a $90,000 profit. Further, it calculates the company's [3] margin of safety and degree of operating leverage. Finally, it analyzes the impact of using a higher quality speaker that would increase costs by $3 per unit but potentially increase sales.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

CVP ANALYSIS REVIEW PROBLEM WITH SOLUTION

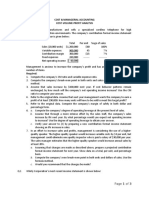

Voltar Company manufactures and sells a specialized cordless telephone for high electromagnetic radiation environments. The company’s

contribution format income statement for the most recent year is given below:

Total Per unit % of sales

Sales (20 000 units) $1 200 000

Variable expenses 900 000

Contribution margin 300 000

Fixed costs 240 000

Operating income $60 000

Management is anxious to increase the company’s profit and has asked for an analysis of a number of items.

Required:

1. Compute the company’s CM ratio and variable expense ratio.

2. Compute the company’s break-even point in both unit sales and dollar sales. Use the equation method.

3. Assume that an increase in unit sales causes total sales to increase by $400,000 next year. If cost behavior patterns remain

unchanged, by how much will the company’s net operating income increase? Use the CM ratio to compute your answer.

4. Refer to the original data. Assume that next year management wants the company to earn a profit of at least $90,000. How

many units will have to be sold to earn this target profit?

5. Refer to the original data. Compute the company’s margin of safety in both dollar and percentage form.

6. Degree of operating leverage:

a. Compute the company’s degree of operating leverage at the present level of sales.

b. Assume that through a more intense effort by the sales staff, the company’s unit sales increase by 8% next year.

By what percentage would you expect net operating income to increase? Use the degree of operating leverage

to obtain your answer.

c. Verify your answer to part (b) by preparing a new contribution format income statement showing an 8% increase

in unit sales.

7. Refer to the original data. In an effort to increase sales and profits, management is considering the use of a higher-quality

speaker. The higher-quality speaker would increase variable costs by $3 per unit, but management could eliminate one quality

inspector who is paid a salary of $30,000 per year. The sales manager estimates that the higher-quality speaker would increase

annual unit sales by at least 20%.

a. Assuming that changes are made as described above, prepare a projected contribution format income statement

for next year. Show data on a total, per unit, and percentage basis.

b. Compute the company’s new break-even point in both unit sales and dollar sales. Use the formula method.

c. Would you recommend that the changes be made?

You might also like

- Cost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3Document3 pagesCost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3mohammad bilal0% (1)

- DMMR CVP MathDocument2 pagesDMMR CVP MathSabbir ZamanNo ratings yet

- Total Per Unit: Sale (20,000u) Variable Costs Contribution Margin Fixed Costs Net ProfitDocument1 pageTotal Per Unit: Sale (20,000u) Variable Costs Contribution Margin Fixed Costs Net ProfitLOVENo ratings yet

- Tugas CVP Lukman LuckyDocument5 pagesTugas CVP Lukman LuckyLukman LuckyNo ratings yet

- CVP Review Problem P 6.29 P 6.30Document4 pagesCVP Review Problem P 6.29 P 6.30nehal hasnain refath0% (1)

- Managerial AccountingDocument1 pageManagerial Accountingacuna.alexNo ratings yet

- Assumptions of CVP AnalysisDocument10 pagesAssumptions of CVP AnalysisJonathan BausingNo ratings yet

- COST VOLUME PROFIT ANALYSIS - ExercisesDocument4 pagesCOST VOLUME PROFIT ANALYSIS - ExercisesLloyd Vincent O. TingsonNo ratings yet

- 20211016231949-A4362 - 201093M 2Document4 pages20211016231949-A4362 - 201093M 2bucin yaNo ratings yet

- CVP Exercise Ref. Bautista, Cancino, Rada, SarmientoDocument5 pagesCVP Exercise Ref. Bautista, Cancino, Rada, SarmientoRodolfo ManalacNo ratings yet

- Cost Volume Profit Analysis - With KEYDocument8 pagesCost Volume Profit Analysis - With KEYPatricia AtienzaNo ratings yet

- CVP QuizDocument1 pageCVP QuizJoana Mica Surbona SIBUYONo ratings yet

- Chap 4 - ActivitiesDocument3 pagesChap 4 - Activities31211022392No ratings yet

- Cost AssignmentDocument4 pagesCost AssignmentSYED MUHAMMAD MOOSA RAZANo ratings yet

- 02 CVP Analysis For PrintingDocument8 pages02 CVP Analysis For Printingkristine claire50% (2)

- Discussion Questions CVP AnalysisDocument2 pagesDiscussion Questions CVP AnalysisAnnamarisse parungaoNo ratings yet

- Ms 03 - CVP AnalysisDocument10 pagesMs 03 - CVP AnalysisDin Rose GonzalesNo ratings yet

- Lecture-11 Relevant Costing LectureDocument6 pagesLecture-11 Relevant Costing LectureNazmul-Hassan Sumon0% (2)

- Solving A CVP ProblemDocument11 pagesSolving A CVP ProblemMahruf OpuNo ratings yet

- 04 Review Problem - CVP AnalysisDocument3 pages04 Review Problem - CVP AnalysisIzzahIkramIllahiNo ratings yet

- 04 Review Problem - CVP AnalysisDocument3 pages04 Review Problem - CVP AnalysisIzzahIkramIllahi100% (1)

- I. Questions:: Let's Check!Document15 pagesI. Questions:: Let's Check!Santiago BuladacoNo ratings yet

- HW 2.2 Afm SendDocument10 pagesHW 2.2 Afm SendAbiodun OlokodanaNo ratings yet

- CH 22 Exercises ProblemsDocument3 pagesCH 22 Exercises ProblemsAhmed El Khateeb100% (1)

- MA 13.2 (No Solutions)Document2 pagesMA 13.2 (No Solutions)Michael ComunelloNo ratings yet

- Cost Volume Profit ERDocument17 pagesCost Volume Profit ERIris BalucanNo ratings yet

- Operating and Financial LeverageDocument52 pagesOperating and Financial Leveragepangilinanac00No ratings yet

- SEATWORK Operating Leverage and Financial LeverageDocument1 pageSEATWORK Operating Leverage and Financial LeverageMARIBEL SANTOSNo ratings yet

- Exam 19111Document6 pagesExam 19111atallah97No ratings yet

- Operating and Financial LeverageDocument3 pagesOperating and Financial LeverageperiNo ratings yet

- CVP Analysis No AnswerDocument9 pagesCVP Analysis No AnswerAybern BawtistaNo ratings yet

- Strategic Cost - CVP Analysis ReviewerDocument2 pagesStrategic Cost - CVP Analysis ReviewerChristine AltamarinoNo ratings yet

- Quiz #3Document4 pagesQuiz #3Jenny BernardinoNo ratings yet

- Management Accounting Sample Final Exam (Solutions Are at The End of The Exam) (40 Marks) There Are 25 Multiple Choice QuestionsDocument16 pagesManagement Accounting Sample Final Exam (Solutions Are at The End of The Exam) (40 Marks) There Are 25 Multiple Choice QuestionsjanineNo ratings yet

- MAS 5 - CVPA ExercisesDocument4 pagesMAS 5 - CVPA ExercisesAngela Miles DizonNo ratings yet

- Review Problem: CVP Relationships: RequiredDocument6 pagesReview Problem: CVP Relationships: RequiredMaika J. PudaderaNo ratings yet

- 6-3B - High-Low Method, Scattergraph, Least-Squares RegressionDocument8 pages6-3B - High-Low Method, Scattergraph, Least-Squares RegressionDias AdhyaksaNo ratings yet

- IPE 481 - Term Final Question - January 2020Document6 pagesIPE 481 - Term Final Question - January 2020Shaumik RahmanNo ratings yet

- E. All of The Above. A. Total Revenue Equals Total CostDocument22 pagesE. All of The Above. A. Total Revenue Equals Total CostNicole KimNo ratings yet

- CVP H101Document4 pagesCVP H101poppy2890No ratings yet

- I B H E A F: Exercises in Cost - Volume - Profit Analysis Ex. 1Document4 pagesI B H E A F: Exercises in Cost - Volume - Profit Analysis Ex. 1I am JacobNo ratings yet

- 6e Brewer CH05 B EOCDocument18 pages6e Brewer CH05 B EOCLiyanCenNo ratings yet

- At 3Document8 pagesAt 3Joshua GibsonNo ratings yet

- Chapter 6:part Two Cost-Volume-ProfitDocument44 pagesChapter 6:part Two Cost-Volume-ProfitFidelina CastroNo ratings yet

- Multiple Choices: Assignment 1Document4 pagesMultiple Choices: Assignment 1Rogger SeptryaNo ratings yet

- Revison Class StudentDocument11 pagesRevison Class StudentÁi Mỹ DuyênNo ratings yet

- Exam 21082011Document8 pagesExam 21082011Rabah ElmasriNo ratings yet

- CVP, Variable Costing and Absorption CostingDocument7 pagesCVP, Variable Costing and Absorption CostingHannah Vaniza NapolesNo ratings yet

- Chapter 06 - Cost-Volume-Profit RelationshipsDocument15 pagesChapter 06 - Cost-Volume-Profit RelationshipsHardly Dare GonzalesNo ratings yet

- Managerial Accounting Exam 2 With SolutionsDocument13 pagesManagerial Accounting Exam 2 With Solutionskwathom1No ratings yet

- Chapter # 8 Exercise & ProblemsDocument4 pagesChapter # 8 Exercise & ProblemsZia Uddin0% (1)

- Contabilidad M3Document13 pagesContabilidad M3Azin RostamiNo ratings yet

- Cost Accounting Interim ExamDocument5 pagesCost Accounting Interim Examgroup 1No ratings yet

- ULOb - Degree of Operating and Financial Leverage-SIM - 0Document11 pagesULOb - Degree of Operating and Financial Leverage-SIM - 0lilienesieraNo ratings yet

- Midterm - Set ADocument8 pagesMidterm - Set ACamille GarciaNo ratings yet

- Cost Volume Profit Analysis: F. M. KapepisoDocument19 pagesCost Volume Profit Analysis: F. M. KapepisosimsonNo ratings yet

- Instructions: Cpa Review School of The PhilippinesDocument17 pagesInstructions: Cpa Review School of The PhilippinesCyn ThiaNo ratings yet

- A. Calculate The Break-Even Dollar Sales For The MonthDocument25 pagesA. Calculate The Break-Even Dollar Sales For The MonthPriyankaNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Budget Planning IntroductionDocument36 pagesBudget Planning IntroductionSUNNY BHUSHANNo ratings yet

- CVP Analysis The Wei Shao ExampleDocument2 pagesCVP Analysis The Wei Shao ExampleSUNNY BHUSHANNo ratings yet

- Budget Planning The CVP AnalysisDocument51 pagesBudget Planning The CVP AnalysisSUNNY BHUSHANNo ratings yet

- CVP Analysis Learning ExercisesDocument3 pagesCVP Analysis Learning ExercisesSUNNY BHUSHANNo ratings yet

- CVP Analysis Learning ExercisesDocument3 pagesCVP Analysis Learning ExercisesSUNNY BHUSHANNo ratings yet

- CVP Analysis Review Problem SolutionDocument3 pagesCVP Analysis Review Problem SolutionSUNNY BHUSHANNo ratings yet

- Exercises E2 42b On Cogm With SolutionDocument3 pagesExercises E2 42b On Cogm With SolutionSUNNY BHUSHANNo ratings yet

- Exercises E2 42b On Cogm With SolutionDocument3 pagesExercises E2 42b On Cogm With SolutionSUNNY BHUSHANNo ratings yet

- Exercises On Cost Classification and CogmDocument3 pagesExercises On Cost Classification and CogmSUNNY BHUSHANNo ratings yet

- Raw Material Consumed Rs 15,000 Direct Labour Charges Rs 9,000 Machine Hours Worked 900 Machine Hours Rate 5. Units Produced 17,100Document5 pagesRaw Material Consumed Rs 15,000 Direct Labour Charges Rs 9,000 Machine Hours Worked 900 Machine Hours Rate 5. Units Produced 17,100Jagadeish jagaNo ratings yet

- Break Even AnalysisDocument77 pagesBreak Even AnalysisIshani GuptaNo ratings yet

- Week 6 Quiz SolutionsDocument12 pagesWeek 6 Quiz SolutionsMehwish Pervaiz100% (1)

- Session 19 - Nestle EIS For Financial ReportingDocument11 pagesSession 19 - Nestle EIS For Financial ReportingRahul ChiplunkarNo ratings yet

- Quizzes For Finals 1 Compilation Chap6,7,1,2Document35 pagesQuizzes For Finals 1 Compilation Chap6,7,1,2Saeym SegoviaNo ratings yet

- CVPDocument13 pagesCVPResty VillaroelNo ratings yet

- Break-Even Point NotesDocument3 pagesBreak-Even Point NotesMinu Mary Jolly100% (1)

- IPPTChap 010Document30 pagesIPPTChap 010Aragaw BirhanuNo ratings yet

- Executive SummaryDocument43 pagesExecutive SummaryapplerafeeNo ratings yet

- Mas TheoriesDocument11 pagesMas TheoriesRoberto UbosNo ratings yet

- Stratcost - Relevant Costing ActivityDocument6 pagesStratcost - Relevant Costing ActivityMark IlanoNo ratings yet

- A. Background: Mathematical Modeling in EonomicsDocument25 pagesA. Background: Mathematical Modeling in EonomicsAzizah NoorNo ratings yet

- Break Evean Point Analysis SeminarDocument2 pagesBreak Evean Point Analysis SeminarCristina IonescuNo ratings yet

- CIPS Level 4 Effective NegotiationDocument170 pagesCIPS Level 4 Effective NegotiationNga Bui100% (4)

- Project:Determining Manufacturing Cost of A Product and Performing CVP AnalysisDocument18 pagesProject:Determining Manufacturing Cost of A Product and Performing CVP Analysistarin rahmanNo ratings yet

- 02 CVP Analysis For PrintingDocument8 pages02 CVP Analysis For Printingkristine claire50% (2)

- Costing English Question-01.09.2022Document5 pagesCosting English Question-01.09.2022Planet ZoomNo ratings yet

- PDFDocument15 pagesPDFHina Sahar100% (1)

- Ch04 Cost Volume Profit AnalysisDocument21 pagesCh04 Cost Volume Profit AnalysisYee Sook Ying0% (1)

- Sci1311 Unit IIDocument16 pagesSci1311 Unit IIReena Bisht DBGI Dehradun100% (1)

- Management AccountingDocument8 pagesManagement AccountingVinu VaviNo ratings yet

- Inline Skating Products Company Marketing PlanDocument22 pagesInline Skating Products Company Marketing PlanPalo Alto Software100% (3)

- 2 Accounting - CourseDocument78 pages2 Accounting - CourseVenkataNo ratings yet

- Notes Management AccountingDocument23 pagesNotes Management AccountingAbidNo ratings yet

- MMBCDocument4 pagesMMBCsandeepshinde1991No ratings yet

- IM Ch14-7e - WRLDocument25 pagesIM Ch14-7e - WRLCharry RamosNo ratings yet

- Sales Force Effectiveness For Pharma IndustryDocument10 pagesSales Force Effectiveness For Pharma IndustrymradulrajNo ratings yet

- Business Plan FOR: AppendixDocument23 pagesBusiness Plan FOR: AppendixNOUN UPDATENo ratings yet

- Cost Concepts and Design EconomicsDocument13 pagesCost Concepts and Design EconomicsOscar Jr SaturninoNo ratings yet

- QB Accounting For ManagementDocument47 pagesQB Accounting For ManagementDevi KomathyNo ratings yet