Professional Documents

Culture Documents

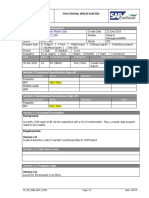

Busness Process Mapping List Prject Name: JBVNL Module: FICO (Finance & Controlling)

Uploaded by

Jit GhoshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Busness Process Mapping List Prject Name: JBVNL Module: FICO (Finance & Controlling)

Uploaded by

Jit GhoshCopyright:

Available Formats

Busness Process Mapping List

Prject Name : JBVNL

Module : FICO (Finance & Controlling)

Business Processes Remarks

Core Processes Business Process Business Process Steps Remarks

01.01 Organisation Structure

FI_01.01.01_Enterprises Structure :

01.01.01.01: Create Company 1. Create Company

01.01.01.02: Create Company Codes 2. Create Company Codes

01.01.01.03: Create Controlling Area 3. Create Controlling Area

01.01.01.04: Create COA, COD & FYV 4. Create COA, COD & FYV 4

FI_01.02.01_GL Master Data Maintenance

01.02.01.01: Create GL Master Create GL Master

01.02.01.02: Edit GL Master Edit GL Master

01.02.01.03: Display GL Madter Display GL Madter

FI_01.02.02_Vendor Master Data Maintenance

01.02.02.01: Create Vendor Master Create Vendor Master

01.02.02.02: Edit Vendor Master Edit Vendor Master

01.02.02.03: Display Vendor Master Display Vendor Master 3

FI_01.02.03_Bank Master Data Maintenance

01.02.03.01: Create House Banks Create House Banks

01.02.03.02: Edit House Banks Edit House Banks

01.02.03.03: Display House Banks Display House Banks 3

FI_01.02.04_Asset Master Data Maintenance

01.02.04.01: Create Asset Master Create Asset Master

01.02.04.02: Edit Asset Master Edit Asset Master

01.02.04.03: Display Asset Master Display Asset Master 3

CO_01.02.05_Profit /Cost Center Master Data

01.02.05.01: Create Profit Center Create Profit Center

01.02.05.02: Edit Profit Center Edit Profit Center

01.02.05.03: Display Profit Center Display Profit Center

01.02.05.04: Create Cost Center Create Cost Center

01.02.05.05: Edit Cost Center Edit Cost Center

01.02.05.06: Display Cost Center Display Cost Center 6

CO_01.02.5A_Cost Element Master Data

01.02.06.01: Create Cost Elment Create Cost Elment

01.02.06.02: Edit Cost Element Edit Cost Element

01.02.06.03: Display Cost Element Display Cost Element 3

CO_01.02.06_Internal Order

01.02.07.01: Create Internal Order 1. Create Internal Order

01.02.07.02: Edit Internal Order 2. Edit Internal Order

01.02.07.03: Display Internal Order 3. Display Internal Order

FI_01.03.01_Asset Capitalization & Management 3

1. Capitalization of Projects under construction /renovation etc

01.03.01.01: Capitalisation of Projects under Construction/ Renovation and Modernisation Schemes. 2. Capitalization of Plant maintenance activities of Capital nature

3. Purchase of Capital Spares & other assets like Furniture & Fixtures, Office Equipment, Construction Equipments

01.03.01.02: AUC Settlement (Premilinary/Final) Software's etc.

01.03.01.02: Capitailiztion of Capital Spares & other Assets (like Furniture and Fixtures, Office 4. Allocation of Interest during construction (IDC) & Common Expenses etc.

Equipment, etc.), Construction Equipment, Software’s etc. 5. Inter Transfer of Assets from one location to other location/ Deposit asset to Centralized store

6. Preliminary Settlement/ Final Settlement

01.03.01.09: Deposit Work/Shiftingof Line 7. Retirement of Assets (Not in Used) /Obsolete Assets / sale of Asset

01.03.01.03: Allocation of Secondary Expenditure during construction /Interest during Construction 8. Sale of Asset

(IDC) etc. on the assets before capitalisation. 9. Assets Written off

10. Deposit of Work

01.03.01.04: Transfer of Assets (Intra Location, Inter Location), Assets Converted into Not in Use 11 Fixed Assets Register

(Unservable)

01.03.01.05: Depreciation Run & posting

01.03.01.06: Retirement of Unserviceable/Obsolete Assets

01.03.01.06: Sale of Assetes (Not In Use)

© 2008 SAP AG. All Rights Reserved.

page 1/10

561084111.xls - 12/01/2021

1. Capitalization of Projects under construction /renovation etc

2. Capitalization of Plant maintenance activities of Capital nature

3. Purchase of Capital Spares & other assets like Furniture & Fixtures, Office Equipment, Construction Equipments

Software's etc.

4. Allocation of Interest during construction (IDC) & Common Expenses etc.

5. Inter Transfer of Assets from one location to other location/ Deposit asset to Centralized store

6. Preliminary Settlement/ Final Settlement

Busness Process Mapping List 7. Retirement of Assets (Not in Used) /Obsolete Assets / sale of Asset

Prject Name : JBVNL 8. Sale of Asset

9. Assets Written off

Module : FICO (Finance & Controlling) 10. Deposit of Work

11 Fixed Assets Register

Business Processes Remarks

Core Processes Business Process Business Process Steps Remarks

01.03.01.07: Asset Written-off

01.03.01.08: Fixed Asset Register 11

FI_01.03.02_Period End Activities for Asset

Accouting

01.03.02.01 :Preliminaary setllement (WBS), Run Depreicaiton & Posting, 1. Depreciation Processing

2. Depreciation Posting

01.03.02.02 :Run Depreicaiton & Posting, 3. Other Month Activities

01.03.02.03: Year End Actitities; Fiscal Year change, Close and Open New year 3

FI_01.04.01 Cash Management

1. Each location Cash Book Process

01.04.01.01: Process of Cash Payment, Permanent Imperest, Short Duration Advance & A9 Receipts 2. Direct Expenses Payment Process

3. Vendor liabilities payment Process through Cash Book (If any)

01.04.01.02: Process of cash Payment of Direct Expenses 4. Employees Expenses Payment and Imprest to Employee Process

01.04.01.03: Cash payment To Vendor 5. Transfer from AO office to Division and Sub Divisions Process

6. Cash Deposit to Bank Process

01.04.01.04: Cash Receipts from Customers 7. Cash withdrawal from Bank Process

01.04.01.05: Cash Payment to Employees (Expenses ,Imprest etc.) 8. Cash Repayment by Employee

9. Cash receipt against cash sale and transferred to Main Cash Book

01.04.01.06: Cash Deposit to Bank Process 10. Cash Receipts against the cash Sales

01.04.01.07: Cash withdrawal from Bank

01.04.01.08: Cash Receipts From Employees (Repayment) 10

01.04.01.09: Cash Receipt Against Cash Sale

01.04.01.10: Cash Transfer location to AO office (Main Cash Book)

FI_01.04.02 Incoming Payment

01.04.02.01: RTGS/NEFT Incoming Payment Process (Loans, Interest Receivable & Fixed 1. Payment of Sale of Scrap Process

Deposit Receipt,Transmission Charges,Miscellaneous) 2. Sale of BOQ

3. MRT Meter Reading Charging

01.04.02.02: Cheques/DD Incoming Payment Process (EMD/SD receivable,Sale of Tender 4. MRT Charges

Forms,Sale of Scrap,Transmission charges (If applicable),Shifting of Lines,Deposit 5. Rent of use JBVNL Assets by other party

Work,Miscellaneous) 6. Occasion of Damage Items sales

01.04.02.03: Incoming Cash Receipts (If any) 6

FI_01.04.03 Out Going Payment

01.04.03.01: RTGS/NEFT Outgoing Payment Process 1. RTGS, NEFT, Transfer Payment process

2. Cheques, Demand Draft, Pay order Payment Process

01.04.03.02: Cheques,Demand Draft Outgoing Payment Pocess 3. Step Payment, Bank to Bank Transfer Process

4. Other Payments- Statutory Payments, Loan Payment, etc..

01.04.03.03: Online Payments(Trasfers ) 5. Vendor Payment (Advance, Partial & Full Payment)

6. Advance Payment to supplier vendor or service Vendor against PO.

01.04.03.04: Cash Paymests 6

FI_01.04.04 Cheque Mangment

1. Cheque Payments: Signed Cheque given/dispatched/hand over vendor along with payment advice

01.04.04.01: Create Cheques Lots and Cheques (Check Leafs) 2. Stop Payment / Request for Cancellation of Cheques

3. Cheque custody of new cheque books and lots

4. Stale cheques Re-payment

01.04.04.02: Vendor Payment with Cheque Print 5. Print the cheques or Manual cheques

6. Void Cheques / Cancellation Cheques

01.04.04.03: Void of destroy leaves 7. Cheques REgister Report or other reports

01.04.04.04: Cheque of Cancellation

7

FI_01.04.05 Bank Reconciliation

01.04.05.01: Bank Reconciliation Statement Process (With Z Screen) 1. Bank Reconciliation 1

01.05 General Ledger Accounting

FI_01.05.01 Adminstrative other Expenses

01.05.01.01: General Expenses Booking without Vendor 1. Administration Expenses process : Fuel/Rent/New Paper etc.

2. Approval Process (Work Flow)

3. Expenses booking with Venor (TDS)

01.05.01.02: Expenses Booking with Vendor (TDS Booking : If applicable) 4. Reversal Of Entries

5. Provisions of Expenses

01.05.01.03: Reversal Of Entries 5

FI_01.05.02 Period End Closing

Month End Activities : Month End Activities :

© 2008 SAP AG. All Rights Reserved.

page 2/10

561084111.xls - 12/01/2021

Busness Process Mapping List

Prject Name : JBVNL

Module : FICO (Finance & Controlling)

Business Processes Remarks

Core Processes Business Process Business Process Steps Remarks

01.05.02.01: Depreciation run 1. Depreciation run

01.05.02.02: Adjustment entries 2. Adjustment entries

01.05.02.03: Recurring Entries 3. Recurring Entries

01.05.02.04: Open/ close posting periods 4. Open/ close posting periods

01.05.02.05: GR/IR Clearing 5. GR/IR Clearing

01.05.02.06: Financial Statements Analysis and Balance Confirmation 6. Financial Statements Analysis and Balance Confirmation

01.05.02.07: Processing Bank Reconciliation Statement 7. Processing Bank Reconciliation Statement

01.05.02.08: Settlement of orders - WBS/PM Orders 8. Settlement of orders - WBS/PM Orders

Year End Activities : Year End Activities :

01.05.02.01: Open/ close posting periods 9. Open/ close posting periods

01.05.02.02: Balance Carry forward customer, vendor 10. Balance Carry forward customer, vendor

01.05.02.03: Change fiscal year for Asset Accounting 11. Change fiscal year for Asset Accounting

01.05.02.04: Closing the Fiscal year for asset accounting 13. Closing the Fiscal year for asset accounting

01.05.02.05: GL balance carry forward 14. GL balance carry forward

01.05.02.06: Copy Number ranges for new Fiscal year 15. Copy Number ranges for new Fiscal year 15

FI_01.05.03 CPF/GPF Trust Accouting

01.05.03.01: Reciept Of Monthly Contribution: 1. Reciept Of Monthly Contribution:

01.05.03.02: Processing of Deposit to Employee Accounts 2. Processing of Deposit to Employee Accounts

3. Loan Against PF

01.05.03.03: Loan Against PF 4. Interest Accural Payment

01.05.03.04: Recovery Against PF Loan 5. Recovery Against PF Loan

01.05.03.05: Processing Interest accrual and payment 6. Processing Interest accrual and payment

01.05.03.06: Separation of Employees (PF) Process Accounting 7. Separation of Employees (PF) Process Accounting

01.05.03.07: Final Settleemnt of Employee 8. Final Settleemnt of Employee

01.05.03.08: Receipt Funds from another employer 9. Receipt Funds from another employer 9

FI_01.05.04 Pension Trust Accouting

01.05.04.01: Amount Recipt agsint Pension from JBVNL Process Accounting 1. Amount Recipt agsint Pension from JBVNL Process Accounting

01.05.04.02: Funds transfers to Respective Profit Center (Circle AO) 2. Funds transfers to Respective Profit Center (Circle AO)

01.05.04.03: Funds Transfers to Employees Accounts Accounting 3. Funds Transfers to Employees Accounts Accounting

01.05.04.04: Payment to Empoyees Process Accounting 4. Payment to Empoyees Process Accounting

01.05.04.05: Payments Accounting in Case of Employees is not created as Vendor 5. Payments Accounting in Case of Employees is not created as Vendor 5

FI_01.05.05 Gratuity Trust Accouting

01.05.05.01: Reciepts of Grautity fund form JBVNL process Accounting 1. Reciepts of Grautity fund form JBVNL process Accounting

01.05.05.02: Graututy Fund Transfer to Circles on Separation 2. Graututy Fund Transfer to Circles on Separation

01.05.05.03: Employees Payment Process Accounting 3. Employees Payment Process Accounting 3

FI_01.05.5A_GIS & GSS Trust

GIS: General Insurance Scheme: GIS: General Insurance Scheme:

01.05.5A.01: Transfer Contribution against GIS fund in JBVNL 1. Transfer Contribution against GIS fund in JBVNL

01.05.5A.02: Reciepts contribution amount from JBVNL in Trust Company 2. Reciepts contribution amount from JBVNL in Trust Company

01.05.5A.03: Transfer Fund in Circle process Accounting 3. Transfer Fund in Circle process Accounting

01.05.5A.04: Payment to Member process Accounting (Without Employees Vendor) 4. Payment to Member process Accounting (Without Employees Vendor)

01.05.5A.05: Payment to Mem ber process accounting (With Employees Vendor) 5. Payment to Mem ber process accounting (With Employees Vendor)

GSS: Group Security Scheme GSS: Group Security Scheme

01.05.5A.06: Transfer fund against GSS fund in JBVNL 6. Transfer fund against GSS fund in JBVNL

01.05.5A.07: Reciepts Fund amount from JBVNL in Trust Company 7. Reciepts Fund amount from JBVNL in Trust Company

01.05.5A.08: Payment to Member process Accounting (Without Employees Vendor) 8. Payment to Member process Accounting (Without Employees Vendor)

01.05.5A.09: Payment to Mem ber process accounting (With Employees Vendor) 9. Payment to Mem ber process accounting (With Employees Vendor) 9

FI_01.05.06 Borrowing Accouting

01.05.06.01: Loans/Grants Accounting (Term Loans, Short Term Loans, Bonds issue) 1. Loans/Grants Accounting (Term Loans, Short Term Loans, Bonds issue)

01.05.06.02: Payment of Interest Accounting 2. Payment of Interest Accounting

© 2008 SAP AG. All Rights Reserved.

page 3/10

561084111.xls - 12/01/2021

Busness Process Mapping List

Prject Name : JBVNL

Module : FICO (Finance & Controlling)

Business Processes Remarks

Core Processes Business Process Business Process Steps Remarks

01.05.06.03: loans repayment process Accounting 3. loans repayment process Accounting

01.05.06.04: Accrual Interest Process Accounting 4. Accrual Interest Process Accounting

FI_01.05.6A Investment Accounting

01.05.6A.01: Investments By JBVNL/Trust Accountng (Fixed Deposits, Mutual Funds, Bonds etc) 1. Investments By JBVNL/Trust Accountng (Fixed Deposits, Mutual Funds, Bonds etc)

01.05.6A.02: Reciept of Interest on FD, Mautual Funds , Boands Etc 2. Reciept of Interest on FD, Mautual Funds , Boands Etc

01.05.6A.03: Divident on Mutual Funds Accounting 3. Divident on Mutual Funds Accounting

01.05.6A.04: Accurual Interest Accounting 4. Accurual Interest Accounting

01.05.6A.05: Redemption of Mutual Funds Processing 5. Redemption of Mutual Funds Processing

01.05.6A.06: Maturity of Bonds & FD 6. Maturity of Bonds & FD 6

FI_01.05.07 Central Accounting Accouting

1. JV Process for Sale & Revenue Booming and Other JV Transactions if Requried

2. Payment of Advance Tax

3. Loan taken and repayment of loan

4. Accruals

5. Provisions

6. Bank Transfers

7. Payment of Statutory dues

8. Accounting for EMD/SD/Tender Fee

9. Correction Vouchers

10. Adjustment Vouchers

11. Clearing Vouchers

01.05.7.01: JV Process for Sale & Revenue Booming and Other JV Transactions if Requried 12. JV for Revenue booking with corresponding account of customer.

13. Revenue from Operation

14. Deposit Work Colection

15. MTR Charges

16. Rent Collection

17. Occassion Collection

18. Tender Form Sales

18

FI_01.06.01 Staturoty Deduction

01.06.01.01: Tax deducted at source (TDS) at the time of Payment or Invoice of Vendors

Statutory Deduction & Accounting:

1. Tax deducted at source (TDS)

01.06.01.02: Work Contract tax (WCT) at the time of Advance Payment or Invoice 2. Work Contract tax (WCT)

3. Tax Collected at source (TCS)

01.06.01.03: Tax Collected at source (TCS) at the time of Advance Payment or Invoice 4. GST on Scrap Sale

5. Any other inward Tax

6. Deposit of TDS Salary and Other than Salary

01.06.01.04: Inward Taxes: CST,VAT & Other Taxes 7. TDS of Payent to Vendor

8. TDS Remmitance, Bank Challan Updation, TDS Certificate etc.

01.06.01.05: Service Tax (GTA) on Services & Reverse Mechanism 9. Inward taxes: GST & other Taxes

10. GST, Reverse Charges Machanism

01.06.01.06: Contractor's Employees EPF/ESI Calculation 10

FI_01.07.01 Material/Service Invoice Verification

1. Invoice Verification (Parking) by stores/Concerns

Invoice Verification after receipt of Material : 2. Approved/Rejected by the accounts Cleark /Accounts

3. Approved/Rejected by the AAP/AO

01.07.01.01: Invoice Verification (Parking) by stores/Concerns 4. Invoice Verification (Posting) by Finance

01.07.01.02: Approved/Rejected by the accounts Cleark /Accounts 5. Invoice verification (Parking) by engineers-in charge/concerns

6. Aprroval/Rejected by the accounts Cleark/ Accoutants

7. Approved /Rejected by the AAP/AO

01.07.01.03: Approved/Rejected by the AAP/AO 8. Invoice Verification (Posting) by Finance

9. Revised or Rectification in Logistic Invoice Verification

01.07.01.04: Invoice Verification (Posting) by Finance 10. Price Variances in Vendors Invoices

11. Quality/ Quantity Variances in the Service & Materials

Invoice Verification after execution of service : 12. Rate differences in Invoice Verification

13. Partial Materials return to Suppliers

01.07.01.05: Invoice Verification (Parking) by Engineer-in-Charge/Concerns 14. Materials transfer/ received from Inter Company

15. Bills/ Expenses Payment on behalf of Other Company

01.07.01.06: Approved/Rejected by the accounts Clerks/ Accountants 16. Payment on asset /liability on behalf of inter Company

01.07.01.07: Approved/Rejected by the AAP/AO

© 2008 SAP AG. All Rights Reserved.

page 4/10

561084111.xls - 12/01/2021

1. Invoice Verification (Parking) by stores/Concerns

2. Approved/Rejected by the accounts Cleark /Accounts

3. Approved/Rejected by the AAP/AO

4. Invoice Verification (Posting) by Finance

5. Invoice verification (Parking) by engineers-in charge/concerns

6. Aprroval/Rejected by the accounts Cleark/ Accoutants

7. Approved /Rejected by the AAP/AO

8. Invoice Verification (Posting) by Finance

Busness Process Mapping List 9. Revised or Rectification in Logistic Invoice Verification

10. Price Variances in Vendors Invoices

Prject Name : JBVNL 11. Quality/ Quantity Variances in the Service & Materials

12. Rate differences in Invoice Verification

Module : FICO (Finance & Controlling) 13. Partial Materials return to Suppliers

14. Materials transfer/ received from Inter Company

15. Bills/ Expenses Payment on behalf of Other Company

Business Processes Remarks

16. Payment on asset /liability on behalf of inter Company

Core Processes Business Process Business Process Steps Remarks

01.07.01.08: Invoice Verification (Posting) by finance

16

FI_01.07.03 EMD/SD/BG/TF

EMD (Earnest Money Deposit) :

1. EMD amount received (Liability) from bidders as Supply Vendors, against tender or quotation, EMD can be in

the form of DD, FDR, PO, BG.

01.07.03.01: Processing EMD (Earnest Money Deposit) from suppliers 2. Recorded all EMD in Control Sheet (Z screen)

3. Like: Information Contains : Tender No. & Date, Vendor Number, Amount, DD/PO/ Number, Drawn on, And

Other Desire Information

4. EMD Deposited in the Bank

5. Forfeited Process

6. Report on outstanding EMD base on their due date

Security Deposit :

7. Suppliers of the Goods/ Services has to submit some amount in term of of SD.

8. SD amount by Cheque, DD.

01.07.03.02: Processing BG (Bank Guarantee) from Suppliers 9. SD depositing in the Bank.

10. EMD convert into SD

11. SD refund process

12. Report on Security Deposits will be maintain as per due date.

BG (Bank Guarantee)

13. Bank Guarantee from potential suppliers it can be Security Deposit, Earnest Money Deposit (EMD),

Performance BG/ Additional PBG.

14. Forfeited Process

01.07.03.03: Processing SD (Security Deposit) from Suppliers of Goods / Services TF (Tender Fees) :

15. Tender Fees collection from potential bidders by selling of Tender forms

16. Tender Fees collection by DD, PO, Payment Gateway.

17. Collected Tender Fees deposited in the Bank.

18. Fees Acconting as Income

01.07.03.04: Processing Tender Fee from the potential bidders

18

FM_01.08.01 Budget System Control

01.08.01.01: Planning of Bugdet Process 1. Creation of Fund Management Area

2. Creation of Fund Centers

01.08.01.02: Organization Structures (FM Area) 3. Creation of Commitment Item

4. Budget Control system is budget all exps for individual responsibility area

01.08.01.03: Master Data Creation. Edit, Display ( Commitment Item, Fund Center) 5. Supplement budget (Revise Budget) During the year

6. Budget ENTRY/ Release / Supplement/ Return/ Transfer

01.08.01.04: Budget ENTRY/ Release / Supplement/ Return/ Transfer 7. Budget Execution / Verification

8. System control the expenditure

01.08.01.05: Budget Execution / Verification 9. Assign Individual Tolerances

10. Availability Control.

01.08.01.06: System control the expenditure

01.08.01.07: Assign Individual Tolerances

01.08.01.08: Availability Control. 10

CO_01.09.01 CO Business Process

01.09.01.01: Cost Center Center Accounting : takes care of integrating FI general ledger accounts with 01: Cost Center Center Accounting : takes care of integrating FI general ledger accounts with CO

CO

01.09.01.02: Cost Element Accoutning : It facilitates the analysis of overhead costs according to where 02: Cost Element Accoutning : It facilitates the analysis of overhead costs according to where the costs were

the costs were incurred within the organization through postings incurred within the organization through postings

01.09.01.02: Profit Center Accouting:The objective of Profit Center is to evaluate performance of Profit 02: Profit Center Accouting:The objective of Profit Center is to evaluate performance of Profit Center based on

Center based on profitability and contribution analysis. profitability and contribution analysis.

01.09.01.03: Internal Order Accounting :Internal orders are used to plan, collect, and settle the costs of 03: Internal Order Accounting :Internal orders are used to plan, collect, and settle the costs of event specific

event specific internal jobs and tasks. internal jobs and tasks.

01.09.01.04: Material Consumption from store to Cost Center throgh Real time transactions 04: Material Consumption from store to Cost Center throgh Real time transactions

01.09.01.05: Booking through Plant Maintenance: Maintenance cost Booking and Settle to Respective

Cost centers 05: Booking through Plant Maintenance: Maintenance cost Booking and Settle to Respective Cost centers

01.09.01.06: Booking Materails Consumption cost and Other Against Project 06: Booking Materails Consumption cost and Other Against Project

01.09.01.07: Manual Reposting Against Cost center and Internal Orders (Adjustments ) 07: Manual Reposting Against Cost center and Internal Orders (Adjustments )

01.09.01.08: Allocating Cost through Assessment or Ditrubution cycle to accurate costing pupose 08: Allocating Cost through Assessment or Ditrubution cycle to accurate costing pupose

8

FI_01.10.01 Store Accounting

© 2008 SAP AG. All Rights Reserved.

page 5/10

561084111.xls - 12/01/2021

Busness Process Mapping List

Prject Name : JBVNL

Module : FICO (Finance & Controlling)

Business Processes Remarks

Core Processes Business Process Business Process Steps Remarks

01.10.01.01: Inventory received against Purchase with ref. of PO (MT:101) 01: Inventory received against Purchase with ref. of PO (MT:101)

01.10.01.02: Inventory transfer from storage location to storage location under one Plant (MT:311) 02: Inventory transfer from storage location to storage location under one Plant (MT:311)

01.10.01.03: Inventory transfer from storage location to Project location under one Plant (MT: 415) 03: Inventory transfer from storage location to Project location under one Plant (MT: 415)

01.10.01.04: Inventory issue from Project Stock to Project (MT : 281Q) 04: Inventory issue from Project Stock to Project (MT : 281Q)

01.10.01.05: Inventory transfer from project location to Plant (MT:411) 05: Inventory transfer from project location to Plant (MT:411)

01.10.01.06: Inventory transfer from Plant to Plant (MT:351/101) 06: Inventory transfer from Plant to Plant (MT:351/101)

01.10.01.07: Inventory issue to direct Project (MT:221) 07: Inventory issue to direct Project (MT:221)

01.10.01.08: Inventory issue to Maintenance Order (MT:261) 08: Inventory issue to Maintenance Order (MT:261)

01.10.01.09: Inventory issue from Plant to Cost Center or AUC (MT: 201,241) 09: Inventory issue from Plant to Cost Center or AUC (MT: 201,241)

01.10.01.10: Movement type "241" is required to issue the material to convert into AUC 10: Movement type "241" is required to issue the material to convert into AUC

01.10.01.11: Invetory return from consumption to store (MT: 281Q/222/262/242/202 and from store 11: Invetory return from consumption to store (MT: 281Q/222/262/242/202 and from store to vendor (MT:

to vendor (MT: 122/161) 122/161) 11

FI_01.11.01 Employees Salary & Other Expesnes

Salary Accounting Processing : Salary Accounting Processing :

01.11.01.01: Salary preocessing Accounting 01: Salary preocessing Accounting

Other than Salary Accounting for Employees : Other than Salary Accounting for Employees :

01.11.01.01: Processing Loan against PF to Employees and deduction Accounting 01: Processing Loan against PF to Employees and deduction Accounting

01.11.01.02: Processing Emperest to Employee Accoutning 02: Processing Emperest to Employee Accoutning

01.11.01.03: Processing Medical Expenses Booking and Reimbursment Accounting 03: Processing Medical Expenses Booking and Reimbursment Accounting

01.11.01.04: Processing Travelling Advance & Expenses Accoounting 04: Processing Travelling Advance & Expenses Accoounting

01.11.01.05: Processing Conveyance Expeneses Accounting 05: Processing Conveyance Expeneses Accounting

01.11.01.06: Processing Telephone expenses Accounting 06: Processing Telephone expenses Accounting 6

01.01 Long Term Loan

Management TRM_01.01.01_Long Term Loan Management

01.03.01.01: Creation of Long Term Loan Creation of Long Term Loan

01.03.01.02: Settlement of Long Term Loan Settlement of Long Term Loan

01.03.01.03: Posting of Long Term Loan to FI Posting of Long Term Loan to FI

01.03.01.04: Change of Lonterm Loan Change of Lonterm Loan

01.03.01.05: Disply of Lonterm Loan Disply of Lonterm Loan

01.03.01.06: Interest Accrued not due Interest Accrued not due

01.03.01.07: Reset of Interest Reset of Interest

TRM_01.01.02_ Short Term Loan Management

01.04.01.01: Creation of Short Term Loan Creation of Short Term Loan

01.04.01.02: Settlement of Short Term Loan Settlement of Short Term Loan

01.04.01.03: Posting of Short Term Loan to FI Posting of Short Term Loan to FI

01.04.01.04: Change of Short term Loan Change of Short term Loan

01.04.01.05: Disply of Short Term Loan Disply of Short Term Loan

01.04.01.06: Interest Accrued not due Interest Accrued not due

© 2008 SAP AG. All Rights Reserved.

page 6/10

561084111.xls - 12/01/2021

Busn

P

Module : TRM

Business Processes

Core Processes

01.01 Long Term Loan Management

Busness Process Mapping List

Prject Name : RVPN

Module : TRM (Treasury and Risk Manage

Business Processes

Business Process

TRM_01.01.01_Long Term Loan Management

TRM_01.01.02_ Short Term Loan Management

Busness Process Mapping List

Prject Name : RVPN

Module : TRM (Treasury and Risk Management)

Business Processes

Business Process Steps

01.03.01.01: Creation of Long Term Loan

01.03.01.02: Settlement of Long Term Loan

01.03.01.03: Posting of Long Term Loan to FI

01.03.01.04: Change of Lonterm Loan

01.03.01.05: Disply of Lonterm Loan

01.03.01.06: Interest Accrued not due

01.03.01.07: Reset of Interest

01.04.01.01: Creation of Short Term Loan

01.04.01.02: Settlement of Short Term Loan

01.04.01.03: Posting of Short Term Loan to FI

01.04.01.04: Change of Short term Loan

01.04.01.05: Disply of Short Term Loan

01.04.01.06: Interest Accrued not due

Tcode Remarks

TCODE Remarks

TM_51

TM_54

TBB1

TM_52

TM_53

TBB4

ZTM_51

TM_51

TM_54

TBB1

TM_52

TM_53

TBB4

You might also like

- Section 1: Document Information: SCM Report Master Data ZMM - Mat - VenDocument3 pagesSection 1: Document Information: SCM Report Master Data ZMM - Mat - VenRicky リキNo ratings yet

- MMFIDocument3 pagesMMFImayoorNo ratings yet

- ABAP KT Tracker v1.0-2Document119 pagesABAP KT Tracker v1.0-2Kalikinkar LahiriNo ratings yet

- Bidcoro - Fi - BBP - V1 0 - 23.05.16Document73 pagesBidcoro - Fi - BBP - V1 0 - 23.05.16Srinivas YakkalaNo ratings yet

- Issue Change Log SAP Business OneDocument5 pagesIssue Change Log SAP Business OneMarcin OrgackiNo ratings yet

- Task/Information Results/Comments Date Answered By: © 2006 by SAP AG, ASAP Business One Version 1.0Document17 pagesTask/Information Results/Comments Date Answered By: © 2006 by SAP AG, ASAP Business One Version 1.0Paul GLNo ratings yet

- Activities Done To Remove The Errors in Costing Run/variance Calculation/settlement Request No'sDocument17 pagesActivities Done To Remove The Errors in Costing Run/variance Calculation/settlement Request No'sHridya PrasadNo ratings yet

- Asset Class Company Code Asset DescriptionDocument13 pagesAsset Class Company Code Asset DescriptionJit GhoshNo ratings yet

- S4H - 458 Test Script TemplateDocument18 pagesS4H - 458 Test Script TemplateAhmed ElhawaryNo ratings yet

- BBP New Format Vendor MasterDocument21 pagesBBP New Format Vendor Mastersowndarya vangalaNo ratings yet

- Integration ID: Fit-to-Standard Workshop Business AreaDocument37 pagesIntegration ID: Fit-to-Standard Workshop Business AreaRafael SilvaNo ratings yet

- S4H - 894 Test ManagementDocument17 pagesS4H - 894 Test ManagementAlison MartinsNo ratings yet

- Business Process Blueprint Finance: ProjectDocument62 pagesBusiness Process Blueprint Finance: ProjectSaravanaRaajaaNo ratings yet

- Current: Double Click To See All Projects and To Use FiltersDocument2 pagesCurrent: Double Click To See All Projects and To Use FiltersvenkatvavilalaNo ratings yet

- AIS Sap Business OneDocument16 pagesAIS Sap Business OneMarcos MedinaNo ratings yet

- Technology Evaluation Centers Inc. Business Performance Management (BPM) Criteria WorksheetDocument93 pagesTechnology Evaluation Centers Inc. Business Performance Management (BPM) Criteria WorksheetjaycieNo ratings yet

- RMP Everymonth Closing Activities: S.No. English Desciption Wave V SAPDocument11 pagesRMP Everymonth Closing Activities: S.No. English Desciption Wave V SAPSyed Zain Ul AbdinNo ratings yet

- KPMG Demo - Obyc GL MappedDocument3 pagesKPMG Demo - Obyc GL MappedJit GhoshNo ratings yet

- HSPL Fi 06 House Bank v1.0Document18 pagesHSPL Fi 06 House Bank v1.0Naveen KumarNo ratings yet

- Year End Closing Activities in Sap Fi CoDocument30 pagesYear End Closing Activities in Sap Fi Coansonyu305No ratings yet

- FS For BDCDocument8 pagesFS For BDCHridya PrasadNo ratings yet

- Enabling - SAP B1 - Tips and Tricks SAP - January 2012Document11 pagesEnabling - SAP B1 - Tips and Tricks SAP - January 2012rklearningNo ratings yet

- License Comparison Chart For SAP Business OneDocument39 pagesLicense Comparison Chart For SAP Business OneAndroNo ratings yet

- Sap BBP TemplateDocument2 pagesSap BBP TemplateUppiliappan GopalanNo ratings yet

- BH5 S4hana1611 BPD en XXDocument23 pagesBH5 S4hana1611 BPD en XXIván Andrés Marchant NúñezNo ratings yet

- Business Blueprint Design Project (Parivartan) :, Ver1.0Document7 pagesBusiness Blueprint Design Project (Parivartan) :, Ver1.0Aditya50% (2)

- BP Op Entpr S4hana2022 09 Prerequisites Matrix en AeDocument122 pagesBP Op Entpr S4hana2022 09 Prerequisites Matrix en AeVinay KumarNo ratings yet

- B1AIP30 - Kickoff Meeting TemplateDocument45 pagesB1AIP30 - Kickoff Meeting TemplateArwin Somo100% (1)

- Prerequisites MatrixDocument81 pagesPrerequisites MatrixdanNo ratings yet

- Practitioner Portal - Payment Advice Run Email Functionality To Multiple Party and No Email Error HandlingDocument14 pagesPractitioner Portal - Payment Advice Run Email Functionality To Multiple Party and No Email Error HandlingJoseNo ratings yet

- Material List: Conserved Foodstuffs, KuwaitDocument2 pagesMaterial List: Conserved Foodstuffs, KuwaitsanjusivanNo ratings yet

- 2.01 Pre Project PreparationDocument3 pages2.01 Pre Project PreparationAdityaNo ratings yet

- Purpose: IRCON - Global Business Process Master List (BPML)Document24 pagesPurpose: IRCON - Global Business Process Master List (BPML)AdityaNo ratings yet

- 1 SAP Migration: 1.1 Solution OverviewDocument6 pages1 SAP Migration: 1.1 Solution OverviewmoorthyNo ratings yet

- BRD TemplateDocument2 pagesBRD TemplateAnonymous hur1IflTczNo ratings yet

- Week - End Holiday Quarter Comp-Of Reason Total Working Hours For The Day ApproverDocument4 pagesWeek - End Holiday Quarter Comp-Of Reason Total Working Hours For The Day ApprovermayoorNo ratings yet

- Unity FSP MFG 06 V01R00Document83 pagesUnity FSP MFG 06 V01R00sowjanyaNo ratings yet

- Incidentrequest Closed Monthly JunDocument250 pagesIncidentrequest Closed Monthly Junأحمد أبوعرفهNo ratings yet

- Business SAP OMDocument22 pagesBusiness SAP OMSuraj PillaiNo ratings yet

- Ap SapDocument3 pagesAp SapkprakashmmNo ratings yet

- If You Want To Activate This Building Block You Have To Activate FirstDocument12 pagesIf You Want To Activate This Building Block You Have To Activate FirstDario GarciaNo ratings yet

- FS SAP Master Data - v1.03Document20 pagesFS SAP Master Data - v1.03ferNo ratings yet

- SAP Business One Service Level AgreementDocument3 pagesSAP Business One Service Level AgreementElsa MatâniaNo ratings yet

- Controlling - 1909 FPS02Document85 pagesControlling - 1909 FPS02Sunil GNo ratings yet

- Useful Resources and DocumentationDocument2 pagesUseful Resources and DocumentationsanjusivanNo ratings yet

- KT UnderstandingDocument20 pagesKT UnderstandingJit GhoshNo ratings yet

- SAP Handover Document: By: Syed Usman TariqDocument13 pagesSAP Handover Document: By: Syed Usman TariqUsman TariqNo ratings yet

- SAS-T-9 Enhancement For Invoice Verification Not Allow If Quality Inspection Not DoneDocument7 pagesSAS-T-9 Enhancement For Invoice Verification Not Allow If Quality Inspection Not DoneRoshanNo ratings yet

- Using The SBO SP TransactionNotification Stored ProcedureDocument25 pagesUsing The SBO SP TransactionNotification Stored ProcedureVeera ManiNo ratings yet

- Easy Enhancement WorkbenchDocument26 pagesEasy Enhancement Workbenchakash1ga17cs006100% (1)

- Rollout Cutover PlanDocument2 pagesRollout Cutover Planpragya2005No ratings yet

- Master Data TemplateDocument10 pagesMaster Data TemplateSiva KumarNo ratings yet

- FS Payment Detail RequirementDocument13 pagesFS Payment Detail RequirementPrathamesh ParkerNo ratings yet

- PS Authorisation MatrixDocument26 pagesPS Authorisation MatrixmayoorNo ratings yet

- S4H - 788 AI - MasterListDocument16 pagesS4H - 788 AI - MasterListAshwini KanranjawanePasalkarNo ratings yet

- Data Migration To SAP S/4HANA From Staging (2Q2)Document27 pagesData Migration To SAP S/4HANA From Staging (2Q2)venkay1123No ratings yet

- SapDocument7 pagesSapsowjanyaNo ratings yet

- Sap Fico Blue PrintDocument57 pagesSap Fico Blue Printuvtechdhananjay05100% (1)

- Investment Management With SAP ERP-FBDocument349 pagesInvestment Management With SAP ERP-FBTushar KohinkarNo ratings yet

- S5 - RA T CodesDocument5 pagesS5 - RA T CodesJit GhoshNo ratings yet

- RAR ProcessDocument16 pagesRAR ProcessJit GhoshNo ratings yet

- Voyager - S4HANA Conversion ProjectDocument4 pagesVoyager - S4HANA Conversion ProjectJit GhoshNo ratings yet

- COPA Activate Account BasedDocument2 pagesCOPA Activate Account BasedJit GhoshNo ratings yet

- Dear Sir,: Larsen & Toubro Limited Electrical & Automation Control & AutomationDocument2 pagesDear Sir,: Larsen & Toubro Limited Electrical & Automation Control & AutomationJit GhoshNo ratings yet

- CESU - RAPDRP - FICO - PC Master DataDocument2 pagesCESU - RAPDRP - FICO - PC Master DataJit GhoshNo ratings yet

- Transaction Code CESU Business Process Master List - FICODocument4 pagesTransaction Code CESU Business Process Master List - FICOJit GhoshNo ratings yet

- Concur Discovery Questions: Topic Item Country/Business UnitsDocument12 pagesConcur Discovery Questions: Topic Item Country/Business UnitsJit GhoshNo ratings yet

- Concur Customer Discovery Questionnaire RevisedDocument13 pagesConcur Customer Discovery Questionnaire RevisedJit GhoshNo ratings yet

- XK99 Mass Vendor ChangeDocument4 pagesXK99 Mass Vendor ChangeJit GhoshNo ratings yet

- Concur Customer Discovery QuestionnaireDocument17 pagesConcur Customer Discovery QuestionnaireJit GhoshNo ratings yet

- DISCOMs - FICO - GL 7TA - 210 ClientDocument49 pagesDISCOMs - FICO - GL 7TA - 210 ClientJit GhoshNo ratings yet

- CESU - RAPDRP - FICO - CC Master DataDocument2 pagesCESU - RAPDRP - FICO - CC Master DataJit GhoshNo ratings yet

- SGR - ID - Wtihholding TaxDocument13 pagesSGR - ID - Wtihholding TaxJit GhoshNo ratings yet

- KPMG Demo - Obyc GL MappedDocument3 pagesKPMG Demo - Obyc GL MappedJit GhoshNo ratings yet

- Asset Legacy Transfer Error - Accumulated Values For Activation Date Not Allowed in Transfer YearDocument2 pagesAsset Legacy Transfer Error - Accumulated Values For Activation Date Not Allowed in Transfer YearJit GhoshNo ratings yet

- As Is - Study Cesu Business Processes & Legacy SystemsDocument19 pagesAs Is - Study Cesu Business Processes & Legacy SystemsJit GhoshNo ratings yet

- Sample - OBYC GL MappedDocument3 pagesSample - OBYC GL MappedJit GhoshNo ratings yet

- Prop. Solution For India Asset and Tax DepreciationDocument8 pagesProp. Solution For India Asset and Tax DepreciationJit Ghosh100% (1)

- Reply-Wesco - FICO AMDocument165 pagesReply-Wesco - FICO AMJit GhoshNo ratings yet

- Deloitte - S4 Hana ConversionDocument18 pagesDeloitte - S4 Hana ConversionJit Ghosh100% (4)

- SAP CO PC Product Costing Q & ADocument14 pagesSAP CO PC Product Costing Q & AJit GhoshNo ratings yet

- Asset Class Company Code Asset DescriptionDocument13 pagesAsset Class Company Code Asset DescriptionJit GhoshNo ratings yet

- FMS Overview Webinar PDFDocument23 pagesFMS Overview Webinar PDFJit GhoshNo ratings yet

- P01Document11 pagesP01loveshare0% (1)

- Payroll Advance PolicyDocument3 pagesPayroll Advance Policysvyasjaydip1990No ratings yet

- Manual of Regulations For Banks Vol 1Document577 pagesManual of Regulations For Banks Vol 1Neneng KunaNo ratings yet

- Miscellaneous DealsDocument38 pagesMiscellaneous Dealswpedro20130% (2)

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRichardNoelFernandesNo ratings yet

- Szabo, Nick - Shelling Out The Origins of Money PDFDocument20 pagesSzabo, Nick - Shelling Out The Origins of Money PDFCody MillerNo ratings yet

- Calculation of Collateral Call and Settlement of Financial Power ContractsDocument35 pagesCalculation of Collateral Call and Settlement of Financial Power ContractsshyamVENKATNo ratings yet

- InvoiceDocument4 pagesInvoicezakaria.ragab13No ratings yet

- SET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirDocument5 pagesSET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirnisharvishwaNo ratings yet

- An Analysis On Marketing Communication of American Express Credit Card and It's Competitors in BangladeshDocument49 pagesAn Analysis On Marketing Communication of American Express Credit Card and It's Competitors in Bangladeshmonti_nsuNo ratings yet

- Final Reports by SunilDocument34 pagesFinal Reports by Sunilryu_clan100% (3)

- Financial Accounting F3 25 August RetakeDocument12 pagesFinancial Accounting F3 25 August RetakeMohammed HamzaNo ratings yet

- Capital Markets ProjectDocument54 pagesCapital Markets Projectjaggis1313100% (4)

- Dishonour of ChequeDocument4 pagesDishonour of ChequeRaj Kumar100% (1)

- Chapter 15Document42 pagesChapter 15Ivo_Nicht100% (1)

- Bank Management RecordsDocument32 pagesBank Management RecordsPawPaul MccoyNo ratings yet

- Ia2 (Chapter 7 - Problem 5)Document3 pagesIa2 (Chapter 7 - Problem 5)entienzafatimahNo ratings yet

- QuizDocument8 pagesQuizReynante Dap-ogNo ratings yet

- Nac 26112019 o MP Comm 1692016Document30 pagesNac 26112019 o MP Comm 1692016Amitoz SinghNo ratings yet

- Himali Akarawita Invoice PDFDocument12 pagesHimali Akarawita Invoice PDFAnura PiyatissaNo ratings yet

- Ahmirah Ali Weekly Stub 1Document1 pageAhmirah Ali Weekly Stub 1Lillian AwtNo ratings yet

- Pas 20 - 23Document6 pagesPas 20 - 23LEIGHANNE ZYRIL SANTOSNo ratings yet

- DocDocument1 pageDocaccounts 3 life100% (1)

- Cash ReceiptDocument40 pagesCash ReceiptAneesh ChandranNo ratings yet

- "Foreign Exchange Management": Summer Project ONDocument59 pages"Foreign Exchange Management": Summer Project ONbhushanpawar5No ratings yet

- Cbjesspl 04Document9 pagesCbjesspl 04Drone MaxNo ratings yet

- What Is Corporate Banking PDFDocument2 pagesWhat Is Corporate Banking PDFSonakshi Behl100% (1)

- 7 Saving, Investment, and The Financial SystemDocument38 pages7 Saving, Investment, and The Financial SystemMUHAMMAD AWAIS100% (1)

- PAK Mock Exam-QFIC-SOLUTION-TOTAL-76Document191 pagesPAK Mock Exam-QFIC-SOLUTION-TOTAL-76cnmouldplasticNo ratings yet

- Unit 3 - StudentDocument9 pagesUnit 3 - Student050610221168No ratings yet