Professional Documents

Culture Documents

GNBCY AE SM Chap14 Differential Analysis The Key To Decision Making

Uploaded by

Man Tran Y Nhi0 ratings0% found this document useful (0 votes)

51 views5 pagesOriginal Title

GNBCY_AE_SM_Chap14_Differential_Analysis_The_Key_to_Decision_Making

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

51 views5 pagesGNBCY AE SM Chap14 Differential Analysis The Key To Decision Making

Uploaded by

Man Tran Y NhiCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

Chapter 14 Differential Analysis: The Key to Decision Making –

Solutions Manual Content

Chapter 14: Applying Excel

The completed worksheet is shown below.

© The McGraw-Hill Companies, Inc., 2015. All rights reserved.

1 Managerial Accounting, Asia Global Edition 2e

Chapter 14 Differential Analysis: The Key to Decision Making –

Solutions Manual Content

Chapter 14: Applying Excel (continued)

The completed worksheet, with formulas displayed, is shown below.

[Note: To display formulas in Excel, select “formulas” => select “Show

formulas” in cells instead of their calculated amounts. To display the

formulas in other versions of Excel, consult Excel Help.]

© The McGraw-Hill Companies, Inc., 2015. All rights reserved.

2 Managerial Accounting, Asia Global Edition 2e

Chapter 14 Differential Analysis: The Key to Decision Making –

Solutions Manual Content

Chapter 14: Applying Excel (continued)

1. With the change in the cost of further processing undyed course wool,

the result is:

With the reduction in the cost of further processing undyed coarse wool,

it is now profitable to process undyed coarse wool into dyed coarse

wool.

© The McGraw-Hill Companies, Inc., 2015. All rights reserved.

3 Managerial Accounting, Asia Global Edition 2e

Chapter 14 Differential Analysis: The Key to Decision Making –

Solutions Manual Content

Chapter 14: Applying Excel (continued)

2. With the revised data, the worksheet should look like this:

© The McGraw-Hill Companies, Inc., 2015. All rights reserved.

4 Managerial Accounting, Asia Global Edition 2e

Chapter 14 Differential Analysis: The Key to Decision Making –

Solutions Manual Content

Chapter 14: Applying Excel (continued)

a. The profit of the overall operation is now $30,000 if all intermediate

products are processed into final products.

b. The profits from further processing are shown below.

Coarse Fine Superfine

Wool Wool Wool

Profit (loss) from further processing.. $30,00 $40,00 $(10,000)

0 0

c. To maximize profit, the company should process undyed coarse wool

into dyed coarse wool and undyed fine wool into dyed fine wool.

However, undyed superfine wool should be sold as is rather than

processed into dyed superfine wool. If this plan is followed, the

overall profit of the company should be $40,000 as shown below:

Combined sales value

($180,000 + $210,000 + $90,000)......... $480,000

Less costs of producing the end products:

Cost of wool.......................................... $290,00

0

Cost of separation process..................... 40,000

Combined costs of dyeing

($50,000 + $60,000)......................... 110,000 440,000

Profit......................................................... $ 40,000

© The McGraw-Hill Companies, Inc., 2015. All rights reserved.

5 Managerial Accounting, Asia Global Edition 2e

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- GNBCY LN Chap01 Managerial Accounting and Business EnvironmentDocument18 pagesGNBCY LN Chap01 Managerial Accounting and Business EnvironmentMan Tran Y NhiNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- GNBCY LN Chap02 Cost ConceptsDocument18 pagesGNBCY LN Chap02 Cost ConceptsMan Tran Y NhiNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- GNBCY AE SM Chap13 Peformance Measurement in Decentralized OrganizationsDocument4 pagesGNBCY AE SM Chap13 Peformance Measurement in Decentralized OrganizationsMan Tran Y NhiNo ratings yet

- Chapter 10: Applying Excel: Chapter 10 Master Budgeting - Solutions Manual ContentDocument6 pagesChapter 10: Applying Excel: Chapter 10 Master Budgeting - Solutions Manual ContentMan Tran Y NhiNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Chapter 5: Applying ExcelDocument8 pagesChapter 5: Applying ExcelMan Tran Y NhiNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Chapter 7: Applying ExcelDocument8 pagesChapter 7: Applying ExcelMan Tran Y NhiNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- GNBCY AE SM Chap11 Flexible Budgets and Performance AnalysisDocument7 pagesGNBCY AE SM Chap11 Flexible Budgets and Performance AnalysisMan Tran Y NhiNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Chapter 13 Test Bank Romney AisDocument35 pagesChapter 13 Test Bank Romney AisMan Tran Y NhiNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Chapter 4: Applying Excel: Chapter 4 Cost-Volume-Profit Relationships - Solution Manual ContentDocument9 pagesChapter 4: Applying Excel: Chapter 4 Cost-Volume-Profit Relationships - Solution Manual ContentMan Tran Y NhiNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Solution Manual Accounting Information Systems 12th Edition by Romney and Steinbart Ch17Document24 pagesSolution Manual Accounting Information Systems 12th Edition by Romney and Steinbart Ch17Man Tran Y NhiNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Chapter 12: Applying Excel: Chapter 12 Standard Costs and Variances - Solutions Manual ContentDocument7 pagesChapter 12: Applying Excel: Chapter 12 Standard Costs and Variances - Solutions Manual ContentMan Tran Y NhiNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Test Bank Ais Accounting Information System Test BankDocument13 pagesTest Bank Ais Accounting Information System Test BankMan Tran Y NhiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Câu Hỏi: The best description of flexible budget isDocument10 pagesCâu Hỏi: The best description of flexible budget isMan Tran Y NhiNo ratings yet

- TinkerPlots Help PDFDocument104 pagesTinkerPlots Help PDFJames 23fNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- HP Scanjet N9120 (Service Manual) PDFDocument394 pagesHP Scanjet N9120 (Service Manual) PDFcamilohto80% (5)

- Solar-range-brochure-all-in-one-Gen 2Document8 pagesSolar-range-brochure-all-in-one-Gen 2sibasish patelNo ratings yet

- EXPERIMENT 1 - Bendo Marjorie P.Document5 pagesEXPERIMENT 1 - Bendo Marjorie P.Bendo Marjorie P.100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A First Etymological Dictionary of BasquDocument29 pagesA First Etymological Dictionary of BasquDaily MailNo ratings yet

- The Data Driven AuditDocument34 pagesThe Data Driven AuditMon compte Mon compteNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Code of Federal RegulationsDocument14 pagesCode of Federal RegulationsdiwolfieNo ratings yet

- Module 1 Supply Chain Management in Hospitality IndustryDocument39 pagesModule 1 Supply Chain Management in Hospitality IndustryHazelyn BiagNo ratings yet

- Afa Coursework ExamplesDocument6 pagesAfa Coursework Examplesiuhvgsvcf100% (2)

- The 5 Pivotal Paragraphs in A PaperDocument1 pageThe 5 Pivotal Paragraphs in A PaperFer Rivas NietoNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hemax-530 PDFDocument2 pagesHemax-530 PDFNice BennyNo ratings yet

- Finding Targets PDFDocument9 pagesFinding Targets PDFSteve TangNo ratings yet

- KARAKTERISTIK GEOTERMAL SUMUR EKSPLORASI AT-1, LAPANGAN PANAS BUMI ATADEI, KABUPATEN LEMBATA NTT. Kastiman Sitorus Dan Arif Munandar SUBDIT PANAS BUMIDocument7 pagesKARAKTERISTIK GEOTERMAL SUMUR EKSPLORASI AT-1, LAPANGAN PANAS BUMI ATADEI, KABUPATEN LEMBATA NTT. Kastiman Sitorus Dan Arif Munandar SUBDIT PANAS BUMIItTo MakinoNo ratings yet

- Per Dev Dlp-1-2 - 3 SelfDocument6 pagesPer Dev Dlp-1-2 - 3 SelfMonisa SocorinNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- SDOF SystemsDocument87 pagesSDOF SystemsAhmet TükenNo ratings yet

- Centrifugal Pumps: Turbo Machines Amit Pathania Roll No:09309 Mechanical EngineeringDocument4 pagesCentrifugal Pumps: Turbo Machines Amit Pathania Roll No:09309 Mechanical EngineeringAmit PathaniaNo ratings yet

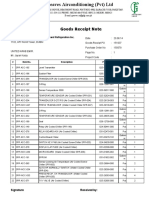

- Goods Receipt Note: Johnson Controls Air Conditioning and Refrigeration Inc. (YORK) DateDocument4 pagesGoods Receipt Note: Johnson Controls Air Conditioning and Refrigeration Inc. (YORK) DateSaad PathanNo ratings yet

- Shift Registers NotesDocument146 pagesShift Registers NotesRajat KumarNo ratings yet

- Powering Laser Diode SystemsDocument134 pagesPowering Laser Diode SystemsNick100% (1)

- (Ug, PG & PHD) Fellowship: Tih-Iot Chanakya GroupDocument3 pages(Ug, PG & PHD) Fellowship: Tih-Iot Chanakya GroupVijay M.MNo ratings yet

- CHASE SSE-EHD 1900-RLS LockedDocument2 pagesCHASE SSE-EHD 1900-RLS LockedMarcos RochaNo ratings yet

- 74 Series Logic ICsDocument6 pages74 Series Logic ICsanon-466841No ratings yet

- PCM 2.4l Turbo 5 de 5Document2 pagesPCM 2.4l Turbo 5 de 5Felix VelasquezNo ratings yet

- SemDocument583 pagesSemMaria SantosNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 00.diesel Engine Power Plant Design PDFDocument4 pages00.diesel Engine Power Plant Design PDFmardirad100% (1)

- Reviewer in PE&H 1st Quarter 18-19Document7 pagesReviewer in PE&H 1st Quarter 18-19rhex minasNo ratings yet

- Chomsky's Universal GrammarDocument4 pagesChomsky's Universal GrammarFina Felisa L. AlcudiaNo ratings yet

- Lab 3 Report Fins RedoDocument3 pagesLab 3 Report Fins RedoWestley GomezNo ratings yet

- Problems: C D y XDocument7 pagesProblems: C D y XBanana QNo ratings yet

- Bombas KMPDocument42 pagesBombas KMPReagrinca Ventas80% (5)