Professional Documents

Culture Documents

Accounts Guru Conclave - Sample Paper

Uploaded by

MitaliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts Guru Conclave - Sample Paper

Uploaded by

MitaliCopyright:

Available Formats

ACCOUNTS GURU’S CONCLAVE

MOCK SAMPLE PAPER (2021-22)

(Based on New Pattern)

DR. VIKAS VIJAY

International Author, Motivational Speaker,

Success Coach and Founder & CEO Full Marks

ACCOUNTANCY

Education Research Institute

B.Com (H), M.Com, B.Ed., C.WA (I),

CLASS - XII

M.Phil, P.hd., L.L.B, Master Trainer NLP

9810278915 (Whats App) (TERM 1)

TM

ACCOUNTS GURU’S MOCK SAMPLE PAPER

in association with RACHNA SAGAR PVT. LTD.

RU

Time allowed : 90 minutes Maximum Marks : 40

General Instructions :

1.

2.

3.

All questions are compulsory.

GU

This paper contains Multiple Choice Questions of 40 marks.

All parts of the question to be marked at its specific serial number.

4. No negative marking

S

5. The paper consists of two parts : Part 1 and Part 2 of 18 and 22 marks each.

NT

PART 1 (18 Marks)

(Fundamentals of Partnership, Change in Profit Sharing Ratio and

Admission of a New Partner)

U

1. The following question consist of two statements, one labelled as the ‘Assertion (A)’ and the other as

CO

‘Reason (R)’. You are to examine these two statements carefully and select the answers using the

code given below:

(a) Both A and R are individually true and R is the correct explanation of A

(b) Both A and R are individually true but R is not the correct explanation of A

AC

(c) A is true but R is false

(d) A is false but R is true

Assertion (A): In order to compensate a partner for contributing capital to the firm in excess of the

profit sharing ratio, firm pays such interest on partner’s capital.

Reason (R): Interest on capital is treated a charge against profit.

2. The profits for the previous three years are given below:

2018-2019 ` 23,000 (including an abnormal gain of ` 8,000)

2019-2020 ` 40,000 (after charging an abnormal loss of ` 12,000)

2020-2021 ` 38,000 (after writing off bad debts amounting to ` 6,000)

ACCOUNTS GURU’S MOCK SAMPLE PAPER | 1

Follow Us: Accounts GuruTM accountsguru_tm Accounts GuruTM accountsgurutm1

The amount of goodwill at two years purchase of the average profits of the last three years will be

___________.

(a) ` 65,000 (b) ` 70,000 (c) ` 68,000 (d) ` 35,000

3. A and B are partners sharing profits in the ratio of 2 : 3. Their Balance Sheet shows machinery at

` 4,00,000; stock at ` 80,000 and Debtors at ` 3,20,000.

C is admitted and new profit sharing ratio is agreed at 6 : 9 : 5. Machinery is revalued at ` 3,40,000 and

a provision is made for doubtful debts @ 2.5%.

A’s share in loss on revaluation amounted to ` 20,000.

Revalued value of stock will be:

(a) ` 98,000 (b) ` 1,00,000 (c) ` 60,000 (d) ` 62,000

4. Gagandeep, a partner advanced a loan of ` 60,000 to the firm on 30th November 2020. The firm

incurred a loss of ` 15,000 during the year ending 31st March, 2021. In the absence of partnership

TM

deed interest a loan allowed to Gagandeep will be

(a) ` 3,600 (b) ` 900 (c) ` 1,200 (d) ` 1,800

5. Vikas and Yogesh were in partnership sharing profits and losses in the ratio of 2 : 1. They admitted

Kunal as a new partner. Kunal brought ` 1,00,000 as his share of goodwill premium, which was entirely

RU

credited to Vikas’s capital account. On the date of admission, goodwill of the firm was valued at

` 5,00,000. The new profit sharing ratio of Vikas, Yogesh and Kunal will be:

(a) 7 : 5 : 3 (b) 7 : 3 : 5 (c) 5 : 7 : 3 (d) 3 : 5 : 7

GU

6. P, Q and R are partners in a firm. Net profit before appropriations is ` 7,87,000. Total interest on

capital and salary to the partners amounted to ` 40,000 and ` 75,000 respectively. P and Q are entitled

to receive a commission @ 6% each on net profit after taking into consideration interest on capital

salaries and all commission. Calculate commission payable to P and Q.

(a) ` 18,000 each (b) ` 40,320 each (c) ` 36,000 each (d) ` 24,000 each

S

7. Charvi and Vaanya were partner sharing Profit and Losses in 3 : 2 with affect from 1st April 2021, they

NT

decided to share future profits equally. On that date, following journal entry was passed by the firm:

Dr. Amount Cr. Amount

Date Particulars L.F.

(`) (`)

U

Charvi’s Current A/c Dr. 30,000

CO

To Vaanya’s Current A/c 30,000

Which of the following balance was existing in the books of the firm on the date of reconstitution?

(a) Contingency Reserve ` 3,00,000

AC

(b) Profit and Loss (Dr.) Balance ` 3,00,000

(c) Profit and Loss (Cr.) Balance ` 3,00,000

(d) Advertisement Suspense Account ` 2,00,000

8. The following question consist of two statements, one labelled as the ‘Assertion (A) ‘and the other as

‘Reason (R)’. You are to examine these two statements carefully and select the answers using the code

given below:

(a) Both A and R are individually true and R is the correct explanation of A

(b) Both A and R are individually true but R is not the correct explanation of A

(c) A is true but R is false

(d) A is false but R is true

2 | ACCOUNTS GURU’S MOCK SAMPLE PAPER

Follow Us: Accounts GuruTM accountsguru_tm Accounts GuruTM accountsgurutm1

Assertion (A): It is necessary to show the true position of the firm at the time of admission of a new

partner.

Reason (R): The gain or loss on revaluation which is transferred to all the partner’s capital account in

new profit sharing ratio.

9. The assets of the firm including Profit and Loss (Dr) balance of ` 10,000 are ` 90,000. The Liabilities

of the firm amounted to ` 40,000. The normal rate of return is 10% and the average profits of the

firm are ` 12,000. The value of goodwill as per capitalization of super profits is __________.

(a) ` 70,000 (b) ` 80,000 (c) ` 40,000 (d) ` 50,000

10. Sanyam, Charvi and Yuvraj are partners in a firm. Yuvraj has been given a guarantee of minimum profit

of ` 14,000 by the firm. Firm incurred a loss of ` 6,000 during the year. Capital accounts of Sanyam

and Charvi will be debited by:

(a) ` 20,000 each (b) ` 7,000 each (c) ` 3,000 each (d) ` 10,000 each

TM

Answer Question 11 to 18 on the basis of formation given below :

A and B share profits in the ratio of 3 : 1. Their Balance Sheet as on 31st March, 2021 was as under:

Amount Amount

RU

Liabilities Assets

(`) (`)

Capitals: A 60,000 Machinery 50,000

B 29,000 89,000 Goodwill 16,000

Workmen Compensation Fund

Creditors

GU9,000 Patent

24,000 Furniture

1,500 Sundry Debtors 30,000

6,000

10,000

Outstanding Expenses

Bills Payable 15,000 (–) Provision for bad debts (4,000) 26,000

S

Stock 25,000

NT

Cash 5,500

1,38,500 1,38,500

hey admitted C as partner on this date. New profit sharing ratio agreed to be 2 : 1 : 1. All partners agreed

T

U

that:

(a) C will bring ` 33,000 as Capital.

CO

(b) C will also bring ` 14,000 as his share of goodwill.

(c) There was a claim of ` 1,000 for workmen compensation.

(d) 5% of the creditors are untraceable and hence to be written back.

AC

(e) Outstanding expenses shown in Balance Sheet are to be reduced to ` 1,200.

(f) Accrued income of ` 1,000 is to be brought in books.

(g) Provision for bad debts was found in excess by ` 1,500.

Answer the following questions:

11. Creditors of ` 1,200 will be:

(a) Debited to Revaluation A/c

(b) Credited to Revaluation A/c

(c) Shown on Liability side of the Balance Sheet

(d) Shown on Asset side of the Balance Sheet

ACCOUNTS GURU’S MOCK SAMPLE PAPER | 3

Follow Us: Accounts GuruTM accountsguru_tm Accounts GuruTM accountsgurutm1

12. Accrued income of ` 1,000 to be:

(a) Debited to Revaluation A/c

(b) Credited to Revaluation A/c

(c) Shown on Liability side of the Balance Sheet

(d) Not recorded anywhere

13. Excess of Provision for Doubtful Debts of ` 1,500 will be:

(a) Credited to Revaluation A/c

(b) Debited to Revaluation A/c

(c) Shown on Liability side of the Balance Sheet

(d) Not recorded anywhere

14. What journal entry will be passed for Workmen’s Compensation Fund?

(a) Dr. Workmen’s Compensation Fund ` 9,000, Cr. Claim for Workmen’s Compensation ` 1,000; Cr. A’s

TM

Capital A/c ` 6,000; Cr. B’s Capital A/c ` 2,000

(b) Dr. Workmen’s Compensation Fund ` 9,000; Cr. A’s Capital A/c ` 6,000; Cr. B’s Capital A/c ` 3,000

(c) Dr. A’s Capital A/c ` 6,000; Dr. B’s Capital A/c ` 2,000; Dr. Claim for Workmen’s Compensation

` 1,000; Cr. Workmen’s Compensation Reserve A/c ` 9,000

RU

(d) Dr. Revaluation ` 1,000; Cr. Claim for Workmen’s Compensation ` 1,000

15. What journal entry is passed for premium for goodwill?

(a) Dr. Premium for Goodwill A/c ` 14,000; Cr. A’s Capital A/c ` 10,500; Cr. B’s Capital A/c

` 3,500 GU

(b) Dr. Premium for Goodwill A/c ` 14,000; Cr. B’s Capital A/c ` 14,000

(c) Dr. Premium for Goodwill A/c ` 14,000; Cr. A’s Capital A/c ` 14,000

(d) Dr. Premium for Goodwill A/c ` 14,000; Cr. Revaluation A/c ` 14,000

S

16. Profit (gain) on Revaluation of Assets and Reassessment of Liabilities is:

NT

(a) ` 2,500 (b) ` 3,000 (c) ` 3,700 (d) ` 4,000

17. The new Capital Balances of all the partners will be:

(a) A – ` 71,000, B – ` 28,000, C – ` 33,000 (b) A – ` 83,000, B – ` 32,000, C – ` 33,000

U

(c) A – ` 69,000, B – ` 28,000, C – ` 33,000 (d) A – ` 69,000, B – ` 32,000, C – ` 33,000

18. Cash balance would appear in the new balance sheet at:

CO

(a) ` 19,500 (b) ` 38,500 (c) ` 52,500 (d) ` 47,000

PART 2 (22 Marks)

AC

(Accounting for Share Capital,

Financial Statements of a Company and Ratio Analysis)

19. Debit Balance of Profit and Loss account is shown under the sub head _________ of the Balance Sheet

as per Revised Schedule III of Companies Act, 2013.

(a) Other Current Assests (b) Reserves and Surplus

(c) Other Current Liabilities (d) Long-term Provisions

20. Sale of scrap is a part of ____________ .

(a) Other income (b) Other expenses

(c) Finance of cost (d) Revenue from operations

4 | ACCOUNTS GURU’S MOCK SAMPLE PAPER

Follow Us: Accounts GuruTM accountsguru_tm Accounts GuruTM accountsgurutm1

21. Which of the following is not a limitation of analysis of financial statements?

(a) Window Dressing (b) Price level changes ignored

(c) Subjectivity (d) Intra-firm comparison possible

22. Under which of the following headings / sub-headings, calls-in-advance will be presented in the Balance

Sheet of a company as per Schedule III, Part I of the Companies Act, 2013?

(a) Current Liabilities

(b) Share Capital

(c) Share Application Money Pending Allotment

(d) Reserves and Surplus

23. The following question consist of two statements, one labelled as the ‘Assertion (A) ‘and the other as

‘Reason (R)’. You are to examine these two statements carefully and select the answers using the code

given below:

(a) Both A and R are individually true and R is the correct explanation of A

TM

(b) Both A and R are individually true but R is not the correct explanation of A

(c) A is true but R is false

(d) A is false but R is true

RU

Assertion (A): Forfeiture of share refers to the cancellation or termination of membership of a share

holder by taking away the shares and rights of membership.

Reason (R): Forfeited shares can be reissued at a discount.

24. The minimum share application money is:

(a) ` 5 per share

(c) 10% of the nominal value of shares

GU (b) 5% of nominal value of shares

(d) 10% of the nominal value of shares

25. H Ltd. had allotted 20,000 shares to the applicants of 28,000 shares on pro-rata basis. The amount

payable on application was ` 2 per share. S applied for 840 shares. The number of shares allotted and

S

the amount carried forward for adjustment against allotment money due from S will be:

NT

(a) 120 shares; ` 240 (b) 680 shares; ` 320 (c) 640 shares; ` 400 (d) 600 shares, ` 480

26. 250 shares of ` 20 each on which first and final call of ` 6 per share is not paid is forfeited. Out of these,

200 shares are reissued for ` 14 per share fully paid up. The amount transferred to capital reserve

U

will be:

(a) ` 1,800 (b) ` 1,200 (c) ` 2,800 (d) ` 1,600

CO

27. Which of the following transactions will increase the Debt of Equity ratio, which is 1 : 2?

(a) Issue of shares for cash (b) Redemption of Preference shares

(c) Redemption of Debentures (d) Conversion of Debentures into Shares

AC

28. The following questions consist of two statements, one labelled as the ‘Assertion (A)’ and the other as

‘Reason (R)’. You are to examine these two statements carefully and select the answers using the code

given below:

(a) Both A and R are individually true and R is the correct explanation of A

(b) Both A and R are individually true but R is not the correct explanation of A

(c) A is true but R is false

(d) A is false but R is true

Assertion (A): The limitations of financial statements also form the limitations of the ratio analysis.

Reason (R): Since the ratios are derived from the financial statements, any weakness in the original

financial statements will also creep in the derived analysis in the form of Accounting Ratios.

ACCOUNTS GURU’S MOCK SAMPLE PAPER | 5

Follow Us: Accounts GuruTM accountsguru_tm Accounts GuruTM accountsgurutm1

On the basis of the information given below answer the following questions (Q. 29 to 32)

Accounts Guru Ltd. want to analyse its liquidity position along with assessment of Inventory position from

the given information:

Inventory Turnover Ratio : 4 times,

Inventory in the beginning was ` 20,000 less than Inventory at the end,

Revenue from Operations ` 6,00,000, Current Liabilities ` 60,000.

Gross Profit Ratio 25%, Quick Ratio 0.75 : 1

Answer the following questions:

29. State the amount of Cost of Revenue from Operations.

(a) ` 4,50,000 (b) ` 4,90,000 (c) ` 4,80,000 (d) ` 3,50,000

30. State the amount of average inventory.

TM

(a) ` 1,25,000 (b) ` 1,12,500 (c) ` 2,50,000 (d) ` 1,52,000

31. State the amount of closing inventory.

(a) ` 1,12,000 (b) ` 1,12,500 (c) ` 1,67,500 (d) ` 1,22,500

RU

32. State the current ratio of Accounts Guru Ltd.

(a) 2.4:1 (b) 2.5:1 (c) 2.79:1 (d) 2.6:1

On the basis of the information given below answer the following questions (Q. 33 to 40)

GU

Ranvijay Ltd. invited applications for issuing 1,00,000 shares of ` 10 each at a premium of ` 2 per share.

Amount per share was payable as follows :

On Application — ` 4 (including premium ` 1)

S

On Allotment — ` 4 (including premium ` 1)

On First and Final Call — Balance

NT

Applications were received for 1,50,000 shares and allotment was made to the applicants as follows:

(i) Applicants of 80,000 shares were allotted 60,000 shares.

U

(ii) Applicants of 50,000 shares were allotted 40,000 shares.

(iii) No shares were allotted to the remaining applicants and their application money was returned.

CO

Yuraj, who belonged to category (ii) and who had applied for 5,000 shares failed to pay the allotment and

call money. His shares were forfeited. Later, half of Yuraj’s forfeited shares were reissued @ ` 18 per share

as fully paid up.

AC

Answer the following questions:

33. State the amount of excess application money refunded to the applicants.

(a) ` 2,00,000 (b) ` 80,000 (c) ` 40,000 (d) ` 1,00,000

34. State the excess application money being adjusted to share allotment account to whom pro-rata allotment

has been made.

(a) ` 2,00,000 (b) ` 80,000 (c) ` 40,000 (d) ` 1,20,000

35. State the amount of calls-in-arrears at the time of receipt of allotment money?

(a) ` 12,000 (b) ` 16,000 (c) ` 18,000 (d) ` 24,000

6 | ACCOUNTS GURU’S MOCK SAMPLE PAPER

Follow Us: Accounts GuruTM accountsguru_tm Accounts GuruTM accountsgurutm1

36. The amount of calls-in-arrear at the time of receipt of first call is:

(a) ` 12,000 (b) ` 16,000 (c) ` 18,000 (d) ` 24,000

37. The amount forfeited on 4,000 shares is:

(a) ` 12,000 (b) ` 14,000 (c) ` 16,000 (d) ` 18,000

38. At the time of forfeiture of shares, Securities Premium Reserve Account will be debited with:

(a) ` 4,000 (b) ` 6,000 (c) ` 8,000 (d) ` 10,000

39. State the amount received at the time of reissue of forfeited shares.

(a) ` 20,000 (b) ` 16,000 (c) ` 36,000 (d) ` 30,000

40. State the amount to be transferred to Capital Reserve Account.

(a) ` 6,000 (b) ` 8,000 (c) ` 3,000 (d) ` 4,000

ANSWERS

TM

1. (c) 2. (b) 3. (a) 4. (c) 5. (a)

6. (c) 7. (b) 8. (c) 9. (b) 10. (d)

11. (b) 12. (b) 13. (a) 14. (a) 15. (c)

RU

16. (d) 17. (a) 18. (c) 19. (b) 20. (d)

21. (d) 22. (a) 23. (b) 24. (b) 25. (d)

26. (d)

30. (b) ` 1,12,500

35. (a)

27. (b)

GU

28. (a)

31. (d) ` 1,22,500 32. (c) 2.79:1

36. (b) 37. (c)

29. (a) ` 4,50,000

33. (b)

38. (a)

34. (d)

39. (c)

40. (b)

S

U NT

CO

AC

ACCOUNTS GURU’S MOCK SAMPLE PAPER | 7

Follow Us: Accounts GuruTM accountsguru_tm Accounts GuruTM accountsgurutm1

You might also like

- Farm LeaseDocument5 pagesFarm LeaseRocketLawyer100% (1)

- ERP and Oracle E-Business Suite ConceptsDocument73 pagesERP and Oracle E-Business Suite ConceptsAlaa Mostafa100% (1)

- Paper 2 Accountancy 2 2pb QP Set 2Document9 pagesPaper 2 Accountancy 2 2pb QP Set 2Harini NarayananNo ratings yet

- QP AccountancyDocument130 pagesQP AccountancyTûshar ThakúrNo ratings yet

- Selenium Question and AnswerDocument35 pagesSelenium Question and AnswerManas Jha50% (2)

- Stanley Diamond Toward A Marxist AnthropologyDocument504 pagesStanley Diamond Toward A Marxist AnthropologyZachNo ratings yet

- Accountancy: Mock PaperDocument24 pagesAccountancy: Mock PaperSuman Bala0% (1)

- Misuse of InternetDocument22 pagesMisuse of InternetPushparaj100% (1)

- Maluno Integrated School: Action Plan On Wins ProgramDocument1 pageMaluno Integrated School: Action Plan On Wins ProgramSherlymae Alejandro Avelino100% (2)

- Gas Extra Inc LTD.-MT103 MD-PGL Draft-WbDocument10 pagesGas Extra Inc LTD.-MT103 MD-PGL Draft-WbwayneNo ratings yet

- 4 5827923419810760428Document250 pages4 5827923419810760428T M Santhosh KumarNo ratings yet

- Vehicle To Vehicle V2V Communication Scope Importa PDFDocument13 pagesVehicle To Vehicle V2V Communication Scope Importa PDFvahidinkormanNo ratings yet

- Cbleacpu 01Document10 pagesCbleacpu 01tripatjotkaur757No ratings yet

- AccountancyDocument183 pagesAccountancyAnita YadavNo ratings yet

- XII - Accounts - Sample Paper-1Document27 pagesXII - Accounts - Sample Paper-1zainab.xf77No ratings yet

- Question Banl XII ACC 2021 - 2022Document12 pagesQuestion Banl XII ACC 2021 - 2022aes event100% (1)

- Practice Accountancy: Time: 3 Hours. M.Mark: 80 General InstructionsDocument13 pagesPractice Accountancy: Time: 3 Hours. M.Mark: 80 General InstructionsTûshar ThakúrNo ratings yet

- Pre-Board Papers With MS AccountancyDocument183 pagesPre-Board Papers With MS Accountancydevanshitandon06No ratings yet

- 12 - Q. Paper - Exam Code FTEE-2005 - 22 - Class - K8 - AccountancyDocument14 pages12 - Q. Paper - Exam Code FTEE-2005 - 22 - Class - K8 - AccountancyShafali Aggarwal TanejaNo ratings yet

- Cbleacpu 02Document10 pagesCbleacpu 02mehtayogesh476No ratings yet

- Accountancy SQPDocument15 pagesAccountancy SQPidealNo ratings yet

- Accountancy: Amount (?)Document4 pagesAccountancy: Amount (?)Thulsi JayadevNo ratings yet

- Accountancy FinalDocument13 pagesAccountancy FinalVikram KaushalNo ratings yet

- Premium Mock 03Document13 pagesPremium Mock 03Rahul MajumdarNo ratings yet

- 12acc03 QPDocument14 pages12acc03 QPSandesh kumar SharmaNo ratings yet

- Wa0045.Document7 pagesWa0045.Pieck AckermannNo ratings yet

- 055 AccountancyDocument15 pages055 AccountancyHari prakarsh NimiNo ratings yet

- 2021 QP.3 Cbse PatterDocument12 pages2021 QP.3 Cbse PatterabiNo ratings yet

- Accountancy 12 Set 2 DS2Document24 pagesAccountancy 12 Set 2 DS2damanpreet152004No ratings yet

- ACC 12 Set - 1 Pre-Board 1 (2023-24)Document9 pagesACC 12 Set - 1 Pre-Board 1 (2023-24)krishchandnani450000No ratings yet

- 055 AccountancyDocument14 pages055 AccountancyHari prakarsh NimiNo ratings yet

- 12th AccountancyDocument34 pages12th AccountancyDYNAMIC VERMA100% (1)

- Half Yearly XII AccDocument7 pagesHalf Yearly XII AccJahnavi GoelNo ratings yet

- Pre Board II FfgsDocument15 pagesPre Board II Ffgslibrarian.dewasNo ratings yet

- Accountancy-SQP 2023Document13 pagesAccountancy-SQP 2023Manogya GondelaNo ratings yet

- Sample Paper 3Document16 pagesSample Paper 3TrostingNo ratings yet

- Sample Paper 2Document15 pagesSample Paper 2TrostingNo ratings yet

- Xii Accountancy QP PB 2 Set B 1Document10 pagesXii Accountancy QP PB 2 Set B 1himankagarwal478No ratings yet

- Model Test Paper-1Document24 pagesModel Test Paper-1Rupali RoyNo ratings yet

- Accountancy Term-2 MVP 2023-24Document7 pagesAccountancy Term-2 MVP 2023-24Cp GpNo ratings yet

- Xii Accountancy QP PB 2 Set BDocument10 pagesXii Accountancy QP PB 2 Set Bbk7232642No ratings yet

- Accountancy QPDocument11 pagesAccountancy QPTûshar Thakúr0% (1)

- Cbleacpu 02Document10 pagesCbleacpu 02tripatjotkaur757No ratings yet

- Mock Test - 2Document11 pagesMock Test - 2Riddhi SharmaNo ratings yet

- Tls Cl-Xii Accountancy P.T 3 Q.P 2021-22Document13 pagesTls Cl-Xii Accountancy P.T 3 Q.P 2021-22Priyank DhadhiNo ratings yet

- Accountancy Sample PaperDocument13 pagesAccountancy Sample PaperFatima IslamNo ratings yet

- Class Xii Accountancy Practice AssignmentDocument6 pagesClass Xii Accountancy Practice AssignmentTûshar ThakúrNo ratings yet

- Change in PSR Test SPCC 23-24 AccountsDocument4 pagesChange in PSR Test SPCC 23-24 AccountsShrishti UniyalNo ratings yet

- SQP 09 AccountancyDocument8 pagesSQP 09 AccountancyacguptaclassesNo ratings yet

- Partnership Test YoutubeDocument14 pagesPartnership Test YoutubeRiddhi GuptaNo ratings yet

- MLM Xii Accountancy 22-23 PDFDocument34 pagesMLM Xii Accountancy 22-23 PDFayush5sharma805No ratings yet

- XII Accounts Pre-Board 1 Set BDocument9 pagesXII Accounts Pre-Board 1 Set BEkam KaurNo ratings yet

- De CV62 S NX QSB Tetgkk WaDocument24 pagesDe CV62 S NX QSB Tetgkk WaShabanaNo ratings yet

- Accountancy SQPDocument13 pagesAccountancy SQPDeepak Kr. VishwakarmaNo ratings yet

- Monthly Test Acc - XiiDocument4 pagesMonthly Test Acc - Xiiramandeep kaurNo ratings yet

- Accountancy-SQP 23-24Document12 pagesAccountancy-SQP 23-24Ashutosh SinghNo ratings yet

- Partnership - Change in PSR - DPP 05 (Of Lecture 07) - (Kautilya)Document11 pagesPartnership - Change in PSR - DPP 05 (Of Lecture 07) - (Kautilya)Shreyash JhaNo ratings yet

- QP Accountancy XIIDocument9 pagesQP Accountancy XIISahil RaikwarNo ratings yet

- Accountancy QP Set-2Document15 pagesAccountancy QP Set-2ABDUL RAHMAN 11BNo ratings yet

- Sample Paper Class 12Document13 pagesSample Paper Class 12akshatbarnwal124No ratings yet

- PRE - BOARD - 2 (2023-2024) : Grade: 12 Marks: 80 Subject: Accountancy Time: 3HRS General InstructionsDocument12 pagesPRE - BOARD - 2 (2023-2024) : Grade: 12 Marks: 80 Subject: Accountancy Time: 3HRS General InstructionsKaustav DasNo ratings yet

- Accountancy: Goodwill: Nature and Valuation 1:00 HOURS Maximum Marks: 20Document3 pagesAccountancy: Goodwill: Nature and Valuation 1:00 HOURS Maximum Marks: 20PRABHAT JOSHINo ratings yet

- Class 12 AMU Model PapersDocument77 pagesClass 12 AMU Model PapersMohammad FarazNo ratings yet

- Sample Paperpre Board II Acct 2324-2Document10 pagesSample Paperpre Board II Acct 2324-2kanakchauhan206No ratings yet

- EntrepreneurshipDocument5 pagesEntrepreneurshipkj89yjzn56No ratings yet

- Accountancy Ms CT Xii Set 1 B 2023Document17 pagesAccountancy Ms CT Xii Set 1 B 2023mendesg4625No ratings yet

- Wa0025.Document8 pagesWa0025.Pieck AckermannNo ratings yet

- 12 AccDocument11 pages12 AccShail CareerNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Keec1gl PDFDocument9 pagesKeec1gl PDFneha bagrechaNo ratings yet

- Nadkarni Classes: F.Y.J.C. Marks: 50 Maths MCQ Time: 1 HoursDocument5 pagesNadkarni Classes: F.Y.J.C. Marks: 50 Maths MCQ Time: 1 HoursMitaliNo ratings yet

- Class: Xii English Core (301) Time: 1 HrsDocument3 pagesClass: Xii English Core (301) Time: 1 HrsMitaliNo ratings yet

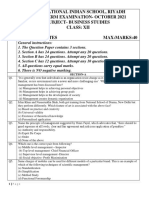

- International Indian School, Riyadh First Term Examination-October 2021 Subject - Business Studies Class: Xii Time:90 Minutes Max:Marks:40Document9 pagesInternational Indian School, Riyadh First Term Examination-October 2021 Subject - Business Studies Class: Xii Time:90 Minutes Max:Marks:40MitaliNo ratings yet

- Skott Marsi Art Basel Sponsorship DeckDocument11 pagesSkott Marsi Art Basel Sponsorship DeckANTHONY JACQUETTENo ratings yet

- Chapter 09 SolutionsDocument43 pagesChapter 09 SolutionsDwightLidstromNo ratings yet

- FBS Ii enDocument10 pagesFBS Ii enunsalNo ratings yet

- Mulberry VarietiesDocument24 pagesMulberry VarietiesKUNTAMALLA SUJATHANo ratings yet

- Truman Show EssayDocument3 pagesTruman Show EssayJess FongNo ratings yet

- Afirstlook PPT 11 22Document20 pagesAfirstlook PPT 11 22nickpho21No ratings yet

- Enidine Wire Rope IsolatorsDocument52 pagesEnidine Wire Rope IsolatorsJocaNo ratings yet

- DWC Ordering InformationDocument15 pagesDWC Ordering InformationbalaNo ratings yet

- Improving Control Valve PerformanceDocument5 pagesImproving Control Valve PerformanceBramJanssen76No ratings yet

- Purchase Invoicing Guide AuDocument17 pagesPurchase Invoicing Guide AuYash VasudevaNo ratings yet

- 01 04 2018Document55 pages01 04 2018sagarNo ratings yet

- Creating A New Silk UI ApplicationDocument2 pagesCreating A New Silk UI Applicationtsultim bhutiaNo ratings yet

- Manipulatives/Interactive Media (Lecture B) : By: John T Franco 11 Humss-3Document25 pagesManipulatives/Interactive Media (Lecture B) : By: John T Franco 11 Humss-3tyron plandesNo ratings yet

- Asme B31.8Document8 pagesAsme B31.8deepndeepsi100% (1)

- Persons Digests For 090613Document10 pagesPersons Digests For 090613pyriadNo ratings yet

- Fridge Zanussi ZK2411VT5 ManualDocument14 pagesFridge Zanussi ZK2411VT5 ManualDragos MoscuNo ratings yet

- Stephen Legaspi CsaDocument15 pagesStephen Legaspi CsaKhristian Joshua G. JuradoNo ratings yet

- Practice Questions SheetDocument4 pagesPractice Questions Sheetsaif hasanNo ratings yet

- S.No Company Name Location: Executive Packers and MoversDocument3 pagesS.No Company Name Location: Executive Packers and MoversAli KhanNo ratings yet

- Genose Massal D - 6 Juli 2021Document102 pagesGenose Massal D - 6 Juli 2021Phyto LianoNo ratings yet

- TechRef SoftstarterDocument11 pagesTechRef SoftstarterCesarNo ratings yet