Professional Documents

Culture Documents

Agency Problems and Divided Policies Around The World

Agency Problems and Divided Policies Around The World

Uploaded by

Safi UllahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Agency Problems and Divided Policies Around The World

Agency Problems and Divided Policies Around The World

Uploaded by

Safi UllahCopyright:

Available Formats

Summary of

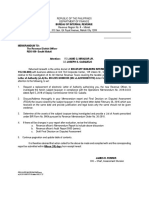

Agency Problems and Divided Policies around the World

This paper practices a sample of firms from 33 countries around the world to lean-to bright on

divided policies of big corporations. We proceeds benefit of unlike legal protection of minority

shareholder crossways these countries to equate divided policies of companies whose minority

shareholder face different risk of expropriation of their wealth by corporate insider. We use this

cross-sectional variation to survey the agency approach to divided policy.

We differentiate two substitute agency model of dividends. In the first model divided are

outcome of operative legal protection shareholders, which aid minority shareholder on the way

to extract divided payment from corporate insiders. In the second divided are supernumerary

for operative legal protection, which remains enable for firms in unguarded legal environment

to found reputation for good treatment of investors through divided policies.

Our data propose that the agency approach is highly applicable to a considerate of corporate

divided policies around the world. More specifically we find unfailing upkeep for the outcome

agency model of divided. Firms functioning in the countries with improved protection of

minority shareholders pay higher divided. Furthermore in these counties fast growth firms pay

lower divided than slow growth firms stable with the idea that legally protected shareholder

are enthusiastic to wait for divided when investment opportunities are good. On the other

hand, poorly protected shareholders seem to take whatever divided they can get, regardless of

investment opportunity. This apparent misallocation of investment is presumably part of the

agency cost of poor legal protection.

In our examination, we discovery no decision evidence on the effect of taxes on divided

policies. Nor can we practice our data to consider the significance of divided signaling. In fact,

our results are contain with the idea that, on the margin, divided policies of firms may transport

information to some investors. Despite the conceivable relevance of alternative theories, firms

give the impression to pay out cash o investor because opportunities to good deal or disinvests

it are in part some degree of by law and because minority shareholder have an adequate

amount of power to quotation it. In this respect, the superiority of legal protection investors is

as essential for divided polices as it is for other fundamental corporate pronouncements.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Social Work in Canada An Introduction Third EditionDocument25 pagesSocial Work in Canada An Introduction Third EditionTimothy MolloyNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Construction Contract PC-1 1998 PDFDocument46 pagesConstruction Contract PC-1 1998 PDFXueming FengNo ratings yet

- Chapter 2 by Farooq and Irfan MSMS Fall Semester 1 (2021-2023)Document14 pagesChapter 2 by Farooq and Irfan MSMS Fall Semester 1 (2021-2023)Safi UllahNo ratings yet

- 2022 - 05 - Bad and Doubtful DebtsDocument39 pages2022 - 05 - Bad and Doubtful DebtsSafi UllahNo ratings yet

- 2022 06 DepreciationDocument46 pages2022 06 DepreciationSafi UllahNo ratings yet

- 2022 - 04 - Accruals and PrepaymentsDocument40 pages2022 - 04 - Accruals and PrepaymentsSafi Ullah100% (1)

- Law and Finance PaperDocument80 pagesLaw and Finance PaperSafi UllahNo ratings yet

- Accounting Fundamentals: in This ChapterDocument37 pagesAccounting Fundamentals: in This ChapterSafi UllahNo ratings yet

- Books of Prime Entry: in This ChapterDocument40 pagesBooks of Prime Entry: in This ChapterSafi UllahNo ratings yet

- The Business Vision and Mission From Book: Strategic Management (Concept and Cases) 14 Edition Author Dr. FredDocument10 pagesThe Business Vision and Mission From Book: Strategic Management (Concept and Cases) 14 Edition Author Dr. FredSafi UllahNo ratings yet

- Ra 9262Document35 pagesRa 9262Moon Beams100% (3)

- Dominos Pizza Case Study PDFDocument9 pagesDominos Pizza Case Study PDFAmr El-Refaey100% (2)

- Mr. Jinnah SpeechDocument2 pagesMr. Jinnah SpeechRohanNo ratings yet

- Participant's Handbook 2020-22 PDFDocument59 pagesParticipant's Handbook 2020-22 PDFvishNo ratings yet

- What Impact Did Anti-Ragging Laws Have On Ragging in Colleges in India in Last 5 YearsDocument7 pagesWhat Impact Did Anti-Ragging Laws Have On Ragging in Colleges in India in Last 5 YearsIshan BhanderiyaNo ratings yet

- Animals and Human Language: Dr. Adel ThameryDocument13 pagesAnimals and Human Language: Dr. Adel Thameryواثق جليل عودة حماديNo ratings yet

- Youth Formation Program Monitoring ChecklistDocument3 pagesYouth Formation Program Monitoring ChecklistGuldam MohammadNo ratings yet

- What Is Meant by Price Elasticity of Demand? (2marks) : Perfumes, Hair-Styles, Cell-Phones and Household AppliancesDocument35 pagesWhat Is Meant by Price Elasticity of Demand? (2marks) : Perfumes, Hair-Styles, Cell-Phones and Household AppliancesAnarina KaulitzNo ratings yet

- DANCEDocument8 pagesDANCEKimberly M SalvadorNo ratings yet

- Township of Scott's Supplemental Letter Brief, Knick v. Township of Scott, No. 17-647 (Nov. 30, 2018)Document10 pagesTownship of Scott's Supplemental Letter Brief, Knick v. Township of Scott, No. 17-647 (Nov. 30, 2018)RHTNo ratings yet

- Fdda RTD 2.21.19Document2 pagesFdda RTD 2.21.19Addy GuinalNo ratings yet

- Focus Questions:: - What Is School Culture, and How Does It Affect Leading, Teaching, and Learning?Document47 pagesFocus Questions:: - What Is School Culture, and How Does It Affect Leading, Teaching, and Learning?Joela CastilNo ratings yet

- 10 Principles of EconomicsDocument2 pages10 Principles of EconomicsEmmanuella Affiong EtukNo ratings yet

- Datamars - Identification Package Polymer - e - EuDocument2 pagesDatamars - Identification Package Polymer - e - Eumel CidNo ratings yet

- The Constitutional Ban On Land Acquisition by Aliens PDFDocument16 pagesThe Constitutional Ban On Land Acquisition by Aliens PDFPatrick ManaloNo ratings yet

- PECSDocument19 pagesPECSJerson Esguerra Rodriguez100% (2)

- Mtech Ranklist4!7!2015Document164 pagesMtech Ranklist4!7!2015Arjun T PNo ratings yet

- MaarleDocument36 pagesMaarleapi-317411236100% (1)

- Mohamed Ahmed Mohamed Ahmed Abdelfattah Abdelfattah: Real Estate ConsultantDocument3 pagesMohamed Ahmed Mohamed Ahmed Abdelfattah Abdelfattah: Real Estate ConsultantMido MidoNo ratings yet

- Final COMMON BARRIERS Glen MendezDocument85 pagesFinal COMMON BARRIERS Glen MendezNikki Jean HonaNo ratings yet

- Kachru's Model ReflectionDocument2 pagesKachru's Model ReflectionHerford Rei GuibangguibangNo ratings yet

- 70 20 10 PrincipleDocument8 pages70 20 10 PrincipleYogesh BhatNo ratings yet

- Unit 2: Creativity, Innovation and Technology EntrepreneurshipDocument33 pagesUnit 2: Creativity, Innovation and Technology Entrepreneurship000No ratings yet

- Energen PT MayoraDocument6 pagesEnergen PT MayoraNur IndahNo ratings yet

- Beneficial Owner FormDocument1 pageBeneficial Owner FormrichlogNo ratings yet

- 6 - Vogt, Eric - Art & Architecture of Powerful QuestionsDocument7 pages6 - Vogt, Eric - Art & Architecture of Powerful QuestionsSHUBHAM_93No ratings yet

- CCPS-edTPA Lesson Plan Day 1 EditDocument5 pagesCCPS-edTPA Lesson Plan Day 1 EditMaryum NisarNo ratings yet

- Exams Catalunya Test Day Photograph Authorisation Form: Candidate Registration Form For Cambridge English ExamDocument1 pageExams Catalunya Test Day Photograph Authorisation Form: Candidate Registration Form For Cambridge English ExamhannahNo ratings yet