Professional Documents

Culture Documents

4.1.1 Ratio of Interest Income To Total Assets: 4.1 Analysis

Uploaded by

Golam Samdanee TaneemOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4.1.1 Ratio of Interest Income To Total Assets: 4.1 Analysis

Uploaded by

Golam Samdanee TaneemCopyright:

Available Formats

4.

1 Analysis

4.1.1 Ratio of Interest Income to Total Assets:

The "Interest income to total assets ratio" reflect banks' reliance

on interest from bank lending as a source of funding. A high ratio is a good

indicator (but a too high ratio is not necessarily a good indicator), while a

low ratio might indicate that banks rely on non-interest source of funds.

(Source: intellectualresearch.com)

Interest Earned

Interest Income to Total Assets = × 100

Total Assests

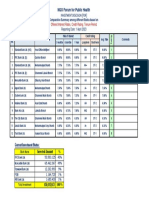

Table 4.1.1: Ratio of Interest Income to Total Assets:

Bank/ Year 2017 2018 2019

Sonali Bank Limited 2.20 2.50 2.80

Rupali Bank Limited 6.10 5.14 5.32

Agrani Bank Limited 5.89 6.59 6.20

Janata Bank Limited 5.02 3.98 3.72

Source: Annual Reports of SBL, RBL, ABL, JBL, BBL and BDBL (2017-2019)

Graphical Presentation:

Ratio of Interest Income to Total Assests

6.59

7 6.1 6.2

5.89

6 5.14 5.32 5.02

5 3.98

3.72

4

2.8

2.5

3 2.2

2

1

0

Sonali Bank Limited Rupali Bank Agrani Bank Janata Bank

Limited Limited Limited

2017 2018 2019

Chart 4.1.1: Ratio of Interest Income to Total Assets

Interpretation:

The presenting graph clarified the highest the higher this ratio the better indicating the bank is

earning a high interest rate or the proportion of interest earning assets (loans) to total assets is

high or both of these effects. This ratio showing that, Agrani Bank earned a highest interest rate

in 2008. In the year of 2007, Rupali bank earned highest interest income than the other

commercial banks. This ratio refers the lowest interest rate earner as Sonali Bank Limited from

the year of 2017 to 2019. Too high of interest income to total assets ratio would be attributed to

the high interest income (rate) derived from high risk loans (subject to default). Also, if the high

interest income is being generated by too high a proportion of assets in loans that could stem

from lack of liquidity. That is, the bank should have a reasonable amount of cash and cash like

securities (easily converted to cash such as Treasury bills) as part of their total assets to meet

withdrawal needs. If the interest income to total assets ratio is too low that usually is from

earning low interest income (rate) and/or too little lending.

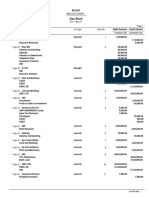

4.1.2 Ratio of Securities of Total Assets:

(Marketable Securities+Cash)

Ratio of Securities of Total Assets =

Current Liabilities

Bank/ Year 2017 2018 2019

Sonali Bank Limited 0.11 0.13 0.08

Rupali Bank Limited 0.14 0.10 0.29

Agrani Bank Limited 0.37 0.28 0.57

Janata Bank Limited 1.45 0.07 6.68

4.1.2 Securities of Total Assets

Securities of Total Assets

6.68

7

6

5

4

3 1.45

2 0.370.280.57

0.110.130.08 0.14 0.1 0.29 0.07

1

0

Sonali Bank Rupali Bank Agrani Bank Janata Bank

Limited Limited Limited Limited

2017 2018 2019

The cash asset ratio is the current value of marketable securities and cash,

divided by the company's current liabilities. Also known as the cash ratio, the

cash asset ratio compares the amount of highly liquid assets (such as cash and

marketable securities) to the amount of short-term liabilities. This figure is used to

measure a firm's liquidity or its ability to pay its short-term obligations.

4.1.3 Ratio of Earning Assets to Total Assets:

Avg . Earning Assests

Ratio of Earning Assets to Total Assets =

Avg .Total Assets

Bank/ Year 2017 2018 2019

Sonali Bank Limited 0.021947539 0.0230497 0.02611021

Rupali Bank Limited 0.0594165 0.0574069 0.05210022

Agrani Bank Limited 0.375782206 0.287728 0.57596832

Janata Bank Limited 0.049304468 0.0441792 0.05165268

Ratio of Earning Assets to Total Assets

0.6

0.5

0.4

0.3

0.2

0.1

0

Sonali Bank Rupali Bank Agrani Bank Janata Bank

Limited Limited Limited Limited

2017 2018 2019

The earning assets to total assets ratio is a formula that banks commonly use to

evaluate the proportion of a company's assets that are actively generating

income. It provides the bank—or any individual investor—with insight into how

likely the company is to generate a profit.

4.1.4 Ratio of Current Deposits to Total Liabilities:

A large base of retail deposits would be evidenced by a high total deposit ratio.

Total customer deposits

Ratio of Current Deposits to Total Liabilities =

Total assets

Bank/ Year 2017 2018 2019

Sonali Bank Limited 0.84 2.6 2.6

Rupali Bank Limited 0.82 0.83 0.83

Agrani Bank Limited 0.78 0.78 0.08

Janata Bank Limited 0.8 0.78 0.77

Ratio of Current Deposits to Total Assets

3 2.6 2.6

2.5

1.5

0.84 0.82 0.83 0.83 0.78 0.78 0.8 0.78 0.77

1

0.5 0.08

0

Sonali Bank Rupali Bank Agrani Bank Janata Bank

Limited Limited Limited Limited

2017 2018 2019

4.1.4 Current Deposits to Total Liabilities

Liability liquidity refers to the ease with which a bank can obtain new debt to acquire cash assets

at low reasonable cost. A potential lender to a bank will look at the loan performance, capital

base and the composition of the outstanding deposits and other liabilities of the Bank.

The higher the total deposit ratio, the lower is the perceived liquidity risk because contrary to

purchased funds, retail deposits are less sensitive to a change in interest rates or a minor

deterioration in business performance.

4.1.5 Ratio of Bank Capital to Total Assets:

T 1∧T 2 Capital

Ratio of Bank Capital to Total Assets =

Total Assets

2017 2018 2019

Sonali Bank

0.34 0.17

Limited 0.88

Rupali Bank

0.83 0.8 0.73

Limited

Agrani Bank

1.4 0.49 0.37

Limited

Janata Bank

2.54 1.23 1.9

Limited

Bank Capital to Total Assets

3 2.54

2.5

1.9

2

1.4

1.5 1.23

0.88 0.83 0.8 0.73

1

0.49

0.34 0.37

0.5 0.17

0

Sonali Bank Rupali Bank Agrani Bank Janata Bank

Limited Limited Limited Limited

2017 2018 2019

The Bank Capital-to-Total Assets ratio calculates a banks assets and capital to determine whether

there is enough capital to cover the assets, expressed as a percentage. In banking, the capital-to-

asset ratios are used in several ways, including the variable capital asset ratio and capital

adequacy ratio (CAR).

The variable capital asset ratio is a method of credit control. Set by the central bank – a

“banker’s bank” that manages the country’s finances – the variable capital asset ratio applies to

commercial banks and determines the ratio of capital a commercial bank should have to its total

assets.

4.1.6 Ratio of Per Employee Assets:

Total Assets

Assets Per Employee =

Total Full−Time Employee

2017 2018 2019

Sonali Bank 7.27 7.56 8.52

Limited

Rupali Bank

6.78 8.25 8.86

Limited

Agrani Bank

3.044147523 3.7024336 4.49008381

Limited

Assets Per Employee

4.49

2019 8.86

8.52

3.7

2018 8.25

7.56

3.04

2017 6.78

7.27

0 1 2 3 4 5 6 7 8 9 10

Sonali Bank Limited Rupali Bank Limited Agrani Bank Limited

The assets per employee ratio reflects the amount of assets a credit union holds per each full-time

employee. The metric is an effective measure of productivity as credit unions derive the bulk of

their incomes from their assets.

4.1.7 Ratio of Salaries and Allowances per Employee:

Salaries and Allowances Per Employee =

(Basic + HRA + Transport Allowances + FBP Allowances + Bonus) – (Provident

Fund – Income Tax – Insurance)

Bank/ Year 2017 2018 2019

Sonali Bank Limited 36,819.80 35,128.01 33,668.47

Rupali Bank Limited - - -

Agrani Bank Limited 10,148.06 10,540.33 10,452.00

Janata Bank Limited

4.1.8 Ratio of Loan and Advances to Total Assets:

Loan and advances are the major component in the total working fund (total assets), which

indicates the ability of bank to utilize its deposits in the form of loan and advances to earn high

return. The ratio is calculated as below:

Loan∧ Advanves

Loan & Advances to Total Assets Ratio =

Total Assets

2017 2018 2019

Sonali Bank

0.018 0.0375

Limited 0.019

Rupali Bank

0.66 0.68 0.65

Limited

Agrani Bank

0.003 0.0023 0.0044

Limited

Janata Bank

0.055 0.0616 0.0612

Limited

Loan and Advances to Total Assets (%)

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0

Sonali Bank Rupali Bank Agrani Bank Janata Bank

Limited Limited Limited Limited

2017 2018 2019

From the above table and figure, it is clear that the loan and advances to total assets

ratio of banks have been regular throughout the study period with only slight

fluctuations.

4.1.9 Ratio of Interest Expenses to Total Assets:

The interest expense ratio is calculated by dividing total interest expense on all loans for one

fiscal or calendar year by the earnings before interest, income taxes, depreciation or amortization

(commonly referred to as EBITDA).

Total Interest Expenses

Interest Expenses to Total Assets =

EBITDA

In a balanced use of the 100% of the EBITDA funds available to a business,

The interest expense ratio should be no more than 25 percent

Owner draws should be 25 percent or less

Term loan principal payments should be 25 percent or less

The remaining 25 percent or more is available for asset purchases.

You might also like

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Task 18: Ratios Peer Comparison of SBI and PNB With Other PSB Interest Income / Total AssetDocument6 pagesTask 18: Ratios Peer Comparison of SBI and PNB With Other PSB Interest Income / Total AssetBijosh ThomasNo ratings yet

- Non-Performing AssetsDocument20 pagesNon-Performing AssetsSagar PawarNo ratings yet

- Bank Management: PGDM Iimc 2020 Praloy MajumderDocument40 pagesBank Management: PGDM Iimc 2020 Praloy MajumderLiontiniNo ratings yet

- Promoter and Promoter GroupDocument14 pagesPromoter and Promoter GroupBijosh ThomasNo ratings yet

- Ratio Analysis of Co-Operative Bank of Surat: Manisha D. PatelDocument11 pagesRatio Analysis of Co-Operative Bank of Surat: Manisha D. Patels.muthuNo ratings yet

- Management of Financial Institutions & ServicesDocument125 pagesManagement of Financial Institutions & ServicesANKUR PUROHITNo ratings yet

- SBI LTD Initiating Coverage 19062020Document8 pagesSBI LTD Initiating Coverage 19062020Devendra rautNo ratings yet

- Study On Npa OF Indian BanksDocument21 pagesStudy On Npa OF Indian BanksSubham ChoudhuryNo ratings yet

- Determinants of Interest Rate Spread in The Banking Sector of Bangladesh: An Econometric AnalysisDocument17 pagesDeterminants of Interest Rate Spread in The Banking Sector of Bangladesh: An Econometric AnalysisAJHSSR JournalNo ratings yet

- Project Report - Group 1 - Section CDocument20 pagesProject Report - Group 1 - Section CNaveen K. JindalNo ratings yet

- Assignment 2 - Banking OperationsDocument5 pagesAssignment 2 - Banking OperationsRAVI JAISWANI Student, Jaipuria IndoreNo ratings yet

- BFM Assignment 2: Submitted By: Adhiraj Rathore E-02 20020441015Document14 pagesBFM Assignment 2: Submitted By: Adhiraj Rathore E-02 20020441015Tabrej AlamNo ratings yet

- PNB Project Sahil Khurana-1Document67 pagesPNB Project Sahil Khurana-1PraveenNo ratings yet

- State Bank of India (SBI) : SynopsisDocument18 pagesState Bank of India (SBI) : SynopsisAshish KumarNo ratings yet

- Andhra Bank: Appraisal Form For Credit Limits Up To Rs.10 Lacs For CPCD AccountsDocument6 pagesAndhra Bank: Appraisal Form For Credit Limits Up To Rs.10 Lacs For CPCD AccountsAbhishek OjhaNo ratings yet

- TASK-17: Non-Performing Asset (NPA)Document11 pagesTASK-17: Non-Performing Asset (NPA)Ashish KattaNo ratings yet

- Fca B SiddharthDocument12 pagesFca B SiddharthSiddharth SangtaniNo ratings yet

- CS FDRDocument1 pageCS FDRRONINo ratings yet

- Group 3 B&I Section ADocument12 pagesGroup 3 B&I Section AAnshi SharmaNo ratings yet

- Business Reponsibility ReportDocument21 pagesBusiness Reponsibility ReportAishwarya PatilNo ratings yet

- "Issues and Success Factors in Micro Financing": Project Report OnDocument39 pages"Issues and Success Factors in Micro Financing": Project Report Onansh.shri90% (10)

- Economics AssignmentDocument11 pagesEconomics AssignmentRAJVINo ratings yet

- Analysis of Bank StatmentsDocument5 pagesAnalysis of Bank Statmentssagar_lawteNo ratings yet

- Comparative Analysis of BanksDocument8 pagesComparative Analysis of BanksVanshika KajariaNo ratings yet

- ICICI Prudential Banking & Financials FundDocument13 pagesICICI Prudential Banking & Financials FundArmstrong CapitalNo ratings yet

- Model Portfolio of Mutual FundDocument7 pagesModel Portfolio of Mutual FundJAYESH TIBREWALNo ratings yet

- Comprehensive Study About Banking Sector: State Bank of India Bank of BarodaDocument13 pagesComprehensive Study About Banking Sector: State Bank of India Bank of BarodaKapil KumarNo ratings yet

- IFB Ethiopia Report PDFDocument3 pagesIFB Ethiopia Report PDFfeyselNo ratings yet

- Bajaj Finance LimitedDocument17 pagesBajaj Finance LimitedRohit singhNo ratings yet

- Assignment of Risk Management of BankingDocument19 pagesAssignment of Risk Management of Bankingshruti_sood52No ratings yet

- Hybrid Fund Completes 5 Years NoteDocument3 pagesHybrid Fund Completes 5 Years NoteMohamed Rajiv AshaNo ratings yet

- Infrastructure Leasing and Financial Services (Il & FS) Revival CaseDocument5 pagesInfrastructure Leasing and Financial Services (Il & FS) Revival CaseGokul GokulNo ratings yet

- Non-Performing Assets: in Bank of IndiaDocument23 pagesNon-Performing Assets: in Bank of Indiaindhu yaluNo ratings yet

- Power Pack BankingDocument26 pagesPower Pack BankingDev DugarNo ratings yet

- Project Report On "Credit Risk Management in State Bank of India"Document22 pagesProject Report On "Credit Risk Management in State Bank of India"Sandeep YadavNo ratings yet

- Bank and Financial Services Management: Nadeem Sakkir B2277 Mba-A (2018-2020)Document17 pagesBank and Financial Services Management: Nadeem Sakkir B2277 Mba-A (2018-2020)Nadeem ZakkirNo ratings yet

- Bank Wise Non-Performing Assets As Percentage of Total Assets Table 1-Gross Npas To Total AssetsDocument12 pagesBank Wise Non-Performing Assets As Percentage of Total Assets Table 1-Gross Npas To Total AssetsAnkit GuptaNo ratings yet

- IJNRD2207081Document11 pagesIJNRD2207081RIZWAN SHAIKNo ratings yet

- Bank Anova PDFDocument7 pagesBank Anova PDFPavithra GowthamNo ratings yet

- Assured ReturnsDocument11 pagesAssured ReturnsTheMoneyMitraNo ratings yet

- IPO Note - Jana Small Finance Bank - SBI Sec - 050224 - EBRDocument8 pagesIPO Note - Jana Small Finance Bank - SBI Sec - 050224 - EBRDivy JainNo ratings yet

- Sbi Micro AssignmentDocument3 pagesSbi Micro AssignmentHerendra Singh ChundawatNo ratings yet

- Role of Commercial Banks in The Economic Development of A Country:-An Indian PerspectiveDocument10 pagesRole of Commercial Banks in The Economic Development of A Country:-An Indian Perspectivepinky kumariNo ratings yet

- Finance TermpaperDocument12 pagesFinance Termpaper21.Tamzid TapuNo ratings yet

- Presentation On Key Performance Indicators (KPI) and CAMEL Analysis of andDocument44 pagesPresentation On Key Performance Indicators (KPI) and CAMEL Analysis of andPravin MehtaNo ratings yet

- Ratio Analysis Uttara Bank VS City BankDocument70 pagesRatio Analysis Uttara Bank VS City BankTaznina Nur MuntahaNo ratings yet

- Investment Management-Equity Research Group 1 Fundamental and Technical AnalysisDocument18 pagesInvestment Management-Equity Research Group 1 Fundamental and Technical AnalysisRuchikaNo ratings yet

- Publikasi - PT Hasjrat Multifinance 20082019 01092020Document1 pagePublikasi - PT Hasjrat Multifinance 20082019 01092020Imam M DarwisNo ratings yet

- FD Vs Debt FundDocument6 pagesFD Vs Debt FundGowardhan TamirisaNo ratings yet

- Axis Bank: Stock Information Stock DataDocument2 pagesAxis Bank: Stock Information Stock DatadarshanmadeNo ratings yet

- Ratio Analysis of SBI Bank LTDDocument4 pagesRatio Analysis of SBI Bank LTDvijay gaurNo ratings yet

- What Ails Indian Banking SectorDocument9 pagesWhat Ails Indian Banking SectorparthiNo ratings yet

- SBI Canara Bank Idbi Bank of BarodaDocument2 pagesSBI Canara Bank Idbi Bank of BarodaKatta AshishNo ratings yet

- FEL ReportDocument14 pagesFEL ReportAteeque MohdNo ratings yet

- AxisDocument71 pagesAxisanu_1987No ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- Mutual Funds in India: Structure, Performance and UndercurrentsFrom EverandMutual Funds in India: Structure, Performance and UndercurrentsNo ratings yet

- Full With Abstract and Bibiliography1Document57 pagesFull With Abstract and Bibiliography1Golam Samdanee TaneemNo ratings yet

- Research Topic: Disaster Management in Shatkhira During AmphanDocument39 pagesResearch Topic: Disaster Management in Shatkhira During AmphanGolam Samdanee TaneemNo ratings yet

- Online MarketinDocument11 pagesOnline MarketinGolam Samdanee TaneemNo ratings yet

- Full Research Knowledge On DengueDocument41 pagesFull Research Knowledge On DengueGolam Samdanee TaneemNo ratings yet

- Bulbul Akter Banue MBA 06817976Document52 pagesBulbul Akter Banue MBA 06817976Golam Samdanee TaneemNo ratings yet

- Southeast University: Research Monograph On "A Critical Analysis of Artho Rin Adalot Ain, 2003"Document1 pageSoutheast University: Research Monograph On "A Critical Analysis of Artho Rin Adalot Ain, 2003"Golam Samdanee TaneemNo ratings yet

- Chapter No. Name of The Topic Page NoDocument1 pageChapter No. Name of The Topic Page NoGolam Samdanee TaneemNo ratings yet

- Page No. Chapter One General IntroductionDocument2 pagesPage No. Chapter One General IntroductionGolam Samdanee TaneemNo ratings yet

- Content Page No. Chapter OneDocument2 pagesContent Page No. Chapter OneGolam Samdanee TaneemNo ratings yet

- Evsjv 'K Pjw"Pî I Uwjwfkb Bbw÷Wudu Cö - Vebv: C Vgvy Wpî WBG©VBDocument9 pagesEvsjv 'K Pjw"Pî I Uwjwfkb Bbw÷Wudu Cö - Vebv: C Vgvy Wpî WBG©VBGolam Samdanee TaneemNo ratings yet

- Chapter One: Broad ObjectiveDocument19 pagesChapter One: Broad ObjectiveGolam Samdanee TaneemNo ratings yet

- 181 Initial PartDocument8 pages181 Initial PartGolam Samdanee TaneemNo ratings yet

- Research Title: Violence Against Children in Bangladehs: AcknowledgementDocument3 pagesResearch Title: Violence Against Children in Bangladehs: AcknowledgementGolam Samdanee TaneemNo ratings yet

- Cases (Nowshad) 11Document18 pagesCases (Nowshad) 11Golam Samdanee TaneemNo ratings yet

- 1.1 What Is Intellectual PropertyDocument32 pages1.1 What Is Intellectual PropertyGolam Samdanee TaneemNo ratings yet

- 2 Lease of Bank Instrument - Pof Block Funds 002aDocument1 page2 Lease of Bank Instrument - Pof Block Funds 002aapi-255857738No ratings yet

- EssayDocument2 pagesEssayDevil faNo ratings yet

- Ac 1201 Effective Interest Method Market Price of BondsDocument24 pagesAc 1201 Effective Interest Method Market Price of BondsAnne Marieline BuenaventuraNo ratings yet

- Treas Rose Snap Shot 0925 Revise 0011Document5 pagesTreas Rose Snap Shot 0925 Revise 0011Ritchiel MirasolNo ratings yet

- OM Hospital NEFTDocument1 pageOM Hospital NEFTMahendra DahiyaNo ratings yet

- A. True B. False True 1 BNKG - CFFT.3.LO: 3.2.3 - LO: 3.2.3: Answer: Points: Learning ObjectivesDocument21 pagesA. True B. False True 1 BNKG - CFFT.3.LO: 3.2.3 - LO: 3.2.3: Answer: Points: Learning ObjectivesLê Đặng Minh ThảoNo ratings yet

- Member LedgersDocument205 pagesMember LedgersDhruv ChandwaniNo ratings yet

- Negotiable Instruments Law Bar ReviewerDocument2 pagesNegotiable Instruments Law Bar ReviewerLance MorilloNo ratings yet

- Crans Montana Presentation PDFDocument49 pagesCrans Montana Presentation PDFJohn OxNo ratings yet

- Jamil NBP NBPDocument82 pagesJamil NBP NBPfr.faisal8265No ratings yet

- A Nationalization of A Bank of Issue CarDocument16 pagesA Nationalization of A Bank of Issue CarChinmoy MishraNo ratings yet

- Ujjivan Annual Report 2017Document300 pagesUjjivan Annual Report 2017Siddharth ShekharNo ratings yet

- Banking Operations IntroductionDocument15 pagesBanking Operations IntroductionIbad Bin Rashid100% (1)

- Exercises (Time Value Money) 2022Document2 pagesExercises (Time Value Money) 2022wstNo ratings yet

- Datatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 386Document4 pagesDatatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 386Justia.comNo ratings yet

- Plaintiff's Statement of Undisputed Facts To QLSDocument8 pagesPlaintiff's Statement of Undisputed Facts To QLSLee PerryNo ratings yet

- Consumer Durable Loans - Disbursement Checklist - Version 2.0 - December 2018Document1 pageConsumer Durable Loans - Disbursement Checklist - Version 2.0 - December 2018Kushal ShahNo ratings yet

- (03A) Cash Quiz ANSWER KEYDocument11 pages(03A) Cash Quiz ANSWER KEYGabriel Adrian ObungenNo ratings yet

- Invoice 4909 PDFDocument1 pageInvoice 4909 PDFGirish ShindeNo ratings yet

- Motion To Dismiss With Prejudice - Bank of America, NA vs. Robles, Andy. 11-08-13Document10 pagesMotion To Dismiss With Prejudice - Bank of America, NA vs. Robles, Andy. 11-08-13JusticeForAmericans100% (1)

- Exim Bank PDFDocument2 pagesExim Bank PDFIngaNo ratings yet

- Kotak Mahindra Bank Rtgs Neft FormDocument1 pageKotak Mahindra Bank Rtgs Neft Formlandb1No ratings yet

- Monthly Authorised Deposit-Taking Institution Statistics February 2023Document11 pagesMonthly Authorised Deposit-Taking Institution Statistics February 2023James RyerNo ratings yet

- Credit Authorisation SchemeDocument6 pagesCredit Authorisation SchemeOngwang KonyakNo ratings yet

- Draft Resolution For Society-TrustDocument2 pagesDraft Resolution For Society-Trustammaiappar0% (2)

- Day Book 2Document2 pagesDay Book 2The ShiningNo ratings yet

- Shale Trading - Journal EntriesDocument5 pagesShale Trading - Journal Entriessayali matkar100% (1)

- Instructional Module: Republic of The Philippines Nueva Vizcaya State University Bayombong, Nueva VizcayaDocument29 pagesInstructional Module: Republic of The Philippines Nueva Vizcaya State University Bayombong, Nueva VizcayaAISLINENo ratings yet

- ' 19285537 Mr. Sai Krithik V.: ICICI Pru Savings Suraksha-LPDocument2 pages' 19285537 Mr. Sai Krithik V.: ICICI Pru Savings Suraksha-LPvinothmcakmdNo ratings yet

- Cash and Cash Equivalent TheoryDocument1 pageCash and Cash Equivalent TheoryExcelsia Grace A. ParreñoNo ratings yet