Professional Documents

Culture Documents

CA Inter IPCC Nov 21 Audit Amendmements

Uploaded by

Vikram KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CA Inter IPCC Nov 21 Audit Amendmements

Uploaded by

Vikram KumarCopyright:

Available Formats

CA Ravi Taori Auditguru.

in

CA Inter IPCC Audit Amendment Nov 21 Exams

Amendments relevant to Audit between 1st Nov 2020 & 30th April 2021

Company Audit

Amendments in Definition of Small Company

Sec 2 (85) Amended on 1st April 21

Limits Changed

Paid up capital limit of 50 lakhs is increased to 2 crores

Previous year turnover limit of Rs 2 crore is increased to 20 crores

Amendments in Company Accounts Sec 128 to Section 138

Sec 128 (1) Amended on 24th March 21 & 1st April 21

&

Company Sec 128(1) gives power to central government to prescribe rules regarding

Account Rules maintenance of books of accounts in electronic medium.

Accounting Under these rules CG has issued new requirement with respect to accounting

Software with software, which is applicable from 1st April 2022

Audit Trail

Proviso added in rule.

Provided that for the financial year commencing on or after the 1st day of April,

2022, every company which uses accounting software for maintaining its books

of account, shall use only such accounting software which has a

feature of recording audit trail of each and every transaction (Edit

History of Each Transaction),

creating an edit log of each change made in books of account along

with the date (Log showing changes made to books of accounts) when

such changes were made and

ensuring that the audit trail (above 2 things) cannot be disabled.

Sec 129 (1) Amended on 24th March 21

& Schedule III

Schedule III is issued under Sec 129 (1)

Changes are introduced in schedule III, on 24th March, these changes are not core

part of audit syllabus, changes related to disclosure of funds given and funds

received are relevant for audit.

Sec 134 (3) Amended on 24th March 21

&

Company Sec 134 (3) provides matters to be specified in BOD report. Clause (q) gives

Account Rules power to central government to specify additional matters in rules.

Additional Under these rules CG has issued 2 additional requirements to be specified in BOD

Reporting report.

Requirements

in BOD Report (xi) the details of

o application made or any proceeding pending under the

Insolvency and Bankruptcy Code, 2016 (31 of 2016) during the

year

o along with their status as at the end of the financial year.

(xii) the details of difference between amount of the

o valuation done at the time of one-time settlement and

CA Ravi Taori Auditguru.in

o the valuation done while taking loan from the Banks or

Financial Institutions (So it is change in value of security which

was offered for taking such loan)

o along with the reasons thereof.

Amendments in Section 138 to 148

Sec 140 Amended on 12th Dec 2020

Penalty

Penalty

Non-Compliance will lead to penalty of 50,000 or remuneration of

Reduced for

non auditor whichever is lower.

compliance of In case of continuing failure, with a further penalty of 500 per day

resignation after the first day of non-compliance during which such failure

related continues, subject to a maximum of 2,00,000

communicatio

n

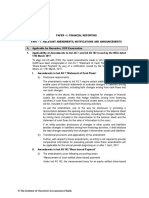

Sec 143 (3) Amended on 24th March 21

Rule 11 Sec 143 (3) (j) gives power to central government to prescribe additional matters

Amendment to be specified in audit report

Under above provision Rule 11 of Company Audit & Auditor’s Rule 2014 is issued

by CG. Earlier there were 3 points now it has increased to 6 points

See Chart On Next page

CA Ravi Taori Auditguru.in

CA Ravi Taori Auditguru.in

Sec 143 (15) Amended on 12th Dec 2020

Fine

Penalty of For Listed Company Rs 5,00,000

Fraud For Any Other Company 1,00,000

Reporting

Reduced

Sec 147 Change in punishment for officers of the company - Punishment of 1 year

imprisonment is removed.

Penalty

Change in punishment for auditor of the company – Section 143 is removed

Reduced

from the list which is considered for non-compliance and punishment.

Bank Audit (Only For New Course)

Above changes as given in company audit are relevant for banking companies also under bank

audit chapter.

You might also like

- CA Final Audit Amendment Nov 21 Exams SummaryDocument8 pagesCA Final Audit Amendment Nov 21 Exams SummaryAnnu DuaNo ratings yet

- Amendment For Law-Nov 21 by AoDocument12 pagesAmendment For Law-Nov 21 by AoConsultant NNo ratings yet

- Companies Act Audit Trail RequirementsDocument8 pagesCompanies Act Audit Trail RequirementsOkkishoreNo ratings yet

- Amendments Cos Act Sripriya KumarDocument49 pagesAmendments Cos Act Sripriya KumarTony VargheseNo ratings yet

- RTP Ipcc-P5Document52 pagesRTP Ipcc-P5aliabbas966No ratings yet

- AuditorDocument9 pagesAuditorRamesh RanjanNo ratings yet

- Inter Law Amendments Notes Nov2022 Mohit PrajapatiDocument2 pagesInter Law Amendments Notes Nov2022 Mohit PrajapatiADARSH MISHRANo ratings yet

- Mao Caro by Prafful BhaleraoDocument9 pagesMao Caro by Prafful BhaleraoSonu BhaleraoNo ratings yet

- FR AmendmentDocument5 pagesFR AmendmentNISHA MITTALNo ratings yet

- Inter Amendments Nov 2023Document8 pagesInter Amendments Nov 2023abhishekkapse654No ratings yet

- Accounts RTP Nov 18 PDFDocument47 pagesAccounts RTP Nov 18 PDFNiharika GuptaNo ratings yet

- FR RTP May 23 - Board NotesDocument43 pagesFR RTP May 23 - Board Notesrocks007123No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument138 pages© The Institute of Chartered Accountants of IndiaPraveen Reddy DevanapalleNo ratings yet

- Nov 23 RTP LawDocument22 pagesNov 23 RTP Lawranveersinghkanawat89188No ratings yet

- CARODocument9 pagesCAROSai Lakshmi PNo ratings yet

- NC Job Growth ActDocument42 pagesNC Job Growth ActGlen BradleyNo ratings yet

- Corporate and Economic Laws 2023 November 1689591454Document56 pagesCorporate and Economic Laws 2023 November 1689591454mdasifraza3196No ratings yet

- Supplement Executive Programme: For June, 2021 ExaminationDocument7 pagesSupplement Executive Programme: For June, 2021 ExaminationVikram DasNo ratings yet

- CH 7 Peer Review Amendments - 4ce022ab b7f5 4f60 A769 D7dcd9f84ceaDocument10 pagesCH 7 Peer Review Amendments - 4ce022ab b7f5 4f60 A769 D7dcd9f84ceaShashikiran MagajiNo ratings yet

- Ssa 210 Nov 2020Document22 pagesSsa 210 Nov 2020Bennice 8No ratings yet

- 71216bos57230 p2Document17 pages71216bos57230 p2Parmeet NainNo ratings yet

- Bos 54534Document12 pagesBos 54534Khawaish MittalNo ratings yet

- Singapore Standard On Auditing: The Auditor's Responsibilities Relating To Other InformationDocument22 pagesSingapore Standard On Auditing: The Auditor's Responsibilities Relating To Other InformationEugene TayNo ratings yet

- Economic Laws Module 1Document405 pagesEconomic Laws Module 1Mohammed AslamNo ratings yet

- Inter Amendments Nov 2021Document27 pagesInter Amendments Nov 2021Manvi SinghNo ratings yet

- NCjobgrowthBeta Beta PresentationDocument39 pagesNCjobgrowthBeta Beta PresentationGlen BradleyNo ratings yet

- Bos 60318Document40 pagesBos 60318Subiksha LakshNo ratings yet

- Amendments in Schedule III of Companies Act, W.E.F. 1st April 2021Document16 pagesAmendments in Schedule III of Companies Act, W.E.F. 1st April 2021Selvi balanNo ratings yet

- Law RTP NOV 23Document60 pagesLaw RTP NOV 23Kartikeya BansalNo ratings yet

- Final Law Amendment Nov 23Document40 pagesFinal Law Amendment Nov 23Vikash AgarwalNo ratings yet

- Apollo Tyres Annual Report FY2023-260-274Document15 pagesApollo Tyres Annual Report FY2023-260-274Carrots TopNo ratings yet

- FR RTP Nov 23Document66 pagesFR RTP Nov 23Kartikeya BansalNo ratings yet

- Bos 58432Document29 pagesBos 58432Khawaish MittalNo ratings yet

- Subjudice Cases (MSO)Document5 pagesSubjudice Cases (MSO)ankurNo ratings yet

- Changes in GST LawDocument31 pagesChanges in GST LawSUNIL PUJARINo ratings yet

- Applicability of Amended Provisions Pertaining To Auditor's Report On Annual Filing For F.Y. 2021-22 - Taxguru - inDocument2 pagesApplicability of Amended Provisions Pertaining To Auditor's Report On Annual Filing For F.Y. 2021-22 - Taxguru - inkishore aroraNo ratings yet

- Audit - RTP - n18Document31 pagesAudit - RTP - n18AngiNo ratings yet

- Tax Laws Practice New Syl Lab Us 06032024Document54 pagesTax Laws Practice New Syl Lab Us 06032024coolboydeepak4No ratings yet

- Companies Act Amendments 2021Document12 pagesCompanies Act Amendments 2021Archie ShahNo ratings yet

- Law p4Document90 pagesLaw p4Shyam virsinghNo ratings yet

- Auditing and Assurance Standards BDocument16 pagesAuditing and Assurance Standards BcolleenyuNo ratings yet

- Schedule XIII-Practical ApproachDocument7 pagesSchedule XIII-Practical Approachmeenu307No ratings yet

- Rules, 2018 To Amend The Companies (Audit and Auditors) Rules, 2014Document46 pagesRules, 2018 To Amend The Companies (Audit and Auditors) Rules, 2014Sunil DesaiNo ratings yet

- GM Test Series: Auditing and AssuranceDocument10 pagesGM Test Series: Auditing and AssuranceAryanAroraNo ratings yet

- Ce Standards B: Agreeing The Terms of Audit EngagementsDocument40 pagesCe Standards B: Agreeing The Terms of Audit EngagementsnikNo ratings yet

- RTP Nov 2020Document30 pagesRTP Nov 2020Syamala GadupudiNo ratings yet

- Rules, 2018 To Amend The Companies (Audit and Auditors) Rules, 2014Document59 pagesRules, 2018 To Amend The Companies (Audit and Auditors) Rules, 2014RAJANEESH V RNo ratings yet

- Do You Know GST I March 2021 I Ranjan MehtaDocument15 pagesDo You Know GST I March 2021 I Ranjan MehtaCA Ranjan MehtaNo ratings yet

- CA Journal - Article On Schedule IIIDocument6 pagesCA Journal - Article On Schedule IIISIDDHARTH MANDELIANo ratings yet

- CARO, 2003-: (As Amended by The CARO Amendment Order 2004)Document19 pagesCARO, 2003-: (As Amended by The CARO Amendment Order 2004)Rishabh GuptaNo ratings yet

- AUDITDocument24 pagesAUDITGEETHANo ratings yet

- AUDITDocument24 pagesAUDITmeahaNo ratings yet

- PSA 210 RedraftedDocument40 pagesPSA 210 RedraftedVal Benedict MedinaNo ratings yet

- Schedule 3 - Amendments-RSA - 06.04.2022Document62 pagesSchedule 3 - Amendments-RSA - 06.04.2022Abhishek PareekNo ratings yet

- EY Tax Alert: Malaysian DevelopmentsDocument12 pagesEY Tax Alert: Malaysian DevelopmentsdanNo ratings yet

- Rtpfinalnew Nov20 p3Document30 pagesRtpfinalnew Nov20 p3cdNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- Interpretation and Application of International Standards on AuditingFrom EverandInterpretation and Application of International Standards on AuditingNo ratings yet

- Codification of Statements on Auditing Standards: Numbers 122 to 133, January 2018From EverandCodification of Statements on Auditing Standards: Numbers 122 to 133, January 2018No ratings yet

- New Questions in Study MaterialDocument17 pagesNew Questions in Study MaterialVikram KumarNo ratings yet

- MMC Fi Cheat SheetDocument2 pagesMMC Fi Cheat SheetSUDHIR WAGHULE0% (1)

- 12 Economics Notes Micro Ch01 IntroductionDocument9 pages12 Economics Notes Micro Ch01 IntroductionRama NagpalNo ratings yet

- CBSE Class-12 Economics Micro Economics Chapter 1 - Introduction Revision NotesDocument10 pagesCBSE Class-12 Economics Micro Economics Chapter 1 - Introduction Revision NotesVikram KumarNo ratings yet

- CA Ravi Taori: List of SasDocument3 pagesCA Ravi Taori: List of SasVikram KumarNo ratings yet

- Accountancy - Theory Base of Accounting - NotesDocument5 pagesAccountancy - Theory Base of Accounting - NotesCP Ispat Unit IINo ratings yet

- Accountancy - Theory Base of Accounting - NotesDocument5 pagesAccountancy - Theory Base of Accounting - NotesCP Ispat Unit IINo ratings yet

- CLASS 11 Accountancy NotesDocument11 pagesCLASS 11 Accountancy NotesVikram KumarNo ratings yet

- CLASS 11 Accountancy NotesDocument11 pagesCLASS 11 Accountancy NotesVikram KumarNo ratings yet

- Vouching Summary NotesDocument6 pagesVouching Summary NotesVikram KumarNo ratings yet

- Contact Details ICAIDocument2 pagesContact Details ICAIVikram KumarNo ratings yet

- 52602bos42131 Iipcc p6Document11 pages52602bos42131 Iipcc p6Vikram KumarNo ratings yet

- GSIS FSB Vs BPI FSB - OrigDocument11 pagesGSIS FSB Vs BPI FSB - OrigMark Gabriel B. MarangaNo ratings yet

- Case AnalysesDocument4 pagesCase AnalysesChristine Joy OriginalNo ratings yet

- DMCIHI - 039 SEC FORM 17A - April 8 PDFDocument286 pagesDMCIHI - 039 SEC FORM 17A - April 8 PDFZo ThelfNo ratings yet

- Special Laws - Securities Regulation CodeDocument15 pagesSpecial Laws - Securities Regulation CodePatrik Oliver PantiaNo ratings yet

- GPB Capital: Massachusetts ComplaintDocument47 pagesGPB Capital: Massachusetts ComplaintTony OrtegaNo ratings yet

- IT Declaration Form Revised SalaryDocument1 pageIT Declaration Form Revised SalaryMANUBHOPALNo ratings yet

- Program Registration Requirements ChecklistDocument6 pagesProgram Registration Requirements ChecklistAlcris BoquiaNo ratings yet

- Investment Requirements For A Food Truck BusinessDocument10 pagesInvestment Requirements For A Food Truck BusinessYna Paulite100% (1)

- Mabini Colleges Inc. vs. Atty. Jose Pajarillo FactsDocument2 pagesMabini Colleges Inc. vs. Atty. Jose Pajarillo FactssakuraNo ratings yet

- RTI Quarterly Reports 2021Document30 pagesRTI Quarterly Reports 2021rahul4u88No ratings yet

- FBM Chapter 1Document31 pagesFBM Chapter 1Claire Evann Villena EboraNo ratings yet

- Collantes v. RomeronDocument8 pagesCollantes v. RomeronMarisse CastañoNo ratings yet

- 024-Industrial Refractories Corporation of The Philippines vs. CA, Et Al G.R. No. 122174 October 3, 2002Document5 pages024-Industrial Refractories Corporation of The Philippines vs. CA, Et Al G.R. No. 122174 October 3, 2002wewNo ratings yet

- Disclosure of Major Corporate Ownership (1974Document23 pagesDisclosure of Major Corporate Ownership (1974Jargons Nether EnNo ratings yet

- Aquino-Sarmiento vs. MoratoDocument15 pagesAquino-Sarmiento vs. MoratoDianne May CruzNo ratings yet

- National Internal Revenue Code of 1997Document95 pagesNational Internal Revenue Code of 1997Jocel Rose TorresNo ratings yet

- Kasus 2.5 Seminar AuditDocument12 pagesKasus 2.5 Seminar AuditFikiyayaNo ratings yet

- Gamboa v. Teves MRDocument20 pagesGamboa v. Teves MRCzarina CidNo ratings yet

- Ozg FCRA Consultant Website: Email: Fcra - Consultant@ozg - Co.inDocument4 pagesOzg FCRA Consultant Website: Email: Fcra - Consultant@ozg - Co.infcra-registration.com - FCRA Registration Consultant - Ozg NGO FundingNo ratings yet

- REPUBLIC ACT NO. 7076 CREATES PEOPLE'S SMALL-SCALE MINING PROGRAMDocument10 pagesREPUBLIC ACT NO. 7076 CREATES PEOPLE'S SMALL-SCALE MINING PROGRAMJey RhyNo ratings yet

- Special Engagement MonitoringDocument37 pagesSpecial Engagement MonitoringAcademeNo ratings yet

- PEZA CITIZENS CHARTER (Rev 10, 31 Mar 2023, 1st Edition) - Compressed PDFDocument458 pagesPEZA CITIZENS CHARTER (Rev 10, 31 Mar 2023, 1st Edition) - Compressed PDFPatrickNo ratings yet

- DOJ OPINION 72 s.2003Document10 pagesDOJ OPINION 72 s.2003Katleya Kate BelderolNo ratings yet

- Application Summary FormDocument2 pagesApplication Summary Formarlyn dimalNo ratings yet

- Sept 8 ConstiDocument39 pagesSept 8 ConstiJohnPaulRomeroNo ratings yet

- The Fall of Enron and Its Implications On The Accounting ProfessiDocument68 pagesThe Fall of Enron and Its Implications On The Accounting Professiabc xyzNo ratings yet

- Disini v. Secretary of JusticeDocument2 pagesDisini v. Secretary of JusticeBelle Cabal50% (2)

- The Basics: Statement of Assets, Liabilities, and Net Worth: What Is A Saln?Document7 pagesThe Basics: Statement of Assets, Liabilities, and Net Worth: What Is A Saln?Ren Irene D MacatangayNo ratings yet

- 02) Lyceum of The Philippines v. CADocument1 page02) Lyceum of The Philippines v. CAJenell CruzNo ratings yet

- Anonymous Financial Contact: UCC-1 Filing and Executive Order 13037 Regarding Human CapitalDocument11 pagesAnonymous Financial Contact: UCC-1 Filing and Executive Order 13037 Regarding Human CapitalAmerican Kabuki100% (6)