Professional Documents

Culture Documents

Annexure - I Illustration - Vii

Uploaded by

Deeksndeeks DeepakOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annexure - I Illustration - Vii

Uploaded by

Deeksndeeks DeepakCopyright:

Available Formats

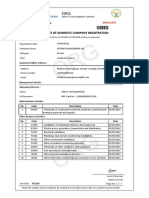

ANNEXURE - I

ILLUSTRATION – VII

1 Name

2 Designation as on 30-06-2018 Assistant Engineer

3 Date of entry in Board Service 18.05.2011

Y M D

4 Service in KSEB Ltd as on 30-06-2018

7 1 13

Non-qualifying Service

(2 Increments barred with cumulative effect as per order dated

5 11.04.2017) 1 2 0

(Date of effect of increment bar is 01.05.2017 and 01.05.2018)

6 5 11 13

Actual qualifying service (Difference of column 4 & 5)

7 Total Qualifying Service (completed years only) 5 years

8 Pre-revised scale of pay (40975-81630)

51305

i Pre-revised Basic Pay as on 30-06-2018 as on 01.05.2016

No of Stagnation increments already drawn in the pre-revised

9 ii Nil

scale

iii Personal Pay if any drawn as on 30-06-2018 Nil

iv Protected amount if any as on 30-06-2018 Nil

10 Revised scale of pay (59100-117400)

Corresponding revised pay stage of the pre-revised pay as provided

11 73900

in Annexure I of the pay revision order 2021

Eligible stagnation increments in revised scale equivalent to the

12 Nil

number as per coloumn 9 (ii)

Service pay(SP) :0.2% of revised pay for each completed years of

13 739

service as on 30.06.2018 in KSEB Ltd. Only (0.2%x5x73900)

14 Personal Pay if any, multyplied by a factor of 1.30 Nil

BP as in SI as in SP as in PP as in

15 Pay as on 01.07.2018 column 11 column 12 column 13 column 14

73900 Nil 739 Nil

16 Pay as on 01.05.2019 76400 Nil 739 Nil

17 Pay as on 01.05.2020 79400 Nil 739 Nil

18 Pay as on 01.05.2021 82400 Nil 739 Nil

Remarks:In this case the increment bar period is started from 01.05.2017. Therefore period from 01.05.2017 to 30.06.2018

( one year and two months) is to be deducted from qualifying service for the calculation of service pay.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ralph Kennedy I. Tong Assignment No 5Document2 pagesRalph Kennedy I. Tong Assignment No 5Tong KennedyNo ratings yet

- Bo - FM - No755 2011 Psi 1303 2008 11 03 2011 TaDocument2 pagesBo - FM - No755 2011 Psi 1303 2008 11 03 2011 TaDeeksndeeks DeepakNo ratings yet

- DeclarationDocument2 pagesDeclarationDeeksndeeks DeepakNo ratings yet

- AE Increment Bar II - IX (B)Document1 pageAE Increment Bar II - IX (B)Deeksndeeks DeepakNo ratings yet

- Product Catalog FisoDocument16 pagesProduct Catalog FisoDeeksndeeks DeepakNo ratings yet

- AE Increment Bar - IX ADocument1 pageAE Increment Bar - IX ADeeksndeeks DeepakNo ratings yet

- FLW User ManualDocument19 pagesFLW User ManualElectrifying GateNo ratings yet

- Registering in Co-WIN Portal - Urgent Action To Be TakenDocument1 pageRegistering in Co-WIN Portal - Urgent Action To Be TakenDeeksndeeks DeepakNo ratings yet

- Is 3043 1987Document95 pagesIs 3043 1987suresh kumarNo ratings yet

- HelplineDocument1 pageHelplineDeeksndeeks DeepakNo ratings yet

- Duties and Responsibilities of Committee & (Check List) - CorrectedDocument5 pagesDuties and Responsibilities of Committee & (Check List) - CorrectedDeeksndeeks DeepakNo ratings yet

- Hager Guide To Surge Protection PDFDocument20 pagesHager Guide To Surge Protection PDFMohamad HishamNo ratings yet

- Ammayum KunjumDocument7 pagesAmmayum KunjumDeeksndeeks DeepakNo ratings yet

- MFM376 DatasheetDocument2 pagesMFM376 DatasheetDeeksndeeks DeepakNo ratings yet

- Tap Position Indicator: TPI EE-610: TPI Standard TPI With Dual 4-20ma Output TPI With Tap Change CounterDocument1 pageTap Position Indicator: TPI EE-610: TPI Standard TPI With Dual 4-20ma Output TPI With Tap Change CounterDeeksndeeks DeepakNo ratings yet

- Ammayum KunjumDocument7 pagesAmmayum KunjumDeeksndeeks DeepakNo ratings yet

- Kerala State Electricity Board LTD: NORMAL CONDITION Tension at 32°C 1718kg (6875/4)Document4 pagesKerala State Electricity Board LTD: NORMAL CONDITION Tension at 32°C 1718kg (6875/4)Deeksndeeks DeepakNo ratings yet

- Kerala State Electricity Board LTD: NORMAL CONDITION Tension at 32°C 1718kg (6875/4)Document4 pagesKerala State Electricity Board LTD: NORMAL CONDITION Tension at 32°C 1718kg (6875/4)Deeksndeeks DeepakNo ratings yet

- Kerala State Electricity Board LTD: NORMAL CONDITION Tension at 32°C 1718kg (6875/4)Document4 pagesKerala State Electricity Board LTD: NORMAL CONDITION Tension at 32°C 1718kg (6875/4)Deeksndeeks DeepakNo ratings yet

- Seeking Comments On Draft Electricity Late Payment Surcharge Amendment Rules 2021Document3 pagesSeeking Comments On Draft Electricity Late Payment Surcharge Amendment Rules 2021Deeksndeeks DeepakNo ratings yet

- Kerala State Electricity Board LTD: NORMAL CONDITION Tension at 32°C 1718kg (6875/4)Document4 pagesKerala State Electricity Board LTD: NORMAL CONDITION Tension at 32°C 1718kg (6875/4)Deeksndeeks DeepakNo ratings yet

- Tower Feasibility-Without EarthwireDocument6 pagesTower Feasibility-Without EarthwireDeeksndeeks DeepakNo ratings yet

- Kerala State Electricity Board LTD: NORMAL CONDITION Tension at 32°C 1718kg (6875/4)Document4 pagesKerala State Electricity Board LTD: NORMAL CONDITION Tension at 32°C 1718kg (6875/4)Deeksndeeks DeepakNo ratings yet

- Importance of Power FactorDocument1 pageImportance of Power FactorDeeksndeeks DeepakNo ratings yet

- Kerala State Electricity Board LTD: NORMAL CONDITION Tension at 32°C 1718kg (6875/4)Document4 pagesKerala State Electricity Board LTD: NORMAL CONDITION Tension at 32°C 1718kg (6875/4)Deeksndeeks DeepakNo ratings yet

- 250kVA Unified Power Quality ControllerDocument28 pages250kVA Unified Power Quality ControllerDeeksndeeks DeepakNo ratings yet

- Importance of Power FactorDocument1 pageImportance of Power FactorDeeksndeeks DeepakNo ratings yet

- Explosive Flux Compression GeneratorDocument22 pagesExplosive Flux Compression GeneratorJinu Anila Nellisseril JacobNo ratings yet

- Electrical Intvw QuestionsDocument21 pagesElectrical Intvw QuestionsDeeksndeeks DeepakNo ratings yet

- M.B.C College of Engg & Tech Dept. of Electrical & Electronics Engineering PeermadeDocument19 pagesM.B.C College of Engg & Tech Dept. of Electrical & Electronics Engineering PeermadeDeeksndeeks DeepakNo ratings yet

- Computations of VATDocument21 pagesComputations of VATMikee TanNo ratings yet

- Certificate of Domestic Company Registration: DuplicateDocument2 pagesCertificate of Domestic Company Registration: DuplicateRutagengwa GilbertNo ratings yet

- PT Alfa YogaDocument6 pagesPT Alfa Yogaghinaa mumthazahrachmatNo ratings yet

- Annual Salary CertificateDocument1 pageAnnual Salary CertificateramgowtamNo ratings yet

- Ind As 105 105: Non-Current Asset Classified As Held For Sale & Discontinued Business / OperationDocument6 pagesInd As 105 105: Non-Current Asset Classified As Held For Sale & Discontinued Business / OperationAayush MayankNo ratings yet

- Assignment Questions - Suggested Answers (E1-9, E1-11, P1-1, P1-2)Document4 pagesAssignment Questions - Suggested Answers (E1-9, E1-11, P1-1, P1-2)Ivy KwokNo ratings yet

- Accounting Level 3 Assignment 1Document9 pagesAccounting Level 3 Assignment 1Markos Getahun100% (2)

- Fidelis Corporate Solutions Private Limited: Payslip For The Month of May 2022Document2 pagesFidelis Corporate Solutions Private Limited: Payslip For The Month of May 2022Dominic angelesNo ratings yet

- Activity 1 - Income and Business Tax (Finals)Document4 pagesActivity 1 - Income and Business Tax (Finals)Jam SurdivillaNo ratings yet

- HUM 121assignment 1Document6 pagesHUM 121assignment 1Nayeem HossainNo ratings yet

- ACCOUNTING 3A HomeworkDocument12 pagesACCOUNTING 3A HomeworkDarynn Linggon0% (1)

- Notification For Departmental Examination 2022 ITO Inspector 14-9-22Document12 pagesNotification For Departmental Examination 2022 ITO Inspector 14-9-22Piyush GautamNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- PRATIKSHADocument10 pagesPRATIKSHAPratiksha GaikwadNo ratings yet

- FIS Global Solutions Philippines Payslip For: 01 Apr 2019 To 15 Apr 2019Document1 pageFIS Global Solutions Philippines Payslip For: 01 Apr 2019 To 15 Apr 2019Zyrha ZelrineNo ratings yet

- Partnership Operations ReviewDocument37 pagesPartnership Operations ReviewShin Shan JeonNo ratings yet

- Imposto de Renda em InglesDocument5 pagesImposto de Renda em InglesIago MartinsNo ratings yet

- Projected Income StatementDocument3 pagesProjected Income StatementSyeda Nida AliNo ratings yet

- Payslip For The Month of Sep 2021: R1 RCM Global Private LimitedDocument1 pagePayslip For The Month of Sep 2021: R1 RCM Global Private LimitedVandana N MNo ratings yet

- Depreciation - WikipediaDocument10 pagesDepreciation - Wikipediapuput075No ratings yet

- Hindustan Unilever Limited Amount: in CroresDocument7 pagesHindustan Unilever Limited Amount: in CroresSakshi Jain Jaipuria JaipurNo ratings yet

- Application For Remittance of Royalty Fee (App-V53)Document4 pagesApplication For Remittance of Royalty Fee (App-V53)Soniya KhuramNo ratings yet

- BASHIR Salary Slip (50129700 May, 2017)Document1 pageBASHIR Salary Slip (50129700 May, 2017)Abidullah KhanNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961NirajNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS July Exam 2016 Multiple Choice (30%) Use The Following Information For Questions 1 and 2Document14 pagesLebanese Association of Certified Public Accountants - IFRS July Exam 2016 Multiple Choice (30%) Use The Following Information For Questions 1 and 2Kololiko 123No ratings yet

- Sindh Education Whatsapp Group #03103377322.: Inspector Inland Revenue Important McqsDocument10 pagesSindh Education Whatsapp Group #03103377322.: Inspector Inland Revenue Important McqsAMAZING VIDEOSNo ratings yet

- CIR v. Central Luzon Drug CorpDocument2 pagesCIR v. Central Luzon Drug CorpSophia SyNo ratings yet

- Deduction Under Income Tax Act 1961Document5 pagesDeduction Under Income Tax Act 1961Suman kushwahaNo ratings yet

- AU-Unitholder-notice-Vanguard AMMA Tax Statement GlossaryDocument4 pagesAU-Unitholder-notice-Vanguard AMMA Tax Statement GlossaryNick KNo ratings yet