Professional Documents

Culture Documents

Pas 19 Employee Benefits

Pas 19 Employee Benefits

Uploaded by

Kristalen Armando0 ratings0% found this document useful (0 votes)

14 views2 pagesPAS 19 EMPLOYEE BENEFITS Summary

Original Title

PAS 19 EMPLOYEE BENEFITS

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPAS 19 EMPLOYEE BENEFITS Summary

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views2 pagesPas 19 Employee Benefits

Pas 19 Employee Benefits

Uploaded by

Kristalen ArmandoPAS 19 EMPLOYEE BENEFITS Summary

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

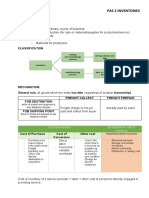

PAS 19 EMPLOYEE BENEFITS

NATURE:

- Consideration given by an entity in exchange for services rendered by employee or for the termination

of employment

1. Short term employee benefit

2. Post-employment benefits

3. Other long term employee benefits

4. Termination benefits

RECOGNITION & MEASUREMENT:

- Fairly Straight forward

- Undiscounted basis

ACCOUNTING/ PRESENTATION

1. Unpaid short-term benefits – accrued expenses

2. Paid benefits (short term) – prepayment

Accumulating Paid absences Nonaccumulating Paid absences

Carried forward Not carry forward

Can be use in future periods

1. Vesting – cash payment

2. Non vesting -

POST EMPLOYMENT BENEFITS

- Payable after the completion of employment – retirement

1. Defined Contribution Plan

Pays fixed contribution into separate entity (fund)

Definite contribution but benefit is indefinite

Employee bears the risk

Accounting Recognition:

Record Expense on period it is payable

Accrued expense on any unpaid contribution at the end of period

Prepaid Expense, excess contribution to the extent of prepayment will lead to cash

refund

2. Defined Benefit Plan

Postemployment benefit plan other than defined contribution plan

Obligated to provide agreed benefits to employee

Employee is guaranteed

Definite benefit but indefinite contribution

Accounting Recognition:

Actuarial assumptions

Discounted basis measurement

Can be unfunded. Fully funded, partly funded

Expensed recognized is not necessarily the amount of contribution for the

period

PAS 19 EMPLOYEE BENEFITS

Components of defined benefit cost

Service Cost Current service Cost

Past service Cost

Any gain or loss on plan settlement

Net Interest 1. Interest expense on deferred benefit obligation

2. Interest income on plan assets

3. Interest expense on effect of asset ceiling

Remeasurements

DISCLOSURE

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Pas 12 Income TaxesDocument3 pagesPas 12 Income TaxesKristalen ArmandoNo ratings yet

- Pas 16 Property Plant and EquipmentDocument4 pagesPas 16 Property Plant and EquipmentKristalen ArmandoNo ratings yet

- Pas 20 Government Grants: Nature: Government Grant Government AssistanceDocument2 pagesPas 20 Government Grants: Nature: Government Grant Government AssistanceKristalen ArmandoNo ratings yet

- Pas 2 Inventories: Nature: DefinitionDocument3 pagesPas 2 Inventories: Nature: DefinitionKristalen ArmandoNo ratings yet

- Receivables: Accounts ReceivableDocument2 pagesReceivables: Accounts ReceivableKristalen ArmandoNo ratings yet

- Intacc Cash and Cash EquivalentsDocument2 pagesIntacc Cash and Cash EquivalentsKristalen ArmandoNo ratings yet

- RMBSDocument23 pagesRMBSapi-3848669No ratings yet

- NO Nama Bank Kode BankDocument4 pagesNO Nama Bank Kode BankAndi Masnah AzisNo ratings yet

- 2024 05 14 15 34 47mar 24 - 160102Document12 pages2024 05 14 15 34 47mar 24 - 160102deepakpetwal18No ratings yet

- International Reserves and Foreign Currency LiquidityDocument5 pagesInternational Reserves and Foreign Currency LiquidityOmer Bin SaleemNo ratings yet

- Tutorial PMS - Financial Question PDFDocument4 pagesTutorial PMS - Financial Question PDFCode PutraNo ratings yet

- 2015 Trust Technology Buyers Guide PDFDocument31 pages2015 Trust Technology Buyers Guide PDFPurnendu MaityNo ratings yet

- Yeasin LawDocument10 pagesYeasin LawSifatShoaebNo ratings yet

- MSRPTDocument3 pagesMSRPTVinayMangannavarNo ratings yet

- Chapter 3 - Financial Statement AnalysisDocument36 pagesChapter 3 - Financial Statement AnalysisQuang NguyễnNo ratings yet

- Uniform CPA Examination. Questions and Unofficial Answers 1992 NDocument116 pagesUniform CPA Examination. Questions and Unofficial Answers 1992 NEllah Sharielle SantosNo ratings yet

- SUD Life Century StarDocument4 pagesSUD Life Century StarPinkyNo ratings yet

- Sanction Letter For Overdraft Against Fixed DepositDocument4 pagesSanction Letter For Overdraft Against Fixed Depositjyotigunu817No ratings yet

- Insurance Types - Non LifeDocument5 pagesInsurance Types - Non LifeKRNo ratings yet

- 05 - Notes On Noncurrent Asset Held For SaleDocument3 pages05 - Notes On Noncurrent Asset Held For SaleLalaine ReyesNo ratings yet

- CH 5 Practice Questions SolutionsDocument24 pagesCH 5 Practice Questions SolutionsChloe IbrahimNo ratings yet

- Module-6 Emerging Issues in Financial Accounting & Computerized Accounting NotesDocument30 pagesModule-6 Emerging Issues in Financial Accounting & Computerized Accounting NotesAbhishek RajNo ratings yet

- DPM 1420Document196 pagesDPM 1420Subham PandeyNo ratings yet

- PFM Manual First Edition July 2019Document366 pagesPFM Manual First Edition July 2019DamasceneNo ratings yet

- Gdfi Promissory NoteDocument2 pagesGdfi Promissory NoteLy M. LumapagNo ratings yet

- Oduro Asamoah JoyceDocument60 pagesOduro Asamoah JoyceAarav AroraNo ratings yet

- ACCT 302 Financial Reporting II Lecture 7Document63 pagesACCT 302 Financial Reporting II Lecture 7Jesse Nelson100% (1)

- Financial Talk LetterDocument1 pageFinancial Talk LetterShokhidulAmin100% (1)

- Topic 3 Double Entry Book Keeping8630Document13 pagesTopic 3 Double Entry Book Keeping8630Kartikey swamiNo ratings yet

- 1st Puc Accountancy Midterm Question Paper Nov 2017-Mandya PDFDocument10 pages1st Puc Accountancy Midterm Question Paper Nov 2017-Mandya PDFBest ThingsNo ratings yet

- 2 - Forest City Tennis Club - CaseDocument13 pages2 - Forest City Tennis Club - CaseDeepak PawarNo ratings yet

- Receipt E22019884Document1 pageReceipt E22019884AlldyNo ratings yet

- Statement of Account As at 16 July 2023: For Adjust Alignment Issue, Didn't RemoveDocument2 pagesStatement of Account As at 16 July 2023: For Adjust Alignment Issue, Didn't RemovekakakkawaiiNo ratings yet

- Skandia Mining Company Financial Statements Income Statement Balance Sheet Assets Liabilities and Owner'S EquityDocument2 pagesSkandia Mining Company Financial Statements Income Statement Balance Sheet Assets Liabilities and Owner'S EquityIzzahIkramIllahiNo ratings yet

- After FFW Protest, Fed Sends Community Bank System 9 Questions, CEO Tryniski Trashes CRADocument4 pagesAfter FFW Protest, Fed Sends Community Bank System 9 Questions, CEO Tryniski Trashes CRAMatthew Russell LeeNo ratings yet

- Watching The Defectives - Europe Distressed - Restructuring Tracker March 2024 (9fin)Document22 pagesWatching The Defectives - Europe Distressed - Restructuring Tracker March 2024 (9fin)vitacoco127No ratings yet