Professional Documents

Culture Documents

Final Statistic Report

Final Statistic Report

Uploaded by

Phúc Hảo Nguyễn LưuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Statistic Report

Final Statistic Report

Uploaded by

Phúc Hảo Nguyễn LưuCopyright:

Available Formats

lOMoARcPSD|9227122

RMIT

ECON 1030 Business Statistic

Assessment 2 Semester 1

Statistical Analysis

Students:

Yuh Yih Celine Leong s3722343

Shin Yi Tay s3701946

Anjie Zhang s3615077

Tutor:

Nithya Tharmaseelan

Tutorial time:

11:30 to 12:30 Thursday 080.08.009

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

lOMoARcPSD|9227122

STATISTICAL MODELLING AND ANALYSIS OF

DISTRIBUTED LEDGER TECHNOLOGY’S

INVESTMENT

Executive Summary

Distributed Ledger Technology (DLT) has captured the imagination of entrepreneurs and

policy makers. According to some, blockchain technology has the potential to revolutionise

transactions protecting the integrity of ownership. One of the leading company in blockchain

technology is DigitalX. This report is to analyse recent share price performance of DigitalX

with general descriptions, Also, it evaluates the constructed histogram based on the weekly

returns to explain the shape and detect the outliers. Additionally, this report explains the linear

regression model by examining the goodness of fit, coefficients and residual analysis as well

as providing two factors that will be able to improve the regression model. Finally, the report

also applies SWOT analysis and the summary of statistical facts to give a recommendation to

the investment in DigitalX.

Introduction

In the advanced world of today, Distributed Ledger Technology (DLT) is a digital data that can

be recorded, shared and synchronized transactions in their respective electronic ledgers.

Blockchain is one type of distributed ledger which can fundamentally change the traditional

ways in the world of finance to make it more efficient, resilient and reliable. DigitalX is a

blockchain-based software company where other traders will be able to buy or sell

cryptocurrency. In this report, there are two variables which consist of DLT weekly returns

(response variable) and ASX Index weekly return (explanatory variable). Moreover, this report

will investigate the relationship between the DLT weekly return and ASX Index weekly return.

Based on the data analysis reported, future investors will be able to decide to invest in DigitalX

due to our supporting reasons.

-1-

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

lOMoARcPSD|9227122

Part A

(1)

DLT weekly closing price

0.4

0.35

0.3

0.25

Price

0.2

DLT

0.15 Closing

0.1 Price

0.05

0

2/28/15

4/30/15

6/30/15

8/31/15

2/29/16

4/30/16

6/30/16

8/31/16

2/28/17

4/30/17

6/30/17

8/31/17

2/28/18

12/28/14

10/31/15

12/31/15

10/31/16

12/31/16

10/31/17

12/31/17

General description

The line graph illustrated the data for the weekly closing price for the Distributed Ledger

Technology (DLT) for the dates between 28 December 2014 and 8 March 2018. Over the 4

years’ period, the starting value of the closing price has increased from $0.145, on 4 January

2015 to the end of the period on 4 March 2018, with a closing price of $0.24.

Notwithstanding, there is a volatility which can be shown in the graph between the period.

DLT’s weekly closing price has been gradually rising except for a surge of closing price from

May 2017 and January 2018. From the graph shown, at the end of year 2014, it shows a slight

increase of $0.12 from the initial $0.14 (from 27 December 2014) to approximately $0.26 in

June 2015. The data then remained at a constant trend, with minimum decrease in variation

between the dates of 15 July 2015 to 31 January 2016. In addition, according to the graph, the

period between December 2014 and July 2016 exhibit that the closing price had a fluctuation

of $0.15. Furthermore, it is interesting to know that on 21 May 2017, the company has recorded

its lowest weekly closing price of $0.022. The steep slope of the graph shows the rapid increase

where it has reached its peak of 0.38 of their weekly closing price in 07 January 2018. It is

important as it only took half a year to approximately climb from the bottom to the peak. Finally,

after closing price reached to the peak, it declined significantly until February 2018.

Overall, the changing trends in the graph outlines the fluctuation in-between each time-period

and that there was an increase in DLT’s weekly closing price from 28 December 2014 to 8

March 2018.

-2-

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

lOMoARcPSD|9227122

(2)

DLT weekly return

70

60

50

Frequnecy

40

30

20

10

Weeky return

The histogram which represents the data of DLT’s weekly returns appears to be a positively-

skewed (right-skewed) distribution, where more data lies on the left-hand side of the histogram.

The right-side of the histogram is more spread out, hence it is not a normal distribution.

Furthermore, after calculation, four outliers are identified. The four outliers are 65.22, 66.67,

80.95 and 95.45. Their Z values are 3.55, 3.63, 4.43 and 5.24 respectively. Based on the rule

of outliers, if Z-value is less than -3 or more than 3, it will be considered as outliers. Therefore,

these numbers are considered as outliers.

Calculation of four outliers:

4 Outliers: 95.45 (Weekly return) 5.24 (Z value)

65.22 (Weekly return) 3.55 (Z value)

66.67 (Weekly return) 3.63 (Z value)

80.95 (Weekly return) 4.43 (Z value)

Z value (95.45) = (Weekly Return-Mean)/Standard deviation = (95.45-1.66)/17.9 = 5.24

Since 3<5.24, then 95.45 is outlier.

Z value (65.22) = (Weekly Return-Mean)/Standard deviation = (65.22-1.66)/17.9 = 3.55

Since 3<3.55, then 65.22 is outlier.

Z value (66.67) = (Weekly Return-Mean)/Standard deviation = (66.67-1.66)/17.9 = 3.63

Since 3<3.63, then 66.67 is outlier.

Z value (80.95) = (Weekly Return-Mean)/Standard deviation = (80.95-1.66)/17.9 = 4.43

Since 3<4.43, then 80.95 is outlier.

-3-

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

lOMoARcPSD|9227122

(3)

Location (Arithmetic mean, median and mode)

Arithmetic mean (1.66) Data analysis of DLT weekly return

The average number of DLT weekly returns is $1.66.

Mean 1.66

Median (0) Standard Error 1.39

The median number of DLT weekly return is 0. Median 0

Therefore, 50% of weekly return have 0 or below and Mode 0

50% of weekly return have 0 or above. Standard Deviation 17.90

Sample Variance 320.35

Mode (0) Kurtosis 7.33

Because 0 appears 14 times, more than any other Skewness 1.95

value. Therefore, the mode is 0. It can be interpreted Range 131.88

that the most common weekly returns of DLT is 0. Minimum -36.43

Maximum 95.45

Shape (Skewness)

Sum 277.85

Skewness (1.95)

Count 167.00

Because skewness is 1.95, which means that it is

more than zero. Also, because median is less than First quartile -8.07

mean. Therefore, data of DLT weekly return is Third quartile 7.19

positive or right skewed. Interquartile 15.26

Spread (Range, Interquartile Range, Sample Variation and Sample Standard Deviation)

Range (131.88)

Range, the difference between the minimum (-36.43) and maximum number (95.45) of DLT

weekly return, is 131.88.

Interquartile (15.26)

Interquartile, the difference between the first quartile (-8.07) and the third quartile (7.19) of

DLT weekly return, is 15.26

Sample variance (𝑆 2 = 320.35)

Sample variance is the measured of variation based on square deviations from the mean. The

variance for the DLT weekly returns is approximately 320.35.

Standard deviation (𝑆 = 17.9)

Standard deviation is the measured of variation based on square deviation from the mean,

which directly related to the variance. The standard deviation foe DLT weekly returns is

approximately 17.9.

(4)

𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑙𝑜𝑠𝑠𝑒𝑠

Empirical probability of a loss = 𝑇𝑜𝑡𝑎𝑙 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑤𝑒𝑒𝑘𝑙𝑦 𝑟𝑒𝑡𝑢𝑟𝑛𝑠

75

= 167

≈ 0.4491

Therefore, approximately 44.9% of DLT weekly return are less than zero which means that

they are making a loss.

-4-

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

lOMoARcPSD|9227122

(5)

ASX Index

7000

6000

5000

4000

Price

3000

ASX Index

2000

1000

0

2/28/15

4/30/15

6/30/15

8/31/15

2/29/16

4/30/16

6/30/16

8/31/16

2/28/17

4/30/17

6/30/17

8/31/17

2/28/18

12/28/14

10/31/15

12/31/15

10/31/16

12/31/16

10/31/17

12/31/17

General description

The line graph displays the weekly closing price for ASX Index between the dates of 28

December 2014 and 28 February 2018.

It can be shown that ASX Index remained at a stable pace across the four years which the data

is based on. The volatility of the data also appears to be relatively low during this time frame.

It is evidently presented that the price of ASX Index only fluctuated in-between 5000 and 6000

from 28 Dec 2014 to 28 February 2018.It is pivotal to know that it has been slightly increased

between the period from $5435.9 to $5933.4. In addition, the highest price of ASX Index was

recorded at $6122.30 in 31 December 2017, whereas the lowest price of ASX index was

$4765.3 in 2 February 2016. The difference between the two indexes is $1357, although it is a

significant amount, in terms of the change of price, but when it is viewed from the graph, it

seems to be justifiable due the time frame. It took them approximately two years to get to their

index to the highest value, this represents a growth that is smooth and gradual.

In conclusion, the stability of ASX Index over four years is relatively high. ASX Index has also

increased during the time period this data is based on.

-5-

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

lOMoARcPSD|9227122

ASX Index weekly return

40

35

30

25

Frequency

20

15

10

Weekly return

Descriptions:

Based on histogram, it is a negative-skewed (left-skewed) distribution, where more data lies

on the right-hand side of the histogram and that the left-side of the histogram appears to be

more spread out. Therefore, this is not a normal distribution. In addition, there is one outlier in

weekly return of ASX Index, which is -5.76. The Z value of -5.76 is -3.17. Based on the rule

of outliers, if Z values is less than -3 or more than 3, it will be considered as outliers. Therefore,

-5.76 is considered as outliers.

Calculation of outlier:

Z value (-5.76) = (Weekly Return-Mean)/Standard deviation = (-5.76-0.07)/1.84 = -3.17

Since -3.17 < 3, then -5.76 is an outlier.

-6-

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

lOMoARcPSD|9227122

Location (Arithmetic mean, median and mode)

Data analysis of ASX weekly return

Arithmetic mean (0.07)

The average number of ASX Index weekly return is 0.07. Mean 0.069340613

Standard Error 0.142516752

Median (0.07) Median 0.068056146

The median number of DLT weekly return is 0. Therefore, Mode #N/A

50% of weekly return have 0 or below and 50% of weekly Standard Deviation 1.841722319

return have 0 or above

Sample Variance 3.391941099

Mode (N/A) Kurtosis 0.697745051

None of the ASX Index have the same price Skewness -0.161031135

Range 10.26819213

Shape (Skewness) Minimum -5.761062381

Maximum 4.507129751

Skewness (-0.16)

Sum 11.57988235

Because skewness is -0.16, which means that it is less than

zero. In addition, because median is slightly less than mean Count 167

(0.069>0.068). Therefore, data of ASX weekly return is First quartile -0.993257808

negative or left skewed. Third quartile 1.165977962

Interquartile 2.15923577

Spread (Range, interquartile, sample variance and

standard deviation)

Range (10.27)

Rage, the difference between the minimum (-5.76) and maximum number (4.51) of DLT

weekly return, is 10.27.

Interquartile (2.16)

Interquartile, the difference between the first quartile (-0.99) and the third quartile (1.17) of

DLT weekly return, is 2.16

Sample variance (S2=3.39)

Sample variance is the measured of variation based on square deviations from the mean. The

variance for ASX returns is approximately 3.39

Standard deviation (S=1.84)

Sample variance is the measured of variation based on square deviations from the mean, which

directly related to the variance. The standard deviation for ASX returns is approximately 1.84

𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑙𝑜𝑠𝑠𝑒𝑠

Empirical probability of a loss = 𝑇𝑜𝑡𝑎𝑙 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑤𝑒𝑒𝑘𝑙𝑦 𝑟𝑒𝑡𝑢𝑟𝑛𝑠

81

= 167

≈ 0.4850

Therefore, approximately 48.5% of DLT weekly return are less than zero which means that

they are making a loss.

-7-

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

lOMoARcPSD|9227122

Part B

(1)

Goodness of Fit

R Square

𝑆𝑆𝑅 0.0138

𝑅 𝑠𝑞𝑢𝑎𝑟𝑒 = = ≈ 2.58638 ∗ 10−7 = 0.000000258638 ≈ 0

𝑆𝑆𝑇 53177.4526

Interpretation:

The coefficient of determination (R≈0) indicates that approximately 0% of the variation in

returns of DLT closing price is explained by the variation in the ASX 200 Index returns.

This suggests a poor fit.

Adjusted R Squared

2 𝑛−1

𝑅𝑎𝑑𝑗 = 1 − [(1 − 𝑅2 ) ] = −0.006060346

𝑛−𝑘−1

Interpretation:

-0.60603% in the variation in returns of DLT closing price has been explained by the regression

of ASX Index returns on DLT closing price returns. The remaining 99.39397% variation in

DLT closing price returns left unexplained. This suggest a poor fit.

-8-

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

lOMoARcPSD|9227122

Lieaner Regression

120

100

80

DLT Weekly returns

60

40 Y = 0.0049X + 1.6634

R² = 2.6E-07 Weekly return

20

Linear (Weekly return)

0

-8 -6 -4 -2 0 2 4 6

-20

-40

-60

ASX weekly returns

Coefficients

Prediction line

̂𝑖 = 1.663 + 0.005𝑋𝑖

𝑌

Predicted return of DLT closing price = 1.663 + 0.005*(returns of ASX 200 Index)

Intercept (1.663)

If the value of independent variable (ASX Index) is zero, then the estimated dependent variable

(DLT closing price) is on average would be 1.663.

Slope coefficient (0.005)

For every increase in one dollar in ASX 200 Index, DLT closing price is estimated to increase

on average by 0.005.

-9-

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

lOMoARcPSD|9227122

Inference about the slope: T test (95% confidence interval)

H0 : β1 = 0 (No linear relationship)

H1 : β1 ≠ 0 (linear relationship does exist)

95% confidence interval

𝛼 = 0.05, Two tails distribution, therefore, each tail is 0.025

𝑡0.025,167−2 critical value = 1.96

Decision rule

Do not reject H0 , If critical value t lies on between -1.96 and 1.96

Test Statistic:

𝑏1 − 𝛽1 0.005 − 0

𝑡= = = 0.007

𝑆𝑏1 0.757

Conclusion

Because 0.007 is in-between -1.96 and 1.96, therefore, do not reject H0 , which means that

there is no linear relationship between dependent variable DLT’s weekly returns and

independent variable ASX’s weekly returns.

Inference about the slope: P-value approach (95% confidence interval)

H0 : β1 = 0 (No linear relationship)

H1 : β1 ≠ 0 (linear relationship does exist)

Significant: 𝛼 = 0.05

Decision rule:

Do not reject H0 , if P-value is more than 𝛼.

P-value=0.995

Conclusion:

Because P-value (0.995>0.05), therefore, do not reject H0 , which means that there is no linear

relationship between dependent variable DLT’s weekly returns and independent variable

ASX’s weekly returns.

Confidence Interval Estimate for the slope (95% confidence interval)

𝑏1 ± 𝑡𝑛−2 (Lower 95%: -1.48884, upper 95%: 1.49873)

At 95% level of confident, the confident interval for the slop is (-1.48884, 1.49873); we are

95% confident that for every increase in one dollar in ASX 200 Index, DLT closing price is

estimated to increase on average between -1.49 and 1.50. Because the 95% confidents interval

does include 0.

Conclusion:

There is no significant relationship between dependent variable DLT’s weekly returns and

independent variable ASX’s weekly returns.

- 10 -

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

lOMoARcPSD|9227122

Residual Plot

120

100

80

60

Residuals

40

20

0

-8 -6 -4 -2 0 2 4 6

-20

-40

-60

Formula of residual:

̂𝑖

𝑒𝑖 = 𝑌𝑖 − 𝑌

Residual Analysis

Residual analysis is used to evaluate the assumptions and thus determine the regression model

selected is an appropriated model. There are four assumptions of regression (Known as LINE),

which are linearity, independence, normality and equal variance.

Linearity

Linearity states that whether the relationship between variables is linear or not. To assess

linearity, the residuals are plotted against the independent variable which is ASX weekly

returns. There is no apparent pattern or relationship between residual and independent variable.

The residuals appear to be evenly spread above and below 0 for the different value of

independent variable. In short, the linear model is appropriate for the DLT weekly returns.

Independence

Independence of errors requires that the errors are independent of one another. Based on the

residual graph above, it shows that it is independent because the errors for a specific time period

are often correlated with previous time period.

- 11 -

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

lOMoARcPSD|9227122

Normality

Normality requires that the errors are normally distributed at each value of X. Based on the

normal probability plot, it showed that it is not a straight line. Therefore, this is not a normal

distribution.

Normal Probability Plot

150

100

Percent

50

0

0 20 40 60 80 100 120

-50

Sample Percentile

Equal Variance

Equal variance requires that the variance of the errors is constant for all values of X. The

variability of this residual plots is constant. Therefore, this is a constant variance.

- 12 -

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

lOMoARcPSD|9227122

(2)

There are various ways for the regression model to be improved, it is mainly used to enhance

its accuracy. The two factors that can be used to improve the regression model are adding

another independent variable and using the exploratory analysis method.

One factor that will improve the regression model could be adding another independent

variable. By adding another independent variable, the adjusted R Square value will increase.

Having an increased value of adjusted R Square is important as it is being used to determine

the variability of the response data around the mean. Generally, the higher adjusted R Square

value, the better the model fit the data. An example of another independent variable that the

regression model can adopt is, taking into account the company’s market share. By adding this

independent variable, it will lead us to the multiple regression equation that shows the change

in Y (DLT’s weekly return) when there is a unit change in the respective independent (X)

variable (ASX weekly index and DLT’s market share). It is important as it estimates the

association between the specific independent variable and the outcome, while the other variable

remain constant. The R Square value will explain the percentage of the variation in Y is

dependent by the independent variables. The information of the company’s market share can

be determined by dividing the company’s total sales by the industry’s total sales over a fiscal

period. It can be sourced from the regression model which is shown in part b, question one,

where it outlines the regression statistical values from the summary output. The influence is

most likely to be positive as it will strengthen the fit of the model, which shows a measure of

the closeness of the data to the fitted regression line (goodness of fit).

Another factor could be using the exploratory analysis method. It is a data analysis approach,

finding information in the data provided to generate ideas and gain insights of different aspects

about the data. It helps to better understand the relationship between the dependent (Y or DLT’s

weekly return) variable and the other independent (X or ASX weekly index) variable (that can

be more than 1). This factor is important as it encourages and supports the strength of their

relationship to determine if the model is suitable. The required information can also be sourced

from the summary output table in part B, question one. The presence of outliers or extreme

values in the data brings a significant impact to the regression model, so it is crucial that they

are treated. It will help control the variation of the predicted estimated values due to the outliers.

This is likely to improve the regression model as it will keep the model more regulated for the

future predicted estimate values. The influence is most likely to be positive as it would have

analysed the pattern of the regression model, which gives an idea whether it should be

improved or not.

- 13 -

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

lOMoARcPSD|9227122

Part C

Ministerial brief

Purpose

The purpose of this ministerial brief is to investigate the benefits of Distributed Ledger

Technology (DLT) by applying SWOT analysis and statistical facts.

Analytical overview (SWOT)

DLT’s strengths includes how it prioritise its transparency and speed during its transaction

process and it is inexpensive as it is through use of blockchain technology. A weakness

involves is the lack of technological maturity. Further research and development needs to be

explored to fix its initial defect and targets to solve a specific problem. The opportunities

encompass the social aspect, where more people are willing to accept and adopt the blockchain

technology. The technological impact is that there is a high possibility of blockchain creating

a new form of programmable money. Moreover, the threats incorporate the political view point,

where regulatory status is uncertain as modern currencies are regulated by their government

and lead to a hurdle generated by pre-existing financial institution which blockchain

technology will face if it remains unsettled. The technological aspect is salient as the security

remains sceptical since data circulates and can be easily leaked if the encryption code is present.

Summary of facts

Based on statistical analysis, DigitalX’s weekly returns has no linear relationship with ASX

movement, which means that dependent variable, DigitalX, cannot be explained by the change

in independent variable, ASX. In addition, the empirical probability of making losses in DLT’s

weekly return is relatively high.

Conclusion

Overall, because of the concerns about this infant block chain technology and the data analysis,

it is not a sensible decision to invest in DigitalX.

Conclusion

In conclusion, analysis of this company incorporates use of DLT closing price graph to observe

the overall trend and use of histogram based on weekly returns to find out skewed distribution

as well as outliers. Moreover, descriptive analysis is applied to explain location, shape and

spread of the data as well as relatively high empirical probability of losses. In addition, ASX

returns is used to develop a linear regression model with DLT weekly returns for detecting that

the dependent variable (weekly returns of DigitalX) and independent variable (weekly returns

of ASX) have no linear relationship between each other. Also, factors which are adding

independent variables and using exploratory analysis are provided to improve the regression

model. Finally, SWOT analysis shows that there are many concerns about this infant

blockchain technology. Therefore, individuals should not invest in DigitalX though analysing

various aspect of this company.

- 14 -

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

lOMoARcPSD|9227122

Appendices

References

Berenson, Jayne, Levine, O’Brien, Szabat & Watson, Basic Business Statistic, 4th edn, Pearson,

Australia.

Hanson RT, Reeson A, Staples M 2017, Distributed Ledger: Scenarios for the Australian

economy over the coming decades, viewed 24 May 2018,

<https://publications.csiro.au/rpr/download?pid=csiro:EP175257&dsid=DS1>.

Williams, S 2017, “5 Big Advantages of Blockchain, and 1 Reason to be very worried”, The

Motley Fool, viewed 24 May 2018, <https://www.fool.com/investing/2017/12/11/5-big-

advantages-of-blockchain-and-1-reason-to-be.aspx>.

- 15 -

Downloaded by Chen Nguy?n (khaihung1210@gmail.com)

You might also like

- Spare Parts Muvi V2Document26 pagesSpare Parts Muvi V2antonio Javier100% (1)

- High Level Overview: Task Name Jan Feb Mar AprDocument14 pagesHigh Level Overview: Task Name Jan Feb Mar AprTomasz WilczewskiNo ratings yet

- Cab Harness Connectors DiagramDocument1 pageCab Harness Connectors DiagramTavyLocNo ratings yet

- MASTER Rotation Plan 2nd Year PBBSC NursingDocument3 pagesMASTER Rotation Plan 2nd Year PBBSC NursingDelphy VargheseNo ratings yet

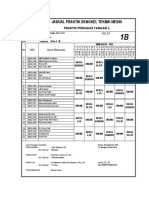

- Jadwal Praktek Bengkel 1B PDFDocument2 pagesJadwal Praktek Bengkel 1B PDFAdib RizqullohNo ratings yet

- Jadwal Praktek Bengkel 1BDocument2 pagesJadwal Praktek Bengkel 1BAdib RizqullohNo ratings yet

- Multi-Port PR Burner Capacities Chart-A100617Document1 pageMulti-Port PR Burner Capacities Chart-A100617Mohd BaharuddinNo ratings yet

- Local Situation Covid19 enDocument11 pagesLocal Situation Covid19 enHo AndyNo ratings yet

- Dionel C. Agustin Bsed 1E Theology 102 Lesson 9 Activity 3Document5 pagesDionel C. Agustin Bsed 1E Theology 102 Lesson 9 Activity 3mylene agustinNo ratings yet

- Local Situation Covid19 enDocument10 pagesLocal Situation Covid19 enDEFNo ratings yet

- Urbana 2018-19 Academic Calendar V3Document3 pagesUrbana 2018-19 Academic Calendar V3Muhammad AsadNo ratings yet

- Last Tti Share %: Total ResultDocument193 pagesLast Tti Share %: Total ResultFarshad AziziNo ratings yet

- Local Situation Covid19 enDocument10 pagesLocal Situation Covid19 enHally TillsNo ratings yet

- 7 16 10TheWrongDebateDocument3 pages7 16 10TheWrongDebaterichardck30No ratings yet

- Task 16 FDocument3 pagesTask 16 FstudyyyyymailNo ratings yet

- Settlement MarkerGraphs (Main Viaduct (GTP) )Document1 pageSettlement MarkerGraphs (Main Viaduct (GTP) )Batu GajahNo ratings yet

- Milestone Report - Rehabilitation of Existing Tanks Baseline ScheduleDocument1 pageMilestone Report - Rehabilitation of Existing Tanks Baseline ScheduleDeonNo ratings yet

- Tekton Inch To Metric Conversion ChartDocument1 pageTekton Inch To Metric Conversion ChartOvidiu BucseNo ratings yet

- Accenture QuestionsDocument7 pagesAccenture QuestionsRevanth TallaNo ratings yet

- Absen AnekaDocument1 pageAbsen Anekabang awiNo ratings yet

- Pier 11944-Eb30aDocument5 pagesPier 11944-Eb30aMayra Raviela SoteloNo ratings yet

- The Non-Deliverable Forward (NDF) Market For The Indian RupeeDocument9 pagesThe Non-Deliverable Forward (NDF) Market For The Indian RupeeandrewpereiraNo ratings yet

- China Weekly Report: Aluminum Industry ChainDocument17 pagesChina Weekly Report: Aluminum Industry Chainnerolf73No ratings yet

- Actividades Del Día:: Reporte Diario de AvanceDocument2 pagesActividades Del Día:: Reporte Diario de Avancederwin huertaNo ratings yet

- Local Situation Covid19 enDocument8 pagesLocal Situation Covid19 enErik ChanNo ratings yet

- Parts Book 45Document1 pageParts Book 45ZeckNo ratings yet

- NVIDIA Capital Market OverviewDocument2 pagesNVIDIA Capital Market OverviewSimon ChristNo ratings yet

- Lab 1 Ruler ReadingDocument3 pagesLab 1 Ruler ReadingJerelyn AgadNo ratings yet

- Throtractor PoolDocument1 pageThrotractor Poolimamirfandi11No ratings yet

- Actividades Del Día:: Reporte Diario de AvanceDocument2 pagesActividades Del Día:: Reporte Diario de Avancederwin huertaNo ratings yet

- Actividades Del Día:: Reporte Diario de AvanceDocument2 pagesActividades Del Día:: Reporte Diario de Avancederwin huertaNo ratings yet

- Pre-Test ResultDocument1 pagePre-Test ResultRicardo NacionalNo ratings yet

- ACCA-Part Time-ATX (M)Document2 pagesACCA-Part Time-ATX (M)Wong Yong Sheng WongNo ratings yet

- 29PT6657-85 PhilipsDocument4 pages29PT6657-85 PhilipsHugo Flores CastilloNo ratings yet

- Local Situation Covid19 enDocument10 pagesLocal Situation Covid19 engggAaaaNo ratings yet

- Item No. Tap Size (Inch), NC Drill Size (In) Drill Size (MM) Tap Size (Inch), NFDocument6 pagesItem No. Tap Size (Inch), NC Drill Size (In) Drill Size (MM) Tap Size (Inch), NFiversonNo ratings yet

- Januar Y: SUN MON TUE WED THU FRI SAT SUN MON TUE WED THU FRI SAT SUN MON TUE WED THU FRI SATDocument4 pagesJanuar Y: SUN MON TUE WED THU FRI SAT SUN MON TUE WED THU FRI SAT SUN MON TUE WED THU FRI SATAssel MadanguitNo ratings yet

- Klasifikasi Penyakit Hepatitis Menggunakan Metode LVQ Dan PSODocument6 pagesKlasifikasi Penyakit Hepatitis Menggunakan Metode LVQ Dan PSOM Ryan AnugerahNo ratings yet

- SUBSEA 7 SA (Oil & Gas Services & Equip) : Earnings & Estimates Market DataDocument1 pageSUBSEA 7 SA (Oil & Gas Services & Equip) : Earnings & Estimates Market DataSahil GoelNo ratings yet

- Houlihan Lokey Private Performing Credit Index q4 2022Document6 pagesHoulihan Lokey Private Performing Credit Index q4 2022vitacoco127No ratings yet

- Mancal t200Document2 pagesMancal t200oliveiralauroNo ratings yet

- ARISANDocument19 pagesARISANPrizca Ce' LeoNo ratings yet

- Coronado High School Calendar - Google Search PDFDocument1 pageCoronado High School Calendar - Google Search PDFRebekka ArnadottirNo ratings yet

- PHP 1 TP 5 JFDocument9 pagesPHP 1 TP 5 JFAKASH TIWARINo ratings yet

- CAT 3508 SensorsDocument6 pagesCAT 3508 SensorsMazhar HussainNo ratings yet

- Rancangan Pelajaran HarianDocument2 pagesRancangan Pelajaran HarianJb LeongNo ratings yet

- SPC XL 2010 For Microsoft Excel: Use The Links Below To Explore The Examples Control Chart ExamplesDocument56 pagesSPC XL 2010 For Microsoft Excel: Use The Links Below To Explore The Examples Control Chart ExamplesRavindra ErabattiNo ratings yet

- DRM Assignment Name - Harsh ID No. - 2015A3PS0302H Serial No. - 42 Instrument Name - CUMMINSINDDocument29 pagesDRM Assignment Name - Harsh ID No. - 2015A3PS0302H Serial No. - 42 Instrument Name - CUMMINSINDharsh19021996No ratings yet

- Subneteo 24-30Document2 pagesSubneteo 24-30Martin ZigaranNo ratings yet

- 01 Do I WannaDocument1 page01 Do I WannaLuis AlonzoNo ratings yet

- Kegiatan / Tindakan Yang Dilakukn Di Ukgs Binaan BP Gigi PKM DTP Cigalontang Tahun 2016Document3 pagesKegiatan / Tindakan Yang Dilakukn Di Ukgs Binaan BP Gigi PKM DTP Cigalontang Tahun 2016Imam DarusalamNo ratings yet

- Ptmcctchap 10 BondDocument30 pagesPtmcctchap 10 BondjgmvmNo ratings yet

- Host - 0 MD5500V1 172.30.236.20: Gia Huynh 1 (6) - PVDocument2 pagesHost - 0 MD5500V1 172.30.236.20: Gia Huynh 1 (6) - PVOMC TổNo ratings yet

- IP Addressing/Subnetting Simplified: Brian Sterck May 6, 2005Document63 pagesIP Addressing/Subnetting Simplified: Brian Sterck May 6, 2005lokendra_niecNo ratings yet

- Lecture 4Document22 pagesLecture 4Tewodros AmbasajerNo ratings yet

- Golfbuddies ScoringDocument2 pagesGolfbuddies Scoringderekq21No ratings yet

- SPPM IDocument1 pageSPPM Ihugolm9No ratings yet

- BerserkDocument1 pageBerserkwshhhNo ratings yet

- Matrices: Question Paper Paper 2Document10 pagesMatrices: Question Paper Paper 2Dilshan WickramanayakaNo ratings yet