Professional Documents

Culture Documents

1111

1111

Uploaded by

yes yesno0 ratings0% found this document useful (0 votes)

6 views4 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views4 pages1111

1111

Uploaded by

yes yesnoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

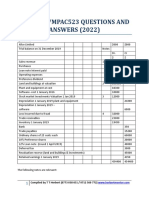

College of Business and AccountancyAccountancy DepartmentIntermediate Accounting

IMIDTERM TERMINAL OUTPUT

_____________________________________________________________________________

_____________

ACCOUNTING FOR INCOME TAXESI.

THEORY1.

Taxable income of a corporation

a. differs from accounting income due to differences in

intraperiod

allocation between the twomethods of income determination.

b. differs from accounting income due to differences in

interperiod

allocation and permanentdifferences between the two methods of income determination.

c. is based on generally accepted accounting principles.d. is reported on the

corporation's income statement.

2.

The deferred tax expense is the

a. increase in balance of deferred tax asset minus the increase in balance of deferred

tax liability.

b. increase in balance of deferred tax liability minus the increase in balance of deferred

tax asset.

c. increase in balance of deferred tax asset plus the increase in balance of deferred

tax liability.d. decrease in balance of deferred tax asset minus the increase in balance of

deferred tax liability.

3.

Interperiod tax allocation results in a deferred tax liability from

a. an income item partially recognized for financial purposes but fully recognized for tax

purposes inany one

year. b. the amount of deferred tax consequences attributed to temporary differences that resu

lt in netdeductible amounts in future years.c. an income item fully recognized for tax and

financial purposes in any one year.

d. the amount of deferred tax consequences attributed to temporary differences that result in

nettaxable amounts in future years.

4.

Which of the following situations would require interperiod income tax allocation procedures?

a. An excess of percentage depletion over cost depletion b. Interest received on municipal

bonds

c. A temporary difference exists at the balance sheet date because the tax basis of an

asset orliability and its reported amount in the financial statements differ

d. Proceeds from a life insurance policy on an officer

5.

Machinery was acquired at the beginning of the year. Depreciation recorded during the life of

themachinery could result in

Future FutureTaxable Amounts Deductible Amounts

a. Yes Yes

b. Yes Noc. No Yesd. No No

6.

A temporary difference arises when a revenue item is reported for tax purposes in a period

After it is reported Before it is reportedin financial income in financial income

a. Yes Yes

b. Yes Noc. No Yesd. No No

7.

At the December 31, 2007 balance sheet date, Garth Brooks Corporation reports an

accruedreceivable for financial reporting purposes but not for tax purposes. When this asset

isrecovered in 2008, a future taxable amount will occur and

a. pretax financial income will exceed taxable income in 2008.

b. Garth will record a decrease in a deferred tax liability in 2008.

c. total income tax expense for 2008 will exceed current tax expense for 2008.d. Garth

will record an increase in a deferred tax asset in 2008.

Error! Filename not specified.Error! Filename not specified.Error! Filename not specified.Error!

Filename not specified.

8.

Assuming a 40% statutory tax rate applies to all years involved, which of the followingsituations

will give rise to reporting a deferred tax liability on the balance sheet?I- A revenue is deferred

for financial reporting purposes but not for tax purposes.II- A revenue is deferred for

tax purposes but not for financial reporting purposes.III- An expense is deferred for financial

reporting purposes but not for tax purposes.IV- An expense is deferred for tax purposes but not

for financial reporting purposes.

a. item II only b. items I and II only

c. items II and III only

d. items I and IV only

9.

A major distinction between temporary and permanent differences is

a. permanent differences are not representative of acceptable accounting

practice. b. temporary differences occur frequently, whereas permanent differences occur only

once.c. once an item is determined to be a temporary difference, it maintains that status;

however, a permanent difference can change in status with the passage of time.

d. temporary differences reverse themselves in subsequent accounting periods, whereasperma

nent differences do not reverse.10.

Which of the following are temporary differences that are normally classified as expenses

orlosses that are deductible after they are recognized in financial income?

a. Advance rental receipts.

b. Product warranty liabilities

.c. Depreciable property.d. Fines and expenses resulting from a violation of law.

11.

Which of the following is a temporary difference classified as a revenue or gain that is

taxableafter it is recognized in financial income?

a. Subscriptions received in advance. b. Prepaid royalty received in advance.

c. An installment sale accounted for on the accrual basis for financial reporting purposes

and onthe installment (cash) basis for tax purposes.

d. Interest received on a municipal obligation.

Error! Filename not specified.Error! Filename not specified.Error! Filename not specified.Error!

Filename not specified.

12.

Which of the following differences would result in future taxable amounts?

a. Expenses or losses that are tax deductible after they are recognized in financial

income. b. Revenues or gains that are taxable before they are recognized in financial

income.c. Revenues or gains that are recognized in financial income but are never included in

taxable income.

d. Expenses or losses that are tax deductible before they are recognized in financial income.13.

An example of a permanent difference is

a. proceeds from life insurance on officers. b. interest expense on money borrowed to invest in

municipal bonds.c. insurance expense for a life insurance policy on officers.

d. all of these

.

14.

Which of the following will

not

result in a temporary difference?

a. Product warranty liabilities b. Advance rental receiptsc. Installment sales

d. All of these will result in a temporary difference.15.

A company uses the equity method to account for an investment. This would result in what

typeof difference and in what type of deferred income tax?

Type of Difference Deferred Taxa. Permanent Asset b. Permanent Liabilityc. Temporary Asset

d. Temporary Liability16.

A company records an unrealized loss on short-term securities. This would result in what typeof

difference and in what type of deferred income tax?

Type of Difference Deferred Taxa. Temporary Liability

b. Temporary Asset

c. Permanent Liabilityd. Permanent Asset

Error! Filename not specified.Error! Filename not specified.Error! Filename not specified.

Error! Filename not specified.

Error! Filename not specified.

Millions of books, audiobooks, magazines, documents, sheet music, and more for free.

Download this PDF

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- FAR Final Preboards (May 2023)Document19 pagesFAR Final Preboards (May 2023)John DoeNo ratings yet

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tariff Methodology For The Setting of Pipeline Tariffs - 5th Edition PDFDocument41 pagesTariff Methodology For The Setting of Pipeline Tariffs - 5th Edition PDFChicoUiobiNo ratings yet

- Gulf Oil ExhibitsDocument20 pagesGulf Oil Exhibitsaskpeeves1No ratings yet

- Powerplan Powerttax Income Tax OverviewDocument2 pagesPowerplan Powerttax Income Tax OverviewKoffee Farmer0% (1)

- KPMGDocument29 pagesKPMGLauren ObrienNo ratings yet

- Financial Statements of Nonprofit OrganizationsDocument4 pagesFinancial Statements of Nonprofit Organizationsyes yesnoNo ratings yet

- Contractual Adjustments A Portion of A Hospital's Revenue Is Collectible From Third Party Payors, Such As The Philhealth andDocument2 pagesContractual Adjustments A Portion of A Hospital's Revenue Is Collectible From Third Party Payors, Such As The Philhealth andyes yesnoNo ratings yet

- Unrestricted FundDocument2 pagesUnrestricted Fundyes yesnoNo ratings yet

- 5 GovaccDocument1 page5 Govaccyes yesnoNo ratings yet

- 4 GovaccDocument2 pages4 Govaccyes yesnoNo ratings yet

- 3 GovaccDocument1 page3 Govaccyes yesnoNo ratings yet

- CHAPTER 4 - Job Order Costing: Learning ObjectivesDocument3 pagesCHAPTER 4 - Job Order Costing: Learning Objectivesyes yesnoNo ratings yet

- 2 GovaccDocument1 page2 Govaccyes yesnoNo ratings yet

- 1 GovaccDocument2 pages1 Govaccyes yesnoNo ratings yet

- General Ledger and Reporting SystemDocument3 pagesGeneral Ledger and Reporting Systemyes yesnoNo ratings yet

- Principles of Graph DesignDocument5 pagesPrinciples of Graph Designyes yesnoNo ratings yet

- 1.4 Match The Description in The Right Column With The Information Characteristic in The Left ColumnDocument5 pages1.4 Match The Description in The Right Column With The Information Characteristic in The Left Columnyes yesnoNo ratings yet

- P4Document3 pagesP4yes yesnoNo ratings yet

- Apply The Value Chain Concept To S&S. Explain How It Would Perform The Various Primary and Support ActivitiesDocument2 pagesApply The Value Chain Concept To S&S. Explain How It Would Perform The Various Primary and Support Activitiesyes yesnoNo ratings yet

- Bank Statements Provide Information About All of The Following ExceptDocument3 pagesBank Statements Provide Information About All of The Following Exceptyes yesnoNo ratings yet

- Select Two Types of Information Found in An Annual Report, Other Than The Financial Statements and Accompanying Footnotes, and Describe How They Are Helpful To The Users of Annual ReportsDocument3 pagesSelect Two Types of Information Found in An Annual Report, Other Than The Financial Statements and Accompanying Footnotes, and Describe How They Are Helpful To The Users of Annual Reportsyes yesnoNo ratings yet

- Audited FS MIL 2011 PDFDocument60 pagesAudited FS MIL 2011 PDFrachna357100% (1)

- Summer Internship Training Report: Working Capital Management in GSK Consumer Healthcare LTDDocument38 pagesSummer Internship Training Report: Working Capital Management in GSK Consumer Healthcare LTDkbdeepu23No ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- Fatima Fertilizer Annual ReportDocument106 pagesFatima Fertilizer Annual ReportMuhammad Imran Umer100% (1)

- Summer Internship Report On Financial Analysis of Wipro LTDDocument77 pagesSummer Internship Report On Financial Analysis of Wipro LTDSatyam ShuklaNo ratings yet

- Far NosolnDocument11 pagesFar NosolnStela Marie CarandangNo ratings yet

- Adoption of IFRS SpainDocument31 pagesAdoption of IFRS SpainIie SriwijayaNo ratings yet

- CH 02Document55 pagesCH 02Kokoh HengkyNo ratings yet

- Hero Motocorp LTD Balance Sheet Common Size Particulars 17-18 16-17 Percentage of 17-18 Percentage of 16-17Document25 pagesHero Motocorp LTD Balance Sheet Common Size Particulars 17-18 16-17 Percentage of 17-18 Percentage of 16-17pranav sarawagiNo ratings yet

- Crownford General Corp. Notes To Financial Statements: (Amounts in Philippine Pesos)Document19 pagesCrownford General Corp. Notes To Financial Statements: (Amounts in Philippine Pesos)Mel VillahermosaNo ratings yet

- Accounting For Income TaxDocument14 pagesAccounting For Income TaxJasmin Gubalane100% (1)

- Question Bank PDFDocument576 pagesQuestion Bank PDFZaid AhmadNo ratings yet

- All Numbers Are in INR and in x10MDocument6 pagesAll Numbers Are in INR and in x10MGirish RamachandraNo ratings yet

- Tatamotors 2004Document48 pagesTatamotors 2004avneetchawlaNo ratings yet

- MFRS101 Presentation of Financial StatemntsDocument8 pagesMFRS101 Presentation of Financial StatemntsIsmahani HaniNo ratings yet

- QuestionDocument5 pagesQuestionLevi OrtizNo ratings yet

- Cfas Pas 1-16Document8 pagesCfas Pas 1-16Sagad KeithNo ratings yet

- IAS 7 With Notes (2021) - GZU MastersDocument16 pagesIAS 7 With Notes (2021) - GZU MastersTawanda Tatenda HerbertNo ratings yet

- Tutorial Letter 101/3/2019: Specific Financial ReportingDocument32 pagesTutorial Letter 101/3/2019: Specific Financial Reportingstephen chinogaramombeNo ratings yet

- Solved Radioco A Domestic Corporation Owns 100 of Tvco A ManufacturingDocument1 pageSolved Radioco A Domestic Corporation Owns 100 of Tvco A ManufacturingAnbu jaromiaNo ratings yet

- BKAR3033 Syllabus A211Document5 pagesBKAR3033 Syllabus A211Hairil NazriNo ratings yet

- Centrica PLC: Used Peer Group: ProfileDocument17 pagesCentrica PLC: Used Peer Group: ProfileWilliam FannNo ratings yet

- A Guide To Solving Accounting Problems in Income TaxDocument3 pagesA Guide To Solving Accounting Problems in Income TaxMargery BumagatNo ratings yet

- Case Nowyouseeitjetfa 121004054109 Phpapp01Document12 pagesCase Nowyouseeitjetfa 121004054109 Phpapp01Samarth KudalkarNo ratings yet