Professional Documents

Culture Documents

Union Performance Commercial Ministry Petroleum Natural Gas 14 2014 Chapter 8 Annexures

Union Performance Commercial Ministry Petroleum Natural Gas 14 2014 Chapter 8 Annexures

Uploaded by

RASHID AHMED SHAIKH0 ratings0% found this document useful (0 votes)

6 views5 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views5 pagesUnion Performance Commercial Ministry Petroleum Natural Gas 14 2014 Chapter 8 Annexures

Union Performance Commercial Ministry Petroleum Natural Gas 14 2014 Chapter 8 Annexures

Uploaded by

RASHID AHMED SHAIKHCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 5

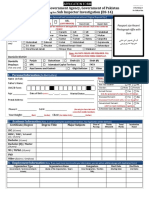

Annexure 1

(Referred to in Para 1.1.1)

Report No.14 of 2014

CONSUMPTION OF PETROLEUM PRODUCTS.

(000 Metric Tonne)

LPG 12010 [ 12191 13135 [14331 18350

SKO. 9365 9303) 9304 8928 8229

HSD a7eso | si710| 56242] aoo71| 64750

Sub total 9043 | 73204| 7862/3330 | 88328

Ms tosa2| _11258| izeta{ 14194 | 14902

Naptha + NGL 13204 [13011 torsa]toe7e [11222

ATE 4543 4423 4627, 5078) 5536)

tbo 667 552 457 455 a5

Lubricants & Greases. 2290 2000 2539 2429 2633,

FO &LSHS. sari7| 12588 | 11629 [10789 9307,

Bitumen 4506 4747 4934 4536 4638

‘Sub total assag | 4sa7a|a7taa[4eisa| 48742,

Petroleum coke 5950 6166 6586 4982 6138

Others ‘5604 4750 5400) 4569 4924

‘Sub total 17554[ 10016 | 11987 e552 [11062

TOTAL 128046 | 133500] 1378 141040 | 148132

Tource: FPAC

Annexure Il

[Referred to in Para 1.1.1 & 3.1.1)

Production of Major Petroleum Products

(000 Metric Tonne)

LPG $868 9335] 10345 9624 9554

Naphtha 7983 |__t797 | __1e7e2| 19309 18707

MS. 14174 |__tese7 |__ 22554 | 25802 27207

ATE eoi5| 8356 | 9304 9817 10061

‘SKO e027 | _ 846% 8833 7898 8013

HSD_ a482| 64130 | 73240 | 77684 32928

TO 713) 608 a2, 507 B02

Lubes 5 870 950 941 1027

FO 12642 |__14774 |__ 15287 | __18672 77D

LSHS 3315 | 3046 2627 71985 ai

Bitumen 4450 | __ 46204873 4446 4599

Others: T1455 | _10124 | _17755| 19010 21955

Total 749879 | 157436 | tes000 | 195786 | 203994

Source: FPAC

Report No.14 of 2014

Annexure Ill

(Referred lo in Para 1.1.1 & 3.1.1)

Import/Exports of Crude and Petroleum Products

“000 mts

IMPORTS

CRUDE 121,672 | 1,32,775 | 1,59,259 | 1,63,595 174,729,

PRODUCT

LPG 2es3| 2423 | 2718 | 4,502 5084

NAPHTHA 5983] 5.023 [1,734 [2,078 1974

PETROL 328 397 a5 [1,702 654

KEROSENE, 7489 | 1448 385 | 1.381 564

DIESEL 2.951| _2,742[ 2,531 [ 2,073 1054

CUBES 1,253) 986 [1.419 | 1.214 1546

FUEL OIL, 3,659 | _ 2,760 896, 925 1128

BITUMEN EG 105 6 6, o7

OTHERS: 2.931 | _2,702| 3,928 | 2,875 2828

TOTAL PRODUCTIMPORT | 22,462| 18,586 | 14,665) 16,615 14,997

TOTAL IMPORTS 7,44,134 | 1,51,361 | 1,73,924 | 1,80,410 7,86,726

EXPORTS:

TPG 39 709 131 154 174

NAPHTHA a207 | 7eoT | 9ett | 10855 10139

PETROL, 4258 | 5440 | 9771 | 13578 14524

AVIATIONTURBINE FUEL | 4486 | 3701| 4588) 4478 4561

KEROSENE 137, 77 46 33 34

DIESEL 74,308 | 14720 | 16451 |__20395 20407

DO 0 04 ai] 98.0 84

CUBES, a 738 2 23, 27

FUEL OIL are| 6207 | _5155| 6734 7895

BITUMEN 3 5 au 56, 5

OTHERS: 3,122 905 [ _2870[ 2027 2088

TOTAL EXPORT 40,779 | 38,944 | 51,023 | 59,077 60,837

NET IMPORT 7,03,355 | 1,12,417 | 1,22,901 | 1,21,333 7,235,889,

Net Product Export 18,317 | 20,358 | 36,358 | 42,262 45,840

Annexure IV

[Referred to in Para 3.1.9)

Report No.14 of 2014

Impact of sale of HFHSD at regulated price

Total Sale of HFHSD to Private 221,178 | 3,23,405 | 2,60,548 | 2,46,038 | 2,22,637

Parties (KL)

‘Average under recovery RS per KL eso} 8574) 1,305] 4688) 10,380

for HSD

Loss to exchequer (© in erore) 139 27 7 12 234

A 805

BPCL

Total Sale of HFHSD to Private 154211 | 125,741] 95,049 | 1,47,962 | 1.65487

Parties (KL)

‘Average under recovery RS per KL 6a04 | 8460) 1,406, 4.914 | 10,395,

for HSD

Loss fo exchequer (Fin crore) a7 107 3 73 172

@) a2

PCL

Total Sale of HFHSD to Private 27,087 | 40,159] 97,665] 36,012] 25,835

Parties (KL)

‘Average under recovery €perKL for | __6.339| 6,276 Taz | 4946 | 70,399

HSD

Loss fo exchequer (Fin crore) 7 33 4 18 a

© 709

@)+@)+(C) — Cincrore 1376

Report No.14 of 2014

Annexure V

(Referred to in Para 3.2.2 (A))

Changes in customs duty rates since 1 April 2002

O7a72002 20

19/08/2004 15

(0170372005 10.

14/06/2006 75

(05/06/2008 25

‘27i02i2010 75

ZBIO6I2O11 25

Annexure VI

(Referred to in Para 3.2.2 A)

‘Changes in Excise duty rates since 1 April 2002

Goss | Advalor | Spoctie Tots | Aavalor | Speco | Tot

ca Joma |) | quiyat Jem | tr) | uty at

Dein Dei

‘qaarza0z | 1800 | 3200] 7.00] 7053} Te.00 Too} 285] 1600] 1600

‘wer002 | 7800 | 3000} 700, Toez] 7400 Too] 280 | 1600 | 1600

ara003 | T800 | 3000] 700] ireT | 7400 Tso] 358, 1600] 1600

Teero0s | Tao | 2600 _ FSO] Ter} Too Tso] Saz[ 1600] 800

Torarz004 | 1800 | 23.00] 780] 11.80} 8.00 Tso] sor 1200] 800

Tams | 1800 | Boo] 1300) 1458} B00 325 | 480) NLP NIC

"raz006 | 2500] a0] 1300] 7459} 8.00 325[ 480] NL] NI

Taan07 | 2500 | 600| 1300) 1486 | 6.00 325| 460) NPN

az008 | 2500 | _NT| 1235] 1478} Ni a0 478] NPN

‘ierzo08 [2500 | —_ na} 7435 [73.75] NT 3e0| 77] NE NL

zero | 2500 | _Nv| 1336] 1478} NI 4e0| 478] NN

eT | 2500 [Nr] 7435 [Tare] —_NT Zoo | _206) NIC NE

qanriz | 4500] Nw] —taa5] 1478 | Ni 200] 206] NE} NIC

Tar | 4500 | NT 920] S48 | Ni 345 | 358] Ni Wi

NOTE: With effect from IMarch 2003, NCCD at the rate of 80/per MT imposed on crude ol,

Source: Notes for Supplementaries of PPAC of January 2013

Annexure Vi

(Referred to in para 3.2.2. B (i))

Report No.14 of 2014

Statement of Actual rates of Sales tax/VAT levied by various States/UTs as on 01.12.2012

“| Andhra Pradesh 22257. Ea 3%

2_[ Arunachal Pradesh 12.50% ah 25

3. | Assam 16.50% 5% Fe vate

r1aicylvae

| Bihar 20% ca i 1%

| chhatisgarh 25% 25% 4h NI

| NOT of Den 20% rebate FOE, | _€ZSUIRL (Air Ambience 8% NC

cffecive 29.05.2012 | Charges) + 12.5% VAT.

7 | Caarat ake VATH2% Ces On DIVAT + NE NI

“own Rate+ VAT 3% Cass *VAT

= [Gea 2.10% 20% wh nO

‘| Himachal Pradesh 25% 2.60% NE 4%

70" | Haryana’ ZORVAT +5% Adatonal | BB%> VAT +5% Adaivonal NE NO

‘Taxon VAT Taxon VAT

7i,_| drarkand 20%, 78% i, 3h

72, | Jammu & Kashmir | 20% MST + @S000KL | 1296 MST + €1000KC 3% 0%

(Employment Ges) (Employment Coss)

73. | Kerala 26.68 Salo Tax + 1% | 188% Sale Tax + 1% Socal | _SVATHT™ 3%

Social Security Cess.on | Securiy Cess on Sale Tax | Sorat Security

‘sr (Cosson VAT

7a | Kamae, Then Tax ee ST | Se Em Tar TSE ST o Te

75 | Maohya Pradesh | 1% Entry Taxs 27% VAT | 1% Entry Tax + 23% VAT 3% aT Eni

Tax 45% VAT

76. | Waharaciva 5% VAT CTL ae 3% 3%

(Acditional Surcharge)

7_| wanipur 20%. 13.50% Oh a

78. | Meghalaya 20% Dh Surcharge. | 128K 32% Surcharget 0% 0%

Rebate of €1.53/L, ‘O.50/Ltr Rebate

7a wiaeam 20% "ie om a

20. Nagaiand 20 5 Surenarg Te 5%, Surcharge [om 45SC | Aas SC

21. | Odisha Ty, Eniry Tax +16% VAT [1% Enty Tax + 18% VAT [196 Enuy Tax [1% Enty Tax

22. | Punjab © 1000/KL (Coss) +28% ‘B.T5% VAT 10% | 5% VAT + 10% | 4% VAT+ 10%

VAT+ 10% Adaltonal Tax | Adcitional Taxon VAT | Adaitonal on | Adeltional on

‘on VAT. VAT. VAT.

2. | Rajasthan DEVE VAT + 500K TH VAT E500 NIL NIL{Subsiy oF

(Coss) (Cess}0.54/Lt. (Rebaie) ®25iCy),

2a] Sik te rGoss € SOOKE | 7.5% ress € 2000/KL om 4%

25. | Taminada 2% 21.49% 5%. NIL,

26. Tripura 20% 13.50%, 0% sie

27 | Wiost Bongal 25% Sale Tax + TOOOKL | 17% Salo Tax + TT00UKL{ Nie NIL

(Cess) (Cees) € 260IKL (Sale Tax

Redato)

2. | Utar Pradesh B5e% 129% FavAT Hm NE

‘dl Tax

73, | Utarakhand 25% VAT ooror€ TOL | 21% VAT. € 1 2aNI(VAT Ni WIL

Robata) + actroi € 10/L

30. | Andaman & Naser Nc NE NC ce

isan

i] Chandigarh TORI [Cess) + ZOEVAT | € TOK [Cass] + 12.5% VAT 3 Ni

3 | Basra & Nooer 20% 15% cs a%

35_| Daman & Diz 20% 75% Hi oy

34. [ Lakshadwoop NIL NI NI NL,

35, | Pusuchen 5% 74% NIC 1%

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Federal Government Agency, Government of Pakistan Sub Inspector Investigation (BS-14)Document3 pagesFederal Government Agency, Government of Pakistan Sub Inspector Investigation (BS-14)Salman KhanNo ratings yet

- Sazgar Annual Account 2019Document76 pagesSazgar Annual Account 2019RASHID AHMED SHAIKHNo ratings yet

- Usaid Monthly Report April-2015Document7 pagesUsaid Monthly Report April-2015RASHID AHMED SHAIKHNo ratings yet

- Presentation On LNG For Pip Seminar in Pso HouseDocument26 pagesPresentation On LNG For Pip Seminar in Pso HouseRASHID AHMED SHAIKHNo ratings yet

- Standard Operating Procedures For LNG Carriers in Port QasimDocument9 pagesStandard Operating Procedures For LNG Carriers in Port QasimRASHID AHMED SHAIKHNo ratings yet

- Sop For LNG Carriers at Port - Qasim - AuthorityDocument25 pagesSop For LNG Carriers at Port - Qasim - AuthorityRASHID AHMED SHAIKHNo ratings yet

- Marketing and Petroleum Act 1974Document15 pagesMarketing and Petroleum Act 1974RASHID AHMED SHAIKHNo ratings yet

- Ogra Natural Gas Third Party Access Rules 2012Document23 pagesOgra Natural Gas Third Party Access Rules 2012RASHID AHMED SHAIKHNo ratings yet

- Petroleum - Pricing Mechanism in IndiaDocument13 pagesPetroleum - Pricing Mechanism in IndiaRASHID AHMED SHAIKHNo ratings yet

- Arab Gulf FOB Mean PricesDocument2 pagesArab Gulf FOB Mean PricesRASHID AHMED SHAIKHNo ratings yet

- MPRA Paper 25905Document118 pagesMPRA Paper 25905RASHID AHMED SHAIKHNo ratings yet

- Factors Influence The Location of Retail Store ANSHUL JAINDocument98 pagesFactors Influence The Location of Retail Store ANSHUL JAINRASHID AHMED SHAIKHNo ratings yet

- Petroleum Product PricingDocument118 pagesPetroleum Product PricingRASHID AHMED SHAIKHNo ratings yet

- Mardana Quwwat-e-Baah Barhaiye (Kutubistan - Blogspot.com) PDFDocument119 pagesMardana Quwwat-e-Baah Barhaiye (Kutubistan - Blogspot.com) PDFRASHID AHMED SHAIKHNo ratings yet