Professional Documents

Culture Documents

Sbi Magnum Global Fund Factsheet (September-2021-4-1)

Uploaded by

Dilip Pandey0 ratings0% found this document useful (0 votes)

7 views1 pageOriginal Title

sbi magnum global fund factsheet (september-2021-4-1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageSbi Magnum Global Fund Factsheet (September-2021-4-1)

Uploaded by

Dilip PandeyCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

EQUITY-THEMATIC FUND

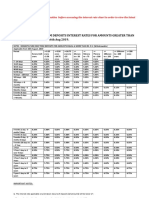

NET ASSET VALUE LAST IDCW Face value: `10

Option NAV (`) Record Date IDCW (in `/Unit) NAV (`)

Reg-Plan-IDCW 84.8943 29-Nov-17 (Reg Plan) 5.10 54.5060

29-Nov-17 (Dir Plan) 6.20 66.3252

Reg-Plan-Growth 277.8945

25-Nov-16 (Reg Plan) 5.00 45.0759

Dir-Plan-IDCW 106.3708 25-Nov-16 (Dir Plan) 6.00 54.3465

Dir-Plan-Growth 297.9888 30-Oct-15 (Reg Plan) 5.10 49.9803

30-Oct-15 (Dir Plan) 5.10 59.5549

Investment Objective

Pursuant to payment of IDCW, the NAV of IDCW Option of scheme/plans

To provide the investor with the would fall to the extent of payout and statutory levy, if applicable.

opportunity of long-term capital

appreciation by investing in diversified

portfolio comprising primarily of MNC

companies. PORTFOLIO

Fund Details Stock Name (%) Of Total AUM Stock Name (%) Of Total AUM

• Type of Scheme

Equity Shares Gland Pharma Ltd. 1.93

An open-ended Equity Scheme investing in

companies following the MNC theme. Colgate Palmolive (India) Ltd. 7.10 Page Industries Ltd. 1.91

• Date of Allotment: 30/09/1994 Hindustan Unilever Ltd. 6.12 Abbott India Ltd. 1.36

• Report As On: 31/08/2021

Nestle India Ltd. 5.30 Mtar Technologies Ltd. 1.23

• AAUM for the Month of August 2021

` 5,190.19 Crores Divi's Laboratories Ltd. 4.98 Esab India Ltd. 1.03

• AUM as on August 31, 2021 Grindwell Norton Ltd. 4.89 ELGI Equipments Ltd. 0.87

` 5,346.08 Crores

• Fund Manager: Mr. Anup Upadhyay HCL Technologies Ltd. 3.96 CSB Bank Ltd. 0.75

Managing Since: May-2018 SKF India Ltd. 3.95 Burger King India Ltd. 0.74

Total Experience: Over 13 years

Maruti Suzuki India Ltd. 3.51 United Breweries Ltd. 0.71

• Benchmark: Nifty MNC Index (TRI)

• Exit Load: For exit within 12 months from the Procter & Gamble Hygiene And Health Care Ltd. 3.45 Kennametal India Ltd. 0.54

date of allotment - 1.00%; Schaeffler India Ltd. 3.31 CCL Products (India) Ltd. 0.24

For exit after 12 months from the date of

allotment - Nil Ambuja Cements Ltd. 2.80 Total 87.89

• Entry Load: N.A. Galaxy Surfactants Ltd. 2.77 Foreign Equity shares

• Plans Available: Regular, Direct

Dixon Technologies (India) Ltd. 2.58 Alphabet Inc. 4.05

• Options: Growth, IDCW

• SIP Britannia Industries Ltd. 2.58 Nvidia Corporation 2.35

Any Day SIP’ Facility is available for Monthly, Cummins India Ltd. 2.49 Microsoft Corporation 2.22

Quarterly, Semi-Annual and Annual frequencies

through electronic mode like OTM / Debit ABB India Ltd. 2.44 Netflix Inc 2.00

Mandate. Default SIP date will be 10th. In case Pfizer Ltd. 2.20 Total 10.62

the SIP due date is a Non Business Day, then the

Ajanta Pharma Ltd. 2.18 Cash, Cash Equivalents And Others 1.49

immediate following Business Day will be

considered for SIP processing. PI Industries Ltd. 2.10 Grand Total 100.00

Daily - Minimum 500 & in multiples of 1

Westlife Development Ltd. 2.00

thereafter for a minimum of 12 instalments.

(Kindly refer notice cum addendum dated June Wabco India Ltd. 1.99

02, 2020 for further details) ITC Ltd. 1.95

Weekly - Minimum ` 1000 & in multiples of ` 1

thereafter for a minimum of 6 instalments. (or) Timken India Ltd. 1.93

Minimum 500 & in multiples of 1 thereafter for a

minimum of 12 instalments.

Monthly - Minimum ` 1000 & in multiples of ` 1 PORTFOLIO CLASSIFICATION BY PORTFOLIO CLASSIFICATION BY

thereafter for minimum six months (or)

minimum ` 500 & in multiples of ` 1 thereafter

INDUSTRY ALLOCATION (%) ASSET ALLOCATION (%)

for minimum one year.

Quarterly - Minimum ` 1500 & in multiples of `

Consumer Goods 30.03

1.49

Industrial Manufacturing 22.68 10.62

1 thereafter for minimum one year.

Semi Annual - Minimum ` 3000 & in multiples Pharma 12.65

of ` 1 thereafter for a minimum of 4

IT 12.58

installments.

Annual - Minimum ` 5000 & in multiples of ` 1 Automobile 5.50 20.94 43.68

thereafter for a minimum of 4 installments. Cement & Cement Products 2.80

• Minimum Investment

Chemicals 2.77

` 5000 & in multiples of ` 1

• Additional Investment Consumer Services 2.74

` 1000 & in multiples of ` 1 Fertilisers & Pesticides 2.10

Quantitative Data Media, Entertainment & Publication 2.00 23.27

Textiles 1.91

Standard Deviation# : 16.59% Financial Services 0.75

#

Beta : 0.84 Large Cap Smallcap Midcap Foreign Equityshares

# Cash, Cash Equivalents And Others# 1.49

Sharpe Ratio : 0.76

Portfolio Turnover* Cash, Cash Equivalents, And Others

Equity Turnover : 0.27

Total Turnover : 0.27 SBI Magnum Global Fund

Total Turnover = Equity + Debt + Derivatives This product is suitable for investors who are seeking^:

#

Source: CRISIL Fund Analyser • Long term capital appreciation.

*Portfolio Turnover = lower of total sale or total

purchase for the last 12 months (including equity • Investments in equity stocks of MNC companies.

derivatives) upon Avg. AUM of trailing twelve months.

Risk Free rate: FBIL Overnight Mibor rate (3.38% as on Investors understand that their principal ^Investors should consult their financial advisers if in doubt about whether the product is suitable

31st August 2021) Basis for Ratio Calculation: 3 Years will be at Very High risk for them.

Monthly Data Points

Ratios are computed using Total Return Index (TRI) as

per SEBI Circular dated Jan 4, 2018 19

You might also like

- Kim - Sbi International Access - Us Equity FofDocument14 pagesKim - Sbi International Access - Us Equity FofDilip PandeyNo ratings yet

- भारतीय स्टेट बैंक १०३ जागा PDFDocument2 pagesभारतीय स्टेट बैंक १०३ जागा PDFRavi PilgarNo ratings yet

- HDFC RatesDocument4 pagesHDFC RatesdesikanttNo ratings yet

- HDFC Account Closure FormDocument1 pageHDFC Account Closure FormNicholas JonesNo ratings yet

- Personal DesDocument2 pagesPersonal DesDilip PandeyNo ratings yet

- Electricity Department Government of Goa (Electricity Bill Payments)Document2 pagesElectricity Department Government of Goa (Electricity Bill Payments)Dilip PandeyNo ratings yet

- Additional Surveillance Measure (ASM) Frequently Asked QuestionsDocument4 pagesAdditional Surveillance Measure (ASM) Frequently Asked QuestionsManish PandeyNo ratings yet

- Additional Surveillance Measure (ASM) Frequently Asked QuestionsDocument4 pagesAdditional Surveillance Measure (ASM) Frequently Asked QuestionsManish PandeyNo ratings yet

- Mutual Fund Factsheet How ToDocument4 pagesMutual Fund Factsheet How ToAvinash KumbharNo ratings yet

- Sub: Long - Term Additional Surveillance Measure (LT-ASM) Framework - UpdateDocument3 pagesSub: Long - Term Additional Surveillance Measure (LT-ASM) Framework - UpdateDilip PandeyNo ratings yet

- Sbi International Access-Us Equity Fof Factsheet (September-2021-582-11)Document1 pageSbi International Access-Us Equity Fof Factsheet (September-2021-582-11)Dilip PandeyNo ratings yet

- CertificateDocument1 pageCertificateDilip PandeyNo ratings yet

- NISM Investment Adviser Level 1 - Series X-A Study Material NotesDocument26 pagesNISM Investment Adviser Level 1 - Series X-A Study Material NotesSRINIVASAN69% (16)

- Sbi Balanced Advantage Fund Portfolio (November-2021-595-2)Document18 pagesSbi Balanced Advantage Fund Portfolio (November-2021-595-2)Dilip PandeyNo ratings yet

- Nism Investment Adviser Study Material PDFDocument28 pagesNism Investment Adviser Study Material PDFMuralidhar GoliNo ratings yet

- Bus Ticket PDFDocument1 pageBus Ticket PDFDilip Pandey83% (6)

- Subject CT1 Financial Mathematics Core Technical Syllabus: For The 2015 ExamsDocument6 pagesSubject CT1 Financial Mathematics Core Technical Syllabus: For The 2015 ExamsnigerianhacksNo ratings yet

- Nism Investment Adviser Study Material PDFDocument28 pagesNism Investment Adviser Study Material PDFMuralidhar GoliNo ratings yet

- Electricity Department Government of Goa (Electricity Bill Payments)Document1 pageElectricity Department Government of Goa (Electricity Bill Payments)Dilip PandeyNo ratings yet

- Red Bus TicketDocument1 pageRed Bus TicketDilip Pandey100% (1)

- LIC RelivingDocument1 pageLIC RelivingDilip PandeyNo ratings yet

- PGPSM Prospects 2016-17Document28 pagesPGPSM Prospects 2016-17Dilip PandeyNo ratings yet

- ID Proof - Pikanksh ShuklaDocument4 pagesID Proof - Pikanksh ShuklaDilip PandeyNo ratings yet

- Subject CT1 Financial Mathematics Core Technical Syllabus: For The 2015 ExamsDocument6 pagesSubject CT1 Financial Mathematics Core Technical Syllabus: For The 2015 ExamsnigerianhacksNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Kumari Bank Limited: Damauli BranchDocument28 pagesKumari Bank Limited: Damauli BranchBijaya DhakalNo ratings yet

- Mark 1.00 Out of 1.00: CompleteDocument6 pagesMark 1.00 Out of 1.00: CompleteAriyaNo ratings yet

- Commerce, Bengali and English For 12 WbseDocument306 pagesCommerce, Bengali and English For 12 WbseDI S HANo ratings yet

- (B) 3,100 9,545 (F) 82 (H) 11 (I) 6 (J) (D) 39,780Document3 pages(B) 3,100 9,545 (F) 82 (H) 11 (I) 6 (J) (D) 39,780Kavya GopakumarNo ratings yet

- Resolution NoDocument2 pagesResolution Nowmarasigan2610No ratings yet

- Cost Accounting Concepts and TechniquesDocument117 pagesCost Accounting Concepts and TechniquesEman MirzaNo ratings yet

- Cfa-Level-Ii-Errata 2021Document3 pagesCfa-Level-Ii-Errata 2021ConradoCantoIIINo ratings yet

- BIR Form 2551M Monthly Percentage TaxDocument3 pagesBIR Form 2551M Monthly Percentage TaxBaby BoyNo ratings yet

- FIN CCC Tanvir Ahmed Rony ID-18019042Document29 pagesFIN CCC Tanvir Ahmed Rony ID-18019042tanveer ahmedNo ratings yet

- 3.1.5 Audit of Inventories ANSWERDocument38 pages3.1.5 Audit of Inventories ANSWERAnna TaylorNo ratings yet

- Indian Accounting Standards (Ind AS) : Semester VIDocument19 pagesIndian Accounting Standards (Ind AS) : Semester VIChirag GadiaNo ratings yet

- Chapter 6: Financial Planning ProcessDocument13 pagesChapter 6: Financial Planning ProcessBOSS I4N TVNo ratings yet

- CHAPTER 8 - Accounting For ReceivablesDocument41 pagesCHAPTER 8 - Accounting For ReceivablesVanessa BatallaNo ratings yet

- Chapter 3 Financial InstrumentsDocument64 pagesChapter 3 Financial InstrumentsCyryll PayumoNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankVishal GandhleNo ratings yet

- Compendium of Opinions Vol. XXVI - EACDocument304 pagesCompendium of Opinions Vol. XXVI - EACDarpan Gawade100% (1)

- A Study On Working Capital Management in Zuari Cement LTD., YerraguntlaDocument5 pagesA Study On Working Capital Management in Zuari Cement LTD., Yerraguntlasree anugraphicsNo ratings yet

- SEC Form 17-QDocument20 pagesSEC Form 17-QnnovNo ratings yet

- Identify Indian Industry CaseDocument4 pagesIdentify Indian Industry CaseMrigank MauliNo ratings yet

- Babson Classic Collection: Starbucks CorporationDocument18 pagesBabson Classic Collection: Starbucks CorporationgogojamzNo ratings yet

- Tutorial PerakaunanDocument5 pagesTutorial PerakaunanNureenKamalNo ratings yet

- BUS 505.assignmentDocument16 pagesBUS 505.assignmentRashìd RanaNo ratings yet

- Capital RationingDocument24 pagesCapital RationingNeelesh GaneshNo ratings yet

- AC11 - CHAPTER 3 Subsequent To Date of AcquisitionDocument76 pagesAC11 - CHAPTER 3 Subsequent To Date of Acquisitionanon_467190796100% (1)

- Advanced Financial ReportingDocument5 pagesAdvanced Financial ReportingShravan Subramanian BNo ratings yet

- TLR Shareholder Rights and ActivismDocument109 pagesTLR Shareholder Rights and ActivismAnshul Singh100% (1)

- Chapter 7Document11 pagesChapter 7jake doinog86% (14)

- Alternative Division of Scheduled Banks and Non Scheduled Banks (Without Non Scheduled Bank Structure)Document2 pagesAlternative Division of Scheduled Banks and Non Scheduled Banks (Without Non Scheduled Bank Structure)Samuel HranlehNo ratings yet

- Account Statement From 21 May 2023 To 21 Nov 2023Document15 pagesAccount Statement From 21 May 2023 To 21 Nov 2023ranjeetatirkey1988No ratings yet

- Portfolio Management Through Mutual FundsDocument14 pagesPortfolio Management Through Mutual FundsMedha SinghNo ratings yet