Professional Documents

Culture Documents

gstr1 Return Summary

Uploaded by

Mamatha Reddy0 ratings0% found this document useful (0 votes)

5 views15 pagesOriginal Title

gstr1_return_summary

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views15 pagesgstr1 Return Summary

Uploaded by

Mamatha ReddyCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 15

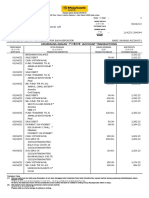

Summary For B2B(4)

No. of Recipients No. of Invoices Total Invoice Value

1 1 118000.000

Recipientver Namece Numbervoice dateoice ValueOf Supplyse Charge Tax Rateoice Typece GSTIN

36CZHPDMamatha INV-0000 07-Dec-2 118000.0036-TelangN Regular

Total TaxTotal Cess

100000.0 0.000

Rate ble Value s Amount

18 100000 0

Summary For B2CL(5)

No. of Invoices Total Invoice Value Total TaxTotal Cess

0 0.000 0.000 0.000

ce Numbervoice dateoice ValueOf Supply Tax Rate Rate ble Value s Amountce GSTIN

Summary For B2CS(7)

Total TaxTotal Cess

0.000 0.000

TypeOf Supply Tax Rate Rate ble Value s Amountce GSTIN

Summary For CDNR(9B)

No. of Recipients No. of Notes Total Note Value

0 0 0.000

Recipientver Namee NumberNote DateNote TypeOf Supplyse Chargepply Type ote Value Tax Rate

Total TaxTotal Cess

0.000 0.000

Rate ble Value s Amount

Summary For CDNUR(9B)

No. of Notes Total Note Value Total TaxTotal Cess

0 0.000 0.000 0.000

UR Typee NumberNote DateNote TypeOf Supply ote Value Tax Rate Rate ble Value s Amount

Total Cess

Summary For EXP(6)

No. of Invoices Total Invoice Valu No. of Shipping Bill Total TaxTotal Cess

0 0.000 0 0.000

port Type

ce Numbervoice dateoice ValuePort Codeill Number Bill Date Rate ble Value s Amount

Total Cess

Summary For Advance Received (11B)

Total AdvTotal Cess

0.000 0.000

Of Supply Tax Rate Rate Received s Amount

Summary For Advance Adjusted (11B)

Total AdvTotal Cess

0.000 0.000

Of Supply Tax Rate Rate Received s Amount

Summary For Nil rated, exempted and non GST outward supplies (8)

Total Nil Total ExeTotal Non-GST Supplies

0.000 0.000 0.000

escriptiond SuppliesST supply) Supplies

Inter-Stat 0 0 0

Intra-Stat 0 0 0

Inter-Stat 0 0 0

Intra-Stat 0 0 0

HSN(12)

o. of HSN Total Valueotal Taxable Valuerated Tax ntral Taxte/UT Tax

1 118000.000 100000.0 0.000 9000.000 9000.000

HSN escription UQC l Quantityotal Value Rate ble Valueax Amountax Amountax Amount

999999 ConsultanOTH 1 118000 18 100000 0 9000 9000

otal Cess

0.000

s Amount

0

You might also like

- Tax Chapter 20 No Homework Forming and Operating PartnershipsDocument99 pagesTax Chapter 20 No Homework Forming and Operating PartnershipsAstha GoplaniNo ratings yet

- Estatement 20190107 PDFDocument39 pagesEstatement 20190107 PDFNosheen hafeezNo ratings yet

- SAP Payroll BasicsDocument19 pagesSAP Payroll Basicsprdeshpande100% (3)

- GSTR1Document31 pagesGSTR1shubhamt25No ratings yet

- GSTR1 Stupl 08ABFCS1229J1Z9 November 2021 BusyDocument92 pagesGSTR1 Stupl 08ABFCS1229J1Z9 November 2021 BusyYathesht JainNo ratings yet

- GST 27aaach1537n1zg 201707 20170908144917Document27 pagesGST 27aaach1537n1zg 201707 20170908144917Rakesh JainNo ratings yet

- GSTR 1Document28 pagesGSTR 1Kristina PabloNo ratings yet

- GSTIN/UIN of Recipient Invoice Number Invoice Date Invoice Value Place of SupplyDocument25 pagesGSTIN/UIN of Recipient Invoice Number Invoice Date Invoice Value Place of SupplyANo ratings yet

- GSTR1 08 01 2018 PDFDocument5 pagesGSTR1 08 01 2018 PDFGourab DeyNo ratings yet

- GSTR1 09gbopk8930e1z6 122021Document4 pagesGSTR1 09gbopk8930e1z6 122021Akash PatelNo ratings yet

- GSTR1 08axvpp9576c1zl 062018 PDFDocument5 pagesGSTR1 08axvpp9576c1zl 062018 PDFkrishan chaturvediNo ratings yet

- GSTR1 19ahepj6908p2zo 032018Document5 pagesGSTR1 19ahepj6908p2zo 032018ATANU KUMAR MONDALNo ratings yet

- Draf T: Form GSTR-4Document6 pagesDraf T: Form GSTR-4padminiNo ratings yet

- GSTR1 29aadcb5666r2zs 032019 PDFDocument5 pagesGSTR1 29aadcb5666r2zs 032019 PDFCa caNo ratings yet

- Sales Report Order Date Invoice ID Order ID Tenant ID Product CategoryDocument23 pagesSales Report Order Date Invoice ID Order ID Tenant ID Product CategoryIndra HedarNo ratings yet

- GSTR-1 Form DetailsDocument4 pagesGSTR-1 Form DetailsTwo ManNo ratings yet

- GSTR-1 October 2020 formDocument5 pagesGSTR-1 October 2020 formTHIMMAPPANo ratings yet

- GSTR-1 FormDocument48 pagesGSTR-1 Formvishnu teja reddyNo ratings yet

- GSTR-1 Form DetailsDocument4 pagesGSTR-1 Form DetailsSantosh Ramdawar JaiswarNo ratings yet

- Tax Invoice Template for Studio ServicesDocument1 pageTax Invoice Template for Studio ServicesSHIVAM KUMARNo ratings yet

- GSTR-1 Form DetailsDocument4 pagesGSTR-1 Form DetailsSantosh Ramdawar JaiswarNo ratings yet

- FIN AL: Form GSTR-1Document5 pagesFIN AL: Form GSTR-1Aditya TiwaryNo ratings yet

- BillDocument1 pageBillritikbhatia530No ratings yet

- GSTR-1 TITLEDocument5 pagesGSTR-1 TITLEshubhamNo ratings yet

- FIN AL: Form GSTR-1Document5 pagesFIN AL: Form GSTR-1siva kumarNo ratings yet

- GSTR-1 May 2019 detailsDocument5 pagesGSTR-1 May 2019 detailssiva kumarNo ratings yet

- GSTR1 27CHRPP4130L1ZT 072018Document5 pagesGSTR1 27CHRPP4130L1ZT 072018KhushiNo ratings yet

- GSTR1 06aarpp8213h1ze 092017Document5 pagesGSTR1 06aarpp8213h1ze 092017Anonymous h2S3GW6No ratings yet

- GSTR-1 Iff 27awhpj3747l1z3 032022Document5 pagesGSTR-1 Iff 27awhpj3747l1z3 032022archana bagalNo ratings yet

- QuotationDocument1 pageQuotationManish DassNo ratings yet

- 6e9db38 48211Document1 page6e9db38 48211howef96789No ratings yet

- FIN AL: Form GSTR-1Document5 pagesFIN AL: Form GSTR-1siva kumarNo ratings yet

- GSTR-9: Government of India/State Department ofDocument10 pagesGSTR-9: Government of India/State Department ofIyengar PrasadNo ratings yet

- GSTIN/UIN of Recipient Invoice Number Invoice Date Invoice Value Place of SupplyDocument24 pagesGSTIN/UIN of Recipient Invoice Number Invoice Date Invoice Value Place of SupplyRam Krishna PandeyNo ratings yet

- Draf T: Form GSTR-1Document5 pagesDraf T: Form GSTR-1hussain28097373No ratings yet

- FIN AL: Form GSTR-1Document5 pagesFIN AL: Form GSTR-1Pruthiv RajNo ratings yet

- FIN AL: Form GSTR-1Document5 pagesFIN AL: Form GSTR-1Ajit GuptaNo ratings yet

- Draf T: Form GSTR-1Document5 pagesDraf T: Form GSTR-1uthaya KumarNo ratings yet

- VAT Invoice - DiomDocument1 pageVAT Invoice - DiomMostafa MousaNo ratings yet

- 150 Massar Al-Ingaz 3M Cat6 CablesDocument1 page150 Massar Al-Ingaz 3M Cat6 CablesIbrahim AljunaidiNo ratings yet

- Draft: ﺔﻴﺒﻳﺮﺿ ةرﻮﺗﺎﻓ Tax InvoiceDocument1 pageDraft: ﺔﻴﺒﻳﺮﺿ ةرﻮﺗﺎﻓ Tax InvoiceTilalNo ratings yet

- Tax Invoice GeneratorDocument1 pageTax Invoice Generatoromkar daveNo ratings yet

- No. of Recipients No. of Invoices: TotalDocument9 pagesNo. of Recipients No. of Invoices: Totaljaved aliNo ratings yet

- Simple GST Invoice For Single Rate of Goods and ServicesDocument8 pagesSimple GST Invoice For Single Rate of Goods and ServicesKM computer & online workNo ratings yet

- GSTR-1 Form SubmissionDocument5 pagesGSTR-1 Form SubmissionGH MOHDNo ratings yet

- GSTR-1 March 2021 detailsDocument4 pagesGSTR-1 March 2021 detailsMïhîr PrÆbhátNo ratings yet

- Draf T: Form GSTR-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesDocument4 pagesDraf T: Form GSTR-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesDivakar KNo ratings yet

- GSTR-1 Form DetailsDocument5 pagesGSTR-1 Form DetailsSantosh Ramdawar JaiswarNo ratings yet

- FIN AL: Form GSTR-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesDocument5 pagesFIN AL: Form GSTR-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesGST Range5 Division1No ratings yet

- GSTR-1 FormDocument5 pagesGSTR-1 FormGST Range5 Division1No ratings yet

- Draf T: Form GSTR-1Document5 pagesDraf T: Form GSTR-1ATANU KUMAR MONDALNo ratings yet

- Img 20230618 0001Document1 pageImg 20230618 0001Kamal TharejaNo ratings yet

- GSTR1 07DGPPK1624C1ZL 032021Document5 pagesGSTR1 07DGPPK1624C1ZL 032021Abhiraj SinghNo ratings yet

- Form GSTR-1: 4A, 4B, 4C, 6B, 6C - B2B InvoicesDocument5 pagesForm GSTR-1: 4A, 4B, 4C, 6B, 6C - B2B InvoicesDSPNo ratings yet

- GSTR-1 June 2018 FormDocument5 pagesGSTR-1 June 2018 FormSourabhNo ratings yet

- GSTR1 08fctps9157l1za 112021Document5 pagesGSTR1 08fctps9157l1za 112021ThamoNo ratings yet

- Simplified Tax Invoice - DiomDocument1 pageSimplified Tax Invoice - DiomMostafa MousaNo ratings yet

- FIN AL: Form GSTR-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesDocument5 pagesFIN AL: Form GSTR-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesVinod VijayNo ratings yet

- General Data: Lessee:: Input Data: Key OutputDocument10 pagesGeneral Data: Lessee:: Input Data: Key OutputShafiqUr RehmanNo ratings yet

- FIN AL: Form GSTR-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesDocument5 pagesFIN AL: Form GSTR-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicespkberliaNo ratings yet

- Form GSTR-1: 4A, 4B, 4C, 6B, 6C - B2B InvoicesDocument5 pagesForm GSTR-1: 4A, 4B, 4C, 6B, 6C - B2B InvoicesDEVENDRA BHARDWAJNo ratings yet

- Estano BdoDocument2 pagesEstano BdoJoey Albarracin SardañasNo ratings yet

- Refund Request for TDS Amount DeductedDocument1 pageRefund Request for TDS Amount DeductedLouis AndersonNo ratings yet

- Required: Do You Agree With Koya's Loss Calculation?Document1 pageRequired: Do You Agree With Koya's Loss Calculation?Chintan TrivediNo ratings yet

- Daily Allowance Claim Form: Only For Use of EngineersDocument10 pagesDaily Allowance Claim Form: Only For Use of EngineersAltafNo ratings yet

- Bill of SupplyDocument2 pagesBill of SupplyGitesh PagarNo ratings yet

- InvoiceDocument1 pageInvoiceG-vision CCTV worksNo ratings yet

- ACCENTURE SOLUTIONS PVT LTD EARNINGS STATEMENTDocument1 pageACCENTURE SOLUTIONS PVT LTD EARNINGS STATEMENTavisinghoo7No ratings yet

- Ravi Chimanbhai Verma: Account StatementDocument7 pagesRavi Chimanbhai Verma: Account StatementRavi VermaNo ratings yet

- DISBURSEMENT REQUEST FORM - V4.1revisedDocument2 pagesDISBURSEMENT REQUEST FORM - V4.1revisedAnshul RastogiNo ratings yet

- BIR OPM On TIN of Involuntary SellerDocument3 pagesBIR OPM On TIN of Involuntary Sellerracquel dimalantaNo ratings yet

- Online Percentage & P&L AssignmentDocument3 pagesOnline Percentage & P&L AssignmentxeloleyNo ratings yet

- Othprocess For Actual Investment Proof - 2021-22 - 2 Process For Actual Investment Proof - 2021-22Document13 pagesOthprocess For Actual Investment Proof - 2021-22 - 2 Process For Actual Investment Proof - 2021-22Dhruv JainNo ratings yet

- State Bank Collect Reprint Remittance Form Payment HistoryDocument1 pageState Bank Collect Reprint Remittance Form Payment HistoryBinayakSwainNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument8 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceKartikey SharmaNo ratings yet

- Dataran Maybank 1 30/06/22Document18 pagesDataran Maybank 1 30/06/22aqifqayyim ismailNo ratings yet

- November 9, 2016 G.R. No. 215957 Commissioner of Internal Revenue, Petitioner FITNESS BY DESIGN, INC., Respondent Decision Leonen, J.Document10 pagesNovember 9, 2016 G.R. No. 215957 Commissioner of Internal Revenue, Petitioner FITNESS BY DESIGN, INC., Respondent Decision Leonen, J.Kent-Kent VillaceranNo ratings yet

- Apqpa0045n 2018Document4 pagesApqpa0045n 2018samaadhuNo ratings yet

- SMCC AccountsDocument1 pageSMCC AccountsRonnel CortezNo ratings yet

- Rekening Koran 05101000262300 2023-08-09 2023 - 01-30 00312266Document6 pagesRekening Koran 05101000262300 2023-08-09 2023 - 01-30 00312266Muh WirabuanaNo ratings yet

- Sample Memorial RespondentDocument22 pagesSample Memorial RespondentShivani SinghNo ratings yet

- 9.3M DB - CresDocument2 pages9.3M DB - Cresruby caldeNo ratings yet

- Cognizant Flexible Benefit Plan SummaryDocument2 pagesCognizant Flexible Benefit Plan SummarySreenivasa Murthy KotaNo ratings yet

- EcDocument2 pagesEcArgie FlorendoNo ratings yet

- Tax Invoice - TMFYVDDocument1 pageTax Invoice - TMFYVDTauriq SafodienNo ratings yet

- Amazon - in - Order 403-8637517-5929926Document1 pageAmazon - in - Order 403-8637517-5929926Ashima GuptaNo ratings yet

- Payroll Accounting 2013 23rd Edition Bieg Solutions Manual DownloadDocument31 pagesPayroll Accounting 2013 23rd Edition Bieg Solutions Manual DownloadTommie Clemens100% (22)

- Perfee International Limited Payment Invoice 1906279534408W11WJSRKKZNJSDocument1 pagePerfee International Limited Payment Invoice 1906279534408W11WJSRKKZNJSHossainmoajjemNo ratings yet