Professional Documents

Culture Documents

Competitive Profile Matrix Analysis

Uploaded by

PRANAV BHARARAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Competitive Profile Matrix Analysis

Uploaded by

PRANAV BHARARACopyright:

Available Formats

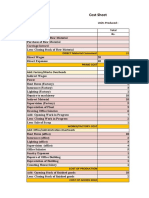

Competitive Profile Matrix

Alexion Pfizer Eli Lilly

Success Weight Rating Score Rating Score Rating Score

Factors

Market .15 2 .3 4 .6 3 .45

Share

R&D .25 4 1 3 .75 4 1

Spending

# of .15 1 .15 4 .6 3 .45

Employees

# of .25 1 .25 4 1 2 .5

Products

Product .2 1 .2 4 .8 3 .6

Variety

Totals 1 1.9 3.75 3

These three companies were chosen because they all fall into an Orphan Drug category.

Market share was determined from the information contained in the BCG matrix.

Currently Alexion has a market share of 7%, Pfizer is currently topping the market as the biggest

pharmaceutical company while Eli Lilly is at 37%.

Pharmaceutical companies spend an average of 18% of their revenues toward research and

development. Pfizer spent 14.8%, Eli Lilly spent 24.7% and Alexion spent 24.6%.

As of December 31, 2016 Alexion employed 3,121 people, Pfizer employed 96,500

people, and Eli Lilly employed 41,975. This is a significant number because every employee a

company has is a knowledge asset and should be seen as a potential for ideas and innovations.

Alexion currently has three products. Pfizer currently has over one hundred products. Eli

Lilly currently has 33 products.

Currently Alexion specializes in Orphan drugs prescribed by a doctor, they have not

branched out past that currently. Pfizer has a variety of different types of drugs and is also into

the over-the-counter market. Eli Lilly also has a variety of drugs for the body but is not in the

over-the-counter market.

Competitive Analysis

This CPM reveals that Alexion is a weak competitor in the Pharmaceutical industry. It is

important to note that Alexion does specialize in the Orphan Drug sections and that should be

considered. They currently have two one of a kind drugs on the market so that makes them

valuable. Alexion is very strong in their research and development which will be a strength when

they are trying to come up with their next one-of-a-kind medicine to treat rare disorders. Based

on the matrix Alexion should not be discredited as it is a small company it should be considered

for its exclusiveness of product that will be rare and difficult to replicate by another competitor.

BCG Matrix and explanation

Company Net Product Sales Growth Rate from Relative Market

2016 2015 to 2016 Share

(Millions)

Pfizer 45,906 .06 1

Allergan 18,597 .01 .41

Bristol-Myers Squibb 18,163 .25 .40

Eli Lilly 17,173 .09 .37

Celgene 11,114 .23 .24

Mylan 10,839 .17 .24

Biogen 9,818 .07 .21

Abbott Laboratories 3,859 .04 .08

Regeneron 3,338 .24 .07

Pharmaceuticals

Alexion 3,082 .18 .07

Pharmaceuticals

For the BCG matrix, U.S. based pharmaceutical companies that fell around Alexion in

the list of top 50 companies for 2017 were used. To calculate the growth rate, the same

companies were found on the list of top 50 companies for 2016 and there 2017 product sales

were subtracted from their 2016 sales and then divided by their 2016 sales ((2016-2015)/2015).

To calculate the relative market shares each company’s 2016 product sales were divided by

Pfizer’s product sales since they were the leading pharmaceutical company in 2016. According

to [ CITATION Pat17 \l 1033 ] the average annual growth rate for the pharmacy industry is 4%

to 7% so the market growth rate median will be 5% for the y-axis.

BCG Matrix

0.25

0.24

0.23

Relative Market Share

0.18

0.17

0.09

0.07

0.06

0.04

0.01

Growth Rate from 2015-2016

This matrix shows that Alexion is currently in the question mark section which

means if they are growing fine as a company but they will need to increase their market share if

they want to get into the stars category with Pfizer. They will do this with market penetration,

market development, product, development, or divestiture.

You might also like

- SOP Contract Labour Validation and Issuing Gate Passes FormatDocument34 pagesSOP Contract Labour Validation and Issuing Gate Passes FormatOmkar100% (1)

- Bi Mhealth9 SumDocument2 pagesBi Mhealth9 SumDavid WNo ratings yet

- BN4206 Assignment Brief 2013 Part BDocument6 pagesBN4206 Assignment Brief 2013 Part BSumayyah ArslanNo ratings yet

- MG309 NDocument15 pagesMG309 Nkishan100% (1)

- Birlasoft CaseA PDFDocument30 pagesBirlasoft CaseA PDFRitika SharmaNo ratings yet

- Sample of ForecastingDocument18 pagesSample of ForecastingMohammad KamruzzamanNo ratings yet

- Literature Review ProformaDocument13 pagesLiterature Review ProformaShashank Varma100% (1)

- Issues-11-075r - The Case - Task 1Document15 pagesIssues-11-075r - The Case - Task 1api-115328034No ratings yet

- Evaluating a Long-Term Supplier's PerformanceDocument4 pagesEvaluating a Long-Term Supplier's PerformanceNikhil Kanodia100% (1)

- MashaweerDocument5 pagesMashaweerebruklcnNo ratings yet

- Case Study Format of KIA MotorsDocument5 pagesCase Study Format of KIA MotorsSujan RoyNo ratings yet

- Business Intelligence Insights for Agha Super Mart ChainDocument14 pagesBusiness Intelligence Insights for Agha Super Mart ChainShariq Ahmed Khan 0332 : Alnoor Society0% (1)

- SQC A2 Group 8Document4 pagesSQC A2 Group 8SHARDUL JOSHINo ratings yet

- 1&2 Assignment # 5Document2 pages1&2 Assignment # 5tejasraiNo ratings yet

- Criteria for Offshore Companies Adopting Agile MethodsDocument4 pagesCriteria for Offshore Companies Adopting Agile MethodsMREGANK SONINo ratings yet

- Training On User Management Tool: Ministry of Finance and Economic CooperationDocument30 pagesTraining On User Management Tool: Ministry of Finance and Economic Cooperationabey.mulugetaNo ratings yet

- Capital Budgeting Decisions ReportDocument10 pagesCapital Budgeting Decisions ReportchioqueNo ratings yet

- MIS Helps PWL Handle Dynamic Wristwatch BusinessDocument2 pagesMIS Helps PWL Handle Dynamic Wristwatch Businessnayan bhowmickNo ratings yet

- 2024LTC Report V11Document83 pages2024LTC Report V11Simon AlvarezNo ratings yet

- 1Document12 pages1Anshuman PrakashNo ratings yet

- KMS at XeroxDocument3 pagesKMS at XeroxPriyanka DargadNo ratings yet

- Taleo ArchitectureDocument2 pagesTaleo Architecturesridhar_eeNo ratings yet

- Group 3 WESCODocument18 pagesGroup 3 WESCOGaurav ChoukseyNo ratings yet

- Business Model Canvas Innovation and Blue Ocean Strategy For EfisheryDocument8 pagesBusiness Model Canvas Innovation and Blue Ocean Strategy For EfisheryPark Sooyoung LizzyNo ratings yet

- High Tire PerformanceDocument8 pagesHigh Tire PerformanceSofía MargaritaNo ratings yet

- Mics New Suggested IcanDocument456 pagesMics New Suggested IcanSuZan DhaMiNo ratings yet

- Ben Thanh Ford market analysis and sales objectivesDocument54 pagesBen Thanh Ford market analysis and sales objectivesTKT HTFNo ratings yet

- Porter's Five Forces Industry AnalysisDocument10 pagesPorter's Five Forces Industry AnalysiskulsoomalamNo ratings yet

- Accelerating The Transformation: ANNUAL REPORT 2019-20 ANNUAL REPORT 2019-20Document300 pagesAccelerating The Transformation: ANNUAL REPORT 2019-20 ANNUAL REPORT 2019-20Atul DarganNo ratings yet

- Satmetrix Whitepaper ThepowerbehindasinglenumberDocument11 pagesSatmetrix Whitepaper Thepowerbehindasinglenumberapi-245135782No ratings yet

- Udyog Aadhaar Registration CertificateDocument1 pageUdyog Aadhaar Registration CertificateNeeraj KushwahNo ratings yet

- VISTA LAND AND LIFESCAPES INC FinalDocument9 pagesVISTA LAND AND LIFESCAPES INC Finalmarie crisNo ratings yet

- Pritha@xlri - Ac.in: To Immediate Cancellation of The ExaminationDocument5 pagesPritha@xlri - Ac.in: To Immediate Cancellation of The ExaminationPradnya Nikam bj21158No ratings yet

- APC 309 Assignment Jan 2014Document4 pagesAPC 309 Assignment Jan 2014Milky WayNo ratings yet

- 03.McAfee. Mastering The Three Worlds of Information TechnologyDocument10 pages03.McAfee. Mastering The Three Worlds of Information Technology5oscilantesNo ratings yet

- Case Study On: Piloting Procter & Gamble From Decision CockpitsDocument3 pagesCase Study On: Piloting Procter & Gamble From Decision CockpitsSabbir AhmedNo ratings yet

- MIS 604 Assess 1 Requirement EngineeringDocument1 pageMIS 604 Assess 1 Requirement EngineeringAbhilasha Dahiya100% (1)

- Coursework BriefDocument5 pagesCoursework BriefÁnh Kim HoàngNo ratings yet

- New Solutions For MichiganDocument28 pagesNew Solutions For MichiganJustin HinkleyNo ratings yet

- Case - Spring GardenDocument1 pageCase - Spring GardenTanu GuptaNo ratings yet

- Agilent ERP FailureDocument2 pagesAgilent ERP FailureIshita JainNo ratings yet

- Assignment1 DBA AgilityDocument10 pagesAssignment1 DBA Agilityأدهم صبريNo ratings yet

- Libro - Building A Project-Driven Enterprise - How To Slash Waste and Boost Profits Through Lean Project Management (2002) PDFDocument384 pagesLibro - Building A Project-Driven Enterprise - How To Slash Waste and Boost Profits Through Lean Project Management (2002) PDFtlatuani1000No ratings yet

- Review Questions Principles of Cost Accounting - 070850Document7 pagesReview Questions Principles of Cost Accounting - 070850Daniel JuliusNo ratings yet

- Case StudyDocument13 pagesCase StudyIvelina Tsekova100% (1)

- Case StudyDocument8 pagesCase StudyRohit Rijhwani100% (1)

- Project Introduction: Chinook DatabaseDocument42 pagesProject Introduction: Chinook DatabaseFiveer FreelancerNo ratings yet

- Ass 2 Lean Mayflower Engineering B 22 - 23 (2) - TaggedDocument12 pagesAss 2 Lean Mayflower Engineering B 22 - 23 (2) - TaggedRahib AliNo ratings yet

- Group - Deepak Yadav 2020MBA124 Shreem Kohli 2020MBA161 Sanka Manoj Chandra 2020MBA Srinath S 2020MBADocument6 pagesGroup - Deepak Yadav 2020MBA124 Shreem Kohli 2020MBA161 Sanka Manoj Chandra 2020MBA Srinath S 2020MBADeepak YadavNo ratings yet

- 1 If You Were Kelly What Would You Tell TheDocument1 page1 If You Were Kelly What Would You Tell TheAmit Pandey100% (1)

- QMM Assignment May2021Document2 pagesQMM Assignment May2021Anupam GuptaNo ratings yet

- Managing An Agile Team: Part 1: Positioning StatementDocument5 pagesManaging An Agile Team: Part 1: Positioning StatementDawn CaldeiraNo ratings yet

- Assignment 6 - Group 3 - Section EDocument6 pagesAssignment 6 - Group 3 - Section ESHUBHAM PRASADNo ratings yet

- Larry Power Started A New Business in The Name ofDocument1 pageLarry Power Started A New Business in The Name ofFreelance WorkerNo ratings yet

- Digital Marketing Web Analysis of Airbnb and CompetitorsDocument14 pagesDigital Marketing Web Analysis of Airbnb and CompetitorsARAVINDAN A 2127011No ratings yet

- Project Management Group-1 Individual Assignment-2: Case Analysis Pert MustangDocument9 pagesProject Management Group-1 Individual Assignment-2: Case Analysis Pert MustangANKIT GUPTANo ratings yet

- CS Baldridge Self-Analysis Worksheet Spin Master ToysDocument4 pagesCS Baldridge Self-Analysis Worksheet Spin Master ToysJoe JosephNo ratings yet

- I.R. Chapter-2 Dr. K.panditDocument10 pagesI.R. Chapter-2 Dr. K.panditDeepak KumarNo ratings yet

- Darling Kenya W15221-PDF-ENGDocument7 pagesDarling Kenya W15221-PDF-ENGrecoil nineNo ratings yet

- Sudarshan Chemicals AssignmentDocument2 pagesSudarshan Chemicals AssignmentPRANAV BHARARANo ratings yet

- DCF Synthesis (With Solutions)Document6 pagesDCF Synthesis (With Solutions)awhan sarangiNo ratings yet

- Cost SheetDocument4 pagesCost SheetPRANAV BHARARANo ratings yet

- Vertical Analysis Exercise: Strictly ConfidentialDocument2 pagesVertical Analysis Exercise: Strictly ConfidentialPRANAV BHARARANo ratings yet

- Final Group ProjectDocument3 pagesFinal Group ProjectPRANAV BHARARANo ratings yet

- Ganesh Textiles Case QuestionsDocument2 pagesGanesh Textiles Case QuestionsPRANAV BHARARANo ratings yet

- Ganesh Textiles Case QuestionsDocument2 pagesGanesh Textiles Case QuestionsPRANAV BHARARANo ratings yet

- Forecasting Div BDocument21 pagesForecasting Div BPRANAV BHARARANo ratings yet

- Job Description and SpecificationDocument2 pagesJob Description and SpecificationPRANAV BHARARANo ratings yet

- BCA - Group 8Document1 pageBCA - Group 8PRANAV BHARARANo ratings yet

- Case Problem On EstimationDocument2 pagesCase Problem On EstimationPRANAV BHARARANo ratings yet

- Sudarshan Chemicals AssignmentDocument2 pagesSudarshan Chemicals AssignmentPRANAV BHARARANo ratings yet

- Help Wendy Peterson analyze Fred Wu's request objectivelyDocument1 pageHelp Wendy Peterson analyze Fred Wu's request objectivelyAdityaNo ratings yet

- Ganesh Textiles ExhibitsDocument7 pagesGanesh Textiles ExhibitsPRANAV BHARARANo ratings yet

- The Role of The Banking Sector in India's EconomyDocument2 pagesThe Role of The Banking Sector in India's EconomyPRANAV BHARARANo ratings yet

- 6117c695a105f MahindrariseDocument1 page6117c695a105f MahindrarisePRANAV BHARARANo ratings yet

- HRM MittensDocument7 pagesHRM MittensPRANAV BHARARANo ratings yet

- Case Problem On EstimationDocument2 pagesCase Problem On EstimationPRANAV BHARARANo ratings yet

- Job Description and SpecificationDocument2 pagesJob Description and SpecificationPRANAV BHARARANo ratings yet

- Dividend Discount Model (Without Solutions)Document3 pagesDividend Discount Model (Without Solutions)PRANAV BHARARANo ratings yet

- Top 3 Indian Bank AnalysisDocument2 pagesTop 3 Indian Bank AnalysisPRANAV BHARARANo ratings yet

- G008 - Toy World SummaryDocument1 pageG008 - Toy World SummaryPRANAV BHARARANo ratings yet

- 1 CDocument1 page1 CPRANAV BHARARANo ratings yet

- Feasibility Report Assignment - Div G - Group 8Document7 pagesFeasibility Report Assignment - Div G - Group 8PRANAV BHARARANo ratings yet

- Butler Lumber 1Document6 pagesButler Lumber 1Bhavna Singh33% (3)

- The Launch of Sony's PlayStation 3 Was Delayed ...Document2 pagesThe Launch of Sony's PlayStation 3 Was Delayed ...PRANAV BHARARANo ratings yet

- FTMBA Proposal on RealPostIt AdvertisingDocument2 pagesFTMBA Proposal on RealPostIt AdvertisingPRANAV BHARARANo ratings yet

- Exhibit No.1 Toy World, Inc.'s Pro-Forma Balance Sheet Under Level Production, 1994 (Thousands of Dollars)Document5 pagesExhibit No.1 Toy World, Inc.'s Pro-Forma Balance Sheet Under Level Production, 1994 (Thousands of Dollars)Rohit Jhawar100% (2)

- How Did Disney Create Its Uniqueness in The Med...Document3 pagesHow Did Disney Create Its Uniqueness in The Med...PRANAV BHARARANo ratings yet

- G008 - Toy World SummaryDocument1 pageG008 - Toy World SummaryPRANAV BHARARANo ratings yet

- Becoming A Premier Partner Measuring Managing andDocument11 pagesBecoming A Premier Partner Measuring Managing andanon_142601308No ratings yet

- 1 SmithKline Corp. Vs Eli Lilly and CompanyDocument3 pages1 SmithKline Corp. Vs Eli Lilly and CompanyKim CajucomNo ratings yet

- ISBDFinal Book 2012 BDocument53 pagesISBDFinal Book 2012 BvadamadaNo ratings yet

- How Would You Evaluate Eli Lily's Strategy To Enter India?Document3 pagesHow Would You Evaluate Eli Lily's Strategy To Enter India?Anonymous qbVaMYIIZNo ratings yet

- Humalog Novolog Apidra: Type of Insulin & Brand Names Onset Peak Duration Role in Blood Sugar Management Rapid-ActingDocument2 pagesHumalog Novolog Apidra: Type of Insulin & Brand Names Onset Peak Duration Role in Blood Sugar Management Rapid-ActingkatrinasdNo ratings yet

- Cymbalta Case AnalysisDocument9 pagesCymbalta Case AnalysisKeenan SlenkerNo ratings yet

- Diabetes Mellitus: Apt. Lelly Winduhani M.Farm - KlinDocument30 pagesDiabetes Mellitus: Apt. Lelly Winduhani M.Farm - KlinListiaNo ratings yet

- Types of Insulin For Diabetes TreatmentDocument2 pagesTypes of Insulin For Diabetes TreatmentKrystale Mae ValdezNo ratings yet

- Eli Lilly - A Case AnalysisDocument18 pagesEli Lilly - A Case AnalysisAthayaSekarNovianaNo ratings yet

- Pharmaceutical Industry: Overview of The IndustryDocument21 pagesPharmaceutical Industry: Overview of The Industryhangchan_superchibiNo ratings yet

- Pay or Die Pitch DeckDocument43 pagesPay or Die Pitch DeckPayorDie100% (2)

- Eli Lilly's Development of Cymbalta to Replace ProzacDocument11 pagesEli Lilly's Development of Cymbalta to Replace ProzacemanuelariobimoNo ratings yet

- Accounting Dissertation Proposal-Example 1Document24 pagesAccounting Dissertation Proposal-Example 1idkolaNo ratings yet

- Eli Lilly and Co The Flexible Facility DecisionDocument6 pagesEli Lilly and Co The Flexible Facility DecisionNeeraj Mehra100% (1)

- I-Bytes Healthcare February Edition 2021Document109 pagesI-Bytes Healthcare February Edition 2021IT ShadesNo ratings yet

- Types of Insulin According to Mode of ActionDocument1 pageTypes of Insulin According to Mode of ActionAssem Ashraf Khidhr100% (1)

- Med TagDocument23 pagesMed TagClarissa GuifayaNo ratings yet

- Cro DirectoryDocument32 pagesCro DirectoryKostubh SinghalNo ratings yet

- The Analysis of Pharmaceutical MarketDocument10 pagesThe Analysis of Pharmaceutical MarketAnamaria BejenariuNo ratings yet

- Eli Lilly: Building Capabilities for Targeted TherapeuticsDocument30 pagesEli Lilly: Building Capabilities for Targeted TherapeuticsKarthik K Janardhanan0% (1)

- Eli LillyDocument15 pagesEli LillyShavikaNo ratings yet

- What Would You DoDocument4 pagesWhat Would You DoNicolas GiraldoNo ratings yet

- Insulin Wall ChartDocument1 pageInsulin Wall Charturcrony10No ratings yet

- Lly Report 11.23.23Document5 pagesLly Report 11.23.23physicallen1791No ratings yet

- Cialis Marketing PlanDocument47 pagesCialis Marketing Plananton_mcmenamin2100% (4)

- InsulinDocument4 pagesInsulinMonNo ratings yet

- Eli Lilly Biotech Pilot Plant, Indianapolis, United States of AmericaDocument5 pagesEli Lilly Biotech Pilot Plant, Indianapolis, United States of AmericaShyam Sunder BudhwarNo ratings yet

- Prozac PaxilDocument9 pagesProzac PaxilTanyaNo ratings yet

- Strama 1Document13 pagesStrama 1Rebecacel PalattaoNo ratings yet

- Eli LillyDocument11 pagesEli LillyvemaNo ratings yet