Professional Documents

Culture Documents

Virtual Coaching Classes Intermediate Level Paper 1: Accounting

Uploaded by

nandish pnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Virtual Coaching Classes Intermediate Level Paper 1: Accounting

Uploaded by

nandish pnCopyright:

Available Formats

Date: 29 July 2020

VIRTUAL COACHING CLASSES

ORGANISED BY BOS, ICAI

INTERMEDIATE LEVEL

PAPER 1: ACCOUNTING

Faculty: Mr. Kapil Arora

© The Institute of Chartered Accountants of India

Chapter 8

Redemption of debentures

28 July 2020 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 2

INTRODUCTION

A debenture is an instrument issued by a company under its seal, acknowledging a debt and containing

provisions as regards repayment of the principal and interest.

a company may issue debentures with an option to convert such debentures into shares, either wholly or

partly at the time of redemption.

Company should create a debenture redemption reserve account out of the profits of the company available

for payment of dividend and the amount credited to such account should not be utilised by the company for

any purpose other than the redemption of debentures.

28 July 2020 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 3

REDEMPTION OF DEBENTURES

Debentures are usually redeemable i.e. either redeemed in cash or convertible after a time period.

Redeemable debentures may be redeemed:

after a fixed number of years; or

any time after a certain number of years has elapsed since their issue; or

on giving a specified notice; or

by annual drawing.

A company may also purchase its debentures, as and when convenient, in the open market and when

debentures are quoted at a discount on the Stock Exchange, it may be profitable for the company to purchase

and cancel them.

28 July 2020 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 4

DEBENTURE REDEMPTION RESERVE

A company issuing debentures may be required to create a debenture redemption reserve account out of

the profits available for distribution of dividend and amounts credited to such account cannot be utilised

by the company except for redemption of debentures.

An appropriate amount is transferred from profits every year to Debenture Redemption Reserve and its

investment is termed as Debenture Redemption Reserve Investment (or Debenture Redemption Fund).

In the last year or at the time of redemption of debentures, Debenture Redemption Reserve Investments

are encashed and the amount so obtained is used for the redemption of debentures.

28 July 2020 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 5

BALANCE IN DEBENTURE REDEMPTION RESERVE (DRR)

the Debenture Redemption Reserves tables is credited to the Debenture Redemption Reserve account and

debited to profit and loss account.

That shows the intention of the company to set aside sum of money to build up a fund for redeeming

debentures. Immediately, the company should also purchase outside investments.

The entry for the purpose naturally will be to debit Debenture Redemption Reserve Investments and credit

Bank

28 July 2020 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 6

BALANCE IN DEBENTURE REDEMPTION RESERVE (DRR)

If the debentures are purchased within the interest period, the price would be inclusive of interest provided

these are purchased “Cum-interest”; but if purchased “Ex-interest”, the interest to the date of purchase

would be payable to the seller additionally.

In order to adjust the effect thereof the amount of interest accrued till the date of purchase, if paid, is debited

to the Interest Account against which the interest for the whole period will be credited. As a result, the

balance in the account would be left equal to the interest for the period for which the debentures were held

by the company.

28 July 2020 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 7

ADEQUACY OF DEBENTURE REDEMPTION RESERVE (DRR)

Debenture Redemption Reserve (DRR) and investment or deposit of sum in respect of debentures maturing

during the year ending on the 31st day of March of next year

NO DRR – All India financial institutions regulated by Reserve Bank of India

- All listed NBFCs and listed HFCs (Housing Finance Companies)

- Other listed companies

- All unlisted NBFCs and unlisted HFCs for privately placed debentures

Other unlisted companies

DRR shall be 10% of the value of the outstanding debentures issued

28 July 2020 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 8

INVESTMENT OF DEBENTURE REDEMPTION RESERVE (DRR) AMOUNT

All listed NBFCs

All listed HFCs

All other listed companies (other than AIFIs, Banking Companies and Other FIs); and

All unlisted companies which are not NBFCs and HFCs

shall on or before the 30th day of April in each year, in respect of debentures issued, deposit or invest, as the

case may be, a sum which should not be less than 15% of the amount of its debentures maturing during the

year ending on the 31st day of March of next year, in any one or more of the following methods, namely:

in deposits with any scheduled bank, free from charge or lien;

in unencumbered securities of the Central Government or of any State Government;

in unencumbered securities

in unencumbered bonds issued by any other company

Provided that the amount remaining deposited or invested, as the case may be, shall not at any time fall

below 15% of the amount of debentures maturing during the 31st day of March of that year.

28 July 2020 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 9

INVESTMENT OF DEBENTURE REDEMPTION RESERVE (DRR) AMOUNT

In case of partly convertible debentures, DRR shall be created in respect of non- convertible portion of

debenture issue in accordance with this sub-rule.

The amount credited to DRR shall not be utilised by the company except for the purpose of redemption of

debentures.

28 July 2020 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 10

JOURNAL ENTRIES – AFTER ALLOTMENT

For setting aside fixed amount of profit for redemption

Profit and loss Dr.

To Debenture redemption reserve

For investing the amount set aside for redemption

Debenture Redemption Reserve Investment A/c

To Bank A/c

For receipt of interest on Debenture Redemption Reserve Investments

Bank A/c

To Interest on Debenture Redemption Reserve Investment A/c

For transfer of interest on Debenture Redemption Reserve Investments (DRRI)

Interest on Debenture Redemption Reserve Investment A/c Dr

To Profit and loss A/c*

28 July 2020 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 11

JOURNAL ENTRIES – At Redemption of debentures

For encashment of Debenture Redemption Reserve Investments

Bank A/c Dr.

To Debenture Redemption Reserve Investment A/c

For amount due to debenture holders on redemption

Debentures A/c Dr.

To Debenture holders A/c

For payment to debenture holders

Debenture holders A/c Dr.

To Bank A/c

After redemption of debentures, DRR should be transferred to general reserve

DRR A/c Dr.

To General Reserve

28 July 2020 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 12

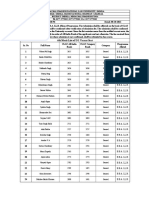

METHODS OF REDEMPTION OF DEBENTURES

BY PAYMENT IN LUMPSUM

Under payment in lumpsum method, at maturity or at the expiry of a specified period of debenture the

payment of entire debenture is made in one lot or even before the expiry of the specified period

BY PAYMENT IN INSTALMENTS

Under payment in instalments method, the payment of specified portion of debenture is made in

instalments at specified intervals.

PURCHASE OF DEBENTURES IN OPEN MARKET

Debentures sometimes are purchased in open market. In such a case Own Debenture Account is debited

and bank is credited.

28 July 2020 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 13

METHODS OF REDEMPTION OF DEBENTURES

28 July 2020 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 14

METHODS OF REDEMPTION OF DEBENTURES

Illustration 1

Illustration 2

Illustration 3

Illustration 4

Illustration 5

Illustration 6

28 July 2020 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 15

THANK YOU

28 July 2020 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 16

You might also like

- Employee's Information FormDocument1 pageEmployee's Information FormLyle RabasanoNo ratings yet

- Chapter 6 - Strategy Analysis and ChoiceDocument28 pagesChapter 6 - Strategy Analysis and ChoiceSadaqat AliNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Dividend Policy of Reliance Industries Itd.Document24 pagesDividend Policy of Reliance Industries Itd.rohit280273% (11)

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Notes of 4. Issue of DebenturesDocument6 pagesNotes of 4. Issue of DebenturesatuldipsNo ratings yet

- Accounting of Life Insurance CompaniesDocument4 pagesAccounting of Life Insurance CompaniesAnish ThomasNo ratings yet

- FAR 4309 Investment in Debt Securities 2Document6 pagesFAR 4309 Investment in Debt Securities 2ATHALIAH LUNA MERCADEJASNo ratings yet

- Empowering Communities in Disadvantaged UrbanAreasDocument243 pagesEmpowering Communities in Disadvantaged UrbanAreasaud_rius0% (1)

- How to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingFrom EverandHow to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingNo ratings yet

- China Banking V CADocument3 pagesChina Banking V CARaymart SalamidaNo ratings yet

- Chapter 3-5 To 3-13Document9 pagesChapter 3-5 To 3-13XENA LOPEZNo ratings yet

- Tutorial 7Document74 pagesTutorial 7Dylan Rabin PereiraNo ratings yet

- Red. of DebenturesDocument20 pagesRed. of DebenturesPadala LakshmiNo ratings yet

- Supplement Corporate Accounting 25092023Document12 pagesSupplement Corporate Accounting 25092023apnipathshala06No ratings yet

- Redemption OF Debentures: After Studying This Unit, You Will Be Able ToDocument34 pagesRedemption OF Debentures: After Studying This Unit, You Will Be Able TodeepakNo ratings yet

- 19668ipcc Acc Vol1 Chapter-3Document20 pages19668ipcc Acc Vol1 Chapter-3Vignesh SrinivasanNo ratings yet

- Redemption OF Debentures: After Studying This Unit, You Will Be Able ToDocument36 pagesRedemption OF Debentures: After Studying This Unit, You Will Be Able ToAkansha GuptaNo ratings yet

- Alternative Funding InstrumentsDocument7 pagesAlternative Funding InstrumentsManasvi GuptaNo ratings yet

- Declaration Payment of Dividend 71Document5 pagesDeclaration Payment of Dividend 71Anshul RathiNo ratings yet

- Block 5 ECO 02 Unit 2Document9 pagesBlock 5 ECO 02 Unit 2HozefadahodNo ratings yet

- AccountsDocument10 pagesAccountsvaishnaviNo ratings yet

- Dividend DistributionDocument24 pagesDividend DistributionSai PhaniNo ratings yet

- Tamam FS - 2020 - EnglishDocument27 pagesTamam FS - 2020 - EnglishDhanviper NavidadNo ratings yet

- Redemption of Debentures.Document11 pagesRedemption of Debentures.Basil shibuNo ratings yet

- Partnership Accounting Liquidation - InstallmentDocument4 pagesPartnership Accounting Liquidation - InstallmentMerielyn MetilloNo ratings yet

- Lesson 5 Tax Planning With Reference To Capital StructureDocument37 pagesLesson 5 Tax Planning With Reference To Capital StructurekelvinNo ratings yet

- Issuance Process of Commercial Paper CPsDocument3 pagesIssuance Process of Commercial Paper CPsmohakbhutaNo ratings yet

- Redemption of DebenturesDocument11 pagesRedemption of Debenturesadeeba_kaziiNo ratings yet

- Mock 2Document28 pagesMock 2Sayan Kumar PatiNo ratings yet

- Redemption of Debenture NEWDocument17 pagesRedemption of Debenture NEWGrave diggerNo ratings yet

- Prudential NormsDocument24 pagesPrudential NormsProf. Amit kashyapNo ratings yet

- Fin. Acounting Project 2022Document14 pagesFin. Acounting Project 2022Sahil ParmarNo ratings yet

- Indian Financial Systems, Institutions and Markets - NPADocument84 pagesIndian Financial Systems, Institutions and Markets - NPASahil Sheth100% (1)

- Model NFS - Full PFRS (2022) - Nonlending and NonfinancingDocument35 pagesModel NFS - Full PFRS (2022) - Nonlending and NonfinancingJoel RazNo ratings yet

- Accounting ch9 Solutions QuestionDocument49 pagesAccounting ch9 Solutions Questionaboodyuae2000No ratings yet

- 5th & 6th Sesion - Debt IssueDocument25 pages5th & 6th Sesion - Debt IssueSuvajitLaikNo ratings yet

- Question Bank-Ch 5-Taxation and RegulationsDocument4 pagesQuestion Bank-Ch 5-Taxation and Regulationsteerthlumbhani6No ratings yet

- Profit or Ioss Pre and Post IncorporationDocument22 pagesProfit or Ioss Pre and Post IncorporationRanjana TrivediNo ratings yet

- Commercial PaperDocument15 pagesCommercial PapervenkatNo ratings yet

- Retained EarningsDocument72 pagesRetained EarningsItronix MohaliNo ratings yet

- SARHAD OpinionDocument2 pagesSARHAD OpinionExtra KhanNo ratings yet

- Corporate TaxDocument17 pagesCorporate TaxVishnupriya RameshNo ratings yet

- Irac Norms: Bank Branch AuditDocument45 pagesIrac Norms: Bank Branch AuditjamilsbmmNo ratings yet

- Insurance AuditDocument7 pagesInsurance AuditArpit jainNo ratings yet

- Basic Understanding of DividendDocument2 pagesBasic Understanding of DividendAniruddhShastreeNo ratings yet

- Digital Assignment - 3: Submitted To: Submitted byDocument11 pagesDigital Assignment - 3: Submitted To: Submitted byMonashreeNo ratings yet

- Accounting of Life Insurance Companies: Prakash VDocument4 pagesAccounting of Life Insurance Companies: Prakash VSaurav RaiNo ratings yet

- Group 6Document15 pagesGroup 6Anand Singh RathoreNo ratings yet

- CTPDocument31 pagesCTPMohit ChhabriaNo ratings yet

- Unit - 4Document10 pagesUnit - 4devil hNo ratings yet

- What Is Commercial PaperDocument3 pagesWhat Is Commercial PaperSj Rao100% (1)

- WA0004. - RemovedDocument76 pagesWA0004. - Removedsushil.saliyan1003No ratings yet

- Tybbi Fra TheoryDocument5 pagesTybbi Fra TheoryNavin Saraf100% (1)

- Advanced Financial Accounting 10th Edition Christensen Solutions ManualDocument25 pagesAdvanced Financial Accounting 10th Edition Christensen Solutions ManualHerbertRangelqrtc100% (57)

- Dividend Distibution Policy 05.08.2022Document6 pagesDividend Distibution Policy 05.08.2022Anshul GuptaNo ratings yet

- 3rd & 4th Sesion - UnderwritingDocument32 pages3rd & 4th Sesion - UnderwritingSuvajitLaikNo ratings yet

- By Geet Arora Bba 3 Year Roll No - 4204Document15 pagesBy Geet Arora Bba 3 Year Roll No - 4204geet882004No ratings yet

- Model NFS - Full PFRS (2022) - LENDING AND FINANCINGDocument39 pagesModel NFS - Full PFRS (2022) - LENDING AND FINANCINGJoel RazNo ratings yet

- Horngrens Accounting 12Th Edition Nobles Solutions Manual Full Chapter PDFDocument67 pagesHorngrens Accounting 12Th Edition Nobles Solutions Manual Full Chapter PDFconatusimploded.bi6q100% (9)

- Horngrens Accounting 12th Edition Nobles Solutions ManualDocument38 pagesHorngrens Accounting 12th Edition Nobles Solutions Manualtortrixintonate6rmbc100% (13)

- NFO Tata Growing Economies Infrastructure FundDocument12 pagesNFO Tata Growing Economies Infrastructure FundDrashti Investments100% (1)

- Chapter - 7 Income From Other SourcesDocument31 pagesChapter - 7 Income From Other SourcesAnonymous duzV27Mx3No ratings yet

- Npas in Banks: A Theoretical Framework: Chapter - IIDocument17 pagesNpas in Banks: A Theoretical Framework: Chapter - IIY.durgadeviNo ratings yet

- Chapter 1 (Introduction)Document26 pagesChapter 1 (Introduction)Kshitij Shingade100% (1)

- Outstanding: I/We Hereby Confirm Having Understood and Accepted The Terms/ Conditions of ForeclosureDocument1 pageOutstanding: I/We Hereby Confirm Having Understood and Accepted The Terms/ Conditions of ForeclosureVikas sales CorporationNo ratings yet

- Wicon Waste Case NotesDocument2 pagesWicon Waste Case NotesKumar PatelNo ratings yet

- 6 Examples of Liquidity Risk - SimplicableDocument1 page6 Examples of Liquidity Risk - SimplicableSulemanNo ratings yet

- Gnucash GuideDocument257 pagesGnucash GuideAndré SilvaNo ratings yet

- Answers: 高顿财经ACCA acca.gaodun.cnDocument12 pagesAnswers: 高顿财经ACCA acca.gaodun.cnIskandar BudionoNo ratings yet

- Terms and Conditions Current Account/Current Account-I or Savings Account/Savings Account-I (CASA/CASA-i) Double Cash Bonus Campaign 2.0Document12 pagesTerms and Conditions Current Account/Current Account-I or Savings Account/Savings Account-I (CASA/CASA-i) Double Cash Bonus Campaign 2.0mohd addinNo ratings yet

- Vendor Creation FormDocument38 pagesVendor Creation FormDmytro VasylchukNo ratings yet

- E (O) IIIs Order 05 - 08 - 2022Document4 pagesE (O) IIIs Order 05 - 08 - 2022rajesh MehtaNo ratings yet

- Project PeeDocument38 pagesProject PeeHatta AimanNo ratings yet

- Assignment 2: Tracy Van Rensburg STUDENT NUMBER 59548525Document8 pagesAssignment 2: Tracy Van Rensburg STUDENT NUMBER 59548525Chris NdlovuNo ratings yet

- KB220820BICLQ - Sanction LetterDocument4 pagesKB220820BICLQ - Sanction LetterSiddhantNo ratings yet

- Ircon 3018 Dfccil-Ctp-12 Reply To Letter 3367Document2 pagesIrcon 3018 Dfccil-Ctp-12 Reply To Letter 3367Manish SoroutNo ratings yet

- 6th Merit List of UG Vacant SeatDocument4 pages6th Merit List of UG Vacant SeatRavindra RathoreNo ratings yet

- RPS Analisa Laporan Keuangan Agustus 2020Document24 pagesRPS Analisa Laporan Keuangan Agustus 2020Shiel VhyNo ratings yet

- Trade and Other PayablesDocument4 pagesTrade and Other PayablesJOHANNANo ratings yet

- 5102 - Presentation On Target CostingDocument32 pages5102 - Presentation On Target CostingAbdulAhadNo ratings yet

- Finance (Salaries) Department: Loans and Advances by The State Government - Advances ToDocument2 pagesFinance (Salaries) Department: Loans and Advances by The State Government - Advances ToGowtham RajNo ratings yet

- Registration of SocietyDocument48 pagesRegistration of SocietySachin JainNo ratings yet

- Chapter 19 Partnership DissolutionDocument70 pagesChapter 19 Partnership DissolutionhallieNo ratings yet

- Masterclass On EBITDADocument15 pagesMasterclass On EBITDArdttecNo ratings yet

- Estmt - 2023 07 13jDocument6 pagesEstmt - 2023 07 13jluis rodriguezNo ratings yet

- LUHBC NegoSale Batch 28051 100522Document9 pagesLUHBC NegoSale Batch 28051 100522Leo Laurenzhe CorpuzNo ratings yet

- WEEKLY 8th-15th JULY CURRENT AFFAIRS 2022 ENGLISHDocument152 pagesWEEKLY 8th-15th JULY CURRENT AFFAIRS 2022 ENGLISHAnand KanuNo ratings yet

- Adani Power LTD - 20 PDFDocument258 pagesAdani Power LTD - 20 PDFAbhishek MurarkaNo ratings yet