Professional Documents

Culture Documents

Application For A Tax Code, Notification of Change of Details and Requests For A Tax Code Card/Duplicate of The National Health System Card

Uploaded by

uhbsdubghfubgszuhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application For A Tax Code, Notification of Change of Details and Requests For A Tax Code Card/Duplicate of The National Health System Card

Uploaded by

uhbsdubghfubgszuhCopyright:

Available Formats

AA4/8

Revenue

Agency

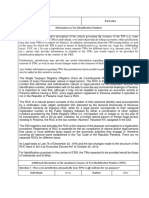

APPLICATION FOR A TAX CODE, NOTIFICATION OF CHANGE OF DETAILS

AND REQUESTS FOR A TAX CODE CARD/DUPLICATE OF THE NATIONAL

HEALTH SYSTEM CARD

(NATURAL PERSONS)

Information regarding the Legislative Decree No 196 of 30 June 2003 “The Code for the Protection of Personal Data” provides for a

processing of personal system of protection for the processing carried out on personal data. A summary is outlined below of how

data pursuant to Article 13 the data contained in this form will be used and what rights are granted to citizens.

of Legislative Decree No

196 of 2003

Purposes of The Ministry of the Economy and Finance and the Revenue Agency inform you, on their behalf and on behalf of

other persons obliged to do so, that in this form there is personal data that will be processed by the Ministry of the

processing

Economy and Finance and the Revenue Agency to allocate the tax code, obtain changes to personal and address

details, obtain information on deceased persons, and send the tax code card or a duplicate of the national health

system card.

The data in the possession of the Ministry of the Economy and Finance and the Revenue Agency may be

communicated to other public entities (for example, the Municipalities) where legislation provides for this, or when

such communication is necessary in order for them to carry out their institutional functions.

The same data may also be communicated to private or public economic entities where the legislation provides

for this.

Personal data The data requested in this form must be supplied to prevent the application of administrative and, in some cases,

criminal sanctions.

Method of The paper form must be submitted by the person concerned, or through a delegate, to any Revenue Agency

processing office.

Any person(s) resident overseas may submit the paper form to the Italian diplomatic or consular representation

in their country of residence or to any Revenue Agency office.

The data will mainly be processed electronically and with logical systems that are adequate to the achievement

of the objectives, which will also be pursued by checking:

• the other data in the possession of the Ministry of the Economy and Finance and the Revenue Agency, also if

provided, as required by law, by other persons

• the data in the possession of other bodies

Data When this data is made available to them and falls under their direct control, the Ministry of the Economy and

controllers Finance and the Revenue Agency become “the data controllers for the processing of the personal data”. They

keep a list of the controllers, which is available upon request.

Persons responsible for "Data controllers" may make use of the services of others designated "responsible".

data processing In particular, the Revenue Agency makes use of the services of the company So.ge.i. S.p.a. as the external

entity responsible for data processing, in its capacity as technologcal partner to which the management of the

information system of the Tax Register is entrusted.

Taxpayer's rights The person (taxpayer) concerned, in terms of article 7 of Legislative Decree No. 196/2003, may view his personal

data at the premises of the data controller or the person responsible for data processing in order to verify the use

to which it is being put or if necessary, to correct or update it within the limits provided for by law, or to cancel it or

oppose its processing, where it is being processed illegally.

These rights may be exercised upon request to:

• Ministry of the Economy and Finance, Via XX Settembre 97 – 00187 Rome;

• Revenue Agency – Via Cristoforo Colombo, 426 c/d – 00145 Rome.

Consent The Ministry of the Economy and Finance and the Revenue Agency, in their capacity as public entities, do not

need to acquire the consent of the persons concerned in order to process their personal data.

This information is given generally on behalf of all the data controllers referred to above.

Revenue AA4/8

Agency

APPLICATION FOR A TAX CODE, NOTIFICATION OF CHANGE OF DETAILS AND

REQUEST FOR TAX CODE CARD/DUPLICATE OF NATIONAL HEALTH SYSTEM CARD

(NATURAL PERSONS)

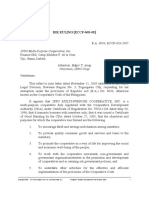

PART A

X

Section I D T APPLICANT TYPE CODE

Applicant type

DIRECT APPLICATION FOR YOURSELF APPLICATION FOR A THIRD PARTY

(only for the allocation of a tax code)

or

Section II

X X

1 ALLOCATION OF A TAX CODE REQUEST FOR A TAX CODE CARD

Application type

TAX CODE

2 CHANGE OF DETAILS

3

NOTIFICATION OF

TAX CODE DATE OF DEATH

DEATH

TAX CODE

4 REQUEST FOR TAX

CODE CERTIFICATE

REQUEST FOR DUPLICA-

5

TE OF TAX CODE

CARD/NATIONAL

TAX CODE

SURNAME

HEALTH SYSTEM CARD

NAME

REASON

PART B SEX

Ramsbacher Simon

Personal details

M

MUNICIPALITY OF BIRTH (or Foreign State) PROVINCE DATE OF BIRTH

Austria, Vienna E E 1 6 0 7 2 0 0 1

PART C

Registered residence/

MUNICIPALITY

Austria

PROVINCE POSTCODE

Tax domicile

TYPE (street, square, etc.) ADDRESS

A 060

Street Mariahilferstraße

HOUSE NUMBER AREA/OTHER

15

PART D FOREIGN STATE

Austria

FEDERAL STATE, PROVINCE, COUNTY

Residence overseas Vienna

TOWN OF RESIDENCE POSTCODE

Vienna 1060

ADDRESS

Mariahilferstraße 15

PART E

Other possible tax TAX CODE

codes allocated

TAX CODE

DOCUMENTS

ENCLOSED

Passport

Austrian identi cation Card

APPLICANT TAX CODE FOR NON-NATURAL PERSONS TAX CODE OF SIGNEE

SIGNATURES

DELEGATE

DATE

08032021 SIGNATURE Fm Rematch

Signee delegate

TAX CODE

born in on

I am submitting the form on this person’s behalf and shall collect any possible certification issued by the office

DATE SIGNATURE

You might also like

- The Hypocritical Hegemon: How the United States Shapes Global Rules against Tax Evasion and AvoidanceFrom EverandThe Hypocritical Hegemon: How the United States Shapes Global Rules against Tax Evasion and AvoidanceNo ratings yet

- Form AA48 Editable AA4 8 Modello INGDocument2 pagesForm AA48 Editable AA4 8 Modello INGNikkesh ANo ratings yet

- Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxFrom EverandLearning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxNo ratings yet

- Form AA48 ING Copy (Dragged)Document1 pageForm AA48 ING Copy (Dragged)chupetNo ratings yet

- Form AA912 - AA9 - 12 - Modello - EN - DefDocument5 pagesForm AA912 - AA9 - 12 - Modello - EN - Defvijayasimhareddy ireddyNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- .Trashed 1688765232 Mexico TINDocument5 pages.Trashed 1688765232 Mexico TINIrma HeenandezNo ratings yet

- Mexico TIN PDFDocument5 pagesMexico TIN PDFArtemioNo ratings yet

- TIN Card As ID For Notarization PurposesDocument9 pagesTIN Card As ID For Notarization PurposesBobby Olavides SebastianNo ratings yet

- Bds News Advice Sai EngDocument2 pagesBds News Advice Sai EngCalimeroNo ratings yet

- Peru TINDocument5 pagesPeru TINMariluz Cassa SalasNo ratings yet

- Ent - X: Special Second DivisionDocument36 pagesEnt - X: Special Second DivisionEugene SardonNo ratings yet

- Benami RewardDocument22 pagesBenami RewardKartik PrabhakarNo ratings yet

- Form PTOL-2038 (Credit Card Payment Authorization)Document3 pagesForm PTOL-2038 (Credit Card Payment Authorization)Anant NarayananNo ratings yet

- Instructions For Complevvm No. 22T101Document27 pagesInstructions For Complevvm No. 22T101zzzzzzNo ratings yet

- Articulo Richard Murphy de Taxresearch Org Uk Sobre Los Acuerdos de Intercambio de Info y Paraisos FiscalesDocument6 pagesArticulo Richard Murphy de Taxresearch Org Uk Sobre Los Acuerdos de Intercambio de Info y Paraisos FiscalesJuan Enrique ValerdiNo ratings yet

- Roydz - Gls Optimum PrimeDocument2 pagesRoydz - Gls Optimum PrimeJig-Etten SaxorNo ratings yet

- How to fill out Data Sheet 22T34Document11 pagesHow to fill out Data Sheet 22T34zzzzzzNo ratings yet

- TIN Issuance for MF-NGO ClientsDocument3 pagesTIN Issuance for MF-NGO ClientsLarry Tobias Jr.No ratings yet

- BIR FORM 2307 SampleDocument6 pagesBIR FORM 2307 SampleEasyHear Philippines by NuGen Hearing Devices, Inc.No ratings yet

- Pia 1099trpDocument6 pagesPia 1099trpMustafa MehdiNo ratings yet

- 2307 Jan 2018 ENCS v3Document13 pages2307 Jan 2018 ENCS v3chatNo ratings yet

- Instructions For Completing Form No. 22t201int (07.03.2022)Document7 pagesInstructions For Completing Form No. 22t201int (07.03.2022)zzzzzzNo ratings yet

- BIR Certificate of Creditable Tax WithheldDocument2 pagesBIR Certificate of Creditable Tax WithheldMdrrmo San MiguelNo ratings yet

- Colombia TINDocument4 pagesColombia TINEdwin GarciaNo ratings yet

- Panama TINDocument5 pagesPanama TINProfit PartnerNo ratings yet

- Disclosure of Data For Fraud InvestigationDocument3 pagesDisclosure of Data For Fraud InvestigationzooeyNo ratings yet

- 2307 Jan 2018 ENCS v3 BIRDocument2 pages2307 Jan 2018 ENCS v3 BIRlnbsanclementeNo ratings yet

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document1 pageCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)dorieNo ratings yet

- Patent Application FormDocument3 pagesPatent Application FormbrucedarNo ratings yet

- Kmu Vs Neda and Ople Vs TorresDocument17 pagesKmu Vs Neda and Ople Vs TorresRon GamboaNo ratings yet

- Panama TINDocument4 pagesPanama TINChelsea EspinosaNo ratings yet

- APV 140597 ADA Acct165672666 Jan2024 - Phil. Long Distance Telecom Inc - For Documentation OnlyDocument4 pagesAPV 140597 ADA Acct165672666 Jan2024 - Phil. Long Distance Telecom Inc - For Documentation OnlyEniger CaspeNo ratings yet

- 1904 January 2018 ENCS FinalDocument3 pages1904 January 2018 ENCS FinalFatima LunaNo ratings yet

- Privacy Policy Office Advisory Opinion No. 2020-015Document4 pagesPrivacy Policy Office Advisory Opinion No. 2020-015zooeyNo ratings yet

- Car History PPSR-1.2.12Document1 pageCar History PPSR-1.2.12suryadevarasarathNo ratings yet

- 2307 - CTT Synergy - CorporationDocument2 pages2307 - CTT Synergy - CorporationRACHEL DAMALERIONo ratings yet

- Sample PMS Terms and ConditionsDocument12 pagesSample PMS Terms and ConditionsJosh Qc OngNo ratings yet

- Certificate of Creditable Tax Withheld at Source: BIR Form NoDocument1 pageCertificate of Creditable Tax Withheld at Source: BIR Form NoMang Inasal AccountingNo ratings yet

- Rmo 5-2017Document12 pagesRmo 5-2017Romer LesondatoNo ratings yet

- Ref 266 SOP For Deregistration of Deceased Taxpayers' NTN - STRNDocument2 pagesRef 266 SOP For Deregistration of Deceased Taxpayers' NTN - STRNNoman QureshiNo ratings yet

- 2306 - 2307Document57 pages2306 - 2307Dearly EnzoNo ratings yet

- Form 2307Document12 pagesForm 2307Reycia Vic QuintanaNo ratings yet

- TIN ArgentinaDocument3 pagesTIN ArgentinaFernando RibicichNo ratings yet

- NeecoDocument5 pagesNeecoMagno AnnNo ratings yet

- 2307 012023 FlashDocument2 pages2307 012023 FlashGregorio LSNo ratings yet

- 111 Tax GuideDocument81 pages111 Tax Guideavelito bautistaNo ratings yet

- GH DepotDocument12 pagesGH DepotNormelita S. Dela CruzNo ratings yet

- Executive Order No. 98Document2 pagesExecutive Order No. 98DanielAlBaniasDelfinNo ratings yet

- 2307 For EBS Private Individual Percenateg TaxDocument4 pages2307 For EBS Private Individual Percenateg TaxAGrace MercadoNo ratings yet

- BIR Certificate Tax DetailsDocument2 pagesBIR Certificate Tax Detailsmizkee missakiNo ratings yet

- Philippines-Netherlands Tax Treaty Dividend RulingDocument3 pagesPhilippines-Netherlands Tax Treaty Dividend Rulingnathalie velasquezNo ratings yet

- NPC AdvisoryOpinionNo. 2017-020 HighlightedDocument5 pagesNPC AdvisoryOpinionNo. 2017-020 HighlightedmccNo ratings yet

- Jurisdiction's Name: Australia Information On Tax Identification Numbers Section I - TIN DescriptionDocument3 pagesJurisdiction's Name: Australia Information On Tax Identification Numbers Section I - TIN DescriptionsyedNo ratings yet

- BIR RULING NO. 1102-18: Tata Consultancy Services (Philippines), IncDocument3 pagesBIR RULING NO. 1102-18: Tata Consultancy Services (Philippines), IncKathleen Leynes100% (1)

- Cert 2307V2018 Global MirakelDocument2 pagesCert 2307V2018 Global MirakelLeo BagtasNo ratings yet

- BIR Ruling ECCP 068-08Document4 pagesBIR Ruling ECCP 068-08Kendra Miranda LorinNo ratings yet

- 2307 Thedeleons Co LTDDocument2 pages2307 Thedeleons Co LTDRACHEL DAMALERIONo ratings yet

- 2307 Jan 2018 ENCS v3 Annex BDocument2 pages2307 Jan 2018 ENCS v3 Annex BAnonymous Z37BIV88% (24)

- Siruba 700K 700KD Parts ListDocument38 pagesSiruba 700K 700KD Parts ListeduardoNo ratings yet

- Crocodile DIY Paper CraftDocument16 pagesCrocodile DIY Paper CraftAlireza Emami100% (1)

- Lighttools Solidworks Link Module: Optimize Parts and AssembliesDocument3 pagesLighttools Solidworks Link Module: Optimize Parts and AssembliesKolin LeeNo ratings yet

- Success: Instrumentation Engineers LTDDocument4 pagesSuccess: Instrumentation Engineers LTDKazi AlimNo ratings yet

- Siwes Report On Computer ScienceDocument29 pagesSiwes Report On Computer ScienceGiwa jelili adebayoNo ratings yet

- MCES LAB MANUAL (WWW - Vtuloop.com)Document70 pagesMCES LAB MANUAL (WWW - Vtuloop.com)madhan karthickNo ratings yet

- III - D S BDTM921 - T V M: ATA Heet WO Alve AnifoldDocument2 pagesIII - D S BDTM921 - T V M: ATA Heet WO Alve Anifoldrob.careyNo ratings yet

- BUS 5560 Economic Evaluations in Healthcare John Catalano Spring I 2023Document11 pagesBUS 5560 Economic Evaluations in Healthcare John Catalano Spring I 2023Essay WritingNo ratings yet

- Shell Air Tool S2 A 100 TDS PDFDocument2 pagesShell Air Tool S2 A 100 TDS PDFDonny HendrawanNo ratings yet

- Ocorrência Protheus ID1 Anexo1Document221 pagesOcorrência Protheus ID1 Anexo1ClaDom CladomNo ratings yet

- Tankers Handbook ExpandedDocument37 pagesTankers Handbook Expandedgua_bod0% (1)

- Shamraiz Khan Sessional2Document5 pagesShamraiz Khan Sessional2Shamraiz KhanNo ratings yet

- Logcat 1655985586793Document22 pagesLogcat 1655985586793Alex ANo ratings yet

- Part 3 Simulation With RDocument42 pagesPart 3 Simulation With RNguyễn OanhNo ratings yet

- FSOG 13-005 General Insp TenarisDocument10 pagesFSOG 13-005 General Insp TenarisJanderson Sanchez Castañeda0% (1)

- Software Engineering Fundamentals - 2021Document24 pagesSoftware Engineering Fundamentals - 2021Incog NitoNo ratings yet

- Homework VLSM tasks - 2010 network design solutionsDocument8 pagesHomework VLSM tasks - 2010 network design solutionsBozhidar IvanovNo ratings yet

- Endpoint Security Essentials Study Guide-PandaDocument117 pagesEndpoint Security Essentials Study Guide-PandaRahul BhosaleNo ratings yet

- 69A-3.012 Standards of The National Fire Protection Association and Other Standards AdoptedDocument7 pages69A-3.012 Standards of The National Fire Protection Association and Other Standards AdoptedpippoNo ratings yet

- Digital Marketing CompanyDocument4 pagesDigital Marketing CompanyArdanNo ratings yet

- Spartan 6 Pin OutDocument204 pagesSpartan 6 Pin Outpalagani muralibabuNo ratings yet

- Brian Tracy - Executive Time Management PDFDocument0 pagesBrian Tracy - Executive Time Management PDFscribdcheaterman67% (6)

- A Study On The Impact of Social Media On Consumer Buying Behaviour of Mobile Phones in ChennaiDocument6 pagesA Study On The Impact of Social Media On Consumer Buying Behaviour of Mobile Phones in ChennaiHeba AliNo ratings yet

- An Introduction To Formal Languages and Automata, Fifth Edition by Peter LinzDocument2 pagesAn Introduction To Formal Languages and Automata, Fifth Edition by Peter Linzshyma naNo ratings yet

- Engineering Drawing Made Easy (Civil Junction)Document47 pagesEngineering Drawing Made Easy (Civil Junction)George MachaNo ratings yet

- Air Control 3: ManualDocument72 pagesAir Control 3: ManualNihat RustamliNo ratings yet

- Shreyasi Ghosh: Get in ContactDocument2 pagesShreyasi Ghosh: Get in ContactKunjan SomaiyaNo ratings yet

- Fisa Tehnica Autocolant Furnir LemnDocument1 pageFisa Tehnica Autocolant Furnir LemnCatalina PopNo ratings yet

- M-17211-2 Avio FAST Method Guide - Syngistix - ESIDocument16 pagesM-17211-2 Avio FAST Method Guide - Syngistix - ESIta quang khanhNo ratings yet

- TACO - Free On Demand TrainingDocument18 pagesTACO - Free On Demand TrainingVinicius Paschoal NatalicioNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Freight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesFrom EverandFreight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesRating: 5 out of 5 stars5/5 (1)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsFrom EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsRating: 4 out of 5 stars4/5 (1)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet